Best Large Metros for Families with Children

Finding a place to live can be challenging, even as the housing market cools. This is especially true for families with children that need to find an area with a decent school system that won’t cost a fortune.

The factors that families consider when deciding where to live will vary, but several elements typically make an area more enticing.

LendingTree considered six variables to help determine which of the nation’s 50 largest metros are best for families with children:

- Median family income

- Median monthly housing costs for homes with a mortgage

- Homeownership rate among families with at least one child

- Percentage of 16- to 19-year-olds not enrolled in school who don’t have a high school diploma or an equivalent degree

- Average round-trip commute time

- Percentage of households with children

These factors were chosen because each tends to impact households with children. As a result, metros strong in these categories are more likely to be better for families than those weak in them. See the methodology for more on why we chose these variables.

On this page

Key findings

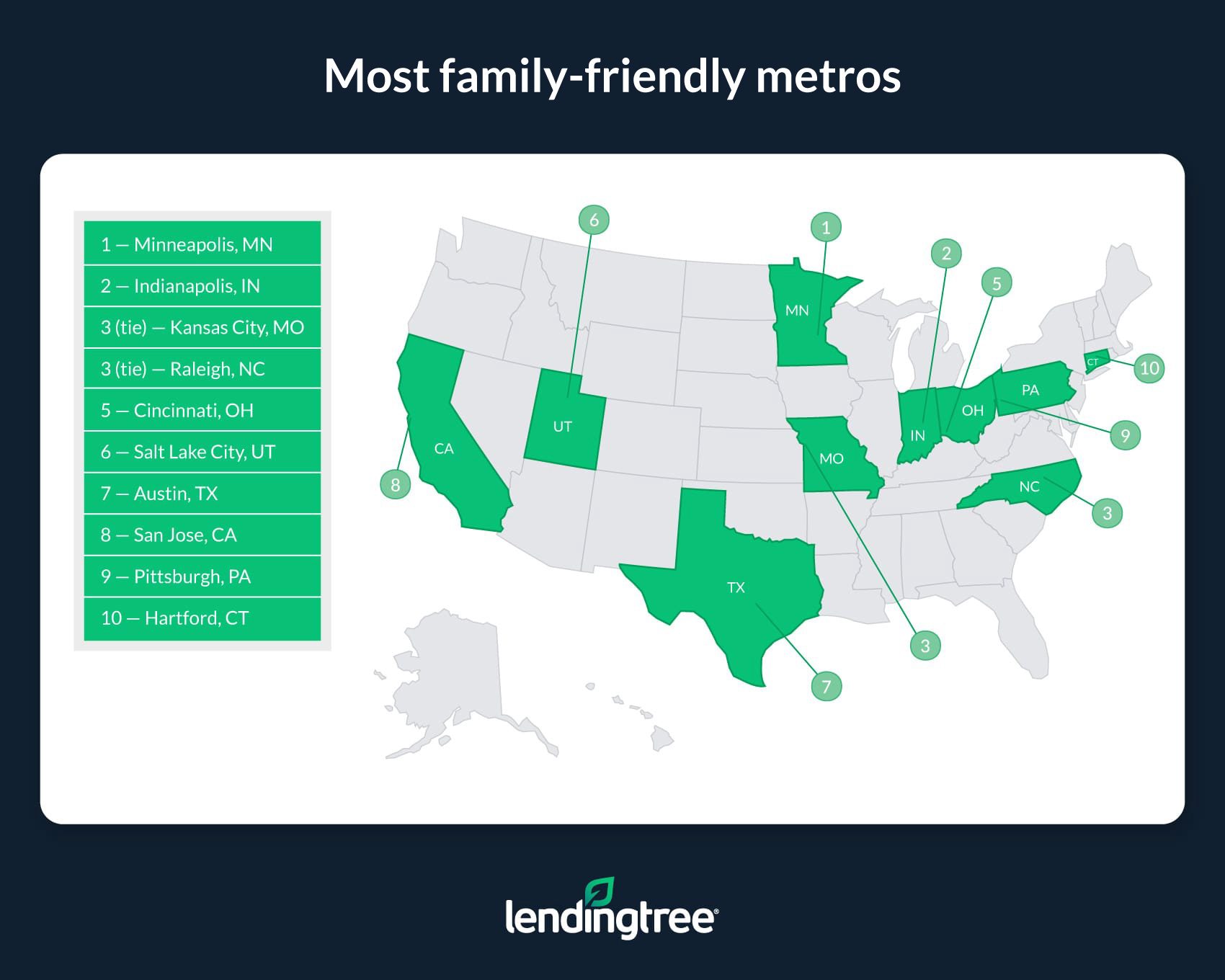

- The metro most friendly to families is Minneapolis. Minneapolis’ top 10 placements in homeownership rate among families (first), commute time (sixth) and median family income (seventh) help it reach first place.

- Indianapolis, Kansas City, Mo., and Raleigh, N.C., are the next best metros for families. Median monthly housing costs for homes with a mortgage are lower in Indianapolis than in every other metro featured. Combined with a high homeownership rate among families with at least one child (fifth), the Indiana metro finishes second. Despite Raleigh’s relatively high housing costs and long commute times, the North Carolina metro and Kansas City rank nicely across the board to tie for third.

