Best Homeowners Insurance in Illinois

Erie is the best home insurance company in Illinois due to its low average annual rate of $2,075 a year and excellent customer satisfaction scores. Nationwide, however, has the cheapest rates for most homeowners at an average rate of $1,545 a year.

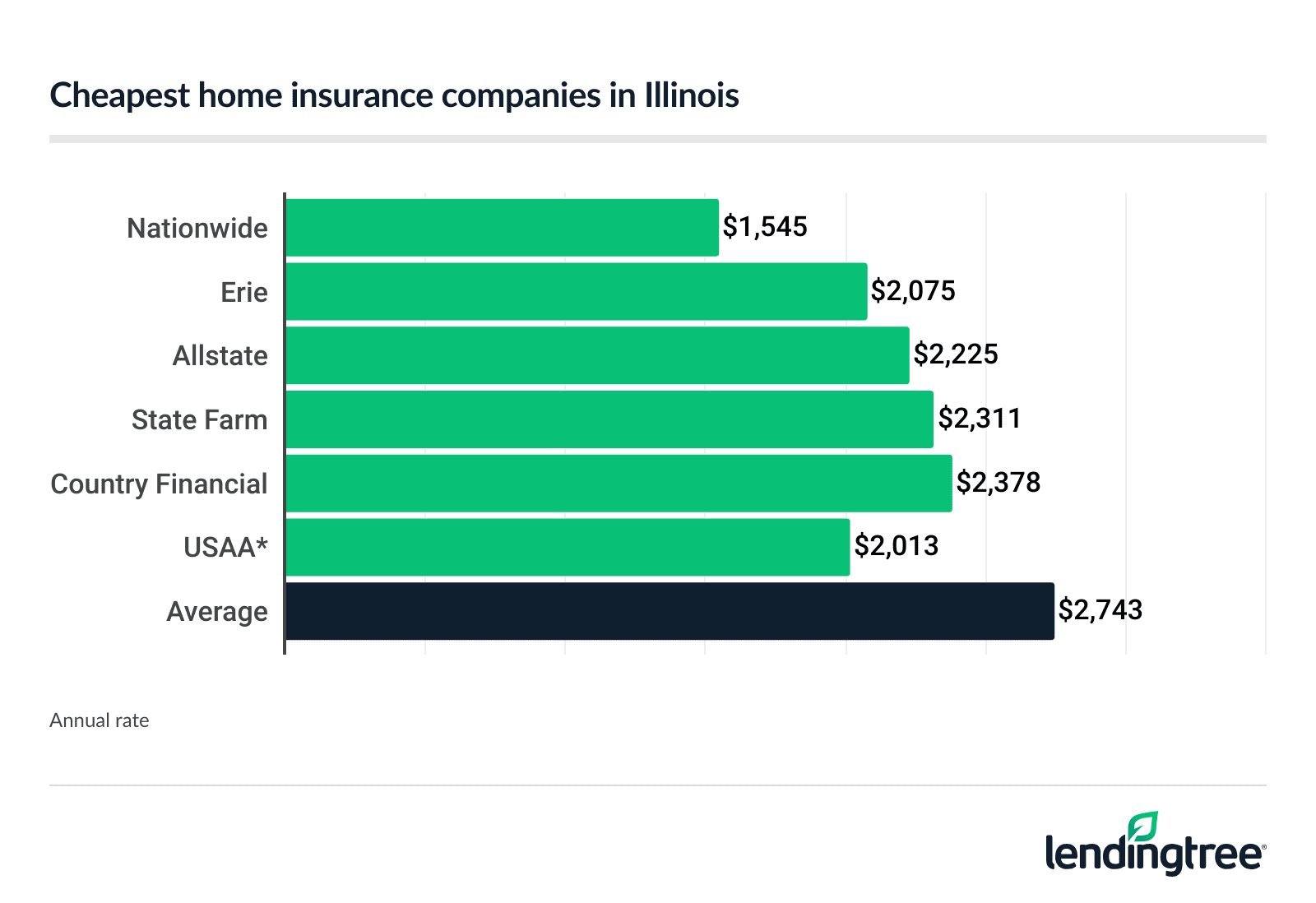

Illinois’ cheapest home insurance companies

Most Illinois homeowners get the cheapest home insurance coverage from Nationwide, which offers an average rate of $1,545 a year. This is 44% less than the state average of $2,743.

