The Best 3-Month CD Rates

Is a 3-month CD right for you?

Three-month CDs are typically best for individuals looking to make short-term investments, but who are not keen on taking risks with their money. If you can relate to that sentiment, you may be interested in knowing which institutions are offering the best rates. Fortunately, we’ve done a lot of the heavy lifting for you by putting together this overview of the best 3 month CD rates. Here’s a look at how we chose them. (Jump down to our list of the best 3 month CD rates if you just want to see who made the list.)

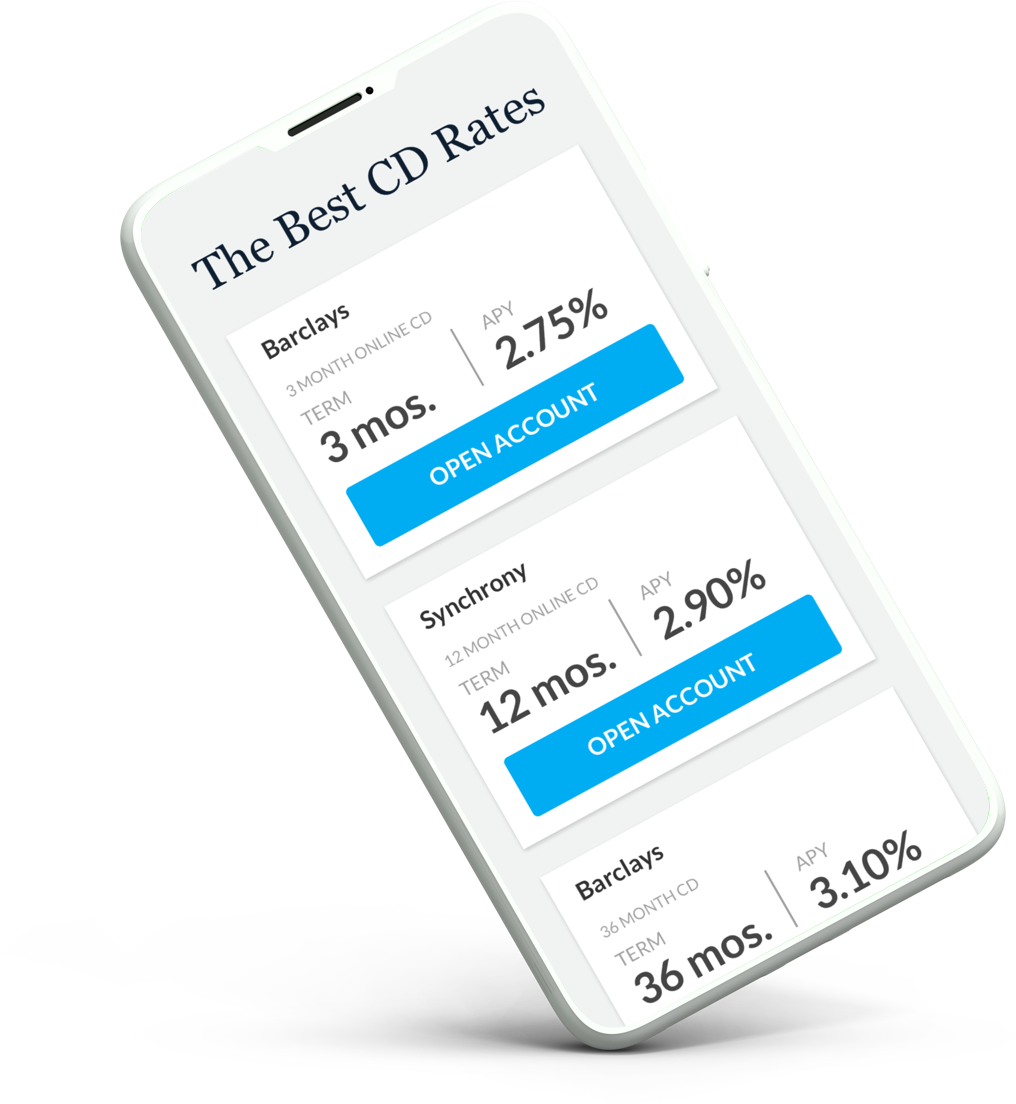

The Best 3-Month CD Rates

Bank/Institution

APY

Min to earn APY

FourLeaf Federal Credit Union

3 Month Certificate

USALLIANCE Financial

3 Month Certificate

Northpointe Bank

92 - 182 Day CD

How we chose the best 3 month CDs

We used data from DepositAccounts.com, a LendingTree company, to compare CD rates by annual percentage yield (APY). We excluded institutions with a health rating below a B, as well as credit unions with very restrictive membership requirements.

Next, we chose the ten CDs with the highest APY. If two CDs had the same APY, we broke the tie by choosing the one with the lower minimum deposit. (We consider the one with the lower minimum a better choice since it will be available to more people.)

All products discussed on this page are insured by either the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA).

Advantages and disadvantages of 3 month CDs

PROS

- People choose CDs over savings accounts because they offer a higher interest rate.

- Three-month CDs offer you the opportunity to make a higher interest rate, while still having access to your money in a relatively short amount of time.

- CDs are also insured up to $250,000 by the FDIC, unlike some riskier investments.

- Three-month CDs allow you to take advantage of a rising rates market.

CONS

- There are, however, disadvantages to short-term investments, primarily interest rates that are lower than those of long-term CD investments.

- In addition, your money is locked in for the full term.

- Most three-month CDs have a very steep penalty for early withdrawal that often means you’ll lose any interest you earn if you access your money before the CD matures

- Depending on the rate you’re earning, CDs also tend to lag behind inflation.

The best way to leverage those 3 month rates

CD laddering, as our subsidiary MagnifyMoney explains, is a great strategy to allow you to have frequent access to your money for reinvestment while still using long-term CDs as an investment strategy. If you have $1,000 to invest, it may look something like this:

-

Three-month CD: $250

-

Six-month CD: $250

-

Nine-month CD: $250

-

12-month CD: $250

When the CDs come to maturity, you could continue to reinvest at the current term or go with a longer term, for example, one year. Because of the staggered start times, you’ll have CDs coming to maturity every three months. You’ll usually earn higher rates from your longer-term CDs. However, you’ll still have frequent access to your funds as they mature in your shorter-term investments.