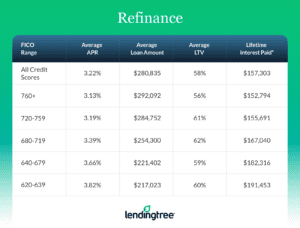

The LendingTree Monthly Mortgage Offers Report contains data from actual loan terms offered to borrowers on LendingTree.com by lenders. We believe it’s an important addition to standard industry surveys and reports on mortgage rates. Most quoted industry rates are for a hypothetical borrower with prime credit who makes a 20% down payment. However, most borrowers do not fit this profile. Our report included the average quoted APR by credit score, together with the average down payment and other metrics described below. We stratified by credit score, so borrowers have added information on how their credit profile affects their loan prospects. The report covers conforming, 30-year fixed loans for both purchase and refinance.

- APR: Actual APR offers to borrowers on our platform.

- Down payment: Though analogous to the loan-to-value ratio (LTV), we find that borrowers identify more closely with the down payment amount. Academic studies have also found that the down payment is the primary concern for homebuyers and is one of the main barriers to entering the homebuying market.

- Loan amount: The average loan amount borrowers are offered.

- LTV: Actual LTV ratio offered to borrowers on our platform. The LTV ratio is a formula that divides the loan amount by the home’s value to assess a borrower’s lending risk.

- Lifetime interest paid: This is the total cost a borrower incurs for the loan, inclusive of fees.