Best Homeowners Insurance in Florida

Tower Hill has the best and cheapest homeowners insurance in Florida, with rates that average $2,443 a year, or $204 a month.

Progressive and State Farm are also great choices due to their discounts and customer satisfaction.

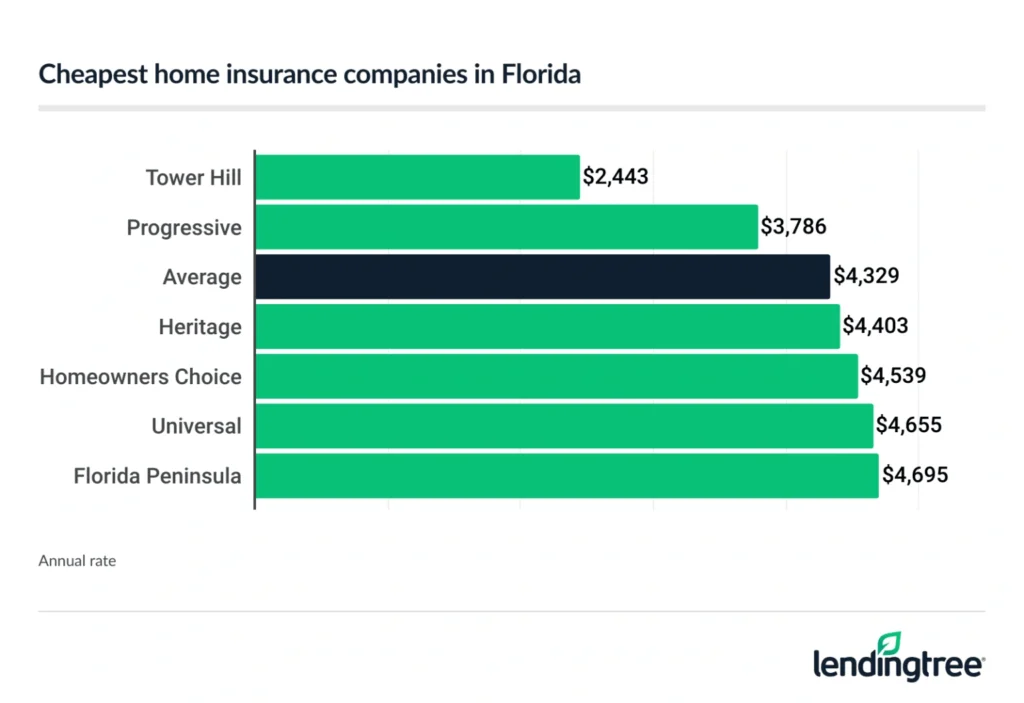

Cheapest insurance companies in Florida

Cheapest home insurance companies in Florida

Tower Hill is the cheapest homeowners insurance company in Florida, offering an average rate of $2,443 a year.

Not only is Tower Hill’s average rate the lowest in the state by far, but it’s more than 40% cheaper than the state’s average price for home insurance.

Home insurance rates in Florida by company

| Company | Annual rate |

|---|---|

| Tower Hill | $2,443 |

| Progressive | $3,786 |

| Heritage | $4,403 |

| Homeowners Choice | $4,539 |

| Universal | $4,655 |

| Florida Peninsula | $4,695 |

| State Farm | $5,180 |

| Citizens | $8,722 |

Citizens is the most-expensive major home insurance option in Florida, at $8,722 a year, but that’s because it is state-run and exists for homeowners who can’t find affordable insurance elsewhere.

To get the cheapest rate for the amount of coverage you need and want, compare home insurance quotes from several companies.

Best home insurance companies in Florida

Cheapest isn’t always best. According to our research, Tower Hill, State Farm and Progressive are actually the best home insurance companies in Florida.

- Tower Hill is our pick for Florida’s best home insurance company overall, and it also offers the lowest rates.

- State Farm is the best company for customer satisfaction.

- Progressive has the best discounts for Florida homeowners.

| Insurance company | Customer satisfaction

Source: J.D. Power 2024 U.S. Home Insurance Study. Average is 640. Higher is better.

| Complaint index

Source: 2024 NAIC complaint index. Average is 1.0. Lower is better.

| LendingTree score |

|---|---|---|---|

| Tower Hill | Not rated | 0.12 (Excellent) |  |

| Progressive | 634 (Poor) | 1.73 (Poor) | |

| State Farm | 643 (Average) | 1.22 (Average) |

Best overall home insurance company: Tower Hill

Annual rate: $2,443

Tower Hill is the best home insurance company in Florida. It has the lowest rates in the state and receives few complaints from customers.

PROS

- Cheapest home insurance rates in Florida

- Many add-on coverage options

- Fewer customer complaints than competitors

CONS

- Can’t get a quote or buy a policy online

Best company for customer satisfaction: State Farm

Annual rate: $5,180

State Farm may be the best homeowners insurance company for you if you value customer service and satisfaction. It also offers several policy add-ons, including water backup and umbrella coverage.

PROS

- Favorable customer satisfaction scores

- Good coverage options

CONS

- Expensive home insurance rates

- Fewer discounts than most competitors

Best home insurance company for discounts: Progressive

Annual rate: $3,786

Progressive has the best discounts of Florida’s top home insurance companies.

You might save money with Progressive if your home is new or has safety systems or alarms, or if you pay for the whole year up front.

Also, customers save an average of 7% when they bundle home and car insurance policies with Progressive.

PROS

- Affordable rates

- Many discounts

- Some discounts are easy to get

CONS

-

Few add-on coverages

Poor customer - satisfaction scores

How much is home insurance in Florida?

Florida home insurance costs $4,329 a year, on average. Paid monthly, that comes to $361.

