Car-Buying Basics: What is MSRP?

Unlike most things for sale in America, from groceries to movie tickets, cars can have several prices. Adding to the confusion are mysterious acronyms like MSRP.

So what is MSRP? It’s the Manufacturer’s Suggested Retail Price – the automaker’s way of saying: “This car is worth this much.” The manufacturer puts a lot of research into determining the MSRP for each vehicle, and dealerships use it as a pricing benchmark for new cars.

On this page

What does MSRP mean for your wallet?

A key word in “manufacturer’s suggested retail price” is “suggested,” according to the Federal Trade Commission (FTC). You don’t have to pay MSRP. Dealers often advertise car sales as some amount “below MSRP.”

In fact, very few vehicles are sold at MSRP. A price below MSRP isn’t necessarily a great deal, though it’s a good place to start negotiations. Here are five tips for negotiating a car’s price.

How is the MSRP set?

The manufacturer sets the MSRP by considering several factors:

Cost to make: How much did all the parts, labor and engineering cost?

Market conditions: How much are people willing to pay for this style, size and brand?

Accessories and packages: Does the car have the luxury package with leather seats or premium audio? What about sport handling capabilities or a specific color scheme?

The overarching goal, of course, is to determine a price that allows both the automaker and the dealer to make a profit while still appealing to their target customer. Use our car affordability calculator to determine how much you can afford to spend on a car.

What does the MSRP include?

MSRP includes the total cost to make the car, plus a profit margin. Depending on the vehicle you look at, you might see two MSRPs.

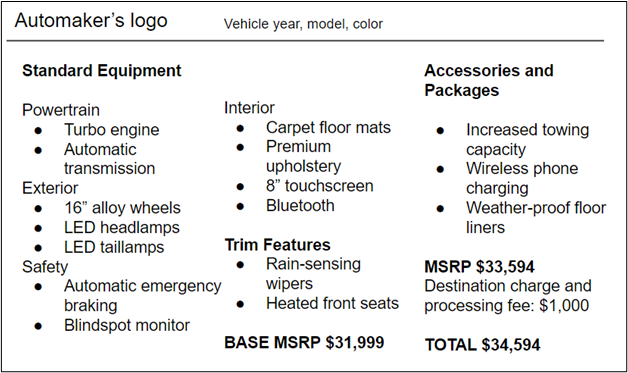

The lowest MSRP (also called the base MSRP) doesn’t include any accessories or packages add-ons, while the highest MSRP includes all the extra options. Here’s an example of what you might see on a window sticker:

Neither the base MSRP nor the regular MSRP includes the “destination charge,” which is a common dealership fee that only applies to new cars and tends to be around $1,000. Note that nothing we’ve covered so far includes taxes or title/license fees.

MSRP vs. invoice price vs. sticker price

MSRP is what automakers think consumers “should” pay to purchase a car from a dealership. The invoice price is what the dealer pays to buy the car from the automaker. If you manage to buy a car for its invoice price, you’re buying it for essentially the same amount that the dealer paid.

The sticker price is the total price for the car, MSRP and destination fees included. It’s the final price that’s on the car’s window sticker – thus, “sticker price.” Sticker price will be the highest of the three, while invoice price is the lowest.

If you want to know the absolute total cost it takes to walk out of the dealership with the car keys in hand, all fees included, ask for the “out-the-door” price. This will include taxes, registration, title fees and the rest of the dealer fees. When negotiating with the dealer, stay focused on the out-the-door price. It’s the best way to be sure you’re getting a good deal.

Can you negotiate MSRP down?

The MSRP is set by the manufacturer, so you can’t negotiate the MSRP — but you can negotiate how much you’ll pay.

Shop around for a car and compare prices. One strategy is to tell the dealer you could get a similar car for less money from another dealership and ask them to beat that price to gain your business.

Why pay over MSRP?

Why pay over MSRP?

You might pay more than the MSRP if you really want a car and there aren’t a lot of cars available — it’s all a question of supply and demand. Dealers call the increase over MSRP a “market adjustment.”

When you’re looking for a car loan, shop around for an auto loan just like you’d shop around for a car. Get an auto loan preapproval directly from a lender of your choice – so you know the interest rate you deserve without a middleman inflating your APR – then ask the dealer if they can beat that rate.