APR vs. Interest Rate: What’s the Difference?

An interest rate tells you the percentage of a loan that you’ll pay as a fee for borrowing that money, while an APR (annual percentage rate) measures all the costs of a loan, including interest and origination fees. In other words, interest rate measures just one factor while APR measures several. The lower your APR, the lower the overall cost of a loan will be.

But which number is the better measure of the value a loan offers you? We’ll go over how to choose a loan with the lowest possible costs, and the best uses for both APRs and interest rates.

On this page

Understanding APR vs. interest rate

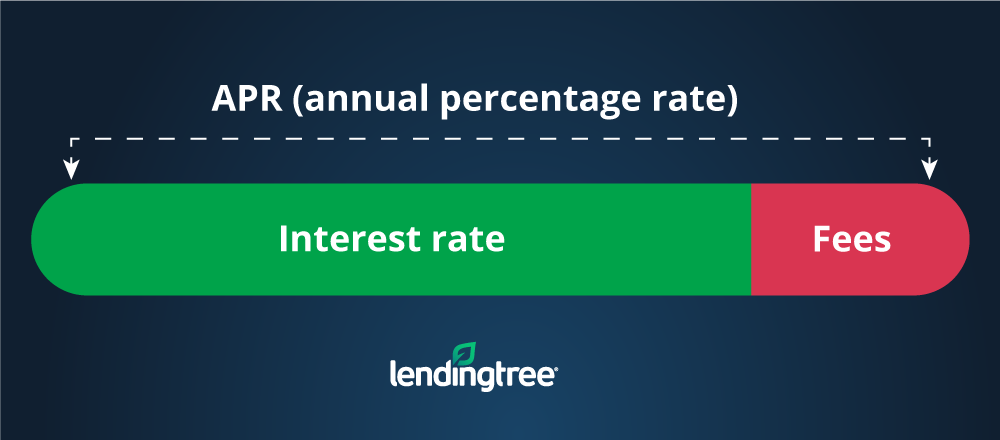

Interest rate and APR are typically not interchangeable. The difference between interest rate and APR is simple: your interest rate is just one part of your APR.

What is an interest rate?

An interest rate is the amount a lender charges you to borrow money. It’s typically expressed as a percentage of the total loan amount. To set the interest rate, lenders look at your credit score and debt-to-income ratio, among other factors like loan amount and loan length. In the case of a mortgage, the characteristics of the property you’re purchasing can also affect your interest rate.

What is an APR?

An annual percentage rate (APR) is a number that captures the total (or “true”) cost of borrowing money. It represents the total yearly cost of the loan, including interest and fees. APRs are expressed as a percentage of the total loan balance.

What to know

For instance, a personal loan with an origination fee (and low APR) could be more cost-effective than a loan without fees (but a higher APR). Similarly, a mortgage with “no closing costs” is really just a mortgage with a higher interest rate than you’d otherwise pay, or a loan whose closing costs are financed and rolled into the loan amount.

The costs and fees included in a loan’s APR can depend on the type of loan. With a personal loan, the APR often includes just the interest rate and any origination fee. Auto loan APRs typically comprise the interest rate, a loan origination fee and finance charges. Mortgage APRs are more complicated — in addition to the interest rate, a mortgage APR may include:

- Origination fees

- Mortgage points

- Mortgage insurance premiums

- Underwriting fees

- Other mortgage closing costs

APRs make it easier for consumers to compare loans — even if those loans have different rates and fees. The Truth in Lending Act requires lenders to provide a loan estimate within three days of receiving a mortgage application; APR information can be found on Page 3 of your estimate.

The importance of APRs when borrowing money

Since your APR is the measure of the total cost of the loan, a lower APR equals a lower cost of borrowing.

For example, let’s assume a good-credit borrower takes out a $15,000 personal loan that’s repaid in fixed monthly payments over five years. The borrower can save money on monthly payments and the overall cost of the loan by choosing the option with the lower APR:

How APR reflects true borrowing costs on a five-year, $15,000 loan

| Loan #1 | Loan #2 | |

|---|---|---|

| APR | 9.50% | 11.50% |

| Monthly payment | $315 | $330 |

| Total cost of the loan | $18,902 | $19,793 |

| Interest and fees paid | $3,902 | $4,793 |

Even with a difference in APR of just two percentage points, the lower-rate option amounts to nearly $900 less money paid in interest.

