Best Homeowners Insurance in Massachusetts

Dorchester Mutual is the best homeowners insurance company in Massachusetts, with the state’s cheapest rates as well as a wide range of coverages and discounts. Dorchester Mutual has an average rate of $685 a year.

Amica is Massachusetts’ best home insurance company if customer service and satisfaction are most important to you.

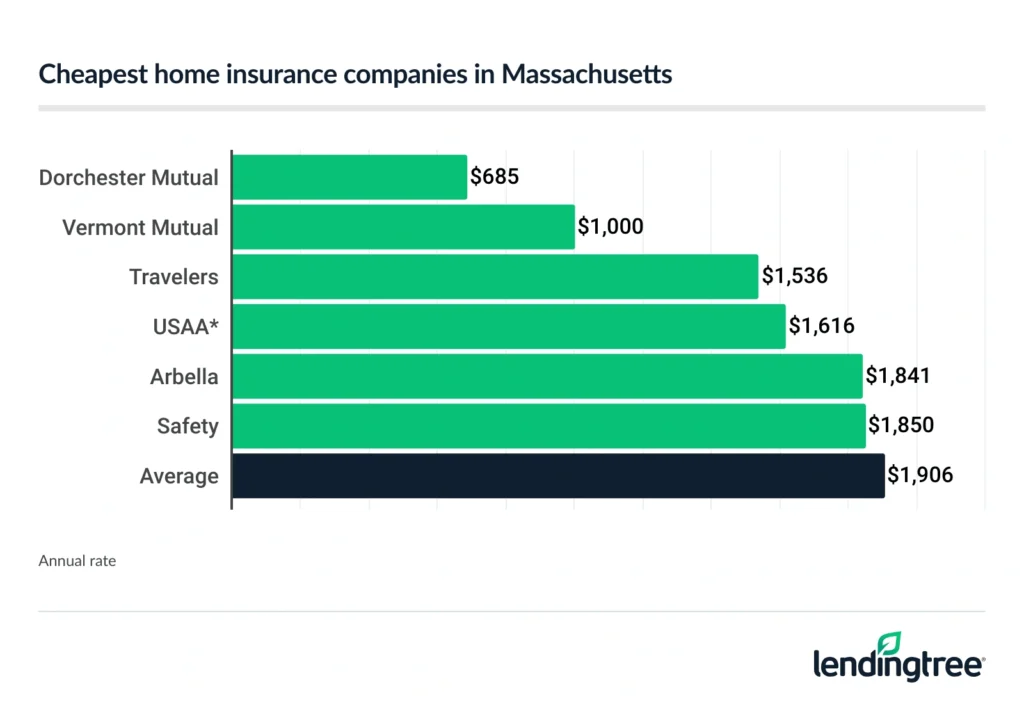

Cheapest home insurance companies in Massachusetts

Dorchester Mutual is the cheapest home insurance company in Massachusetts, with an average rate of $685 a year.

Vermont Mutual also offers affordable home insurance to the state’s homeowners, with rates that average $1,000 a year. This is nearly half the state average rate of $1,906 a year.

| Company | Average Rate |

|---|---|

| Dorchester Mutual | $685 |

| Vermont Mutual | $1,000 |

| Travelers | $1,536 |

| USAA* | $1,616 |

| Arbella | $1,841 |

| Safety | $1,850 |

| Amica | $2,578 |

| Citizens | $3,415 |

To get the cheapest rate for the coverage you need, compare home insurance quotes from multiple companies while you shop for a policy.

Best home insurance companies in Massachusetts

Dorchester Mutual is the best home insurance company overall in Massachusetts, mostly because it has the state’s lowest average rate of $685 a year, or $57 a month.

Amica, Arbella, Safety and Travelers are Massachusetts’ best home insurance companies for specific categories, like coverage options, discounts and customer satisfaction.

Best overall home insurance in Massachusetts: Dorchester Mutual

Dorchester Mutual is Massachusetts’ best home insurance company because of its winning combination of cheap rates, discounts and coverage options.

