Best Homeowners Insurance in New York

NYCM Insurance is the overall best home insurance company in New York, with affordable rates and a good complaint rating. However, some seniors may find The Hartford to be a better choice.

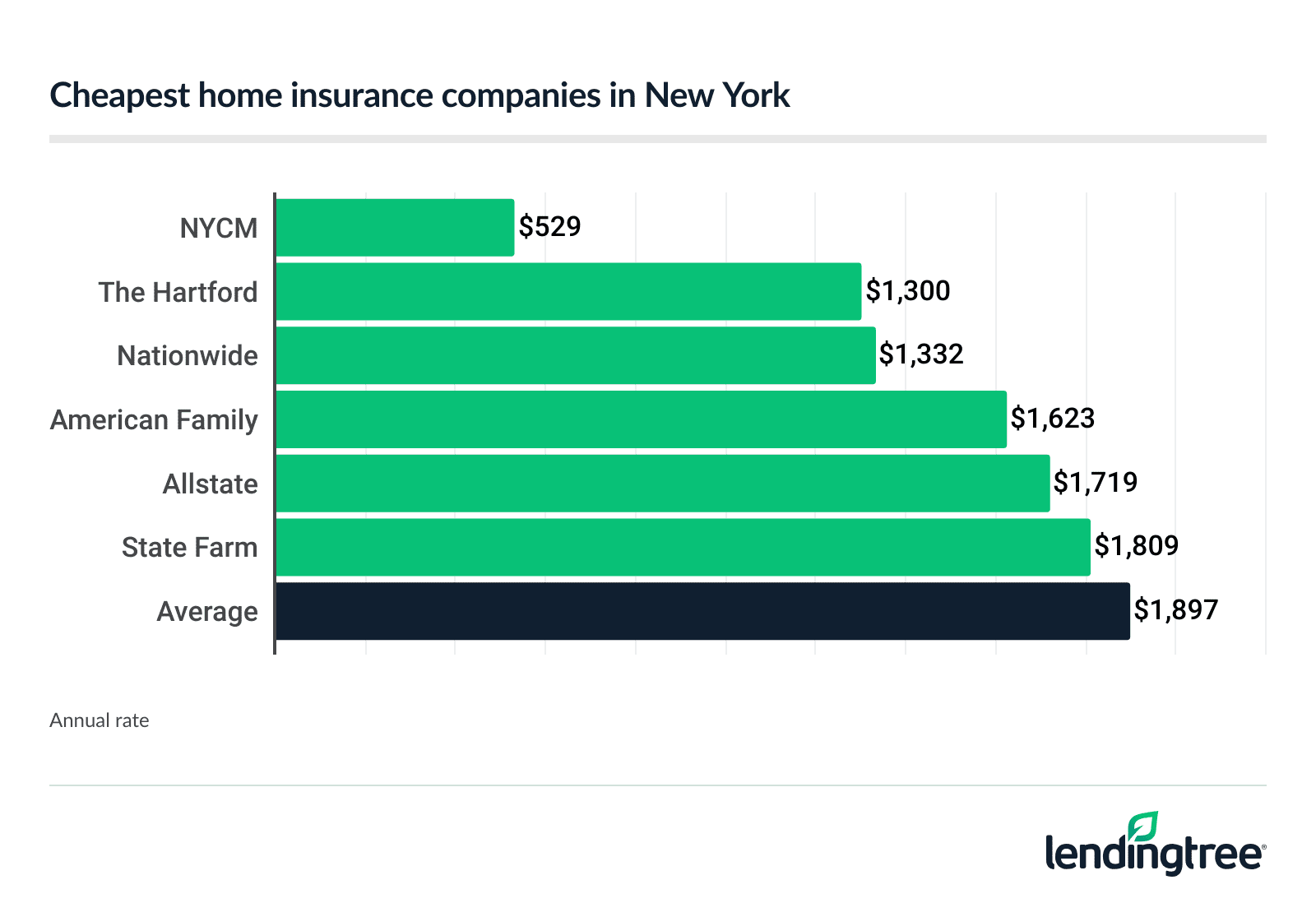

Best cheap home insurance in New York

New York’s cheapest home insurance companies

NYCM has the cheapest rates for homeowners insurance in New York, with an average rate of $529 per year.

NYCM also offers an insurance bundling discount if you buy both your home and auto insurance through it. A unique discount from NYCM is its work from home discount. If you work from home for 20 hours or more a week, you could save even more on your home insurance.

The next-cheapest home insurance option in New York is The Hartford, at $1,300 a year.

Cheapest home insurance quotes in NY

| Company | Average annual rate | LendingTree score | |

|---|---|---|---|

| NYCM | $529 | Not rated |

| The Hartford | $1,300 | Not rated |

| Nationwide | $1,332 | |

| American Family | $1,623 | |

| Allstate | $1,719 | |

| State Farm | $1,809 | |

| Heritage Insurance | $2,196 | Not rated |

| Chubb | $2,320 | Not rated |

| AIG | $2,393 | Not rated |

| Tokio Marine | Tokio Marine | $3,753 | Not rated |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

New York’s best homeowners insurance companies

NYCM is the best home insurance company in New York. It has the most affordable quotes, on average, and also receives few customer complaints.

Older homeowners might find The Hartford to be a better option, though, and should compare home insurance quotes from it as well.

State Farm is the most popular home insurer among the companies we surveyed in New York and is also worth a look.

Top New York home insurance companies

| Company | Annual rate | Satisfaction rating | Complaint rating |

|---|---|---|---|

| Best overall: NYCM | $529 | Not rated | 0.63 (Good) |

| Best for seniors: The Hartford | $1,300 | 626 (Poor) | 0.39 (Good) |

| Most popular: State Farm | $1,809 | 643 (Good) | 1.85 (Poor) |

Ratings include satisfaction scores from J.D. Power’s 2024 U.S. Home Insurance Study and 2022 complaint data from the National Association of Insurance Commissioners (NAIC).

Best overall home insurance company in New York: NYCM

NYCM’s average rate is 72% cheaper than the New York average of $1,897, making it the most affordable in the state.

NYCM also has one of the best NAIC complaint ratings The NAIC rates companies on confirmed complaints by size. A confirmed complaint is one that leads to a finding of fault. of the home insurers we looked at in New York. This means the company receives few customer complaints.

| Pros | Cons |

|---|---|

Very low average rate Many discounts Good complaint index rating 24/7 customer service | Few add-on coverage options No customer satisfaction rating |

Best home insurance in New York for seniors: The Hartford

The Hartford has the second-cheapest home insurance rate in New York, at an average of $1,300 a year, but senior homeowners might save even more money.

The Hartford has an excellent home and auto insurance bundle package that it offers to AARP members, with savings of 5% on car insurance and 20% on home insurance.

| Pros | Cons |

|---|---|

Low average home insurance rate Good bundling perk for seniors Positive complaint rating | Few home insurance discounts Poor customer satisfaction rating |

Most popular home insurance company: State Farm

State Farm is the nation’s most popular choice for home insurance companies, with a 9.2% market share, according to the NAIC.

While its average premium isn’t as cheap as NYCM’s, it’s cheaper than the state average, at an affordable $1,809.

It also has strong J.D. Power customer satisfaction score J.D. Power’s satisfaction scores are based on customer surveys rating companies on factors like price, coverage options and problem resolution. , although its complaint index rating is weak.

| Pros | Cons |

|---|---|

Low average home insurance rate Good satisfaction rating Most popular home insurance company | Poor complaint rating No paperless or pay-in-full discounts |

How much is home insurance in New York?

The average cost of homeowners insurance in New York is $1,897 a year. However, the final quote you get from an insurer is based on many factors, including:

- Age of your home

- Construction materials used

- Crime rates and extreme weather trends in your area

- Insurance claim history

- Coverage limits

- Discounts

Since home insurance companies weigh these factors differently, you should compare home insurance quotes from several insurers to get the cheapest price for a policy.

New York home insurance rates by coverage amounts

How much dwelling coverage you get can greatly impact how much you pay for home insurance. Your policy’s dwelling coverage Your home insurance policy’s dwelling coverage pays to repair or rebuild the structure of your home if a fire, hail or other event damages or destroys it. limit should equal the amount it would take to rebuild your home after a total loss.

| Coverage amount | Average annual rate |

|---|---|

| $350,000 | $1,674 |

| $400,000 | $1,897 |

| $450,000 | $2,118 |

You are not required by law to carry home insurance. However, if you financed your house, expect your lender to require you to carry home insurance for the duration of the loan.

New York home insurance rates by city

Of the biggest cities in New York, Cheektowaga enjoys the lowest average home insurance rate of $1,393 a year.

West Henrietta has the cheapest home insurance of all New York cities and towns, with an average rate of $1,338 a year. Napeague has the state’s highest home insurance rates.

