Cheapest Car Insurance in California (2026)

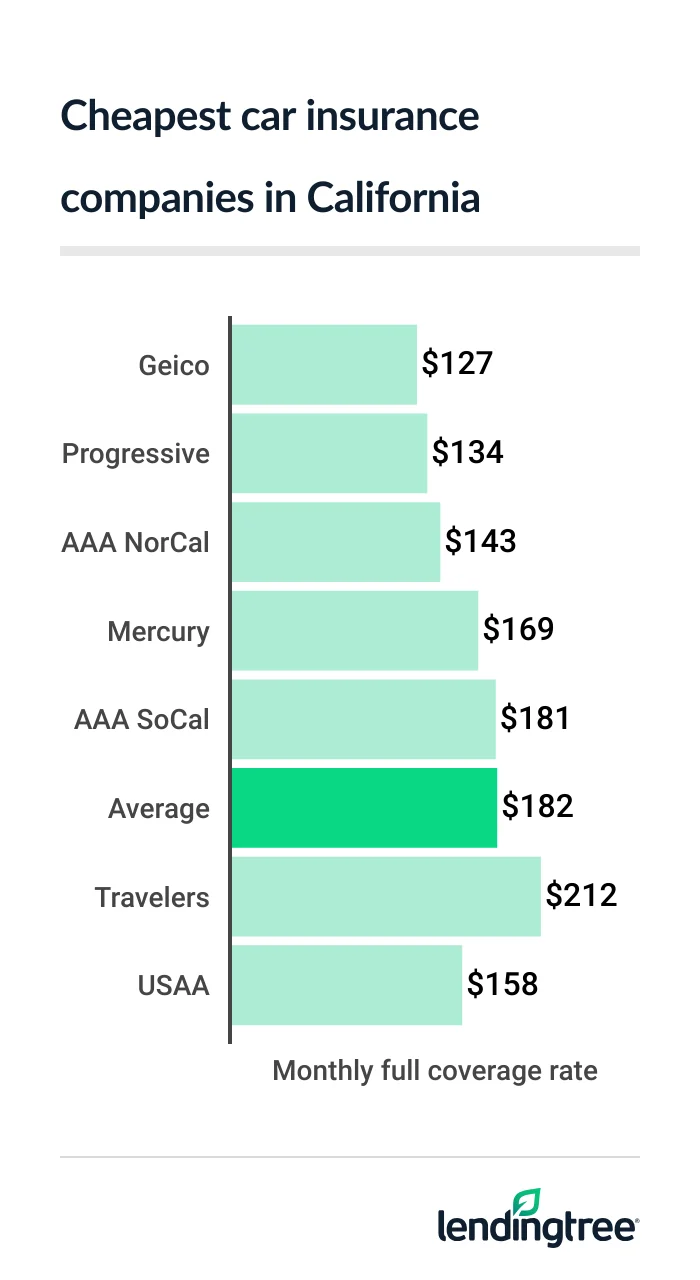

Geico has the cheapest full coverage car insurance rates in California at $127 a month. This is $55 less than the state average of $182 a month.

Best cheap California car insurance

Cheapest full coverage car insurance in California: Geico

Geico has the cheapest full coverage car insurance in California at $127 a month.

Geico is 5% less than the next-cheapest rate of $134 a month from Progressive. However, Progressive is a better choice if you need gap insurance, which Geico doesn’t have.

Cheap full coverage car insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Geico | $127 | |

| Progressive | $134 | |

| AAA NorCal | $143 | |

| Mercury | $169 | |

| AAA SoCal | $181 | |

| Travelers | $212 |  |

| Farmers | $219 | |

| State Farm | $228 |  |

| Allstate | $252 | |

| USAA* | $158 | |

Full coverage

Each company treats these factors differently and offers different car insurance discounts. It’s good to compare car insurance quotes from several companies to find the cheapest rate.

Cheap California liability-only insurance: Geico

At $41 a month, Geico has the cheapest liability insurance in California. This is 40% less than the state average of $69 a month. Progressive has the next-cheapest liability insurance

Liability-only car insurance rates

| Company | Monthly rate |

|---|---|

| Geico | $41 |

| Progressive | $49 |

| AAA NorCal | $50 |

| Mercury | $65 |

| AAA SoCal | $72 |

| State Farm | $75 |

| Farmers | $91 |

| Travelers | $93 |

| Allstate | $103 |

| USAA* | $50 |

Best cheap car insurance for teen drivers: Geico

Most Californians can get the cheapest car insurance for teens from Geico. The company charges young drivers an average of $128 a month for liability auto insurance. USAA is cheaper at $120 a month, but it’s only available to military families.

Geico also has the cheapest full coverage for young drivers at $327 a month. This is slightly less than USAA’s rate of $331 a month.

Teen car insurance rates

| Company | Liability | Full coverage |

|---|---|---|

| Geico | $128 | $327 |

| State Farm | $144 | $393 |

| Progressive | $146 | $390 |

| AAA NorCal | $162 | $445 |

| Mercury | $168 | $400 |

| Travelers | $190 | $414 |

| AAA SoCal | $204 | $434 |

| Farmers | $212 | $459 |

| Allstate | $288 | $562 |

| USAA* | $120 | $331 |

Teens are more likely to get into accidents than older drivers. This is one of the main reasons insurance companies charge teens so much.

Teens usually get cheaper rates when added to a parent’s policy than on their own. If you’re a teen, you can often get car insurance discounts for:

- Getting good grades

- Completing an approved driver training program

- Going to college without a car

The availability of these and other discounts vary by company. It’s good to ask about them when you get your quotes.

Cheap California car insurance after ticket: AAA NorCal

AAA NorCal has the cheapest car insurance for California drivers with a speeding ticket at $180 a month. Also known as CSAA, AAA NorCal is only available to AAA members in Northern California. Geico has the cheapest rates for most other drivers at $199 a month.

Car insurance rates with a ticket

| Company | Monthly rate |

|---|---|

| AAA NorCal | $180 |

| Geico | $199 |

| Progressive | $203 |

| Mercury | $240 |

| AAA SoCal | $252 |

| Farmers | $311 |

| Travelers | $322 |

| State Farm | $344 |

| Allstate | $362 |

| USAA* | $193 |

You usually pay more for car insurance with a bad driving record. However, some companies raise their rates by smaller amounts than others after a ticket or accident. You can often save money by shopping around for cheap quotes.

California’s cheapest car insurance after an accident: Progressive

California drivers with an at-fault accident can get cheap car insurance from Progressive at $218 a month. This is 18% less than the next-cheapest rate of $267 a month from Mercury.

Progressive also has a better customer satisfaction rating than Mercury from J.D. Power

Car insurance rates with an accident

| Company | Monthly rate |

|---|---|

| Progressive | $218 |

| Mercury | $267 |

| AAA NorCal | $289 |

| AAA SoCal | $313 |

| Geico | $320 |

| Farmers | $389 |

| Travelers | $402 |

| State Farm | $444 |

| Allstate | $686 |

| USAA* | $299 |

Best auto insurance for California teens with a ticket or accident: Geico

Most California teens with a ticket or accident can get the cheapest car insurance from Geico. The company’s liability rates average $144 a month for teens with a speeding ticket. This is 24% less than Progressive’s rate of $189 a month.

Geico also has the cheapest liability rate for most teens with an at-fault accident at $175 a month. Progressive and Mercury both have the next-cheapest rate of $211 a month.

Teen insurance rates after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Geico | $144 | $175 |

| Progressive | $189 | $211 |

| Mercury | $222 | $211 |

| State Farm | $229 | $240 |

| AAA NorCal | $245 | $301 |

| Farmers | $269 | $269 |

| AAA SoCal | $290 | $299 |

| Travelers | $295 | $302 |

| Allstate | $344 | $461 |

| USAA* | $148 | $159 |

Cheapest car insurance for California drivers with a DUI: Mercury

Mercury has California’s cheapest DUI insurance at $300 a month. This is only 5% less than Progressive’s rate of $316 a month. However, Progressive offers more discounts than Mercury, which may make it a better deal.

Geico has the next-cheapest rate for drivers with a DUI at $321 a month. This is 7% higher than Mercury’s rate.

Cheap DUI car insurance

| Company | Monthly rate |

|---|---|

| Mercury | $300 |

| Progressive | $316 |

| Geico | $321 |

| Farmers | $389 |

| Travelers | $456 |

| AAA NorCal | $512 |

| AAA SoCal | $588 |

| State Farm | $808 |

| Allstate | $992 |

| USAA* | $491 |

Best car insurance companies in California

Geico is California’s best car insurance company for cheap rates. Its full coverage rates are 30% cheaper than the state average of $182 a month. It also offers several discounts that make it more affordable. These include discounts for:

- Active duty and retired service members, guardsmen and reservists

- Membership in an eligible professional or alumni association

- Home ownership

- Taking a defensive driving class

- Cars with anti-theft systems

Travelers has the best coverage options for California drivers. Its Responsible Driver Plan includes accident forgiveness, which can save you money after an accident. It also offers new car replacement for up to five years. Most other new car replacement

USAA is your best choice if you meet its military eligibility requirements. Along with low rates, it has a higher satisfaction rating than every other car insurance company. This means its customers generally like USAA’s prices, coverage options and service.

Best car insurance company ratings

| Company | LendingTree score | J.D. Power | AM Best |

|---|---|---|---|

| State Farm | 4.5 | 650 | A++ |

| Travelers | 4.4 | 613 | A++ |

| USAA* | 4.1 | 735 | A++ |

| Progressive | 3.8 | 621 | A+ |

| Geico | 3.7 | 645 | A++ |

| Mercury | 3.2 | 594 | A |

| Allstate | 3.2 | 635 | A+ |

| Farmers | 3.1 | 622 | A |

| AAA NorCal | 2.5 | 652 | A |

| AAA SoCal | 2.5 | 652 | A+ |

California car insurance rates by city

Mount Shasta has the cheapest car insurance among California’s cities and towns at $138 a month. This is only slightly less than the average rate of $139 a month in nearby Weed.