What you pay for homeowners insurance depends on several factors, including:

- Where you live

- The amount of coverage you buy

- Your deductible

- Your credit, insurance and claims history

- The age of your home

Florida home insurance rates by coverage amount

The amount of dwelling coverage you buy for your home impacts how much you pay for your home insurance policy. Dwelling coverage is used to help rebuild or repair the structure of your home.

| Dwelling limit | Annual rate |

|---|---|

| $350,000 | $3,812 |

| $400,000 | $4,329 |

| $450,000 | $4,843 |

If your dwelling coverage limit is $450,000, for example, you will pay an average 27% more for home insurance than if this limit were $350,000.

Florida homeowners insurance rates by city

The Hernando County communities of Brookridge, Hernando Beach, High Point and North Weeki Wachee pay the cheapest home insurance rates in Florida. All four have an average home insurance cost of less than $2,200 a year, or $183 a month.

Gainesville homeowners pay the lowest insurance rates among Florida’s biggest cities at $2,225 a year, or $185 a month.

Homeowners in Hialeah Gardens pay the state’s highest average home insurance rates of $9,549 a year, or $796 a month.

The average cost of home insurance in Florida’s largest cities:

- Jacksonville, $2,651 a year

- Miami, $7,515 a year

- Tampa, $3,328 a year

- Orlando, $3,464 a year

| City | Annual rate |

|---|---|

| Alachua | $2,209 |

| Alafaya | $3,695 |

| Alford | $2,897 |

| Allentown | $3,039 |

| Altamonte Springs | $3,093 |

| Altha | $2,925 |

| Altoona | $2,567 |

| Alturas | $3,644 |

| Alva | $3,033 |

| Andrews | $2,946 |

| Anna Maria | $2,900 |

| Anthony | $2,589 |

| Apalachicola | $2,988 |

| Apollo Beach | $3,245 |

| Apopka | $3,629 |

| Arcadia | $2,912 |

| Archer | $2,500 |

| Argyle | $2,735 |

| Aripeka | $2,724 |

| Asbury Lake | $2,415 |

| Astatula | $2,604 |

| Astor | $2,629 |

| Atlantic Beach | $2,361 |

| Atlantis | $4,481 |

| Auburndale | $3,690 |

| Aventura | $7,836 |

| Avon Park | $3,076 |

| Azalea Park | $3,651 |

| Babson Park | $3,633 |

| Bagdad | $3,056 |

| Baker | $3,117 |

| Bal Harbour | $6,938 |

| Baldwin | $2,675 |

| Balm | $3,289 |

| Barberville | $2,691 |

| Bardmoor | $2,564 |

| Bartow | $3,636 |

| Bascom | $2,805 |

| Bay Harbor Islands | $6,917 |

| Bay Hill | $3,577 |

| Bay Lake | $3,583 |

| Bay Pines | $2,461 |

| Bayonet Point | $2,602 |

| Bayshore Gardens | $2,343 |

| Beacon Square | $2,747 |

| Bear Creek | $2,461 |

| Bee Ridge | $2,519 |

| Bell | $2,640 |

| Bellair-Meadowbrook Terrace | $2,428 |

| Belle Glade | $4,264 |

| Belle Isle | $3,536 |

| Belleair | $2,662 |

| Belleair Beach | $2,618 |

| Belleair Bluffs | $2,659 |

| Belleview | $2,591 |

| Bellview | $2,875 |

| Berrydale | $3,018 |

| Beverly Hills | $2,437 |

| Big Coppitt Key | $5,038 |

| Big Pine Key | $5,081 |

| Biscayne Park | $8,570 |

| Bithlo | $3,649 |

| Black Hammock | $3,082 |

| Bloomingdale | $3,255 |

| Blountstown | $2,891 |

| Boca Grande | $3,041 |

| Boca Raton | $4,522 |

| Bokeelia | $3,062 |

| Bonifay | $3,110 |

| Bonita Springs | $2,950 |

| Bostwick | $2,286 |

| Boulevard Gardens | $6,643 |

| Bowling Green | $3,160 |

| Boynton Beach | $4,500 |

| Bradenton | $2,380 |

| Bradenton Beach | $2,899 |

| Bradley | $3,583 |

| Bradley Junction | $3,645 |

| Brandon | $3,279 |

| Branford | $2,642 |

| Brent | $2,810 |

| Bristol | $2,944 |

| Broadview Park | $7,131 |

| Bronson | $2,692 |

| Brooker | $2,483 |

| Brookridge | $2,196 |

| Brooksville | $2,247 |

| Brownsdale | $3,115 |

| Brownsville | $8,293 |

| Bryceville | $2,445 |

| Buckhead Ridge | $2,965 |

| Buckingham | $3,042 |

| Buenaventura Lakes | $4,023 |

| Bunnell | $2,584 |

| Burnt Store Marina | $2,846 |

| Bushnell | $2,492 |

| Butler Beach | $2,383 |

| Cabana Colony | $4,440 |

| Callahan | $2,478 |

| Callaway | $2,634 |

| Campbell | $4,015 |

| Campbellton | $2,903 |

| Canal Point | $4,242 |

| Candler | $2,608 |

| Cantonment | $2,750 |

| Cape Canaveral | $2,848 |

| Cape Coral | $3,011 |

| Captiva | $3,057 |

| Carrabelle | $2,968 |

| Carrollwood | $3,425 |

| Caryville | $3,277 |

| Cassadaga | $2,774 |

| Casselberry | $3,100 |

| Cedar Grove | $2,593 |

| Cedar Key | $2,836 |

| Celebration | $4,018 |