Home insurance rates near you

| City | Average annual rate |

|---|---|

| Accord | $1,658 |

| Acra | $1,681 |

| Adams | $1,687 |

| Adams Basin | $1,388 |

| Adams Center | $1,686 |

| Addison | $1,555 |

| Adirondack | $1,703 |

| Afton | $1,565 |

| Airmont | $1,682 |

| Akron | $1,390 |

| Albany | $1,573 |

| Albertson | $2,518 |

| Albion | $1,491 |

| Alcove | $1,498 |

| Alden | $1,441 |

| Alder Creek | $1,686 |

| Alexander | $1,490 |

| Alexandria Bay | $1,652 |

| Alfred | $1,558 |

| Alfred Station | $1,553 |

| Allegany | $1,555 |

| Allentown | $1,555 |

| Alma | $1,563 |

| Almond | $1,552 |

| Alpine | $1,549 |

| Alplaus | $1,567 |

| Altamont | $1,501 |

| Altmar | $1,496 |

| Alton | $1,478 |

| Altona | $1,740 |

| Amagansett | $4,141 |

| Amawalk | $1,812 |

| Amenia | $1,525 |

| Amityville | $3,762 |

| Amsterdam | $1,618 |

| Ancram | $1,687 |

| Ancramdale | $1,676 |

| Andes | $1,587 |

| Andover | $1,558 |

| Angelica | $1,551 |

| Angola | $1,391 |

| Angola on the Lake | $1,386 |

| Annandale On Hudson | $1,535 |

| Antwerp | $1,663 |

| Apalachin | $1,518 |

| Appleton | $1,415 |

| Apulia Station | $1,416 |

| Aquebogue | $3,479 |

| Arcade | $1,533 |

| Arden | $1,645 |

| Ardsley | $1,881 |

| Ardsley On Hudson | $1,855 |

| Argyle | $1,694 |

| Arkport | $1,555 |

| Arkville | $1,600 |

| Arlington | $1,508 |

| Armonk | $1,867 |

| Arverne | $2,589 |

| Asharoken | $3,093 |

| Ashland | $1,713 |

| Ashville | $1,561 |

| Astoria | $2,439 |

| Athens | $1,696 |

| Athol | $1,692 |

| Athol Springs | $1,401 |

| Atlanta | $1,571 |

| Atlantic Beach | $3,017 |

| Attica | $1,528 |

| Au Sable Forks | $1,741 |

| Auburn | $1,548 |

| Auriesville | $1,572 |

| Aurora | $1,555 |

| Austerlitz | $1,680 |

| Ava | $1,695 |

| Averill Park | $1,554 |

| Avoca | $1,548 |

| Avon | $1,447 |

| Babylon | $3,746 |

| Bainbridge | $1,575 |

| Baiting Hollow | $3,454 |

| Bakers Mills | $1,707 |

| Baldwin | $3,049 |

| Baldwin Harbor | $3,044 |

| Baldwin Place | $1,804 |

| Baldwinsville | $1,405 |

| Ballston Lake | $1,540 |

| Ballston Spa | $1,543 |

| Balmville | $1,636 |

| Bangall | $1,516 |

| Bardonia | $1,678 |

| Barker | $1,415 |

| Barneveld | $1,658 |

| Barnum Island | $3,046 |

| Barrytown | $1,506 |

| Barryville | $1,705 |

| Barton | $1,522 |

| Basom | $1,460 |

| Batavia | $1,508 |

| Bath | $1,554 |

| Baxter Estates | $2,556 |

| Bay Park | $3,043 |

| Bay Shore | $3,757 |

| Bayport | $3,779 |

| Bayside | $2,453 |

| Bayville | $2,461 |

| Baywood | $3,750 |

| Beacon | $1,531 |

| Bear Mountain | $1,685 |

| Bearsville | $1,644 |

| Beaver Dam Lake | $1,627 |

| Beaver Dams | $1,514 |

| Beaver Falls | $1,641 |

| Bedford | $1,909 |

| Bedford Hills | $1,776 |

| Belfast | $1,545 |

| Belle Terre | $3,102 |

| Bellerose | $2,604 |

| Bellerose Terrace | $2,771 |

| Belleville | $1,718 |

| Bellmore | $3,058 |

| Bellona | $1,548 |

| Bellport | $3,795 |

| Bellvale | $1,660 |

| Belmont | $1,549 |

| Bemus Point | $1,566 |

| Bergen | $1,494 |

| Berkshire | $1,512 |

| Berlin | $1,559 |

| Berne | $1,551 |

| Bernhards Bay | $1,511 |

| Bethel | $1,706 |

| Bethpage | $2,516 |

| Bible School Park | $1,527 |

| Big Flats | $1,513 |

| Big Indian | $1,649 |

| Billings | $1,492 |

| Billington Heights | $1,373 |

| Binghamton | $1,517 |

| Binghamton University | $1,517 |

| Black Creek | $1,552 |

| Black River | $1,672 |

| Blasdell | $1,381 |

| Blauvelt | $1,671 |

| Bliss | $1,537 |

| Blodgett Mills | $1,529 |

| Bloomfield | $1,461 |

| Bloomingburg | $1,657 |

| Bloomingdale | $1,755 |

| Bloomington | $1,639 |

| Bloomville | $1,584 |

| Blossvale | $1,660 |

| Blue Mountain Lake | $1,745 |

| Blue Point | $3,777 |

| Bohemia | $3,775 |

| Boiceville | $1,630 |

| Bolivar | $1,551 |

| Bolton Landing | $1,720 |

| Bombay | $1,747 |

| Boonville | $1,656 |

| Boston | $1,383 |

| Bouckville | $1,463 |

| Bovina Center | $1,590 |

| Bowmansville | $1,378 |

| Bradford | $1,560 |

| Brainard | $1,597 |

| Brainardsville | $1,786 |

| Branchport | $1,520 |

| Brant Lake | $1,695 |

| Brantingham | $1,708 |

| Brasher Falls | $1,638 |

| Breesport | $1,508 |

| Breezy Point | $2,575 |

| Brentwood | $3,759 |

| Brewerton | $1,428 |

| Brewster | $1,724 |

| Brewster Hill | $1,724 |

| Briarcliff Manor | $1,867 |

| Bridgehampton | $4,109 |

| Bridgeport | $1,409 |

| Brier Hill | $1,678 |

| Brighton | $1,374 |

| Brightwaters | $3,753 |

| Brinckerhoff | $1,552 |

| Broadalbin | $1,677 |

| Brockport | $1,372 |

| Brocton | $1,571 |

| Bronxville | $1,892 |

| Brookfield | $1,472 |

| Brookhaven | $3,802 |

| Brooklyn | $2,752 |

| Brooktondale | $1,519 |

| Brookville | $2,477 |

| Brushton | $1,754 |

| Buchanan | $1,769 |

| Buffalo | $1,668 |

| Bullville | $1,640 |

| Burdett | $1,520 |

| Burke | $1,751 |

| Burlingham | $1,702 |

| Burlington Flats | $1,563 |

| Burnt Hills | $1,536 |

| Burt | $1,416 |

| Buskirk | $1,708 |

| Busti | $1,562 |

| Byron | $1,498 |

| Cadyville | $1,743 |

| Cairo | $1,700 |

| Calcium | $1,657 |

| Caledonia | $1,453 |

| Callicoon | $1,717 |

| Callicoon Center | $1,720 |

| Calverton | $3,461 |

| Cambria Heights | $2,581 |

| Cambridge | $1,745 |

| Camden | $1,689 |

| Cameron | $1,557 |

| Cameron Mills | $1,566 |

| Camillus | $1,417 |

| Campbell | $1,551 |

| Campbell Hall | $1,631 |

| Canaan | $1,677 |

| Canajoharie | $1,568 |

| Canandaigua | $1,450 |

| Canaseraga | $1,556 |

| Canastota | $1,449 |

| Candor | $1,511 |

| Caneadea | $1,557 |

| Canisteo | $1,551 |

| Canton | $1,638 |

| Cape Vincent | $1,681 |

| Carle Place | $2,486 |

| Carlisle | $1,633 |

| Carmel | $1,721 |

| Carmel Hamlet | $1,724 |

| Caroga Lake | $1,699 |

| Carthage | $1,669 |

| Cassadaga | $1,559 |

| Cassville | $1,621 |

| Castile | $1,538 |

| Castle Creek | $1,521 |

| Castle Point | $1,541 |

| Castleton-on-Hudson | $1,546 |

| Castorland | $1,695 |

| Cato | $1,547 |

| Catskill | $1,697 |

| Cattaraugus | $1,542 |

| Cayuga | $1,542 |

| Cayuga Heights | $1,514 |

| Cayuta | $1,541 |

| Cazenovia | $1,437 |

| Cedarhurst | $3,043 |

| Celoron | $1,556 |

| Center Moriches | $3,870 |

| Centereach | $3,180 |

| Centerport | $3,071 |

| Central Bridge | $1,648 |

| Central Islip | $3,756 |

| Central Square | $1,475 |

| Central Valley | $1,625 |

| Centre Island | $2,480 |

| Ceres | $1,566 |

| Chadwicks | $1,644 |

| Chaffee | $1,388 |

| Champlain | $1,734 |

| Chappaqua | $1,872 |

