Where to Get Cheap Car Insurance in Detroit

Best cheap car insurance companies in Detroit

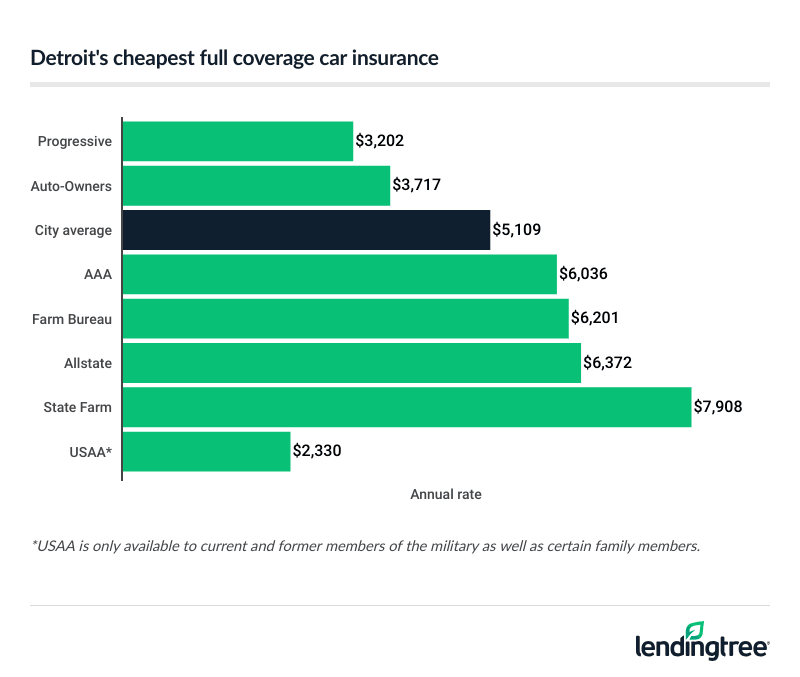

Cheapest full coverage auto insurance in Detroit: Progressive

Progressive has the full coverage car insurance in Detroit, with rates that average $3,202 a year, or $267 a month. This is 37% lower than the city average of $5,109 a year.

USAA’s average rate of $2,330 a year is cheaper than Progressive’s, but only military members and their families can get car insurance from USAA.

Auto-Owners has the next-cheapest rates of $3,717 a year, or $310 a month. Progressive and Auto-Owners each offer several car insurance discounts. Compare quotes from both to see which is the cheapest for you.

Full coverage car insurance quotes

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| Progressive | $3,202 |  |

| Auto-Owners | $3,717 |  |

| AAA | $6,036 |  |

| Farm Bureau | $6,201 |  |

| Allstate | $6,372 |  |

| State Farm | $7,908 |  |

| USAA* | $2,330 |  |

Best cheap liability auto insurance in Detroit: Progressive

At $1,378 a year, or $115 a month, Progressive also offers the cheapest liability car insurance rates in Detroit. Auto-Owners is only 3% more, at $1,414 a year.

If you can’t decide between them, get quotes from both. Also, look at what else they offer, like add-on coverages. Progressive offers different accident forgiveness options, for example. If that’s important to you, it could make your decision easier.

Liability car insurance rates

| Company | Annual rate |

|---|---|

| Progressive | $1,378 |

| Auto-Owners | $1,414 |

| Allstate | $1,983 |

| AAA | $2,073 |

| Farm Bureau | $2,384 |

| State Farm | $5,415 |

| USAA* | $797 |

Cheap auto insurance in Detroit for teen drivers: Auto-Owners

Auto-Owners is the best company if you’re looking for the cheapest car insurance for young drivers in Detroit. Liability car insurance from Auto-Owners costs $2,245 a year, on average. Full coverage costs around $6,237 a year.

Allstate has the next-cheapest liability-only rates for Detroit teens, at $3,876 a year. Farm Bureau comes in second for full coverage, at $10,113 a year. Auto-Owners rates for teens are much cheaper than both of these companies. Also, Auto-Owners offers a 20% good student discount.

