Over a Quarter of Drinkers Admit Alcohol Has Negatively Affected Their Finances, With 37% Planning to Cut Back This Year

Many Americans are cutting back on booze in 2024. According to the latest LendingTree survey of 2,000 U.S. consumers, 37% of American drinkers plan to reduce or eliminate their alcohol intake this year.

Here’s what else we found.

- Many drinkers hope to reduce their alcohol intake in 2024, with Gen Zers the most eager to do so. Among the 58% of Americans who drink alcohol, 37% say they plan to cut back or quit drinking in 2024. This figure is even higher for Gen Zers: Of the 47% who say they drink alcohol, over half (53%) plan to cut back or quit this year. Across all drinkers who want to dial back, they’re most likely to do it for their physical health (64%), finances (41%) and mental health (37%).

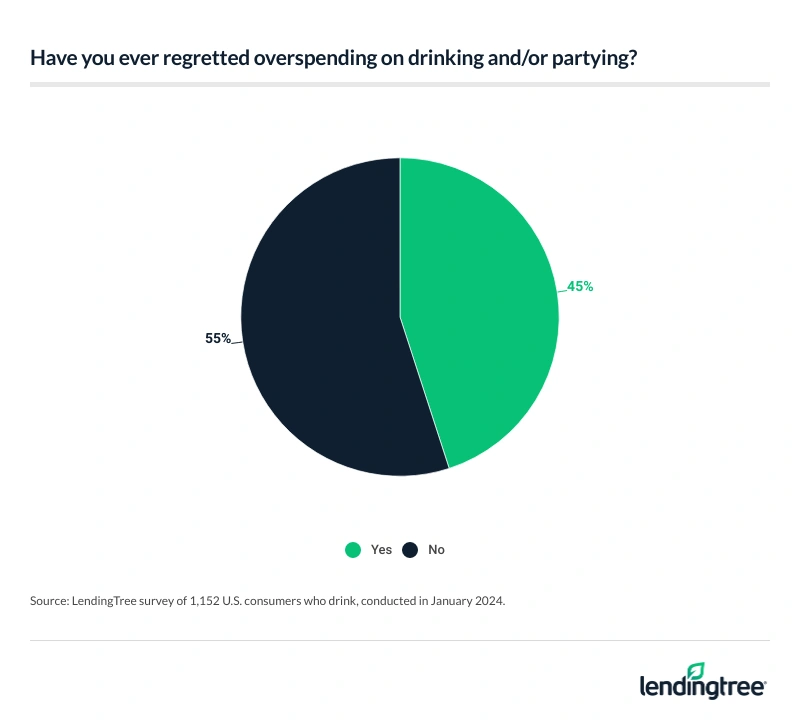

- Some blame alcohol for their overspending. 45% of drinkers say they’ve regretted overspending on alcohol and/or partying, and 17% acknowledge that buying booze has led to debt. Once again, these figures are highest among Gen Zers, with 55% regretting overspending and 29% having gone into debt. Overall, 27% of drinkers and 45% of Gen Z drinkers admit alcohol has negatively affected their finances.

- Booze gets its own budget line for some. About a quarter (26%) of drinkers say they have a specific amount budgeted monthly toward alcohol. Regardless of whether they have a budget, drinkers spend an average of $82 a month on booze. Across generations, millennials are spending the most on alcohol, at an average of $110 monthly. When asked their top reasons for drinking, 66% of drinkers said relaxation, 51% cited socialization and 43% said the taste.