| Charlotteville | $1,662 |

| Chase Mills | $1,674 |

| Chateaugay | $1,748 |

| Chatham | $1,685 |

| Chaumont | $1,666 |

| Chautauqua | $1,576 |

| Chazy | $1,741 |

| Cheektowaga | $1,393 |

| Chelsea | $1,545 |

| Chemung | $1,517 |

| Chenango Bridge | $1,521 |

| Chenango Forks | $1,540 |

| Cherry Creek | $1,559 |

| Cherry Plain | $1,591 |

| Cherry Valley | $1,561 |

| Chester | $1,624 |

| Chestertown | $1,698 |

| Chestnut Ridge | $1,675 |

| Chichester | $1,623 |

| Childwold | $1,666 |

| Chippewa Bay | $1,692 |

| Chittenango | $1,430 |

| Churchville | $1,360 |

| Churubusco | $1,740 |

| Cicero | $1,413 |

| Cincinnatus | $1,564 |

| Circleville | $1,637 |

| Clarence | $1,376 |

| Clarence Center | $1,378 |

| Clark Mills | $1,632 |

| Clarkson | $1,376 |

| Clarksville | $1,492 |

| Claryville | $1,713 |

| Claverack | $1,680 |

| Clay | $1,413 |

| Clayton | $1,683 |

| Clayville | $1,651 |

| Clemons | $1,737 |

| Cleveland | $1,457 |

| Cleverdale | $1,719 |

| Clifton Park | $1,540 |

| Clifton Springs | $1,458 |

| Climax | $1,725 |

| Clinton | $1,637 |

| Clinton Corners | $1,525 |

| Clintondale | $1,639 |

| Clockville | $1,459 |

| Clyde | $1,496 |

| Clymer | $1,574 |

| Cobleskill | $1,636 |

| Cochecton | $1,710 |

| Cochecton Center | $1,711 |

| Coeymans Hollow | $1,489 |

| Cohocton | $1,556 |

| Cohoes | $1,495 |

| Cold Brook | $1,662 |

| Cold Spring | $1,721 |

| Cold Spring Harbor | $3,072 |

| Colden | $1,388 |

| College Point | $2,447 |

| Colliersville | $1,549 |

| Collins | $1,388 |

| Collins Center | $1,384 |

| Colonie | $1,501 |

| Colton | $1,633 |

| Columbiaville | $1,680 |

| Commack | $3,078 |

| Comstock | $1,707 |

| Conesus | $1,469 |

| Conewango Valley | $1,552 |

| Congers | $1,682 |

| Conklin | $1,520 |

| Connelly | $1,643 |

| Constable | $1,758 |

| Constableville | $1,673 |

| Constantia | $1,468 |

| Coopers Plains | $1,542 |

| Cooperstown | $1,574 |

| Copake | $1,695 |

| Copake Falls | $1,682 |

| Copenhagen | $1,668 |

| Copiague | $3,746 |

| Coram | $3,072 |

| Corbettsville | $1,531 |

| Corfu | $1,495 |

| Corinth | $1,539 |

| Corning | $1,546 |

| Cornwall | $1,637 |

| Cornwall-on-Hudson | $1,628 |

| Cornwallville | $1,747 |

| Corona | $2,439 |

| Cortland | $1,542 |

| Cortland West | $1,544 |

| Cortlandt Manor | $1,762 |

| Cossayuna | $1,737 |

| Cottekill | $1,650 |

| Country Knolls | $1,534 |

| Cowlesville | $1,508 |

| Coxsackie | $1,673 |

| Cragsmoor | $1,650 |

| Cranberry Lake | $1,667 |

| Craryville | $1,684 |

| Crittenden | $1,376 |

| Croghan | $1,667 |

| Crompond | $1,796 |

| Cropseyville | $1,562 |

| Cross River | $1,815 |

| Croton Falls | $1,786 |

| Croton-on-Hudson | $1,766 |

| Crown Heights | $1,512 |

| Crown Point | $1,740 |

| Crugers | $1,768 |

| Cuba | $1,549 |

| Cuddebackville | $1,680 |

| Cumberland Head | $1,743 |

| Cutchogue | $3,561 |

| Dale | $1,559 |

| Dalton | $1,507 |

| Dannemora | $1,732 |

| Dansville | $1,486 |

| Darien Center | $1,493 |

| Davenport | $1,576 |

| Davenport Center | $1,585 |

| Dayton | $1,570 |

| De Kalb Junction | $1,640 |

| De Peyster | $1,701 |

| De Ruyter | $1,495 |

| Deansboro | $1,623 |

| Deer Park | $3,729 |

| Deer River | $1,702 |

| Deferiet | $1,712 |

| Delancey | $1,584 |

| Delanson | $1,576 |

| Delevan | $1,545 |

| Delhi | $1,581 |

| Delmar | $1,490 |

| Delphi Falls | $1,383 |

| Denver | $1,603 |

| Depauville | $1,714 |

| Depew | $1,384 |

| Deposit | $1,547 |

| Derby | $1,382 |

| Dewittville | $1,564 |

| Dexter | $1,676 |

| Diamond Point | $1,725 |

| Dickinson Center | $1,748 |

| Dix Hills | $3,092 |

| Dobbs Ferry | $1,881 |

| Dolgeville | $1,677 |

| Dormansville | $1,506 |

| Dover Plains | $1,535 |

| Downsville | $1,593 |

| Dresden | $1,552 |

| Dryden | $1,523 |

| Duane Lake | $1,583 |

| Duanesburg | $1,586 |

| Dundee | $1,538 |

| Dunkirk | $1,540 |

| Durham | $1,685 |

| Durhamville | $1,675 |

| Eagle Bay | $1,686 |

| Eagle Bridge | $1,677 |

| Earlton | $1,691 |

| Earlville | $1,483 |

| East Amherst | $1,378 |

| East Atlantic Beach | $3,030 |

| East Aurora | $1,375 |

| East Berne | $1,491 |

| East Bethany | $1,522 |

| East Branch | $1,602 |

| East Chatham | $1,673 |

| East Concord | $1,393 |

| East Durham | $1,692 |

| East Elmhurst | $2,546 |

| East Farmingdale | $3,515 |

| East Garden City | $3,021 |

| East Glenville | $1,572 |

| East Greenbush | $1,546 |

| East Hampton | $4,117 |

| East Hampton North | $4,116 |

| East Hills | $2,503 |

| East Homer | $1,494 |

| East Islip | $3,794 |

| East Ithaca | $1,508 |

| East Jewett | $1,711 |

| East Marion | $3,600 |

| East Massapequa | $2,833 |

| East Meadow | $3,035 |

| East Meredith | $1,576 |

| East Moriches | $4,030 |

| East Nassau | $1,545 |

| East Northport | $3,074 |

| East Norwich | $2,477 |

| East Otto | $1,512 |

| East Patchogue | $3,785 |

| East Pembroke | $1,515 |

| East Pharsalia | $1,592 |

| East Quogue | $4,034 |

| East Randolph | $1,546 |

| East Rochester | $1,359 |

| East Rockaway | $3,031 |

| East Schodack | $1,546 |

| East Setauket | $3,109 |

| East Shoreham | $3,083 |

| East Springfield | $1,579 |

| East Syracuse | $1,412 |

| East Williamson | $1,485 |

| East Williston | $2,529 |

| East Worcester | $1,587 |

| Eastchester | $1,887 |

| Eastport | $4,027 |

| Eaton | $1,476 |

| Eatons Neck | $3,093 |

| Eden | $1,387 |

| Edmeston | $1,562 |

| Edwards | $1,639 |

| Eggertsville | $1,391 |

| Elba | $1,520 |

| Elbridge | $1,407 |

| Eldred | $1,707 |

| Elizabethtown | $1,749 |

| Elizaville | $1,672 |

| Elka Park | $1,696 |

| Ellenburg Center | $1,734 |

| Ellenburg Depot | $1,731 |

| Ellenville | $1,690 |

| Ellicottville | $1,567 |

| Ellington | $1,553 |

| Ellisburg | $1,726 |

| Elma | $1,380 |

| Elma Center | $1,380 |

| Elmhurst | $2,431 |

| Elmira | $1,505 |

| Elmira Heights | $1,506 |

| Elmont | $2,931 |

| Elmsford | $1,861 |

| Elwood | $3,077 |

| Endicott | $1,519 |

| Endwell | $1,516 |

| Erieville | $1,452 |

| Erin | $1,510 |

| Esperance | $1,575 |

| Essex | $1,744 |

| Etna | $1,546 |

| Evans Mills | $1,662 |

| Fabius | $1,403 |

| Fair Haven | $1,537 |

| Fairmount | $1,422 |

| Fairport | $1,362 |

| Fairview | $1,767 |

| Falconer | $1,556 |

| Fancher | $1,487 |

| Far Rockaway | $2,570 |

| Farmersville Station | $1,551 |

| Farmingdale | $2,681 |

| Farmington | $1,435 |

| Farmingville | $3,279 |

| Farnham | $1,414 |

| Fayetteville | $1,396 |

| Felts Mills | $1,719 |

