Cheapest Boston Car Insurance Companies

Best cheap Boston car insurance companies

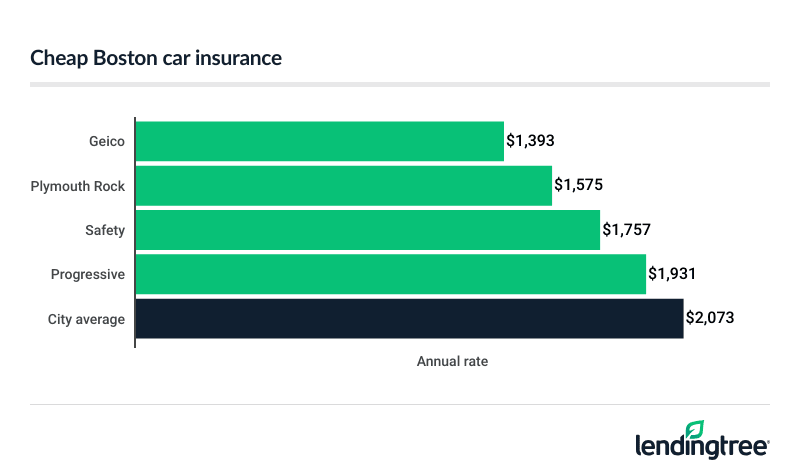

Cheapest full coverage car insurance in Boston: Geico

Geico has Boston’s cheapest full coverage car insurance at $1,393 a year, or $116 a month. This is 33% less than the city average of $173 a month. Plymouth Rock has the next-cheapest full coverage

Plymouth Rock is a better choice than Geico if you need gap insurance

Each company’s rates vary by customer. This makes it good to compare car insurance quotes from a few different companies.

Full coverage car insurance rates

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| Geico | $1,393 | |

| Plymouth Rock | $1,575 | |

| Safety | $1,757 | |

| Progressive | $1,931 | |

| Arbella | $2,325 | |

| Farmers | $2,346 | |

| Hanover | $2,673 | |

| Travelers | $2,883 | |

| USAA* | $1,778 |

Cheap minimum coverage car insurance in Boston: Geico

At $36 a month, Geico has Boston’s cheapest liability insurance, or minimum coverage

Plymouth Rock has the next-cheapest minimum coverage for most drivers at $45 a month. Plymouth Rock also offers home and renters insurance. This often makes it a better choice for bundling one of these policies with your car insurance. Geico agents can get you home or renters insurance from one of the other companies it works with.

Minimum coverage car insurance rates

| Company | Annual rate |

|---|---|

| Geico | $435 |

| Plymouth Rock | $535 |

| Farmers | $586 |

| Hanover | $608 |

| Safety | $719 |

| Arbella | $818 |

| Progressive | $1,018 |

| Travelers | $1,080 |

| USAA* | $532 |

Best cheap car insurance for young drivers: Geico

Geico has Boston’s cheapest car insurance for teens. The company charges young drivers $99 a month for minimum coverage and $291 a month for full coverage. Geico’s discounts for good grades and driver training can make its young driver rates even cheaper.

Plymouth Rock’s young driver rates are only slightly more expensive. They work out to $103 a month for minimum coverage and $293 a month for full coverage. Unfortunately, Plymouth Rock does not have the teen discounts for good grades and driver training.

Young driver car insurance rates

| Company | Minimum coverage annual | Full coverage annual |

|---|---|---|

| Geico | $1,182 | $3,487 |

| Plymouth Rock | $1,240 | $3,521 |

| Hanover | $1,981 | $8,543 |

| Travelers | $2,145 | $5,810 |

| Farmers | $2,241 | $7,308 |

| Progressive | $2,742 | $6,027 |

| Safety | $2,828 | $6,179 |

| Arbella | $2,840 | $6,830 |

| USAA* | $1,189 | $3,824 |

Best auto insurance rates after a speeding ticket: Geico

With an average rate of $127 a month, Geico has the cheapest car insurance for Boston drivers with a speeding ticket on their records. Safety has the next-cheapest rate for most drivers of $183 a month.

A speeding ticket raises the average cost of car insurance in Boston by 29%. However, some companies raise their rates by lower amounts. For example, Geico’s rates only go up by 10% after a speeding ticket. Shopping around can help you find cheap car insurance with a bad driving record.

Car insurance rates after a speeding ticket

| Company | Annual rate |

|---|---|

| Geico | $1,529 |

| Safety | $2,198 |

| Plymouth Rock | $2,270 |

| Arbella | $2,325 |

| Progressive | $2,502 |

| Farmers | $2,947 |

| Travelers | $3,821 |

| Hanover | $4,360 |

| USAA* | $2,068 |

Cheap Boston car insurance after an accident: Plymouth Rock

Plymouth Rock has Boston’s cheapest car insurance quotes after an at-fault accident at $150 a month. This is about 10% less than the second-cheapest rate of $167 a month from Geico.

Car insurance rates with an accident

| Company | Annual rate |

|---|---|

| Plymouth Rock | $1,797 |

| Geico | $2,003 |

| Arbella | $2,661 |

| Safety | $2,664 |

| Progressive | $2,758 |

| Farmers | $4,307 |

| Hanover | $4,738 |

| Travelers | $4,741 |

| USAA* | $2,529 |

Best car insurance for teens with bad driving records

Geico and Plymouth Rock have the cheapest car insurance for young drivers with a prior ticket or accident.

Geico has the cheapest minimum coverage for teens with a speeding ticket at $99 a month. This is about 25% less than Plymouth Rock’s rate of $125 a month.

