Across the country, Americans today have more debt than ever. In June 2017, the cumulative American household debt reached $12.84 trillion, a $114 billion increase from the first quarter of the year.

Of that debt, $1.34 trillion is made up of student loans, $8.69 trillion is mortgage debt and more than $1 trillion exists in the form of credit card debt.

To understand how Americans are managing debt and what their plans are for getting out of debt, we surveyed more than 1,000 people in July 2017 about their financial obligations — from how many years they thought it would take them to pay off their debt to how much their payments totaled each month, and how various factors (including children) impacted the amount of debt they accumulated.

Key findings

Debt isn’t just a financial matter. The burden of monthly bills and monetary obligations hovering over you can have serious emotional consequences. For the millions of Americans faced with debt each year, the first step to overcoming that sense of anger, depression or even shame might be making a plan to get from under what you owe.

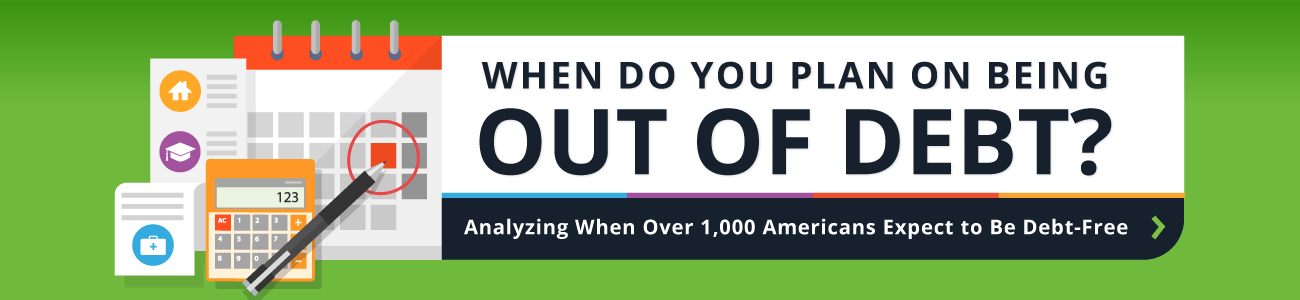

Our survey revealed that nearly three-quarters of Americans had a plan for getting out from underneath the burden of debt. With mortgage rates at a 30-year low in the U.S., 81 percent of Americans told us they had a plan to pay off their housing bills – more than with any other form of debt. Changing your payment structure, putting extra money toward the principal and refinancing into a shorter term are all options if you’re looking to pay that mortgage off quicker than according to a typical 30-year plan.

Like the rising housing debt, credit card debt is at an all-time high and accounted for just over $1 trillion as of July 2017. With more credit cards in American wallets and a total debt growing at nearly 5 percent each year, 73 percent of Americans told us they’d established a plan for paying off their credit card bills. While a majority said they had a blueprint to get out of credit card debt, more than 1 in 4 said they were unsure how they would reduce or eliminate revolving debt.

Debt Americans weren’t as sure about how to pay down? Students loans (30 percent) and medical debt (36 percent), and according to at least one study, medical debt is the leading cause of bankruptcy in the U.S.

