Best Home Insurance in Arizona

State Farm is the best home insurance company in Arizona, charging the state’s cheapest average rate of $145 a month.

Allstate is Arizona’s best home insurance company for policy offerings, and American Family offers the best discounts.

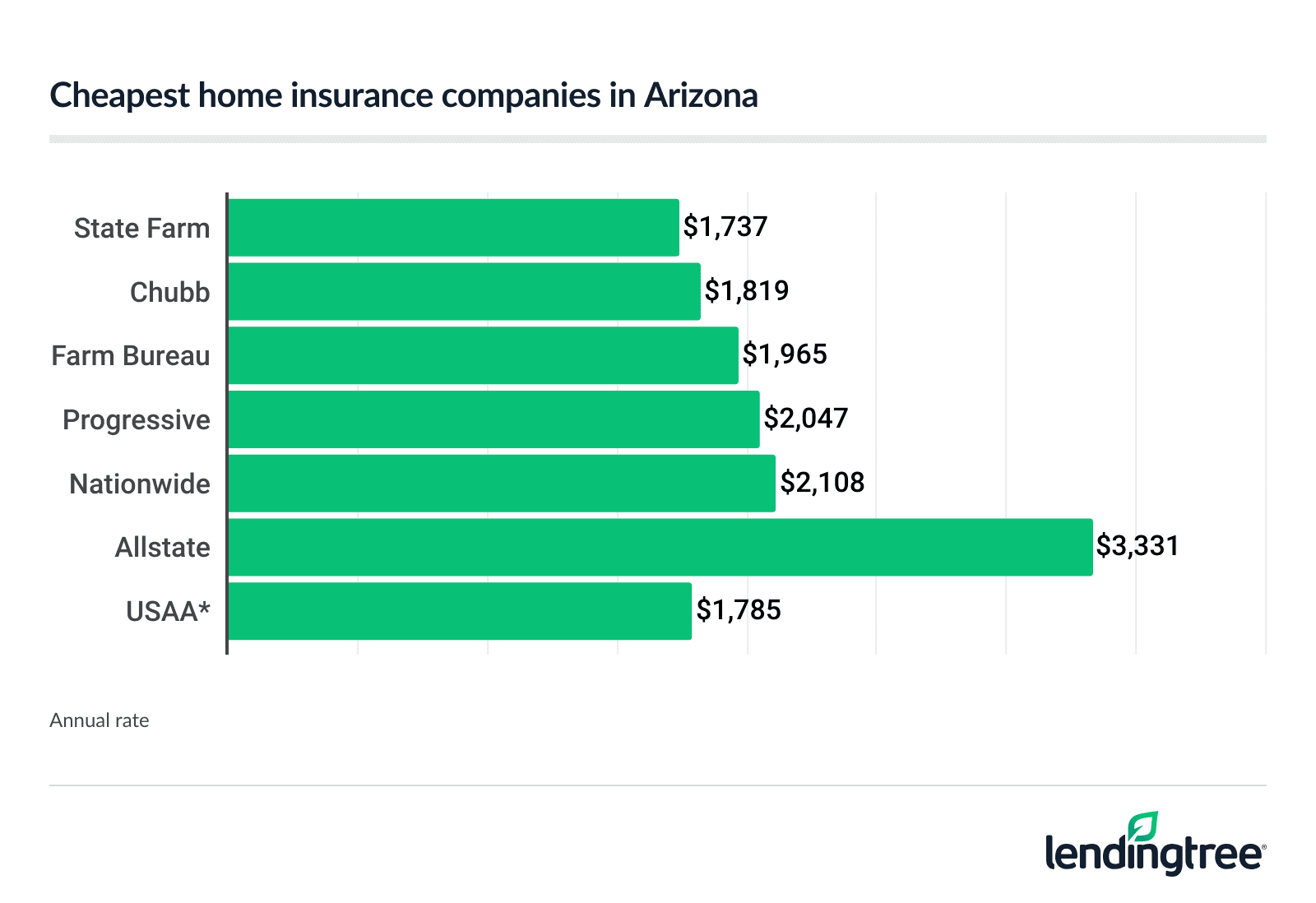

Best cheap home insurance companies in Arizona

Arizona’s cheapest home insurance companies

State Farm has the cheapest homeowners insurance for most Arizonans. Its average rate is $1,737 a year, or $145 a month.

