Love Costs More: Valentine’s Spending Slips as Prices Rise

Even Cupid isn’t immune to a struggling economy.

This year, amid the continued squeeze of inflation, the expected spend on Valentine’s Day gifts fell to an average of $132 among those in relationships, according to a LendingTree study — down from $179 last year. Meanwhile, prices for 32 popular Valentine’s Day chocolates and nine jewelry items rose in price from last year.

Here’s what else we found.

- The cost of love isn’t cheap. 81% of Americans in relationships plan to give their partner a Valentine’s Day gift, with average spending expected to hit $132 — down from $179 last year. Among those in relationships, 22% wish to receive chocolate or candy, while 20% want a card.

- Some of the most popular gifts are rising in price. Prices for 39 popular Valentine’s Day chocolates rose an average of 11.8% year over year, with 82.1% of the items increasing in cost. Jewelry prices also rose, with a 7.9% average increase among 16 items sold by Pandora and Macy’s.

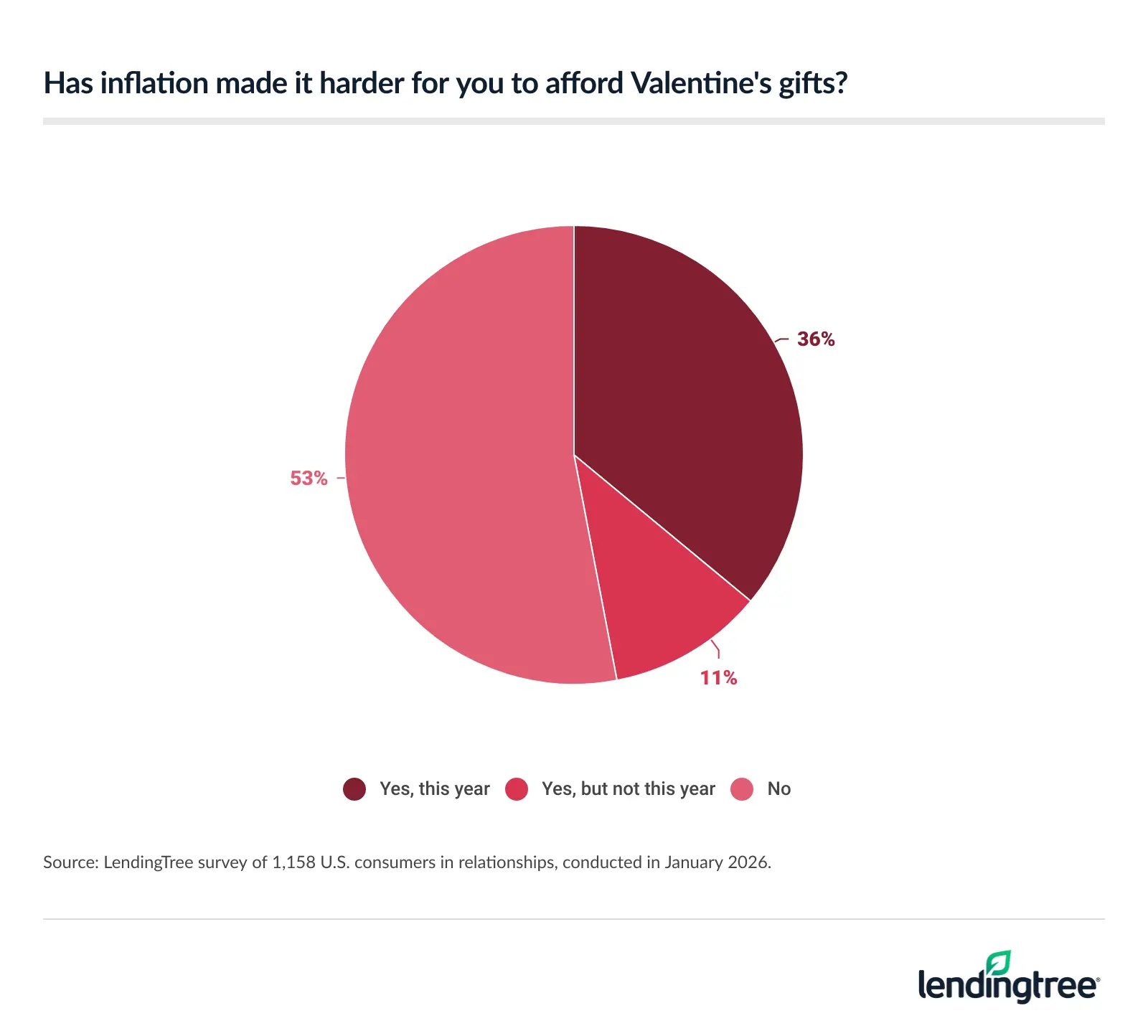

- Many may take on debt for their Valentine. 47% of Americans in relationships say inflation has made gifts harder to afford — including 36% who say that’s true specifically this year. 1 in 4 (25%) people in relationships say it’s possible they’ll take on debt for Valentine’s Day, and 44% say they would keep that a secret from their partner. However, 72% of those in relationships say they would be upset if their significant other took on credit card debt for the holiday.

