Cheap Car Insurance for Ford Mustangs

Best cheap Ford Mustang insurance

Cheapest car insurance for Ford Mustangs

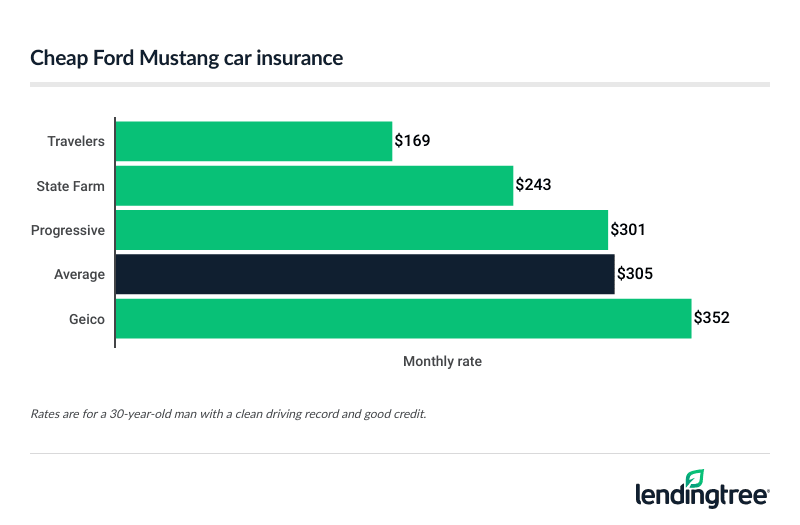

At $169 a month, Travelers has the cheapest full coverage car insurance for Ford Mustangs. This is 30% less than the next-cheapest rate of $243 a month from State Farm.

Travelers also offers new car replacement

Cheapest Ford Mustang insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Travelers | $169 | |

| State Farm | $243 | |

| Progressive | $301 | |

| Geico | $352 | |

| Allstate | $356 | |

| Farmers | $437 | |

| USAA* | $276 | |

What you pay for car insurance depends on factors like your driving record, location and, in most states, your credit history. Each company treats these factors differently, and their rates vary by customer. It’s good to compare car insurance quotes from a few companies to find a cheap rate.

How much is car insurance for a Ford Mustang?

The average cost of car insurance for a Ford Mustang is $305 a month for full coverage. However, rates differ by the type of Mustang you drive.

- The electric Mach-E is the cheapest Mustang to insure, at $287 a month.

- Insurance for a basic Mustang with an Ecoboost engine costs $302 a month.

- At $326 a month, insurance for a high-horsepower Mustang GT is more expensive than average to insure.

Older Mustangs are cheaper to insure than newer ones. For example, insurance for a 2024 Mustang GT costs 11% more than it does for a 2021 model.

Ford Mustang insurance costs by model year

| Model | 2021 monthly | 2022 monthly | 2023 monthly | 2024 monthly | Average |

|---|---|---|---|---|---|

| Mach-E | $272 | $285 | $290 | $301 | $287 |

| Ecoboost | $293 | $294 | $307 | $315 | $302 |

| GT Coupe | $308 | $323 | $332 | $341 | $326 |

Best car insurance for a Ford Mustang

Travelers rates and coverage options make it the best car insurance company for Ford Mustangs. State Farm has the best customer service, based on its satisfaction rating. Progressive is the best insurance choice for Mustangs with custom parts.

Best Mustang insurance companies

| Company | Monthly rate | Satisfaction rating | LendingTree score |

|---|---|---|---|

| Travelers | $169 | 616 | |

| State Farm | $243 | 657 | |

| Progressive | $301 | 622 |

Best overall: Travelers

Travelers saves you money upfront with rates that are 44% less than the average for Mustangs. Its accident forgiveness and new car replacement programs can save you money down the line. Travelers Premier New Car Replacement lasts five years. Other new car replacement programs only last one or two years.