Beverly Hills drivers have California’s most expensive car insurance at $292 a month. This is 60% higher than the state average of $182 a month.

Car insurance costs an average of $252 a month in Los Angeles. San Francisco drivers pay $205 a month. Drivers in San Diego pay $177 a month, which is 3% less than the state average.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Acalanes Ridge | $166 | -9% |

| Acampo | $172 | -6% |

| Acton | $186 | 2% |

| Adelanto | $212 | 16% |

| Adin | $155 | -15% |

| Agoura Hills | $214 | 17% |

| Agua Dulce | $192 | 5% |

| Aguanga | $170 | -7% |

| Ahwahnee | $160 | -12% |

| Airport | $198 | 9% |

| Alameda | $178 | -2% |

| Alamo | $168 | -8% |

| Albany | $172 | -6% |

| Albion | $160 | -12% |

| Alderpoint | $166 | -9% |

| Alhambra | $220 | 21% |

| Aliso Viejo | $173 | -5% |

| Alleghany | $164 | -10% |

| Allendale | $162 | -11% |

| Alondra Park | $211 | 16% |

| Alpaugh | $175 | -4% |

| Alpine | $169 | -8% |

| Alta | $165 | -10% |

| Alta Sierra | $162 | -11% |

| Altadena | $219 | 20% |

| Altaville | $164 | -10% |

| Alturas | $152 | -17% |

| Alum Rock | $185 | 1% |

| Alviso | $171 | -6% |

| Amador City | $175 | -4% |

| Amboy | $191 | 5% |

| American Canyon | $182 | 0% |

| Amesti | $178 | -3% |

| Anaheim | $193 | 6% |

| Anderson | $151 | -17% |

| Angels | $155 | -15% |

| Angels Camp | $155 | -15% |

| Angelus Oaks | $182 | 0% |

| Angwin | $171 | -6% |

| Annapolis | $169 | -8% |

| Antelope | $200 | 10% |

| Antioch | $189 | 4% |

| Anza | $180 | -1% |

| Apple Valley | $186 | 2% |

| Applegate | $159 | -13% |

| Aptos | $152 | -17% |

| Aptos Hills-Larkin Valley | $174 | -4% |

| Arbuckle | $159 | -13% |

| Arcadia | $214 | 17% |

| Arcata | $147 | -19% |

| Arden-Arcade | $193 | 6% |

| Armona | $161 | -11% |

| Arnold | $157 | -14% |

| Aromas | $164 | -10% |

| Arroyo Grande | $148 | -19% |

| Artesia | $203 | 11% |

| Artois | $160 | -12% |

| Arvin | $183 | 1% |

| Ashland | $189 | 4% |

| Atascadero | $150 | -18% |

| Atherton | $175 | -4% |

| Atwater | $173 | -5% |

| Atwood | $190 | 4% |

| Auberry | $166 | -9% |

| Auburn | $163 | -10% |

| Auburn Lake Trails | $169 | -7% |

| August | $200 | 10% |

| Avalon | $164 | -10% |

| Avenal | $165 | -10% |

| Avery | $168 | -8% |

| Avila Beach | $157 | -14% |

| Avilla Beach | $157 | -14% |

| Avocado Heights | $205 | 12% |

| Azusa | $200 | 10% |

| Badger | $177 | -3% |

| Baker | $172 | -6% |

| Bakersfield | $183 | 0% |

| Baldwin Park | $211 | 16% |

| Ballico | $182 | 0% |

| Bangor | $166 | -9% |

| Banning | $172 | -6% |

| Bard | $191 | 5% |

| Barstow | $178 | -2% |

| Bass Lake | $165 | -9% |

| Bay Point | $190 | 4% |

| Bayside | $149 | -18% |

| Bayview | $181 | -1% |

| Beale AFB | $163 | -11% |

| Bear Valley Springs | $161 | -11% |

| Beaumont | $174 | -4% |

| Beckwourth | $167 | -9% |

| Belden | $168 | -8% |

| Bell | $223 | 22% |

| Bell Canyon | $240 | 32% |

| Bell Gardens | $223 | 22% |

| Bella Vista | $151 | -17% |

| Bellflower | $211 | 16% |

| Belmont | $161 | -11% |

| Belvedere | $183 | 0% |

| Belvedere Tiburon | $183 | 0% |

| Ben Lomond | $162 | -11% |

| Benbow | $160 | -12% |

| Benicia | $164 | -10% |

| Benton | $161 | -12% |

| Berkeley | $181 | -1% |

| Bermuda Dunes | $176 | -4% |

| Berry Creek | $164 | -10% |

| Bertsch-Oceanview | $149 | -18% |

| Bethel Island | $180 | -1% |

| Beverly Hills | $292 | 60% |

| Bieber | $171 | -6% |

| Big Bar | $152 | -17% |

| Big Bear City | $174 | -4% |

| Big Bear Lake | $175 | -4% |

| Big Bend | $164 | -10% |

| Big Creek | $179 | -2% |

| Big Oak Flat | $175 | -4% |

| Big Pine | $151 | -17% |

| Big River | $164 | -10% |

| Big Sur | $163 | -10% |

| Biggs | $157 | -14% |

| Biola | $192 | 6% |

| Birds Landing | $180 | -2% |

| Bishop | $149 | -18% |

| Black Point-Green Point | $161 | -11% |

| Blackhawk | $172 | -5% |

| Blairsden-Graeagle | $153 | -16% |

| Blocksburg | $164 | -10% |

| Bloomfield | $164 | -10% |

| Bloomington | $200 | 9% |

| Blue Jay | $189 | 4% |

| Blue Lake | $145 | -20% |

| Blythe | $162 | -11% |

| Bodega | $171 | -6% |

| Bodega Bay | $161 | -12% |

| Bodfish | $170 | -7% |

| Bolinas | $177 | -3% |

| Bonadelle Ranchos-Madera Ranchos | $167 | -9% |

| Bonita | $170 | -7% |

| Bonny Doon | $156 | -15% |

| Bonsall | $176 | -3% |

| Boonville | $160 | -12% |

| Boron | $164 | -10% |

| Boronda | $167 | -9% |

| Borrego Springs | $160 | -12% |

| Bostonia | $180 | -1% |

| Boulder Creek | $172 | -5% |

| Boulevard | $166 | -9% |

| Boyes Hot Springs | $165 | -10% |

| Bradbury | $195 | 7% |

| Bradley | $152 | -17% |

| Brandeis | $193 | 6% |

| Branscomb | $163 | -11% |

| Brawley | $165 | -9% |

| Brea | $187 | 3% |

| Brentwood | $175 | -4% |

| Bret Harte | $192 | 5% |

| Bridgeport | $167 | -8% |

| Bridgeville | $161 | -12% |

| Brisbane | $181 | -1% |

| Broadmoor | $184 | 1% |

| Brookdale | $175 | -4% |

| Brooks | $177 | -3% |

| Brooktrails | $164 | -10% |

| Browns Valley | $163 | -10% |

| Brownsville | $162 | -11% |

| Bryn Mawr | $194 | 6% |

| Buckhorn | $164 | -10% |

| Buellton | $148 | -19% |

| Buena Park | $203 | 11% |

| Burbank | $235 | 29% |

| Burlingame | $177 | -3% |

| Burney | $155 | -15% |

| Burnt Ranch | $159 | -13% |

| Burrel | $177 | -3% |

| Burson | $172 | -6% |

| Butte City | $155 | -15% |

| Butte Creek Canyon | $155 | -15% |

| Butte Valley | $161 | -12% |

| Buttonwillow | $179 | -2% |

| Byron | $174 | -4% |

| Bystrom | $194 | 7% |

| Cabazon | $186 | 2% |

| Calabasas | $250 | 37% |

| Calexico | $171 | -6% |

| Caliente | $171 | -6% |

| California City | $167 | -8% |

| California Hot Springs | $174 | -4% |

| Calimesa | $170 | -7% |

| Calipatria | $179 | -2% |

| Calistoga | $168 | -8% |

| Callahan | $151 | -17% |

| Callender | $148 | -19% |

| Calpella | $157 | -14% |

| Calpine | $153 | -16% |

| Calwa | $184 | 1% |

| Camarillo | $175 | -4% |

| Cambria | $145 | -20% |

| Cambrian Park | $162 | -11% |

| Cameron Park | $169 | -7% |

| Camino | $167 | -8% |

| Camino Tassajara | $172 | -5% |

| Camp Meeker | $172 | -6% |

| Camp Nelson | $170 | -7% |

| Camp Pendleton | $237 | 30% |

| Campbell | $169 | -7% |

| Campo | $173 | -5% |

| Campo Seco | $173 | -5% |

| Camptonville | $160 | -12% |

| Canby | $152 | -16% |

| Canoga Park | $252 | 38% |

| Cantil | $171 | -6% |

| Cantua Creek | $171 | -6% |

| Canyon | $181 | -1% |

| Canyon Country | $207 | 13% |

| Canyon Dam | $165 | -10% |

| Canyon Lake | $182 | 0% |

| Capay | $164 | -10% |

| Capistrano Beach | $169 | -7% |

| Capitola | $150 | -18% |

| Cardiff By The Sea | $165 | -9% |

| Carlotta | $154 | -16% |

| Carlsbad | $169 | -7% |

| Carmel | $153 | -16% |

| Carmel Valley Village | $157 | -14% |

| Carmel-by-the-Sea | $156 | -15% |

| Carmichael | $195 | 7% |

| Carnelian Bay | $161 | -12% |

| Carpinteria | $163 | -11% |

| Carson | $201 | 10% |

| Caruthers | $179 | -2% |

| Casa Conejo | $181 | -1% |

| Casa de Oro-Mount Helix | $176 | -4% |

| Casmalia | $162 | -11% |

| Caspar | $155 | -15% |

| Cassel | $155 | -15% |

| Castaic | $192 | 6% |

| Castella | $161 | -12% |

| Castle Hill | $162 | -11% |

| Castro Valley | $180 | -1% |

| Castroville | $175 | -4% |

| Cathedral City | $183 | 0% |

| Catheys Valley | $159 | -13% |

| Cayucos | $152 | -17% |

| Cazadero | $166 | -9% |

| Cedar Glen | $193 | 6% |

| Cedar Ridge | $161 | -12% |