| Center Hill | $2,492 |

| Century | $2,963 |

| Charlotte Harbor | $3,031 |

| Charlotte Park | $2,937 |

| Chattahoochee | $2,787 |

| Cheval | $3,185 |

| Chiefland | $2,694 |

| Chipley | $3,016 |

| Chokoloskee | $3,344 |

| Christmas | $3,657 |

| Chuluota | $3,082 |

| Citra | $2,584 |

| Citrus Hills | $2,436 |

| Citrus Park | $3,214 |

| Citrus Springs | $2,449 |

| Clarcona | $3,706 |

| Clarksville | $2,901 |

| Clearwater | $2,612 |

| Clearwater Beach | $2,613 |

| Clermont | $2,637 |

| Cleveland | $3,047 |

| Clewiston | $3,379 |

| Cocoa | $2,859 |

| Cocoa Beach | $2,845 |

| Cocoa West | $2,852 |

| Coconut Creek | $6,933 |

| Coleman | $2,532 |

| Combee Settlement | $3,639 |

| Connerton | $2,496 |

| Conway | $3,461 |

| Cooper City | $6,984 |

| Copeland | $3,553 |

| Coral Gables | $8,020 |

| Coral Springs | $7,074 |

| Coral Terrace | $8,463 |

| Cortez | $2,907 |

| Cottondale | $2,929 |

| Country Club | $9,291 |

| Country Walk | $9,093 |

| Crawfordville | $2,552 |

| Crescent City | $2,252 |

| Crestview | $3,077 |

| Crooked Lake Park | $3,643 |

| Cross City | $2,336 |

| Crystal Beach | $2,706 |

| Crystal Lake | $3,646 |

| Crystal River | $2,497 |

| Crystal Springs | $2,337 |

| Cudjoe Key | $5,044 |

| Cutler Bay | $8,736 |

| Cypress Gardens | $3,677 |

| Cypress Lake | $2,889 |

| Dade City | $2,317 |

| Dade City North | $2,300 |

| Dania | $5,746 |

| Dania Beach | $6,857 |

| Davenport | $3,657 |

| Davie | $7,059 |

| Daytona Beach | $2,547 |

| Daytona Beach Shores | $2,416 |

| De Funiak Springs | $2,825 |

| De Leon Springs | $2,748 |

| Debary | $2,765 |

| Deerfield Beach | $6,031 |

| Defuniak Springs | $2,838 |

| Deland | $2,741 |

| DeLand Southwest | $2,697 |

| Delray Beach | $4,421 |

| Deltona | $2,775 |

| Desoto Lakes | $2,497 |

| Destin | $3,191 |

| Doctor Phillips | $3,584 |

| Doctors Inlet | $2,498 |

| Doral | $9,283 |

| Dover | $3,261 |

| Dundee | $3,664 |

| Dunedin | $2,669 |

| Dunnellon | $2,557 |

| Durant | $3,159 |

| Eagle Lake | $3,610 |

| Earleton | $2,250 |

| East Bronson | $2,697 |

| East Lake | $2,616 |

| East Lake-Orient Park | $3,355 |

| East Milton | $3,046 |

| East Palatka | $2,228 |

| Eastlake Weir | $2,604 |

| Eastpoint | $2,988 |

| Eaton Park | $3,619 |

| Eatonville | $3,417 |

| Ebro | $2,901 |

| Edgewater | $2,542 |

| Edgewood | $3,499 |

| Eglin AFB | $3,082 |

| Egypt Lake-Leto | $3,396 |

| El Jobean | $3,036 |

| El Portal | $8,576 |

| Elfers | $2,522 |

| Elkton | $2,307 |

| Ellenton | $2,333 |

| Englewood | $2,708 |

| Ensley | $2,859 |

| Estero | $2,865 |

| Eustis | $2,604 |

| Everglades City | $3,344 |

| Evinston | $2,250 |

| Fairfield | $2,608 |

| Fairview Shores | $3,596 |

| Feather Sound | $2,610 |

| Felda | $3,337 |

| Fellsmere | $3,263 |

| Fern Park | $3,104 |

| Fernandina Beach | $2,487 |

| Ferndale | $2,667 |

| Ferry Pass | $2,831 |

| Fish Hawk | $3,203 |

| Fisher Island | $6,742 |

| Five Points | $2,860 |

| Flagler Beach | $2,467 |

| Flagler Estates | $2,311 |

| Fleming Island | $2,425 |

| Florahome | $2,252 |

| Floral City | $2,445 |

| Florida City | $8,543 |

| Florida Ridge | $3,593 |

| Forest City | $3,185 |

| Fort Denaud | $3,335 |

| Fort Green Springs | $3,154 |

| Fort Lauderdale | $6,476 |

| Fort Mc Coy | $2,469 |

| Fort Meade | $3,635 |

| Fort Myers | $3,000 |

| Fort Myers Beach | $2,957 |

| Fort Myers Shores | $3,050 |

| Fort Ogden | $2,892 |

| Fort Pierce | $4,182 |

| Fort Pierce North | $4,052 |

| Fort Pierce South | $4,053 |

| Fort Walton Beach | $3,120 |

| Fort White | $2,796 |

| Fountain | $2,702 |

| Fountainebleau | $8,846 |

| Four Corners | $3,386 |

| Franklin Park | $6,645 |

| Freeport | $2,737 |

| Frostproof | $3,640 |

| Fruit Cove | $2,270 |

| Fruitland Park | $2,592 |

| Fruitville | $2,513 |

| Fuller Heights | $3,648 |

| Fussels Corner | $3,664 |

| Gainesville | $2,225 |

| Gateway | $3,043 |

| Geneva | $3,115 |

| Georgetown | $2,290 |

| Gibsonton | $3,255 |

| Gifford | $3,487 |

| Gladeview | $8,552 |

| Glen St. Mary | $2,527 |

| Glencoe | $2,622 |

| Glenvar Heights | $8,649 |

| Glenwood | $2,737 |

| Golden Beach | $6,894 |

| Golden Gate | $3,705 |

| Golden Glades | $8,808 |

| Goldenrod | $3,325 |

| Golf | $4,363 |

| Gonzalez | $2,754 |

