Cheapest Car Insurance in Connecticut (2026)

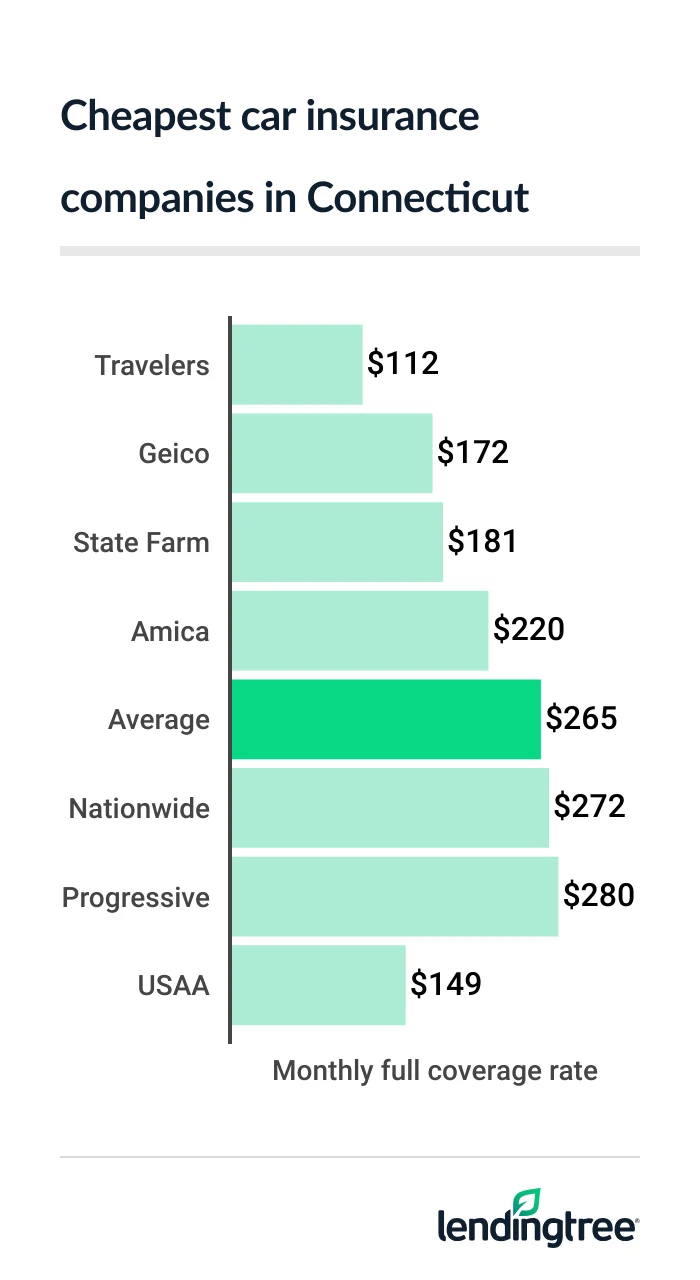

Travelers has the cheapest car insurance for most Connecticut drivers. Its rates average $112 a month for full coverage, which is less than half the state average of $265 per month.

Best cheap car insurance in Connecticut

Cheapest full coverage car insurance in Connecticut: Travelers

Travelers has the cheapest full coverage car insurance in Connecticut, with an average rate of $112 per month. That’s less than half the state average of $265 per month.

Geico has the state’s second-cheapest rate of $172 per month for full coverage

At $149 per month, USAA is cheaper than Geico and State Farm. But you can only get coverage from USAA if you or a family member are current or former military.

Full coverage car insurance rates in CT

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Travelers | $112 | |

| Geico | $172 | |

| State Farm | $181 | |

| Amica | $220 | |

| Nationwide | $272 | |

| Progressive | $280 | |

| Allstate | $283 | |

| Farmers | $342 | |

| Hanover | $642 | |

| USAA* | $149 | |

Geico offers more car insurance discounts than Travelers and State Farm. If you can get a few of them, Geico might be the cheapest company for you.

Some of Geico’s discounts are easy to get, too. These include its discounts for having a vehicle with air bags, anti-lock brakes, an anti-theft system or daytime running lights.

Connecticut’s cheapest liability car insurance: Travelers

With an average rate of $47 per month, Travelers also has the cheapest liability car insurance for Connecticut drivers. This is less than half the state average of $128 per month.