| Cedarpines Park | $179 | -2% |

| Cedarville | $156 | -15% |

| Centerville | $171 | -6% |

| Ceres | $190 | 4% |

| Cerritos | $199 | 9% |

| Challenge | $169 | -7% |

| Charter Oak | $196 | 7% |

| Chatsworth | $243 | 33% |

| Cherry Valley | $174 | -4% |

| Cherryland | $190 | 4% |

| Chester | $159 | -13% |

| Chicago Park | $170 | -7% |

| Chico | $156 | -15% |

| Chilcoot | $156 | -15% |

| China Lake Acres | $155 | -15% |

| Chinese Camp | $163 | -11% |

| Chino | $193 | 6% |

| Chino Hills | $189 | 4% |

| Chowchilla | $169 | -7% |

| Chualar | $160 | -12% |

| Chula Vista | $171 | -6% |

| Cima | $185 | 2% |

| Citrus | $198 | 9% |

| Citrus Heights | $188 | 3% |

| City Of Industry | $180 | -1% |

| Claremont | $180 | -1% |

| Clarksburg | $179 | -2% |

| Clay | $174 | -4% |

| Clayton | $168 | -8% |

| Clearlake | $170 | -7% |

| Clearlake Oaks | $164 | -10% |

| Clearlake Park | $166 | -9% |

| Clearlake Riviera | $161 | -12% |

| Clements | $174 | -5% |

| Cleone | $150 | -18% |

| Clio | $160 | -12% |

| Clipper Mills | $165 | -10% |

| Cloverdale | $155 | -15% |

| Clovis | $168 | -8% |

| Clyde | $183 | 1% |

| Coachella | $190 | 4% |

| Coalinga | $159 | -13% |

| Coarsegold | $165 | -10% |

| Cobb | $178 | -3% |

| Cohasset | $152 | -17% |

| Coleville | $154 | -16% |

| Colfax | $161 | -12% |

| Collierville | $172 | -6% |

| Colma | $207 | 13% |

| Coloma | $171 | -6% |

| Colton | $192 | 5% |

| Columbia | $163 | -11% |

| Colusa | $165 | -10% |

| Commerce | $213 | 17% |

| Comptche | $160 | -12% |

| Compton | $238 | 30% |

| Concord | $173 | -5% |

| Concow | $161 | -12% |

| Contra Costa Centre | $166 | -9% |

| Cool | $169 | -7% |

| Copperopolis | $168 | -8% |

| Corcoran | $162 | -11% |

| Corning | $154 | -15% |

| Corona | $187 | 2% |

| Corona Del Mar | $183 | 0% |

| Coronado | $172 | -6% |

| Coronita | $184 | 1% |

| Corralitos | $174 | -4% |

| Corte Madera | $169 | -7% |

| Costa Mesa | $182 | 0% |

| Cotati | $162 | -11% |

| Coto De Caza | $178 | -2% |

| Cottonwood | $151 | -17% |

| Coulterville | $169 | -7% |

| Country Club | $186 | 2% |

| Courtland | $186 | 2% |

| Covelo | $163 | -11% |

| Covina | $195 | 7% |

| Coyote | $168 | -8% |

| Crescent City | $149 | -18% |

| Crescent Mills | $155 | -15% |

| Cressey | $171 | -6% |

| Crest | $180 | -1% |

| Crestline | $187 | 3% |

| Creston | $153 | -16% |

| Crockett | $178 | -2% |

| Crowley Lake | $163 | -10% |

| Crows Landing | $172 | -5% |

| Cudahy | $223 | 22% |

| Culver City | $217 | 19% |

| Cupertino | $159 | -13% |

| Cutler | $174 | -4% |

| Cutten | $156 | -14% |

| Cypress | $195 | 7% |

| Daggett | $171 | -6% |

| Daly City | $196 | 7% |

| Dana Point | $176 | -4% |

| Danville | $169 | -7% |

| Daphnedale Park | $152 | -17% |

| Darwin | $176 | -3% |

| Davenport | $163 | -10% |

| Davis | $160 | -13% |

| Davis Creek | $161 | -12% |

| Day Valley | $163 | -11% |

| Death Valley | $164 | -10% |

| Deer Park | $170 | -7% |

| Del Aire | $222 | 22% |

| Del Mar | $171 | -6% |

| Del Monte Forest | $150 | -18% |

| Del Rey | $185 | 2% |

| Del Rey Oaks | $152 | -16% |

| Del Rio | $185 | 1% |

| Delano | $174 | -4% |

| Delhi | $172 | -5% |

| Delleker | $155 | -15% |

| Denair | $175 | -4% |

| Descanso | $159 | -13% |

| Desert Center | $167 | -9% |

| Desert Edge | $179 | -2% |

| Desert Hot Springs | $187 | 2% |

| Desert Palms | $168 | -8% |

| Desert Shores | $185 | 1% |

| Desert View Highlands | $201 | 10% |

| Diablo | $168 | -8% |

| Diamond Bar | $201 | 10% |

| Diamond Springs | $165 | -9% |

| Dillon Beach | $173 | -5% |

| Dinuba | $171 | -6% |

| Discovery Bay | $178 | -2% |

| Dixon | $163 | -10% |

| Dixon Lane-Meadow Creek | $149 | -18% |

| Dobbins | $161 | -12% |

| Dogtown | $172 | -6% |

| Dollar Point | $159 | -13% |

| Dorris | $156 | -14% |

| Dos Palos | $168 | -8% |

| Dos Rios | $161 | -12% |

| Douglas City | $160 | -12% |

| Douglas Flat | $166 | -9% |

| Downey | $215 | 18% |

| Downieville | $162 | -11% |

| Doyle | $158 | -13% |

| Drytown | $173 | -5% |

| Duarte | $197 | 8% |

| Dublin | $164 | -10% |

| Ducor | $178 | -2% |

| Dulzura | $184 | 1% |

| Duncans Mills | $178 | -2% |

| Dunlap | $171 | -6% |

| Dunnigan | $159 | -13% |

| Dunsmuir | $143 | -22% |

| Durham | $151 | -17% |

| Dustin Acres | $172 | -6% |

| Dutch Flat | $165 | -9% |

| Eagleville | $165 | -10% |

| Earlimart | $177 | -3% |

| Earp | $164 | -10% |

| East Foothills | $185 | 1% |

| East Hemet | $180 | -1% |

| East Irvine | $184 | 1% |

| East La Mirada | $196 | 8% |

| East Los Angeles | $218 | 20% |

| East Nicolaus | $181 | -1% |

| East Oakdale | $174 | -5% |

| East Orosi | $175 | -4% |

| East Palo Alto | $177 | -3% |

| East Pasadena | $210 | 15% |

| East Porterville | $168 | -8% |

| East Quincy | $149 | -18% |

| East Rancho Dominguez | $233 | 28% |

| East Richmond Heights | $190 | 4% |

| East San Gabriel | $208 | 14% |

| East Sonora | $161 | -12% |

| Easton | $191 | 5% |

| Eastvale | $190 | 4% |

| Echo Lake | $172 | -6% |

| Edison | $192 | 5% |

| Edwards | $164 | -10% |

| Edwards AFB | $161 | -12% |

| El Cajon | $181 | -1% |

| El Centro | $171 | -6% |

| El Cerrito | $178 | -2% |

| El Dorado | $169 | -8% |

| El Dorado Hills | $168 | -8% |

| El Granada | $163 | -10% |

| El Monte | $215 | 18% |

| El Nido | $173 | -5% |

| El Portal | $165 | -9% |

| El Rio | $181 | -1% |

| El Segundo | $190 | 4% |

| El Sobrante | $192 | 5% |

| El Toro | $180 | -1% |

| El Verano | $165 | -10% |

| Eldridge | $172 | -6% |

| Elizabeth Lake | $192 | 5% |

| Elk | $165 | -10% |

| Elk Creek | $154 | -15% |

| Elk Grove | $186 | 2% |

| Elkhorn | $175 | -4% |

| Elmira | $180 | -1% |

| Elverta | $187 | 2% |

| Emerald Lake Hills | $169 | -7% |

| Emeryville | $205 | 13% |

| Emigrant Gap | $177 | -3% |

| Empire | $183 | 0% |

| Encinitas | $167 | -8% |

| Encino | $278 | 52% |

| Escalon | $176 | -3% |

| Escondido | $173 | -5% |

| Esparto | $162 | -11% |

| Essex | $176 | -3% |

| Etna | $145 | -20% |

| Eucalyptus Hills | $169 | -7% |

| Eureka | $158 | -13% |

| Exeter | $162 | -11% |

| Fair Oaks | $186 | 2% |

| Fairbanks Ranch | $181 | -1% |

| Fairfax | $174 | -4% |

| Fairfield | $174 | -4% |

| Fairmead | $169 | -7% |

| Fairview | $190 | 4% |

| Fall River Mills | $160 | -12% |

| Fallbrook | $172 | -6% |

| Farmersville | $176 | -3% |

| Farmington | $173 | -5% |

| Fawnskin | $175 | -4% |

| Fellows | $164 | -10% |

| Felton | $156 | -14% |

| Ferndale | $148 | -19% |

| Fetters Hot Springs-Agua Caliente | $165 | -10% |

| Fiddletown | $164 | -10% |

| Fieldbrook | $146 | -20% |

| Fields Landing | $170 | -7% |

| Fillmore | $175 | -4% |

| Finley | $165 | -10% |

| Firebaugh | $164 | -10% |

| Fish Camp | $160 | -12% |

| Five Points | $174 | -5% |

| Florence-Graham | $242 | 33% |

| Florin | $213 | 17% |

| Floriston | $162 | -11% |

| Flournoy | $168 | -8% |

| Folsom | $168 | -8% |

| Fontana | $197 | 8% |

| Foothill Farms | $205 | 13% |

| Foothill Ranch | $169 | -7% |

| Forbestown | $163 | -11% |

| Ford City | $172 | -6% |

| Forest Falls | $182 | 0% |

| Forest Knolls | $172 | -6% |

| Forest Meadows | $156 | -14% |

| Forest Ranch | $159 | -13% |

| Foresthill | $167 | -8% |

| Forestville | $166 | -9% |

| Forks Of Salmon | $164 | -10% |

| Fort Bidwell | $160 | -12% |

| Fort Bragg | $150 | -18% |

| Fort Dick | $164 | -10% |

| Fort Irwin | $176 | -3% |