| Goodland | $3,309 |

| Gotha | $3,662 |

| Goulding | $2,824 |

| Goulds | $8,788 |

| Graceville | $2,869 |

| Graham | $2,508 |

| Grand Island | $2,591 |

| Grand Ridge | $2,879 |

| Grandin | $2,280 |

| Grant | $2,860 |

| Grant-Valkaria | $2,800 |

| Green Cove Springs | $2,405 |

| Greenacres | $4,527 |

| Greenbriar | $2,577 |

| Greensboro | $2,769 |

| Greenville | $2,547 |

| Greenwood | $2,804 |

| Grenelefe | $3,664 |

| Gretna | $2,741 |

| Grove City | $2,905 |

| Groveland | $2,625 |

| Gulf Breeze | $3,182 |

| Gulf Gate Estates | $2,498 |

| Gulf Hammock | $2,693 |

| Gulf Stream | $4,349 |

| Gulfport | $2,458 |

| Gun Club Estates | $4,374 |

| Haines City | $3,678 |

| Hallandale | $5,873 |

| Hallandale Beach | $5,820 |

| Hampton | $2,489 |

| Harbor Bluffs | $2,659 |

| Harbour Heights | $3,109 |

| Harlem | $3,366 |

| Harold | $3,069 |

| Hastings | $2,300 |

| Havana | $2,702 |

| Haverhill | $4,541 |

| Hawthorne | $2,248 |

| Heathrow | $3,090 |

| Heritage Pines | $2,454 |

| Hernando | $2,454 |

| Hernando Beach | $2,190 |

| Hialeah | $9,372 |

| Hialeah Gardens | $9,549 |

| High Point | $2,193 |

| High Springs | $2,446 |

| Highland Beach | $4,402 |

| Highland City | $3,625 |

| Highland Park | $3,608 |

| Hilliard | $2,490 |

| Hillsboro Beach | $5,613 |

| Hobe Sound | $3,461 |

| Holden Heights | $3,499 |

| Holder | $2,499 |

| Holiday | $2,641 |

| Hollister | $2,282 |

| Holly Hill | $2,563 |

| Hollywood | $6,572 |

| Holmes Beach | $2,897 |

| Holt | $3,103 |

| Homeland | $3,619 |

| Homestead | $8,662 |

| Homestead Base | $8,723 |

| Homosassa | $2,374 |

| Homosassa Springs | $2,429 |

| Horizon West | $3,576 |

| Horseshoe Beach | $2,497 |

| Hosford | $2,932 |

| Howey-in-the-Hills | $2,607 |

| Hudson | $2,531 |

| Hunters Creek | $3,660 |

| Hurlburt Field | $3,159 |

| Hutchinson Island South | $4,180 |

| Hypoluxo | $4,444 |

| Immokalee | $3,621 |

| Indialantic | $2,862 |

| Indian Harbour Beach | $2,881 |

| Indian Lake Estates | $3,619 |

| Indian River Estates | $4,078 |

| Indian River Shores | $3,859 |

| Indian Rocks Beach | $2,636 |

| Indian Shores | $2,613 |

| Indiantown | $3,787 |

| Inglis | $2,823 |

| Inlet Beach | $3,118 |

| Intercession City | $4,021 |

| Interlachen | $2,256 |

| Inverness | $2,445 |

| Inverness Highlands North | $2,437 |

| Inverness Highlands South | $2,451 |

| Inwood | $3,713 |

| Iona | $2,902 |

| Islamorada | $5,026 |

| Island Grove | $2,243 |

| Istachatta | $2,478 |

| Ives Estates | $8,572 |

| Jacksonville | $2,651 |

| Jacksonville Beach | $2,367 |

| Jan Phyl Village | $3,709 |

| Jasmine Estates | $2,612 |

| Jasper | $2,696 |

| Jay | $3,010 |

| Jennings | $2,725 |

| Jensen Beach | $3,380 |

| June Park | $2,887 |

| Juno Beach | $4,327 |

| Juno Ridge | $4,326 |

| Jupiter | $4,131 |

| Jupiter Farms | $4,185 |

| Kathleen | $3,650 |

| Kenansville | $4,006 |

| Kendale Lakes | $9,139 |

| Kendall | $8,723 |

| Kendall West | $9,286 |

| Kenneth City | $2,557 |

| Kensington Park | $2,493 |

| Kenwood Estates | $4,442 |

| Key Biscayne | $6,796 |

| Key Colony Beach | $4,989 |

| Key Largo | $5,101 |

| Key Vista | $2,744 |

| Key West | $5,045 |

| Keystone | $3,194 |

| Keystone Heights | $2,444 |

| Killarney | $3,663 |

| Kissimmee | $3,972 |

| La Crosse | $2,243 |

| Labelle | $3,157 |

| Lacoochee | $2,337 |

| Lady Lake | $2,869 |

| Laguna Beach | $3,073 |

| Lake Alfred | $3,685 |

| Lake Belvedere Estates | $4,529 |

| Lake Butler | $3,016 |

| Lake City | $2,830 |

| Lake Clarke Shores | $4,362 |

| Lake Como | $2,282 |

| Lake Geneva | $2,543 |

| Lake Hamilton | $3,683 |

| Lake Harbor | $4,254 |

| Lake Helen | $2,764 |

| Lake Lorraine | $3,103 |

| Lake Magdalene | $3,397 |

| Lake Mary | $3,081 |

| Lake Monroe | $3,110 |

| Lake Mystic | $2,943 |

| Lake Panasoffkee | $2,480 |

| Lake Park | $4,319 |

| Lake Placid | $2,899 |

| Lake Sarasota | $2,527 |

| Lake Wales | $3,630 |

| Lake Worth | $4,486 |

| Lakeland | $3,644 |

| Lakeland Highlands | $3,644 |

| Lakeshore | $3,610 |

| Lakeside | $2,420 |

| Lakewood Gardens | $4,353 |

| Lakewood Park | $4,041 |

| Lamont | $2,533 |

| Lanark Village | $2,972 |

| Land O’ Lakes | $2,497 |

| Lantana | $4,426 |

| Largo | $2,599 |

| Lauderdale Lakes | $6,842 |

| Lauderdale-by-the-Sea | $4,961 |

