42% of Millennials Have Been in Debt for Their Pet

From adoption fees and preventative vaccines to well-formulated foods and training, just trying to give your pet the best chance to live a happy and healthy life can be expensive in itself. When you add medical emergencies to the mix, your costs will only increase.

In a survey of 760 pet owners during the first three days of July 2019, we reveal how the average pet owner fares with financial surprises and how they typically pay for these unexpected expenses for their pets.

- Key findings

- Millennials have had the most pet debt

- Cat owners are more likely to worry about pet expenses

- More than 1 in 3 pet owners would turn to high-interest debt in a pet emergency

- How to afford an emergency pet expense

- Methodology

Key findings

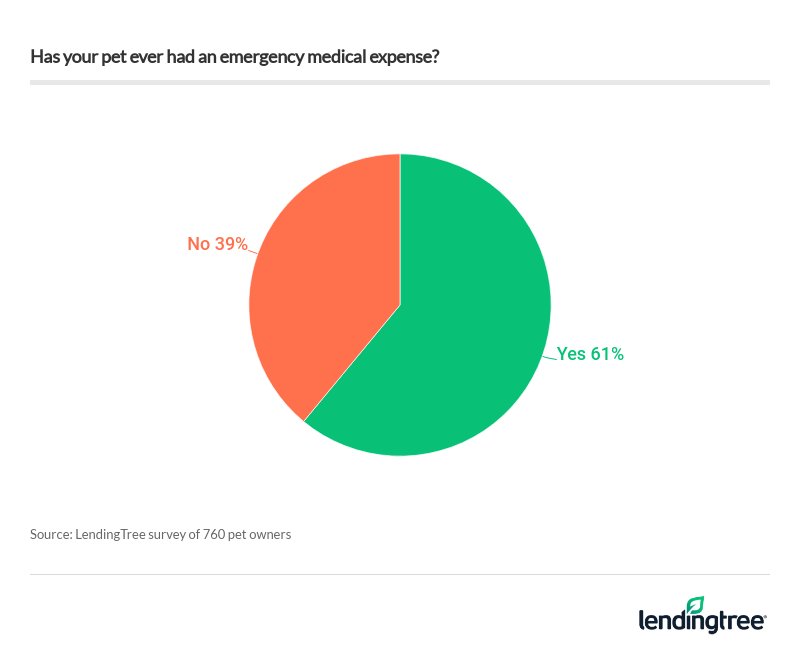

- More than 6 in 10 pet owners said their pet has had an emergency medical expense, and most said it’s happened more than once.

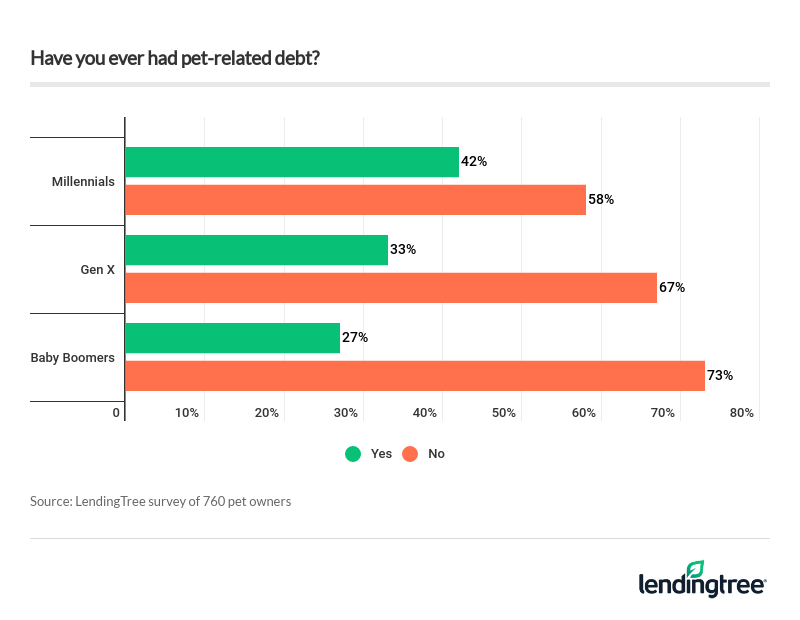

- About 42% of millennial pet owners have been in pet-related debt, and nearly 1 in 10 are currently paying it off. Across all age groups, more than one-third (36%) have been in debt for a pet.

