When we think of a relationship, we tend to consider obvious things: love, kids, a long life together. A topic that isn’t so obvious when it comes to your significant other but impacts your financial future? Debt.

So, who does think of debt when they consider a partner? The answer is actually more people than you may think. According to a study completed by Utah State University, couples that argue about finances once a week are more than 30 percent more likely to divorce than couples that argue about money a few times a month. The more debt and money problems there are, the harder it is to be happy in your relationship.

Finding the person to spend the rest of your life with is an amazing feeling, but what happens if your true love has amazing, outstanding debt? To learn more, we surveyed people to find out how different amounts of debt and money might affect potential romantic relationships.

Does Debt Really Matter?

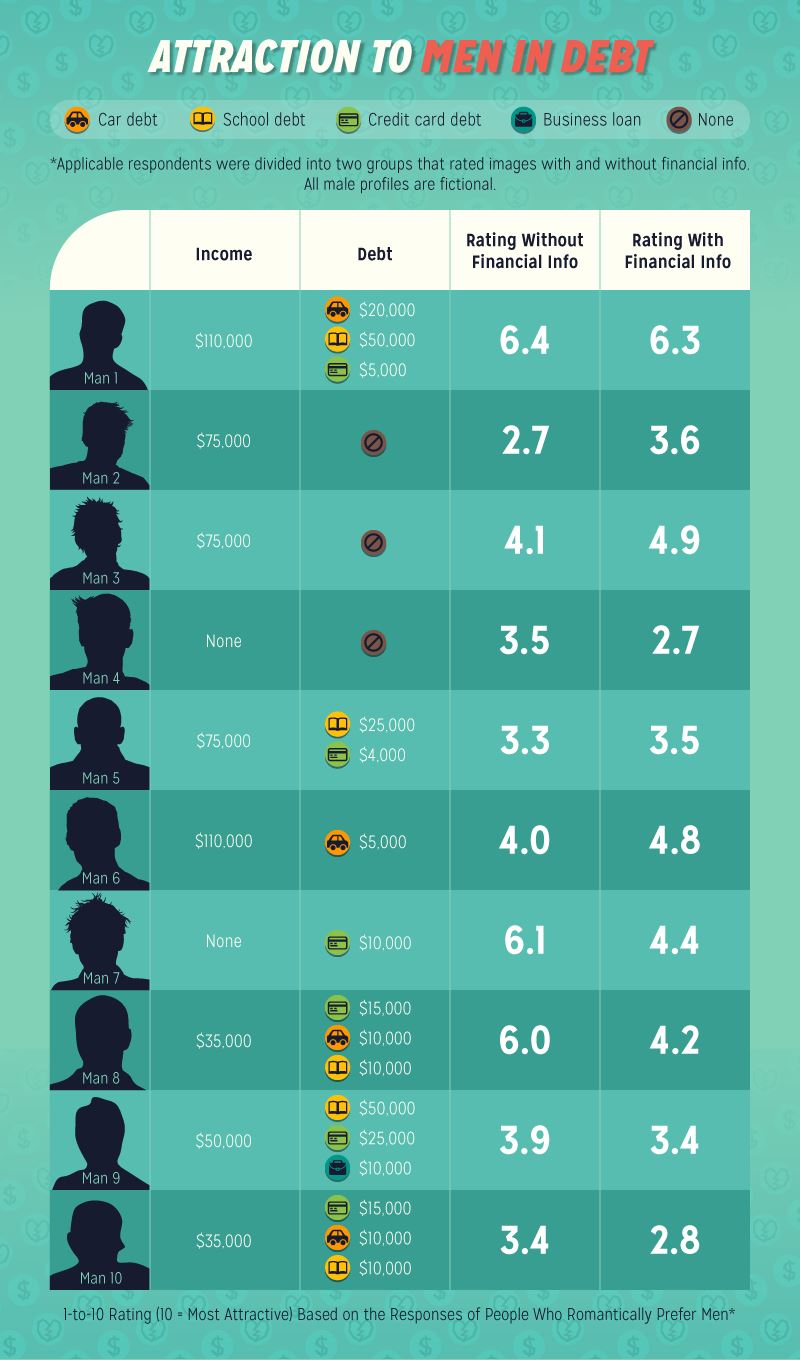

We showed our survey respondents generic headshots of fictional men. The respondents rated the men on looks alone. Participants rated a second fictional man with fictional finance information attached (e.g., debt and income). We compared the attractiveness scores.