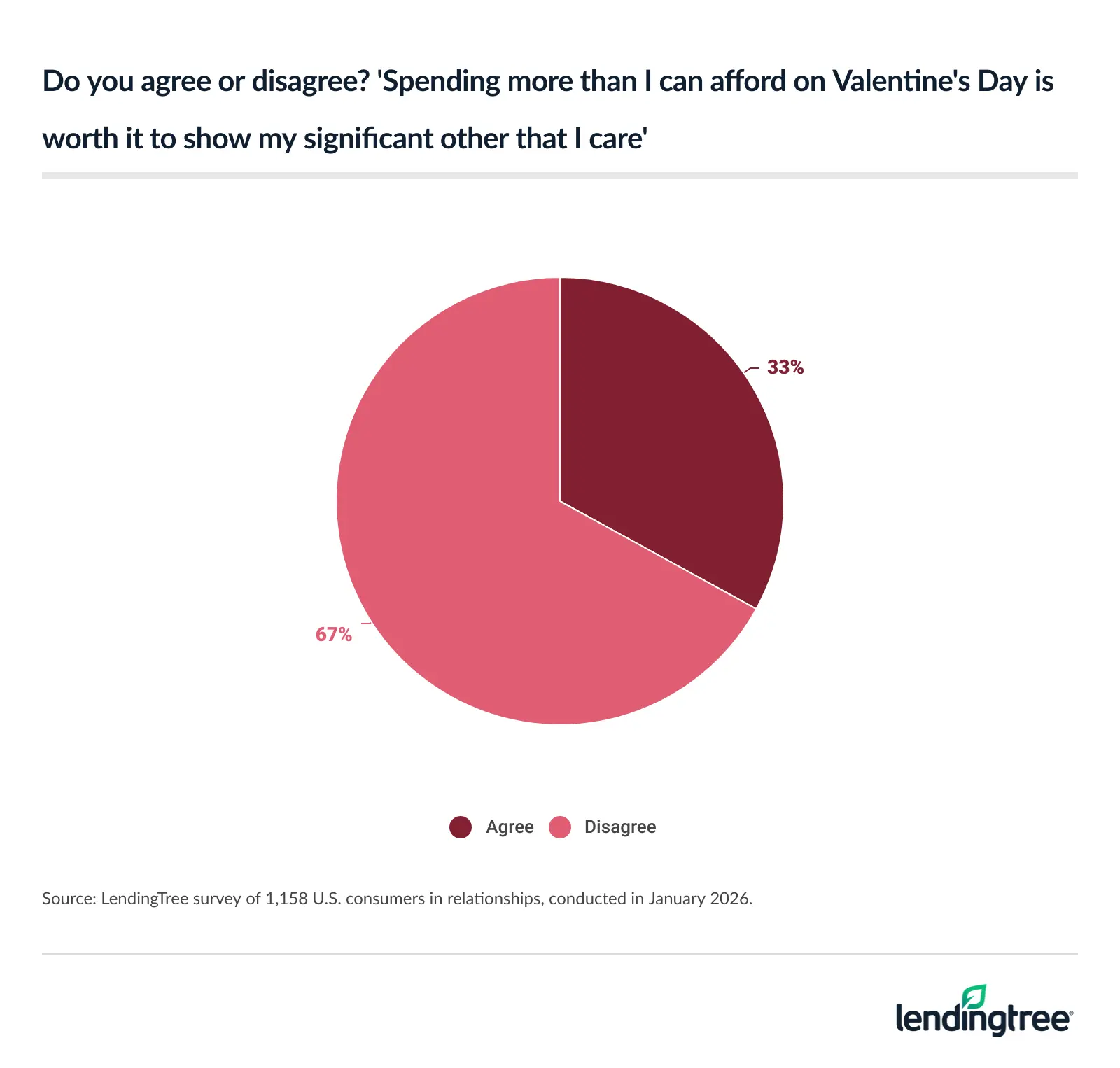

- Some say that showing their love is priceless. 1 in 3 (33%) Americans in relationships believe overspending on Valentine’s Day is worth it if it shows how much they care. Meanwhile, 2 in 5 (40%) Americans say they’ve skipped Valentine’s Day celebrations in the past to save money — and 57% say they’d avoid the holiday altogether if they could.

Average Valentine’s Day spending is down

This Valentine’s Day, 81% of Americans in relationships plan to give their partner a gift. But love isn’t cheap: Average spending is expected to hit $132. That amount rises to $200 or more among those with children younger than 18 ($206) and six-figure earners ($200), with millennials ages 30 to 45 ($192) close behind.

Still, average spending is down from $179 last year and $180 in 2024.

Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life,” believes that the decrease is more likely to be a temporary response to the economy, rather than a permanent shift. “Most people want to give generously on Valentine’s Day, but tough times often require sacrifice,” he says. “For many people, that means dialing back on holiday spending.”

Most people want to give generously on Valentine’s Day, but tough times often require sacrifice. For many people, that means dialing back on holiday spending.

That said, 24% of Americans report they’ll spend less this year than last year, while 17% plan to spend more, and 59% believe they’ll spend about the same amount. Men are more than twice as likely as women to increase their spending this year, at 23% versus 11%.

Meanwhile, those in relationships expect their partner will spend $118 on them.

Among those in a relationship, 22% wish to receive chocolate or candy, and 20% want a card. The next most common gifts that lovebirds want include:

- A special meal at home (19%)

- Flowers (18%)

- Experiential gift (travel, tickets, dinner out, etc.) (15%)