| Fort Jones | $152 | -17% |

| Fort Washington | $171 | -6% |

| Fortuna | $150 | -18% |

| Foster City | $160 | -12% |

| Fountain Valley | $188 | 3% |

| Fowler | $179 | -2% |

| Franklin | $173 | -5% |

| Frazier Park | $178 | -2% |

| Freedom | $178 | -3% |

| Fremont | $171 | -6% |

| French Camp | $189 | 4% |

| French Gulch | $156 | -14% |

| French Valley | $179 | -2% |

| Fresno | $182 | 0% |

| Friant | $183 | 0% |

| Fruitdale | $173 | -5% |

| Fruitridge Pocket | $210 | 15% |

| Fullerton | $192 | 5% |

| Fulton | $171 | -6% |

| Galt | $174 | -5% |

| Garden Acres | $186 | 2% |

| Garden Grove | $201 | 10% |

| Garden Valley | $167 | -8% |

| Gardena | $211 | 16% |

| Garnet | $187 | 2% |

| Gasquet | $152 | -16% |

| Gazelle | $150 | -18% |

| Georgetown | $165 | -10% |

| Gerber | $154 | -16% |

| Geyserville | $160 | -12% |

| Gilroy | $167 | -9% |

| Glen Avon | $187 | 3% |

| Glen Ellen | $172 | -6% |

| Glencoe | $163 | -10% |

| Glendale | $274 | 50% |

| Glendora | $185 | 2% |

| Glenhaven | $165 | -9% |

| Glenn | $151 | -17% |

| Glennville | $171 | -6% |

| Gold River | $193 | 6% |

| Gold Run | $165 | -10% |

| Golden Hills | $161 | -11% |

| Goleta | $160 | -12% |

| Gonzales | $159 | -13% |

| Good Hope | $192 | 5% |

| Goodyears Bar | $162 | -11% |

| Goshen | $172 | -6% |

| Graeagle | $153 | -16% |

| Granada Hills | $251 | 37% |

| Grand Terrace | $181 | -1% |

| Grangeville | $163 | -11% |

| Granite Bay | $171 | -6% |

| Granite Hills | $181 | -1% |

| Grass Valley | $160 | -12% |

| Graton | $167 | -8% |

| Grayson | $182 | 0% |

| Greeley Hill | $169 | -7% |

| Green Acres | $181 | -1% |

| Green Valley | $181 | -1% |

| Green Valley Lake | $183 | 0% |

| Greenacres | $175 | -4% |

| Greenbrae | $177 | -3% |

| Greenfield | $174 | -5% |

| Greenhorn | $149 | -18% |

| Greenview | $152 | -17% |

| Greenville | $155 | -15% |

| Greenwood | $173 | -5% |

| Grenada | $147 | -19% |

| Gridley | $157 | -14% |

| Grimes | $168 | -8% |

| Grizzly Flats | $176 | -3% |

| Groveland | $163 | -10% |

| Grover Beach | $153 | -16% |

| Guadalupe | $160 | -12% |

| Gualala | $163 | -11% |

| Guasti | $190 | 4% |

| Guatay | $170 | -7% |

| Guerneville | $169 | -7% |

| Guinda | $167 | -8% |

| Gustine | $168 | -8% |

| Hacienda Heights | $200 | 9% |

| Half Moon Bay | $163 | -10% |

| Hamilton Branch | $157 | -14% |

| Hamilton City | $153 | -16% |

| Hanford | $163 | -11% |

| Happy Camp | $158 | -13% |

| Harbison Canyon | $181 | -1% |

| Harbor City | $204 | 12% |

| Harmony | $163 | -10% |

| Hartley | $162 | -11% |

| Hat Creek | $154 | -16% |

| Hathaway Pines | $171 | -6% |

| Hawaiian Gardens | $205 | 12% |

| Hawthorne | $223 | 22% |

| Hayfork | $159 | -13% |

| Hayward | $187 | 3% |

| Healdsburg | $163 | -10% |

| Heber | $173 | -5% |

| Helendale | $176 | -3% |

| Helm | $176 | -4% |

| Hemet | $182 | 0% |

| Herald | $174 | -4% |

| Hercules | $181 | -1% |

| Herlong | $159 | -13% |

| Hermosa Beach | $187 | 2% |

| Hesperia | $195 | 7% |

| Hickman | $180 | -1% |

| Hidden Hills | $250 | 37% |

| Hidden Meadows | $170 | -7% |

| Hidden Valley Lake | $173 | -5% |

| Highgrove | $192 | 5% |

| Highland | $196 | 7% |

| Highlands-Baywood Park | $163 | -11% |

| Hillsborough | $177 | -3% |

| Hilmar | $174 | -5% |

| Hilmar-Irwin | $174 | -5% |

| Hinkley | $175 | -4% |

| Hollister | $165 | -10% |

| Holt | $197 | 8% |

| Holtville | $167 | -9% |

| Holy City | $174 | -4% |

| Home Garden | $163 | -11% |

| Home Gardens | $189 | 4% |

| Homeland | $179 | -2% |

| Homestead Valley | $167 | -9% |

| Homewood | $160 | -12% |

| Honeydew | $167 | -8% |

| Hood | $173 | -5% |

| Hoopa | $188 | 3% |

| Hopland | $157 | -14% |

| Hornbrook | $149 | -18% |

| Hornitos | $166 | -9% |

| Hughson | $178 | -3% |

| Humboldt Hill | $156 | -14% |

| Hume | $174 | -4% |

| Huntington Beach | $186 | 2% |

| Huntington Park | $225 | 24% |

| Huron | $162 | -11% |

| Hyampom | $159 | -13% |

| Hydesville | $153 | -16% |

| Idyllwild-Pine Cove | $170 | -7% |

| Igo | $150 | -18% |

| Imperial | $171 | -6% |

| Imperial Beach | $183 | 0% |

| Independence | $158 | -13% |

| Indian Wells | $173 | -5% |

| Indio | $180 | -1% |

| Industry | $209 | 15% |

| Inglewood | $236 | 29% |

| Interlaken | $174 | -4% |

| Inverness | $166 | -9% |

| Inyokern | $160 | -12% |

| Ione | $169 | -7% |

| Irvine | $184 | 1% |

| Irwindale | $205 | 12% |

| Isla Vista | $161 | -12% |

| Isleton | $169 | -7% |

| Ivanhoe | $169 | -7% |

| Jackson | $162 | -11% |

| Jacumba | $168 | -8% |

| Jamestown | $164 | -10% |

| Jamul | $176 | -4% |

| Janesville | $159 | -13% |

| Jenner | $169 | -7% |

| Johannesburg | $164 | -10% |

| Jolon | $158 | -13% |

| Joshua Tree | $164 | -10% |

| Julian | $169 | -8% |

| Junction City | $153 | -16% |

| June Lake | $164 | -10% |

| Jurupa Valley | $185 | 1% |

| Kaweah | $167 | -9% |

| Keeler | $175 | -4% |

| Keene | $171 | -6% |

| Kelly Ridge | $160 | -12% |

| Kelseyville | $161 | -12% |

| Kennedy | $204 | 12% |

| Kensington | $170 | -6% |

| Kentfield | $177 | -3% |

| Kenwood | $167 | -8% |

| Kerman | $177 | -3% |

| Kernville | $156 | -14% |

| Keswick | $152 | -17% |

| Kettleman City | $162 | -11% |

| Keyes | $190 | 4% |

| King City | $148 | -19% |

| Kings Beach | $172 | -6% |

| Kings Canyon National Pk | $175 | -4% |

| Kingsburg | $171 | -6% |

| Kirkwood | $170 | -7% |

| Kit Carson | $160 | -12% |

| Klamath | $161 | -11% |

| Klamath River | $158 | -13% |

| Kneeland | $154 | -16% |

| Knights Landing | $170 | -7% |

| Knightsen | $175 | -4% |

| Korbel | $154 | -15% |

| Kyburz | $170 | -7% |

| La Canada Flintridge | $216 | 19% |

| La Crescenta | $229 | 26% |

| La Grange | $179 | -2% |

| La Habra | $194 | 7% |

| La Habra Heights | $194 | 7% |

| La Honda | $173 | -5% |

| La Jolla | $177 | -3% |

| La Mesa | $166 | -9% |

| La Mirada | $203 | 11% |

| La Palma | $199 | 9% |

| La Presa | $178 | -2% |

| La Puente | $207 | 13% |

| La Quinta | $178 | -2% |

| La Riviera | $198 | 9% |

| La Selva Beach | $174 | -4% |

| La Verne | $184 | 1% |

| Ladera | $166 | -9% |

| Ladera Heights | $250 | 37% |

| Ladera Ranch | $175 | -4% |

| Lafayette | $167 | -8% |

| Laguna Beach | $186 | 2% |

| Laguna Hills | $173 | -5% |

| Laguna Niguel | $177 | -3% |

| Laguna Woods | $177 | -3% |

| Lagunitas | $178 | -2% |

| Lake Almanor Country Club | $157 | -14% |

| Lake Arrowhead | $189 | 3% |

| Lake California | $151 | -17% |

| Lake City | $153 | -16% |

| Lake Elsinore | $187 | 3% |

| Lake Forest | $173 | -5% |

| Lake Hughes | $192 | 5% |

| Lake Isabella | $166 | -9% |

| Lake Los Angeles | $211 | 16% |

| Lake Mathews | $192 | 5% |

| Lake Nacimiento | $157 | -14% |

| Lake San Marcos | $166 | -9% |

| Lake Wildwood | $153 | -16% |

| Lake of the Pines | $160 | -12% |

| Lake of the Woods | $178 | -2% |

| Lakehead | $150 | -18% |

| Lakeland Village | $190 | 4% |

| Lakeport | $154 | -16% |

| Lakeshore | $178 | -2% |

| Lakeside | $174 | -4% |

| Lakeview | $182 | 0% |

| Lakewood | $193 | 6% |

| Lamont | $189 | 3% |

| Lanare | $169 | -7% |

| Lancaster | $203 | 12% |

| Landers | $166 | -9% |

| Larkfield-Wikiup | $167 | -9% |

| Larkspur | $174 | -5% |

| Las Flores | $171 | -6% |

| Las Lomas | $174 | -4% |

| Lathrop | $186 | 2% |

| Laton | $170 | -7% |

| Lawndale | $205 | 12% |

| Laytonville | $167 | -8% |