PROS

- Cheapest insurance for Ford Mustangs

- New car replacement lasts five years

- Accident forgiveness also available

CONS

- Low customer satisfaction rating

Best for customer service: State Farm

State Farm’s high satisfaction score means its customers like its prices, coverage and service. Although it’s not the cheapest company for Mustang insurance, its rates are 20% less than the average. State Farm also offers several discounts that make its rates more affordable.

PROS

- Excellent rating for overall customer satisfaction

- Mustang insurance rates are 20% less than the average

- Several discounts available to save you money

CONS

- Travelers has a cheaper average rate for Mustangs

Best for custom Mustangs: Progressive

Most car insurance companies only pay to restore your car to its original factory condition. Progressive offers up to $5,000 in coverage for custom parts and equipment. This is an optional add-on that many other companies don’t have. Progressive also offers accident forgiveness, but not new car replacement.

PROS

- Add-on coverage for customer parts and equipment

- Offers accident forgiveness

- Discounts can make its rates more affordable

CONS

- Rates before discounts are just average

Mustang car insurance rates by age

The average cost of Mustang car insurance for a 16-year-old is $1,171 a month for full coverage. This is nearly four times the average rate of $305 a month for a 30-year-old.

Mustang car insurance rates by age

| Driver age | Annual rate | Monthly rate |

|---|---|---|

| 16 | $14,503 | $1,171 |

| 18 | $10,423 | $869 |

| 20 | $6,823 | $569 |

| 25 | $4,042 | $337 |

| 30 | $3,659 | $305 |

| 35 | $3,432 | $286 |

| 40 | $3,309 | $276 |

A lack of driving experience makes young drivers more likely to crash than older drivers. This translates into higher insurance rates for teen drivers. Teens usually get cheaper rates when added to a parent’s policy than they do on their own.

If you avoid tickets and accidents, your rates become more affordable in your mid-20s. For example, a 25-year-old pays less than half as much for Mustang insurance as an 18-year-old.

Cheapest Mustang insurance after a ticket or accident

Travelers has the cheapest Mustang GT insurance for drivers with bad driving records. Its rates average $232 a month after a speeding ticket and $258 a month after an at-fault accident.

State Farm has the next-cheapest rates at $274 a month after a ticket and $295 a month after an accident.

A ticket raises the average cost of Mustang GT insurance by 28% to $392 a month. An at-fault accident raises rates by 44% to $441 a month. These high costs make it especially important to shop around for car insurance with a bad driving record.

Mustang insurance rates after a ticket or accident

| Company | Ticket annual rate | Accident annual rate |

|---|---|---|

| Travelers | $232 | $258 |

| State Farm | $274 | $295 |

| Allstate | $438 | $592 |

| Progressive | $460 | $516 |

| Geico | $464 | $632 |

| Farmers | $474 | $483 |

| USAA* | $401 | $310 |

Is car insurance for a Mustang expensive?

Ford Mustangs are moderately expensive to insure. The cost of car insurance for a Mustang is 13% higher than the rate for a Toyota Camry. However, a Mustang is 15% cheaper to insure than a Nissan Z.

Insurance costs for Mustangs vs. other cars

| Vehicle | Annual rate | Monthly rate |

|---|---|---|

| Toyota Camry | $3,239 | $270 |

| Honda Civic | $3,336 | $278 |

| Kia K5 | $3,579 | $298 |

| Ford Mustang | $3,659 | $305 |

| Nissan Z | $4,300 | $358 |

Methodology

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of car insurance quotes for typical drivers in Illinois. Prices are shown for comparative purposes only. Your actual rates may vary.

Quotes are for a 30-year-old man with good credit and a clean driving record. Unless otherwise noted, quotes are for 2021-2024 Mustang Ecoboosts, Mustang GTs and Mustang Mach-Es.

Full coverage policies include:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $25,000

- Uninsured motorist: $50,000 per person, $100,000 per accident

- Personal injury protection in Maryland and Minnesota

- Collision: $500 deductible

- Comprehensive: $500 deductible

—

For LendingTree scores, our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military and their families.