Love Meets Money: Nearly Half of Americans Say the Economy Has Raised the Stakes in Romance

Love isn’t always about finding someone who makes your heart flutter — many Americans are willing to hedge their bets by choosing partners with money to their name. In fact, 26% of unmarried Americans say they’d consider marrying someone primarily for financial stability.

Here’s a closer look at Americans’ perspectives on love and money.

Key findings

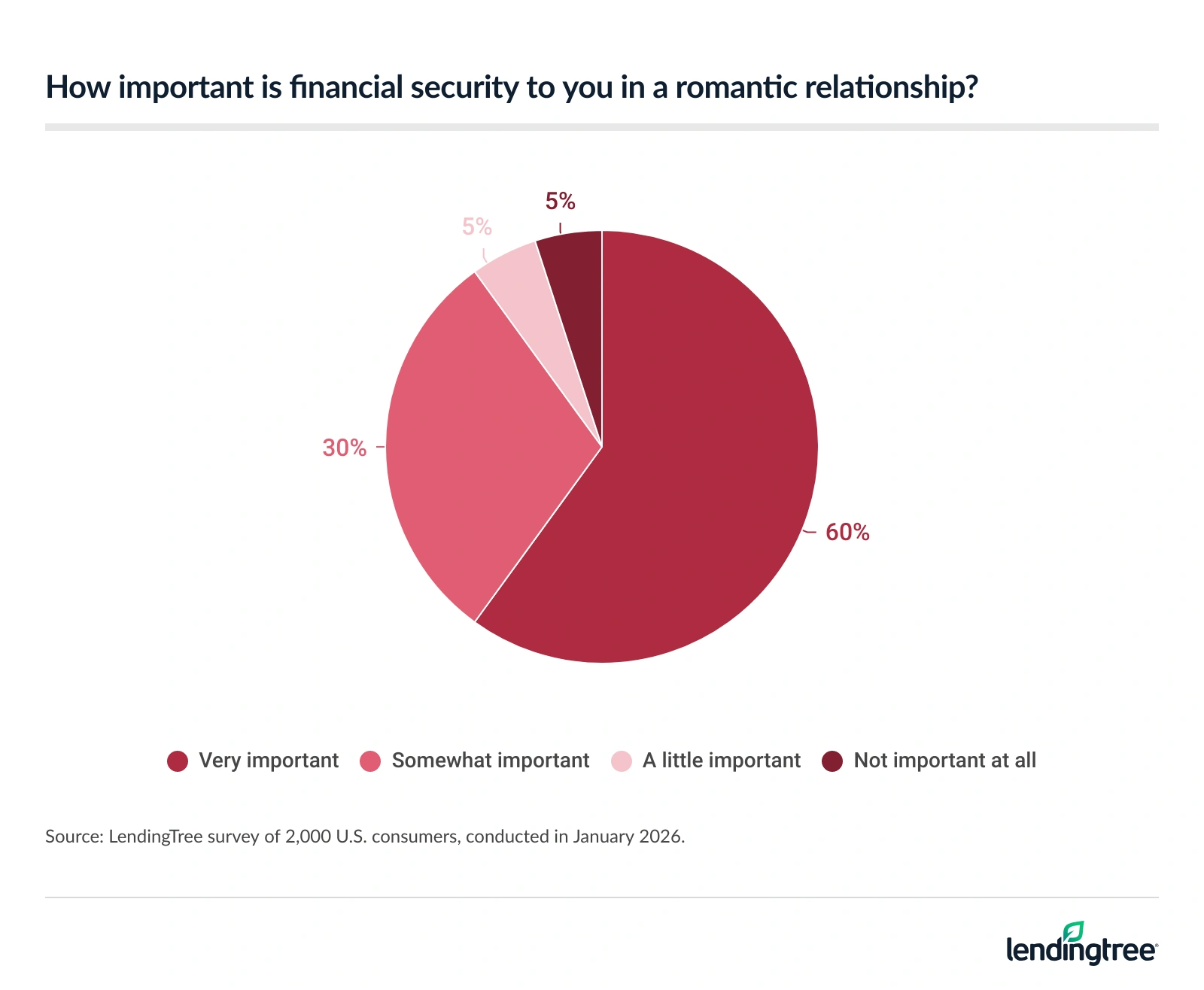

- Money can’t buy love, but financial security helps. 9 in 10 (90%) Americans say financial security is at least somewhat important in a romantic relationship. In fact, 26% of unmarried Americans say they’d consider marrying someone primarily for financial security, and 49% of all Americans say the current economic climate has made their partners’ (or potential partners’) finances more important to them. That percentage is higher among Gen Zers (60%) and millennials (59%).