In particular, Dorchester Mutual offers:

- The state’s cheapest home insurance rates by a wide margin

- Many discounts that can save you money, such as lower rates for smart home and protective devices

- Interesting add-on coverages, like home computer coverage and personal cyber protection

Among Massachusetts home insurance companies, Dorchester Mutual also has the advantage of being locally based and focused, serving state homeowners since 1855.

Best cheap home insurance rates in Massachusetts: Dorchester Mutual

If getting the cheapest homeowners insurance in Massachusetts is your goal, Dorchester Mutual is probably the best company for you.

Dorchester’s average home insurance rate is $685 a year. None of the other companies we surveyed in the state come close. Second-place Vermont Mutual’s average rate is over $300 more at $1,000 a year.

Best home insurance company for customer satisfaction: Amica

Amica is the best insurance company for Massachusetts homeowners who value customer service and satisfaction the most.

- Amica’s J.D. Power customer satisfaction rating of 844 is one of the highest among insurance companies that serve everyone.

- Its complaint rating of 0.33 from the National Association of Insurance Commissioners (NAIC) is among the best from the companies surveyed.

Amica’s rates are higher than the state average, but it offers several home insurance discounts that could lower your policy cost. With the company’s multiline discount, for example, you can save up to 30% when you bundle home insurance with auto, umbrella or life coverage.

Best home insurance discounts in Massachusetts: Arbella and Safety

Arbella and Safety are the best home insurance companies in Massachusetts for discounts that can lower the cost of your policy.

Arbella offers home insurance discounts for:

- First-time customers (up to 7% discount)

- Home energy assessment (5%)

- New home (20%)

- Policy renewal (3%)

- Safety devices (3%)

Safety has home insurance discounts for:

- Claim-free (16%)

- Electronic policy issuance (up to 5% discount)

- Fire and burglar alarms (16%)

- New home (18%)

Both Arbella and Safety have multipolicy or bundle discounts that can save you money when you insure your home and auto together. Arbella’s bundling discount goes as high as 25%, while Safety’s is 20%.

Safety also provides multipolicy discounts if you have a personal umbrella and/or dwelling fire policy, as well as an auto policy with the company.

Best home insurance coverage options: Travelers

Travelers is the best homeowners insurance company in Massachusetts for add-on coverage options.

It offers additional coverage for:

- Green homes

- Jewelry and valuable items

- Water backup and sump pump discharge or overflow

- Identity fraud

Travelers also lets policyholders insure contents or personal property at replacement cost rather than actual cash value. Actual cash value pays you the depreciated value of damaged or destroyed belongings, while replacement cost covers buying new replacements for your valuables.

Policyholders can get additional replacement cost coverage for their home’s structure, too.

How much is home insurance in Massachusetts?

The average cost of home insurance in Massachusetts is $1,906 a year, or $159 a month, if you have a dwelling coverage limit of $400,000.

If your dwelling limit is lower than that, you’ll usually pay less for home insurance, while a higher limit could cost you more.

Massachusetts home insurance rates by coverage amount

| Dwelling Limit | Annual Rate |

|---|---|

| $350,000 | $1,727 |

| $400,000 | $1,906 |

| $450,000 | $2,094 |

Insurance for a home with a dwelling coverage limit of $350,000 costs 18% less than it does for a home with a $450,000 limit.

Dwelling coverage helps pay to repair or rebuild the structure of your home if a covered peril damages or destroys it.

One of the best ways to find out how much a policy will cost you is to compare home insurance quotes from several companies.

Massachusetts homeowners insurance rates by city

Where you live is one of many rate factors that determine what you pay for home insurance. This is why homeowners in Boston tend to pay higher home insurance rates than those in Springfield.

