How to Get Cheap Renters Insurance in Kentucky

Best cheap Kentucky renters insurance

Cheapest renters insurance in Kentucky

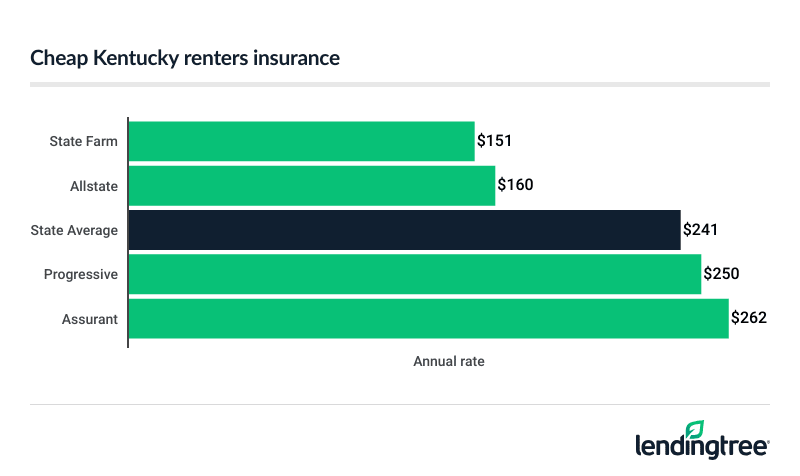

State Farm has the cheapest renters insurance in Kentucky at $151 a year. This is only slightly less than Allstate’s rate of $160 a month.

State Farm also has a higher J.D. Power

Kentucky renters insurance rates

| Company | Monthly Rate | Annual rate | LendingTree score | |

|---|---|---|---|---|

| State Farm | $13 | $151 | |

| Allstate | $13 | $160 | |

| Progressive | $21 | $250 | |

| Assurant | $22 | $262 | |

| Amica | $28 | $340 |

Your actual rate depends on factors like the type of unit you rent and the amount of coverage you need. Each company treats these factors differently, and their rates vary by customer. This makes it important to compare renters insurance quotes from a few different companies.

Best renters insurance companies in Kentucky

- State Farm is Kenucky’s best renters insurance company for cheap rates.

- Allstate, which is almost as cheap, is often the best company for retired renters.

- Assurant has Kentucky’s best renters insurance coverage options.

All three companies have strong financial ratings from AM Best. Among other things, this shows they can pay claims.

Kentucky renters insurance ratings

| Company | Monthly rate | Satisfaction rating

Source: J.D. Power 2024 U.S. Home Insurance Study. Higher is better, 659 is average.

| AM Best rating |

|---|---|---|---|

| State Farm | $13 | 679 | A++ |

| Allstate | $13 | 639 | A+ |

| Assurant | $22 | Not rated | A+ |

Best for cheap rates: State Farm

Monthly rate: $13

State Farm’s renters insurance rates are 37% less than the state average of $20 a month.

Its liability coverage includes up to $500 for damage a pet causes to your unit. This can come in handy if you’re a pet owner. Some companies don’t cover pet damage to your unit at all.

State Farm doesn’t have as many insurance discounts as some competitors, although it does lower your premium if you bundle your policy with their car insurance, or if your unit has basic security devices like smoke detectors and dead-bolt locks.

PROS

- Cheapest renters insurance in Kentucky

- Good customer satisfaction rating

- Covers pet damage to your unit

CONS

- Limited discounts

Best for retired renters: Allstate

Monthly rate: $13

A 25% discount for retirees over 55 years old can make Allstate a money-saving option for older renters. You can save even more by bundling your renters policy with your car insurance and setting up automatic payments.