Although USAA is the second-cheapest home insurance company in Illinois, with rates of around $2,013 a year, it only sells insurance policies to current and veteran military.

Erie comes in second for most homeowners in Illinois. Its average rate is $2,075 a year, which is still quite a bit cheaper than the state average.

Cheapest Illinois home insurance rates

| Company | Average annual rate Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. | LendingTree score | |

|---|---|---|---|

| Nationwide | $1,545 | |

| Erie | $2,075 | |

| Allstate | $2,225 | |

| State Farm | $2,311 | |

| Country Financial | $2,378 | |

| Chubb | $2,444 | |

| American Family | $2,924 | |

| Farmers | $3,562 | |

| AAA | $5,948 | |

| USAA* | $2,013 |

Best homeowners insurance companies in Illinois

Erie is the best home insurance company in Illinois overall because of its affordable rates and great customer ratings.

You should compare quotes from some other companies as well, depending on your needs:

- Nationwide has the state’s lowest rates

- Chubb receives few customer complaints

- Allstate offers many discounts to save you money

- USAA is the best company for members of the military and their families

Illinois home insurance companies by cost and rating

| Company | Best for | Annual rate | Customer satisfaction score Source: J.D. Power 2024 U.S. Home Insurance Study. Higher is better; 640 is average. | Complaint rating Source: 2024 National Association of Insurance Commissioners (NAIC) Complaint Index. Lower is better; 1.0 is average. |

|---|---|---|---|---|

| Erie | Overall | $2,075 | 674 | 0.44 |

| Nationwide | Low rates | $1,545 | 641 | 1.3 |

| USAA* | Military | $2,013 | 737 | 0.37 |

| Chubb | Satisfaction | $2,444 | 688 | 0.08 |

| Allstate | Discounts | $2,225 | 631 | 1.07 |

Best overall home insurance in Illinois: Erie Insurance

Annual rate: $2,075

![]()

Pros

Low average rates

Excellent customer satisfaction scores

Several good add-on coverages

Cons

Fewer discounts than most competitors

No online quotes

Erie has the second-cheapest home insurance rates for most Illinois residents. It also makes its customers happy. Erie’s satisfaction rating from J.D. Power is the second highest of the companies we surveyed in Illinois.

Also noteworthy is Erie’s guaranteed replacement coverage. After a total loss, it covers the entire cost of rebuilding your home, even if that’s more than your dwelling coverage limit.

Best home insurance rates in Illinois: Nationwide

Annual rate: $1,545

![]()

Pros

State’s cheapest rates

Several home insurance discounts

Many optional coverages

Cons

Complaint rating is worse than average

No online chat with agents

Nationwide has the lowest rates for home insurance in Illinois, at an average of $1,545 a year. It also offers several good discounts, including ones for bundling and buying a new home, that can make your premium even cheaper.

Another reason to check out Nationwide is that it lets you customize your coverage more than most home insurance companies. Some of its many add-ons cover equipment breakdown, as well as water backup and service line damage.

Best for Illinois homeowners in the military: USAA

Annual rate: $2,013

Pros

Second-lowest rates in state

Excellent customer satisfaction

Few complaints

Military-specific coverages

Cons

Fewer discounts than many competitors

No personalized service

USAA’s agents are based in call centers, and you usually get a different agent each time you call.

USAA has a great reputation for affordable rates and top-notch customer service. It only sells insurance products to currently serving and veteran military and their families, though. If you fall into any of those categories, USAA is an excellent choice.

In fact, USAA offers coverage specifically for those in the military. This includes coverage, with no deductible, for uniforms and personal property that are damaged or lost due to war.

USAA has an affordable average rate of $2,013 a year for Illinois homeowners. It also scores well with customers. USAA’s satisfaction and complaint ratings with J.D. Power J.D. Power’s satisfaction scores are based on customer surveys rating companies on factors like price, coverage options and problem resolution. and the NAIC The NAIC rates companies on confirmed complaints by size. A confirmed complaint is one that leads to a finding of fault. are among the best of the companies we surveyed in Illinois.