- Nearly 1 in 5 pet owners spend more than $1,000 annually on their pet, though it’s worth noting that 24% spend about $300 to $499.

- Of those surveyed, 62% factored their pet into a monthly budget, while 26% did not. And 13% of respondents said they don’t have a monthly budget at all.

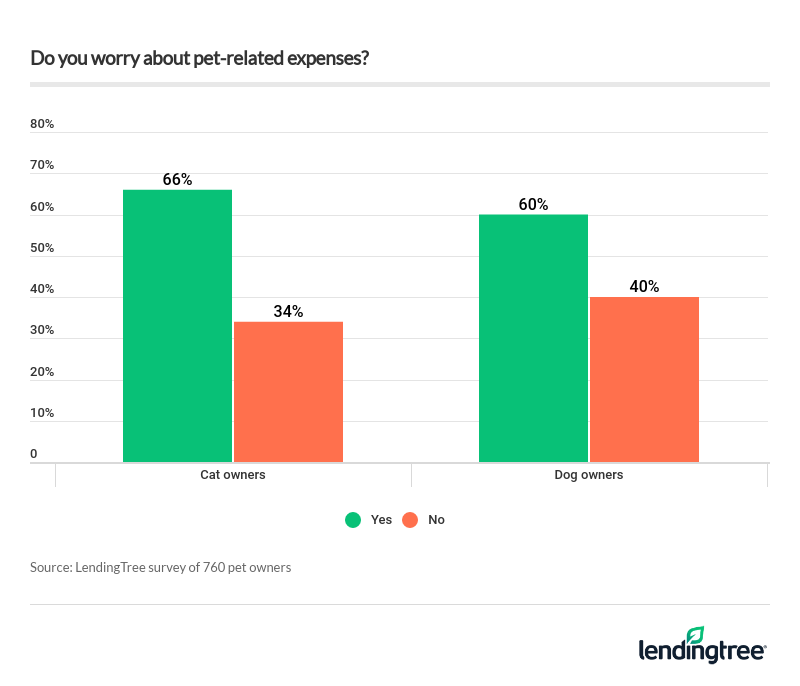

- About 59% of pet owners worry about animal-related expenses, and cat owners (66%) are slightly more likely to stress than dog owners (60%).

- Approximately 41% of people surveyed paid for emergency expenses with a credit card. Other payment methods include cash (39%), savings (11%), pet insurance (6%) and personal loans (1%).