Consider Geico for liability insurance

Liability-only insurance rates in CT

| Company | Monthly rate |

|---|---|

| Travelers | $47 |

| Geico | $78 |

| State Farm | $89 |

| Amica | $109 |

| Nationwide | $120 |

| Allstate | $135 |

| Progressive | $157 |

| Farmers | $192 |

| Hanover | $294 |

| USAA* | $61 |

Best cheap car insurance for Connecticut teens: Geico

For the cheapest teen car insurance in Connecticut, get quotes from Geico and Amica.

Geico has the state’s cheapest liability car insurance for most teen drivers at $266 per month. Amica is close behind, with an average rate of $270 per month.

Monthly car insurance rates for teens

| Company | Liability only | Full coverage |

|---|---|---|

| Geico | $266 | $584 |

| Amica | $270 | $552 |

| State Farm | $287 | $553 |

| Allstate | $404 | $667 |

| Progressive | $463 | $923 |

| Nationwide | $487 | $1,019 |

| Travelers | $490 | $1,229 |

| Hanover | $698 | $1,319 |

| Farmers | $805 | $1,302 |

| USAA* | $152 | $358 |

For full coverage, Amica has the cheapest rates for most Connecticut teens at $552 per month. State Farm comes next at $553 per month, and then Geico at $584.

Though USAA’s average rates are cheaper for both types of coverage, only those with military ties qualify.

Teens pay the highest car insurance rates of any age group. This is mostly because they tend to get into more accidents than older drivers.

To save money on teen car insurance, make sure you compare car insurance quotes from several companies before you buy or renew a policy.

Looking for discounts can also help you find lower teen car insurance rates. Many companies offer discounts for students who get good grades or don’t take their cars to college with them.

Cheapest car insurance after a speeding ticket in Connecticut: Travelers

Travelers is the cheapest car insurance company for Connecticut drivers with a speeding ticket on their records. Its average rate is $151 per month, which is less than half the state average of $323 per month.

Car insurance rates with a speeding ticket

| Company | Monthly rate |

|---|---|

| Travelers | $151 |

| State Farm | $193 |

| Amica | $254 |

| Nationwide | $272 |

| Allstate | $283 |

| Geico | $309 |

| Progressive | $355 |

| Farmers | $437 |

| Hanover | $804 |

| USAA* | $171 |

The state’s second-cheapest rates for drivers with a ticket come from State Farm. Its average rate is $193 per month.

State Farm has a better J.D. Power customer satisfaction score than Travelers. It also has several discounts that could make your premium

A speeding ticket usually causes your car insurance to go up about 22% in Connecticut.

Best Connecticut car insurance rates after an accident: Travelers

At $125 per month, Travelers has Connecticut’s cheapest car insurance after an accident. State Farm is next, with an average rate of $181 per month.

The average cost of car insurance with an accident on your driving record is $445 per month in Connecticut.

Car insurance rates with an accident

| Company | Monthly rate |

|---|---|

| Travelers | $125 |

| State Farm | $181 |

| Geico | $309 |

| Amica | $331 |

| Progressive | $407 |

| Nationwide | $426 |

| Allstate | $669 |

| Farmers | $780 |

| Hanover | $1,009 |

| USAA* | $211 |

Not only does Travelers have cheaper rates than State Farm for drivers after an accident, but it offers them more coverage options as well. Two examples are accident forgiveness

A typical Connecticut driver sees their car insurance rate go up by 68% after an at-fault accident. Travelers only raises its rates by 12% after a crash, on average.

Cheap insurance for Connecticut teens with a bad driving record: Amica and State Farm

The cheapest car insurance in Connecticut for teens with a ticket or accident on their records comes from Amica and State Farm.

Amica has the state’s cheapest rates for most teens with a ticket at $288 per month. State Farm is cheapest for most teens after an accident at $287 per month.

Teen rates with a prior ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Amica | $288 | $326 |

| State Farm | $312 | $287 |

| Geico | $362 | $401 |

| Allstate | $404 | $1,116 |

| Nationwide | $487 | $533 |

| Progressive | $497 | $515 |

| Travelers | $563 | $536 |

| Hanover | $843 | $839 |

| Farmers | $1,131 | $1,911 |

| USAA* | $186 | $225 |

Although Amica’s rates for teens with an accident are 14% higher than State Farm’s, Amica also has more discounts. Depending on which ones you can get, it could be your cheapest option.