The results show a man’s attractiveness went up only when his debt was no more than half of his income. Fictional “Man 1” had one of the larger incomes, but because his debt was over half of his income his rating decreased. “Man 8” had the greatest decrease of attractiveness; his income and debt were the same and his attractiveness dropped from a 6.0 to a 4.2.

Debt can be a real deal breaker when it comes to being in a relationship. Some find it difficult to picture a future with a seemingly financially irresponsible person because romantic partnerships often involve house-buying and college-fund-planning as well as other important economic decisions.

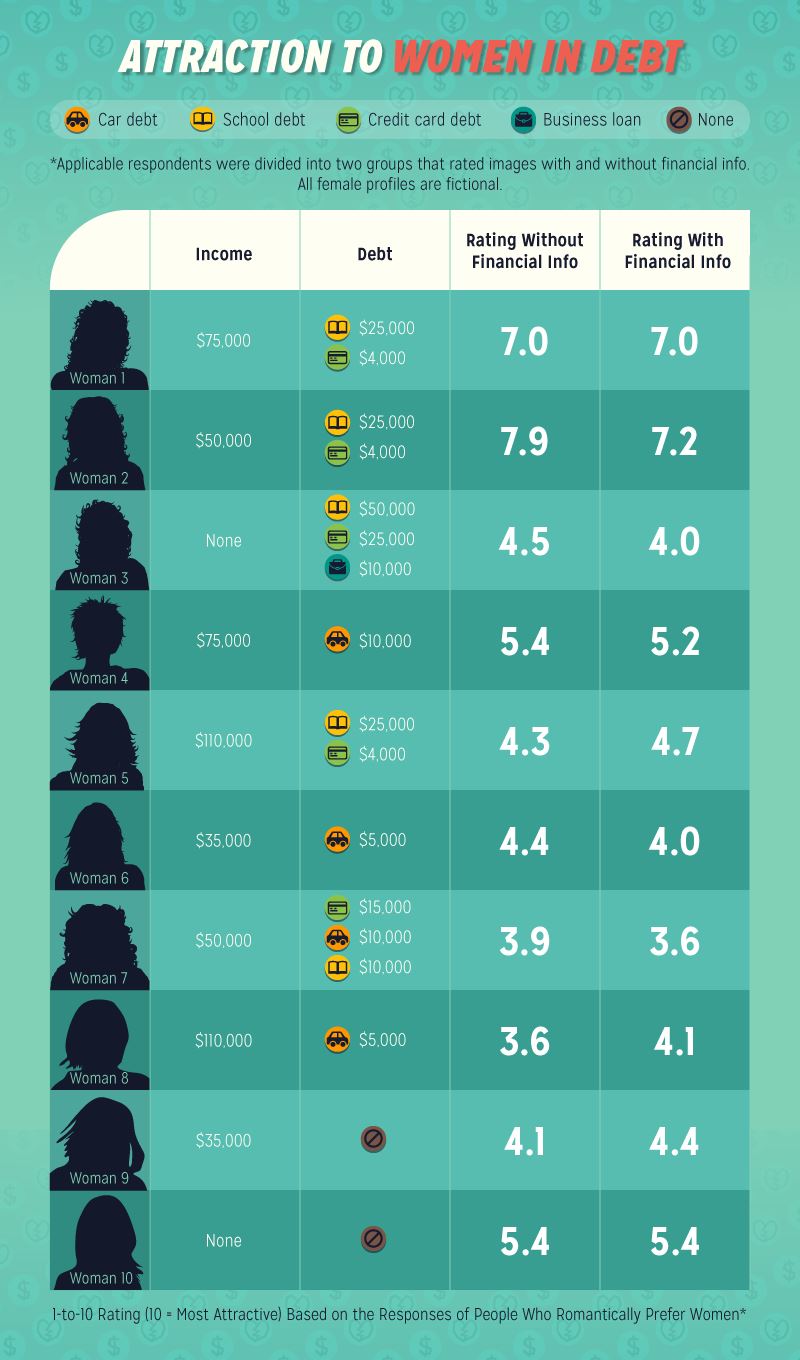

We applied the same profile analysis to a group of fictional women. In the financial situations of the women, the results are a little different than those of the men. Both men and women agree that attractiveness goes up when income is significantly higher than debt.