| Le Grand | $164 | -10% |

| Lebec | $177 | -3% |

| Lee Vining | $164 | -10% |

| Leggett | $164 | -10% |

| Lemon Cove | $161 | -12% |

| Lemon Grove | $177 | -3% |

| Lemon Hill | $216 | 18% |

| Lemoore | $162 | -11% |

| Lemoore Station | $162 | -11% |

| Lennox | $221 | 21% |

| Lenwood | $178 | -2% |

| Lewiston | $151 | -17% |

| Lexington Hills | $176 | -4% |

| Likely | $162 | -11% |

| Lincoln | $168 | -8% |

| Lincoln Village | $192 | 5% |

| Linda | $169 | -7% |

| Linden | $179 | -2% |

| Lindsay | $175 | -4% |

| Linnell Camp | $170 | -7% |

| Litchfield | $152 | -17% |

| Little Lake | $174 | -5% |

| Little River | $162 | -11% |

| Littlerock | $207 | 13% |

| Live Oak | $157 | -14% |

| Livermore | $156 | -14% |

| Livingston | $170 | -7% |

| Llano | $183 | 0% |

| Lockeford | $174 | -4% |

| Lockwood | $150 | -18% |

| Lodi | $176 | -4% |

| Loleta | $156 | -15% |

| Loma Linda | $180 | -1% |

| Loma Mar | $160 | -12% |

| Loma Rica | $169 | -7% |

| Lomita | $191 | 5% |

| Lompico | $159 | -13% |

| Lompoc | $152 | -16% |

| London | $171 | -6% |

| Lone Pine | $160 | -12% |

| Long Barn | $164 | -10% |

| Long Beach | $202 | 11% |

| Lookout | $153 | -16% |

| Loomis | $174 | -4% |

| Los Alamitos | $182 | 0% |

| Los Alamos | $156 | -15% |

| Los Altos | $161 | -12% |

| Los Altos Hills | $162 | -11% |

| Los Angeles | $252 | 38% |

| Los Banos | $170 | -7% |

| Los Gatos | $172 | -6% |

| Los Molinos | $152 | -16% |

| Los Olivos | $151 | -17% |

| Los Osos | $144 | -21% |

| Los Ranchos | $149 | -18% |

| Lost Hills | $171 | -6% |

| Lotus | $177 | -3% |

| Lower Lake | $171 | -6% |

| Loyalton | $150 | -17% |

| Loyola | $156 | -14% |

| Lucas Valley-Marinwood | $167 | -9% |

| Lucerne | $156 | -15% |

| Lucerne Valley | $179 | -2% |

| Ludlow | $182 | 0% |

| Lynwood | $224 | 23% |

| Lytle Creek | $186 | 2% |

| Macdoel | $150 | -18% |

| Mad River | $156 | -14% |

| Madeline | $166 | -9% |

| Madera | $169 | -7% |

| Madera Acres | $174 | -5% |

| Madison | $162 | -11% |

| Magalia | $158 | -13% |

| Malibu | $225 | 23% |

| Mammoth Lakes | $163 | -10% |

| Manchester | $162 | -11% |

| Manhattan Beach | $189 | 4% |

| Manila | $147 | -19% |

| Manteca | $180 | -1% |

| Manton | $157 | -14% |

| March ARB | $181 | 0% |

| Maricopa | $167 | -8% |

| Marin City | $179 | -2% |

| Marina | $155 | -15% |

| Marina Del Rey | $233 | 28% |

| Mariposa | $162 | -11% |

| Markleeville | $156 | -15% |

| Marshall | $174 | -4% |

| Martell | $180 | -1% |

| Martinez | $166 | -9% |

| Marysville | $169 | -7% |

| Mather | $198 | 9% |

| Maxwell | $158 | -13% |

| Mayfair | $188 | 3% |

| Mayflower Village | $202 | 11% |

| Maywood | $217 | 19% |

| Mc Kittrick | $165 | -10% |

| McArthur | $158 | -14% |

| McClellan | $210 | 15% |

| McClellan Park | $210 | 15% |

| McCloud | $150 | -18% |

| McFarland | $183 | 0% |

| McKinleyville | $146 | -20% |

| McSwain | $173 | -5% |

| Mead Valley | $192 | 5% |

| Meadow Valley | $157 | -14% |

| Meadow Vista | $159 | -13% |

| Meadowbrook | $192 | 5% |

| Mecca | $193 | 6% |

| Meiners Oaks | $164 | -10% |

| Mendocino | $154 | -15% |

| Mendota | $179 | -2% |

| Menifee | $181 | -1% |

| Menlo Park | $160 | -12% |

| Mentone | $179 | -2% |

| Merced | $173 | -5% |

| Meridian | $162 | -11% |

| Mi Wuk Village | $167 | -8% |

| Mi-Wuk Village | $167 | -8% |

| Middletown | $175 | -4% |

| Midpines | $163 | -11% |

| Midway City | $204 | 12% |

| Milford | $158 | -13% |

| Mill Creek | $165 | -9% |

| Mill Valley | $178 | -3% |

| Millbrae | $179 | -2% |

| Millville | $152 | -16% |

| Milpitas | $165 | -9% |

| Mineral | $160 | -12% |

| Minkler | $171 | -6% |

| Mira Loma | $187 | 3% |

| Mira Monte | $167 | -8% |

| Miranda | $166 | -9% |

| Mission Canyon | $164 | -10% |

| Mission Hills | $198 | 9% |

| Mission Viejo | $174 | -4% |

| Moccasin | $178 | -3% |

| Modesto | $188 | 3% |

| Mojave | $174 | -4% |

| Mokelumne Hill | $163 | -10% |

| Mono Hot Springs | $167 | -8% |

| Mono Vista | $161 | -12% |

| Monrovia | $193 | 6% |

| Montague | $143 | -22% |

| Montalvin Manor | $207 | 13% |

| Montara | $175 | -4% |

| Montclair | $192 | 5% |

| Monte Rio | $164 | -10% |

| Monte Sereno | $168 | -8% |

| Montebello | $216 | 18% |

| Montecito | $175 | -4% |

| Monterey | $160 | -12% |

| Monterey Park | $216 | 19% |

| Montgomery Creek | $156 | -15% |

| Montrose | $236 | 29% |

| Monument Hills | $160 | -12% |

| Moorpark | $181 | -1% |

| Morada | $187 | 3% |

| Moraga | $172 | -5% |

| Moreno Valley | $194 | 7% |

| Morgan Hill | $159 | -13% |

| Morongo Valley | $179 | -2% |

| Morro Bay | $151 | -17% |

| Moss Beach | $166 | -9% |

| Moss Landing | $167 | -8% |

| Mount Aukum | $172 | -6% |

| Mount Hamilton | $169 | -7% |

| Mount Hermon | $156 | -14% |

| Mount Laguna | $173 | -5% |

| Mount Shasta | $138 | -25% |

| Mount Wilson | $214 | 17% |

| Mountain Center | $170 | -7% |

| Mountain Gate | $152 | -17% |

| Mountain House | $181 | -1% |

| Mountain Pass | $183 | 1% |

| Mountain Ranch | $163 | -10% |

| Mountain View | $159 | -13% |

| Mountain View Acres | $201 | 10% |

| Mt Baldy | $185 | 2% |

| Murphys | $156 | -14% |

| Murrieta | $179 | -2% |

| Muscoy | $196 | 8% |

| Myers Flat | $160 | -12% |

| Myrtletown | $161 | -12% |

| Napa | $169 | -7% |

| National City | $181 | -1% |

| Navarro | $166 | -9% |

| Needles | $163 | -11% |

| Nelson | $159 | -13% |

| Nevada City | $159 | -13% |

| New Almaden | $176 | -3% |

| New Cuyama | $155 | -15% |

| Newark | $172 | -5% |

| Newberry Springs | $164 | -10% |

| Newbury Park | $181 | -1% |

| Newcastle | $168 | -8% |

| Newell | $149 | -18% |

| Newman | $173 | -5% |

| Newport Beach | $184 | 1% |

| Newport Coast | $193 | 6% |

| Nicasio | $179 | -2% |

| Nice | $163 | -10% |

| Nicolaus | $181 | -1% |

| Niland | $167 | -8% |

| Nipomo | $151 | -17% |

| Nipton | $175 | -4% |

| Norco | $176 | -3% |

| Norden | $175 | -4% |

| North Auburn | $163 | -10% |

| North Edwards | $161 | -12% |

| North El Monte | $211 | 16% |

| North Fair Oaks | $169 | -7% |

| North Fork | $171 | -6% |

| North Highlands | $205 | 13% |

| North Hills | $261 | 43% |

| North Hollywood | $281 | 54% |

| North Lakeport | $154 | -16% |

| North Palm Springs | $193 | 6% |

| North Richmond | $213 | 17% |

| North San Juan | $166 | -9% |

| North Tustin | $186 | 2% |

| Northridge | $260 | 43% |

| Norwalk | $204 | 12% |

| Novato | $164 | -10% |

| Nubieber | $165 | -9% |

| Nuevo | $182 | 0% |

| O’Neals | $169 | -7% |

| O’Brien | $160 | -12% |

| Oak Hills | $192 | 6% |

| Oak Park | $201 | 10% |

| Oak Run | $160 | -12% |

| Oak View | $168 | -8% |

| Oakdale | $174 | -5% |

| Oakhurst | $160 | -12% |

| Oakland | $205 | 13% |

| Oakley | $184 | 1% |

| Oakville | $182 | 0% |

| Oasis | $185 | 1% |

| Occidental | $168 | -8% |

| Oceano | $153 | -16% |

| Oceanside | $174 | -5% |

| Ocotillo | $165 | -10% |

| Oildale | $176 | -3% |

| Ojai | $164 | -10% |

| Olancha | $168 | -8% |

| Old Fig Garden | $173 | -5% |

| Old Station | $163 | -11% |

| Olema | $176 | -3% |

| Olivehurst | $167 | -8% |

| Olympic Valley | $170 | -7% |

| Ontario | $197 | 8% |

| Onyx | $168 | -8% |

| Orange | $181 | -1% |

| Orange Cove | $176 | -3% |

| Orangevale | $177 | -3% |

| Orcutt | $150 | -18% |

| Oregon House | $176 | -3% |

| Orick | $157 | -14% |

| Orinda | $169 | -7% |

| Orland | $150 | -18% |