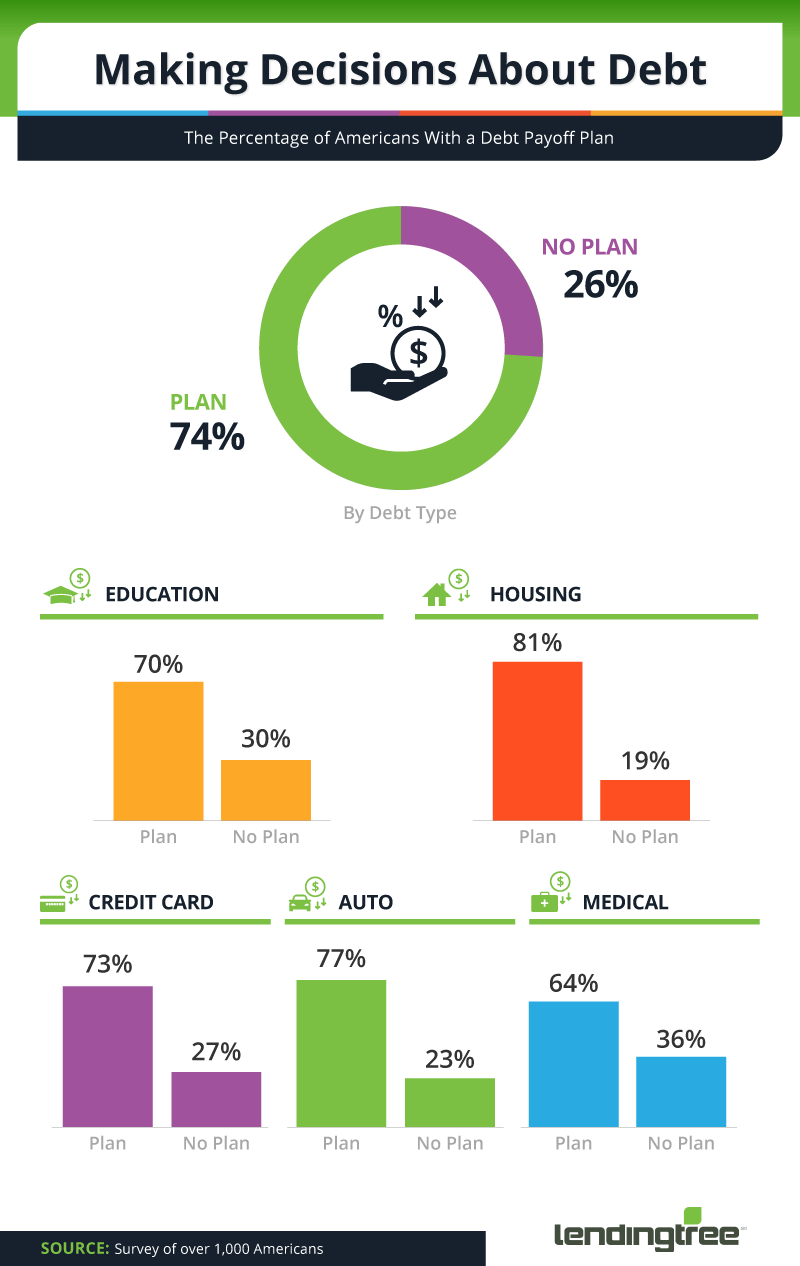

So just how far into the future do American debt relief plans stretch? Years, if not decades, in most cases.

On average, Americans told us they thought it would take them 22 years to pay off their housing debt. Of course, even that may be longer than necessary, and with the right plan in place, it’s feasible to pay off a home ahead of schedule. Though 30 years is the typical length of a mortgage, as recently as February 2015, 59 percent of mortgage applicants were refinancing their current homes, many to reduce their monthly payments. However, by choosing to save money now, they may be paying more in the long run. Lowering your payments could extend the lifetime of the loan, thereby increasing the interest and your total amount paid.

As with paying off their mortgages, Americans said it would take them more than two decades (24 years) to pay off their student loans. With more than 44 million people across the country facing student loan debt, the average graduating student in 2016 owed more than $28,000.

Like with mortgages, there are some key tactics you can keep in mind to help eliminate student loans from your life. Loan consolidation, repayment assistance through your employer and even refinancing are just a few of the options Americans have to get ahead of their student debt payments to eventually get rid of them entirely. Other than the standard 10-year payment plan, there are many government options to help Americans struggling with their student loan debt. There are 15-, 25- and 30-year plans available for those seeking lower monthly payments, but an extended lifetime on their loan. Another popular option offered by the government: income-based repayment plans that allow you to pay your loans based on your income.

Lastly, Americans indicated they expected to pay off their credit cards within six and a half years on average, and five years where medical debt and their auto loans are concerned. According to our survey, Americans with credit card debt owed, on average, $6,819, meaning that they expect to pay back over $1,000 a year to their credit card debt alone. In all, 82 percent of respondents with credit card debt admitted to paying on time, while the other 18 percent may find themselves subject to recurring late penalties that average anywhere from $25 to $35 a month, depending on their creditor.

The length of auto loans has steadily increased since 2002, according to one source. As Americans seek to lower their monthly debt payments, they find themselves seeking longer loans on just about everything — even their cars. Longer, 72- and 84-month leases have become increasingly popular, meaning that car owners will be paying off their vehicles 10 or 20 percent longer than they used to. Cars are a depreciating asset, and typically lose 22 percent of their value within the first year, so buyers looking for longer auto loans should consider all aspects of their loan before opting for lower monthly payments.