While USAA has the second-cheapest average rate of $1,785 a year, it sells insurance only to members of the military, veterans and their families. Chubb has the second-cheapest rates for most Arizonans, at $1,819 a year.

Cheapest home insurance quotes in Arizona

| Company | Average annual rate | LendingTree score |

|---|---|---|

State Farm State Farm | $1,737 | |

Chubb Chubb | $1,819 | |

Farm Bureau Farm Bureau | $1,965 | |

Progressive Progressive | $2,047 | |

Nationwide Nationwide | $2,108 | |

Allstate Allstate | $3,331 | |

American Family American Family | $3,657 | |

Farmers Farmers | $5,157 | |

USAA* USAA* | $1,785 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. *USAA is only available to active-duty and veteran military members and their families.

Best homeowners insurance companies in Arizona

USAA has the best customer service and one of the cheapest rates in Arizona. However, USAA is only available to military members, veterans and their families.

State Farm, Allstate and American Family are also great choices for homeowners in Arizona.

| Company | Annual rate | J.D. Power overall satisfaction | NAIC complaint index |

|---|---|---|---|

| Best overall: State Farm | $1,737 | 880 (above average) | 1.69 (average) |

| Best policy offerings: Allstate | $3,331 | 868 (average) | 3.08 (poor) |

| Best discounts: American Family | $3,657 | 875 (above average) | 0.93 (good) |

| Best for military families: USAA | $1,785 | 906 (above average) | 2.26 (poor) |

Best overall: State Farm

Annual rate: $1,737

![]()

Pros

Cheapest average rate in Arizona for most homeowners

High overall satisfaction

Good discounts

Cons

Subpar complaint rating

State Farm offers excellent rates and has a high customer satisfaction rating. Its overall satisfaction rating is the highest of the insurers J.D. Power includes in its annual study.

While State Farm’s NAIC complaint rating could be better, it is still low in comparison to the size of the company.

Best policy offerings: Allstate

Annual rate: $3,331

![]()

Pros

Excellent optional features

Many discounts available

Cons

High complaint rating

While Allstate’s home insurance rates are slightly above the state average, its policy offerings can help lower your premium.

Allstate also offers great optional features that can help you save money. Allstate’s Rateguard shields you from a rate increase after your first claim. Allstate’s Deductible Rewards program can lower your deductible if you avoid making a claim.

Best discounts: American Family

Annual rate: $3,657

![]()

Pros

Great bundle discount

Discount is available for houses less than 15 years old

Loyalty discount is available just after one year with American Family

It has a good customer service history

Cons

American Family’s average home insurance rate is above average

American Family’s home insurance rates are higher than the state average, but it offers a good array of discounts to lower your rates. Their bundle discount can save you up to 20% on home insurance and 29% on auto insurance. Its satisfaction and complaint ratings also make the company worth a look.

Best for military families: USAA

Annual rate: $1,785

![]()

Pros

Second-cheapest homeowners insurance rates in Arizona

Active-duty service members get coverage for military equipment and uniforms

Personal property coverage at replacement cost

Cons

Only available to current and veteran military and their families

No dedicated agents

On top of offering an average home insurance rate that’s well below the state average, USAA has policy offerings aimed at active-duty and veteran military members.

Cost of home insurance in Arizona

The average cost of home insurance in Arizona is $2,623 a year, 6% cheaper than the national average of $2,801.

Several factors determine what you pay for a home insurance policy, including:

- Age of the home

- Construction materials used

- Your ZIP code

- Claim history

- Coverage limits and deductibles chosen

- Discounts you qualify for

While home insurance companies may offer similar policies, they rarely cost the same. This is because home insurance companies weigh rate and risk factors differently. One company may see your claim history as more of a risk than another company, for example.

To get the coverage you want at the cheapest price, compare home insurance quotes from several companies.