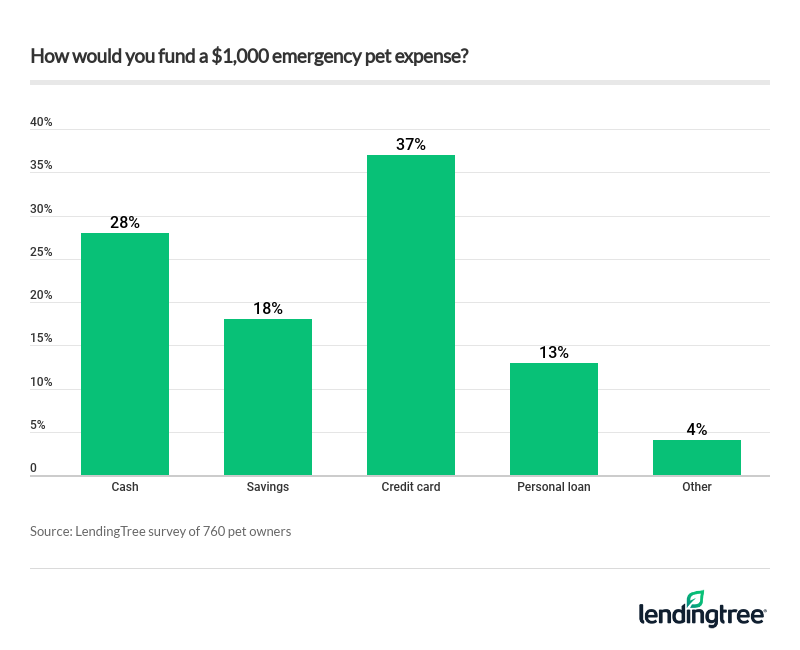

- If a $1,000 pet-related emergency expense were to come up tomorrow, 37% would turn to a credit card, while 28% would use cash, 18% would pay with savings and 13% would take out a personal loan.

- Three-quarters of pet owners lack pet insurance — and 39% have regretted not having a policy for their furry friend. As a group, millennials are more likely to have pet insurance: 34% of millennials have it, versus 18% of Gen Xers and 9% of baby boomers.

- Despite the financial strain — and the fact that 36% of pet owners regret paying for the expense that caused their debt — 77% of those who have had pet debt would still consider getting another animal.

Millennials have had the most pet debt

Overall, taking on debt to pay for a pet’s emergency medical expense is more likely than not — about 6 in 10 pet owners reported doing so.

When you look at the generational breakdown, millennials were the most likely to report taking on debt on behalf of a pet.

The tendency to take on pet debt tends to lessen with age. Baby boomers, for example, had the lowest reported tendency to take on pet debt. This could be due to the fact that, as you age, your salary (and therefore, your general net wealth) tends to increase.

According to a MagnifyMoney study on the generational gap, for instance, the average millennial has a net worth of $100,800 in 2019 while the average Gen Xer has a net worth of $509,100. (Note: MagnifyMoney is owned by LendingTree.) This makes it slightly easier for older generations to afford emergency medical expenses, whereas younger pet owners have less options in how to pay for such occurrences.

Cat owners are more likely to worry about pet expenses

With the potential for surprise medical emergencies comes the inevitable likelihood that you’re going to worry about paying for those expenses. When you compare those worries according to type of pet, cat owners tend to worry a bit more than dog owners.

More than 1 in 3 pet owners would turn to high-interest debt in a pet emergency

The best way to combat financial worry is to have a plan to pay for emergency expenses. Of those surveyed, the majority said they’d have to turn to a credit card — a potentially expensive option for most people — to afford a $1,000 pet emergency.

However, it’s also worth pointing out that the next most popular options (which amount to almost half of responses) were cash and savings. These are the most affordable payment options since both rely on existing funds rather than debt.

How to afford an emergency pet expense

As mentioned earlier, one way to avoid the stress that comes with an emergency pet expense is to have a solid plan in place for dealing with it, should the situation arise. The first step is knowing what your options are, and then you’ll be able to compare those options and select the one that works best for you and your finances.

Creating and funding a savings account specifically for those expenses is, of course, the best way to go since it would not involve taking on any debt. But that isn’t always realistic, and if something were to come up before you’d saved enough to cover the expense, you’d still have to find alternative options.

Personal loans

A personal loan is an unsecured loan that can be used to pay for pretty much anything (though there are limitations). To qualify, you’ll generally need to have good or excellent credit, or a qualified cosigner, as well as a low debt-to-income ratio and proof that you can repay the loan, like a steady income.

In general, the better your credit, the better the terms of your loan may be and the more likely you are to get approved in the first place. That said, there are lenders who offer bad credit personal loans, but those loans are usually more expensive and can even come with APRs comparable to that of a credit card. So it’s always a good idea to check out prequalification, which doesn’t impact your credit score, to compare your options.

Pros

- Interest rates are typically lower than for credit cards. Though interest rates for personal loans can be high, depending on your credit score, they are typically lower than they are for credit cards.