| Lauderhill | $7,017 |

| Laurel | $2,576 |

| Laurel Hill | $2,956 |

| Lawtey | $2,491 |

| Lealman | $2,587 |

| Lecanto | $2,387 |

| Lee | $2,550 |

| Leesburg | $2,591 |

| Lehigh Acres | $3,025 |

| Leisure City | $8,682 |

| Lely | $3,483 |

| Lely Resort | $3,381 |

| Lighthouse Point | $5,678 |

| Limestone Creek | $4,451 |

| Lithia | $3,241 |

| Live Oak | $2,787 |

| Lloyd | $2,519 |

| Lochloosa | $2,250 |

| Lochmoor Waterway Estates | $3,049 |

| Lockhart | $3,669 |

| Long Key | $5,047 |

| Longboat Key | $2,797 |

| Longwood | $3,096 |

| Lorida | $2,890 |

| Loughman | $3,635 |

| Lowell | $2,608 |

| Lower Grand Lagoon | $3,063 |

| Loxahatchee | $4,207 |

| Loxahatchee Groves | $4,222 |

| Lulu | $2,803 |

| Lutz | $3,232 |

| Lynn Haven | $2,698 |

| Macclenny | $2,521 |

| Madeira Beach | $2,448 |

| Madison | $2,531 |

| Maitland | $3,535 |

| Malabar | $2,830 |

| Malone | $2,818 |

| Manasota Key | $2,907 |

| Manatee Road | $2,669 |

| Mango | $3,360 |

| Mangonia Park | $4,480 |

| Marathon | $4,998 |

| Marathon Shores | $5,017 |

| Marco Island | $3,316 |

| Margate | $6,935 |

| Marianna | $2,852 |

| Mary Esther | $3,125 |

| Mascotte | $2,629 |

| Matlacha | $3,203 |

| Mayo | $2,610 |

| Mc Alpin | $2,762 |

| Mc David | $2,949 |

| Mc Intosh | $2,609 |

| McGregor | $2,897 |

| Meadow Oaks | $2,401 |

| Meadow Woods | $3,646 |

| Medley | $9,318 |

| Medulla | $3,649 |

| Melbourne | $2,853 |

| Melbourne Beach | $2,840 |

| Melbourne Village | $2,891 |

| Melrose | $2,317 |

| Memphis | $2,384 |

| Merritt Island | $2,853 |

| Mexico Beach | $3,094 |

| Miami | $7,515 |

| Miami Beach | $6,677 |

| Miami Gardens | $9,108 |

| Miami Lakes | $9,382 |

| Miami Shores | $8,606 |

| Miami Springs | $9,212 |

| Micanopy | $2,239 |

| Micco | $2,786 |

| Mid Florida | $3,116 |

| Middleburg | $2,423 |

| Midway | $2,990 |

| Milligan | $3,097 |

| Milton | $3,030 |

| Mims | $2,839 |

| Minneola | $2,629 |

| Miramar | $7,201 |

| Miramar Beach | $3,004 |

| Molino | $2,914 |

| Monticello | $2,699 |

| Montura | $3,372 |

| Montverde | $2,644 |

| Moon Lake | $2,410 |

| Moore Haven | $2,974 |

| Morriston | $2,706 |

| Mossy Head | $2,834 |

| Mount Dora | $2,719 |

| Mount Plymouth | $2,629 |

| Mulberry | $3,649 |

| Murdock | $3,041 |

| Myakka City | $2,372 |

| Myrtle Grove | $2,824 |

| Nalcrest | $3,610 |

| Naples | $3,512 |

| Naples Manor | $3,381 |

| Naples Park | $3,310 |

| Naranja | $8,701 |

| Nassau Village-Ratliff | $2,490 |

| Navarre | $3,024 |

| Navarre Beach | $3,184 |

| Neptune Beach | $2,362 |

| New Port Richey | $2,477 |

| New Port Richey East | $2,455 |

| New Smyrna Beach | $2,550 |

| Newberry | $2,318 |

| Niceville | $2,943 |

| Nichols | $3,610 |

| Nobleton | $2,478 |

| Nocatee | $2,230 |

| Nokomis | $2,560 |

| Noma | $2,876 |

| North Bay Village | $8,440 |

| North Brooksville | $2,299 |

| North DeLand | $2,747 |

| North Fort Myers | $3,047 |

| North Key Largo | $5,328 |

| North Lauderdale | $6,864 |

| North Miami | $8,319 |

| North Miami Beach | $8,562 |

| North Palm Beach | $4,391 |

| North Port | $2,589 |

| North Redington Beach | $2,462 |

| North River Shores | $2,975 |

| North Sarasota | $2,514 |

| North Weeki Wachee | $2,125 |

| Northdale | $3,271 |

| O Brien | $2,772 |

| Oak Hill | $2,424 |

| Oak Ridge | $3,575 |

| Oakland | $3,615 |

| Oakland Park | $6,551 |

| Oakleaf Plantation | $2,439 |

| Ocala | $2,595 |

| Ocean Breeze Park | $3,033 |

| Ocean City | $3,085 |

| Ocean Ridge | $4,399 |

| Ochopee | $3,560 |

| Ocklawaha | $2,573 |

| Ocoee | $3,710 |

| Odessa | $2,792 |

| Ojus | $8,629 |

| Okahumpka | $2,658 |

| Okeechobee | $3,055 |

| Old Town | $2,325 |

| Oldsmar | $2,656 |

| Olga | $3,041 |

| Olustee | $2,549 |

| Olympia Heights | $9,023 |

| Ona | $2,965 |

| Oneco | $2,481 |

| Opa-locka | $9,266 |

| Orange City | $2,759 |

| Orange Lake | $2,608 |

| Orange Park | $2,419 |

| Orange Springs | $2,613 |

| Orangetree | $3,716 |

| Orlando | $3,464 |

| Orlovista | $3,644 |

| Ormond Beach | $2,547 |

| Ormond-By-The-Sea | $2,436 |

| Osprey | $2,576 |

| Osteen | $2,817 |

| Otter Creek | $2,675 |

| Oviedo | $3,101 |

| Oxford | $2,487 |

| Ozona | $2,663 |

| Pace | $2,996 |

| Pahokee | $4,250 |

| Paisley | $2,617 |