| Orleans | $158 | -14% |

| Oro Grande | $178 | -2% |

| Orosi | $175 | -4% |

| Oroville | $161 | -12% |

| Oroville East | $160 | -12% |

| Oxnard | $182 | 0% |

| Pacheco | $166 | -9% |

| Pacific Grove | $148 | -19% |

| Pacific Palisades | $246 | 35% |

| Pacifica | $169 | -8% |

| Pacoima | $250 | 37% |

| Paicines | $158 | -13% |

| Pajaro | $174 | -4% |

| Pala | $193 | 6% |

| Palermo | $162 | -11% |

| Palm Desert | $171 | -6% |

| Palm Springs | $185 | 2% |

| Palmdale | $210 | 15% |

| Palo Alto | $165 | -9% |

| Palo Cedro | $155 | -15% |

| Palo Verde | $165 | -9% |

| Palomar Mountain | $177 | -3% |

| Palos Verdes Estates | $189 | 4% |

| Palos Verdes Peninsula | $189 | 4% |

| Panorama City | $275 | 51% |

| Paradise | $155 | -15% |

| Paramount | $219 | 20% |

| Parker Dam | $163 | -11% |

| Parklawn | $192 | 5% |

| Parksdale | $174 | -5% |

| Parkway | $214 | 18% |

| Parkwood | $169 | -7% |

| Parlier | $178 | -2% |

| Pasadena | $212 | 16% |

| Pasatiempo | $156 | -15% |

| Paskenta | $164 | -10% |

| Paso Robles | $157 | -14% |

| Patterson | $182 | 0% |

| Patterson Tract | $172 | -6% |

| Patton | $193 | 6% |

| Patton Village | $159 | -13% |

| Pauma Valley | $183 | 1% |

| Paynes Creek | $160 | -12% |

| Pearblossom | $190 | 4% |

| Pebble Beach | $150 | -18% |

| Pedley | $185 | 1% |

| Penn Valley | $153 | -16% |

| Penngrove | $161 | -12% |

| Penryn | $167 | -9% |

| Perris | $195 | 7% |

| Pescadero | $161 | -12% |

| Petaluma | $167 | -8% |

| Petrolia | $158 | -13% |

| Phelan | $187 | 3% |

| Phillipsville | $162 | -11% |

| Philo | $156 | -14% |

| Phoenix Lake | $161 | -12% |

| Pico Rivera | $202 | 11% |

| Piedmont | $182 | 0% |

| Piedra | $177 | -3% |

| Piercy | $162 | -11% |

| Pilot Hill | $180 | -1% |

| Pine Grove | $162 | -11% |

| Pine Hills | $156 | -14% |

| Pine Mountain Club | $174 | -5% |

| Pine Mountain Lake | $163 | -10% |

| Pine Valley | $154 | -15% |

| Pinecrest | $179 | -2% |

| Pinole | $188 | 3% |

| Pinon Hills | $181 | -1% |

| Pioneer | $164 | -10% |

| Pioneertown | $167 | -9% |

| Piru | $184 | 1% |

| Pismo Beach | $152 | -16% |

| Pittsburg | $190 | 4% |

| Pixley | $166 | -9% |

| Placentia | $185 | 1% |

| Placerville | $166 | -9% |

| Plainview | $175 | -4% |

| Planada | $177 | -3% |

| Platina | $162 | -11% |

| Playa Del Rey | $209 | 15% |

| Playa Vista | $208 | 14% |

| Pleasant Grove | $178 | -3% |

| Pleasant Hill | $167 | -8% |

| Pleasanton | $161 | -12% |

| Pleasure Point | $151 | -17% |

| Plumas Lake | $167 | -8% |

| Plymouth | $165 | -10% |

| Point Arena | $170 | -7% |

| Point Mugu NAWC | $192 | 5% |

| Point Reyes Station | $168 | -8% |

| Pollock Pines | $168 | -8% |

| Pomona | $201 | 10% |

| Pope Valley | $176 | -4% |

| Poplar-Cotton Center | $175 | -4% |

| Port Costa | $174 | -4% |

| Port Hueneme | $181 | -1% |

| Porter Ranch | $248 | 36% |

| Porterville | $168 | -8% |

| Portola | $155 | -15% |

| Portola Valley | $166 | -9% |

| Posey | $165 | -9% |

| Potrero | $169 | -7% |

| Potter Valley | $162 | -11% |

| Poway | $165 | -10% |

| Prather | $165 | -10% |

| Princeton | $155 | -15% |

| Proberta | $154 | -16% |

| Prunedale | $169 | -7% |

| Quail Valley | $182 | 0% |

| Quartz Hill | $196 | 7% |

| Quincy | $149 | -18% |

| Rackerby | $164 | -10% |

| Rail Road Flat | $164 | -10% |

| Rainbow | $172 | -6% |

| Raisin City | $176 | -4% |

| Ramona | $174 | -5% |

| Ranchita | $167 | -8% |

| Rancho Calaveras | $173 | -5% |

| Rancho Cordova | $196 | 8% |

| Rancho Cucamonga | $191 | 5% |

| Rancho Mirage | $179 | -2% |

| Rancho Murieta | $170 | -7% |

| Rancho Palos Verdes | $194 | 6% |

| Rancho San Diego | $182 | 0% |

| Rancho Santa Fe | $180 | -1% |

| Rancho Santa Margarita | $175 | -4% |

| Randsburg | $174 | -5% |

| Ravendale | $172 | -6% |

| Raymond | $165 | -9% |

| Red Bluff | $147 | -20% |

| Red Corral | $162 | -11% |

| Red Mountain | $178 | -2% |

| Redcrest | $159 | -13% |

| Redding | $152 | -17% |

| Redlands | $178 | -2% |

| Redondo Beach | $187 | 2% |

| Redway | $170 | -7% |

| Redwood City | $169 | -7% |

| Redwood Estates | $177 | -3% |

| Redwood Valley | $157 | -14% |

| Reedley | $174 | -5% |

| Reliez Valley | $167 | -8% |

| Rescue | $172 | -6% |

| Reseda | $272 | 49% |

| Rialto | $199 | 9% |

| Richgrove | $180 | -1% |

| Richmond | $200 | 10% |

| Richvale | $168 | -8% |

| Ridgecrest | $155 | -15% |

| Ridgemark | $165 | -10% |

| Rimforest | $189 | 3% |

| Rio Dell | $153 | -16% |

| Rio Linda | $208 | 14% |

| Rio Nido | $178 | -2% |

| Rio Oso | $178 | -2% |

| Rio Vista | $163 | -10% |

| Rio del Mar | $152 | -17% |

| Ripley | $162 | -11% |

| Ripon | $166 | -9% |

| River Pines | $172 | -6% |

| Riverbank | $183 | 0% |

| Riverdale | $169 | -7% |

| Riverdale Park | $192 | 5% |

| Riverside | $188 | 3% |

| Robbins | $178 | -3% |

| Rocklin | $170 | -7% |

| Rodeo | $185 | 1% |

| Rohnert Park | $168 | -8% |

| Rolling Hills | $189 | 4% |

| Rolling Hills Estates | $189 | 4% |

| Rollingwood | $207 | 13% |

| Rosamond | $178 | -2% |

| Rose Hills | $200 | 10% |

| Rosedale | $174 | -5% |

| Roseland | $183 | 1% |

| Rosemead | $213 | 17% |

| Rosemont | $198 | 9% |

| Roseville | $174 | -5% |

| Ross | $190 | 4% |

| Rossmoor | $182 | 0% |

| Rough And Ready | $151 | -17% |

| Round Mountain | $166 | -9% |

| Round Valley | $149 | -18% |

| Rouse | $194 | 7% |

| Rowland Heights | $206 | 13% |

| Rubidoux | $185 | 1% |

| Rumsey | $175 | -4% |

| Running Springs | $188 | 3% |

| Ruth | $156 | -14% |

| Rutherford | $182 | 0% |

| Ryde | $176 | -4% |

| Sacramento | $200 | 10% |

| Salida | $177 | -3% |

| Salinas | $172 | -6% |

| Salton City | $180 | -1% |

| Salyer | $163 | -11% |

| Samoa | $163 | -11% |

| San Andreas | $171 | -6% |

| San Anselmo | $169 | -7% |

| San Antonio Heights | $186 | 2% |

| San Ardo | $144 | -21% |

| San Bernardino | $201 | 10% |

| San Bruno | $179 | -2% |

| San Buenaventura (Ventura) | $166 | -9% |

| San Carlos | $164 | -10% |

| San Clemente | $172 | -6% |

| San Diego | $177 | -3% |

| San Diego Country Estates | $174 | -5% |

| San Dimas | $188 | 3% |

| San Fernando | $227 | 24% |

| San Francisco | $205 | 12% |

| San Gabriel | $216 | 18% |

| San Geronimo | $176 | -3% |

| San Gregorio | $169 | -7% |

| San Jacinto | $189 | 4% |

| San Joaquin | $173 | -5% |

| San Jose | $175 | -4% |

| San Juan Bautista | $160 | -12% |

| San Juan Capistrano | $175 | -4% |

| San Leandro | $190 | 4% |

| San Lorenzo | $185 | 1% |

| San Lucas | $156 | -15% |

| San Luis Obispo | $160 | -12% |

| San Luis Rey | $179 | -2% |

| San Marcos | $168 | -8% |

| San Marino | $208 | 14% |

| San Martin | $161 | -12% |

| San Mateo | $167 | -9% |

| San Miguel | $162 | -11% |

| San Pablo | $207 | 13% |

| San Pasqual | $210 | 15% |

| San Pedro | $200 | 9% |

| San Quentin | $180 | -1% |

| San Rafael | $171 | -6% |

| San Ramon | $167 | -8% |

| San Simeon | $153 | -16% |

| San Ysidro | $175 | -4% |

| Sanger | $171 | -6% |

| Santa Ana | $194 | 7% |

| Santa Barbara | $168 | -8% |

| Santa Clara | $168 | -8% |

| Santa Clarita | $199 | 9% |

| Santa Cruz | $158 | -13% |

| Santa Fe Springs | $197 | 8% |

| Santa Margarita | $157 | -14% |

| Santa Maria | $157 | -14% |

| Santa Monica | $235 | 29% |

| Santa Nella | $168 | -8% |

| Santa Paula | $168 | -8% |

| Santa Rita Park | $175 | -4% |

| Santa Rosa | $174 | -5% |