Amica offers car insurance discounts to young drivers who:

- Are away at school and without a car

- Complete an accredited driver training program

- Get good grades in high school or college

- Are under 30 and have parents who’ve been Amica customers for at least five years

Connecticut’s cheapest DUI car insurance: Travelers

For the cheapest DUI insurance in Connecticut, make sure you get a quote from Travelers. The company’s average rate for drivers with a driving under the influence (DUI) conviction is the state’s lowest at $193 per month.

Progressive is has the second-cheapest insurance rates for Connecticut drivers with a DUI. Its rates average $320 per month.

CT insurance rates after a DUI

| Company | Monthly rate |

|---|---|

| Travelers | $193 |

| Progressive | $320 |

| Allstate | $405 |

| State Farm | $406 |

| Nationwide | $581 |

| Geico | $704 |

| Amica | $762 |

| Farmers | $820 |

| USAA* | $308 |

You should expect your car insurance premium to nearly double after a DUI in Connecticut. With Travelers, the difference may not be as drastic. We found the company’s rates go up 72% after a DUI, on average.

Cheapest Connecticut car insurance rates for bad credit: Travelers

With an average rate of $221 per month, Travelers has Connecticut’s cheapest car insurance for bad credit. Geico comes in second for most of the state’s drivers, with rates of around $258 per month.

Connecticut insurance rates for bad credit

| Company | Monthly rate |

|---|---|

| Travelers | $221 |

| Geico | $258 |

| Nationwide | $380 |

| Progressive | $401 |

| Allstate | $475 |

| Amica | $687 |

| Farmers | $688 |

| State Farm | $717 |

| USAA* | $247 |

On average, drivers with bad credit in Connecticut pay $453 per month for full coverage car insurance. That’s 71% more than what drivers with good credit pay.

Best car insurance companies in Connecticut

Travelers, Geico and Amica are the best car insurance companies in Connecticut.

Connecticut car insurance company ratings

| Company | J.D. Power | AM Best | LendingTree |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Amica | 735 | A+ | |

| Farmers | 622 | A | |

| Geico | 645 | A++ | |

| Hanover | 607 | A | |

| Nationwide | 645 | A | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| Travelers | 613 | A++ | |

| USAA* | 735 | A++ |

Travelers has the cheapest rates for most of the state’s drivers. It also offers many discounts and coverage options.

Amica’s rates are often higher than Travelers’, but it also has more discounts. And its J.D. Power customer satisfaction score is tied for the best among the companies we surveyed.

Geico has even more discounts. In fact, it offers the most discounts of the state’s top car insurance companies. Customers don’t rate Geico as highly as they do Amica, though.

Connecticut car insurance rates by city

Drivers in Andover have the cheapest car insurance in Connecticut, on average. Rates there average $229 per month.

The state’s most expensive cities for car insurance are Bridgeport and New Haven, where rates average $367 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Abington | $255 | -4% |