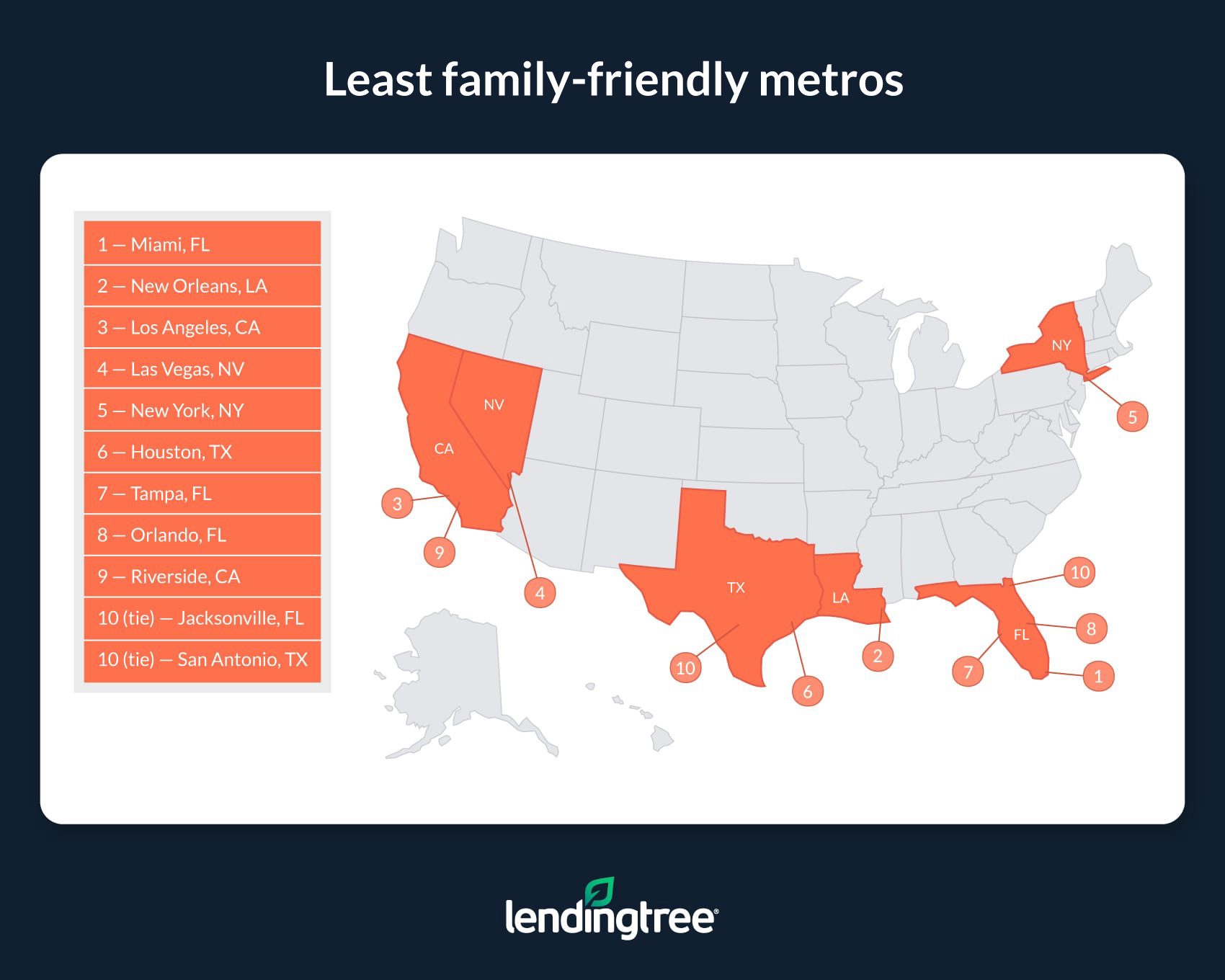

- Miami, New Orleans and Los Angeles are the metros least friendly to families. Miami doesn’t rank higher than 37th in any category. While it doesn’t rank last in any category, its low median family income, family homeownership rate and share of households with children put it at the bottom. Similarly, New Orleans’ low family income and large share of 16- to 19-year-olds without diplomas and not in school and Los Angeles’ low homeownership rate among families and high housing costs help land the Big Easy and the City of Angels in 49th and 48th, respectively.

Most family-friendly metros

No. 1: Minneapolis

- Median family income: $110,778

- Median monthly housing costs for homes with a mortgage: $1,820

- Homeownership rate among families with at least one child: 78.54%

- Percentage of 16- to 19-year-olds not enrolled in school who don’t have a high school diploma or an equivalent degree: 2.24%

- Average round-trip commute: 46.6 minutes

- Percentage of households with children: 27.87%

No. 2: Indianapolis

- Median family income: $86,713

- Median monthly housing costs for homes with a mortgage: $1,347

- Homeownership rate among families with at least one child: 72.74%

- Percentage of 16- to 19-year-olds not enrolled in school who don’t have a high school diploma or an equivalent degree: 2.75%

- Average round-trip commute: 49.8 minutes

- Percentage of households with children: 28.08%

No. 3 (tie): Kansas City, Mo.