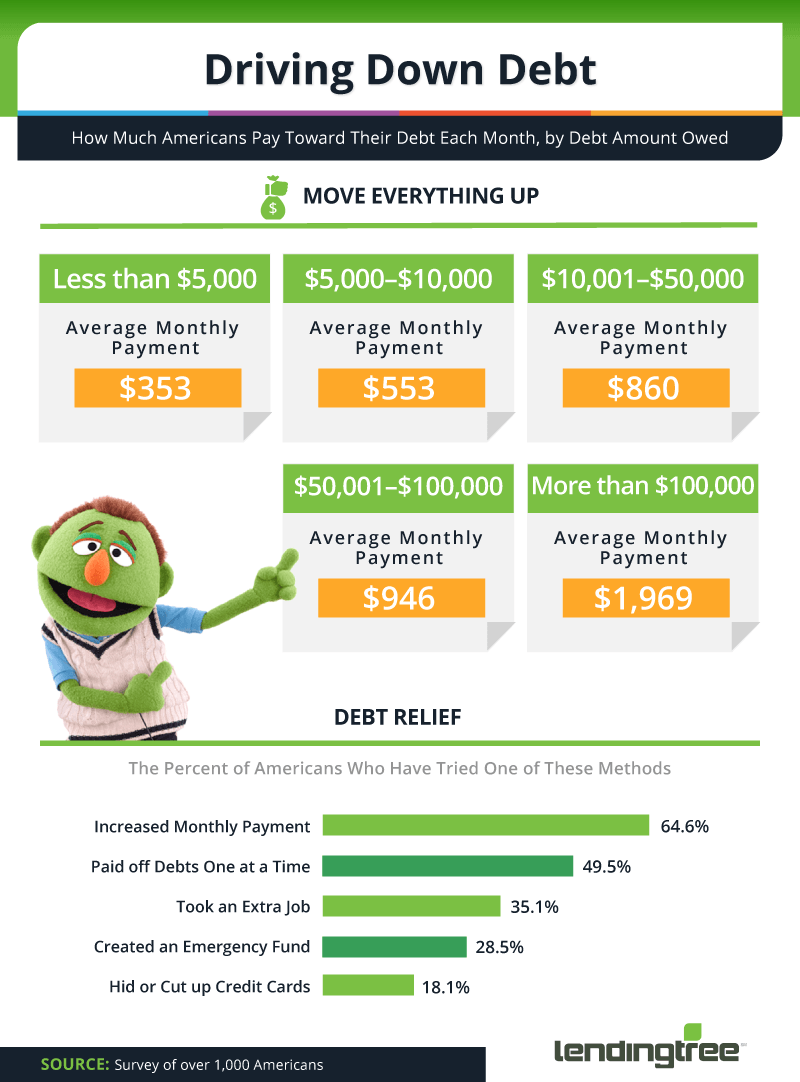

It may be an obvious assumption that the less debt you have, the lower your monthly payments would be, and the more debt you have, the larger your monthly payments would be. So it could be expected that Americans with less than $5,000 in total debt said they had the lowest overall monthly payments on those obligations – $353. Meanwhile, debt over $100,000 created the highest overall monthly burden on Americans. People with more than $100,000 in various forms of debt indicated paying $1,969 to cover those expenses.

Americans have tried a variety of methods to pay off their debt, or to prevent accruing new debt, our survey revealed that almost 65 percent of Americans have increased monthly payments, nearly 50% paid their debts off one at a time, and 35 percent took an extra job. More than one in four people have created an emergency fund to aid with future financial strife, and almost 20 percent hid or cut up credit cards.

If you think debt only impacts your financial life, you might want to reconsider that position. Studies have shown debt can have a negative impact on your love life. In many cases, large sums of debt like the kind accumulated in student loans can be viewed as “baggage” by a significant other and could even ultimately be a deal breaker.