| Amston | $234 | -12% |

| Andover | $229 | -14% |

| Ansonia | $291 | 10% |

| Ashford | $239 | -10% |

| Avon | $240 | -10% |

| Ballouville | $256 | -3% |

| Baltic | $247 | -7% |

| Bantam | $246 | -7% |

| Barkhamsted | $248 | -6% |

| Beacon Falls | $286 | 8% |

| Berlin | $251 | -5% |

| Bethany | $294 | 11% |

| Bethel | $262 | -1% |

| Bethlehem | $255 | -4% |

| Bethlehem Village | $255 | -4% |

| Bloomfield | $293 | 10% |

| Blue Hills | $293 | 10% |

| Bolton | $229 | -13% |

| Botsford | $296 | 12% |

| Bozrah | $240 | -10% |

| Branford | $267 | 1% |

| Branford Center | $267 | 1% |

| Bridgeport | $367 | 38% |

| Bridgewater | $255 | -4% |

| Bristol | $255 | -4% |

| Broad Brook | $244 | -8% |

| Brookfield | $260 | -2% |

| Brooklyn | $236 | -11% |

| Burlington | $244 | -8% |

| Byram | $270 | 2% |

| Canaan | $239 | -10% |

| Canterbury | $236 | -11% |

| Canton | $240 | -9% |

| Canton Center | $259 | -2% |

| Canton Valley | $240 | -9% |

| Centerbrook | $243 | -8% |

| Central Village | $230 | -13% |

| Chaplin | $234 | -12% |

| Cheshire | $268 | 1% |

| Cheshire Village | $268 | 1% |

| Chester | $243 | -8% |

| Chester Center | $243 | -8% |

| Clinton | $244 | -8% |

| Cobalt | $262 | -1% |

| Colchester | $238 | -10% |

| Colebrook | $242 | -9% |

| Collinsville | $240 | -9% |

| Columbia | $235 | -12% |

| Conning Towers Nautilus Park | $237 | -11% |

| Cornwall Bridge | $246 | -7% |

| Cos Cob | $270 | 2% |

| Coventry | $231 | -13% |

| Coventry Lake | $231 | -13% |

| Cromwell | $253 | -5% |

| Crystal Lake | $234 | -12% |

| Danbury | $268 | 1% |

| Danielson | $229 | -13% |

| Darien | $257 | -3% |

| Dayville | $229 | -13% |

| Deep River | $241 | -9% |

| Deep River Center | $241 | -9% |

| Derby | $291 | 10% |

| Durham | $255 | -4% |

| East Berlin | $274 | 3% |

| East Brooklyn | $236 | -11% |

| East Canaan | $239 | -10% |

| East Glastonbury | $303 | 14% |

| East Granby | $245 | -7% |

| East Haddam | $238 | -10% |

| East Hampton | $249 | -6% |

| East Hartford | $297 | 12% |

| East Hartland | $237 | -10% |

| East Haven | $323 | 22% |

| East Killingly | $251 | -5% |

| East Lyme | $238 | -10% |

| East Windsor | $244 | -8% |

| East Windsor Hill | $262 | -1% |

| East Woodstock | $251 | -5% |

| Eastford | $234 | -12% |

| Easton | $261 | -2% |

| Ellington | $234 | -12% |

| Enfield | $239 | -10% |

| Essex Village | $243 | -8% |

| Fabyan | $251 | -5% |

| Fairfield | $276 | 4% |

| Falls Village | $241 | -9% |

| Farmington | $246 | -7% |

| Gales Ferry | $242 | -9% |

| Gaylordsville | $267 | 1% |

| Georgetown | $292 | 10% |

| Gilman | $260 | -2% |

| Glastonbury | $249 | -6% |

| Glastonbury Center | $249 | -6% |

| Glenville | $270 | 2% |

| Goshen | $242 | -9% |

| Granby | $236 | -11% |

| Greens Farms | $289 | 9% |

| Greenwich | $270 | 2% |

| Grosvenor Dale | $249 | -6% |

| Groton | $237 | -11% |

| Groton Long Point | $237 | -11% |

| Guilford | $259 | -2% |

| Guilford Center | $259 | -2% |

| Haddam | $250 | -6% |

| Hadlyme | $261 | -1% |

| Hamden | $324 | 22% |

| Hampton | $234 | -12% |

| Hanover | $262 | -1% |

| Hartford | $365 | 38% |

| Harwinton | $244 | -8% |

| Hawleyville | $295 | 11% |

| Hazardville | $239 | -10% |

| Hebron | $234 | -12% |

| Heritage Village | $264 | 0% |

| Higganum | $250 | -6% |

| Ivoryton | $243 | -8% |

| Jewett City | $239 | -10% |

| Kensington | $251 | -5% |

| Kent | $248 | -6% |

| Killingworth | $244 | -8% |

| Lake Pocotopaug | $249 | -6% |

| Lakeside | $271 | 2% |

| Lakeville | $247 | -7% |

| Lebanon | $240 | -9% |

| Ledyard | $242 | -9% |