However, in the hypothetical situations of the women, the attractiveness rating didn’t change when “Woman 10” was shown to not have debt or income. Also, the ratings of the women didn’t change by nearly as much as the men’s ratings did. The greatest decrease in attractiveness comes from “Woman 2”; her attractiveness lowered from 7.9 to 7.2.

Based on our results, the higher the debt compared with income, the less attractive someone may seem. Survey results also showed leniency when it came to student loan debt. Of the fictional scenarios where income outweighs debt, having more school debt didn’t hurt the attractiveness of the person as much as having greater car or credit card debt.

According to TIME Money, financial obligations like home mortgages and student loans are referred to as “good” debt and “bad” debt (credit card debt would be considered bad, for instance). Trying to better yourself by going to school and racking up student loans or taking out a mortgage on a house look better than maxing out a credit card to buy a new flat-screen TV or the latest sports car on a bicycle budget. Regardless, debt is debt; unless you have a plan to take care of it, it could be the end of a relationship before it really begins.

Men vs. Women

Does Gender Play a Role in Money Making?

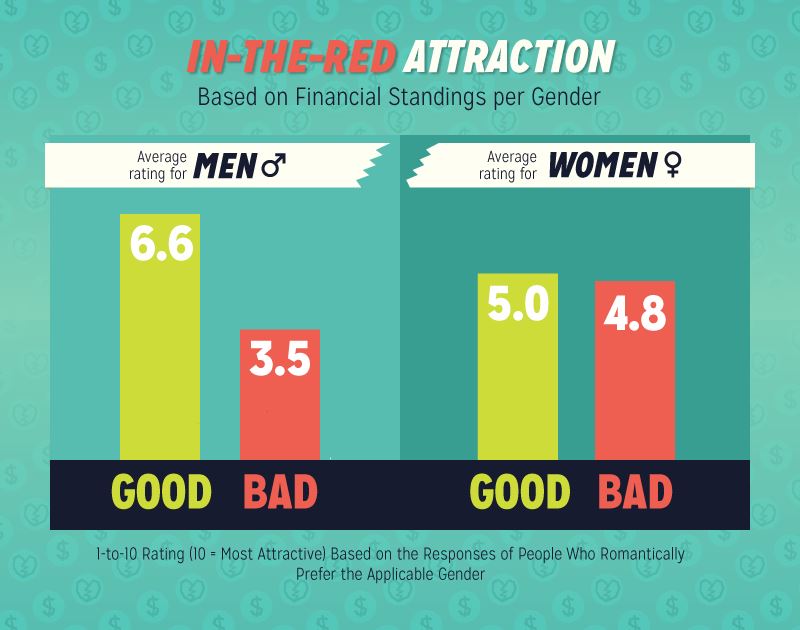

Our survey results showed a large gap between gender ratings when it came to the impact of debt on attractiveness. For the women rated in the study, there was very little difference between the average rating of the women in good financial standings versus those in bad standings. For our fictional male profiles, respondents rated a good financial standing nearly two times higher than a bad one.

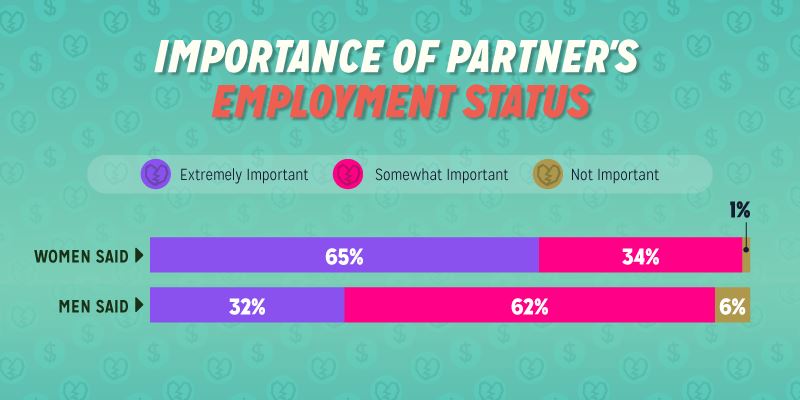

Sixty-five percent of female survey respondents said it was extremely important for their partner to work. Business News Daily came to a similar conclusion; it found that 75 percent of women said it was unlikely that they’d date a man who was unemployed.

In the same Business News Daily study, 46 percent of men said they would date someone who was unemployed. In our study, less than a third of men considered their partner being employed as “extremely important”.