Home insurance rates by coverage amounts

The dwelling coverage limit you choose for your home insurance affects your premium. For example, there’s a $613 cost difference between a $350,000 and a $450,000 home insurance policy in Arizona. That’s an extra $51 a month.

| Dwelling limit | Average annual rate |

|---|---|

| $350,000 | $2,498 |

| $400,000 | $2,801 |

| $450,000 | $3,111 |

When choosing your dwelling coverage limit, you’ll want to make it equal to the replacement value of your home in the event of a total loss. This is usually less than the market value of the home.

Arizona home insurance rates by city

Among cities in Arizona, home insurance rates range from $2,080 in San Luis to $3,458 in Forest Lakes.

| City | Average annual rate |

|---|---|

| Aguila | $2,400 |

| Ajo | $2,585 |

| Ak-Chin Village | $2,722 |

| Alpine | $2,592 |

| Amado | $2,506 |

| Anthem | $2,489 |

| Apache Junction | $2,683 |

| Arizona City | $2,848 |

| Arizona Village | $2,475 |

| Arlington | $2,570 |

| Avenue B and C | $2,202 |

| Avondale | $2,524 |

| Avra Valley | $2,421 |

| Bagdad | $2,439 |

| Bapchule | $2,735 |

| Bellemont | $2,549 |

| Benson | $2,388 |

| Bisbee | $2,525 |

| Black Canyon City | $2,303 |

| Blackwater | $2,793 |

| Blue | $3,276 |

| Blue Gap | $2,435 |

| Bluewater | $2,310 |

| Bouse | $2,234 |

| Buckeye | $2,477 |

| Bullhead City | $2,316 |

| Bylas | $2,544 |

| Cactus Flats | $2,375 |

| Cameron | $2,579 |

| Camp Verde | $2,323 |

| Carefree | $2,410 |

| Casa Grande | $2,776 |

| Casas Adobes | $2,487 |

| Cashion | $2,424 |

| Catalina | $2,464 |

| Catalina Foothills | $2,447 |

| Cave Creek | $2,464 |

| Central | $2,478 |

| Central Heights-Midland City | $2,580 |

| Chambers | $2,474 |

| Chandler | $2,540 |

| Chandler Heights | $2,609 |

| Chinle | $2,466 |

| Chino Valley | $2,259 |

| Chloride | $2,316 |

| Cibecue | $2,777 |

| Cibola | $2,156 |

| Cienega Springs | $2,252 |

| Citrus Park | $2,424 |

| Clarkdale | $2,238 |

| Clay Springs | $2,914 |

| Claypool | $2,606 |

| Clifton | $2,389 |

| Cochise | $2,414 |

| Colorado City | $2,397 |

| Concho | $2,521 |

| Congress | $2,326 |

| Coolidge | $2,814 |

| Cordes Lakes | $2,506 |

| Cornville | $2,279 |

| Corona De Tucson | $2,412 |

| Cortaro | $2,432 |

| Cottonwood | $2,267 |

| Crown King | $2,581 |

| Dateland | $2,345 |

| Desert Hills | $2,366 |

| Dewey | $2,325 |

| Dilkon | $2,434 |

| Dolan Springs | $2,236 |

| Doney Park | $2,343 |

| Donovan Estates | $2,194 |

| Douglas | $2,294 |

| Dragoon | $2,420 |

| Drexel Heights | $2,371 |

| Dudleyville | $2,888 |

| Duncan | $2,473 |

| Eagar | $2,698 |

| Eden | $2,404 |

| Ehrenberg | $2,193 |

| El Mirage | $2,477 |

| Elfrida | $2,319 |

| Elgin | $3,172 |

| Eloy | $2,802 |

| Flagstaff | $2,469 |

| Florence | $2,794 |

| Flowing Wells | $2,503 |

| Forest Lakes | $3,458 |

| Fort Apache | $2,553 |

| Fort Defiance | $2,497 |

| Fort Huachuca | $2,467 |

| Fort Mcdowell | $2,498 |

| Fort Mohave | $2,376 |

| Fort Thomas | $2,464 |

| Fort Valley | $2,545 |

| Fortuna Foothills | $2,142 |

| Fountain Hills | $2,687 |

| Fredonia | $2,212 |

