More Than Half of Americans Cutting Back Travel Due to Economy

Economic uncertainty can influence where, when and how often Americans travel.

A LendingTree survey of 2,000 consumers found that nearly 3 in 4 Americans worry the economy might impact their summer getaways (and beyond). And more than 1 in 2 are cutting back on the number of trips they plan to take as a result.

From potential tariffs to global political issues, find out what’s driving some to reroute their travel plans. We also offer strategies on how to cancel or postpone trips without losing deposits or ruining your year.

- Travelers are cutting back, with the economy to blame. Nearly three-quarters (71%) of Americans are concerned economic conditions will affect their ability to travel. A majority (57%) cite recent travel cost increases, and more than half (53%) are cutting back on the number of trips they plan to take.

- Summer will heat up soon, but traveling might cool down. Economic uncertainty has led 35% of Americans to cancel or postpone a trip in the past year, while 23% are changing where they travel.

- Tariffs are top of mind for some travelers. 4 in 10 Americans say tariffs have affected their potential travel plans, significantly impacting Gen Zers (52%). Additionally, 67% are now more likely to choose domestic destinations over international ones.

- Global politics have many travelers worried. More than half (53%) of Americans are concerned about flying internationally due to political hostility. 62% worry about the treatment they might receive abroad as Americans. As such, 27% have felt uncomfortable stating their nationality abroad, while 30% of Gen Zers have even pretended to be from a different country while traveling internationally.