- Jewelry (13%)

- Clothing (12%)

- Beauty items (10%)

- Accessories (10%)

- Beauty treatments (9%)

- A homemade or DIY gift (9%)

- A stuffed animal (7%)

Many people will get what they want this year: Chocolate or candy is the most gifted item for Valentine’s Day at 30%, followed by a card (27%) and a special meal at home (23%). Other common gifts include:

- Flowers (21%)

- Experiential gift (16%)

- Clothing (13%)

- Jewelry (12%)

- Beauty items (10%)

- A homemade or DIY gift (10%)

- Accessories (9%)

- A stuffed animal (9%)

- Beauty treatments (7%)

Common gift prices are on the rise

Rising costs may be the biggest culprit for love-busting this year. Of the 39 popular Valentine’s Day chocolates analyzed, 82.1% rose in price. That means just seven items didn’t see a price increase. The average increase across all items was 11.8% year over year, with the cost of Hershey’s, KitKat and Reese’s miniatures assorted chocolate Valentine’s candy (67.0%) rising the most.

In a distant second, the cost of the Russell Stover Valentine’s Day red foil heart assorted milk and dark chocolate gift box rose by 27.3%, while Lindt Lindor milk chocolate candy truffles (26.1%) ranked third.

Jewelry prices also rose, with a 7.9% increase among 16 items sold by Pandora and Macy’s compared to last year. Of the 16 jewelry items, nine increased in price, while six remained unchanged.

Still, Valentine’s Day price increases aren’t new. LendingTree’s prior analysis found that from 2024 to 2025, Valentine’s Day chocolate prices rose by an average of 8.3%, while jewelry prices increased by 4.5%.

Broader inflation data shows these increases extend beyond individual products. Over the past year, jewelry prices rose the most (8.3%), followed by candy and sweets (6.8%) and flowers (6.4%), according to consumer price index data. Meanwhile, the cost of dining out increased the least at 3.7%.