Williamstown homeowners pay the lowest average home insurance premiums, at $1,158 a year. Homeowners in Chilmark pay the state’s highest home insurance premiums, which average $5,044 a year.

| City | Annual Rate |

|---|---|

| Abington | $1,859 |

| Accord | $2,127 |

| Acton | $1,401 |

| Acushnet | $2,547 |

| Acushnet Center | $2,487 |

| Adams | $1,168 |

| Agawam | $1,266 |

| Allston | $2,141 |

| Amesbury Town | $1,550 |

| Amherst | $1,242 |

| Amherst Center | $1,235 |

| Andover | $1,557 |

| Arlington | $1,406 |

| Arlington Heights | $1,411 |

| Ashburnham | $1,432 |

| Ashby | $1,437 |

| Ashfield | $1,241 |

| Ashland | $1,447 |

| Ashley Falls | $1,245 |

| Assonet | $2,381 |

| Athol | $1,403 |

| Attleboro | $1,966 |

| Attleboro Falls | $2,024 |

| Auburn | $1,428 |

| Auburndale | $1,479 |

| Avon | $1,625 |

| Ayer | $1,339 |

| Babson Park | $1,715 |

| Baldwinville | $1,409 |

| Barnstable | $3,695 |

| Barre | $1,417 |

| Becket | $1,306 |

| Bedford | $1,405 |

| Belchertown | $1,277 |

| Bellingham | $1,611 |

| Belmont | $1,446 |

| Berkley | $1,855 |

| Berkshire | $1,213 |

| Berlin | $1,413 |

| Bernardston | $1,210 |

| Beverly | $1,846 |

| Billerica | $1,397 |

| Blackstone | $1,436 |

| Blandford | $1,317 |

| Bliss Corner | $2,716 |

| Bolton | $1,442 |

| Bondsville | $1,296 |

| Boston | $2,007 |

| Bourne | $3,479 |

| Boxborough | $1,405 |

| Boxford | $1,583 |

| Boylston | $1,413 |

| Braintree Town | $1,629 |

| Brant Rock | $2,174 |

| Brewster | $3,647 |

| Bridgewater | $1,901 |

| Brighton | $2,140 |

| Brimfield | $1,387 |

| Brockton | $1,977 |

| Brookfield | $1,427 |

| Brookline | $1,883 |

| Brookline Village | $1,878 |

| Bryantville | $1,975 |

| Buckland | $1,292 |

| Burlington | $1,403 |

| Buzzards Bay | $3,263 |

| Byfield | $1,586 |

| Cambridge | $1,550 |

| Canton | $1,617 |

| Carlisle | $1,437 |

| Carver | $2,056 |

| Cataumet | $4,087 |

| Centerville | $3,682 |

| Charlemont | $1,308 |

| Charlestown | $2,160 |

| Charlton | $1,468 |

| Charlton City | $1,458 |

| Charlton Depot | $1,445 |

| Chartley | $2,138 |

| Chatham | $4,247 |

| Chelmsford | $1,339 |

| Chelsea | $2,217 |

| Cherry Valley | $1,408 |

| Cheshire | $1,220 |

| Chester | $1,303 |

| Chesterfield | $1,298 |

| Chestnut Hill | $1,773 |

| Chicopee | $1,392 |

| Chilmark | $5,044 |

| Clinton | $1,386 |

| Cochituate | $1,429 |

| Cohasset | $2,239 |

| Colrain | $1,302 |

| Concord | $1,400 |

| Conway | $1,292 |

| Cordaville | $1,369 |

| Cotuit | $3,893 |

| Cummaquid | $3,904 |

| Cummington | $1,284 |

| Cuttyhunk | $4,637 |

| Dalton | $1,221 |

| Danvers | $1,623 |

| Dedham | $1,616 |

| Deerfield | $1,207 |

| Dennis | $3,578 |

| Dennis Port | $3,873 |

| Devens | $1,328 |

| Dighton | $1,825 |

| Dorchester | $2,148 |

| Dorchester Center | $2,077 |

| Douglas | $1,430 |

| Dover | $1,560 |

| Dracut | $1,399 |

| Drury | $1,226 |

| Dudley | $1,451 |

| Dunstable | $1,361 |

| Duxbury | $2,381 |

| East Boston | $2,167 |

| East Bridgewater | $1,894 |

| East Brookfield | $1,417 |

| East Dennis | $3,697 |

| East Douglas | $1,414 |

| East Falmouth | $3,828 |

| East Freetown | $2,376 |

| East Harwich | $3,837 |