Takeaway

APR vs. interest rate effect on a mortgage loan

As you shop for loans, it may feel easiest to compare mortgage offers by referencing their advertised interest rates. Like APRs, interest rates are expressed as a percentage of the total loan balance. But don’t make the mistake of stopping there: Loans that appear to be similar on the surface — sharing identical interest rates and similar monthly payments — should be compared by APR to ensure you’re clear on the true costs you’ll face over the life of each loan.

Consider the following example that compares two 30-year, fixed-rate $320,000 mortgages. The home’s purchase price is $400,000 for both loans, meaning the borrower made a 20% down payment, and they both carry a 6.28% interest rate.

| Example loan A | Example loan B | |

|---|---|---|

| Home price | $400,000 | $400,000 |

| Loan amount | $320,000 | $320,000 |

| Interest rate | 6.28% | 6.28% |

| Mortgage points | 1 ($3,200) | 2 ($6,400) |

| Origination fees | $3,200 | $1,600 |

| Adjusted loan balance (loan amount + fees and points) | $326,400 | $328,000 |

| Monthly payment (principal and interest) | $2,281.24 | $2,292.46 |

| APR | 6.19% | 6.23% |

Along with origination fees, you’ll notice that both loans have mortgage points — an upfront charge a borrower pays to get a lower mortgage rate. One point is equal to 1% of the loan amount, so each point in the example above costs $3,200.

At first glance, Loan A appears to be a better deal since it costs $1,600 less in points and fees and has a monthly mortgage payment (based on the adjusted loan balance) that’s about $11 lower. However, to truly understand the cost of each loan, we’ll need to compare the annual percentage rates. As you can see in the last row, the APR on Loan A is lower, making it indeed the better deal.

Takeaway

Understanding the APRs of variable- and adjustable-rate loans

So far, we’ve only been working with fixed-rate loans in our examples. But APR calculations become more complicated — and more limited in their utility — when dealing with variable-rate loans, including adjustable-rate mortgages (ARMs). With these loans, interest rates vary over the life of the loan but, at the beginning, they typically offer lower interest rates than comparable fixed-rate alternatives.

How ARM interest rates work

The timetable associated with an ARM’s fixed and adjustable periods will be right in its name: in the case of a 5/1 ARM, for example, the rate is fixed for the first five years and then adjusts annually thereafter.

Calculating the APR on a variable- or adjustable-rate loan is a bit like trying to hit a moving target, as it’s very improbable that once the interest rate begins to adjust, the index rate will be at the exact same level it was on the day you closed. It’s also practically impossible for the index rate to stay the same for the remainder of the loan term, since the market fluctuates constantly.

If you really want to compare ARM rates using APR, you’ll need to understand that the APR won’t reflect the maximum interest rate the loan could reach. To compare ARMs, it’s also important to ensure you’re comparing APRs for loans with the same rate type and repayment term: 30-year fixed to 30-year fixed, 5/1 ARM to 5/1 ARM and so on.

How to calculate the APR on a loan

To calculate the APR on a loan, you’ll need to know your:

- Loan amount

- Fees or other costs (such as an origination fee or other closing costs)

- Interest rate

- Loan length (or term)

- Your monthly payment amount

Calculating APR may sound complicated, but think of it as simply multiplying the periodic interest rate by the number of periods in a year.

You can use Microsoft Excel to determine the annual percentage rate for your loan. Simply plug the following formula into an Excel sheet:

=RATE(total number of payments, -payment amount, loan value, 0)*12

Payment amount should be expressed as a negative value, since your loan decreases by that amount with each repayment. Loan value represents the total amount of your loan minus any fees, and the final zero represents the final value of your loan when it has been fully repaid.

How is an interest rate calculated?

Interest rates are complex and determined both by factors you can and can’t control. Ultimately, each lender decides exactly how they would like to calculate the interest rates they’re willing to offer you—there’s no single formula that calculates what interest rate you deserve. Therefore, although it may be helpful to understand how interest rates work at a high level, the most practical thing to do is focus your efforts on what you can control.

How to get a great interest rate on your loan

Here are a few strategies to get the best interest rate possible in your situation:

Improve your credit. More than any other factor, your credit score affects how much lenders will charge you to borrow money. You can improve your credit score by making on-time payments for your existing accounts, paying down your outstanding debt balances and removing any errors you may find on your credit reports.

Consider where you want to buy. Location, location, location — it’s not just true for real estate, but also for credit. Many lenders charge a different amount to borrowers in one state versus another, or even one county versus another. You can use the Consumer Financial Protection Bureau’s Explore Interest Rates tool to compare rates by location.

