Cheap Car Insurance in San Francisco

San Francisco’s cheapest car insurance

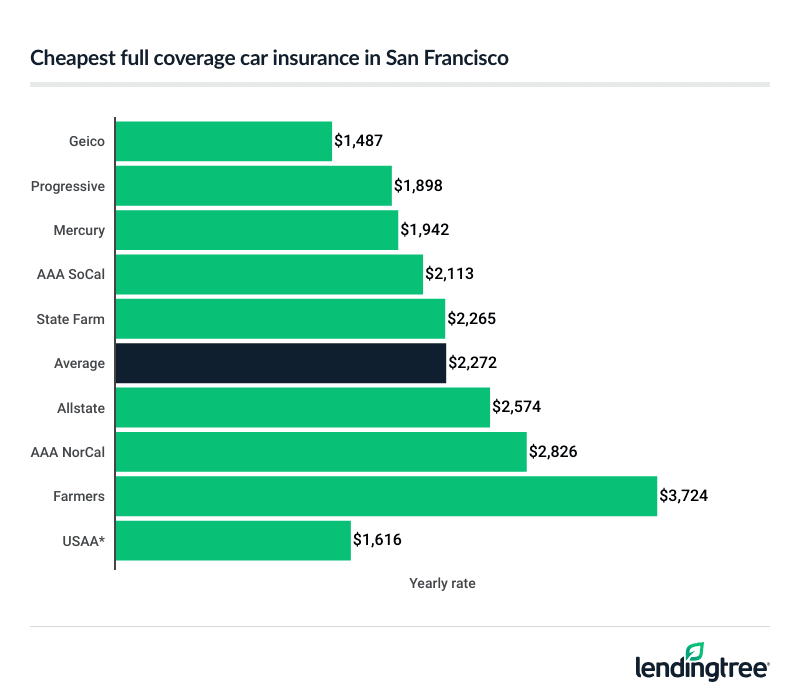

Cheapest full coverage car insurance in San Francisco: Geico

Geico offers the cheapest full coverage car insurance in San Francisco. On average, it costs $1,487 a year, or about $124 a month. Progressive is the next-cheapest company at $1,898 a year. Both companies cost less than the city’s average rate of $2,272 a year for full coverage

The cheapest company for you often depends on the discounts you can get. Geico gives a 23% discount if your car has airbags and another 23% if it has an anti-theft system. With both, you save even more. State Farm gives a 20% multi-policy discount when you insure two or more cars with it.

Full coverage car insurance rates

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| Geico | $1,487 | |

| Progressive | $1,898 | |

| Mercury | $1,942 | |

| AAA SoCal | $2,113 | |

| State Farm | $2,265 | |

| Allstate | $2,574 | |

| AAA NorCal | $2,826 | |

| Farmers | $3,724 | |

| USAA* | $1,616 |

San Francisco’s cheapest liability auto insurance: Geico

Geico has the cheapest liability car insurance in San Francisco, with rates of around $480 a year, or $40 a month. Progressive is the next-cheapest, at $679 a year.

For comparison, the average price for liability coverage

Neither company offers many extra coverage options, but they both offer roadside assistance

Liability car insurance rates

| Company | Annual rate |

|---|---|

| Geico | $480 |

| Progressive | $679 |

| State Farm | $712 |

| AAA NorCal | $712 |

| Mercury | $718 |

| AAA SoCal | $741 |

| Allstate | $996 |

| Farmers | $1,115 |

| USAA* | $619 |

Cheap auto insurance for San Francisco teens: State Farm

Young drivers in San Francisco get the cheapest liability car insurance with State Farm, at an average cost of $1,369 a year. For full coverage, Geico is the cheapest option at $3,846 a year.

Both companies give discounts for good students. If you keep a 3.0 GPA or higher, State Farm cuts your rate by up to 25%. Geico offers a 15% discount.

Teens pay the highest car insurance rates because they are more likely to get into accidents than other drivers. Your rates usually drop as you get older, especially if you keep a clean driving record.

Car insurance for teen drivers

| Company | Liability coverage | Full coverage |

|---|---|---|

| State Farm | $1,369 | $3,899 |

| Geico | $1,486 | $3,846 |

| Mercury | $1,850 | $4,657 |

| Progressive | $2,055 | $5,713 |

| AAA SoCal | $2,118 | $5,125 |

| AAA NorCal | $2,316 | $8,803 |

| Farmers | $2,561 | $8,268 |

| Allstate | $2,734 | $5,802 |

| USAA* | $1,497 | $3,466 |

San Francisco’s cheapest auto insurance after a speeding ticket: Geico

San Francisco drivers with a speeding ticket on their records get the cheapest car insurance from Geico, at about $2,325 a year, or $194 a month. Mercury is next at $2,760 a year, and Progressive comes in third at $2,920 a year.

Geico offers more car insurance discounts than Mercury and Progressive. If you can get a few discounts from Mercury or Progressive, though, one of them could be the cheapest company for you. This is why it’s so important to compare car insurance quotes from several different companies before you buy or renew.

Car insurance rates after a ticket

| Company | Annual rate |

|---|---|

| Geico | $2,325 |

| Mercury | $2,760 |

| Progressive | $2,920 |

| AAA SoCal | $3,314 |

| State Farm | $3,447 |

| AAA NorCal | $3,576 |

| Allstate | $3,712 |

| Farmers | $5,266 |

| USAA* | $1,969 |

Cheapest car insurance after an accident in San Francisco: Mercury

Mercury has the cheapest car insurance after an accident for San Francisco drivers. Its average rate is $3,061 a year, or $255 a month. Progressive is close behind at $3,126 a year.