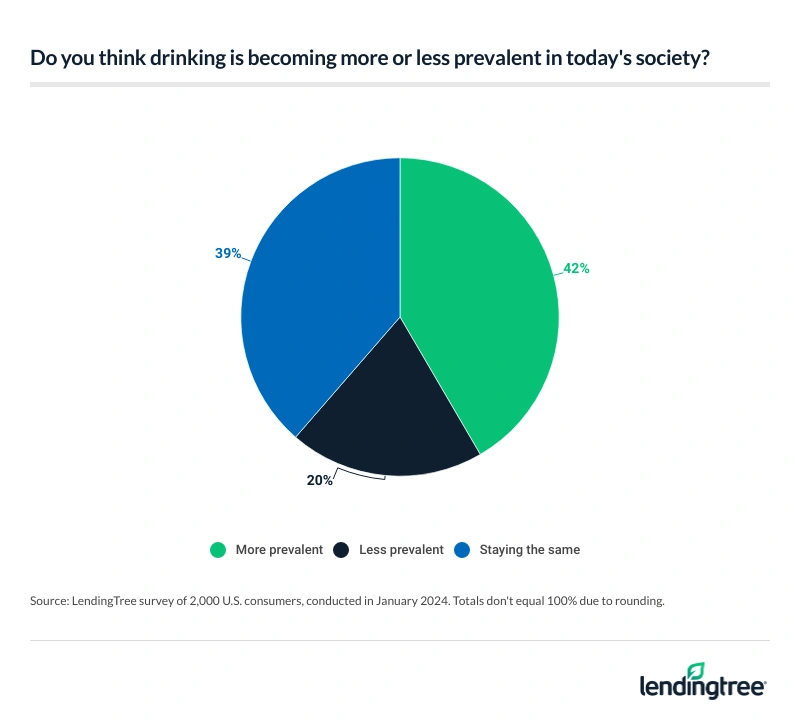

- Despite drinkers reducing their consumption, Americans believe drinking is becoming more prevalent in society. Across all Americans, 42% think drinking is becoming more prevalent. However, 36% of drinkers say their alcohol consumption has slowed down in the past year, while just 18% say they drank more in the past year than before. Among those who don’t drink, 35% say it’s due to lack of interest, 20% say they abstain for their physical health, and 8% each cite religious and addiction reasons.

Some drinkers plan to cut back on alcohol in 2024

Overall, 58% of Americans drink alcohol. Six-figure earners (71%), those earning $75,000 to $99,999 (68%) and parents with young children (66%) are the most likely to drink. By generation, millennials ages 28 to 43 (65%) are the most likely to say similarly. That’s followed by:

- Gen Xers ages 44 to 59 (58%)

- Baby boomers ages 60 to 78 (53%)

- Gen Zers ages 18 to 27 (47%)

Additionally, men (61%) are more likely to drink than women (54%). Meanwhile, 16% of Americans used to drink but stopped.

Some drinkers are ready to dial back. Across all drinkers, 37% say they plan to cut back or quit drinking in 2024. That’s particularly true for Gen Zers (53%), millennials (47%) and parents with young children (45%).

When asked why they want to cut back, 64% cited their physical health, making it the top reason. That’s followed by finances (41%) and mental health (37%). Other common reasons include:

- Lack of interest (23%)

- Family reasons (21%)

- Religious reasons (10%)

- Legal reasons (5%)

According to LendingTree chief consumer finance analyst Matt Schulz, it’s understandable that finances are the second most common reason for reducing alcohol consumption.

“The economy plays at least a small role in this,” he says. “Alcohol tends to be pretty expensive. When inflation rises and interest rates spike, there may not be as much room in the budget for booze. It’s not just about the price tag with alcohol, though. Being unhealthy can be expensive, too, and cutting back or quitting alcohol can be a significant step toward improved health.”

As far as substitutions, 36% of drinkers have tried nonalcoholic or low-alcohol alternatives. Six-figure earners (46%) and Gen Zers (44%) are the most likely to have given alternatives a shot.

Alcohol leads to ‘pour’ financial decisions for some

Many drinkers may have high spirits but low balances. Across all drinkers, 45% say they’ve regretted overspending on alcohol and/or partying. Meanwhile, 17% say they’ve gone into debt from buying alcohol and/or partying.

Gen Zers struggle the most with alcohol spending: Among this age group, 55% have regretted overspending and 29% have gone into debt. Millennials aren’t far behind, though, with 53% regretting overspending and 26% having gone into debt. While parents with children younger than 18 are only slightly less likely to have gone into debt from alcohol (25%), 55% admit to regretting overspending.

Overall, 27% of drinkers say alcohol has negatively affected their finances. That’s particularly true for Gen Zers (45%), parents with children younger than 18 (37%) and millennials (36%).

According to Schulz, it can be dangerously easy to overspend while drinking.

“People often make bad decisions when they’ve had too much to drink, and that can be the case when it comes to money,” he says. “But it can help to lean on friends when it comes to spending. Everyone knows a designated driver is a great way to stay safe on the roads, but a similar concept can apply to your finances. If you’re concerned about overspending, hand over your credit cards and debit cards to your trusted friend when handing over your keys.”