Choose your loan amount wisely. For both personal and home loans, a higher loan amount generally comes with a higher interest rate. Mortgage lenders are likely to charge a higher interest rate for smaller loans below $100,000 or jumbo loans (in 2023, any loan over $726,200 in most U.S. counties).

Use a cosigner. If you can’t qualify for a favorable APR or terms on your own, you might consider getting a personal loan with a cosigner. By cosigning the loan, your trusted friend or family member is taking on the responsibility of repaying the loan if you don’t make payments. Because of the reduced lending risk, you may receive a lower APR.

Make a bigger down payment. If you’re taking out a home loan, it’s common to also make a down payment. Generally, the bigger your down payment, the lower your interest rate will be.

Avoid lender credits. Mortgage borrowers have the option to purchase lender credits, which will typically lower your closing costs, but there’s a catch — you’ll have to agree to a higher interest rate.

What is a good APR for a loan?

Personal loan APRs vary widely depending on a number of factors, including credit score, desired loan amount and loan length. Financial experts agree that 36% is the dividing line between an affordable loan and a potentially predatory one. The best personal loan candidates may receive single-digit rates, but borrowers with bad credit may struggle to qualify with reputable lenders and could see APRs above 100%.

Mortgage loan APRs also vary depending on your characteristics as a borrower, the lender and the home you want to buy. As of the first week in April 2023, a 30-year mortgage with a middle-of-the-road APR would be around 6.27%, while an expensive loan might have an APR of 7.77% or more. A higher-priced mortgage loan (HPML) is the industry term for a loan that’s significantly more expensive (at least 1.5%) than the average rate offered to qualified buyers.

Whether an APR is “good” depends on your unique financial situation, as well as the loan purpose.

For example, if you want to consolidate credit card debt with high interest rates, a personal loan with a lower APR than what you’re currently paying on your credit cards can save you money in the long run. Similarly, if you’re debating whether to refinance your mortgage loan, you should look for a new loan with an interest rate at least 1% lower than your current rate.

If you want to take out a personal loan for home improvement, be sure that the cost of the loan doesn’t negate any value gained from renovations. This loan calculator can help you determine the total cost of a loan based on your rate.

In general, personal loans used for unnecessary purposes, like vacations or weddings, are typically not advised, since the cost of borrowing will just add to the cost of the original expense. However, borrowers who can secure low APRs may find that the convenience of a personal loan is worth the long-term cost.

If you’re ready to hunt for the best APR for your credit profile, start by seeing what your bank or credit union has to offer. You can also fill out a single form with LendingTree and receive up to five personal loan offers from top lenders.

4 tips to remember when loan shopping

Shopping around will help you get the best deal. In fact, nearly half of borrowers who compare multiple loan options will save money on their mortgage, according to a recent LendingTree survey. But these savings are not limited to mortgages — for example, car buyers can save more than $5,000 by shopping around for an auto loan.

The lesson here is that, although it may be tempting to settle on a lender before combing through competitors’ loan offers, taking the time to comparison shop can potentially save you thousands in interest over the life of your loan.

Keep the following tips front of mind as you compare loan offers:

- Focus on APR vs. interest rate based on your needs. It makes sense to focus on APRs if you care most about getting the best deal on your monthly payments. On the other hand, if you’re more concerned about saving money in the long haul, it’s logical to give more weight to interest rates.

- Keep the loan term in mind. Some borrowers look for loans with longer repayment terms so they can keep their monthly payments low, but it’s important to remember that you’ll pay more in interest over the life of the loan with a longer term. When comparing loan offers, weigh the higher overall cost of a longer loan term with the lower monthly payment and consider your financial priorities.

- Ask about additional fees. Although APRs can be a powerful tool as you compare loan offers, they aren’t foolproof, especially when it comes to mortgage loans. Mortgage lenders are required to include certain costs in their APR calculations, but there are additional fees — for example, appraisal or inspection fees — that may not be represented in the APR.

Takeaway

4. If purchasing discount points, calculate a “break-even point.” When you pay for mortgage points, you’re essentially paying some interest upfront to receive a lower interest rate in return. But if you don’t stay in the home long enough, you won’t recoup what you spent on points.

→ To calculate a break-even point, divide the amount you paid in points by the amount you stand to save each month due to the lower rate. The result will be the number of months you need to remain in the home in order to break even.