More Debt, Less Attractive

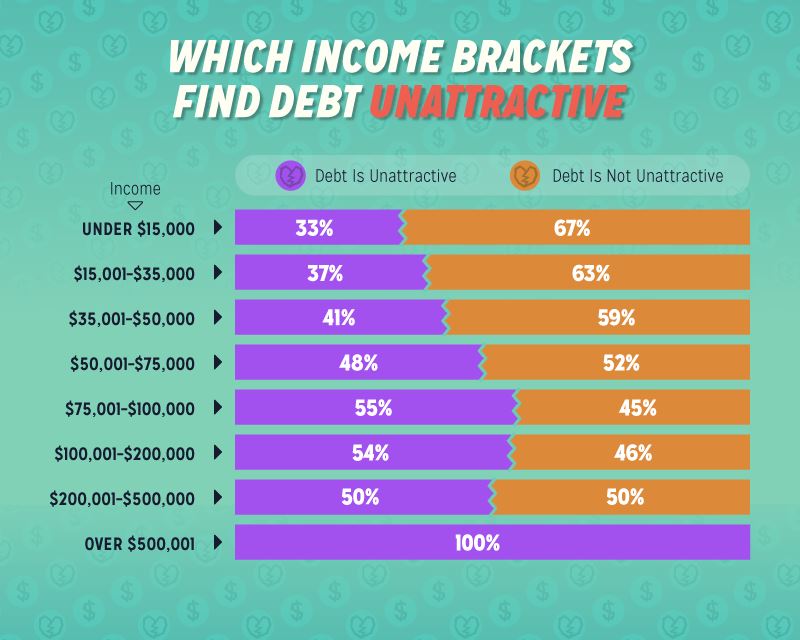

We divided survey participants into income groups and asked if debt makes someone less attractive. Most people with a lower income said debt doesn’t make someone less attractive. As income increased, purse strings tightened and hearts closed. Respondents at the $75,000-mark were nearly split. Those making over $500,001 agreed debt makes someone unattractive.

Dating and Marriage: Can Debt Affect Your Future Together?

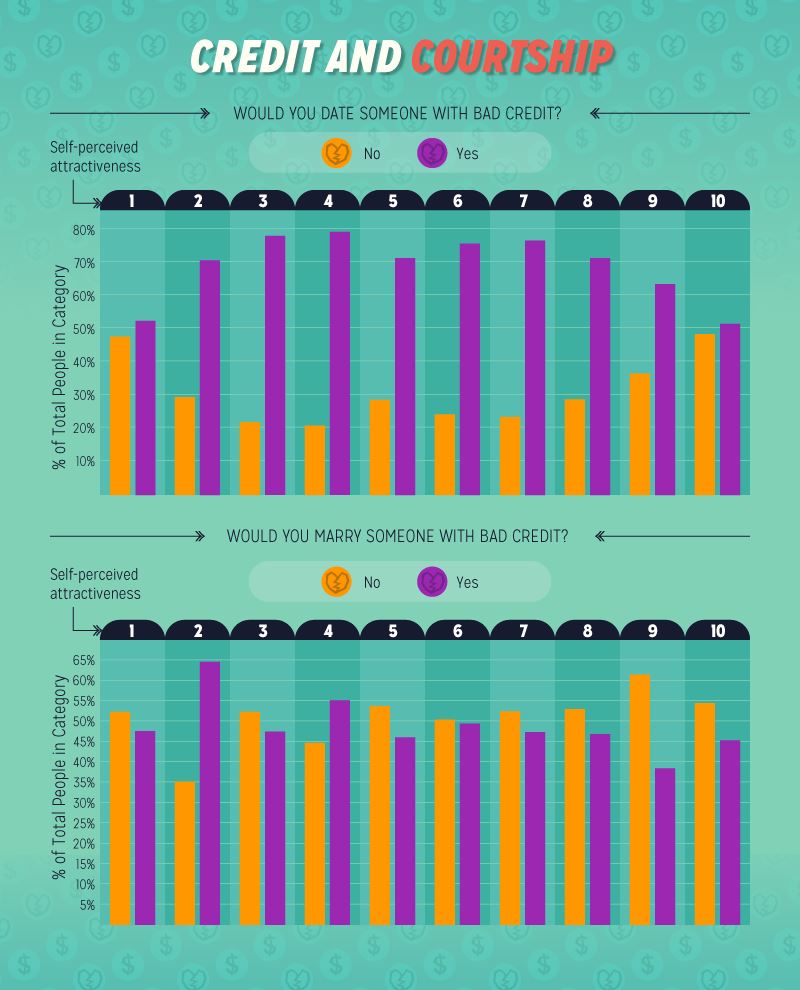

People who are in the dating game and battling a sub-par credit score will be relieved to know that most people are open to dating someone with bad credit. For the most part, people who rated their own attractiveness between 2 and 9 said they were ok with dating someone with poor credit. However, their opinions changed significantly when asked if they would marry someone with bad credit.