Best complaint rating: Chubb

Annual rate: $2,444

Pros

Fewer customer complaints than competitors

Rates are cheaper than state average

Unique coverages for high-value homes

Cons

Not many discounts

Few add-on options

No mobile app

While Chubb’s average rate is higher than that of Nationwide, USAA and Erie, its complaint rating is the best of the companies we surveyed. This means Chubb receives many fewer customer complaints that are expected for a company of its size.

Something to keep in mind about Chubb is that it usually only insures high-value homes. This can depend on where you live, though, so talk with an agent to see if you can get a policy from Chubb.

Best for discounts: Allstate

Annual rate: $2,225

Pros

Affordable average rate

Lots of home insurance discounts

Several coverage add-ons

Cons

Customer satisfaction score is below average

Complaint rating also is below average

Allstate’s average rate for home insurance in Illinois is $2,225 a year. That’s more expensive than Nationwide and Erie, but Allstate has a great selection of discounts that could make it your cheapest option if you qualify for a few.

With Allstate, you could get a discount if you:

- Switch to Allstate without a recent claim

- Set up automatic payments

- Pay on time

- Buy a newly built home

- Bundle home and auto insurance

How much is home insurance in Illinois?

The average cost of homeowners insurance in Illinois is $2,743 a year. Your premium is based on many factors, including:

- Your home’s age

- Materials used to build it

- Crime rates and severe weather in your area

- Your insurance claim history

- Deductible and coverage limits

- Discounts

Home insurance companies weigh these risks differently, which is why you may get different quotes from each one. One of the best ways to get the most coverage at the lowest price is to compare home insurance quotes from several insurers.

Home insurance rates by coverage amounts

Part of the cost of your home insurance policy is based on the amount of dwelling coverage Dwelling coverage pays to repair or rebuild the structure of your home if a fire, hail or other event damages or destroys it. you need. The higher your dwelling coverage limit, the higher your premium will be, and vice versa.

Home insurance cost by dwelling coverage limit

| Coverage amount | Average annual rate |

|---|---|

| $350,000 | $2,472 |

| $400,000 | $2,743 |

| $450,000 | $3,022 |

No state law requires you to carry home insurance, but your mortgage lender will usually require it as part of your lending agreement.

Even if you don’t have a mortgage, home insurance is an excellent investment to protect yourself from a financial disaster.

Illinois home insurance rates by city

Of Illinois’ biggest cities, Naperville has the lowest average rate of $2,337 a year for home insurance. Chicago has the most expensive rate of $3,322 a year.