Plymouth Rock has the cheapest minimum coverage for teens with an accident at $114 a month. This is only slightly less than Geico’s rate of $121 a month.

Young driver rates after a ticket or accident

| Company | Ticket annual | Accident annual |

|---|---|---|

| Geico | $1,182 | $1,457 |

| Plymouth Rock | $1,494 | $1,362 |

| Farmers | $2,359 | $2,887 |

| Travelers | $2,530 | $3,258 |

| Hanover | $2,560 | $2,646 |

| Safety | $2,828 | $3,299 |

| Arbella | $2,840 | $3,191 |

| Progressive | $2,976 | $3,065 |

| USAA* | $1,694 | $2,292 |

Cheapest car insurance for Boston drivers with a DUI

At $190 a month each, Geico and Progressive tie for Boston’s cheapest rates with a DUI (driving under the influence) conviction. Plymouth Rock comes in second with an average rate of $195 a month.

The city average for DUI insurance is $3,596 a year, or nearly $300 a month.

Car insurance rates with a DUI

| Company | Annual rate |

|---|---|

| Geico | $2,277 |

| Progressive | $2,277 |

| Plymouth Rock | $2,337 |

| Arbella | $3,851 |

| Safety | $3,884 |

| Hanover | $3,907 |

| Travelers | $4,475 |

| Farmers | $4,989 |

| USAA* | $4,364 |

Best-rated car insurance companies in Boston

Geico, Plymouth Rock and Safety are Boston’s best car insurance companies. Geico has the best rates, and Plymouth Rock balances low rates and flexible coverage options. Safety stands out for its excellent customer satisfaction rating from J.D. Power

- Geico also has several car insurance discounts that make its rates more affordable. These include discounts for military service members and government employees. Safe drivers can also get discounts with Geico’s Drive Easy smartphone app.

-

Plymouth Rock doesn’t offer as many discounts as Geico. However, it has a few useful coverage options that Geico doesn’t have. These include accident forgiveness, gap coverage and new car replacement

.If your car is totaled, newer car replacement pays the market value of a car one-year newer than your own.

- Safety has a better satisfaction score from J.D. Power than most other Boston car insurance companies. This means its customers are generally happy with the company’s prices, coverage options and service.

Unlike Geico and Plymouth Rock, Safety does not offer online quotes. It does offer accident forgiveness and new car replacement, but only through its Safety Shield Plus package. You have to pay for all of the coverages in the package, even if you only want one or two.

Car insurance company ratings

| Company | Satisfaction score

Source: J.D. Power 2024 U.S. Auto Insurance Study. Higher scores are better.

| Financial strength

Source: AM Best. A++ and A+ are “superior.” A- and A are “excellent.” Financial strength allows companies to pay claims.

| LendingTree score |

|---|---|---|---|

| Arbella | 617 | A | |

| Farmers | 619 | A | |

| Geico | 637 | A++ | |

| Hanover | 631 | A | |

| Plymouth Rock | 618 | A- | |

| Progressive | 622 | A+ | |

| Safety | 663 | A | |

| Travelers | 616 | A++ | |

| USAA* | 739 | A++ |

Boston car insurance rates by neighborhood

East Boston’s 02128 ZIP code has the city’s most expensive car insurance at $207 a month. South Boston’s 02127 ZIP has the next-highest rate of $183 a month.

Fifteen ZIP codes tie for the area’s cheapest car insurance at $170 a month. These include ZIP codes for North End, Back Bay and nearby neighborhoods.

Boston car insurance rates by ZIP code

| ZIP code | Annual rate | ZIP vs. city average |

|---|---|---|

| 02108 | $2,037 | -2% |

| 02109 | $2,037 | -2% |

| 02110 | $2,037 | -2% |

| 02111 | $2,037 | -2% |

| 02113 | $2,037 | -2% |

| 02114 | $2,037 | -2% |

| 02115 | $2,037 | -2% |

| 02116 | $2,037 | -2% |

| 02118 | $2,037 | -2% |

| 02127 | $2,194 | 6% |

| 02128 | $2,490 | 20% |

| 02133 | $2,037 | -2% |

| 02163 | $2,086 | 1% |

| 02199 | $2,037 | -2% |

| 02203 | $2,037 | -2% |

| 02210 | $2,037 | -2% |

| 02215 | $2,037 | -2% |

| 02222 | $2,037 | -2% |

Boston car insurance requirements

Boston drivers need to meet Massachusetts’ car insurance requirements to drive legally. That means you must get at least these coverages and limits:

-

Personal injury protection

: $8,000PIP covers injuries to you and your passengers, whether you or another driver causes the accident. It also covers lost wages and certain other expenses.

-

Bodily injury liability

: $25,000 per person, $50,000 per accidentBodily injury liability helps cover the medical bills of anyone you injure in a car accident.

-

Property damage liability

: $30,000Property damage liability covers damage you cause to property like fences, toll booths and light posts.

-

Uninsured motorist

: $25,000 per person, $50,000 per accidentUninsured motorist covers you and your passengers for injuries caused by a driver with no insurance. It’s required in about 20 states and optional everywhere else.

If you have a car loan, your lender will also make you get collision

Methodology

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of thousands of car insurance quotes for typical Boston drivers. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2015 Honda Civic EX. Teen rates are for an 18-year-old male.

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $25,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: $8,000

- Collision: $500 deductible

- Comprehensive: $500 deductible

—

For LendingTree scores, our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military, their spouses and children, and the spouses and children of USAA members.