Family and friends may have the opposite effect for some, though, as 41% of drinkers admit these groups influence their habits. That’s particularly true for Gen Zers (67%) and six-figure earners (53%).

26% have a budget for their booze

Some drinkers are serious about their liquid assets — or, at least, about how much of their assets they’re putting toward liquid. Just over a quarter (26%) of drinkers set aside a certain amount of money toward alcohol monthly.

Gen Zers (40%), those with children younger than 18 (35%) and millennials (33%) are particularly likely to set a budget. Meanwhile, men (31%) are much more likely to have a booze budget than women (22%).

Regardless of whether they have a budget, drinkers spend an average of $82 a month on booze, with those with children younger than 18 ($119), six-figure earners ($119) and millennials ($110) spending the most. Men ($100) also spend significantly more monthly than women ($62).

Schulz says alcohol spending can add up, but that’s not necessarily a bad budget item.

“That $82-a-month number may not seem like much, but that’s about $1,000 a year on alcohol,” he says. “If alcohol is one of your passions, you absolutely should make it a budget item. Doing so can make you aware of your spending on a regular basis. That way, if you have a month in which you spend more than usual, you can move money around within your budget and keep your budget on track. However, if you track your alcohol spending regularly and see it steadily rising, it might be a sign of a growing problem and a need to get help.”

When asked their top reasons for drinking, 66% of drinkers said relaxation — the most common response. Meanwhile, 51% like the socialization and 43% enjoy the taste. That’s followed by:

- Celebration (42%)

- Stress relief (40%)

- Entertainment (24%)

- To get drunk (16%)

- To self-medicate (9%)

- Peer pressure (3%)

As far as what drinkers are consuming, 37% like beer and/or hard seltzers, 35% prefer liquor and 28% like wine. Notably, Gen Zers are most likely to prefer liquor (44%), while every other generation is more likely to prefer beer and/or seltzer.

Americans believe drinking is more prevalent in society

Despite many drinkers cutting back, 42% of all Americans think drinking is becoming more prevalent in society. Gen Zers (50%), six-figure earners (48%) and parents with children younger than 18 (48%) are most likely to hold this belief.

Meanwhile, 20% think it’s becoming less prevalent.

Despite that, 36% of drinkers say their alcohol consumption has slowed down in the past year, with those earning $75,000 to $99,999 (41%) and Gen Zers (39%) the most likely to have slowed down. Just 18% say they drank more in the past year than before.

As far as how often they’re drinking, 44% of drinkers say they consume alcohol weekly — the most common response. Following that:

- 21% only drink on special occasions

- 18% drink monthly

- 17% drink daily

Men (22%) are more likely to report daily drinking than women (13%). Meanwhile, just over 1 in 5 (21%) baby boomers drink daily — the most likely age group to do so.

Among those who don’t drink, 35% say it’s due to a lack of interest. Meanwhile, 20% abstain for their physical health and 8% each don’t drink for religious or addiction reasons.

Raise the bar, lower the expenses: Top expert tips to cut alcohol spending

Waking up with a financial hangover can be rough, but budgeting for booze can help prevent those rough mornings. For those looking to cut their alcohol spending, Schulz recommends the following:

- Look for other social outlets. “It can be easy to default to meeting someone at the bar for drinks, but there are plenty of other fun ways to be social,” he says. “For example, healthy activities such as hiking, basketball or jogging can provide an inexpensive rush and another great social outlet, while keeping costs to a minimum.”

- Plan to save. “Happy hours can be a lot of fun and can also bring major savings,” Schulz says. “If you’re going to meet a friend for drinks, consider planning it for a day or a time when drinks are cheaper and food deals might be available. The savings can be significant, especially if it’s something you do regularly. Or throw a BYOB get-together at a trusted friend or relative’s house. The drinks will be cheaper, and if anyone consumes too much, they’ll have a safe place to stay without getting on the road.”

- Consider a rewards credit card. The right credit card can help extend your alcohol budget. If you make your drinks at home, consider opening a credit card with grocery rewards. If you prefer drinks out, look for those with restaurant rewards.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 78 from Jan. 2 to 8, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78