| Ferndale | $1,715 |

| Feura Bush | $1,489 |

| Fillmore | $1,550 |

| Findley Lake | $1,566 |

| Fine | $1,653 |

| Fire Island | $3,776 |

| Firthcliffe | $1,630 |

| Fishers | $1,443 |

| Fishers Island | $3,316 |

| Fishers Landing | $1,719 |

| Fishkill | $1,548 |

| Fishs Eddy | $1,603 |

| Flanders | $3,479 |

| Fleischmanns | $1,604 |

| Floral Park | $2,681 |

| Florida | $1,631 |

| Flower Hill | $2,514 |

| Flushing | $2,448 |

| Fly Creek | $1,561 |

| Fonda | $1,580 |

| Forest Hills | $2,444 |

| Forestburgh | $1,706 |

| Forestport | $1,661 |

| Forestville | $1,546 |

| Fort Ann | $1,711 |

| Fort Covington Hamlet | $1,750 |

| Fort Drum | $1,656 |

| Fort Edward | $1,615 |

| Fort Hunter | $1,591 |

| Fort Johnson | $1,644 |

| Fort Montgomery | $1,613 |

| Fort Plain | $1,571 |

| Fort Salonga | $3,090 |

| Frankfort | $1,663 |

| Franklin | $1,584 |

| Franklin Springs | $1,662 |

| Franklin Square | $2,968 |

| Franklinville | $1,551 |

| Fredonia | $1,545 |

| Freedom | $1,541 |

| Freehold | $1,687 |

| Freeport | $3,049 |

| Freeville | $1,517 |

| Fremont Center | $1,715 |

| Fresh Meadows | $2,455 |

| Frewsburg | $1,560 |

| Friendship | $1,552 |

| Fulton | $1,484 |

| Fultonham | $1,630 |

| Fultonville | $1,569 |

| Gabriels | $1,768 |

| Gainesville | $1,533 |

| Galeville | $1,394 |

| Gallupville | $1,697 |

| Galway | $1,551 |

| Gang Mills | $1,542 |

| Gansevoort | $1,541 |

| Garden City | $2,535 |

| Garden City Park | $2,589 |

| Garden City South | $2,777 |

| Gardiner | $1,645 |

| Gardnertown | $1,637 |

| Garnerville | $1,684 |

| Garrattsville | $1,568 |

| Garrison | $1,712 |

| Gasport | $1,393 |

| Gates | $1,381 |

| Geneseo | $1,483 |

| Geneva | $1,517 |

| Genoa | $1,555 |

| Georgetown | $1,433 |

| Germantown | $1,673 |

| Gerry | $1,552 |

| Getzville | $1,373 |

| Ghent | $1,688 |

| Gilbertsville | $1,576 |

| Gilboa | $1,649 |

| Glasco | $1,632 |

| Glen Aubrey | $1,509 |

| Glen Cove | $2,449 |

| Glen Head | $2,463 |

| Glen Oaks | $2,457 |

| Glen Spey | $1,705 |

| Glen Wild | $1,709 |

| Glenfield | $1,654 |

| Glenford | $1,644 |

| Glenham | $1,555 |

| Glenmont | $1,488 |

| Glens Falls | $1,672 |

| Glens Falls North | $1,678 |

| Glenwood | $1,378 |

| Glenwood Landing | $2,457 |

| Gloversville | $1,697 |

| Golden's Bridge | $1,815 |

| Gordon Heights | $3,397 |

| Goshen | $1,621 |

| Gouverneur | $1,638 |

| Gowanda | $1,443 |

| Grahamsville | $1,724 |

| Grand Gorge | $1,606 |

| Grand Island | $1,395 |

| Grandyle Village | $1,390 |

| Granite Springs | $1,812 |

| Granville | $1,725 |

| Great Bend | $1,713 |

| Great Neck | $2,547 |

| Great Neck Estates | $2,546 |

| Great Neck Gardens | $2,555 |

| Great Neck Plaza | $2,556 |

| Great River | $3,794 |

| Great Valley | $1,567 |

| Greece | $1,380 |

| Green Island | $1,493 |

| Greene | $1,575 |

| Greenfield Center | $1,534 |

| Greenfield Park | $1,667 |

| Greenhurst | $1,566 |

| Greenlawn | $3,069 |

| Greenport | $3,593 |

| Greenport West | $3,596 |

| Greenvale | $2,530 |

| Greenville | $1,746 |

| Greenwich | $1,734 |

| Greenwood | $1,556 |

| Greenwood Lake | $1,631 |

| Greig | $1,709 |

| Groton | $1,537 |

| Groveland | $1,471 |

| Guilderland | $1,498 |

| Guilderland Center | $1,504 |

| Guilford | $1,571 |

| Hadley | $1,556 |

| Hagaman | $1,579 |

| Hague | $1,702 |

| Hailesboro | $1,638 |

| Haines Falls | $1,716 |

| Halcottsville | $1,606 |

| Halesite | $3,071 |

| Hall | $1,462 |

| Hamburg | $1,388 |

| Hamden | $1,581 |

| Hamilton | $1,447 |

| Hamlin | $1,376 |

| Hammond | $1,634 |

| Hammondsport | $1,558 |

| Hampton | $1,731 |

| Hampton Bays | $4,036 |

| Hampton Manor | $1,534 |

| Hancock | $1,597 |

| Hankins | $1,743 |

| Hannacroix | $1,656 |

| Hannawa Falls | $1,637 |

| Hannibal | $1,493 |

| Harbor Hills | $2,542 |

| Harbor Isle | $3,050 |

| Harpersfield | $1,591 |

| Harpursville | $1,532 |

| Harriman | $1,625 |

| Harris | $1,719 |

| Harris Hill | $1,372 |

| Harrison | $1,894 |

| Harrisville | $1,665 |

| Hartford | $1,700 |

| Hartsdale | $1,891 |

| Hartwick | $1,563 |

| Hastings | $1,476 |

| Hastings-on-Hudson | $1,932 |

| Hauppauge | $3,076 |

| Haverstraw | $1,686 |

| Haviland | $1,520 |

| Hawthorne | $1,861 |

| Head of the Harbor | $3,119 |

| Hector | $1,531 |

| Helena | $1,692 |

| Hemlock | $1,458 |

| Hempstead | $2,977 |

| Henderson | $1,686 |

| Henderson Harbor | $1,718 |

| Henrietta | $1,362 |

| Hensonville | $1,730 |

| Heritage Hills | $1,807 |

| Herkimer | $1,663 |

| Hermon | $1,638 |

| Herricks | $2,529 |

| Heuvelton | $1,644 |

| Hewlett | $3,033 |

| Hewlett Bay Park | $3,044 |

| Hewlett Harbor | $3,042 |

| Hicksville | $2,467 |

| High Falls | $1,651 |

| Highland | $1,636 |

| Highland Falls | $1,610 |

| Highland Lake | $1,731 |

| Highland Mills | $1,625 |

| Highmount | $1,654 |

| Hillburn | $1,691 |

| Hillcrest | $1,689 |

| Hillsdale | $1,689 |

| Hillside | $1,633 |

| Hillside Lake | $1,525 |

| Hilton | $1,350 |

| Himrod | $1,536 |

| Hinckley | $1,695 |

| Hinsdale | $1,556 |

| Hobart | $1,582 |

| Hoffmeister | $1,763 |

| Hogansburg | $1,749 |

| Holbrook | $3,631 |

| Holland | $1,387 |

| Holland Patent | $1,655 |

| Holley | $1,457 |

| Hollis | $2,465 |

| Hollowville | $1,682 |

| Holmes | $1,526 |

| Holtsville | $3,678 |

| Homer | $1,546 |

| Honeoye | $1,472 |

| Honeoye Falls | $1,371 |

| Hoosick Falls | $1,574 |

| Hopewell Junction | $1,526 |

| Hornell | $1,556 |

| Horseheads | $1,513 |

| Horseheads North | $1,504 |

| Hortonville | $1,739 |

| Houghton | $1,553 |

| Howard Beach | $2,550 |

| Howells | $1,642 |

| Howes Cave | $1,608 |

| Hubbardsville | $1,471 |

| Hudson | $1,677 |

| Hudson Falls | $1,687 |

| Hughsonville | $1,516 |

| Huguenot | $1,680 |

| Huletts Landing | $1,730 |

| Hunt | $1,503 |

| Hunter | $1,693 |

| Huntington | $3,070 |

| Huntington Bay | $3,086 |

| Huntington Station | $3,069 |

| Hurley | $1,636 |

| Hurleyville | $1,723 |

| Hyde Park | $1,515 |

| Ilion | $1,663 |

| Indian Lake | $1,733 |

| Inlet | $1,719 |

| Interlaken | $1,540 |

| Inwood | $2,987 |

| Ionia | $1,424 |

| Irondequoit | $1,381 |

| Irving | $1,396 |

| Irvington | $1,877 |

| Island Park | $3,047 |

| Islandia | $3,306 |

| Islip | $3,758 |

| Islip Terrace | $3,761 |

| Ithaca | $1,518 |

| Jackson Heights | $2,434 |

| Jacksonville | $1,536 |

| Jamaica | $2,537 |

| Jamesport | $3,489 |

| Jamestown | $1,554 |