| Gadsden | $2,197 |

| Ganado | $2,433 |

| Gila Bend | $2,552 |

| Gilbert | $2,523 |

| Glendale | $2,625 |

| Globe | $2,586 |

| Gold Canyon | $2,662 |

| Golden Valley | $2,317 |

| Goodyear | $2,407 |

| Grand Canyon | $2,265 |

| Gray Mountain | $3,131 |

| Greasewood | $2,383 |

| Green Valley | $2,288 |

| Greer | $3,036 |

| Guadalupe | $2,751 |

| Hackberry | $2,264 |

| Happy Jack | $2,613 |

| Hayden | $2,652 |

| Heber | $2,476 |

| Hereford | $2,653 |

| Higley | $2,463 |

| Holbrook | $2,478 |

| Hotevilla | $2,431 |

| Houck | $2,444 |

| Huachuca City | $2,509 |

| Hualapai | $2,295 |

| Humboldt | $2,418 |

| Hunter Creek | $2,527 |

| Icehouse Canyon | $2,619 |

| Jerome | $2,411 |

| Joseph City | $2,480 |

| Kachina Village | $2,554 |

| Kaibeto | $2,331 |

| Kaka | $2,680 |

| Kayenta | $2,430 |

| Keams Canyon | $2,444 |

| Kearny | $2,772 |

| Kingman | $2,283 |

| Kirkland | $2,540 |

| Kykotsmovi Village | $2,309 |

| Lake Havasu City | $2,381 |

| Lake Montezuma | $2,644 |

| Lakeside | $2,830 |

| Laveen | $2,748 |

| Leupp | $2,410 |

| Linden | $2,669 |

| Litchfield Park | $2,404 |

| Littlefield | $2,277 |

| Low Mountain | $2,390 |

| Lower Santan Village | $2,492 |

| Lukachukai | $2,450 |

| Luke AFB | $2,456 |

| Lukeville | $2,541 |

| Lupton | $2,472 |

| Mammoth | $2,641 |

| Many Farms | $2,464 |

| Marana | $2,495 |

| Marble Canyon | $2,358 |

| Maricopa | $2,817 |

| Mayer | $2,504 |

| Mc Neal | $2,446 |

| McNary | $2,852 |

| Meadview | $2,275 |

| Mesa | $2,727 |

| Mescal | $2,384 |

| Miami | $2,606 |

| Moenkopi | $2,238 |

| Mohave Valley | $2,477 |

| Morenci | $2,353 |

| Mormon Lake | $2,506 |

| Morristown | $2,385 |

| Mount Lemmon | $2,766 |

| Mountainaire | $2,564 |

| Munds Park | $3,253 |

| Naco | $2,585 |

| Nazlini | $2,495 |

| New Kingman-Butler | $2,181 |

| New River | $2,534 |

| Nogales | $2,326 |

| North Rim | $2,444 |

| Nutrioso | $2,617 |

| Oatman | $2,329 |

| Oracle | $2,616 |

| Oro Valley | $2,498 |

| Overgaard | $2,512 |

| Page | $2,332 |

| Palo Verde | $2,568 |

| Paradise Valley | $2,897 |

| Parker | $2,301 |

| Parker Strip | $2,267 |

| Parks | $3,344 |

| Patagonia | $2,344 |

| Paulden | $2,267 |

| Payson | $2,469 |

| Peach Springs | $2,370 |

| Pearce | $2,331 |

| Peoria | $2,432 |

| Peridot | $3,025 |

| Petrified Forest National Park | $2,566 |

| Phoenix | $2,983 |

| Picacho | $2,784 |

| Picture Rocks | $2,455 |

| Pima | $2,384 |

| Pine | $2,826 |

| Pinedale | $2,540 |

| Pinetop | $2,857 |

| Pirtleville | $2,413 |

| Polacca | $2,324 |

| Pomerene | $2,370 |

| Portal | $2,325 |

| Poston | $2,283 |

| Prescott | $2,417 |

| Prescott Valley | $2,269 |

| Quartzsite | $2,266 |

| Queen Creek | $2,459 |

| Rainbow City | $2,811 |

| Red Rock | $2,655 |

| Red Valley | $2,502 |

| Rillito | $2,394 |

| Rimrock | $2,340 |

| Rincon Valley | $2,383 |

| Rio Rico | $2,276 |

| Rio Verde | $2,728 |

| Rock Point | $2,489 |

| Roll | $2,242 |

| Roosevelt | $2,675 |

| Round Rock | $2,500 |

| Sacaton | $2,733 |

| Saddlebrooke | $2,329 |

| Safford | $2,352 |

| Sahuarita | $2,427 |