Cost of home insurance near you

| City | Average annual rate |

|---|---|

| Abingdon | $2,673 |

| Adair | $2,820 |

| Addieville | $3,082 |

| Addison | $2,328 |

| Albany | $2,433 |

| Albers | $2,944 |

| Albion | $3,222 |

| Aledo | $2,762 |

| Alexander | $2,825 |

| Alexis | $2,690 |

| Algonquin | $2,426 |

| Allendale | $3,158 |

| Allerton | $2,687 |

| Alorton | $3,531 |

| Alpha | $2,774 |

| Alsey | $2,830 |

| Alsip | $2,672 |

| Altamont | $2,698 |

| Alto Pass | $3,496 |

| Alton | $2,969 |

| Altona | $2,795 |

| Alvin | $2,740 |

| Amboy | $2,493 |

| Anchor | $2,474 |

| Ancona | $2,459 |

| Andalusia | $2,766 |

| Andover | $2,719 |

| Anna | $3,497 |

| Annapolis | $2,966 |

| Annawan | $2,722 |

| Antioch | $2,700 |

| Apple River | $2,577 |

| Arcola | $2,507 |

| Argenta | $2,617 |

| Arlington | $2,650 |

| Arlington Heights | $2,442 |

| Armington | $2,592 |

| Armstrong | $2,687 |

| Aroma Park | $2,715 |

| Arrowsmith | $2,490 |

| Arthur | $2,543 |

| Ashland | $2,791 |

| Ashley | $3,151 |

| Ashmore | $2,585 |

| Ashton | $2,513 |

| Assumption | $2,956 |

| Athens | $2,857 |

| Atkinson | $2,735 |

| Atlanta | $2,631 |

| Atwood | $2,636 |

| Auburn | $2,735 |

| Augusta | $2,818 |

| Aurora | $2,360 |

| Ava | $3,524 |

| Aviston | $2,888 |

| Avon | $2,801 |

| Baileyville | $2,472 |

| Bannockburn | $2,696 |

| Bardolph | $2,755 |

| Barnhill | $3,393 |

| Barrington | $2,449 |

| Barrington Hills | $2,439 |

| Barry | $2,867 |

| Barstow | $2,709 |

| Bartelso | $2,892 |

| Bartlett | $2,357 |

| Bartonville | $2,567 |

| Basco | $2,732 |

| Batavia | $2,289 |

| Batchtown | $2,946 |

| Bay View Gardens | $2,454 |

| Baylis | $2,784 |

| Beach Park | $2,597 |

| Beardstown | $2,715 |

| Beason | $2,616 |

| Beckemeyer | $2,868 |

| Bedford Park | $2,571 |

| Beecher | $2,588 |

| Beecher City | $2,845 |

| Belknap | $3,592 |

| Belle Rive | $3,361 |

| Belleville | $2,900 |

| Bellevue | $2,581 |

| Bellmont | $3,129 |

| Bellwood | $2,944 |

| Belvidere | $2,444 |

| Bement | $2,773 |

| Benld | $2,872 |

| Bensenville | $2,336 |

| Benson | $2,483 |

| Benton | $3,541 |

| Berkeley | $2,556 |

| Berwick | $2,648 |

| Berwyn | $2,576 |

| Bethalto | $2,950 |

| Bethany | $2,750 |

| Bingham | $2,856 |

| Bishop Hill | $2,750 |

| Bismarck | $2,722 |

| Blackstone | $2,507 |

| Blandinsville | $2,792 |

| Bloomingdale | $2,403 |

| Bloomington | $2,422 |

| Blue Island | $2,739 |

| Blue Mound | $2,624 |

| Bluff Springs | $2,742 |

| Bluffs | $2,932 |

| Bluford | $3,349 |

| Boles | $3,462 |

| Bolingbrook | $2,486 |

| Bolivia | $2,796 |

| Bondville | $2,391 |

| Bone Gap | $3,231 |

| Bonfield | $2,760 |

| Bonnie | $3,342 |

| Boody | $2,510 |

| Boulder Hill | $2,348 |

| Bourbonnais | $2,647 |

| Bowen | $2,789 |

| Braceville | $2,624 |

| Bradford | $2,679 |

| Bradley | $2,668 |

| Braidwood | $2,610 |

| Breese | $2,853 |

| Bridgeport | $3,172 |

| Bridgeview | $2,587 |

| Brighton | $2,865 |

| Brimfield | $2,539 |

| Bristol | $2,346 |

| Broadlands | $2,486 |

| Broadview | $2,875 |

| Brocton | $2,746 |

| Brookfield | $2,454 |

| Brooklyn | $3,221 |

| Brookport | $3,553 |

| Broughton | $3,477 |

| Browns | $3,257 |

| Brownstown | $2,889 |

| Brussels | $2,943 |

| Bryant | $2,807 |

| Buckingham | $2,736 |

| Buckley | $2,558 |

| Buckner | $3,567 |

| Buda | $2,705 |

| Buffalo | $2,803 |

| Buffalo Grove | $2,491 |

| Buffalo Prairie | $2,713 |

| Bulpitt | $2,853 |

| Buncombe | $3,610 |

| Bunker Hill | $2,883 |