| Jamestown West | $1,557 |

| Jamesville | $1,398 |

| Jasper | $1,565 |

| Java Center | $1,505 |

| Java Village | $1,512 |

| Jay | $1,744 |

| Jefferson | $1,613 |

| Jefferson Heights | $1,687 |

| Jefferson Valley | $1,785 |

| Jefferson Valley-Yorktown | $1,805 |

| Jeffersonville | $1,719 |

| Jericho | $2,502 |

| Jewett | $1,730 |

| Johnsburg | $1,714 |

| Johnson | $1,642 |

| Johnson City | $1,516 |

| Johnsonville | $1,567 |

| Johnstown | $1,656 |

| Jordan | $1,472 |

| Jordanville | $1,656 |

| Kanona | $1,557 |

| Kaser | $1,687 |

| Katonah | $1,782 |

| Kattskill Bay | $1,687 |

| Kauneonga Lake | $1,740 |

| Keene | $1,747 |

| Keene Valley | $1,779 |

| Keeseville | $1,761 |

| Kendall | $1,464 |

| Kenmore | $1,400 |

| Kennedy | $1,551 |

| Kenoza Lake | $1,718 |

| Kensington | $2,555 |

| Kent | $1,470 |

| Kerhonkson | $1,661 |

| Keuka Park | $1,529 |

| Kew Gardens | $2,463 |

| Kiamesha Lake | $1,707 |

| Kill Buck | $1,568 |

| Killawog | $1,541 |

| Kinderhook | $1,654 |

| King Ferry | $1,555 |

| Kings Park | $3,109 |

| Kings Point | $2,554 |

| Kingston | $1,634 |

| Kirkville | $1,409 |

| Kirkwood | $1,526 |

| Kiryas Joel | $1,629 |

| Knowlesville | $1,501 |

| Knoxboro | $1,649 |

| La Fargeville | $1,661 |

| La Fayette | $1,399 |

| Lackawanna | $1,381 |

| Lacona | $1,486 |

| Lagrangeville | $1,526 |

| Lake Carmel | $1,720 |

| Lake Clear | $1,747 |

| Lake Erie Beach | $1,391 |

| Lake George | $1,722 |

| Lake Grove | $3,069 |

| Lake Hill | $1,644 |

| Lake Huntington | $1,711 |

| Lake Katrine | $1,661 |

| Lake Luzerne | $1,691 |

| Lake Mohegan | $1,766 |

| Lake Peekskill | $1,706 |

| Lake Placid | $1,734 |

| Lake Pleasant | $1,727 |

| Lake Ronkonkoma | $3,181 |

| Lake Success | $2,549 |

| Lake View | $1,380 |

| Lakeland | $1,419 |

| Lakemont | $1,560 |

| Lakeview | $3,008 |

| Lakeville | $1,458 |

| Lakewood | $1,551 |

| Lancaster | $1,377 |

| Lanesville | $1,701 |

| Lansing | $1,522 |

| Larchmont | $1,896 |

| Latham | $1,497 |

| Lattingtown | $2,468 |

| Laurel | $3,522 |

| Laurel Hollow | $2,477 |

| Laurens | $1,568 |

| Lawrence | $3,009 |

| Lawrenceville | $1,698 |

| Lawtons | $1,394 |

| Le Roy | $1,489 |

| Lee Center | $1,679 |

| Leeds | $1,695 |

| Leicester | $1,470 |

| Leonardsville | $1,451 |

| Levittown | $2,963 |

| Lewis | $1,747 |

| Lewiston | $1,409 |

| Liberty | $1,720 |

| Lido Beach | $3,047 |

| Lily Dale | $1,579 |

| Lima | $1,442 |

| Lime Lake | $1,543 |

| Limerick | $1,693 |

| Limestone | $1,564 |

| Lincoln Park | $1,633 |

| Lincolndale | $1,812 |

| Lindenhurst | $3,742 |

| Lindley | $1,551 |

| Linwood | $1,486 |

| Lisbon | $1,636 |

| Lisle | $1,529 |

| Little Falls | $1,673 |

| Little Genesee | $1,552 |

| Little Neck | $2,463 |

| Little Valley | $1,570 |

| Little York | $1,513 |

| Liverpool | $1,395 |

| Livingston Manor | $1,707 |

| Livonia | $1,461 |

| Livonia Center | $1,474 |

| Lloyd Harbor | $3,085 |

| Loch Sheldrake | $1,726 |

| Locke | $1,555 |

| Lockport | $1,389 |

| Lockwood | $1,540 |

| Locust Valley | $2,463 |

| Lodi | $1,545 |

| Long Beach | $3,039 |

| Long Eddy | $1,631 |

| Long Island City | $2,437 |

| Long Lake | $1,733 |

| Lorenz Park | $1,678 |

| Lorraine | $1,717 |

| Lowman | $1,513 |

| Lowville | $1,666 |

| Lycoming | $1,539 |

| Lynbrook | $3,020 |

| Lyncourt | $1,455 |

| Lyndonville | $1,492 |

| Lyon Mountain | $1,748 |

| Lyons | $1,477 |

| Lyons Falls | $1,658 |

| Macedon | $1,447 |

| Machias | $1,544 |

| Madison | $1,452 |

| Madrid | $1,635 |

| Mahopac | $1,720 |

| Mahopac Falls | $1,740 |

| Maine | $1,526 |

| Malden Bridge | $1,685 |

| Malden On Hudson | $1,665 |

| Mallory | $1,507 |

| Malone | $1,749 |

| Malverne | $3,002 |

| Malverne Park Oaks | $3,003 |

| Mamaroneck | $1,900 |

| Manchester | $1,447 |

| Manhasset | $2,525 |

| Manhasset Hills | $2,528 |

| Manlius | $1,398 |

| Mannsville | $1,688 |

| Manorhaven | $2,548 |

| Manorville | $3,819 |

| Maple Springs | $1,572 |

| Maple View | $1,493 |

| Maplecrest | $1,731 |

| Marathon | $1,548 |

| Marcellus | $1,419 |

| Marcy | $1,638 |

| Margaretville | $1,604 |

| Mariaville Lake | $1,590 |

| Marietta | $1,409 |

| Marilla | $1,375 |

| Marion | $1,449 |

| Marlboro | $1,633 |

| Martville | $1,545 |

| Maryknoll | $1,769 |

| Maryland | $1,578 |

| Masonville | $1,575 |

| Maspeth | $2,435 |

| Massapequa | $2,832 |

| Massapequa Park | $2,822 |

| Massena | $1,629 |

| Mastic | $3,744 |

| Mastic Beach | $3,777 |

| Matinecock | $2,466 |

| Mattituck | $3,520 |

| Mattydale | $1,408 |

| Maybrook | $1,624 |

| Mayfield | $1,723 |

| Mayville | $1,570 |

| Mc Connellsville | $1,676 |

| Mc Donough | $1,565 |

| Mc Graw | $1,548 |

| Mc Lean | $1,513 |

| Mechanicstown | $1,619 |

| Mechanicville | $1,563 |

| Mecklenburg | $1,535 |

| Medford | $3,611 |

| Medina | $1,483 |

| Medusa | $1,492 |

| Mellenville | $1,659 |

| Melrose | $1,559 |

| Melrose Park | $1,546 |

| Melville | $3,078 |

| Memphis | $1,412 |

| Menands | $1,500 |

| Mendon | $1,368 |

| Meridale | $1,577 |

| Meridian | $1,545 |

| Merrick | $3,049 |

| Merritt Park | $1,548 |

| Mexico | $1,479 |

| Middle Falls | $1,732 |

| Middle Granville | $1,731 |

| Middle Grove | $1,537 |

| Middle Island | $3,077 |

| Middle Village | $2,439 |

| Middleburgh | $1,605 |

| Middleport | $1,419 |

| Middlesex | $1,509 |

| Middletown | $1,632 |

| Middleville | $1,655 |

| Milford | $1,574 |

| Mill Neck | $2,466 |

| Millbrook | $1,532 |

| Miller Place | $3,115 |

| Millerton | $1,523 |

| Millport | $1,503 |

| Millwood | $1,744 |

| Milton | $1,592 |

| Mineola | $2,649 |

| Minerva | $1,786 |

| Minetto | $1,474 |

| Mineville | $1,747 |

| Minoa | $1,413 |

| Model City | $1,424 |

| Modena | $1,646 |

| Mohawk | $1,665 |

| Mohegan Lake | $1,763 |

| Moira | $1,757 |

| Mongaup Valley | $1,719 |

| Monroe | $1,607 |

| Monsey | $1,687 |

| Montauk | $4,093 |

| Montebello | $1,693 |

| Montgomery | $1,631 |

| Monticello | $1,699 |

| Montour Falls | $1,544 |

| Montrose | $1,770 |

| Mooers | $1,737 |

| Mooers Forks | $1,741 |

| Moravia | $1,548 |

| Moriah | $1,739 |

| Moriah Center | $1,743 |

| Moriches | $3,865 |

| Morris | $1,577 |

| Morrisonville | $1,741 |

| Morristown | $1,669 |

| Morrisville | $1,454 |

| Morton | $1,366 |

| Mottville | $1,457 |

| Mount Ivy | $1,689 |

| Mount Kisco | $1,769 |

| Mount Marion | $1,639 |

| Mount Morris | $1,490 |

| Mount Sinai | $3,104 |

