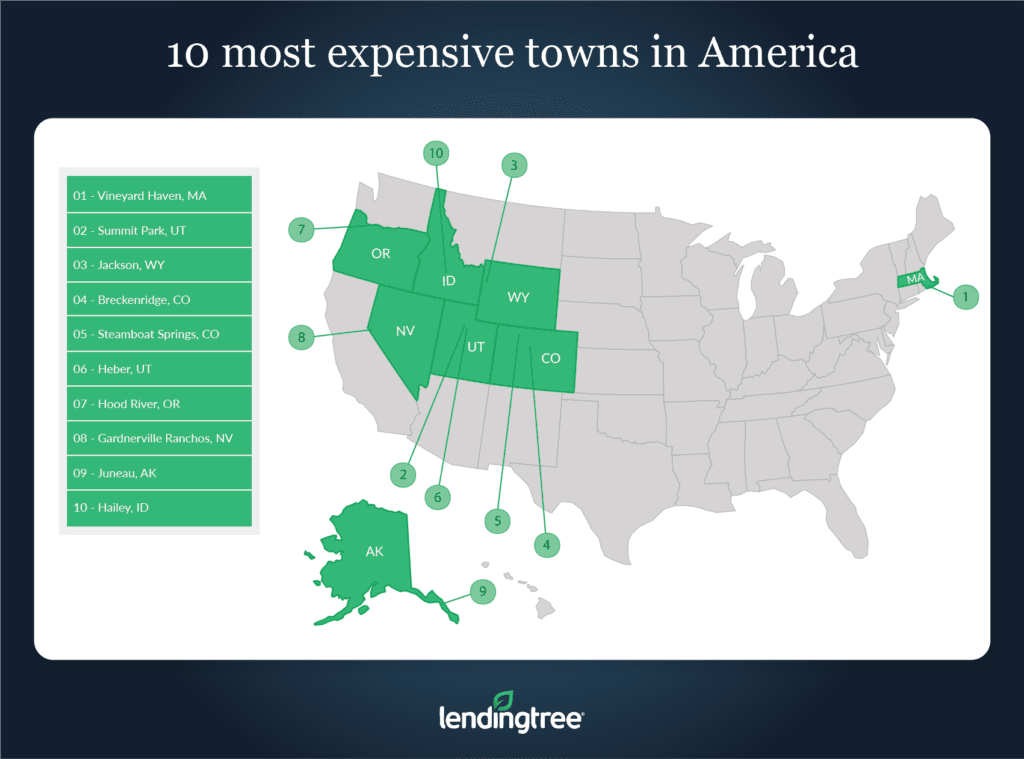

LendingTree Finds America’s Most Expensive Small Towns Have Pricier Housing Than 50 Largest U.S. Cities

The town and country lifestyle is often depicted as simple, idyllic and inexpensive when compared with big-city living, especially when it comes to housing costs. But is this stereotype accurate?

To take a look at how costly buying a house in a small town can get, LendingTree analyzed the 50 towns in the United States with populations under 50,000 that had the most expensive median-home values. LendingTree then ranked the towns based on where home values were the highest and also compared home values in these towns to home values in the nation’s 50 largest cities. The goal: To determine whether towns are actually less expensive than cities.

Ultimately, LendingTree found that many towns across the country are chock full of expensive real estate, with prices that rival those common in big cities. These findings suggest that small-town living may not be as affordable as once thought. The real estate mantra, “location, location, location,” holds true even for small towns, but some of them can be pricey.

Key findings

- Small towns Vineyard Haven, Mass., Summit Park, Utah and Jackson, Wyo., have the most expensive home prices in the nation. The median home prices in these towns are $667,400, $598,900 and $563,100 respectively, meaning that a home in any of these areas costs about as much as a home in Los Angeles does. In fact, homes in Vineyard Haven and Summit Park are even more expensive than they are in Los Angeles.

- Relative to income, homes in Vineyard Haven, Mass., Breckenridge, Colo. and Jackson, Wyo., are the most expensive. In these areas, the median home price is an average of 7.5 times higher than the median area income. This suggests that homebuyers in these towns have to stretch their budgets in order to buy a home.

- Homes are the least expensive relative to median household income in Los Alamos, N.M., Gillette, Wyo. and Rock Springs, Wyo. The median home price in these areas is an average 2.7 times higher than the median area income, suggesting that homes in each town are relatively affordable. However, this isn’t all that surprising given that the median income in each town is higher than the overall average for the towns featured in LendingTree’s study, while home prices are lower than average.

- On average, buying a home in one of the nation’s 50 most expensive towns is more costly than buying a home in one of the nation’s largest metros. An average of the median home prices across the towns featured in LendingTree’s study is $271,224. In the nation’s 50 largest cities, the average of median home prices is $269,180.

- Although America’s most expensive towns are often more expensive than its largest cities, people who live in towns tend to earn less income than they would in a city. The median household income across the nation’s most expensive towns averages to $60,150, nearly $7,000 less than the average median household income across the nation’s 50 largest cities.

No. 1: Vineyard Haven, Mass.

- Total population: 17,321

- Median household income: $71,224

- Median home value: $667,400

- Home value-to-income ratio: 9.37

- City with comparable median home value: Los Angeles

- Median home value — comparable city: $579,500

- Home value-to-income ratio — comparable city: 8.38

No. 2: Summit Park, Utah

- Total population: 40,511

- Median household income: $100,453

- Median home value: $598,900

- Home value-to-income ratio: 5.96

- City with comparable median home value: Los Angeles

- Median home value — comparable city: $579,500

- Home value-to-income ratio — comparable city: 8.38

No. 3: Jackson, Wyo.

- Total population: 34,139

- Median household income: $78,452

- Median home value: $563,100

- Home value-to-income ratio: 7.18

- City with comparable median home value: Los Angeles

- Median home value — comparable city: $579,500

- Home value-to-income ratio — comparable city: 8.38

Small towns can be just as expensive as cities, presenting challenges to buyers

Though it may seem counterintuitive for a small town to be more expensive than a big city, LendingTree’s study highlights just how often that’s true. Unfortunately, while home prices in towns are frequently just as costly as they are in cities, incomes in small towns are usually lower.

For those struggling to afford a home, there are many loan programs that can help make homeownership a more achievable goal, especially for buyers with lower incomes. For example, loans backed by the U.S. Department of Agriculture (USDA) can help buyers living in USDA-eligible rural areas avoid making a down payment on a home and get a low mortgage rate. Loans insured by the Federal Housing Administration (FHA) are another option for potential buyers who have little cash saved for a down payment or those who have less-than-stellar credit.

Methodology

All of the data used in this study comes from the 2018 American Community Survey with 5-Year Estimates. For the purposes of this analysis, LendingTree used micropolitan-level data for areas with a population of 50,000 people or less to approximate town-level data, and metropolitan-level data to approximate city-level data.

For each town, the home value-to-income ratio was calculated by dividing an area’s median home value by its median household income. The larger the ratio, the more expensive homes are relative to an area’s median income.

LendingTree research analyst Jacob Channel contributed to this report.