| Litchfield | $246 | -7% |

| Long Hill | $237 | -11% |

| Madison | $256 | -4% |

| Madison Center | $256 | -4% |

| Manchester | $259 | -2% |

| Mansfield Center | $234 | -12% |

| Mansfield Depot | $255 | -4% |

| Marion | $268 | 1% |

| Marlborough | $240 | -10% |

| Mashantucket | $258 | -3% |

| Meriden | $275 | 4% |

| Middle Haddam | $278 | 5% |

| Middlebury | $289 | 9% |

| Middlefield | $262 | -1% |

| Middletown | $266 | 0% |

| Milford | $295 | 11% |

| Milldale | $283 | 7% |

| Monroe | $276 | 4% |

| Montville | $246 | -7% |

| Moodus | $238 | -10% |

| Moosup | $230 | -13% |

| Morris | $254 | -4% |

| Mystic | $237 | -11% |

| Naugatuck | $285 | 8% |

| New Britain | $289 | 9% |

| New Canaan | $253 | -5% |

| New Fairfield | $264 | 0% |

| New Hartford | $244 | -8% |

| New Hartford Center | $244 | -8% |

| New Haven | $367 | 39% |

| New London | $249 | -6% |

| New Milford | $248 | -6% |

| New Preston | $250 | -6% |

| New Preston Marble Dale | $268 | 1% |

| Newington | $267 | 1% |

| Newtown | $263 | -1% |

| Niantic | $238 | -10% |

| Noank | $237 | -11% |

| Norfolk | $245 | -8% |

| North Branford | $272 | 3% |

| North Canton | $262 | -1% |

| North Franklin | $234 | -12% |

| North Granby | $236 | -11% |

| North Grosvenor Dale | $232 | -12% |

| North Haven | $305 | 15% |

| North Stonington | $233 | -12% |

| North Westchester | $262 | -1% |

| North Windham | $234 | -12% |

| Northfield | $246 | -7% |

| Northford | $272 | 3% |

| Northwest Harwinton | $244 | -8% |

| Norwalk | $269 | 2% |

| Norwich | $246 | -7% |

| Oakdale | $246 | -7% |

| Oakville | $275 | 4% |

| Old Greenwich | $270 | 2% |

| Old Lyme | $242 | -9% |

| Old Mystic | $237 | -11% |

| Old Saybrook | $241 | -9% |

| Old Saybrook Center | $241 | -9% |

| Oneco | $256 | -3% |

| Orange | $291 | 10% |

| Oxford | $279 | 5% |

| Oxoboxo River | $246 | -7% |

| Pawcatuck | $237 | -11% |

| Pemberwick | $270 | 2% |

| Pequabuck | $273 | 3% |

| Pine Meadow | $267 | 1% |

| Plainfield | $230 | -13% |

| Plainfield Village | $230 | -13% |

| Plainville | $252 | -5% |

| Plantsville | $247 | -7% |

| Plymouth | $257 | -3% |

| Pomfret Center | $239 | -10% |

| Poquonock | $268 | 1% |

| Poquonock Bridge | $237 | -11% |

| Portland | $245 | -8% |

| Preston | $268 | 1% |

| Prospect | $294 | 11% |

| Putnam | $232 | -12% |

| Quaker Hill | $234 | -12% |

| Quinebaug | $243 | -8% |

| Redding | $256 | -3% |

| Redding Center | $279 | 5% |

| Redding Ridge | $279 | 5% |

| Ridgefield | $260 | -2% |

| Riverside | $270 | 2% |

| Riverton | $259 | -2% |

| Rockfall | $280 | 6% |

| Rockville | $240 | -10% |

| Rocky Hill | $256 | -3% |

| Rogers | $253 | -5% |

| Roxbury | $258 | -3% |

| Salem | $238 | -10% |

| Salisbury | $247 | -7% |

| Salmon Brook | $236 | -11% |

| Sandy Hook | $263 | -1% |

| Saybrook Manor | $241 | -9% |

| Scotland | $230 | -13% |

| Seymour | $286 | 8% |

| Sharon | $246 | -7% |

| Shelton | $277 | 4% |

| Sherman | $262 | -1% |

| Sherwood Manor | $239 | -10% |

| Simsbury | $242 | -9% |

| Simsbury Center | $242 | -9% |

| Somers | $236 | -11% |

| Somersville | $257 | -3% |

| South Britain | $308 | 16% |

| South Coventry | $231 | -13% |

| South Glastonbury | $249 | -6% |

| South Kent | $248 | -6% |

| South Lyme | $263 | -1% |

| South Willington | $252 | -5% |

| South Windham | $243 | -8% |

| South Windsor | $240 | -10% |

| South Woodstock | $237 | -11% |

| Southbury | $264 | 0% |

| Southington | $247 | -7% |

| Southport | $276 | 4% |

| Southwood Acres | $239 | -10% |

| Stafford Springs | $233 | -12% |

| Staffordville | $257 | -3% |