| East Longmeadow | $1,291 |

| East Orleans | $3,749 |

| East Otis | $1,310 |

| East Pepperell | $1,348 |

| East Princeton | $1,401 |

| East Sandwich | $3,476 |

| East Taunton | $2,114 |

| East Templeton | $1,406 |

| East Walpole | $1,596 |

| East Wareham | $2,513 |

| East Weymouth | $1,657 |

| Eastham | $3,874 |

| Easthampton | $1,303 |

| Easthampton Town | $1,266 |

| Edgartown | $4,498 |

| Elmwood | $2,029 |

| Erving | $1,173 |

| Essex | $1,783 |

| Everett | $1,501 |

| Fairhaven | $2,732 |

| Fall River | $2,318 |

| Falmouth | $3,976 |

| Fayville | $1,362 |

| Feeding Hills | $1,335 |

| Fiskdale | $1,457 |

| Fitchburg | $1,351 |

| Florence | $1,246 |

| Forestdale | $3,469 |

| Foxboro | $1,629 |

| Foxborough | $1,621 |

| Framingham | $1,430 |

| Franklin | $1,588 |

| Franklin Town | $1,591 |

| Gardner | $1,401 |

| Georgetown | $1,587 |

| Gilbertville | $1,439 |

| Gill | $1,199 |

| Glendale | $1,214 |

| Gloucester | $2,047 |

| Goshen | $1,293 |

| Grafton | $1,407 |

| Granby | $1,254 |

| Granville | $1,347 |

| Great Barrington | $1,206 |

| Green Harbor | $2,174 |

| Green Harbor-Cedar Crest | $2,348 |

| Greenbush | $2,179 |

| Greenfield Town | $1,211 |

| Groton | $1,370 |

| Groveland | $1,549 |

| Hadley | $1,252 |

| Halifax | $1,971 |

| Hampden | $1,297 |

| Hanover | $1,881 |

| Hanscom AFB | $1,434 |

| Hanson | $1,883 |

| Harvard | $1,383 |

| Harwich Center | $4,011 |

| Harwich Port | $4,167 |

| Hatfield | $1,235 |

| Hathorne | $1,679 |

| Haverhill | $1,545 |

| Haydenville | $1,263 |

| Heath | $1,290 |

| Hingham | $2,077 |

| Hinsdale | $1,242 |

| Holbrook | $1,634 |

| Holden | $1,408 |

| Holland | $1,367 |

| Holliston | $1,442 |

| Holyoke | $1,350 |

| Hopedale | $1,415 |

| Hopkinton | $1,479 |

| Housatonic | $1,195 |

| Hubbardston | $1,456 |

| Hudson | $1,438 |

| Hull | $2,383 |

| Humarock | $2,252 |

| Huntington | $1,289 |

| Hyannis | $3,845 |

| Hyannis Port | $3,796 |

| Hyde Park | $2,062 |

| Indian Orchard | $1,388 |

| Ipswich | $1,756 |

| Jamaica Plain | $2,068 |

| Jefferson | $1,397 |

| Kingston | $2,326 |

| Lake Pleasant | $1,215 |

| Lakeville | $2,053 |

| Lancaster | $1,464 |

| Lanesboro | $1,255 |

| Lawrence | $1,729 |

| Lee | $1,182 |

| Leeds | $1,221 |

| Leicester | $1,419 |

| Lenox | $1,184 |

| Lenox Dale | $1,185 |

| Leominster | $1,384 |

| Leverett | $1,295 |

| Lexington | $1,403 |

| Lincoln | $1,399 |

| Linwood | $1,401 |

| Littleton | $1,360 |

| Littleton Common | $1,360 |

| Longmeadow | $1,260 |

| Lowell | $1,530 |

| Ludlow | $1,308 |

| Lunenburg | $1,418 |

| Lynn | $2,074 |

| Lynnfield | $1,610 |

| Malden | $1,413 |

| Manchaug | $1,383 |

| Manchester | $1,915 |

| Manchester By The Sea | $1,857 |

| Manomet | $2,011 |

| Mansfield | $1,707 |

| Mansfield Center | $1,965 |

| Marblehead | $1,963 |

| Marion | $2,871 |

| Marion Center | $2,700 |

| Marlborough | $1,474 |

| Marshfield | $2,411 |

| Marshfield Hills | $2,350 |

| Marstons Mills | $3,844 |

| Mashpee | $3,869 |

| Mashpee Neck | $3,853 |

| Mattapan | $2,066 |

| Mattapoisett | $2,872 |

| Mattapoisett Center | $2,691 |

| Maynard | $1,401 |

| Medfield | $1,582 |