Travelers cutting back, with economy to blame

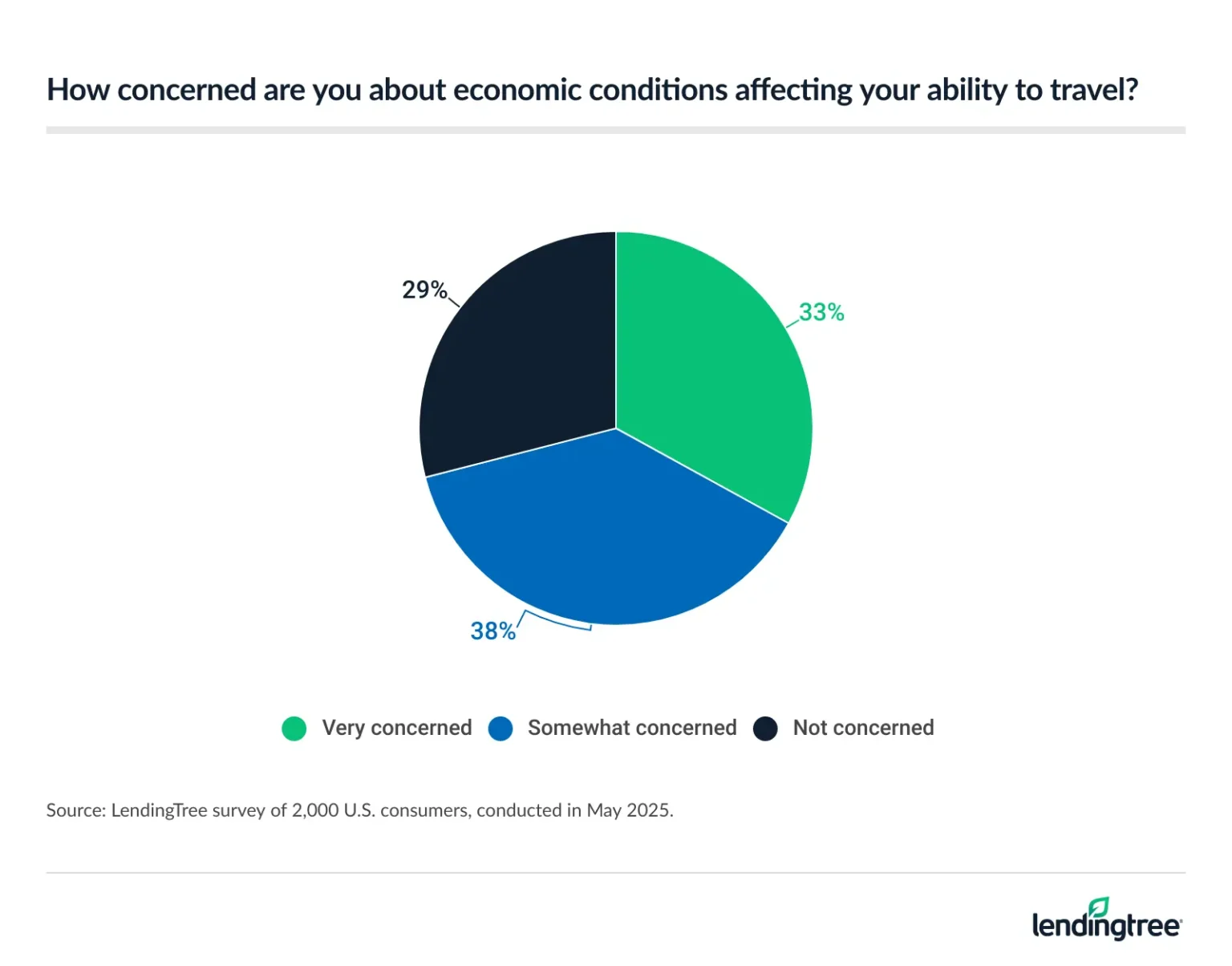

More than 7 in 10 (71%) Americans are concerned about travel plans with the economy in flux. This is in line with other reports, including a May 2025 University of Michigan survey that reported a 24.5% year-over-year decline in consumer sentiment.

Younger generations are especially concerned about economic conditions impacting their travel ability, with Gen Zers ages 18 to 28 (83%) and millennials ages 29 to 44 (75%) more likely to say so than Gen Xers ages 45 to 60 (67%) and baby boomers ages 61 to 79 (63%).

And more than 8 in 10 (82%) with kids younger than 18 — for whom travel may be more expensive — are wary of the economy as it relates to future trips.

A majority of consumers (57%) say they’ve noticed a recent increase in the cost of traveling, but some of that could be driven by assumptions. According to the U.S. Travel Association, airline fares were 7.9% lower in April 2025 than in April 2024, lodging was 2.4% cheaper and gas was 11.7% cheaper.

“Prices are still high for so many things, and many Americans are concerned the implementation of tariffs will only make things worse,” says Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.” “Those concerns are spurring many people to proceed with caution, delaying bigger expenses such as vacations until things seem more steady.”

In fact, 53% of Americans are cutting back on the number of trips they plan to take. The percentage is higher among people with children younger than 18 (63%) and Gen Zers (57%). Surprisingly, higher-income earners are just as, if not more, likely to cut back on their trips than those making less:

- Less than $30,000: 47%

- $30,000 to $49,999: 56%

- $50,000 to $99,999: 55%

- $100,000 or more: 55%

Summer will heat up soon, but traveling might cool down

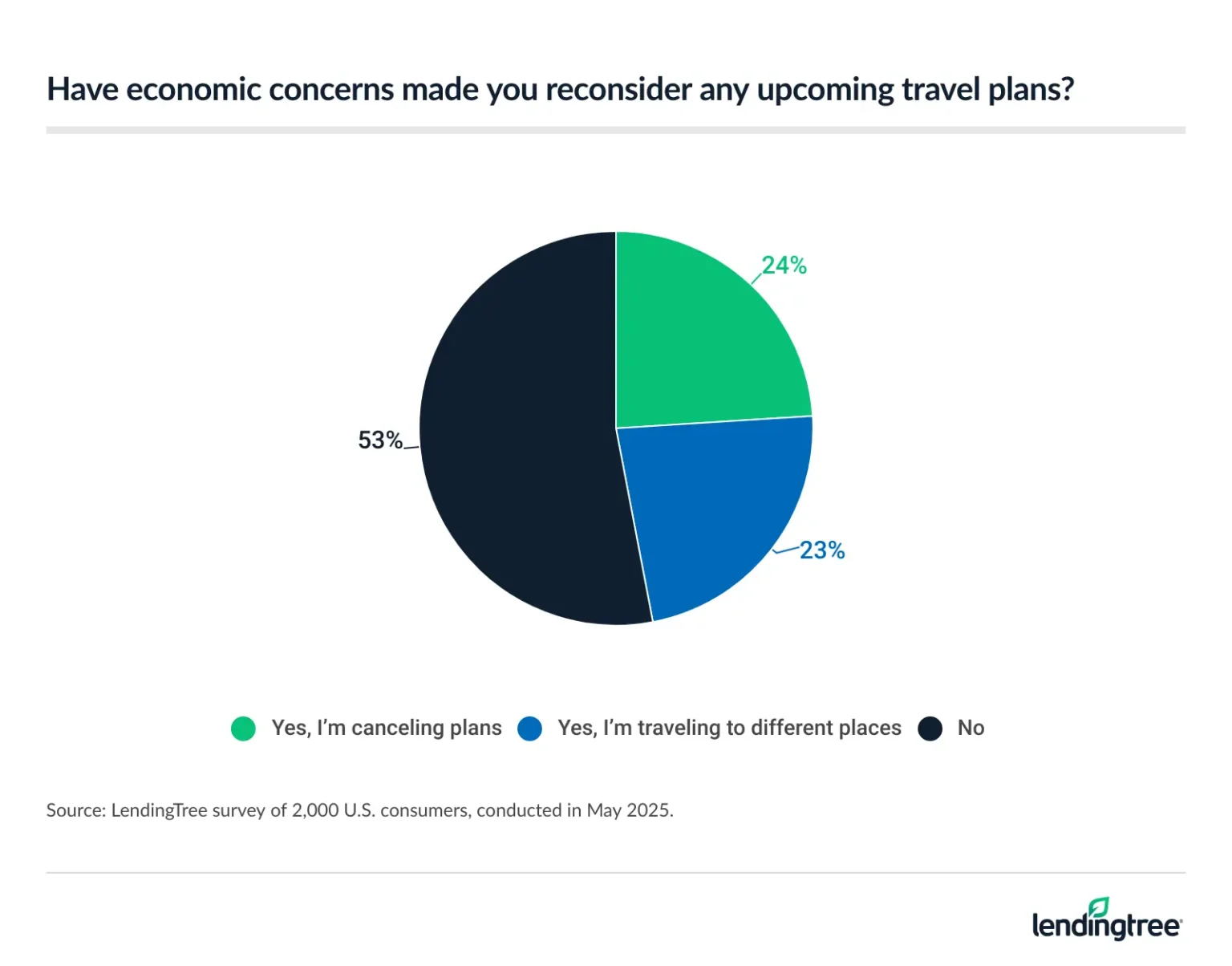

People aren’t just thinking about economic conditions — many are taking action. For instance, 35% of Americans have canceled or postponed a trip in the past year, with even higher percentages among parents with kids younger than 18 (47%) and Gen Zers (46%).

Not everyone is canceling, though — 23% are changing their travel destinations, including 31% of the highest earners (those with incomes of $100,000 or more).

“Dialing back your vacation plans can free up money to go toward other financial goals, such as building an emergency fund or paying off high-interest debt,” Schulz says. “It may not be fun, but those are two moves that provide greater peace of mind during economic uncertainty.”

In addition, scaling back vacation spending now can allow travelers to save up for an even bigger and better vacation in the future, and pay for it primarily with cash instead of taking on debt, he adds.

Tariffs top of mind for some travelers

One of the key factors contributing to some of the uncertainty has been the on-again, off-again nature of the tariff policies. Four in 10 Americans blame tariffs for affecting their travel plans, with an even greater percentage of Gen Zers (52%) expressing the same sentiment.

But perhaps some of that tariff-related anxiety is unwarranted, Schulz says. “For the most part, I think the fear of the possible impact of tariffs is weighing far more heavily on people than the actual current impact of tariffs. People are scared tariffs are going to send prices higher on most everything, including travel, so they’re being more cautious and waiting to see how things play out.”