With those price hikes in mind, Schulz says shopping around is almost always good advice for people looking for the best deals. “There can definitely be meaningful differences in price, quality and availability among different retailers, so comparison shopping can be well worth your time,” he says. “With Valentine’s Day, the best gifts don’t have to be bought in a store. A romantic hand-made dinner can be an amazing option and cost far less than going to a restaurant.”

Full rankings: Chocolate Valentine’s Day products that rose/fell in price the most

| Product | Old price | Price per ounce | New price | Price per ounce | Difference in price (%) |

|---|---|---|---|---|---|

| Hershey’s, KitKat and Reese’s miniatures assorted chocolate Valentine’s candy gift box | $5.97 | $0.93 | $9.97 | $1.56 | 67.0% |

| Russell Stover Valentine’s Day red foil heart assorted milk and dark chocolate gift box | $17.97 | $1.19 | $22.87 | $1.52 | 27.3% |

| Lindt Lindor milk chocolate candy truffles | $7.82 | $0.92 | $9.86 | $1.16 | 26.1% |

| Lindor Valentine’s assorted candy heart box | $15.99 | $2.91 | $19.99 | $3.63 | 25.0% |

| Russell Stover Valentine’s Day satin heart pecan delights milk chocolate gift box | $12.97 | $1.80 | $15.86 | $2.20 | 22.3% |

| Russell Stover Valentine’s Day red foil heart assorted milk and dark chocolate candy gift box | $12.97 | $1.30 | $15.86 | $1.59 | 22.3% |

| Whitman’s sampler Valentine’s Day red floral heart assorted milk and dark chocolate gift box | $12.97 | $1.26 | $15.86 | $1.54 | 22.3% |

| Reese’s miniatures milk chocolate peanut butter cups Valentine’s candy | $5.97 | $0.92 | $3.96 | $1.10 | 19.8% |

| Hershey’s pot of gold milk and dark chocolate | $6.98 | $0.70 | $5.97 | $0.83 | 18.8% |

| Ghirardelli Valentine’s chocolate caramel collection hearts | $10.99 | $2.68 | $12.99 | $3.17 | 18.2% |

| Elmer Chocolate assorted chocolate romantic rose chic | $10.97 | $0.91 | $12.97 | $1.08 | 18.2% |

| Lindt Valentine’s raspberry cheesecake white chocolate truffles | $5.99 | $1.00 | $5.99 | $1.17 | 17.6% |

| Lindt Valentine’s strawberries and cream chocolate | $5.99 | $1.00 | $5.99 | $1.17 | 17.6% |

| Ghirardelli Valentine’s sea salt caramel dark chocolate hearts bag | $5.99 | $1.25 | $5.99 | $1.46 | 17.1% |

| Ghirardelli Valentine’s caramel milk hearts chocolate | $5.99 | $1.25 | $5.99 | $1.46 | 17.1% |

| Ghirardelli Valentine’s lava cake dark chocolate hearts bag | $5.99 | $1.25 | $5.99 | $1.46 | 17.1% |

| Dove Valentine’s dark chocolate hearts | $4.99 | $0.56 | $5.69 | $0.64 | 14.0% |

| Dove Valentine’s milk chocolate hearts | $4.99 | $0.56 | $5.69 | $0.64 | 14.0% |

| Demet’s turtles, milk chocolate Valentine’s satin heart | $14.98 | $2.17 | $16.97 | $2.46 | 13.3% |

| Reese’s Valentine’s Day peanut butter hearts candy | $4.69 | $0.52 | $5.29 | $0.58 | 12.8% |

| York Valentine’s Day dark chocolate peppermint hearts candy snack size | $4.69 | $0.49 | $5.29 | $0.55 | 12.8% |

| Hershey’s Kisses Valentine’s Day milk chocolate candy | $4.69 | $0.46 | $5.29 | $0.52 | 12.8% |

| Demet’s turtles, original milk chocolate pecan Valentine’s bag | $5.97 | $0.87 | $6.72 | $0.97 | 12.6% |

| Butterfinger minis heart box, peanut-buttery chocolatey, Valentine’s Day gift | $5.97 | $0.90 | $5.97 | $1.01 | 11.9% |

