What Credit Score Do You Need to Buy a House?

A 620 credit score is typically what you’ll need to get a mortgage for a home purchase. Although you can buy a house with a credit score as low as 500, you’ll pay a higher rate and make a larger down payment. You’ll also end up with a much larger monthly mortgage payment, which has a direct effect on the home price you’ll qualify for.

Knowing the minimum required credit score to buy a house — as well as how your scores affect your rate and payment — can help you decide whether it’s time to buy or wait.

What’s a good credit score to buy a house?

Most lenders set a 620 minimum benchmark for you to buy a house, though that’s not necessarily a “good” score to buy a house. There’s a few reasons the minimum score isn’t good for buying a house:

- The lower your credit score, the higher your payment.

- The higher your payment, the higher your debt-to-income (DTI) ratio.

- The higher your DTI ratio, the less you qualify for to buy a home.

Conventional lenders now require a 780 credit score or higher to qualify for the lowest mortgage interest rates, so anything above 780 is considered an excellent score to buy a house. Armed with this score, you can secure a more affordable monthly payment and have more buying power when making purchase offers. Lenders often reward high credit score borrowers with fewer documentation requirements, a smoother approval process and exceptions for high DTI ratios.

That doesn’t mean you can’t get a mortgage with a score below 780. Most standard home loan programs require you to meet minimum credit score requirements, which range from 500 to 620.

How a good credit score helps you buy a house

Besides a lower interest rate and monthly payment, there are some added benefits to buying a home with a high credit score. A good credit score can help you:

You can get approved with more total debtLenders measure your DTI ratio by dividing your total debt by your gross income. Although most lending programs cap your DTI at 45%, a high credit score may allow exceptions up to 50%.

You can reduce mortgage insurance costsIf you can’t quite swing a 20% down payment, you can at least keep your monthly private mortgage insurance (PMI) costs (on a conventional loan) lower with a high credit score. PMI is usually part of your monthly payment.

You can afford a more expensive homeYour credit score affects both your interest rate and mortgage payment, so it has an impact on how much house you can afford. Try our home affordability calculator to see the difference a few percentage points can make on the home price you qualify for.

The example in the table below shows these numbers in action as we compare the interest rate, monthly payment and maximum home price you can afford with a higher and lower conventional credit score. The example also assumes you earn $85,000 per year and have $750 per month in nonmortgage debt.

| Credit score | Interest rate | Monthly payment | Maximum home price |

|---|---|---|---|

| 780 | 6.75% | $2,295* | $335,689 |

| 620 | 7.63% | $2,295* | $316,232 |

*Includes an $800 annual homeowners insurance premium, $3,640 in annual property taxes and a maximum 43% DTI ratio.

→ The bottom line: A low credit score reduces your homebuying power by $19,457 in this example.

Most lenders use the FICO credit score system

Minimum mortgage credit score by loan program

FHA loans and VA loans backed by the Federal Housing Administration (FHA) and U.S. Department of Veterans Affairs (VA), respectively, cater to borrowers with credit scores as low as 500. Still, most homebuyers choose conventional loans to purchase homes, despite the stringent qualifying rules set by Fannie Mae and Freddie Mac, which require a minimum 620 score.

The table below breaks down the minimum credit scores for each loan program.

| Loan program | Minimum FICO Score |

|---|---|

| Conventional | 620 |

| FHA | 580 with a 3.5% down payment 500 with a 10% down payment |

| VA | No minimum requirement, though most lenders set their minimum between 580 and 620 |

| USDA | 640 |

| Jumbo | 700 or higher |

What credit score is needed to buy a house based on the mortgage type?

Conventional loan. This popular loan program is a good fit if you have a credit score of at least 620 and can make a 20% down payment. If you’re making a lower down payment, pay close attention to your PMI premium: The lower your credit score, the higher your mortgage insurance premium and monthly payment will be.

FHA loan. A loan backed by the Federal Housing Administration (FHA) is often the only choice for borrowers with a credit score between 500 and 619. You’ll pay for FHA mortgage insurance that includes an upfront premium of 1.75% of your loan amount and annual mortgage insurance premiums ranging between 0.15% and 0.75%. However, unlike PMI, the premium percentage is the same regardless of your credit score.

VA loan. This loan type can only be made to eligible veterans, active-duty service members, reservists and surviving spouses. Lenders don’t require mortgage insurance or a down payment. Although the VA has no minimum score requirement, most lenders set their minimum between 580 and 620.