| Salome | $2,146 |

| San Carlos | $2,585 |

| San Luis | $2,080 |

| San Manuel | $2,673 |

| San Simon | $2,325 |

| San Tan Valley | $2,515 |

| Sanders | $2,502 |

| Sasabe | $2,419 |

| Sawmill | $2,502 |

| Scottsdale | $2,834 |

| Second Mesa | $2,313 |

| Sedona | $2,352 |

| Seligman | $2,410 |

| Sells | $2,567 |

| Shonto | $2,391 |

| Show Low | $2,660 |

| Sierra Vista | $2,429 |

| Sierra Vista Southeast | $2,447 |

| Skull Valley | $2,562 |

| Snowflake | $2,409 |

| Solomon | $2,560 |

| Somerton | $2,129 |

| Sonoita | $2,504 |

| South Tucson | $2,428 |

| Springerville | $2,841 |

| St. David | $2,504 |

| St. Johns | $2,479 |

| St. Michaels | $2,403 |

| Stanfield | $2,720 |

| Strawberry | $2,825 |

| Summit | $2,396 |

| Sun City | $2,571 |

| Sun City West | $2,469 |

| Sun Lakes | $2,489 |

| Sun Valley | $2,461 |

| Supai | $2,307 |

| Superior | $2,907 |

| Surprise | $2,406 |

| Swift Trail Junction | $2,403 |

| Tacna | $2,214 |

| Tanque Verde | $2,480 |

| Taylor | $2,430 |

| Teec Nos Pos | $2,489 |

| Tempe | $2,761 |

| Temple Bar Marina | $2,317 |

| Thatcher | $2,395 |

| Tolleson | $2,535 |

| Tombstone | $2,427 |

| Tonalea | $2,319 |

| Tonopah | $2,523 |

| Tonto Basin | $2,423 |

| Topawa | $2,561 |

| Topock | $2,547 |

| Tortilla Flat | $2,941 |

| Tsaile | $2,486 |

| Tuba City | $2,222 |

| Tubac | $2,370 |

| Tucson | $2,500 |

| Tucson Estates | $2,459 |

| Tumacacori | $2,306 |

| Turkey Creek | $2,783 |

| Vail | $2,402 |

| Valencia West | $2,366 |

| Valentine | $2,540 |

| Valle Vista | $2,220 |

| Valley Farms | $2,969 |

| Verde Village | $2,267 |

| Vernon | $2,581 |

| Vicksburg | $2,170 |

| Waddell | $2,318 |

| Wall Lane | $2,118 |

| Wellton | $2,154 |

| Wenden | $2,147 |

| Whetstone | $2,514 |

| White Hills | $2,260 |

| White Mountain Lake | $2,673 |

| Whitecone | $2,477 |

| Whiteriver | $2,818 |

| Wickenburg | $2,292 |

| Wikieup | $2,237 |

| Willcox | $2,850 |

| Williams | $2,587 |

| Williamson | $2,437 |

| Willow Beach | $2,260 |

| Willow Valley | $2,470 |

| Window Rock | $2,483 |

| Winslow | $2,392 |

| Winslow West | $2,432 |

| Wittmann | $2,396 |

| Woodruff | $2,771 |

| Yarnell | $2,416 |

| Young | $2,564 |

| Youngtown | $2,677 |

| Yucca | $2,644 |

| Yuma | $2,165 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

Methodology

The rates shown in this article are based on nonbinding quotes collected from Quadrant Information Services. Your rates may vary. Average rates were compiled from rates in Arizona. The following coverages and deductibles were used unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

Customer satisfaction and claims satisfaction ratings obtained from the J.D. Power 2023 U.S. Home Insurance Study.

Complaint ratings come from National Association of Insurance Commissioners (NAIC) records for 2023. A confirmed complaint is one that leads to a finding of fault. A company with a 2.0 complaint rating has twice as many confirmed complaints as expected for its size. A company with a 0.5 rating has half as many.

*USAA is only available to active-duty and veteran military members and their families.