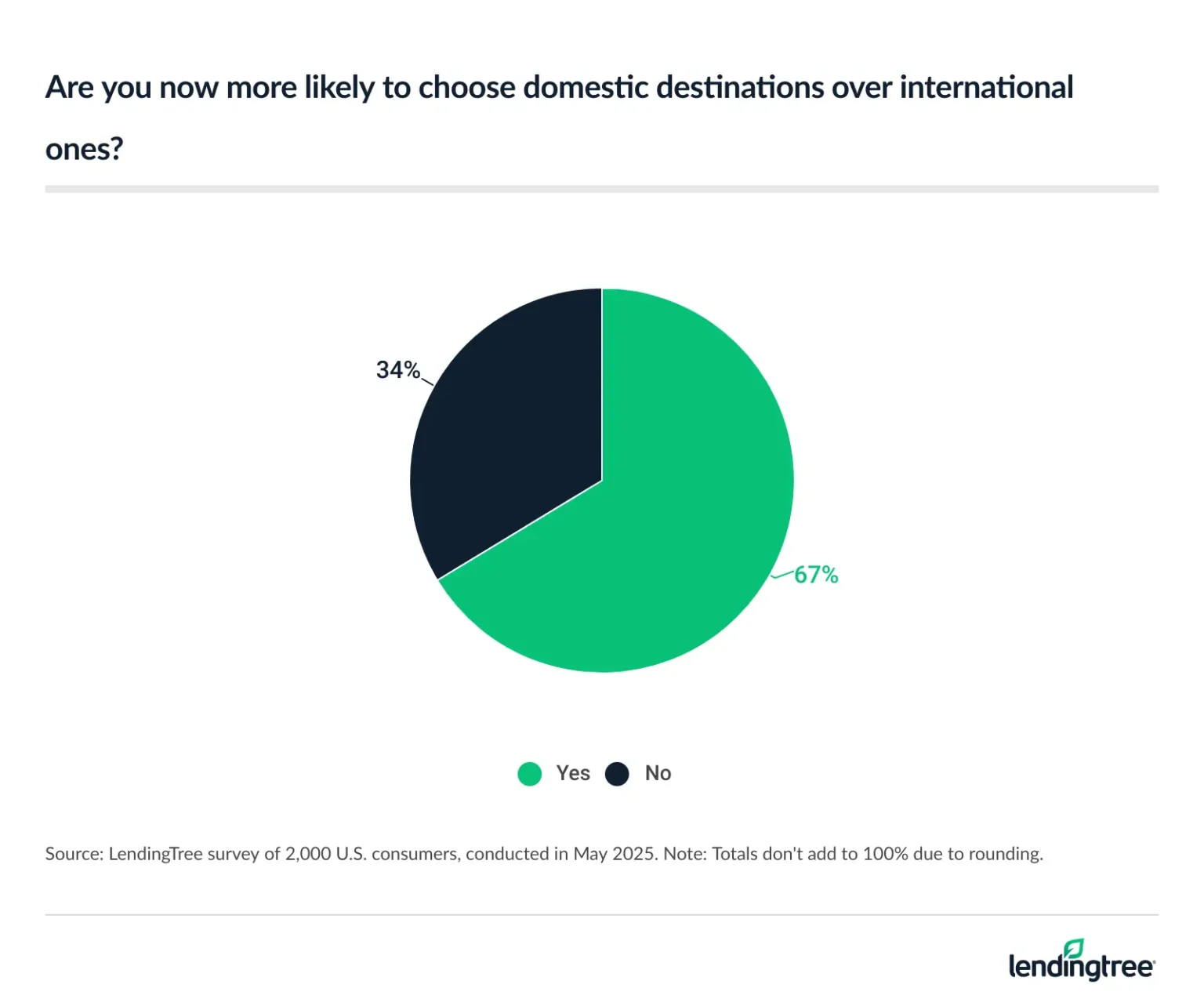

This could be one reason why 67% say they’re now more likely to choose domestic destinations over international ones. Considering that a weaker U.S. dollar makes traveling to Europe more expensive, for instance, switching to a U.S.-based vacation could make financial sense in some cases.