| Palatka | $2,244 |

| Palm Bay | $2,836 |

| Palm Beach | $4,399 |

| Palm Beach Gardens | $4,429 |

| Palm Beach Shores | $4,350 |

| Palm City | $3,463 |

| Palm Coast | $2,527 |

| Palm Harbor | $2,656 |

| Palm River-Clair Mel | $3,322 |

| Palm Shores | $2,819 |

| Palm Springs | $4,365 |

| Palm Springs North | $9,267 |

| Palm Valley | $2,399 |

| Palmdale | $2,950 |

| Palmetto | $2,383 |

| Palmetto Bay | $8,121 |

| Palmetto Estates | $8,698 |

| Palmona Park | $3,035 |

| Panacea | $2,982 |

| Panama City | $2,751 |

| Panama City Beach | $3,057 |

| Parker | $2,855 |

| Parkland | $6,957 |

| Parrish | $2,360 |

| Pasadena Hills | $2,374 |

| Patrick AFB | $2,861 |

| Paxton | $2,723 |

| Pea Ridge | $2,979 |

| Pebble Creek | $3,180 |

| Pelican Bay | $3,304 |

| Pembroke Park | $6,805 |

| Pembroke Pines | $7,102 |

| Pensacola | $2,933 |

| Perry | $2,490 |

| Pierson | $2,731 |

| Pine Air | $4,368 |

| Pine Castle | $3,567 |

| Pine Hills | $3,711 |

| Pine Island Center | $3,019 |

| Pine Manor | $3,024 |

| Pine Ridge | $2,816 |

| Pinecrest | $8,530 |

| Pineland | $3,031 |

| Pinellas Park | $2,562 |

| Pinetta | $2,544 |

| Pinewood | $8,551 |

| Pioneer | $3,382 |

| Placida | $2,967 |

| Plant City | $3,222 |

| Plantation | $6,552 |

| Plantation Mobile Home Park | $4,551 |

| Plymouth | $3,663 |

| Poinciana | $3,744 |

| Point Baker | $3,011 |

| Polk City | $3,666 |

| Pomona Park | $2,268 |

| Pompano Beach | $6,463 |

| Ponce de Leon | $3,124 |

| Ponce Inlet | $2,496 |

| Ponte Vedra | $2,316 |

| Ponte Vedra Beach | $2,355 |

| Port Charlotte | $3,038 |

| Port LaBelle | $3,322 |

| Port Orange | $2,537 |

| Port Richey | $2,563 |

| Port Salerno | $3,347 |

| Port St. Joe | $3,159 |

| Port St. John | $2,802 |

| Port St. Lucie | $4,021 |

| Pretty Bayou | $2,812 |

| Princeton | $8,759 |

| Progress Village | $3,311 |

| Punta Gorda | $2,996 |

| Punta Rassa | $3,106 |

| Putnam Hall | $2,280 |

| Quail Ridge | $2,400 |

| Quincy | $2,725 |

| Raiford | $2,725 |

| Raleigh | $2,701 |

| Reddick | $2,604 |

| Redington Beach | $2,475 |

| Redington Shores | $2,533 |

| Richmond Heights | $8,511 |

| Richmond West | $8,832 |

| Ridge Manor | $2,302 |

| Ridge Wood Heights | $2,493 |

| Ridgecrest | $2,576 |

| Rio | $3,041 |

| Rio Pinar | $3,712 |

| River Park | $4,089 |

| River Ranch | $3,619 |

| River Ridge | $2,405 |

| Riverview | $3,312 |

| Riviera Beach | $4,434 |

| Rockledge | $2,887 |

| Roeville | $3,000 |

| Roosevelt Gardens | $6,645 |

| Roseland | $3,592 |

| Rotonda | $2,950 |

| Rotonda West | $2,973 |

| Royal Palm Beach | $4,355 |

| Royal Palm Estates | $4,555 |

| Ruskin | $3,159 |

| Safety Harbor | $2,573 |

| Salem | $2,447 |

| Samoset | $2,328 |

| Samsula-Spruce Creek | $2,602 |

| San Antonio | $2,403 |

| San Carlos Park | $3,002 |

| San Castle | $4,486 |

| San Mateo | $2,238 |

| Sanderson | $2,577 |

| Sanford | $3,091 |

| Sanibel | $3,050 |

| Santa Rosa Beach | $3,079 |

| Sarasota | $2,542 |

| Sarasota Springs | $2,525 |

| Satellite Beach | $2,869 |

| Satsuma | $2,265 |

| Sawgrass | $2,398 |

| Schall Circle | $4,535 |

| Scottsmoor | $2,883 |

| Sebastian | $3,333 |

| Sebring | $2,885 |

| Seffner | $3,252 |

| Seminole | $2,551 |

| Seminole Manor | $4,471 |

| Seville | $2,774 |

| Sewall’s Point | $3,012 |

| Shady Grove | $2,558 |

| Shady Hills | $2,421 |

| Shalimar | $3,099 |

| Sharpes | $2,837 |

| Siesta Key | $2,565 |

| Silver Lake | $2,572 |

| Silver Springs | $2,590 |

| Silver Springs Shores | $2,599 |

| Sky Lake | $3,654 |

| Sneads | $2,886 |

| Solana | $2,952 |

| Sopchoppy | $2,675 |

| Sorrento | $2,629 |

| South Apopka | $3,642 |

| South Bay | $4,279 |

| South Beach | $3,873 |

| South Bradenton | $2,360 |

| South Brooksville | $2,252 |

| South Daytona | $2,551 |

| South Gate Ridge | $2,506 |

| South Highpoint | $2,592 |

| South Miami | $8,528 |

| South Miami Heights | $8,705 |

| South Palm Beach | $4,377 |

| South Pasadena | $2,463 |

| South Patrick Shores | $2,846 |

| South Sarasota | $2,554 |

| South Venice | $2,586 |

| Southchase | $3,645 |

| Southeast Arcadia | $2,897 |

| Southgate | $2,513 |

| Southwest Ranches | $7,355 |

| Sparr | $2,609 |

| Spring Hill | $2,257 |

| Springfield | $2,598 |

| Springhill | $3,024 |

