LendingTree Releases Monthly Mortgage Offer Report for May

CHARLOTTE, N.C., June 6, 2018 – LendingTree®, the nation’s leading online loan marketplace, today released its monthly Mortgage Offers Report which analyzes data from actual loan terms offered to borrowers on LendingTree.com by lenders on LendingTree’s network. The purpose of the report is to empower consumers by providing additional information on how their credit profile affects their loan prospects.

- May’s best rate offers for borrowers with the best credit profiles had an average APR of 4.35% for conforming 30-year fixed purchase loans, up from 4.26% in April. We consider people with the best credit profiles to be those who received the best mortgage offers through the LendingTree platform.

- Refinance loan offers for borrowers with the best profiles were up 12 bps to 4.35%. Mortgage rates vary dependent upon parameters including credit score, loan-to-value, income and property type.

- For the average borrower, purchase APRs for conforming 30-yr fixed loans offered on LendingTree’s platform were up 10 bps to 5.02%. The loan note rate of 4.91% was also up 10 bps.

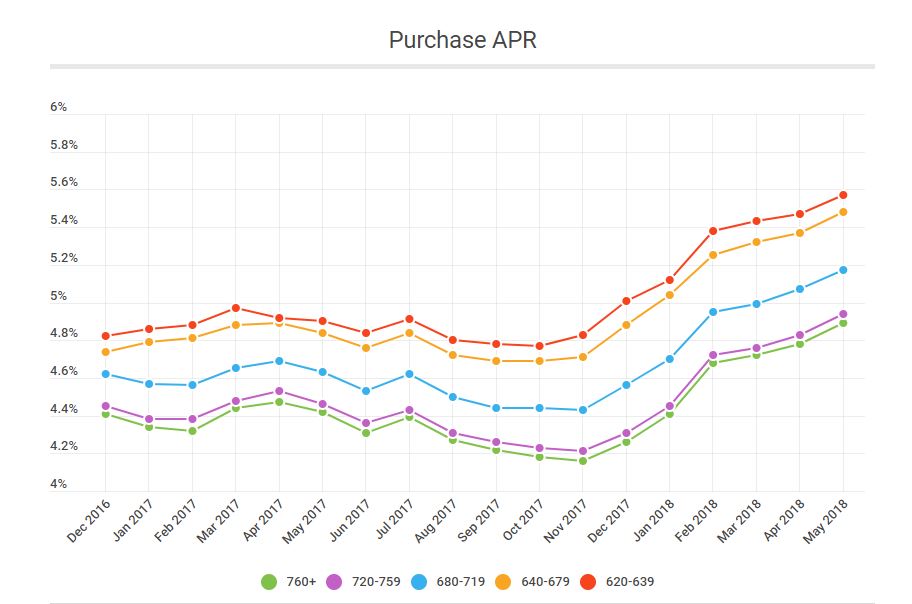

- Consumers with the highest credit scores (760+) saw offered APRs of 4.89% in March, vs. 5.17% for consumers with scores of 680 to 719. The APR spread of 28 bps between these score ranges was down 1 bps from March, yet still near the widest since this data series began in March 2016. The spread represents almost $15,000 in additional costs for borrowers with lower credit scores over 30 years for the average purchase loan amount of $236,697. The additional costs are due to higher interest rates, larger fees or a combination of the two

- Refinance APRs for conforming 30-yr fixed loans were up 11 bps to 5.00%. The credit score bracket spread narrowed 1 bps to 23 bps, amounting to just over $12,000 in extra costs over the life of the loan for lower credit score borrowers given an average refinance loan of $239,665.

- Average proposed purchase down payments were up over $2,000 month-over-month at $60,009.

Purchase APR by Credit Score Range

Purchase Mortgage Offers by Credit Score

| Purchase | |||||

| FICO Range | Average APR | Average Down Payment | Average Loan Amount | Average LTV | Lifetime Interest Paid* |

| Over all | 5.02% | $60,009 | $236,697 | 82% | $221,783 |

| 760+ | 4.89% | $78,352 | $259,008 | 78% | $215,025 |

| 720-759 | 4.94% | $55,828 | $236,779 | 83% | $217,766 |

| 680-719 | 5.17% | $37,353 | $213,642 | 86% | $229,767 |

| 640-679 | 5.48% | $56,992 | $200,725 | 76% | $246,051 |

| 620-639 | 5.57% | $53,758 | $189,604 | 76% | $250,727 |

*Lifetime interest paid is calculated based on the overall average loan amount to enable comparison.

Refinance Mortgage Offers by Credit Score

| Refinance | |||||

| FICO Range | Average APR | Average Down Payment | Average Loan Amount | Average LTV | Lifetime Interest Paid* |

| Over all | 5.00% | $125 | $239,665 | 62% | $223,469 |

| 760+ | 4.87% | $219 | $247,469 | 59% | $216,620 |

| 720-759 | 4.92% | $176 | $243,290 | 65% | $219,499 |

| 680-719 | 5.10% | $14 | $235,119 | 65% | $228,638 |

| 640-679 | 5.27% | $0 | $222,323 | 60% | $237,855 |

| 620-639 | 5.44% | $0 | $214,798 | 60% | $246,797 |

*Lifetime interest paid is calculated based on the overall average loan amount to enable comparison.

“Low inventories pushing prices higher is the theme of this year’s housing market,” said Tendayi Kapfidze, LendingTree's Chief Economist and report author. “Supply problems are particularly acute for lower priced homes. Sales for homes under $100,000 were down 13% Y/Y in April and those between $100,000 and $250,000 were down 1% Y/Y. Rising rates have yet to temper demand, which is supported by a robust labor market, so buyers should do all they can to position themselves competitively. Improving your credit score is crucial, and we strongly advise getting financing in place ahead of the house hunt and comparing multiple loan offers first.”

About the Report

The LendingTree Mortgage Offers Report contains data from actual loan terms offered to borrowers on LendingTree.com by lenders. We believe it is an important addition to standard industry surveys and reports on mortgage rates. Most quoted industry rates are for a hypothetical borrower with prime credit who makes a 20% down payment. Most borrowers do not fit this profile. Our report includes the average quoted APR by credit score, together with the average down payment and other metrics described below. We stratify by credit score, so borrowers have added information on how their credit profile affects their loan prospects. The report covers conforming 30-yr fixed loans for both purchase and refinance.

- APR: Actual APR offers to borrowers on our platform

- Down Payment: Though analogous to the LTV, we find that borrowers identify more closely with the down payment. Academic studies have also found that the down payment is the primary concern for homebuyers and one of the main impediments to entering the homebuying market.

- Loan Amount: The average loan amount borrowers are offered

- LTV: Actual LTV offered to borrowers on our platform

- Lifetime Interest Paid: This is the total cost a borrower incurs for the loan, inclusive of fees.

To view the original report, visit https://www.lendingtree.com/home/mortgage-offers-report-may-2018/.

About LendingTree

LendingTree (NASDAQ: TREE) is the nation's leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 65 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 500 lenders offering home loans, personal loans, credit cards, student loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.