Car insurance rates for teens by company

| Company | Minimum coverage | Full coverage |

|---|---|---|

| Auto-Owners | $2,245 | $6,237 |

| Allstate | $3,876 | $13,203 |

| Farm Bureau | $3,889 | $10,113 |

| AAA | $4,092 | $12,383 |

| Progressive | $5,969 | $15,432 |

| State Farm | $14,627 | $20,290 |

| USAA* | $1,386 | $4,601 |

Detroit’s cheapest car insurance after a speeding ticket: Progressive

Detroit drivers with a speeding ticket should look at Progressive for car insurance. Its average rate for these drivers is $3,948 a year, or $329 a month. This is 36% cheaper than the city average of $6,170.

Auto-Owners is not far behind, at $4,349 a year. Both companies offer bundling discounts that can make a difference in who is cheaper for you.

Detroit car insurance rates with a speeding ticket

| Company | Annual rate |

|---|---|

| Progressive | $3,948 |

| Auto-Owners | $4,349 |

| Farm Bureau | $6,201 |

| AAA | $7,198 |

| Allstate | $8,342 |

| State Farm | $10,163 |

| USAA* | $2,990 |

Cheap auto insurance in Detroit after an accident: Auto-Owners

Auto-Owners is the most affordable company for Detroit drivers needing car insurance after an accident. Its rates average $4,349 a year, or $362 a month. Progressive is the next-cheapest option, at $4,653 a year.

If you finance your car, look into each insurer’s loan/lease payoff coverage. Also called GAP insurance, this type of coverage pays off your loan balance if your car is totaled.

Detroit car insurance rates after an accident

| Company | Annual rate |

|---|---|

| Auto-Owners | $4,349 |

| Progressive | $4,653 |

| Farm Bureau | $7,590 |

| AAA | $8,619 |

| State Farm | $9,411 |

| Allstate | $10,086 |

| USAA* | $3,287 |

Cheap car insurance for Detroit teens with bad driving records: Auto-Owners

At $2,617 a year, Auto-Owners has the cheapest car insurance for young drivers with poor driving records. Auto-Owners’ rates after a ticket or an accident are the same. Farm Bureau is the next-cheapest company, with average rates of $3,889 after a ticket and $4,756 after an accident.

Both companies’ average rates are cheaper than the city average. Detroit teens pay an average of $6,235 a year after a ticket, and $6,334 after an accident.

Car insurance rates for teens with incidents

| Company | Ticket | Accident |

|---|---|---|

| Auto-Owners | $2,617 | $2,617 |

| Farm Bureau | $3,889 | $4,756 |

| AAA | $4,538 | $5,208 |

| Allstate | $5,235 | $5,529 |

| Progressive | $6,278 | $6,772 |

| State Farm | $19,490 | $17,869 |

| USAA* | $1,595 | $1,659 |

Cheapest auto insurance in Detroit after a DUI: Progressive

Progressive has the cheapest car insurance after a DUI for most Detroit drivers, at $3,735 a year, or $311 a month. Auto-Owners is next, with an average rate of $8,364 a year.

If you are in the military and have a DUI on your record, get a car insurance quote from USAA. USAA’s average rate of $4,211 a year after a DUI is 50% cheaper than Auto-Owners. All three of these companies are cheaper than the city average of $14,492 a year.

Car insurance quotes after a DUI

| Company | Annual rate |

|---|---|

| Progressive | $3,735 |

| Auto-Owners | $8,364 |

| AAA | $14,900 |

| Farm Bureau | $16,184 |

| State Farm | $22,129 |

| Allstate | $31,922 |

| USAA* | $4,211 |

Detroit’s best car insurance companies

Progressive and Auto-Owners are the best car insurance companies for most Detroit drivers looking for cheap rates. Both also offer a wide range of discounts and good add-on coverages.