Allstate also makes it easy to add more protection to your policy. It offers add-on coverage for valuables like jewelry, as well as extra liability coverage

PROS

- Discounts for retired renters, and for bundling and auto-pay

- Rates almost as low as State Farm

- Extra insurance protections available

CONS

- Satisfaction rating is worse than the industry average

Best coverage options: Assurant

Monthly rate: $22

The usual Assurant renters policy covers your belongings at their “replacement value.” This pays to replace damaged or stolen items with new ones — rather than many other companies which only pay the lower “actual cash value,” after depreciation.

The company also covers mold damage and offers add-on coverage for pet damage to your unit.

Unfortunately, Assurant does not offer very many discounts. This can make it more expensive than other companies, which have more ways to lower your premium.

PROS

- Covers your belongings at replacement cost

- Policies often cover mold damage

- Add-on coverage for pet damage

CONS

- Limited discounts

Kentucky renters insurance rates by city

Among Kentucky’s largest cities, Madisonville has the most expensive renters insurance at $23 a month — just a little more expensive than the $22-a-month average in Ashland, Henderson and Hopkinsville.

Florence, on the other hand, has Kentucky’s cheapest renters insurance at $17 a month. Eight cities tied for the second-cheapest rate of $19 a month.

Tenants in Louisville pay an average of $20 a month for renters insurance. This is on par with the state average, also $20 a month. Renters insurance in Lexington costs an average of $19 a month.

Renters insurance rates near you

| City | Monthly rate |

|---|---|

| Ashland | $22 |

| Bowling Green | $19 |

| Burlington | $19 |

| Covington | $21 |

| Elizabethtown | $19 |

| Erlanger | $21 |

| Florence | $17 |

| Fort Thomas | $20 |

| Frankfort | $21 |

| Georgetown | $19 |

| Henderson | $22 |

| Hopkinsville | $22 |

| Independence | $19 |

| Lexington | $19 |

| Louisville | $20 |

| Madisonville | $23 |

| Mount Washington | $21 |

| Nicholasville | $20 |

| Owensboro | $19 |

| Paducah | $22 |

| Radcliff | $21 |

| Richmond | $19 |

| Saint Matthews | $21 |

| Winchester | $21 |

Does Kentucky require renters insurance?

Kentucky law does not require renters insurance. However, many landlords require it for a lease.

Renters insurance is often worth getting even when it’s not required for a lease. It’s cheap, and your renters insurance coverage can come in handy after a burglary, fire or other disaster.

Your landlord’s insurance usually takes care of structural damage to your unit or building, but not your personal possessions.

You can get renters insurance for just about any type of unit. This includes an apartment, house, condominium unit or mobile home.

What does renters insurance cover?

A typical renters insurance policy includes coverage for:

- Your personal property, or belongings

- Additional living expenses for temporary housing after a covered disaster

- Personal liability for injuries or damage you cause to others

- Medical expenses for a guest injured at your home

Renters insurance usually covers common disasters like fires, windstorms and burst pipes. However, renters insurance does not cover everything: You’ll need separate insurance for floods, earthquakes or sinkholes.

Renters insurance usually only provides limited coverage for certain valuables. For example, many companies cap their standard coverage for jewelry $1,000 or so.

However, most companies offer optional add-ons that give these items more protection. It’s good to ask about these coverage options for any valuables you may have.

Frequently asked questions

Renters insurance costs an average of $20 a month in Kentucky. You can usually get it for less if you bundle your car and renters policy with the same company.

At $151 a month, State Farm has the cheapest renters insurance in Kentucky. Allstate is only slightly more expensive at $160 a month. Both companies’ rates work out to about $13 a month.

Methodology

LendingTree collected thousands of renters insurance quotes from Kentucky’s largest renters insurance companies.

Rates are based on coverage for a 30-year-old single woman who has no recent renters insurance claims. Your rates may vary. Coverage limits include:

- Personal property coverage: $20,000

- Deductible: $500

- Personal liability: $100,000

- Guest medical protection: $1,000

- Loss of use: $9,000

—

For LendingTree scores, our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings, and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included NAIC’s Complaint Index scores and financial strength ratings from AM Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.