Dive deeper into your credit score.

Checking your credit score is just the first step in taking control of your finances. Get free score insights, personalized recommendations, and credit alerts with LendingTree Spring.

What is a credit score?

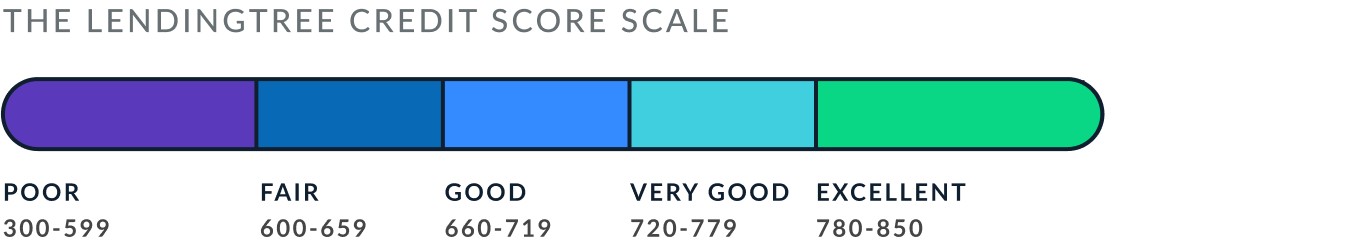

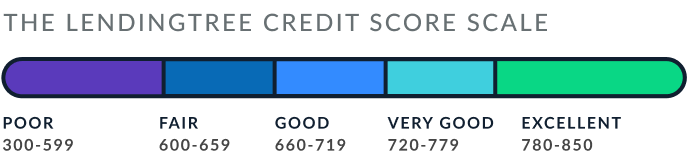

A credit score is a three-digit tally — ranging from 300 to 850 — assigned to consumers based on their credit activity. This can include getting a credit card, taking out a personal loan and paying your bills.

Creditors use your credit score to weigh your creditworthiness, or how likely you are to repay your bills in full and on time. Your credit score affects everything from renting an apartment to the rates and amounts you receive on mortgages and other loans.

The higher your score, the more creditworthy you are to lenders. If your credit score is low, lenders will perceive you as a risky borrower and charge you higher interest rates.

How your score is calculated

Your credit activity is reported to the three credit bureaus – Equifax, Experian and TransUnion – which keep a record in what’s known as your credit report.

Your credit score is calculated based on the events recorded on your credit report and can vary depending on which of the credit bureaus is used, as some creditors only report to one or two of the credit bureaus instead of all three.

While many creditors look at your FICO Score, some lenders use VantageScore instead, a credit score model created by the three credit bureaus. LendingTree provides you with the most recent version of your VantageScore 3.0.

Why check your credit score?

There are many reasons to check your credit score. First, it’s good to know where you stand since the interest rate you receive on loans – including mortgages, auto loans, personal loans and more – is dependent on your score. And second, keeping an eye on your credit score can alert you of errors or fraudulent activity in your name. If you notice a sudden drop in your score, for example, you can check any new credit activities or changes using LendingTree Spring.

FICO Score vs. VantageScore

FICO Score

The FICO Score is the most commonly used model employed by lenders. In fact, 90% of lenders in the U.S. use FICO Score. The average FICO Score is 716, which falls under the “good” rating.

| FICO Score range | Rating |

|---|---|

| 800+ | Excellent |

| 740-799 | Very good |

| 670-739 | Good |

| 580-669 | Fair |

| 579 or less | Poor |

VantageScore

VantageScore was created by the three credit bureaus and is not as commonly used as FICO Score. Still, over 2,600 companies use this credit scoring model, so this number is well worth tracking.

| VantageScore range | Rating |

|---|---|

| 781-850 | Excellent |

| 661-780 | Good |

| 601-660 | Fair |

| 500-600 | Poor |

| 300-499 | Very poor |

What impacts your credit score?

Your credit score is based on the activity on your credit report. Anything from bankruptcy to missed payments to hard credit pulls can cause your credit score to shift. Your credit score is most heavily impacted by the following factors:

- Payment history: 35%

- Credit utilization: 30%

- Length of credit history: 15%

- Credit mix: 10%

- New credit accounts: 10%

What doesn’t impact your credit score?

There are some misconceptions around what will and won’t impact your credit score. When it comes to calculating your credit score, these factors are not taken into account:

- Checking your credit score: If you are personally checking your credit score, your credit score will not go down. It’s only when someone else runs a hard credit pull — such as a creditor you applied with — that your credit score can dip by a few points. Even this only stays on your credit report for up to two years.

- Soft credit pulls: Prequalifying for new credit will not impact your credit score. These only involve soft credit pulls, which still allow you to see what potential rates, fees, terms and amounts your creditor may offer you. If you decide to move forward with the creditor, then you’ll have to go through a hard credit pull, which can impact your credit.

- Demographics: Your credit score is not impacted by factors like race, ethnicity, religion or gender. It also is not impacted by your employment status or income level, though some creditors may take these factors into account when deciding whether to approve you for a form of credit.

Credit score resources

-

credit repair services

When looking into credit repair services, it’s important to research as much as possible. You want to make sure you identify and avoid any scams and protect yourself.

-

how to build credit

Perhaps you’re just starting out on your own and need to build your credit. Luckily, you can start establishing credit by starting small – such as opening up a student credit card or putting some bills in your own name. Make sure to pay every single bill on time and get in the habit of monitoring your credit score regularly.

-

improve your credit

You can improve your credit by paying all of your bills on time, using your credit card wisely, disputing any errors on your credit report and keeping your credit utilization low.