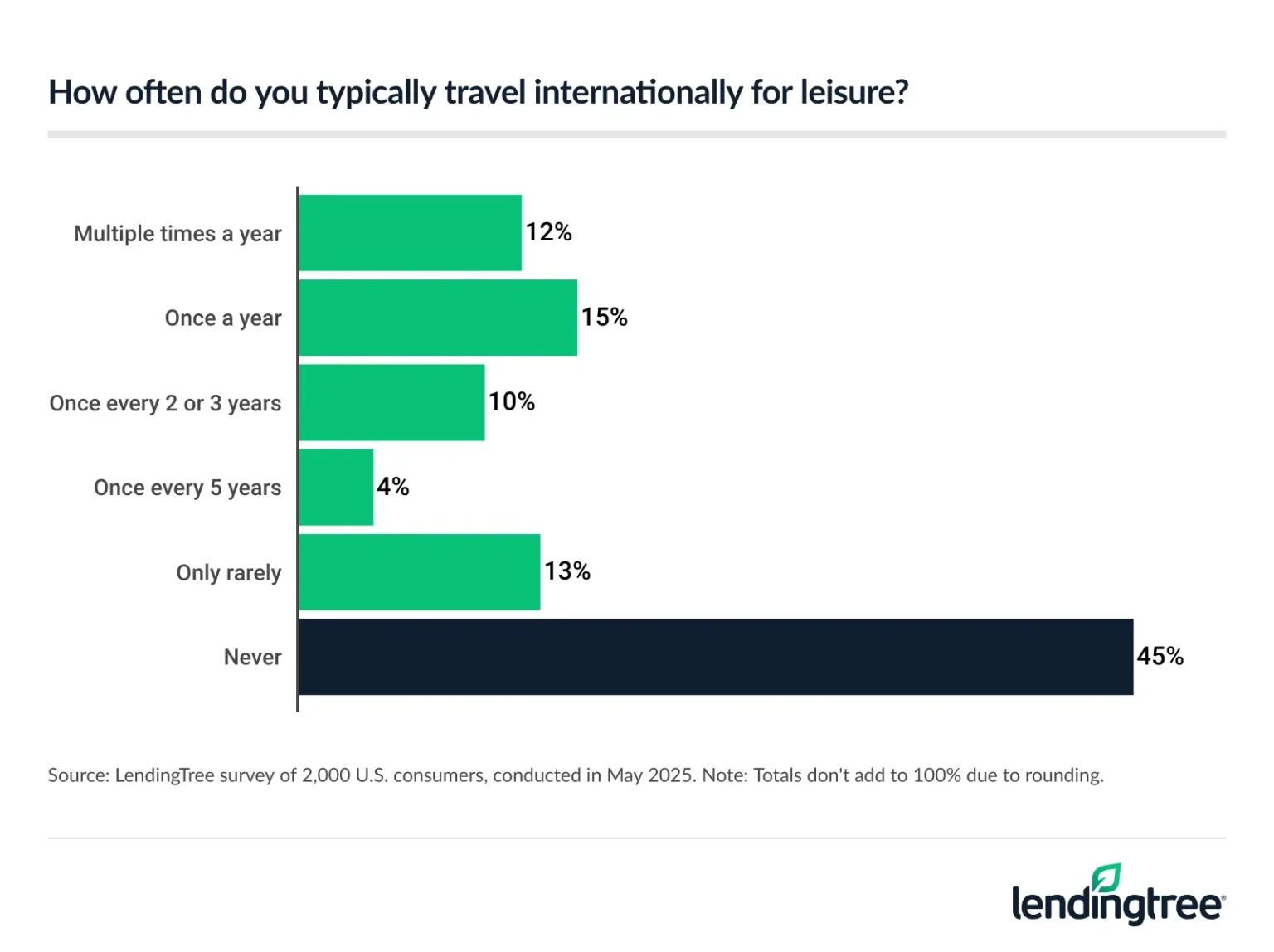

In general, 28% say they travel abroad at least once a year, and another 14% do so every two to five years.

However, the most frequent international travelers say they’re likely to stay closer to home for the time being:

- Those who normally travel internationally multiple times a year: 75%

- Every 2 to 3 years: 70%

- Once a year: 67%

Global politics have many travelers worried

It’s not just the economy that has jet-setters reconsidering plans. Just over half (53%) of Americans are concerned about flying internationally due to political hostility. More than 6 in 10 (62%) worry about how they’ll be treated overseas because they’re American. And 27% have felt uncomfortable even sharing their nationality abroad.

Toward that end, 30% of the youngest Americans (Gen Zers) have pretended to be from a different country while traveling internationally. However, the vast majority of baby boomers (97%) say they’ve never hidden their American heritage.

5 travel tips when you need to cancel or postpone plans

While canceling travel plans if you’re worried about finances might seem like a logical step, doing so could be costly, Schulz warns. “You may not always be able to get your money back for something you’d already arranged. Depending on the circumstances of your trip, that could mean you’ll lose significant money.”

Here are some strategies to limit the loss if you decide to cancel or change plans:

- Read the cancellation fine print before booking the cheaper rate. “It can be tempting to go for the noncancelable rate to save money when booking hotels and other things,” Schulz says. “However, there’s a risk. Before you buy, ask yourself if you’re comfortable with that risk. If you aren’t, spending a little extra money for more flexibility may be the best move.”

- If you booked with a travel card, see if you have trip cancellation insurance and check how it works. “Most people don’t know much about the great perks their credit card offers, and travel insurance is a perfect example,” Schulz says. Policies can vary widely, so it’s important to read the fine print or call your credit card company to ask for details. “When used wisely, the right travel insurance with your credit card can save you real money and real headaches,” Schulz says.

- Consider if scaling back, rather than canceling, your trip might help you salvage your getaway. Taking a day or two off your trip could help make it more affordable, assuming you’re able to change hotels/flights without incurring too many fees. Other ways to save might be staying with family or friends for a night or two, driving instead of flying or downgrading your accommodations.

- See if switching your travel dates might help you save. “The difference in travel cost and availability in peak season versus off-peak times can be night and day,” Schulz says. In fact, he says it can make a dream vacation a possibility. Obviously, there are a lot of factors to consider, such as whether off-peak means risking bad weather, so be sure to think about the big picture.

- Lean on credit card rewards to cover some of the costs. If you have accumulated points or miles to redeem, it can be a great way to offset some of your expenses, Schulz says. “The best-case scenario would involve free hotel nights and airfares, upgraded rooms, priority boarding, complimentary breakfasts and other such perks,” he says. But even if you don’t get all those benefits, every little bit can help. For example, getting 1% or 2% back on everything you spend with a cash back card can help extend your budget, while extra rewards at gas stations can make a family road trip more affordable, Schulz explains. “It’s all about finding the right travel card to match your needs.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from May 1 to 6, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79