| Stamford | $287 | 8% |

| Sterling | $237 | -11% |

| Stevenson | $287 | 8% |

| Stonington | $237 | -11% |

| Storrs | $234 | -12% |

| Storrs Mansfield | $234 | -12% |

| Stratford | $296 | 12% |

| Suffield | $238 | -10% |

| Taconic | $266 | 0% |

| Taftville | $246 | -7% |

| Tariffville | $242 | -9% |

| Terramuggus | $240 | -10% |

| Terryville | $257 | -3% |

| Thomaston | $253 | -5% |

| Thompson | $232 | -12% |

| Thompsonville | $239 | -10% |

| Tolland | $233 | -12% |

| Torrington | $241 | -9% |

| Trumbull | $275 | 4% |

| Uncasville | $246 | -7% |

| Unionville | $246 | -7% |

| Vernon Rockville | $240 | -10% |

| Versailles | $264 | -1% |

| Voluntown | $242 | -9% |

| Wallingford | $264 | -1% |

| Wallingford Center | $264 | -1% |

| Washington | $250 | -6% |

| Washington Depot | $250 | -6% |

| Waterbury | $333 | 26% |

| Waterford | $234 | -12% |

| Watertown | $275 | 4% |

| Wauregan | $230 | -13% |

| Weatogue | $242 | -9% |

| West Cornwall | $247 | -7% |

| West Granby | $236 | -11% |

| West Hartford | $270 | 2% |

| West Hartland | $256 | -4% |

| West Haven | $331 | 25% |

| West Mystic | $254 | -4% |

| West Simsbury | $242 | -9% |

| West Suffield | $238 | -10% |

| Westbrook | $240 | -9% |

| Westbrook Center | $240 | -9% |

| Weston | $262 | -1% |

| Westport | $266 | 0% |

| Wethersfield | $270 | 2% |

| Willimantic | $234 | -12% |

| Willington | $234 | -12% |

| Wilton | $261 | -1% |

| Wilton Center | $261 | -1% |

| Winchester Center | $269 | 1% |

| Windham | $234 | -12% |

| Windsor | $276 | 4% |

| Windsor Locks | $245 | -8% |

| Winsted | $244 | -8% |

| Wolcott | $292 | 10% |

| Woodbridge | $297 | 12% |

| Woodbury | $252 | -5% |

| Woodbury Center | $252 | -5% |

| Woodmont | $295 | 11% |

| Woodstock | $237 | -11% |

| Woodstock Valley | $256 | -3% |

| Yantic | $254 | -4% |

Drivers in the rest of Connecticut’s biggest cities pay average rates that are between those extremes.

- Stamford, $287

- Hartford, $365

- Waterbury, $333

Minimum coverage for car insurance in Connecticut

Connecticut requires all drivers to have at least these amounts of liability car insurance coverage:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $25,000 per person

- Uninsured motorist: $25,000 per person, $50,000 per accident

Bodily injury liability helps cover the medical bills of anyone you injure in a car accident. Property damage liability covers damage you cause to property like fences, toll booths and light posts.

Uninsured motorist covers you and your passengers for injuries caused by a driver with no insurance. Even though insurance is required by law, about 10% of Connecticut’s drivers don’t have it, according to the Insurance Research Council.

Frequently asked questions

The average cost of car insurance in Connecticut is $265 per month if you buy full coverage. For liability-only coverage, the state average cost is $128 per month.

The cheapest car insurance in Connecticut comes from Travelers, which charges about $47 per month for liability-only coverage.

Travelers also has the state’s cheapest full coverage insurance, with rates of around $112 per month.

No. Connecticut repealed its no-fault law in 1993. If you cause an accident, you’re financially responsible for injuries to other people and damage to their property. Your liability insurance covers these expenses, up to the limits you choose for your policy.

How we selected the cheapest car insurance companies in Connecticut

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Connecticut

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.