Auto-Owners is also the best car insurance company for teen drivers in Detroit. Along with low rates, it offers these teen discounts:

-

Good Student discount

Students may get a Good Student discount of up to 20% if they maintain a 3.0 or better grade-point average.

-

Student Away at School discount

Available for students who attend school more than 100 miles from home and don’t take their car with them.

USAA is the best car insurance company for military members. It offers the cheapest overall rates in Detroit, as well as great customer service.

Detroit car insurance company ratings

| Company | J.D. Power** | AM Best | LendingTree score |

|---|---|---|---|

| AAA | 630 | Not rated |  |

| Allstate | 652 | A+ |  |

| Auto-Owners | 646 | A++ |  |

| Farm Bureau | 656 | A |  |

| Progressive | 648 | A+ |  |

| State Farm | 665 | A++ |  |

| USAA* | 726 | A++ |  |

Detroit auto insurance rates by neighborhood

Detroit’s 48242 ZIP code has the city’s cheapest average car insurance rate of $7,172 a year. Romulus, a western suburb of Detroit, makes up most of this ZIP code.

Detroit drivers living in the 48213 ZIP code pay the highest auto insurance rates, at an average of $9,673 a year. This ZIP code includes the Wayne County area.

Car insurance rates near you

| ZIP code | Annual rate | % from average |

|---|---|---|

| 48201 | $9,029 | 3% |

| 48202 | $8,970 | 2% |

| 48203 | $8,704 | -1% |

| 48204 | $9,163 | 4% |

| 48205 | $9,547 | 9% |

| 48206 | $9,312 | 6% |

| 48207 | $9,007 | 3% |

| 48208 | $9,034 | 3% |

| 48209 | $8,642 | -2% |

| 48210 | $8,924 | 2% |

| 48211 | $9,171 | 4% |

| 48212 | $8,994 | 2% |

| 48213 | $9,673 | 10% |

| 48214 | $9,216 | 5% |

| 48215 | $8,853 | 1% |

| 48216 | $8,956 | 2% |

| 48217 | $8,138 | -7% |

| 48219 | $8,402 | -4% |

| 48221 | $8,854 | 1% |

| 48223 | $8,510 | -3% |

| 48224 | $9,163 | 4% |

| 48226 | $8,783 | 0% |

| 48227 | $9,201 | 5% |

| 48228 | $9,101 | 4% |

| 48233 | $7,816 | -11% |

| 48234 | $9,306 | 6% |

| 48235 | $9,048 | 3% |

| 48236 | $7,614 | -13% |

| 48238 | $9,167 | 4% |

| 48239 | $7,871 | -10% |

| 48242 | $7,172 | -18% |

| 48243 | $7,817 | -11% |

Detroit car insurance requirements

Detroit drivers need 20/40/10 car insurance, at a minimum. This means they need at least:

- $20,000 of bodily injury liability coverage per person

- $40,000 of bodily injury liability coverage per accident

- $10,000 of property damage coverage

If you want damage to your own vehicle covered after an accident, you need to get full coverage. You’ll need this if you financed your car, too.

Frequently asked questions

Michigan is a no-fault car insurance state. This means you file medical expense claims with your own car insurance company after an accident, no matter who caused it. Michigan requires drivers to carry personal injury protection (PIP) to cover these claims.

The state offers various PIP limits, ranging from $50,000 to unlimited. You can opt out if someone in your household has car or medical insurance to cover costs after an accident.

High population density, many uninsured drivers and extreme weather also affect the city’s car insurance rates.

Michigan state law requires drivers to carry at least its minimum coverage limits. Full coverage car insurance isn’t required by law in Detroit. But, it’s usually needed if you financed or leased your car.

Methodology

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2015 Honda Civic EX.

Minimum liability policies provide liability coverage with Michigan’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $25,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: minimum limits, where required by law

- Collision: $500 deductible

- Comprehensive: $500 deductible

—

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.