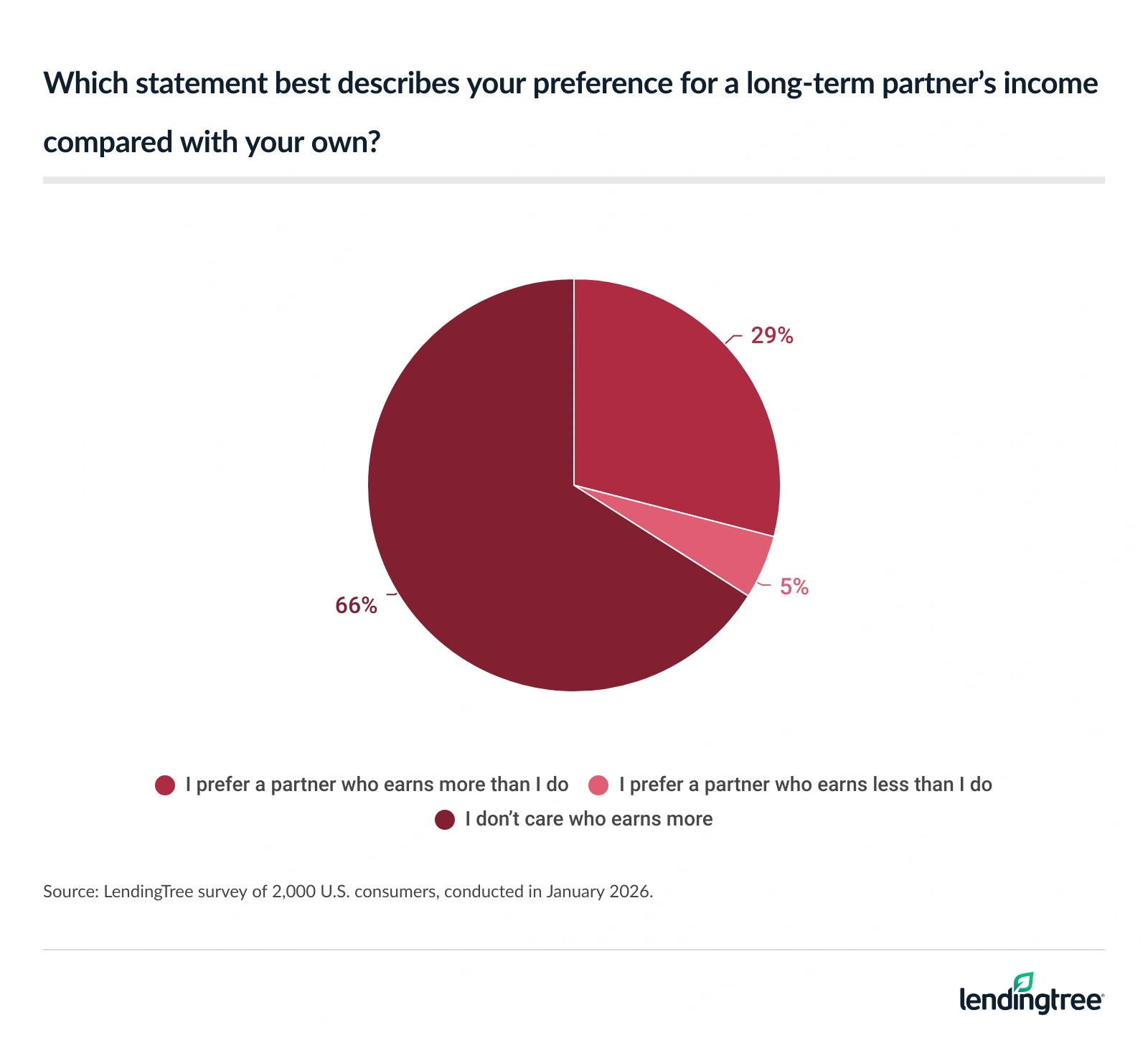

- Many Americans wish their current partner were more financially secure. Nearly 3 in 10 (29%) prefer a partner who earns more than they do, with women (35%) more likely to feel this way than men (22%). Among those currently in a relationship, 46% say they wish their spouse or partner were more financially secure, led by parents of young kids (60%).

- For some, more money makes it hard to leave. More than a quarter of Americans (28%) say they’ve stayed in a relationship longer than they wanted due to financial reasons. Meanwhile, 27% say someone having a lot of money makes them more romantically attractive, rising to 44% among Gen Zers. Additionally, 23% say they’ve gone on a date mainly to receive something of value rather than out of genuine interest, and that figure jumps to 40% for Gen Zers.

- When it comes to “sugar” relationships, Americans don’t quite know how to feel. Most Americans (81%) say they’ve never been in a sugar relationship — defined as one in which a person provides financial support in exchange for companionship or romance. However, 35% of Gen Zers say they have. While 32% of Americans say sugar relationships are at least somewhat socially unacceptable, a majority (54%) say this type of relationship can be a respectable decision.

Americans want Cupid to come with receipts

Americans strongly consider financial security when picking a partner, with 90% saying it’s at least somewhat important in a romantic relationship. And 60% say it’s very important.

Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — says no one should be surprised that people judge their partners, at least in part, by their debt level, credit score and overall financial stability.

