How Does LendingTree Get Paid?

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

Cash-Out Refinance, Home Equity Loan, or HELOC: Which Is Best For You?

Content was accurate at the time of publication.

Are you currently considering a cash-out refinance versus a home equity loan or HELOC? Knowing how each of these equity-tapping loans work will help you make a cost-effective choice that best helps you reach your financial goals. Let’s find out which financing option is the best fit for you.

| Cash-out refinance | Home equity loan | Home Equity Line of Credit (HELOC) |

|---|---|---|

| Only one mortgage payment | 2nd mortgage – doesn’t impact original loan | 2nd mortgage – doesn’t impact original loan |

| Better for lower credit score borrowers (620+) | Better for higher credit score borrowers (700+) | Better for higher credit score borrowers (700+) |

| A fixed, stable monthly payment | A fixed, stable monthly payment | Better for unpredictable funding needs |

| A fixed interest rate | Borrowers with a first mortgage they want to leave alone | Access to funds as needed |

| Better for borrowers with higher debt compared to their income | Better for borrowers with lower debt compared to their income | Better for borrowers with lower debt compared to their income |

How is a cash-out refinance loan is different from a home equity loan?

- The primary difference between a cash-out refinance loan and other home equity loan options is that a cash-out refinance loan converts one mortgage into a separate larger one.

- Every other home equity loan option creates a second mortgage on your home.

- With a traditional home equity loan, you take on a second mortgage at a fixed rate with up to 30 years for repayment.

- One thing to consider is the fees associated with each loan.

What is the difference between a home equity loan and line of credit (HELOC)?

- With a home equity loan, you get a lump sum at one time. The interest rate is fixed, and you pay the same monthly payment for the entire term of your loan.

- Home equity loans are often used for home improvements, one-time expenses and debt consolidation. However, there are no restrictions on how you use the money.

- With a home equity line of credit, you are given a credit line based on how much equity you have in your home. You can then access your credit line whenever you want, up to your credit limit. When you make your payment each month, that credit becomes available for use again, similar to a credit card.

- The interest rate on a home equity line of credit is variable, which means it can change to reflect current economic conditions. Because your outstanding line balance changes and the interest rate are variable, your payment could be different each month.

- Home equity lines of credit are commonly used for home improvements, vacations, college tuition or just to have access to cash whenever you need it.

What can the cash be used for?

You can use the money from a cash-out refinance for any purpose. Most homeowners use the proceeds for the following reasons:

- Home improvement projects – Some ideas include remodeling the kitchen or bathrooms or updating appliances and furnishings.

- Investment purposes – Cash-out refinancing offers homeowners access to capital to help build their retirement savings or purchase an investment property.

- Consolidate high-interest debt – Refinance rates tend to be lower compared to other forms of debt like credit cards. The proceeds allow you to pay these debts off and pay the loan back with one, lower-cost monthly payment instead.

- Child’s college education – College is expensive, so tapping into home equity can make sense if the interest rate is much lower than the rate for a student loan.

Note: On average, borrowers request to take $50-$100k in cash out of their homes for various purposes. Cash-out refinancing, home equity loans, and HELOCs are all great opportunities to leverage the cash in your home.

Here’s how to get started:

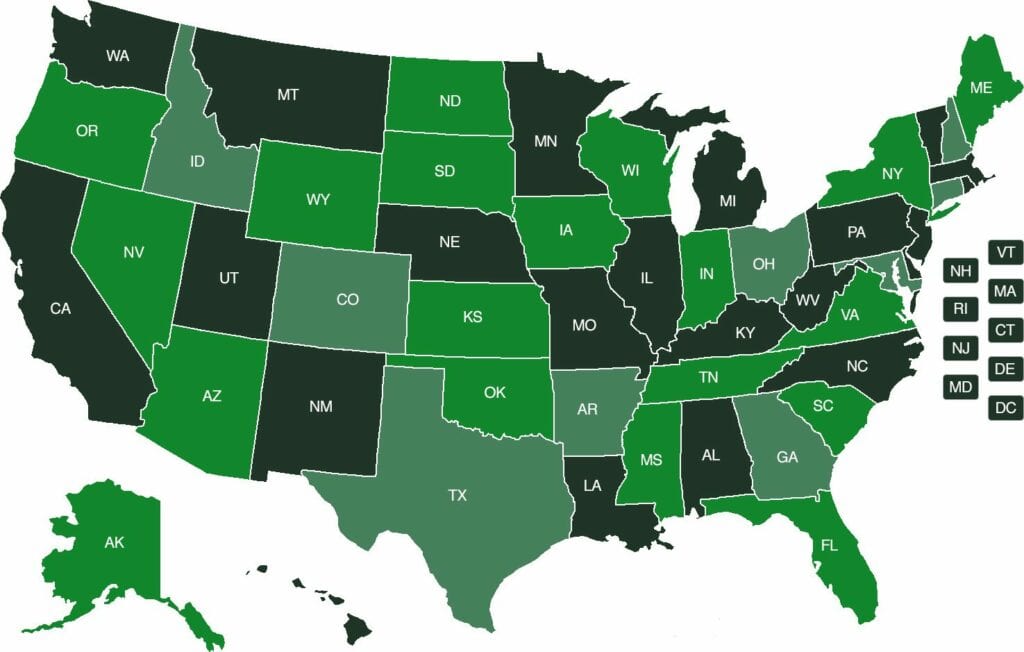

Step 1: Begin by selecting your state below.

Step 2: Once you go through a few questions, you will have the opportunity to compare quotes from multiple lenders!