- Median family income: $93,068

- Median monthly housing costs for homes with a mortgage: $1,588

- Homeownership rate among families with at least one child: 70.46%

- Percentage of 16- to 19-year-olds not enrolled in school who don’t have a high school diploma or an equivalent degree: 2.83%

- Average round-trip commute: 46.0 minutes

- Percentage of households with children: 28.04%

No. 3 (tie): Raleigh, N.C.

- Median family income: $104,329

- Median monthly housing costs for homes with a mortgage: $1,695

- Homeownership rate among families with at least one child: 73.97%

- Percentage of 16- to 19-year-olds not enrolled in school who don’t have a high school diploma or an equivalent degree: 2.42%

- Average round-trip commute: 53.0 minutes

- Percentage of households with children: 30.67%

Least family-friendly metros

No. 1: Miami

- Median family income: $75,335

- Median monthly housing costs for homes with a mortgage: $2,005

- Homeownership rate among families with at least one child: 56.56%

- Percentage of 16- to 19-year-olds not enrolled in school who don’t have a high school diploma or an equivalent degree: 4.02%

- Average round-trip commute: 56.6 minutes

- Percentage of households with children: 24.79%

No. 2: New Orleans

- Median family income: $73,344

- Median monthly housing costs for homes with a mortgage: $1,505

- Homeownership rate among families with at least one child: 63.57%

- Percentage of 16- to 19-year-olds not enrolled in school who don’t have a high school diploma or an equivalent degree: 5.93%

- Average round-trip commute: 50.0 minutes

- Percentage of households with children: 24.38%

No. 3: Los Angeles

- Median family income: $93,791

- Median monthly housing costs for homes with a mortgage: $2,781

- Homeownership rate among families with at least one child: 48.21%

- Percentage of 16- to 19-year-olds not enrolled in school who don’t have a high school diploma or an equivalent degree: 2.82%

- Average round-trip commute: 56.8 minutes

- Percentage of households with children: 26.46%

Striking a balance is key to finding a place to live with your family

The main reason why this considers six variables to determine which metros are best for families is that there’s often no single aspect that makes living in an area worthwhile.

There are instances where one feature of a metro can be all that is necessary to make that place a good choice for a family. But, generally, focusing heavily on only one thing a metro offers while ignoring its other aspects can lead to disappointment and hardship.

Regardless of your preferences, you’ll likely be better off looking for an area that’s strong in many categories important to your family rather than fixating on an area that excels in only one category important to your household.

Tips for finding a family home

Because home prices and mortgage rates are high, finding an affordable family home might appear particularly difficult. But there are various ways for families to find a decent place to live that won’t break the bank. Here are a few tips on how to do just that:

- Shop around to get your lowest possible rate on a mortgage. By shopping around for a mortgage before choosing a lender, you can increase your odds of finding a lower rate on your loan. The lower your rate, the more money you could save each month on housing payments and the more cash you could have left for family-related expenses.

- Use home equity to remodel your current place. If you’ve found your family has seemingly outgrown your home, it doesn’t mean you need to consider a move. Instead, tapping into your home’s equity could help you afford renovations that make your home more suitable for your family. For example, a home equity loan can help you transform an office into a nursery or a half-bathroom into a full one.

- Consider renting. Though our study emphasizes homeownership, renting can be a good option for many households. This is especially true when considering that renting is usually considerably cheaper than owning.

Methodology

Data in our study comes from the U.S. Census Bureau 2021 American Community Survey with one-year estimates (the latest available). The six variables that make up the overall ranking were weighted equally. They were chosen for the following reasons:

- Median family income: Higher incomes make it easier for families to afford necessities.

- Median monthly housing costs for homes with a mortgage: The less money a family spends on a house, the more money they have left for other expenses.

- Homeownership rate among families with at least one child: Homeownership can benefit families for various reasons. Not only can owning a home help families build intergenerational wealth, but homeowners can tap into their home’s equity if they need extra money for expenses like medical debt or college. If an area has a high homeownership rate among families, it suggests that it’s more attainable for those who live there.

- Percentage of 16- to 19-year-olds not enrolled in school who don’t have a high school diploma or an equivalent degree: One way to gauge school quality is to look at how many students complete high school. A larger share of 16- to 19-year-olds who aren’t enrolled in school and don’t have diplomas could suggest that the quality of an area’s school systems are in dispute.

- Average round-trip commute time: Taking care of a family is time-consuming, so areas where parents spend less time commuting could be better fits for families. Note that average round-trip commute time is found by multiplying the average commute time to work, as reported by the American Community Survey, by two.

- Percentage of households with children: Typically, more children living in an area means more schools and day care centers for families. Further, families might have an easier time fitting into a community if they aren’t the only ones with children.