“Fair or not, people can see those things as indicators of whether someone generally has it together in life,” he says. “While that’s often unfair to the person who is financially struggling, it’s not unfair to expect them to discuss their finances with you as you progress in your relationship. Open and honest discussion of money is a nonnegotiable thing when it comes to relationships, and an unwillingness to talk about it can be a far bigger red flag than some debt or a middling credit score.”

It’s so important that over a quarter (26%) of unmarried Americans would consider marrying someone primarily for financial security. That’s especially true among those with children younger than 18 (35%), six-figure earners (33%) and Gen Zers ages 18 to 29 (32%).

Love costs more: Valentine’s spending slips as prices rise

Meanwhile, 56% of unmarried Americans wouldn’t date someone with significant debt.

Today’s tough living standards may play a role, as 49% of all Americans say the current economic climate has made their partners’ (or potential partners’) finances more important to them. That rises to 60% among Gen Zers and 59% among millennials ages 30 to 45.

The cash is greener on the other side

Some Americans have a preference when it comes to their partner’s earnings. While 66% say they don’t care who earns more, a significant 29% say they prefer a partner who earns more than they do.

However, Schulz says it can be challenging when one partner earns much more or owes much more than the other.

“Open, honest communication is always important in relationships, but it’s perhaps never more so than when there are financial imbalances between the partners,” he says. “Without ongoing discussion, confusion, resentment and even anger can grow over how finances are being managed. Those early talks may make for some awkward times at the dinner table, but it’s far, far better to have those expectation-setting conversations ahead of time rather than when everything is already on fire after something goes wrong.”

Those with children younger than 18 (40%), Gen Zers (40%) and six-figure earners (35%) are among the most likely to prefer partners who earn more. Additionally, women (35%) are more likely to have this preference than men (22%).

Of those who are in relationships, 46% wish their spouse or partner were more financially secure, led again by parents of young kids (60%).

That being said, though, 71% of Americans have never ended or avoided a relationship because of financial differences.

Financial security may be keeping couples together

Money may keep some unhappy couples stuck. A significant 28% of Americans have stayed in a relationship longer than they wanted for financial reasons, such as shared rent, bills or a shared lifestyle.

Schulz acknowledges that it can be terrifying to feel trapped in a relationship because of money.

“In many ways, financial stability is freedom,” he says. “It gives you the ability to take action to get yourself out of an unsatisfying or even unsafe relationship. That’s why I support both partners having at least some money that is just theirs. As much as we all would love to think that our marriage is going to be blissful and dreamy for our entire lives, that’s not the reality for millions of Americans. Having your own money means that if you feel you need to extricate yourself from a bad relationship, you can do it far more easily.”

Having your own money means that if you feel you need to extricate yourself from a bad relationship, you can do it far more easily.

With that in mind, 27% say someone having a lot of money makes them more romantically attractive, jumping to 44% among Gen Zers, 42% among those with children younger than 18 and 39% among six-figure earners.

Meanwhile, 23% say they’ve gone on a date mainly to receive something of value — like a free meal, gift or experience — rather than out of genuine interest. That’s most common among those with children younger than 18 (40%) and Gen Zers (40%).

Gen Zers aren’t afraid of a little sugar

While financial security is certainly an incentive for many, “sugar” relationships — defined as one in which a person provides financial support for companionship or romance — are still controversial. Most Americans say they have never been in one, at 81%.

However, 35% of Gen Zers and those with children younger than 18 say they have, tying for the highest share by group.

While 32% of Americans say sugar relationships are at least somewhat socially unacceptable, a notable 54% say this type of relationship can be a respectable decision.

Meanwhile, Schulz says these relationships have the potential to leave recipients extremely vulnerable.

“As appealing as a sugar relationship might be, it’s still just a relationship, and relationships often don’t end well,” he says. “Having some funds that are just yours can give you peace of mind that if the relationship suddenly goes bad, you’d be OK. Of course, your see-ya-later fund may not be anywhere near the amount that you get regularly from your sugar partner, but it’s still hugely important.”

Balancing financial security with love: Top expert tips

For those trying to balance love and money — especially those managing debt — it can be difficult to ensure financial dependence doesn’t quietly drive your relationship choices. We offer the following advice:

- Prioritize communication. “It all starts with open and honest communication,” Schulz says. “If you don’t have that, you’re fighting an uphill battle.”

- Keep some cash to yourself. “Don’t be afraid to keep a see-ya-later fund,” he says. “Financial freedom and stability are power, and if your relationship goes south, you’ll need it.”

- Work together and give each other grace. “Though that see-ya-later fund is important, one of the best financial moves that anyone can make is picking the right partner,” he says. “That doesn’t mean that person is perfect. It doesn’t mean they agree with you on everything. It doesn’t even mean that you won’t have major blow-ups. However, if you and your partner are generally communicative, pulling in the same direction and cheering each other on through the good times and the bad, count yourself lucky.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 80 from Jan. 14 to 17, 2026. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2026:

- Generation Z: 18 to 29

- Millennials: 30 to 45

- Generation X: 46 to 61

- Baby boomers: 62 to 80

Get debt consolidation loan offers from up to 5 lenders in minutes