| Milk chocolate Valentine teddy figures* | $6.49 | $1.30 | $7.00 | $1.40 | 7.9% |

| Ferrero Rocher milk chocolate hazelnut, Valentine’s chocolate heart gift box | $10.97 | $1.57 | $11.56 | $1.65 | 5.4% |

| Lindt Lindor Valentine’s milk chocolate truffles friend heart | $7.99 | $2.66 | $8.40 | $2.80 | 5.1% |

| Russell Stover Valentine’s red foil heart | $5.99 | $1.49 | $6.29 | $1.56 | 5.0% |

| Lindt Valentine’s classic heart chocolate truffles | $21.99 | $3.86 | $23.10 | $4.05 | 5.0% |

| Lindt Valentine’s gourmet chocolate truffles heart | $21.99 | $3.28 | $23.10 | $3.45 | 5.0% |

| Lindt Valentine’s passion heart assorted gourmet chocolate truffles | $29.99 | $2.83 | $31.50 | $2.97 | 5.0% |

| Custom Lindor pick and mix 75-pc Valentine gift bag* | $39.99 | $0.53 | $42.00 | $0.56 | 5.0% |

| Dove milk chocolate truffle hearts Valentine’s Day candy gift | $13.47 | $2.31 | $13.47 | $2.31 | 0.0% |

| Snickers minis Valentine’s Day chocolate candy bars | $4.98 | $0.48 | $4.97 | $0.47 | -0.2% |

| Hershey’s hugs and kisses assorted milk chocolate and white creme Valentine’s candy | $5.99 | $0.92 | $5.97 | $0.92 | -0.3% |

| Dove Valentine’s assorted chocolate truffle heart | $18.99 | $2.22 | $18.59 | $2.17 | -2.1% |

| M&M’s Valentine’s milk chocolate classroom exchange bag | $8.79 | $0.72 | $7.89 | $0.65 | -10.2% |

| Lindt Lindor Valentine’s Day assorted chocolate candy truffles | $7.87 | $0.93 | $5.94 | $0.70 | -24.5% |

| KitKat miniatures Valentine’s Day milk chocolate | $7.99 | $1.25 | $5.97 | $0.93 | -25.3% |

Full rankings: Valentine’s Day jewelry products that rose/fell in price the most

| Product | Old price | New price | Difference in price (%) |

|---|---|---|---|

| Le Vian GODIVA x Le Vian chocolate ganache heart pendant necklace featuring chocolate diamond in 14k gold | $2,200 | $3,200 | 45.5% |

| Trumiracle diamond stud earrings (1/2 ct. t.w.) in 14k gold | $850 | $1,200 | 41.2% |

| Grown With Love lab grown ruby (9-1/4 ct. t.w.) & lab grown diamond (1/2 ct. t.w.) heart halo 18″ pendant necklace in 14k gold | $2,050 | $2,550 | 24.4% |

| Red heart & arrow murano glass dangle charm | $88 | $95 | 8.0% |

| Pandora Moments heart clasp snake chain bracelet | $75 | $80 | 6.7% |

| Handwritten love charm | $38 | $40 | 5.3% |

| Pavé cuban chain bracelet silver | $225 | $235 | 4.4% |

| Sparkling elevated heart ring | $120 | $125 | 4.2% |

| Celestial sun and moon ring set | $151 | $153 | 1.3% |

| Engravable heart tag dangle charm | $75 | $75 | 0.0% |

| Pandora talisman sterling silver lab-grown diamond heart ring | $390 | $390 | 0.0% |

| Pandora Moments studded chain bracelet silver | $88 | $88 | 0.0% |

| Brook & York willow initial pendant gold | $115 | $115 | 0.0% |

| Macy’s diamond accent heart x link bracelet in silver plate | $100 | $100 | 0.0% |

| Wrapped diamond 16″ collar necklace (1 ct. t.w.) silver | $1,600 | $1,600 | 0.0% |

| Beaded open heart charm | $35 | $30 | -14.3% |

Amid inflation, lovebirds take on debt

Love and debt occasionally go hand-in-hand, but that may be particularly true this year. Among those in relationships, 47% of Americans say inflation has made Valentine’s Day gifts harder to afford, including 36% who believe that’s true this year.