| Medford | $1,459 |

| Medway | $1,599 |

| Melrose | $1,405 |

| Mendon | $1,415 |

| Menemsha | $4,616 |

| Merrimac | $1,556 |

| Methuen Town | $1,526 |

| Middleboro | $2,011 |

| Middleborough Center | $1,928 |

| Middlefield | $1,298 |

| Middleton | $1,606 |

| Milford | $1,395 |

| Mill River | $1,275 |

| Millbury | $1,417 |

| Millers Falls | $1,212 |

| Millis | $1,599 |

| Millis-Clicquot | $1,599 |

| Millville | $1,413 |

| Milton | $1,589 |

| Milton Village | $1,625 |

| Minot | $2,249 |

| Monponsett | $2,015 |

| Monroe Bridge | $1,290 |

| Monson | $1,289 |

| Monson Center | $1,289 |

| Montague | $1,244 |

| Monterey | $1,287 |

| Monument Beach | $3,503 |

| Nahant | $2,005 |

| Nantucket | $4,868 |

| Natick | $1,434 |

| Needham | $1,542 |

| Needham Heights | $1,567 |

| New Bedford | $2,722 |

| New Braintree | $1,417 |

| New Salem | $1,307 |

| New Seabury | $3,869 |

| New Town | $1,417 |

| Newbury | $1,781 |

| Newburyport | $1,747 |

| Newton | $1,483 |

| Newton Center | $1,494 |

| Newton Highlands | $1,500 |

| Newton Lower Falls | $1,493 |

| Newton Upper Falls | $1,513 |

| Newtonville | $1,492 |

| Nonantum | $1,454 |

| Norfolk | $1,601 |

| North Adams | $1,206 |

| North Amherst | $1,227 |

| North Andover | $1,579 |

| North Attleboro | $1,990 |

| North Billerica | $1,374 |

| North Brookfield | $1,402 |

| North Carver | $1,955 |

| North Chatham | $4,262 |

| North Chelmsford | $1,374 |

| North Dartmouth | $2,561 |

| North Dighton | $2,075 |

| North Eastham | $3,858 |

| North Easton | $2,032 |

| North Egremont | $1,275 |

| North Falmouth | $3,679 |

| North Grafton | $1,398 |

| North Hatfield | $1,249 |

| North Lakeville | $1,964 |

| North Marshfield | $2,259 |

| North Oxford | $1,416 |

| North Pembroke | $1,882 |

| North Plymouth | $2,317 |

| North Reading | $1,390 |

| North Scituate | $2,286 |

| North Seekonk | $2,080 |

| North Truro | $3,879 |

| North Uxbridge | $1,419 |

| North Waltham | $1,415 |

| North Westport | $2,608 |

| North Weymouth | $1,663 |

| Northampton | $1,238 |

| Northborough | $1,393 |

| Northbridge | $1,405 |

| Northfield | $1,296 |

| Northwest Harwich | $3,827 |

| Norton | $1,699 |

| Norton Center | $1,959 |

| Norwell | $1,964 |

| Norwood | $1,611 |

| Nutting Lake | $1,413 |

| Oak Bluffs | $4,506 |

| Oakham | $1,473 |

| Ocean Bluff | $2,226 |

| Ocean Bluff-Brant Rock | $2,347 |

| Ocean Grove | $2,445 |

| Onset | $2,515 |

| Orange | $1,234 |

| Orleans | $3,739 |

| Osterville | $3,624 |

| Otis | $1,308 |

| Oxford | $1,470 |

| Palmer | $1,324 |

| Paxton | $1,417 |

| Peabody | $1,620 |

| Pembroke | $1,882 |

| Pepperell | $1,344 |

| Petersham | $1,474 |

| Pinehurst | $1,405 |

| Pittsfield | $1,186 |

| Plainfield | $1,309 |

| Plainville | $1,634 |

| Plymouth | $2,302 |

| Plympton | $1,987 |

| Pocasset | $3,530 |

| Prides Crossing | $1,618 |

| Princeton | $1,387 |

| Provincetown | $4,048 |

| Quincy | $1,772 |

| Randolph | $1,606 |

| Raynham | $1,873 |

| Raynham Center | $2,110 |

| Reading | $1,399 |

| Readville | $2,113 |

| Rehoboth | $1,886 |

| Revere | $2,161 |

| Richmond | $1,205 |

| Rochdale | $1,457 |