| St. Augustine | $2,270 |

| St. Augustine Beach | $2,379 |

| St. Augustine Shores | $2,233 |

| St. Augustine South | $2,232 |

| St. Cloud | $4,000 |

| St. James City | $3,059 |

| St. Johns | $2,288 |

| St. Leo | $2,332 |

| St. Lucie Village | $4,026 |

| St. Marks | $2,873 |

| St. Pete Beach | $2,452 |

| St. Petersburg | $2,456 |

| Stacey Street | $4,539 |

| Starke | $2,503 |

| Steinhatchee | $2,611 |

| Stock Island | $5,006 |

| Stuart | $3,144 |

| Sugarmill Woods | $2,312 |

| Sumatra | $2,871 |

| Summerfield | $2,586 |

| Summerland Key | $5,046 |

| Sumterville | $2,461 |

| Sun City | $3,242 |

| Sun City Center | $3,274 |

| Suncoast Estates | $3,042 |

| Sunny Isles Beach | $6,946 |

| Sunrise | $7,334 |

| Sunset | $8,713 |

| Surfside | $6,929 |

| Suwannee | $2,497 |

| Sweetwater | $9,309 |

| Sydney | $3,267 |

| Taft | $3,643 |

| Tallahassee | $2,253 |

| Tallevast | $2,481 |

| Tamarac | $7,026 |

| Tamiami | $9,272 |

| Tampa | $3,328 |

| Tangelo Park | $3,616 |

| Tangerine | $3,064 |

| Tarpon Springs | $2,610 |

| Tavares | $2,583 |

| Tavernier | $4,994 |

| Taylor Creek | $3,089 |

| Telogia | $2,871 |

| Temple Terrace | $3,287 |

| Tequesta | $3,873 |

| Terra Ceia | $2,959 |

| The Acreage | $4,269 |

| The Crossings | $9,036 |

| The Hammocks | $9,134 |

| The Meadows | $2,502 |

| The Villages | $2,726 |

| Thonotosassa | $3,226 |

| Three Lakes | $9,025 |

| Three Oaks | $3,005 |

| Tice | $3,039 |

| Tierra Verde | $2,411 |

| Tiger Point | $3,077 |

| Timber Pines | $2,260 |

| Titusville | $2,838 |

| Town ‘n’ Country | $3,435 |

| Treasure Island | $2,454 |

| Trenton | $2,615 |

| Trilby | $2,350 |

| Trinity | $2,401 |

| Tyndall AFB | $3,076 |

| Umatilla | $2,561 |

| Union Park | $3,689 |

| University | $3,430 |

| University Park | $9,321 |

| Upper Grand Lagoon | $3,070 |

| Valparaiso | $3,116 |

| Valrico | $3,251 |

| Vamo | $2,543 |

| Venice | $2,549 |

| Venice Gardens | $2,522 |

| Venus | $2,899 |

| Vernon | $3,006 |

| Vero Beach | $3,455 |

| Vero Beach South | $3,412 |

| Viera East | $2,839 |

| Villano Beach | $2,368 |

| Villas | $3,029 |

| Vineyards | $3,693 |

| Virginia Gardens | $9,143 |

| Wabasso | $3,274 |

| Wabasso Beach | $3,847 |

| Wacissa | $2,533 |

| Wahneta | $3,677 |

| Waldo | $2,211 |

| Wallace | $3,007 |

| Warm Mineral Springs | $2,566 |

| Warrington | $3,184 |

| Washington Park | $6,644 |

| Watergate | $4,629 |

| Watertown | $2,818 |

| Wauchula | $2,915 |

| Wausau | $2,895 |

| Waverly | $3,637 |

| Webster | $2,517 |

| Wedgefield | $3,662 |

| Weeki Wachee Gardens | $2,203 |

| Weirsdale | $2,703 |

| Wekiwa Springs | $3,100 |

| Welaka | $2,268 |

| Wellborn | $2,772 |

| Wellington | $4,415 |

| Wesley Chapel | $2,444 |

| West Bradenton | $2,333 |

| West DeLand | $2,700 |

| West Lealman | $2,542 |

| West Little River | $8,596 |

| West Melbourne | $2,906 |

| West Miami | $8,422 |

| West Palm Beach | $4,333 |

| West Park | $6,820 |

| West Pensacola | $2,823 |

| West Perrine | $8,712 |

| West Samoset | $2,355 |

| West Vero Corridor | $3,264 |

| Westchase | $3,226 |

| Westchester | $8,950 |

| Westgate | $4,376 |

| Weston | $7,504 |

| Westview | $8,560 |

| Westville | $3,002 |

| Westwood Lakes | $9,330 |

| Wewahitchka | $2,877 |

| Whiskey Creek | $2,898 |

| White City | $4,080 |

| White Springs | $2,745 |

| Whitfield | $2,583 |

| Wildwood | $2,482 |

| Williamsburg | $3,618 |

| Williston | $2,597 |

| Willow Oak | $3,645 |

| Wilton Manors | $6,539 |

| Wimauma | $3,277 |

| Windermere | $3,607 |

| Windsor | $3,864 |

| Winter Beach | $3,302 |

| Winter Garden | $3,614 |

| Winter Haven | $3,678 |

| Winter Park | $3,359 |

| Winter Springs | $3,076 |

| Woodville | $2,271 |

| World Golf Village | $2,264 |

| Wright | $3,102 |

| Yalaha | $2,566 |

| Yankeetown | $2,798 |

| Youngstown | $2,783 |

| Yulee | $2,508 |

| Zellwood | $3,605 |

| Zephyrhills | $2,369 |

| Zephyrhills North | $2,407 |

| Zephyrhills South | $2,407 |

| Zephyrhills West | $2,393 |

| Zolfo Springs | $2,938 |

Florida homeowners insurance rates by county

Homeowners in Alachua County pay the cheapest home insurance rates among Florida counties. The average rate there is $2,229 a year, or $186 a month.