- Approval is usually fast. If you’re approved for a personal loan, you can get funding in your bank account in as little as a few days.

Cons

- You typically need good credit to get approved. Because personal loans are typically unsecured, lenders look more at your credit score and financial history for approval.

- You may have to pay fees. Personal loans may charge origination fees, which can range from 1% to 4% of your loan amount and increase overall costs.

Credit cards

In general, credit cards are the most expensive debt option. The average credit card APR is 15.13%, though it can be higher than 25%, depending on your credit score. The best way to avoid high interest payments is to charge the medical expense to your credit card and then pay off the balance before your next billing cycle, if you can afford to do that.

Another option is to use a 0% APR balance transfer credit card. These usually come with a 3% to 5% transfer fee and would allow you to pay off the debt over a number of months without having to pay any interest. However, this option is often limited to those with good or excellent credit.

Keep in mind that if you do apply for a new card, that will impact your credit score. That’s in addition to the fact that you’d be increasing your revolving credit, which also impacts your score. You’ll also want to be mindful to pay off your balance in full before the promotional period ends to avoid getting hit with a high interest rate.

If you choose to use a credit card to cover your pet’s emergency medical expenses, you’ll want to shop around for the best deal and do the math to make sure a balance transfer card is the best option for you before sending in any applications.

Pros

- You could avoid paying interest. If you qualify for a 0% APR introductory period — and you pay off your full balance before the promotional period ends — you could avoid paying any interest.

- You can space out repayment. Most introductory periods last from six to 18 months, giving you time to pay off the amount you borrowed to cover your pet’s emergency medical expense.

Cons

- You need good credit to qualify. Typically, low or zero-interest credit card offers are only available to those with good or great credit scores.

- Interest rates could be high. Depending on your credit score, you could pay an APR upwards of 25%.

Secured loan

Unlike most personal loans, secured loans rely on collateral, rather than credit. These include types of borrowing like a Home Equity Line of Credit (HELOC), secured cards and auto loans. Because they’re backed by collateral, secured loans can have lower interest rates and fees than unsecured loans, which means that they can be less expensive options for the right borrowers. So for those who don’t have great credit but do have assets that they are willing to put up as insurance that they will make their loan payments, this could be an option.

However, it’s worth noting that the secured loans space can be ripe for predatory loans. Payday loans, for example, are secured loans that are notorious for having exorbitant APRs, even ranging as high as triple digits. That often leaves people trapped in a debt cycle. And of course if you were to miss a payment on any kind of secured loan, your collateral is at risk for repossession.

Again, shopping around for the best secured loans, reading lender reviews and comparing your various options is vital to for those facing any unexpected expense.

Pros

- You don’t need great credit. Because your loan is backed by collateral, you don’t necessarily need great credit to get approved.

- They can have lower interest rates and fees. Because the loan poses less of a risk to the lender, you typically won’t have to pay as much in interest or fees.

Cons

- Your collateral is at risk. If you fail to repay your loan, your personal property, such as your car or house backing the loan may be repossessed.

- There’s the risk of predatory loans. Because predatory lending is prevalent in the secured loans space, you’ll need to be extra vigilant about prepayment penalties and exorbitantly high APRs.

Whether your best option for handling an emergency expense turns out to be a personal loan, credit card or secured loan will depend on your unique circumstances, risk tolerance and credit profile. Ultimately, your pet’s health should be a high priority, but that doesn’t mean you have to — or should — risk your long-term financial welfare to pay for emergency expenses. In reality, having a pet-emergency plan of action is a vital part of being a responsible pet owner, and doing so ensures not only that you’ll worry less about those potential costs, but also that your pet will be able to get the medical treatment they need, when they need it.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 760 pet owners, with the sample base proportioned to represent the general population. The survey was fielded July 1-3, 2019.

For the purposes of our survey, generations are defined as follows:

- Millennials are between the ages of 22 and 37

- Gen Xers are between the ages of 38 and 53

- Baby boomers are between the ages of 54 and 72