| Rochester | $2,295 |

| Rockland | $1,863 |

| Rockport | $1,985 |

| Roslindale | $2,045 |

| Rowe | $1,275 |

| Rowley | $1,721 |

| Roxbury | $2,146 |

| Roxbury Crossing | $2,140 |

| Royalston | $1,473 |

| Russell | $1,318 |

| Rutland | $1,410 |

| Sagamore | $3,505 |

| Sagamore Beach | $3,639 |

| Salem | $1,838 |

| Salisbury | $1,787 |

| Sandisfield | $1,305 |

| Sandwich | $3,476 |

| Saugus | $1,736 |

| Savoy | $1,244 |

| Scituate | $2,350 |

| Seekonk | $1,878 |

| Sharon | $1,621 |

| Sheffield | $1,251 |

| Shelburne Falls | $1,243 |

| Sheldonville | $1,601 |

| Sherborn | $1,428 |

| Shirley | $1,365 |

| Shrewsbury | $1,409 |

| Shutesbury | $1,284 |

| Siasconset | $4,868 |

| Silver Beach | $3,483 |

| Smith Mills | $2,625 |

| Somerset | $2,302 |

| Somerville | $1,534 |

| South Amherst | $1,224 |

| South Ashburnham | $1,388 |

| South Barre | $1,433 |

| South Boston | $2,238 |

| South Carver | $2,183 |

| South Chatham | $4,213 |

| South Dartmouth | $2,785 |

| South Deerfield | $1,233 |

| South Dennis | $3,695 |

| South Duxbury | $2,317 |

| South Easton | $2,054 |

| South Egremont | $1,241 |

| South Grafton | $1,419 |

| South Hadley | $1,269 |

| South Hamilton | $1,618 |

| South Harwich | $3,821 |

| South Lancaster | $1,420 |

| South Lee | $1,302 |

| South Orleans | $3,796 |

| South Walpole | $1,597 |

| South Wellfleet | $3,852 |

| South Weymouth | $1,629 |

| South Yarmouth | $3,828 |

| Southampton | $1,249 |

| Southborough | $1,382 |

| Southbridge | $1,424 |

| Southbridge Town | $1,410 |

| Southfield | $1,324 |

| Southwick | $1,339 |

| Spencer | $1,453 |

| Springfield | $1,588 |

| Sterling | $1,400 |

| Still River | $1,399 |

| Stockbridge | $1,205 |

| Stoneham | $1,420 |

| Stoughton | $1,606 |

| Stow | $1,362 |

| Sturbridge | $1,461 |

| Sudbury | $1,421 |

| Sunderland | $1,209 |

| Sutton | $1,418 |

| Swampscott | $1,923 |

| Swansea | $2,294 |

| Taunton | $1,799 |

| Teaticket | $3,828 |

| Templeton | $1,407 |

| Tewksbury | $1,415 |

| Thorndike | $1,320 |

| Three Rivers | $1,324 |

| Topsfield | $1,616 |

| Townsend | $1,331 |

| Truro | $4,087 |

| Turners Falls | $1,211 |

| Tyngsboro | $1,341 |

| Upton | $1,387 |

| Uxbridge | $1,395 |

| Village Of Nagog Woods | $1,407 |

| Vineyard Haven | $4,475 |

| Waban | $1,498 |

| Wakefield | $1,389 |

| Wales | $1,349 |

| Walpole | $1,592 |

| Waltham | $1,439 |

| Ware | $1,274 |

| Wareham | $2,753 |

| Wareham Center | $2,588 |

| Warren | $1,452 |

| Warwick | $1,284 |

| Watertown Town | $1,449 |

| Waverley | $1,447 |

| Wayland | $1,445 |

| Webster | $1,446 |

| Wellesley | $1,550 |

| Wellesley Hills | $1,590 |

| Wellfleet | $4,081 |

| Wendell | $1,302 |

| Wendell Depot | $1,289 |

| Wenham | $1,633 |

| West Barnstable | $3,498 |

| West Boxford | $1,675 |

| West Boylston | $1,411 |

| West Bridgewater | $1,846 |

| West Brookfield | $1,432 |

| West Chatham | $4,247 |

| West Chesterfield | $1,288 |

| West Chop | $4,645 |

| West Concord | $1,399 |

| West Dennis | $3,875 |

| West Falmouth | $3,962 |

| West Groton | $1,363 |

| West Harwich | $4,201 |

| West Hatfield | $1,238 |

| West Hyannisport | $4,169 |