According to Forbes, if you’re considering marriage with someone, an important step is sitting down to review each other’s credit. The lesson here: don’t wait until you’re ready to get married to work on improving your credit score!

The Importance of Finances Before Dating

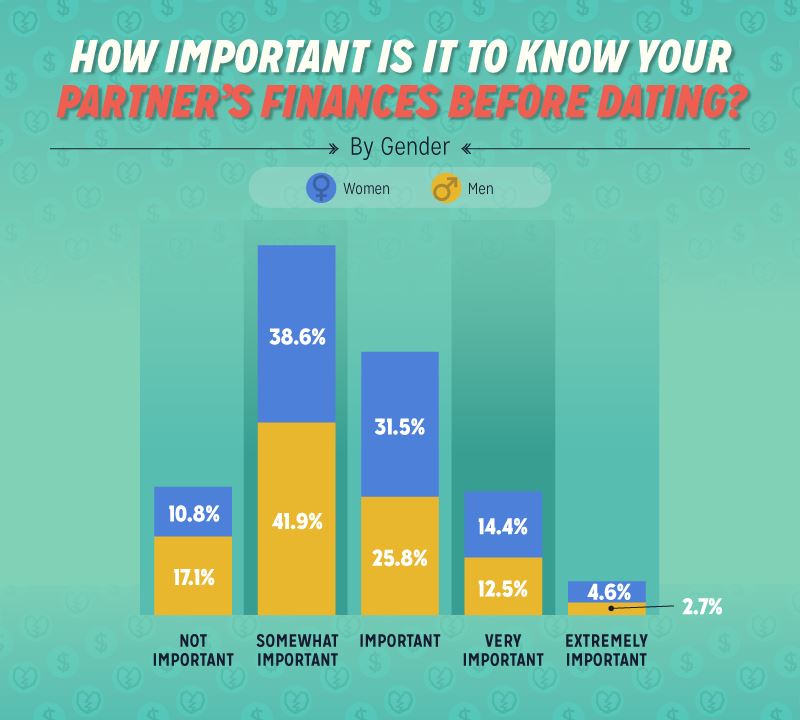

Based on our survey, most participants responded it is at least somewhat important to know about their partner’s finances before dating. 10.8 percent of female respondents and 17.1 percent of male respondents said finances weren’t important at all when getting to know someone. There were only a few who believed their partner’s finances would be something extremely important to know before dating.

According to Mental Floss, it is best to use the time early in a relationship to discuss personal finances – when you both are exceptionally happy and kind to each other, and still getting to know one another. It’s better to have the conversation early because both parties may not be so open later in the relationship.