Miami-Dade has the highest average home insurance rates among Florida counties at $8,407 a year, or $701 a month.

| County | Annual rate |

|---|---|

| Alachua | $2,229 |

| Baker | $2,543 |

| Bay | $2,815 |

| Bradford | $2,488 |

| Brevard | $2,850 |

| Broward | $6,710 |

| Calhoun | $2,893 |

| Charlotte | $3,000 |

| Citrus | $2,435 |

| Clay | $2,444 |

| Collier | $3,478 |

| Columbia | $2,813 |

| Dade | $7,387 |

| DeSoto | $2,905 |

| Dixie | $2,367 |

| Duval | $2,632 |

| Escambia | $2,905 |

| Flagler | $2,521 |

| Franklin | $2,981 |

| Gadsden | $2,739 |

| Gilchrist | $2,522 |

| Glades | $2,966 |

| Gulf | $2,961 |

| Hamilton | $2,715 |

| Hardee | $3,008 |

| Hendry | $3,371 |

| Hernando | $2,244 |

| Highlands | $2,901 |

| Hillsborough | $3,296 |

| Holmes | $2,974 |

| Indian River | $3,497 |

| Jackson | $2,859 |

| Jefferson | $2,614 |

| Lafayette | $2,577 |

| Lake | $2,628 |

| Lee | $2,996 |

| Leon | $2,253 |

| Levy | $2,746 |

| Liberty | $2,912 |

| Madison | $2,543 |

| Manatee | $2,493 |

| Marion | $2,589 |

| Martin | $3,294 |

| Miami-Dade | $8,407 |

| Monroe | $5,049 |

| Nassau | $2,484 |

| Okaloosa | $3,105 |

| Okeechobee | $3,089 |

| Orange | $3,550 |

| Osceola | $3,981 |

| Palm Beach | $4,400 |

| Pasco | $2,470 |

| Pinellas | $2,571 |

| Polk | $3,641 |

| Putnam | $2,262 |

| Santa Rosa | $3,045 |

| Sarasota | $2,547 |

| Seminole | $3,102 |

| St. Johns | $2,303 |

| St. Lucie | $4,091 |

| Sumter | $2,566 |

| Suwannee | $2,777 |

| Taylor | $2,505 |

| Union | $2,726 |

| Volusia | $2,609 |

| Wakulla | $2,751 |

| Walton | $2,893 |

| Washington | $3,057 |

Additional home insurance coverages needed in Florida

Florida state law doesn’t require home insurance, but mortgage lenders usually do.

Lenders may require more than standard home insurance in Florida, too. Depending on where you live, you might need flood, windstorm and/or sinkhole coverage as well.

Flood insurance

Standard home insurance policies don’t cover flood damage or destruction. For that, you need separate coverage.

You can buy flood insurance in Florida through the government-run National Flood Insurance Program (NFIP) or from private flood insurance companies. The average cost of flood insurance in Florida is $760 a year, however, your rate will vary by your exact location.

NFIP flood insurance policies offer up to $250,000 coverage for your home and $100,000 for your possessions. If you need or want more than those amounts, contact private flood insurance companies.

Windstorm insurance

Standard homeowners insurance policies usually cover wind damage, but yours might exclude it if you live on or near the Florida coast.

Several companies sell windstorm insurance in Florida. If you struggle to find a company that will sell it to you, go to Citizens.

Sinkhole insurance

A typical home insurance policy only covers sinkhole damage if the sinkhole leaves a visible hole in the ground and the damage is such that you can no longer live in your home.

In all other cases, standard homeowners insurance won’t cover sinkhole damage to your Florida home.

To be covered in as many situations as possible, you can buy sinkhole insurance as an endorsement to an existing policy or as standalone coverage.

Frequently asked questions

You might think severe weather like hurricanes and flooding is responsible for Florida’s high home insurance costs.

Although it plays a role, frivolous lawsuits and insurance fraud are more to blame.

Increasing costs tied to the lawsuits and fraud have caused several local insurance companies to close their doors. They’ve also caused national companies to pull back on serving the state or to leave it altogether.

Both reactions have helped raise home insurance rates statewide.

Tower Hill charges the most affordable home insurance rates to Florida homeowners, at an average of $2,443 a year.

Methodology

The rates shown in this article are based on non-binding quotes collected from Quadrant Information Services. Average rates were compiled from rates in Florida. The following coverages and deductibles were used unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

—

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

Overall satisfaction ratings are from the J.D. Power 2024 U.S. Home Insurance Study.

Complaint ratings are based on NAIC data from 2024.