| Mount Tremper | $1,622 |

| Mount Upton | $1,577 |

| Mount Vernon | $2,055 |

| Mount Vision | $1,562 |

| Mountain Dale | $1,702 |

| Mountain Lodge Park | $1,629 |

| Mountainville | $1,640 |

| Mumford | $1,347 |

| Munnsville | $1,463 |

| Munsey Park | $2,498 |

| Munsons Corners | $1,541 |

| Muttontown | $2,485 |

| Myers Corner | $1,520 |

| Nanuet | $1,673 |

| Napanoch | $1,693 |

| Napeague | $4,149 |

| Naples | $1,514 |

| Narrowsburg | $1,711 |

| Nassau | $1,540 |

| Natural Bridge | $1,676 |

| Nedrow | $1,409 |

| Nelliston | $1,571 |

| Nelsonville | $1,720 |

| Nesconset | $3,073 |

| Neversink | $1,730 |

| New Berlin | $1,554 |

| New Cassel | $2,585 |

| New City | $1,683 |

| New Hampton | $1,629 |

| New Hartford | $1,630 |

| New Hempstead | $1,692 |

| New Hyde Park | $2,528 |

| New Kingston | $1,600 |

| New Lebanon | $1,675 |

| New Lisbon | $1,568 |

| New Milford | $1,632 |

| New Paltz | $1,641 |

| New Rochelle | $1,984 |

| New Russia | $1,778 |

| New Square | $1,692 |

| New Suffolk | $3,579 |

| New Windsor | $1,632 |

| New Woodstock | $1,434 |

| New York | $2,795 |

| New York Mills | $1,627 |

| Newark | $1,456 |

| Newark Valley | $1,523 |

| Newburgh | $1,632 |

| Newcomb | $1,775 |

| Newfane | $1,414 |

| Newfield | $1,514 |

| Newport | $1,661 |

| Newton Falls | $1,646 |

| Newtonville | $1,513 |

| Niagara Falls | $1,621 |

| Niagara University | $1,421 |

| Nichols | $1,517 |

| Nicholville | $1,686 |

| Nineveh | $1,531 |

| Niobe | $1,572 |

| Niskayuna | $1,568 |

| Nissequogue | $3,110 |

| Niverville | $1,656 |

| Norfolk | $1,633 |

| North Amityville | $3,747 |

| North Babylon | $3,739 |

| North Ballston Spa | $1,538 |

| North Bangor | $1,754 |

| North Bay | $1,648 |

| North Bay Shore | $3,754 |

| North Bellmore | $3,060 |

| North Bellport | $3,763 |

| North Blenheim | $1,680 |

| North Boston | $1,393 |

| North Branch | $1,715 |

| North Brookfield | $1,473 |

| North Chatham | $1,677 |

| North Chili | $1,348 |

| North Collins | $1,396 |

| North Creek | $1,727 |

| North Evans | $1,386 |

| North Gates | $1,381 |

| North Granville | $1,703 |

| North Great River | $3,763 |

| North Greece | $1,345 |

| North Haven | $3,667 |

| North Hills | $2,484 |

| North Hoosick | $1,609 |

| North Hudson | $1,763 |

| North Java | $1,504 |

| North Lawrence | $1,640 |

| North Lindenhurst | $3,742 |

| North Lynbrook | $3,026 |

| North Massapequa | $2,838 |

| North Merrick | $3,050 |

| North New Hyde Park | $2,534 |

| North Patchogue | $3,780 |

| North Pitcher | $1,586 |

| North River | $1,738 |

| North Rose | $1,496 |

| North Salem | $1,810 |

| North Sea | $4,116 |

| North Syracuse | $1,416 |

| North Tonawanda | $1,390 |

| North Valley Stream | $2,976 |

| North Wantagh | $3,061 |

| Northampton | $3,474 |

| Northeast Ithaca | $1,514 |

| Northport | $3,088 |

| Northville | $2,295 |

| Northwest Harbor | $4,114 |

| Northwest Ithaca | $1,515 |

| Norwich | $1,552 |

| Norwood | $1,638 |

| Noyack | $3,672 |

| Nunda | $1,505 |

| Nyack | $1,670 |

| Oak Hill | $1,740 |

| Oakdale | $3,793 |

| Oakfield | $1,518 |

| Oakland Gardens | $2,459 |

| Oaks Corners | $1,462 |

| Obernburg | $1,720 |

| Ocean Beach | $3,762 |

| Oceanside | $3,041 |

| Odessa | $1,541 |

| Ogdensburg | $1,628 |

| Olcott | $1,416 |

| Old Bethpage | $2,565 |

| Old Brookville | $2,475 |

| Old Chatham | $1,667 |

| Old Field | $3,102 |

| Old Forge | $1,663 |

| Old Westbury | $2,541 |

| Olean | $1,548 |

| Olivebridge | $1,642 |

| Olmstedville | $1,749 |

| Oneida | $1,560 |

| Oneonta | $1,564 |

| Ontario | $1,452 |

| Ontario Center | $1,464 |

| Orange Lake | $1,626 |

| Orangeburg | $1,663 |

| Orchard Park | $1,381 |

| Orient | $3,604 |

| Oriskany | $1,641 |

| Oriskany Falls | $1,627 |

| Ossining | $1,765 |

| Oswegatchie | $1,690 |

| Oswego | $1,491 |

| Otego | $1,580 |

| Otisville | $1,639 |

| Ouaquaga | $1,556 |

| Ovid | $1,552 |

| Owego | $1,526 |

| Owls Head | $1,741 |

| Oxbow | $1,708 |

| Oxford | $1,569 |

| Oyster Bay | $2,479 |

| Oyster Bay Cove | $2,479 |

| Ozone Park | $2,545 |

| Painted Post | $1,540 |

| Palatine Bridge | $1,569 |

| Palenville | $1,694 |

| Palisades | $1,663 |

| Palmyra | $1,444 |

| Panama | $1,568 |

| Paradox | $1,775 |

| Parish | $1,481 |

| Parishville | $1,653 |

| Parksville | $1,723 |

| Patchogue | $3,780 |

| Patterson | $1,733 |

| Pattersonville | $1,590 |

| Paul Smiths | $1,761 |

| Pavilion | $1,521 |

| Pawling | $1,521 |

| Peach Lake | $1,755 |

| Pearl River | $1,666 |

| Peconic | $3,562 |

| Peekskill | $1,763 |

| Pelham | $1,905 |

| Pelham Manor | $1,892 |

| Penfield | $1,360 |

| Penn Yan | $1,533 |

| Pennellville | $1,473 |

| Perkinsville | $1,560 |

| Perry | $1,531 |

| Perrysburg | $1,518 |

| Peru | $1,743 |

| Peterboro | $1,469 |

| Petersburg | $1,559 |

| Phelps | $1,479 |

| Philadelphia | $1,670 |

| Phillipsport | $1,703 |

| Philmont | $1,686 |

| Phoenicia | $1,648 |

| Phoenix | $1,456 |

| Piercefield | $1,659 |

| Piermont | $1,664 |

| Pierrepont Manor | $1,708 |

| Piffard | $1,467 |

| Pine Bush | $1,644 |

| Pine City | $1,515 |

| Pine Hill | $1,683 |

| Pine Island | $1,640 |

| Pine Plains | $1,577 |

| Pine Valley | $1,504 |

| Piseco | $1,725 |

| Pitcher | $1,586 |

| Pittsford | $1,361 |

| Plainedge | $2,703 |

| Plainview | $2,484 |

| Plainville | $1,430 |

| Plandome | $2,497 |

| Plandome Heights | $2,494 |

| Plandome Manor | $2,497 |

| Plattekill | $1,635 |

| Plattsburgh | $1,737 |

| Plattsburgh West | $1,740 |

| Pleasant Valley | $1,526 |

| Pleasantville | $1,860 |

| Plessis | $1,719 |

| Plymouth | $1,558 |

| Poestenkill | $1,576 |

| Point Lookout | $3,048 |

| Poland | $1,678 |

| Pomona | $1,693 |

| Pond Eddy | $1,742 |

| Poplar Ridge | $1,527 |

| Poquott | $3,098 |

| Port Byron | $1,536 |

| Port Chester | $1,890 |

| Port Crane | $1,533 |

| Port Dickinson | $1,518 |

| Port Ewen | $1,643 |

| Port Gibson | $1,443 |

| Port Henry | $1,743 |

| Port Jefferson | $3,101 |

| Port Jefferson Station | $3,080 |

| Port Jervis | $1,680 |

| Port Kent | $1,787 |

| Port Leyden | $1,652 |

| Port Washington | $2,547 |

| Port Washington North | $2,551 |

| Portageville | $1,543 |

| Porter Corners | $1,534 |

| Portlandville | $1,579 |

| Portville | $1,554 |

| Potsdam | $1,638 |

| Pottersville | $1,690 |

| Poughkeepsie | $1,513 |

| Poughquag | $1,525 |

| Pound Ridge | $1,918 |

| Prattsburgh | $1,554 |