The Importance of Finances Before Marriage

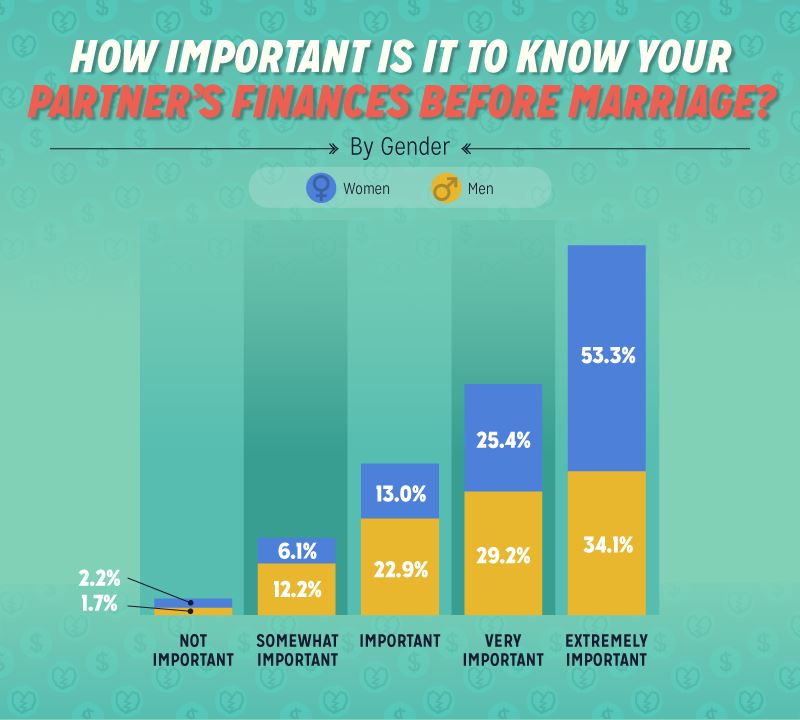

Knowing your partner’s finances before marriage seemed to matter a lot more to participants. More than half of the female respondents said it is extremely important to know their significant other’s financial situation before tying the knot. Less than 4 percent of all participants said that it is not important at all.

A recent survey conducted by Experian shows 59 percent of divorcees consider finance to be a key factor in their break-ups. Forty-seven percent didn’t even know their spouse’s credit score until after they married. Having a finance discussion prior to marriage can potentially save your relationship from ending prematurely.

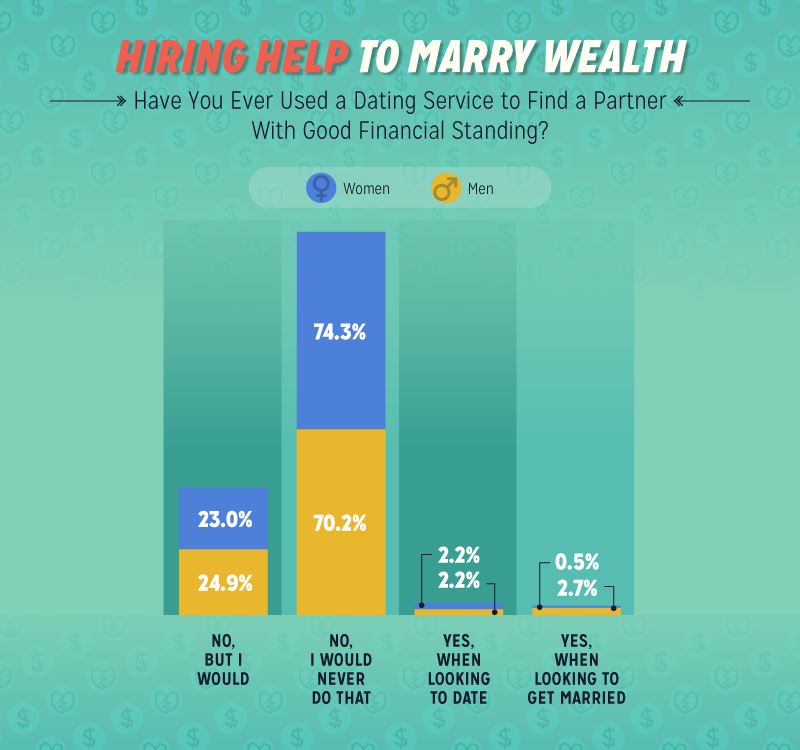

Financial Security Through Dating Services

An alternative to finding a partner in the real world is to use a dating service. Though it may seem uncommon, there are dating sites set up solely for the purpose of finding a partner who is financially stable. We asked participants if they would use a dating service to find someone based on their financial standing. More than 70 percent of both male and female respondents said they would never use that type of service, but nearly a quarter of men and women said they would be willing to give it a try.

According to a survey by the Pew Research Center, only 28 percent of the general public thinks of financial stability as a very important reason to get married. Using a dating service related to financial security doesn’t seem to be a popular way to find a soul mate.

