6 Reasons Homeowners Are Refinancing Through LendingTree

1. Refinancing Could Save You Tons

Refinance rates continue to drop, now reaching their lowest rates since the fall of 2016.

These rates have lenders dealing with more refinance applications than they can handle, but this might not last long. Current rates could save 11.3 million homeowners an average $268/month by refinancing today. But don’t wait to check, rates might start to rise at any moment.

The savings don’t stop there. You’ll get to hold on to a lot more of your hard-earned cash by doing one thing: paying your mortgage off faster. Take this account from a borrower writing on morningfinance.com: when he put pencil to paper, it turned out that 72% of the monthly payment on a 30-year mortgage was going straight to interest. By switching to a 15-year mortgage, he could save $159,447.09 in pure interest.

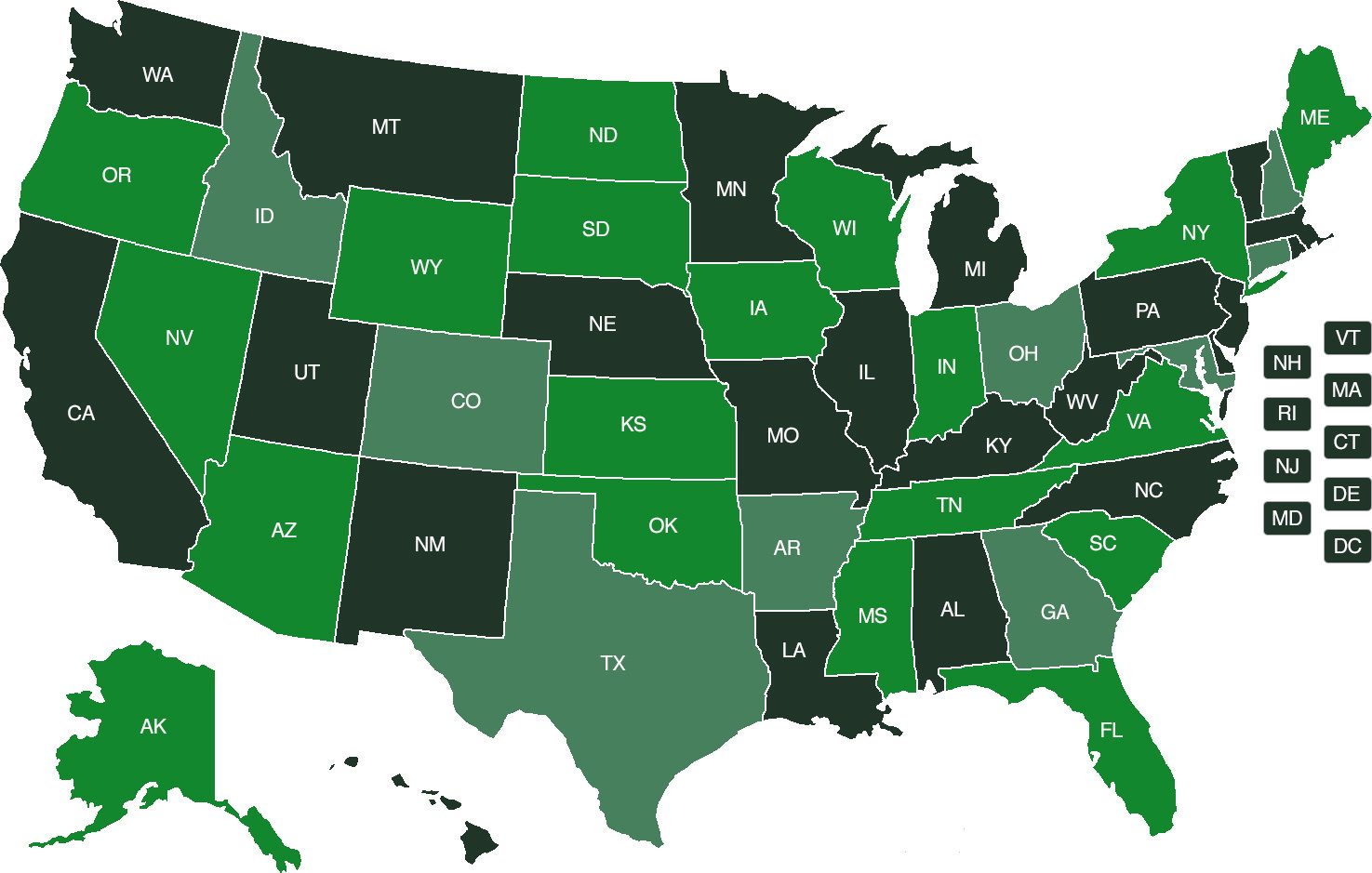

2. Get The Best Deal For Your State

LendingTree analyzes the savings available by comparing mortgage rates across the country, and then collects those offers for you, so you can compare them in one place. Find the savings you can get in your state here.

3. Find Your Offers Fast!

LendingTree is fast. How fast? You can get offers from lenders in minutes! Answer a series of questions on a click-through form to help determine the right type of loan for you and to quickly see the rates available. What makes it so easy are the questions formatted for an off-hand response. No studying needed!

4. Get The Best Offer For You

The rates and offers you get from the lenders listed are personalized to your financial situation, not some general offerings that often are inaccurate. Based on factors like your credit score, financial history, and loan amount requested, you get matched with the best offers, for your circumstance. See how you qualify here.

5. When Banks Compete, You Win!

Many of the country’s top lending institutions, national to local, fill the LendingTree marketplace. When you use LendingTree, these banks compete for your business so that you have the leverage. No legwork needed on your end. Now that it’s a competitive market, you no longer have to settle with the first offer you get! Make the banks compete!

6. All The Extra Gadgets

Calculators, Free Credit Score, Lender Ratings, and a wealth of knowledge. All these help you plan out your monthly payments, access your credit score so you know a feasible loan amount, and determine which is the best lender for you. After all, LendingTree’s goal is to set you up for success, so that you can choose confidently.