| Prattsville | $1,704 |

| Preble | $1,544 |

| Preston Hollow | $1,511 |

| Prospect | $1,695 |

| Pulaski | $1,503 |

| Pulteney | $1,547 |

| Pultneyville | $1,490 |

| Purchase | $1,891 |

| Purdys | $1,786 |

| Purling | $1,735 |

| Putnam Lake | $1,728 |

| Putnam Station | $1,738 |

| Putnam Valley | $1,720 |

| Pyrites | $1,686 |

| Quaker Street | $1,589 |

| Queens Village | $2,484 |

| Queensbury | $1,683 |

| Quiogue | $4,021 |

| Quogue | $4,023 |

| Rainbow Lake | $1,781 |

| Randolph | $1,554 |

| Ransomville | $1,403 |

| Rapids | $1,390 |

| Raquette Lake | $1,755 |

| Ravena | $1,481 |

| Ray Brook | $1,745 |

| Raymondville | $1,676 |

| Reading Center | $1,550 |

| Red Creek | $1,534 |

| Red Hook | $1,581 |

| Red Oaks Mill | $1,515 |

| Redfield | $1,540 |

| Redford | $1,756 |

| Redwood | $1,653 |

| Rego Park | $2,439 |

| Remsen | $1,654 |

| Remsenburg | $4,011 |

| Rensselaer | $1,535 |

| Rensselaer Falls | $1,646 |

| Rensselaerville | $1,487 |

| Retsof | $1,504 |

| Rexford | $1,547 |

| Rexville | $1,554 |

| Rhinebeck | $1,512 |

| Rhinecliff | $1,479 |

| Richburg | $1,522 |

| Richfield Springs | $1,602 |

| Richford | $1,521 |

| Richland | $1,496 |

| Richmond Hill | $2,548 |

| Richmondville | $1,637 |

| Richville | $1,700 |

| Ridge | $3,055 |

| Ridgewood | $2,440 |

| Rifton | $1,629 |

| Riparius | $1,704 |

| Ripley | $1,543 |

| Riverhead | $3,479 |

| Riverside | $3,474 |

| Rochester | $1,505 |

| Rock City Falls | $1,556 |

| Rock Hill | $1,698 |

| Rock Stream | $1,544 |

| Rock Tavern | $1,617 |

| Rockaway Park | $2,580 |

| Rockville Centre | $3,044 |

| Rocky Point | $3,105 |

| Rodman | $1,726 |

| Rome | $1,680 |

| Romulus | $1,571 |

| Ronkonkoma | $3,407 |

| Roosevelt | $3,026 |

| Rooseveltown | $1,663 |

| Roscoe | $1,660 |

| Roseboom | $1,587 |

| Rosedale | $2,569 |

| Rosendale | $1,636 |

| Rosendale Hamlet | $1,644 |

| Roslyn | $2,491 |

| Roslyn Estates | $2,491 |

| Roslyn Harbor | $2,502 |

| Roslyn Heights | $2,497 |

| Rotterdam | $1,578 |

| Rotterdam Junction | $1,576 |

| Round Lake | $1,545 |

| Round Top | $1,686 |

| Rouses Point | $1,743 |

| Roxbury | $1,596 |

| Ruby | $1,656 |

| Rush | $1,343 |

| Rushford | $1,554 |

| Rushville | $1,493 |

| Russell | $1,638 |

| Russell Gardens | $2,552 |

| Rye | $1,897 |

| Rye Brook | $1,888 |

| Sabael | $1,728 |

| Sackets Harbor | $1,671 |

| Saddle Rock | $2,542 |

| Sag Harbor | $3,673 |

| Sagaponack | $4,108 |

| Salamanca | $1,566 |

| Salem | $1,742 |

| Salisbury | $2,637 |

| Salisbury Center | $1,676 |

| Salisbury Mills | $1,629 |

| Salt Point | $1,528 |

| Saltaire | $3,765 |

| Sanborn | $1,405 |

| Sand Lake | $1,572 |

| Sand Ridge | $1,463 |

| Sands Point | $2,547 |

| Sandusky | $1,535 |

| Sandy Creek | $1,481 |

| Saranac | $1,746 |

| Saranac Lake | $1,748 |

| Saratoga Springs | $1,542 |

| Sardinia | $1,395 |

| Saugerties | $1,640 |

| Saugerties South | $1,632 |

| Sauquoit | $1,626 |

| Savannah | $1,501 |

| Savona | $1,553 |

| Sayville | $3,797 |

| Scarsdale | $1,886 |

| Schaghticoke | $1,563 |

| Schenectady | $1,554 |

| Schenevus | $1,568 |

| Schodack Landing | $1,556 |

| Schoharie | $1,601 |

| Schroon Lake | $1,751 |

| Schuyler Falls | $1,752 |

| Schuyler Lake | $1,560 |

| Schuylerville | $1,549 |

| Scio | $1,552 |

| Scipio Center | $1,544 |

| Scotchtown | $1,635 |

| Scotia | $1,571 |

| Scotts Corners | $1,916 |

| Scottsburg | $1,496 |

| Scottsville | $1,352 |

| Sea Cliff | $2,455 |

| Seaford | $3,055 |

| Searingtown | $2,511 |

| Selden | $3,057 |

| Selkirk | $1,491 |

| Seneca Castle | $1,470 |

| Seneca Falls | $1,545 |

| Seneca Knolls | $1,417 |

| Setauket-East Setauket | $3,097 |

| Severance | $1,780 |

| Shandaken | $1,669 |

| Sharon Springs | $1,629 |

| Shelter Island | $3,631 |

| Shelter Island Heights | $3,554 |

| Shenorock | $1,808 |

| Sherburne | $1,552 |

| Sherman | $1,571 |

| Sherrill | $1,654 |

| Shinnecock Hills | $4,090 |

| Shirley | $3,775 |

| Shokan | $1,640 |

| Shoreham | $3,088 |

| Shortsville | $1,448 |

| Shrub Oak | $1,770 |

| Shushan | $1,745 |

| Sidney | $1,572 |

| Sidney Center | $1,580 |

| Silver Bay | $1,696 |

| Silver Creek | $1,518 |

| Silver Lake | $1,524 |

| Silver Springs | $1,531 |

| Sinclairville | $1,557 |

| Skaneateles | $1,447 |

| Skaneateles Falls | $1,400 |

| Slate Hill | $1,632 |

| Slaterville Springs | $1,516 |

| Sleepy Hollow | $1,875 |

| Slingerlands | $1,492 |

| Sloan | $1,410 |

| Sloansville | $1,697 |

| Sloatsburg | $1,697 |

| Smallwood | $1,710 |

| Smithboro | $1,547 |

| Smithtown | $3,092 |

| Smithville Flats | $1,591 |

| Smyrna | $1,561 |

| Sodus | $1,467 |

| Sodus Point | $1,462 |

| Solsville | $1,471 |

| Solvay | $1,417 |

| Somers | $1,812 |

| Sonyea | $1,464 |

| Sound Beach | $3,102 |

| South Bethlehem | $1,505 |

| South Blooming Grove | $1,634 |

| South Butler | $1,488 |

| South Byron | $1,511 |

| South Cairo | $1,734 |

| South Colton | $1,640 |

| South Dayton | $1,543 |

| South Fallsburg | $1,710 |

| South Farmingdale | $2,724 |

| South Floral Park | $2,845 |

| South Glens Falls | $1,534 |

| South Hempstead | $3,011 |

| South Hill | $1,508 |

| South Huntington | $3,066 |

| South Jamesport | $3,557 |

| South Kortright | $1,582 |

| South Lima | $1,466 |

| South Lockport | $1,386 |

| South New Berlin | $1,566 |

| South Nyack | $1,664 |

| South Otselic | $1,578 |

| South Ozone Park | $2,549 |

| South Plymouth | $1,559 |

| South Richmond Hill | $2,548 |

| South Salem | $1,817 |

| South Valley Stream | $3,020 |

| South Wales | $1,375 |

| Southampton | $4,100 |

| Southfields | $1,620 |

| Southold | $3,593 |

| Southport | $1,505 |

| Spackenkill | $1,511 |

| Sparkill | $1,664 |

| Sparrow Bush | $1,677 |

| Speculator | $1,748 |

| Spencer | $1,524 |

| Spencerport | $1,360 |

| Spencertown | $1,683 |

| Speonk | $4,024 |

| Sprakers | $1,567 |

| Spring Brook | $1,377 |

| Spring Glen | $1,681 |

| Spring Valley | $1,688 |

| Springfield Center | $1,569 |

| Springfield Gardens | $2,563 |

| Springs | $4,122 |

| Springville | $1,385 |

| Springwater | $1,479 |

| St. Albans | $2,554 |

| St. Bonaventure | $1,550 |

| St. James | $3,094 |

| St. Johnsville | $1,649 |

| St. Regis Falls | $1,694 |

| Staatsburg | $1,511 |

| Stafford | $1,496 |

| Stamford | $1,615 |

| Stanfordville | $1,534 |

| Stanley | $1,494 |

| Star Lake | $1,645 |

| Staten Island | $2,216 |

| Steamburg | $1,573 |

| Stella Niagara | $1,386 |