Meanwhile, a significant 25% of people in relationships say it’s possible they’ll take on credit card debt for Valentine’s Day, and 44% of them would keep it a secret from their partner.

With that in mind, though, 72% of those in relationships say they would be upset if their significant other took on credit card debt for the holiday.

Schulz says hiding debt is particularly dangerous. “Open and honest communication about money is a nonnegotiable thing that couples must have to succeed in the long term,” he says. “It’s no big deal to hide the fact that you’re buying an engagement ring, planning a surprise birthday or organizing a special trip. Those are short-term secrets for special occasions. However, when you’re hiding big financial secrets for long periods of time, that’s a bad sign.”

How long would it take to pay off Valentine’s debt? Of those who think they might take on debt, 27% believe they’ll pay it off in less than two months. Meanwhile, 60% believe it will take two to six months to pay off.

Love is worth the financial pain

Many believe love is worth the cost. In fact, 1 in 3 (33%) Americans in relationships believe that overspending on Valentine’s Day is worth it if it shows how much they care. Gen Zers ages 18 to 29 (55%) and those with children younger than 18 (51%) are especially likely to feel that way.

Meanwhile, 29% of all Americans say they’ve set a Valentine’s Day spending limit with their partner, and 16% haven’t done so but would consider doing it in the future.

Conversely, 40% of all Americans say they’ve skipped Valentine’s Day celebrations in the past to save money — and an even more significant 57% say they’d avoid the holiday altogether if they could.

What about couples with plans? Of those in relationships, 40% will stay in and spend time together, 36% will enjoy a special meal at home and 33% will go out for dinner.

Filling hearts without draining wallets: Top expert tips

It’s possible to have a special Valentine’s Day without incurring financial pain. For those looking to cut back on expenses while still showing appreciation for their loved one, we offer the following advice:

- Communicate. “If money is tighter than usual and you’re going to have to dial back the gift-giving on Valentine’s Day this year, tell your partner,” Schulz says. “It probably won’t be an easy conversation, but it’s important. How your partner reacts will also be illuminating. It’s perfectly natural for them to be a little disappointed, but — ultimately — they should respect the situation you find yourself in and be understanding.”

- Prioritize. “If you know that your partner loves a bouquet of flowers but doesn’t care about fancy dinners, keep those things in mind when you’re planning the big day,” he says. “By focusing on giving them the things that they love the most rather than just spending to spend, you can get the biggest bang possible for your Valentine’s buck.”

- Leverage credit card perks. “Using the right rewards card can help you extend your Valentine’s budget,” Schulz says. “Maybe it gets you a free (or almost-free) hotel night or airfare. Maybe the card’s sign-up bonus helps you afford a nice dinner. Or maybe just 2% in cash back makes it a little easier to pay your bills at the end of the month.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 80 on Jan. 2, 2026. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2026:

- Generation Z: 18 to 29

- Millennials: 30 to 45

- Generation X: 46 to 61

- Baby boomers: 62 to 80

To analyze the prices of Valentine’s Day products, LendingTree researchers examined 39 chocolate and 16 jewelry items.

Historical prices and product sizes were collected Jan. 1-8, 2025, and compared with prices from Jan. 1-8, 2026. For each product, researchers calculated the price per ounce or per unit and the year-over-year change.

We gathered chocolate and jewelry data from the following retail websites:

- Lindt

- Macy’s

- Pandora

- Target

- Walmart

Additionally, analysts used data from the Bureau of Labor Statistics (BLS) consumer price index (CPI) for jewelry, indoor plants and flowers, food away from home, and sugar and sweets, comparing November 2024 to November 2025 — the latest available. The CPI figures represent the U.S. city average and aren’t seasonally adjusted.

Recommended Articles

Lovebirds Plan to Spend $179 on Average This Valentine’s Day, While 56% of Americans Would Skip the Holiday if They Could

Inflation and Valentine’s Day: You Can Expect to Pay 8.3% More for Chocolate and 4.5% More for Jewelry This Year

136 Holiday Spending Statistics, From Valentine’s Day to New Year’s Eve