| Santa Rosa Valley | $175 | -4% |

| Santa Venetia | $167 | -9% |

| Santa Ynez | $157 | -14% |

| Santa Ysabel | $176 | -3% |

| Santee | $161 | -11% |

| Saranap | $162 | -11% |

| Saratoga | $167 | -8% |

| Saticoy | $165 | -9% |

| Sausalito | $179 | -2% |

| Scotia | $151 | -17% |

| Scott Bar | $156 | -14% |

| Scotts Valley | $153 | -16% |

| Sea Ranch | $154 | -16% |

| Seacliff | $152 | -17% |

| Seal Beach | $176 | -4% |

| Searles Valley | $163 | -11% |

| Seaside | $159 | -13% |

| Sebastopol | $166 | -9% |

| Seeley | $173 | -5% |

| Seiad Valley | $155 | -15% |

| Selma | $182 | 0% |

| Sequoia National Park | $172 | -5% |

| Shackelford | $194 | 7% |

| Shafter | $179 | -2% |

| Shandon | $167 | -9% |

| Shasta | $151 | -17% |

| Shasta Lake | $152 | -16% |

| Shaver Lake | $162 | -11% |

| Shell Ridge | $160 | -12% |

| Sheridan | $175 | -4% |

| Sherman Oaks | $269 | 47% |

| Shingle Springs | $166 | -9% |

| Shingletown | $147 | -19% |

| Shoshone | $166 | -9% |

| Sierra City | $154 | -16% |

| Sierra Madre | $189 | 4% |

| Sierraville | $156 | -14% |

| Signal Hill | $200 | 10% |

| Silver Lakes | $176 | -3% |

| Silverado | $176 | -3% |

| Simi Valley | $190 | 4% |

| Sky Valley | $179 | -2% |

| Skyforest | $182 | 0% |

| Sleepy Hollow | $169 | -7% |

| Sloughhouse | $170 | -7% |

| Smartsville | $166 | -9% |

| Smith River | $149 | -18% |

| Snelling | $174 | -5% |

| Soda Springs | $166 | -9% |

| Solana Beach | $169 | -7% |

| Soledad | $158 | -13% |

| Solvang | $153 | -16% |

| Somerset | $173 | -5% |

| Somes Bar | $165 | -10% |

| Somis | $179 | -2% |

| Sonoma | $165 | -10% |

| Sonora | $161 | -12% |

| Soquel | $153 | -16% |

| Soulsbyville | $161 | -12% |

| South Dos Palos | $168 | -8% |

| South El Monte | $215 | 18% |

| South Gate | $222 | 22% |

| South Lake Tahoe | $165 | -10% |

| South Monrovia Island | $195 | 7% |

| South Oroville | $160 | -12% |

| South Pasadena | $210 | 15% |

| South San Francisco | $182 | 0% |

| South San Gabriel | $213 | 17% |

| South San Jose Hills | $204 | 12% |

| South Taft | $172 | -6% |

| South Whittier | $197 | 8% |

| Spreckels | $161 | -12% |

| Spring Valley | $174 | -5% |

| Spring Valley Lake | $197 | 8% |

| Springville | $162 | -11% |

| Squaw Valley | $169 | -7% |

| Squirrel Mountain Valley | $166 | -9% |

| St. Helena | $168 | -8% |

| Stallion Springs | $161 | -11% |

| Standard | $175 | -4% |

| Standish | $157 | -14% |

| Stanford | $160 | -12% |

| Stanton | $206 | 13% |

| Stevenson Ranch | $199 | 9% |

| Stevinson | $173 | -5% |

| Stewarts Point | $175 | -4% |

| Stinson Beach | $179 | -2% |

| Stirling City | $173 | -5% |

| Stockton | $192 | 5% |

| Stonyford | $158 | -13% |

| Storrie | $174 | -4% |

| Stratford | $162 | -11% |

| Strathmore | $175 | -4% |

| Strawberry | $180 | -1% |

| Strawberry Valley | $169 | -7% |

| Studio City | $263 | 44% |

| Sugarloaf | $177 | -3% |

| Suisun City | $178 | -2% |

| Sultana | $174 | -5% |

| Summerland | $171 | -6% |

| Sun City | $179 | -2% |

| Sun Valley | $265 | 46% |

| Sun Village | $207 | 13% |

| Sunland | $237 | 30% |

| Sunnyside | $179 | -2% |

| Sunnyside-Tahoe City | $159 | -13% |

| Sunnyslope | $185 | 1% |

| Sunnyvale | $163 | -10% |

| Sunol | $172 | -6% |

| Sunset Beach | $189 | 4% |

| Surfside | $186 | 2% |

| Susanville | $152 | -17% |

| Sutter | $171 | -6% |

| Sutter Creek | $161 | -12% |

| Sylmar | $235 | 29% |

| Taft | $172 | -6% |

| Taft Heights | $172 | -6% |

| Taft Mosswood | $204 | 12% |

| Tahoe City | $159 | -13% |

| Tahoe Vista | $171 | -6% |

| Tahoma | $162 | -11% |

| Talmage | $157 | -14% |

| Tamalpais-Homestead Valley | $178 | -3% |

| Tara Hills | $207 | 13% |

| Tarpey Village | $179 | -2% |

| Tarzana | $287 | 57% |

| Taylorsville | $157 | -14% |

| Tecate | $170 | -6% |

| Tecopa | $164 | -10% |

| Tehachapi | $161 | -11% |

| Tehama | $155 | -15% |

| Temecula | $177 | -3% |

| Temelec | $165 | -10% |

| Temescal Valley | $185 | 1% |

| Temple City | $212 | 16% |

| Templeton | $154 | -15% |

| Termo | $167 | -9% |

| Terra Bella | $171 | -6% |

| The Sea Ranch | $154 | -16% |

| Thermal | $185 | 1% |

| Thermalito | $161 | -12% |

| Thornton | $174 | -5% |

| Thousand Oaks | $188 | 3% |

| Thousand Palms | $173 | -5% |

| Three Rivers | $165 | -9% |

| Tiburon | $183 | 0% |

| Tipton | $168 | -8% |

| Tollhouse | $167 | -9% |

| Toluca Lake | $253 | 39% |

| Tomales | $164 | -10% |

| Topanga | $242 | 33% |

| Topaz | $156 | -14% |

| Toro Canyon | $163 | -11% |

| Torrance | $191 | 5% |

| Trabuco Canyon | $178 | -2% |

| Tracy | $176 | -4% |

| Tranquillity | $178 | -2% |

| Traver | $176 | -4% |

| Travis AFB | $168 | -8% |

| Tres Pinos | $163 | -11% |

| Trinidad | $145 | -20% |

| Trinity Center | $156 | -14% |

| Trona | $163 | -11% |

| Truckee | $159 | -13% |

| Tujunga | $264 | 45% |

| Tulare | $173 | -5% |

| Tulelake | $149 | -18% |

| Tuolumne City | $163 | -11% |

| Tupman | $177 | -3% |

| Turlock | $182 | 0% |

| Tustin | $184 | 1% |

| Twain | $163 | -11% |

| Twain Harte | $158 | -13% |

| Twentynine Palms | $202 | 11% |

| Twin Bridges | $173 | -5% |

| Twin Lakes | $151 | -17% |

| Twin Peaks | $181 | 0% |

| Ukiah | $157 | -14% |

| Union City | $180 | -1% |

| Universal City | $258 | 41% |

| University of California Davis | $158 | -14% |

| Upland | $190 | 4% |

| Upper Lake | $162 | -11% |

| Vacaville | $165 | -9% |

| Val Verde | $192 | 6% |

| Valencia | $195 | 7% |

| Valinda | $204 | 12% |

| Valle Vista | $180 | -1% |

| Vallecito | $159 | -13% |

| Vallejo | $188 | 3% |

| Valley Center | $177 | -3% |

| Valley Ford | $169 | -8% |

| Valley Springs | $173 | -5% |

| Valley Village | $284 | 56% |

| Valyermo | $186 | 2% |

| Van Nuys | $286 | 57% |

| Vandenberg AFB | $152 | -17% |

| Vandenberg Village | $152 | -16% |

| Venice | $229 | 26% |

| Ventura | $167 | -8% |

| Verdugo City | $230 | 26% |

| Vernalis | $172 | -6% |

| Vernon | $252 | 38% |

| Victor | $182 | 0% |

| Victorville | $201 | 10% |

| Vidal | $169 | -7% |

| View Park-Windsor Hills | $254 | 39% |

| Villa Grande | $168 | -8% |

| Villa Park | $185 | 2% |

| Vina | $162 | -11% |

| Vincent | $198 | 9% |

| Vine Hill | $166 | -9% |

| Vineburg | $173 | -5% |

| Vineyard | $207 | 13% |

| Vinton | $156 | -14% |

| Visalia | $170 | -7% |

| Vista | $173 | -5% |

| Vista Santa Rosa | $185 | 1% |

| Volcano | $158 | -13% |

| Walker | $154 | -16% |

| Wallace | $166 | -9% |

| Walnut | $202 | 11% |

| Walnut Creek | $163 | -11% |

| Walnut Grove | $171 | -6% |

| Walnut Park | $225 | 24% |

| Warm Springs | $186 | 2% |

| Warner Springs | $170 | -7% |

| Wasco | $178 | -3% |

| Washington | $173 | -5% |

| Waterford | $182 | 0% |

| Waterloo | $186 | 2% |

| Watsonville | $177 | -3% |

| Waukena | $173 | -5% |

| Wawona | $163 | -11% |

| Weaverville | $143 | -21% |

| Weed | $139 | -24% |

| Weedpatch | $186 | 2% |

| Weimar | $165 | -10% |

| Weldon | $163 | -11% |

| Wendel | $165 | -9% |

| Weott | $163 | -11% |

| West Athens | $262 | 44% |

| West Bishop | $149 | -18% |

| West Carson | $199 | 9% |

| West Covina | $201 | 10% |

| West Goshen | $172 | -6% |

| West Hills | $240 | 32% |

| West Hollywood | $284 | 56% |

| West Menlo Park | $160 | -12% |

| West Modesto | $193 | 6% |

| West Park | $191 | 5% |

| West Point | $160 | -12% |

| West Puente Valley | $207 | 13% |

| West Rancho Dominguez | $215 | 18% |