| Stephentown | $1,565 |

| Sterling | $1,547 |

| Sterling Forest | $1,635 |

| Stewart Manor | $2,565 |

| Stillwater | $1,572 |

| Stittville | $1,665 |

| Stockton | $1,573 |

| Stone Ridge | $1,640 |

| Stony Brook | $3,109 |

| Stony Brook University | $3,116 |

| Stony Creek | $1,690 |

| Stony Point | $1,683 |

| Stormville | $1,534 |

| Stottville | $1,678 |

| Stow | $1,564 |

| Stratford | $1,688 |

| Strykersville | $1,503 |

| Stuyvesant | $1,656 |

| Stuyvesant Falls | $1,646 |

| Suffern | $1,690 |

| Sugar Loaf | $1,633 |

| Summit | $1,637 |

| Summitville | $1,727 |

| Sunnyside | $2,429 |

| Sunset Bay | $1,524 |

| SUNY Oswego | $1,491 |

| Surprise | $1,683 |

| Swain | $1,554 |

| Swan Lake | $1,713 |

| Sylvan Beach | $1,645 |

| Syosset | $2,484 |

| Syracuse | $1,527 |

| Taberg | $1,686 |

| Tallman | $1,657 |

| Tannersville | $1,687 |

| Tappan | $1,665 |

| Tarrytown | $1,875 |

| Terryville | $3,074 |

| Thendara | $1,692 |

| Theresa | $1,669 |

| Thiells | $1,692 |

| Thomaston | $2,555 |

| Thompson Ridge | $1,652 |

| Thompsonville | $1,719 |

| Thornwood | $1,864 |

| Thousand Island Park | $1,709 |

| Three Mile Bay | $1,676 |

| Ticonderoga | $1,746 |

| Tillson | $1,642 |

| Tioga Center | $1,537 |

| Titusville | $1,517 |

| Tivoli | $1,533 |

| Tomkins Cove | $1,674 |

| Tonawanda | $1,407 |

| Town Line | $1,379 |

| Treadwell | $1,578 |

| Tribes Hill | $1,585 |

| Troupsburg | $1,556 |

| Trout Creek | $1,600 |

| Troy | $1,548 |

| Trumansburg | $1,533 |

| Truxton | $1,542 |

| Tuckahoe | $2,992 |

| Tully | $1,442 |

| Tunnel | $1,555 |

| Tupper Lake | $1,752 |

| Turin | $1,669 |

| Tuxedo Park | $1,631 |

| Ulster Park | $1,639 |

| Unadilla | $1,584 |

| Union Hill | $1,472 |

| Union Springs | $1,549 |

| Uniondale | $2,979 |

| Unionville | $1,651 |

| University at Buffalo | $1,378 |

| University Gardens | $2,551 |

| Upper Brookville | $2,471 |

| Upper Jay | $1,777 |

| Upper Nyack | $1,664 |

| Upton | $3,546 |

| Utica | $1,655 |

| Vails Gate | $1,630 |

| Valatie | $1,659 |

| Valhalla | $1,889 |

| Valley Cottage | $1,672 |

| Valley Falls | $1,568 |

| Valley Stream | $3,026 |

| Van Buren Point | $1,541 |

| Van Etten | $1,513 |

| Van Hornesville | $1,690 |

| Varysburg | $1,504 |

| Verbank | $1,533 |

| Vermontville | $1,767 |

| Vernon | $1,662 |

| Vernon Center | $1,649 |

| Verona | $1,669 |

| Verona Beach | $1,660 |

| Verplanck | $1,772 |

| Versailles | $1,541 |

| Vestal | $1,520 |

| Victor | $1,387 |

| Victory | $1,545 |

| Victory Mills | $1,565 |

| Village Green | $1,398 |

| Village of the Branch | $3,083 |

| Viola | $1,684 |

| Voorheesville | $1,485 |

| Waccabuc | $1,777 |

| Waddington | $1,632 |

| Wading River | $3,247 |

| Wainscott | $4,144 |

| Walden | $1,622 |

| Wales Center | $1,384 |

| Walker Valley | $1,651 |

| Wallkill | $1,632 |

| Walton | $1,589 |

| Walton Park | $1,627 |

| Walworth | $1,446 |

| Wampsville | $1,469 |

| Wanakah | $1,389 |

| Wanakena | $1,700 |

| Wantagh | $3,051 |

| Wappingers Falls | $1,525 |

| Warners | $1,419 |

| Warnerville | $1,680 |

| Warrensburg | $1,703 |

| Warsaw | $1,526 |

| Warwick | $1,628 |

| Washington Heights | $1,629 |

| Washington Mills | $1,684 |

| Washingtonville | $1,624 |

| Wassaic | $1,529 |

| Water Mill | $4,101 |

| Waterford | $1,553 |

| Waterloo | $1,552 |

| Waterport | $1,466 |

| Watertown | $1,666 |

| Waterville | $1,626 |

| Watervliet | $1,484 |

| Watkins Glen | $1,538 |

| Waverly | $1,543 |

| Wawarsing | $1,666 |

| Wayland | $1,531 |

| Webster | $1,366 |

| Weedsport | $1,535 |

| Wellesley Island | $1,668 |

| Wells | $1,730 |

| Wells Bridge | $1,601 |

| Wellsburg | $1,513 |

| Wellsville | $1,552 |

| Wesley Hills | $1,696 |

| West Babylon | $3,744 |

| West Bay Shore | $3,753 |

| West Bloomfield | $1,429 |

| West Burlington | $1,566 |

| West Camp | $1,625 |

| West Carthage | $1,667 |

| West Chazy | $1,733 |

| West Clarksville | $1,553 |

| West Coxsackie | $1,662 |

| West Davenport | $1,577 |

| West Eaton | $1,490 |

| West Edmeston | $1,435 |

| West Elmira | $1,503 |

| West End | $1,574 |

| West Falls | $1,375 |

| West Fulton | $1,646 |

| West Glens Falls | $1,683 |

| West Harrison | $1,898 |

| West Haverstraw | $1,684 |

| West Hempstead | $2,971 |

| West Henrietta | $1,338 |

| West Hills | $3,076 |

| West Hurley | $1,640 |

| West Islip | $3,746 |

| West Kill | $1,701 |

| West Lebanon | $1,671 |

| West Leyden | $1,712 |

| West Monroe | $1,473 |

| West Nyack | $1,675 |

| West Oneonta | $1,561 |

| West Park | $1,657 |

| West Point | $1,613 |

| West Sand Lake | $1,545 |

| West Sayville | $3,796 |

| West Seneca | $1,407 |

| West Shokan | $1,640 |

| West Stockholm | $1,684 |

| West Valley | $1,518 |

| West Winfield | $1,611 |

| Westbrookville | $1,696 |

| Westbury | $2,581 |

| Westdale | $1,702 |

| Westerlo | $1,495 |

| Westernville | $1,677 |

| Westfield | $1,573 |

| Westford | $1,566 |

| Westhampton | $4,030 |

| Westhampton Beach | $4,023 |

| Westmere | $1,502 |

| Westmoreland | $1,646 |

| Weston Mills | $1,554 |

| Westport | $1,750 |

| Westtown | $1,623 |

| Westvale | $1,429 |

| Wevertown | $1,738 |

| Wheatley Heights | $3,410 |

| Whippleville | $1,790 |

| White Lake | $1,740 |

| White Plains | $1,890 |

| White Sulphur Springs | $1,720 |

| Whitehall | $1,734 |

| Whitesboro | $1,638 |

| Whitestone | $2,451 |

| Whitesville | $1,561 |

| Whitney Point | $1,536 |

| Willard | $1,566 |

| Willet | $1,555 |

| Williamson | $1,456 |

| Williamstown | $1,490 |

| Williamsville | $1,372 |

| Williston Park | $2,532 |

| Willow | $1,637 |

| Willsboro | $1,754 |

| Willseyville | $1,522 |

| Wilmington | $1,751 |

| Wilson | $1,407 |

| Windham | $1,694 |

| Windsor | $1,530 |

| Wingdale | $1,532 |

| Winthrop | $1,651 |

| Witherbee | $1,770 |

| Wolcott | $1,510 |

| Woodbourne | $1,720 |

| Woodbury | $2,514 |

| Woodgate | $1,666 |

| Woodhaven | $2,539 |

| Woodhull | $1,556 |

| Woodmere | $2,997 |

| Woodridge | $1,718 |

| Woodsburgh | $3,043 |

| Woodside | $2,435 |

| Woodstock | $1,639 |

| Worcester | $1,565 |

| Wurtsboro | $1,670 |

| Wyandanch | $3,750 |

| Wynantskill | $1,543 |

| Wyoming | $1,529 |

| Yaphank | $3,720 |

| Yonkers | $2,028 |

| Yorktown Heights | $1,810 |

| Yorkville | $1,636 |

| Youngstown | $1,414 |

| Youngsville | $1,714 |

| Yulan | $1,740 |

| Zena | $1,640 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.