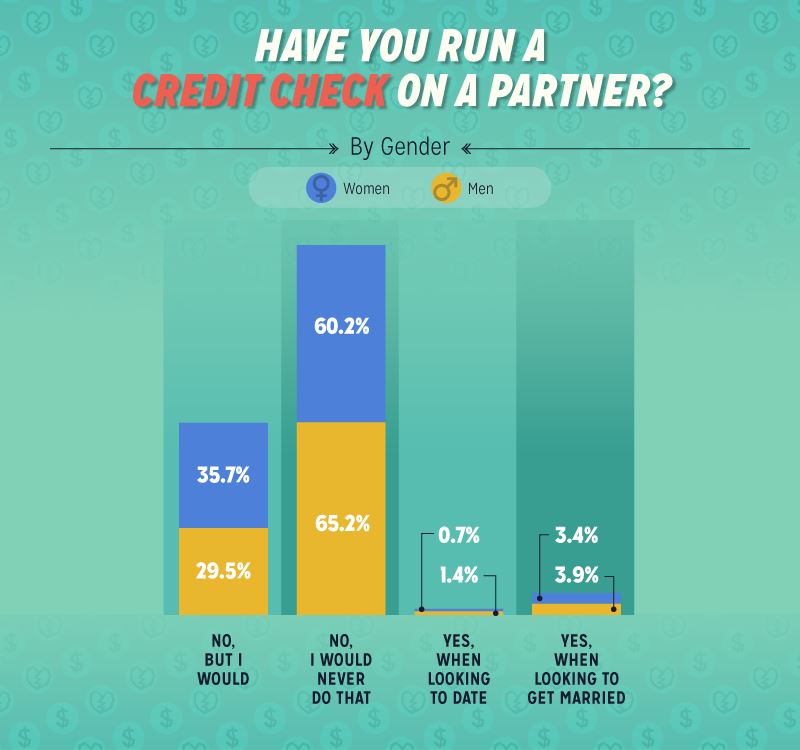

Is Checking Your Partner’s Credit Crossing the Line?

When you want to find out someone’s financial standing without asking, a credit check should suffice. But if you could check, would you? Most respondents said they draw the line somewhere before checking their partner’s credit. However, 4.1 percent of women and 5.3 percent of men said they have checked their partner’s credit score at some point, and roughly 35 percent of women and 30 percent of men said they hadn’t in previous relationships, but they would.

Hiding money from a significant other can be disastrous in a relationship. According to CNBC, 1 in 6 newlyweds admit they are hiding a financial account from their partner. Finding out a spouse is hiding money from you can be upsetting, but it may be more upsetting to find out your spouse ran a credit check on you without your permission.

Devotion to Debt

Mixing love-and-money can be tricky, but with the right person (or by yourself) it’s always possible to get ahead of debt. A steady income and carefully managed finances can put you ahead of the debt curve. Some people suggest resolving debts before getting married, but we all know love doesn’t always wait. It is possible to be in love and in debt if you’re investing in both.

If you or your partner are struggling to get out of debt or need help managing your finances, visit LendingTree.com or call 800-813-4620.

Methodology

This study consisted of two sets of surveys. First, we surveyed 2,000 Americans about their opinions on debt and personal relationships. There were two different versions of the survey: version one, in which people were shown generic headshots of men or women, and asked to rate them on looks alone; and version two, a second profile in which participants were asked to rate the same images with fictional finance information attached (e.g., debt and income). By comparing the ratings of each hypothetical person, we could visualize the differences in ratings when financial information was factored into the equation. The second survey was given to 1,008 Americans and focused specifically on their opinions of credit score and its effect on attractiveness. The first six graphics were created from the first set of surveys of 2,000 people, while the final four sections are based from the second survey of 1,008 people.

Sources

http://www.countryfinancialsecurityblog.com/til-debt-due-us-part/

http://time.com/money/4185220/credit-card-debt-embarrassing/

http://time.com/money/4192436/credit-card-debt-love/

http://www.businessnewsdaily.com/2753-dating-unemployed-men-women.html

http://www.theatlantic.com/business/archive/2015/07/couples-student-loans-love-debt/398606/

http://www.forbes.com/sites/heatherstruck/2011/07/20/credit-score-fico-can-hurt-you/#4a36a1cb5b81

http://mentalfloss.com/article/76054/how-and-when-talk-about-money-new-relationship

http://www.experian.com/blogs/ask-experian/survey-results-when-divorce-does-damage-to-your-credit/

http://www.pewsocialtrends.org/2013/06/13/chapter-4-marriage-and-parenting/#reasons-for-getting-married

http://www.cnbc.com/2016/05/03/spouses-hide-this-money-secret.html

Fair Use Statement

Do you like what you see? We encourage journalists to use any of the graphics included in the above piece for noncommercial purposes. Just make sure to give credit where it’s due by properly citing LendingTree.com in your coverage as well as providing a link back to this page.