Progressive has more discounts than Mercury. With only a $65 difference in yearly cost, Progressive could end up being the cheaper option for you if you can get a few.

Car insurance rates after an accident

| Company | Annual rate |

|---|---|

| Mercury | $3,061 |

| Progressive | $3,126 |

| AAA SoCal | $3,614 |

| Geico | $3,772 |

| State Farm | $4,444 |

| AAA NorCal | $5,741 |

| Farmers | $6,582 |

| Allstate | $6,997 |

| USAA* | $3,087 |

Cheap car insurance for San Francisco teens with bad driving records: Geico

Geico offers the cheapest car insurance for teens with bad driving records. Its average rate is $1,669 a year after a ticket and $2,047 a year after an accident. State Farm is the next-cheapest company at $2,173 a year after a ticket and $2,281 after an accident.

Cheapest rates for teens with bad driving records

| Company | Ticket | Accident |

|---|---|---|

| Geico | $1,669 | $2,047 |

| State Farm | $2,173 | $2,281 |

| Mercury | $2,449 | $2,314 |

| Progressive | $2,671 | $2,978 |

| Farmers | $3,228 | $3,228 |

| Allstate | $3,257 | $4,349 |

| AAA SoCal | $3,302 | $3,091 |

| AAA NorCal | $3,520 | $4,329 |

| USAA* | $1,844 | $1,980 |

Cheapest San Francisco auto insurance with a DUI: Mercury

Mercury has the cheapest car insurance rates after a DUI for San Francisco drivers, at about $3,452 a year, or $288 a month. Geico is the second-cheapest option, at $3,737 a year.

Because Geico offers more discounts, it could still end up being the cheaper choice for you.

After teens, drivers with DUIs are the riskiest group for car insurance companies. How long a DUI stays on your record depends on your state. In San Francisco, it stays on your record for 10 years.

Cheapest car insurance with a DUI

| Company | Annual rate |

|---|---|

| Mercury | $3,452 |

| Geico | $3,737 |

| Progressive | $4,554 |

| Farmers | $6,582 |

| AAA SoCal | $6,645 |

| Allstate | $10,135 |

| AAA NorCal | $10,188 |

| USAA* | $5,004 |

Best car insurance companies in San Francisco

Geico is the best car insurance company in San Francisco. It offers the cheapest average rates for both liability and full coverage car insurance.

State Farm scores better than Geico for customer satisfaction, but it also usually costs more.

San Francisco’s best-rated car insurance companies

| Company | J.D. Power** | AM Best | LendingTree score |

|---|---|---|---|

| AAA NorCal | 658 | Not rated | |

| AAA SoCal | 658 | Not rated | |

| Allstate | 635 | A+ | |

| Farmers | 619 | A | |

| Geico | 637 | A++ | |

| Mercury | 596 | A | |

| Progressive | 622 | A+ | |

| State Farm | 657 | A++ | |

| USAA* | 739 | A++ |

Car insurance rates in San Francisco by neighborhood

San Francisco’s 94128 ZIP code has the cheapest car insurance rates in the city at about $2,053 a year, or $171 a month. This is 10% lower than the city average of $2,272.

The 94124 ZIP code has the highest average rate of $2,675 a year, which is 18% more than the city average.

Car insurance rates by ZIP code

| ZIP | Annual rate | % from average |

|---|---|---|

| 94102 | $2,502 | 10% |

| 94103 | $2,316 | 2% |

| 94104 | $2,450 | 8% |

| 94105 | $2,293 | 1% |

| 94107 | $2,132 | -6% |

| 94108 | $2,370 | 4% |

| 94109 | $2,234 | -2% |

| 94110 | $2,242 | -1% |

| 94111 | $2,205 | -3% |

| 94112 | $2,374 | 5% |

| 94114 | $2,090 | -8% |

| 94115 | $2,286 | 1% |

| 94116 | $2,224 | -2% |

| 94117 | $2,103 | -7% |

| 94118 | $2,187 | -4% |

| 94121 | $2,277 | 0% |

| 94122 | $2,175 | -4% |

| 94123 | $2,086 | -8% |

| 94124 | $2,675 | 18% |

| 94127 | $2,136 | -6% |

| 94128 | $2,053 | -10% |

| 94129 | $2,159 | -5% |

| 94130 | $2,575 | 13% |

| 94131 | $2,065 | -9% |

| 94132 | $2,382 | 5% |

| 94133 | $2,255 | -1% |

| 94134 | $2,531 | 11% |

| 94141 | $2,441 | 7% |

| 94143 | $2,413 | 6% |

| 94158 | $2,093 | -8% |

| 94188 | $2,097 | -8% |

Car insurance companies look at more than your ZIP code when setting your rate. Other factors include:

- The make and model of your car

- Your driving and claims history

- Your coverage limits and deductible

San Francisco’s minimum car insurance requirements

Drivers in San Francisco are required by law to have a minimum of 30/60/15 liability car insurance. This means:

-

$30,000 of bodily injury liability

coverage for one personBodily injury liability helps cover the medical bills of anyone you injure in a car accident.

- $60,000 of bodily injury liability coverage for two or more people

-

$15,000 of property damage liability

coverageProperty damage liability covers damage you cause to property like fences, toll booths and light posts.

Methodology

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2015 Honda Civic EX.

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $25,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: minimum limits, where required by law

- Collision: $500 deductible

- Comprehensive: $500 deductible

—

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighed these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military, as well as certain family members.