| West Sacramento | $191 | 5% |

| West Whittier-Los Nietos | $207 | 13% |

| Westhaven-Moonstone | $145 | -20% |

| Westlake Village | $195 | 7% |

| Westley | $186 | 2% |

| Westminster | $201 | 10% |

| Westmont | $262 | 44% |

| Westmorland | $168 | -8% |

| Westport | $163 | -10% |

| Westwood | $157 | -14% |

| Wheatland | $169 | -7% |

| Whiskeytown | $171 | -6% |

| Whitethorn | $163 | -11% |

| Whitewater | $182 | 0% |

| Whitmore | $154 | -16% |

| Whittier | $200 | 9% |

| Wildomar | $181 | -1% |

| Williams | $165 | -10% |

| Willits | $164 | -10% |

| Willow Creek | $156 | -15% |

| Willowbrook | $244 | 34% |

| Willows | $150 | -18% |

| Wilmington | $200 | 10% |

| Wilseyville | $174 | -5% |

| Wilton | $183 | 0% |

| Winchester | $179 | -2% |

| Windsor | $162 | -11% |

| Winnetka | $256 | 41% |

| Winter Gardens | $174 | -4% |

| Winterhaven | $173 | -5% |

| Winters | $165 | -9% |

| Winton | $174 | -5% |

| Wishon | $166 | -9% |

| Witter Springs | $157 | -14% |

| Wofford Heights | $168 | -8% |

| Woodacre | $175 | -4% |

| Woodbridge | $175 | -4% |

| Woodcrest | $186 | 2% |

| Woodlake | $174 | -5% |

| Woodland | $166 | -9% |

| Woodland Hills | $250 | 37% |

| Woodside | $169 | -7% |

| Woodville | $173 | -5% |

| Woody | $172 | -6% |

| Wrightwood | $179 | -2% |

| Yermo | $169 | -8% |

| Yettem | $176 | -3% |

| Yolo | $170 | -7% |

| Yorba Linda | $182 | 0% |

| Yorkville | $161 | -12% |

| Yosemite Lakes | $165 | -10% |

| Yosemite National Park | $163 | -11% |

| Yountville | $165 | -9% |

| Yreka | $140 | -23% |

| Yuba City | $176 | -3% |

| Yucaipa | $172 | -6% |

| Yucca Valley | $167 | -9% |

| Zamora | $166 | -9% |

| Zayante | $156 | -14% |

| Zenia | $156 | -15% |

Best and worst drivers in California

According to the World Population Review, California has the second-highest rate of fatal crashes in the U.S., at 3,847 in 2024. This is just behind Texas, at 3,874. However, accident rates can vary significantly between cities and age groups.

Bakersfield has the best drivers in California, while Moreno Valley has the state’s worst drivers. Younger drivers are also more likely to be involved in an accident.

ZIP codes and age groups with high accident rates usually pay higher insurance rates. Auto insurance companies charge these increased rates to offset the cost of a claim.

California cities with the best and worst drivers

Of the biggest cities in California, Bakersfield has the fewest car-related incidents with around 6 incidents occurring per 1,000 drivers. Stockton is the next best city for incidents.

Best drivers by city

| City | Incidents per 1,000 drivers |

|---|---|

| Bakersfield | 5.58 |

| Stockton | 6.16 |

| Glendale | 6.30 |

| Santa Clarita | 6.51 |

| Sacramento | 7.16 |

On the other end, Moreno Valley has the most car-related incidents in California with around 16 incidents occurring per 1,000 drivers. Moreno Valley also has some of the highest rates for car insurance in the state, at $1,991 a year. Fresno has the next-highest rate of driving incidents in California with around 15 incidents.

Worst drivers by city

| City | Incidents per 1,000 drivers |

|---|---|

| Moreno Valley | 15.71 |

| Fresno | 14.59 |

| Fremont | 13.58 |

| Irvine | 13.35 |

| Oakland | 12.79 |

California cities with the most speeding tickets

Modesto has the highest rate of speeding tickets in California with around 9 out of every 1,000 drivers receiving a speeding ticket. Oxnard has the next highest rate for speeding tickets.

Most speeding tickets by city

| City | Speeding-related incidents per 1,000 drivers |

|---|---|

| Modesto | 8.94 |

| Oxnard | 8.37 |

| Fremont | 7.59 |

| Fresno | 6.96 |

| Moreno Valley | 6.11 |

California cities with the most accidents

Moreno Valley has the highest number of car-related accidents in California with around 7 accidents occurring per 1,000 drivers. The top five cities with the most accidents are all located in Southern California.

| City | Accidents per 1,000 drivers |

|---|---|

| Moreno Valley | 7.03 |

| Irvine | 5.87 |

| Santa Clarita | 5.21 |

| Ontario | 5.08 |

| Huntington Beach | 4.68 |

California cities with the most DUIs

Modesto drivers get the most DUIs among California’s largest cities with around 4 out of every 1,000 drivers receiving a DUI.

Most DUIs by city

| City | DUIs per 1,000 drivers |

|---|---|

| Modesto | 3.58 |

| Stockton | 1.94 |

| Santa Ana | 1.47 |

| Irvine | 1.40 |

| Oxnard | 1.39 |

In 2024, California made DUI laws more strict by changing the blood alcohol content (BAC) that qualifies for a DUI from 0.08% to 0.05%, according to the California DMV.

Worst drivers by age group

Younger drivers have the highest number of traffic-related incidents in California, while middle-aged drivers have the lowest number of traffic-related incidents.

Worst drivers by generation

| Generation | Incidents per 1,000 drivers |

|---|---|

| Gen Z (circa 1997-2012) | 67.37 |

| Millennial (circa 1981-1996) | 45.86 |

| Gen X (circa 1965-1980) | 36.40 |

| Boomer (circa 1946-1964) | 38.16 |

| Silent Generation (circa 1928-1945) | 43.84 |

Teens and young adults also pay the highest car insurance rates among all age groups due to their inexperience. Fortunately, your rates decrease as you get older if you maintain a clean driving record.

Worst drivers by car make

Subaru is the automobile brand most often involved in a traffic-related incident in California with around 57 incidents occurring per 1,000 Subaru drivers. Mazda comes in second.

Worst drivers by car brand

| Make | Incidents per 1,000 drivers |

|---|---|

| Subaru | 57.16 |

| Mazda | 53.77 |

| Ram | 50.99 |

| Volkswagen | 48.85 |

| Tesla | 48.63 |

California car insurance requirements

You need liability car insurance to drive legally in California. The state’s minimum car insurance requirements are:

-

Bodily injury liability

: $30,000 per person, $60,000 per accidentBodily injury liability helps cover the medical bills of other people you injure in a car accident.

-

Property damage liability

: $15,000Property damage liability covers damage you cause to property like fences, toll booths and light posts.

California monitors the insurance status of registered vehicles electronically. Insurance companies report new policies and cancellations to the DMV. Your vehicle’s registration can be suspended if you cancel your policy without a new one in place.

If you have a car loan, your lender will require you to have full coverage car insurance. This usually means getting collision

Frequently asked questions

The average cost of car insurance in California is $182 a month for full coverage. Minimum coverage policies cost an average of $69 a month.

Geico has the cheapest car insurance for most California drivers with a clean driving record. Progressive has the cheapest rates for drivers with a recent at-fault accident or DUI.

Car insurance is required by California law. Insurance companies report new policies and cancellations to the DMV. Your vehicle’s registration can be suspended if the system detects a lapse in your car insurance.

How we selected the cheapest car insurance companies in California

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: minimum limits, where required by law

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in California

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.