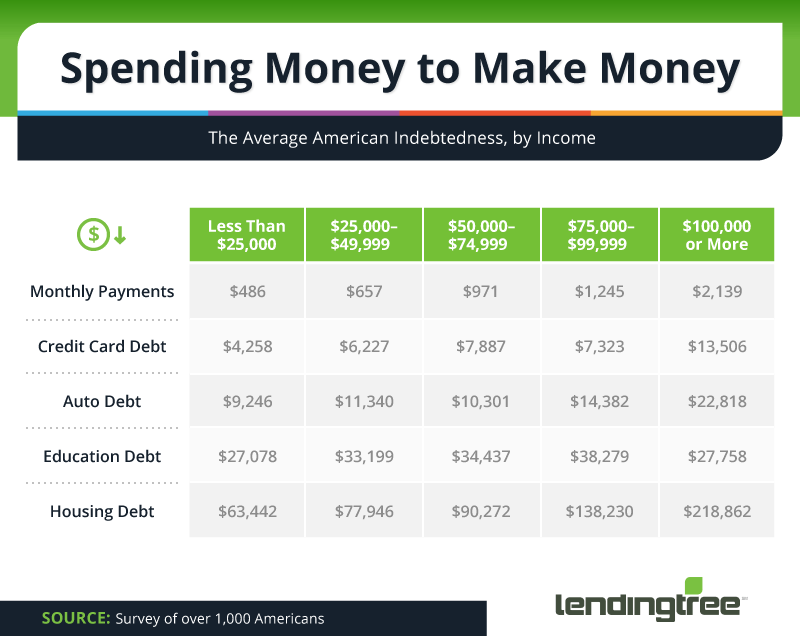

Americans’ average indebtedness varied by income, as to be expected. However, the credit card debt of Americans who make $100,000 or more was over $13,000 — nearly double that of any other income bracket, and triple the credit card debt of people making less than $25,000.

Meanwhile, education debt continued to be a burden for everyone, with every income bracket reporting that they owed no less than $27,000, on average. Americans making between $75,000 and $99,999 reported the most average education debt, at just over $38,000.

Perhaps this is surprising to some, as it could be expected that those with higher incomes have the ability to pay off their debt quicker. However, studies have shown that many upper-middle-class Americans live paycheck to paycheck, and more than 1 in 3 American households typically spend more than they earn.

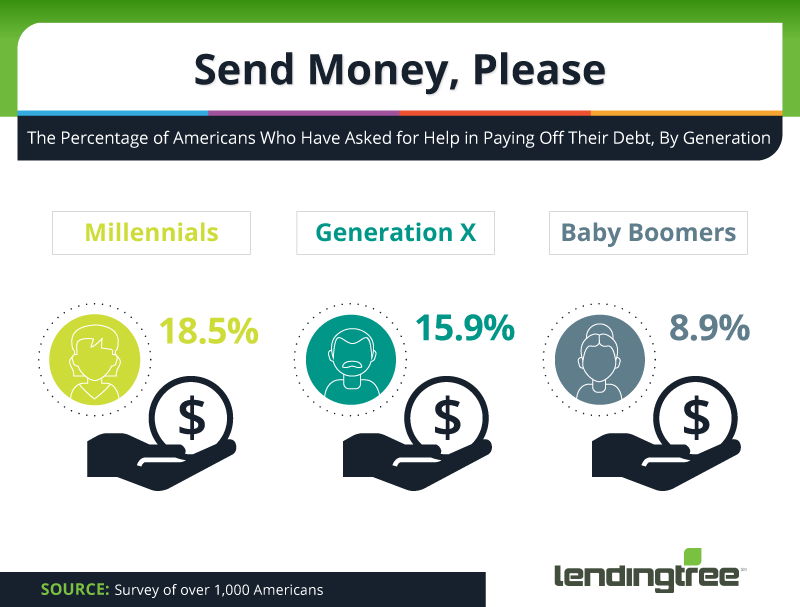

According to one study, millennials hold an estimated $1.1 trillion of the country’s $3.6 trillion consumer debt. It’s clear that millennials don’t have a great relationship with debt, and they’re earning less today on average than any generation in the last 30 years. That level of financial hardship may make them more likely to ask for help paying their bills than any other generation.

Our study revealed that 18.5 percent of Americans under the age of 37 admitted to asking for money, compared with 15.9 percent of Gen Xers and less than 10 percent of baby boomers. If you’re looking to avoid the awkwardness of asking for money, consider implementing a strict budget, setting aside some extra money for emergencies or even seeking professional advice to help keep your finances in order.

Raising children may be among the most extraordinary human experiences for some, but it’s also among the most costly.

