Tip 1

Create a simple budget

Budgeting is easier than it sounds, and it’s a great way to establish smart money habits. Here’s how to get started:

First, determine your monthly income.

This can include wages, tips, financial aid, savings, money from grandma — any cash you rely on every month. If your income varies, try tracking it for a couple of months to get an average number.

Then, add up your monthly spending.

Include fixed expenses that stay the same every month (like rent or your phone bill), plus estimate your variable expenses that change each month (like dining out and clothes shopping).

Identify any goals you’re working toward.

Keep your eye on the prize, whether you want to create an emergency fund, save for a study abroad trip, or cut down on spending. Establishing goals helps you figure out your finances.

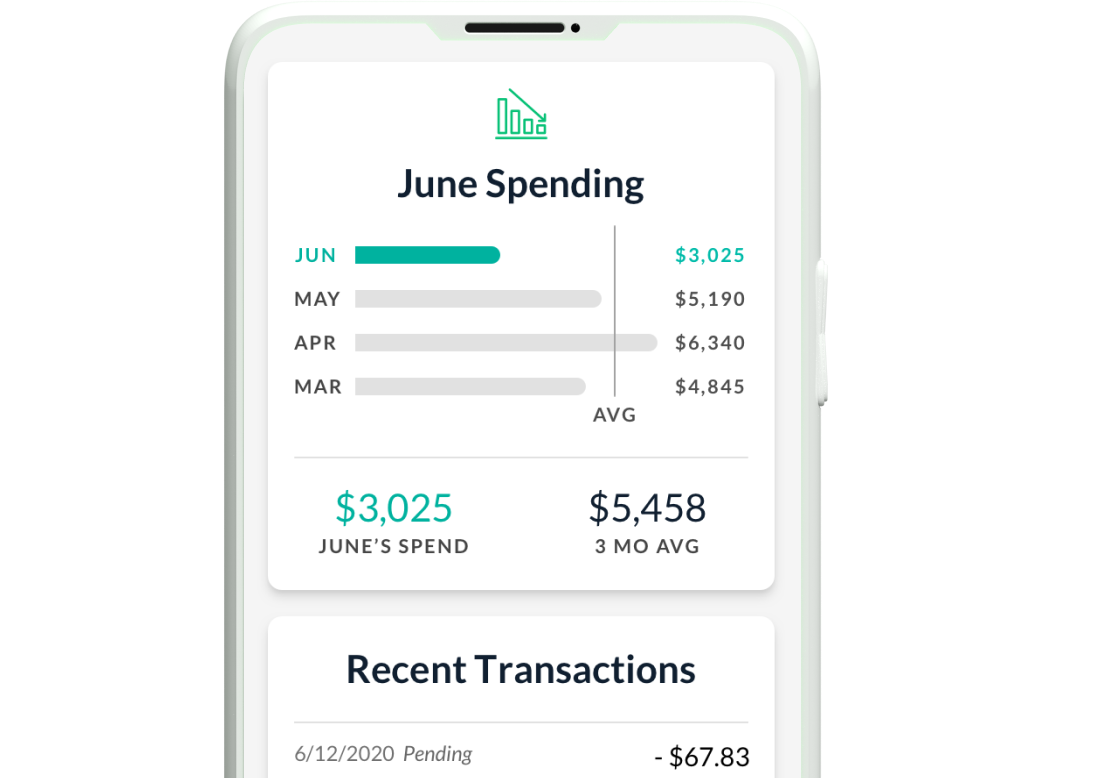

Get the LendingTree App for easier budgeting

With the free LendingTree app, you can link all your bank accounts to automatically track spending and saving and help reach your goals.

tip 2

Get to know your credit score

Your credit score is a number that determines your creditworthiness, or how likely you are to repay a loan. It’s based on factors like your payment history and what types of loans you have.

Credit scores can affect everything from your ability to get a credit card to the cost of your car payments — even landlords and employers may check your credit score when deciding if you’ll get that apartment or job.

Since credit scores are heavily impacted by credit history, lots of students haven’t had the chance to build good credit scores yet. That’s totally normal! Once you start getting loans and credit cards in your name (and making on-time payments), you’ll be one step closer to a great score and solid financial future.

Here are some things you can do to help:

Sign up to get your free credit score

Target your score to make sure everything is correct

Pay your bills on time, every time.

Consider getting a student credit card

Tip 3

Find a good student credit card

Credit cards aren’t for everyone, especially if you tend to overspend or are forgetful when it comes to dates and payments. But if you’re an organized and responsible spender, you could likely benefit from a credit card.

Credit cards help you build credit history, and on-time payments improve your credit score. Plus, credit cards often offer added perks and rewards like cash back and travel protection.

Not sure where to start?

We’ve rounded up some of the best student cards available at the moment:

| Best student credit cards of May 2022 | |

| Best for Cash Back | Discover it® Student Cash Back |

| Best student card for selecting a cashback rewards category based on your spending | Bank of America® Customized Cash Rewards Credit Card for Students |

| Best student card for flat-rate cashback rewards | Capital One Quicksilver Student Cash Rewards Credit Card |

| Best card for International students | Deserve® EDU Mastercard for Students |

| Best student card for an easy-to-earn sign-up bonus | Chase Freedom® Student credit card |

| Best student card for travel | Bank of America® Travel Rewards Credit Card for Students |

| Best student card for dining, entertainment, and groceries | Capital One SavorOne Student Cash Rewards Credit Card |

tip 4

Start saving and investing now

While you may not feel like you have enough money to save or invest right now, even a few dollars here and there can add up to big savings down the road.

Thanks to the time value of money, the longer your money has to compound and grow, the more you’ll have later. Just a few years can make a dramatic difference. Check it out:

Say you start investing $50 per month when you’re 25 years old, compounded monthly and averaging a 12% annual return. When you’re ready to retire at 65, you’ll have just under $600k.

But your friend starts investing $50 per month when they’re 20 years old, also compounded monthly and averaging a 12% annual return. When they retire at 65, they’ll have almost $1.1 million. That five-year difference is worth half a million dollars!

TIP 5

Fight fraud and college student scams

Budgeting is easier than it sounds, and it’s a great way to establish smart money habits. Here’s how to

get started:

-

Think before you share on social media.

Scammers can use your profile and posts to figure out email addresses, passwords and more. Set your accounts to private and be careful who you add to your network.

-

Be suspicious of unexpected calls and emails.

Don’t give out sensitive information to anyone who contacts you, even if they say they’re from your bank or a scholarship provider. Instead, hang up and call their official number to ensure you’re talking to the real people.

-

Consider using a credit card.

If you have a credit card, you may want to reach for it first when making a purchase. Most credit card companies offer robust fraud protection, so it won’t cost you if your card is lost or stolen.

-

Monitor your credit score.

Sign up for alerts to notify you when there’s new activity on your credit profile. That way, if you see something that you didn’t authorize (like someone applying for a loan in your name), you can stop potential fraud and protect yourself.