The $42K Benefit that 89% of Veterans Haven’t Redeemed

It’s True: Decades-Old Veteran Home Loan Offer Still Works

Own A Home?

Here is the Briefing

- Get the Cash you need from a Cash out VA Refinance. Refinance up to 100% of your homes value, get your escrow refunded, plus get up to 2 months of skipped mortgage payments.

- Don’t Have a VA Loan? Interest rates are lower on a VA loan than a conventional mortgage. See how to transition to a mortgage with VA benefits.

- Have A VA Loan? Drop your payment with a VA streamline. Vets receive A No Appraisal VA loan and without any out-of-pocket expenses. Reduce your payment with a VA streamline. See how to transition to a mortgage with VA benefits.

In 1944, the United States Department of Veterans Affairs crafted a program that would help the country’s bravest conquer a domestic endeavor: homeownership. The program was designed as a “thank you” to service members that would reduce the hurdles to homebuying brought on by the financial sacrifices made while serving the country. But what few veterans know is that the program never expired. In fact, today’s record-low interest rates make it more lucrative than ever.

Borrow from Your Own Home

If participants fall on hard times, the equity built up in their home can act as an emergency savings account. Up to 100% of the value of your home can be borrowed–a loan from your very own investment.

Calculate Your Savings

When you add up the value of the PMI exemption and exclusive interest rate discount, the potential savings are nothing to sneeze at. The annual payments on a typical $250,000 loan could be $3,100 lower under a VA loan than a conventional home loan.*

No Additional Insurance Required

Typically, any homeowner with less than 20% equity in their home is required by their lender to purchase additional mortgage insurance (PMI) to cover the risk of a potential foreclosure. Not vets. Because VA loans are backed by the full faith and credit of the United States Government, no additional PMI is required. That exemption can save veterans hundreds of dollars per month alone.

Check Your Eligibility

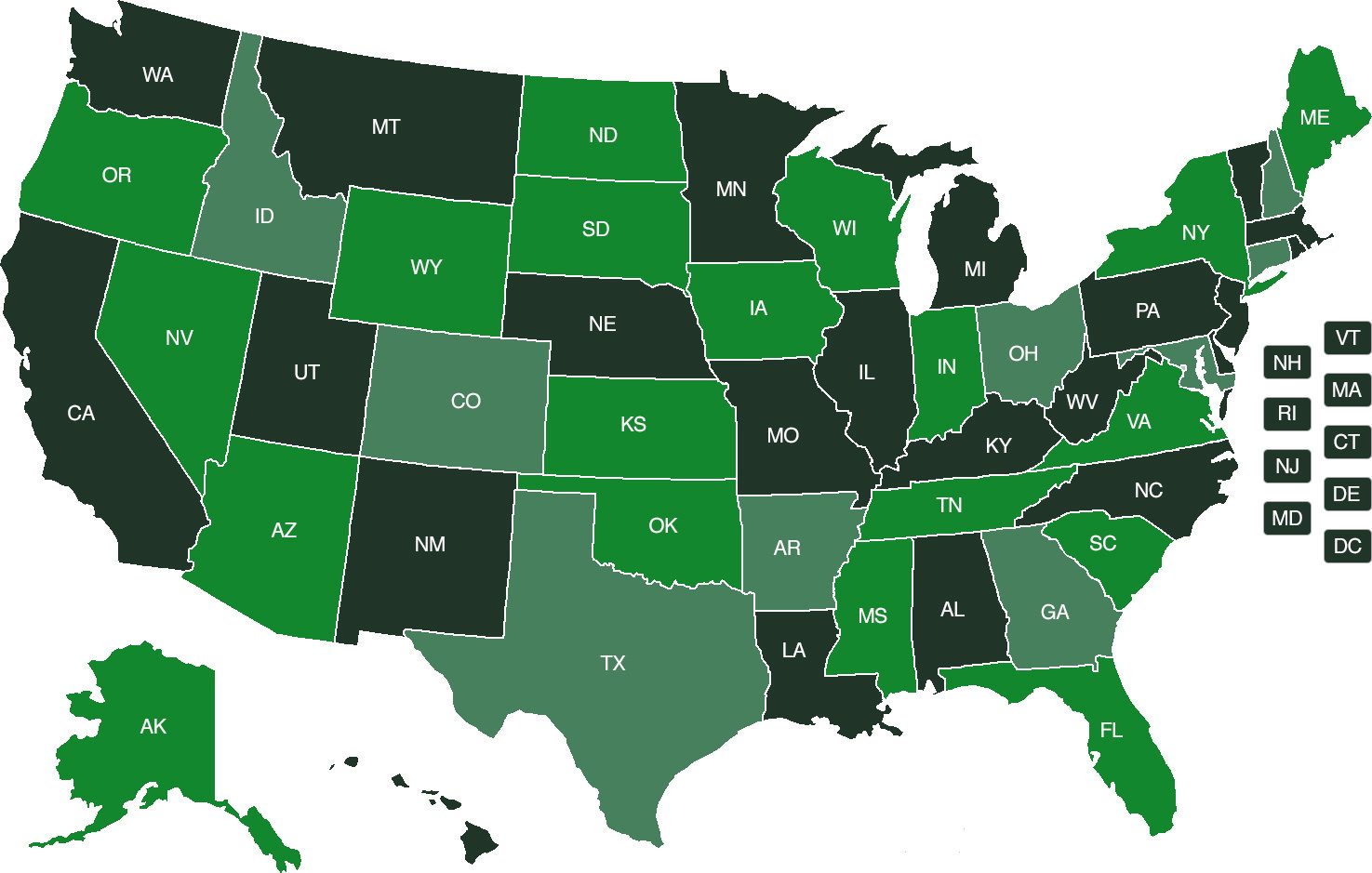

This special program requires a minimum service of between 90 days and 2 years for most veterans. Find out if you’re eligible by selecting your state from the map below.

P.S. Already have a home loan from a traditional lender?

You aren’t out of luck. Learn how to switch to a mortgage with VA benefits.

P.P.S. Have a VA loan but want to refinance for a lower rate?

You may be able to switch to a lower rate instantly, without any out-of-pocket cost. Learn more.