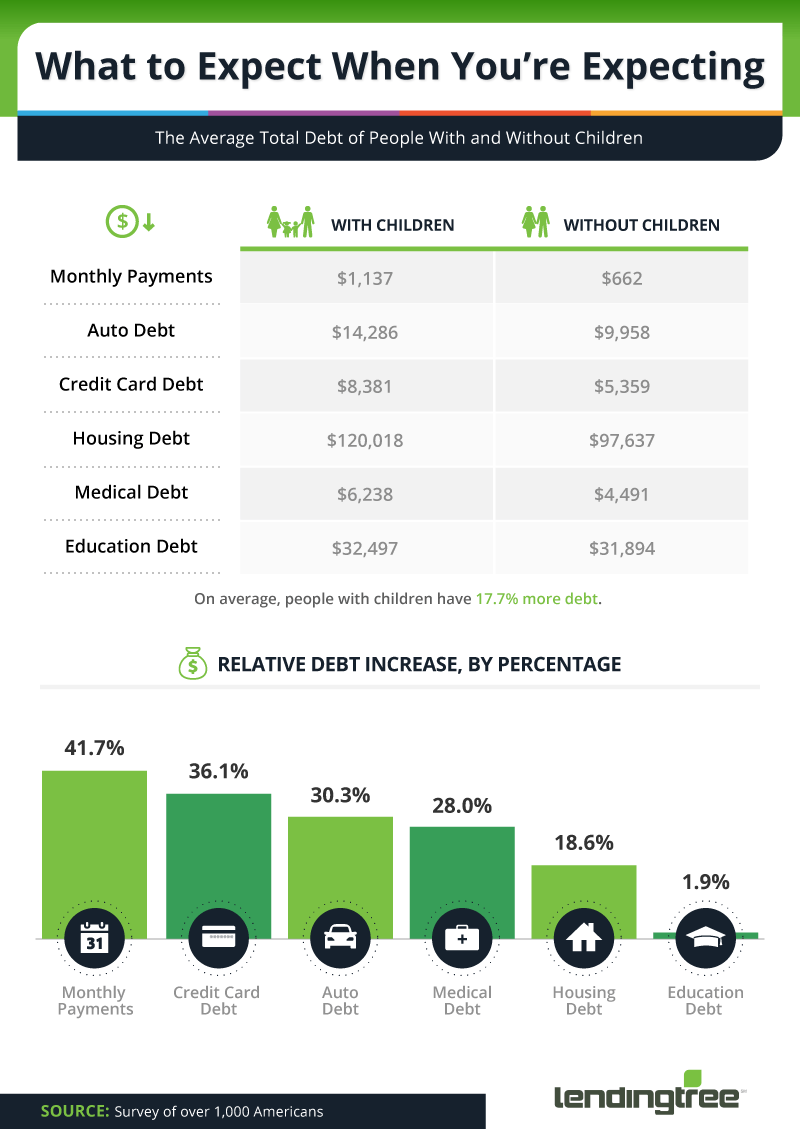

The average cost to raise a child in the U.S. today adds up to nearly $234,000 — or $12,000 to $14,000 each year. On average, Americans with children had 17.7 percent more debt than those without, the impact of which can reach far beyond the wallet for both parents and children.

The amount of debt increased in every category we studied, with the biggest increase in credit card debt, where Americans with children revealed that they were 36.1 percent more in debt than their counterparts without children. Auto debt wasn’t far behind — Americans with children were 30.3 percent more indebted, reporting their average auto debt to be $14,286 compared to $9,958 for those without children.

While research shows that parents having housing debt can act as a benefit for children, credit card debt could have negative behavioral ramifications. Parents with more debt were more likely to have children with behavior issues compared to those with less — a connection that grew when their debt was unsecured (as with credit cards). Parents’ fear and anxiety over financial struggles can trickle down to their children, potentially playing a negative role in their development and well-being.

One debt that didn’t increase much? Education debt. With only a 1.9 percent increase in debt for Americans with children, education debt continues to be a significant burden to everyone regardless of their life decisions.

The tools you need, today

Four in 5 Americans are in debt. While those obligations may range from student loans and mortgages to credit cards and medical debt, Americans polled expected it would take them five to seven years to fully pay off auto, credit card and medical debts, and more than two decades for student loans and mortgages.

Methodology

We surveyed more than 1,000 Americans online in July 2017 about their levels of debt, repayment plans and estimations of when they would be debt-free. The survey was weighted to the U.S. Census Bureau’s 2015 American Community Survey for age and gender.

Sources

Fair Use Statement

Do you like what you see? We encourage journalists to use any of the graphics included in the above piece for noncommercial purposes. Just make sure to give credit where it’s due by properly citing LendingTree.com in your coverage as well as providing a link back to this page.