USDA loan. The U.S. Department of Agriculture (USDA) backs this loan type to help low- and moderate-income buyers finance rural homes. No down payment is required, but you’ll pay upfront and annual guarantee fees that work like FHA mortgage insurance. The USDA doesn’t set a minimum credit score, but most lenders require at least 640.

Jumbo loan. This is your only choice if you’re borrowing above the conforming loan limits, and these loans are more common in expensive cities throughout the country. Most jumbo loan programs require a credit score of at least 700, although there may be programs with lower score limits if you can afford a higher interest rate and payment.

Lenders use credit scores from the three credit bureaus

Mortgage lenders typically pull your credit history from all three of the main credit reporting bureaus — Equifax, Experian and TransUnion — to calculate your score. Then, they use the middle score to quote you a rate and approve your loan. You can get a free credit report from each credit reporting agency once a year. However, a mortgage credit report, obtained when applying with a lender, will give you a better idea of where you stand as a potential homebuyer. The typical cost for a mortgage credit report is between $30 and $50.

What credit score is needed to buy a house and get the best mortgage rate?

A lot has changed in 2023, starting with a higher minimum credit score standard for the best conventional loan rates, and changes to fees for credit scores ranging from 620 to 779. Here’s what changed:

- 780 is the new benchmark for the lowest rates. This is 40 points higher than the previous 740 minimum, and means you’ll pay a slightly higher rate for scores between 740 and 779 than before the changes.

- 639 to 679 credit scores get a break on their rates. Although you’ll still pay a higher rate than you would with a credit score above 679, Fannie Mae and Freddie Mac have eased up on the extra charges for this lower score range.

- Investment and multifamily property rates may be lower. If you’re buying an investment property or two- to four-unit house, lenders may offer you a better rate, since fees for these types of properties were reduced.

What determines your credit score

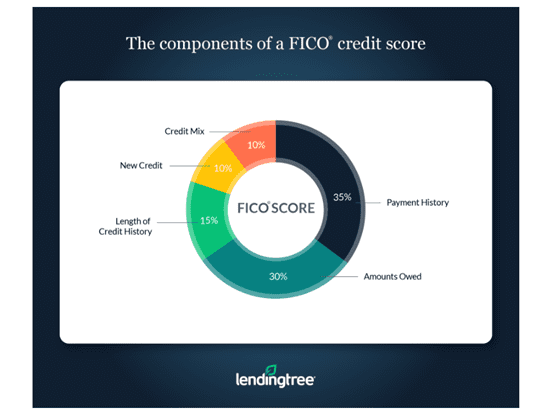

The image below shows the components of your credit score. As you can see, payment history and amounts owed have the biggest impact, followed by length of credit history, new credit and the mix of credit accounts you have.

How to increase your credit score before house hunting

If your eyes are set on homebuying, here are some things you can do now to boost your credit score:

- Shrink your credit card balances. As a general rule, avoid using more than 30% of your total available credit to maximize your scores. For the best scores, limit your monthly spending to less than 10% of your total available credit.

- Pay your bills on time. Even one recent late payment can send your scores into a freefall.

- Avoid authorized user cards. You’re responsible for charges as a primary cardholder. If an authorized user racks up a large amount of debt on the card and can’t pay it off, your credit score could take a hit.

- Don’t cosign on debt. Whether it’s a student loan or a car lease, your credit score could take a hit if a cosigned account is paid late, even if you’re not the primary borrower.

- Avoid multiple credit applications. Besides pulling your scores down, inquiries require explanations. You’ll need to dig up paperwork for any account that doesn’t show up on your credit report.

- Don’t open up new credit cards or take on new loans. Limit new credit applications within a year of applying for a mortgage to maximize your credit scores.

- Fix errors if you find them. Credit reports may have errors that you can fix by contacting the credit bureaus.

How to buy a house with bad credit

There are some steps that may help improve your odds of buying a house with low credit scores.

Make a larger down paymentLenders may be more willing to consider a loan application with poor credit scores if you’re making more than the minimum down payment. Consider asking a relative for a gift, and stockpile those tax refunds and bonuses to build your down payment fund.

Pay down your debtAnother way to offset low credit scores is to get rid of as much debt as possible. Mortgage underwriters may look more favorably on an application with a very low DTI ratio, even if your credit history has some bumps in it.

Ask about non-QM mortgagesNon-qualified mortgages, more commonly as non-QM loans, don’t have to meet the stringent federal standards tied to common loan programs. Some non-QM loans even allow you to get a loan one day after completing a bankruptcy or foreclosure, as long as you have a large down payment and can afford a higher interest rate.