| West Medford | $1,431 |

| West Millbury | $1,435 |

| West Newbury | $1,542 |

| West Newton | $1,498 |

| West Roxbury | $2,056 |

| West Springfield Town | $1,270 |

| West Stockbridge | $1,235 |

| West Tisbury | $4,557 |

| West Townsend | $1,391 |

| West Wareham | $2,688 |

| West Warren | $1,446 |

| West Yarmouth | $3,820 |

| Westborough | $1,400 |

| Westfield | $1,260 |

| Westford | $1,319 |

| Westminster | $1,365 |

| Weston | $1,441 |

| Westport | $2,688 |

| Westport Point | $2,516 |

| Westwood | $1,592 |

| Weweantic | $2,596 |

| Weymouth | $1,668 |

| Whately | $1,213 |

| Wheelwright | $1,420 |

| White Horse Beach | $1,972 |

| White Island Shores | $2,596 |

| Whitinsville | $1,387 |

| Whitman | $1,841 |

| Wilbraham | $1,293 |

| Williamsburg | $1,284 |

| Williamstown | $1,158 |

| Wilmington | $1,477 |

| Winchendon | $1,381 |

| Winchendon Springs | $1,381 |

| Winchester | $1,436 |

| Windsor | $1,279 |

| Winthrop Town | $2,274 |

| Woburn | $1,416 |

| Woods Hole | $3,914 |

| Woodville | $1,439 |

| Worcester | $1,695 |

| Woronoco | $1,305 |

| Worthington | $1,279 |

| Wrentham | $1,620 |

| Yarmouth Port | $3,610 |

Additional home insurance coverages needed in Massachusetts

Standard home insurance doesn’t cover flood damage or destruction. For that, you need a separate flood insurance policy.

You can buy flood insurance through the National Flood Insurance Program (NFIP) or from private flood insurance companies.

NFIP flood insurance policies offer up to $250,000 coverage for your home and $100,000 for your belongings. If you need or want more than those amounts, contact private flood insurance companies.

Frequently asked questions

No, Massachusetts law does not require you to buy home insurance. If you have a mortgage for your home, though, your lender may require it. Your lender may also require you to get flood insurance for your home if it’s in a flood zone.

Home insurance covers damage to your home and property due to perils like fire, hail, wind, falling objects and burst pipes. It also usually covers vandalism and theft.

Home insurance usually doesn’t cover damage caused by floods, earthquakes, mine subsidence, sinkholes or other earth movements.

To find cheap home insurance in Massachusetts, compare quotes from several companies before buying or renewing a policy. See if you qualify for any discounts, too. And make sure you have the right kinds and amounts of coverage.

Methodology

The rates shown in this article are based on nonbinding quotes collected from Quadrant Information Services. Average rates were compiled from rates in Massachusetts. The following coverages and deductibles were used unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

Customer satisfaction and claims satisfaction ratings obtained from the J.D. Power 2023 U.S. Home Insurance Study.

Complaint ratings come from NAIC records for 2023. A confirmed complaint is one that leads to a finding of fault. A company with a 2.0 complaint rating has twice as many confirmed complaints as expected for its size. A company with a 0.5 rating has half as many.

*USAA is only available to current and former members of the military and their families.