| Burbank | $2,631 |

| Bureau | $2,650 |

| Burlington | $2,429 |

| Burnham | $3,420 |

| Burnt Prairie | $3,384 |

| Burr Ridge | $2,296 |

| Bushnell | $2,740 |

| Butler | $2,939 |

| Byron | $2,429 |

| Cabery | $2,398 |

| Cahokia | $3,512 |

| Cairo | $3,552 |

| Calhoun | $3,079 |

| Calumet City | $2,893 |

| Calumet Park | $2,758 |

| Camargo | $2,532 |

| Cambria | $3,517 |

| Cambridge | $2,772 |

| Camden | $2,789 |

| Cameron | $2,654 |

| Camp Grove | $2,530 |

| Camp Point | $2,904 |

| Campbell Hill | $3,478 |

| Campton Hills | $2,291 |

| Campus | $2,436 |

| Canton | $2,803 |

| Cantrall | $2,749 |

| Capron | $2,505 |

| Carbon Cliff | $2,692 |

| Carbondale | $3,443 |

| Carlinville | $2,888 |

| Carlock | $2,452 |

| Carlyle | $2,881 |

| Carmi | $3,406 |

| Carol Stream | $2,413 |

| Carpentersville | $2,388 |

| Carrier Mills | $3,496 |

| Carterville | $3,504 |

| Carthage | $2,742 |

| Cary | $2,444 |

| Casey | $3,017 |

| Caseyville | $3,298 |

| Castleton | $2,562 |

| Catlin | $2,657 |

| Cedar Point | $2,489 |

| Cedarville | $2,386 |

| Central City | $3,081 |

| Centralia | $2,955 |

| Centreville | $3,549 |

| Cerro Gordo | $2,761 |

| Chadwick | $2,537 |

| Chambersburg | $2,738 |

| Champaign | $2,355 |

| Chana | $2,470 |

| Channahon | $2,595 |

| Channel Lake | $2,707 |

| Charleston | $2,524 |

| Chatham | $2,702 |

| Chenoa | $2,495 |

| Cherry | $2,652 |

| Cherry Valley | $2,378 |

| Chester | $2,749 |

| Chesterfield | $2,884 |

| Chestnut | $2,695 |

| Chicago | $3,322 |

| Chicago Heights | $2,859 |

| Chicago Ridge | $2,624 |

| Chillicothe | $2,472 |

| Chrisman | $2,786 |

| Christopher | $3,542 |

| Cicero | $2,648 |

| Cisco | $2,781 |

| Cisne | $3,437 |

| Cissna Park | $2,508 |

| Clare | $2,374 |

| Claremont | $3,064 |

| Clarendon Hills | $2,240 |

| Clayton | $2,883 |

| Claytonville | $2,526 |

| Clifton | $2,539 |

| Clinton | $2,717 |

| Coal City | $2,644 |

| Coal Valley | $2,704 |

| Coatsburg | $2,907 |

| Cobden | $3,539 |

| Coello | $3,429 |

| Coffeen | $2,918 |

| Colchester | $2,853 |

| Colfax | $2,508 |

| Collinsville | $2,989 |

| Collison | $2,711 |

| Colona | $2,681 |

| Colp | $3,452 |

| Columbia | $2,650 |

| Colusa | $2,706 |

| Compton | $2,460 |

| Congerville | $2,438 |

| Cooksville | $2,473 |

| Cornell | $2,505 |

| Cornland | $2,667 |

| Cortland | $2,314 |

| Cottage Hills | $2,954 |

| Coulterville | $2,799 |

| Country Club Hills | $2,867 |

| Countryside | $2,435 |

| Cowden | $2,825 |

| Crainville | $3,508 |

| Crescent City | $2,559 |

| Crest Hill | $2,488 |

| Creston | $2,383 |

| Crestwood | $2,681 |

| Crete | $2,627 |

| Creve Coeur | $2,577 |

| Cropsey | $2,473 |

| Crossville | $3,425 |

| Crystal Lake | $2,453 |

| Crystal Lawns | $2,548 |

| Cuba | $2,883 |

| Cullom | $2,571 |

| Cutler | $3,100 |

| Cypress | $3,663 |

| Dahinda | $2,725 |

| Dakota | $2,432 |

| Dalton City | $2,732 |

| Dalzell | $2,636 |

| Dana | $2,493 |

| Danvers | $2,561 |

| Danville | $2,586 |

| Darien | $2,264 |

| Davis | $2,363 |

| Davis Junction | $2,475 |

| Dawson | $2,788 |

| De Land | $2,765 |

| De Pue | $2,666 |

| De Soto | $3,464 |

| De Witt | $2,702 |

| Decatur | $2,524 |

| Deer Grove | $2,430 |

| Deer Park | $2,428 |

| Deerfield | $2,644 |

| DeKalb | $2,283 |

| Delavan | $2,617 |

| Dennison | $3,149 |

| Des Plaines | $2,554 |

| Dewey | $2,409 |

| Diamond | $2,643 |

| Dieterich | $2,746 |

| Dix | $3,335 |

| Dixmoor | $2,899 |

| Dixon | $2,434 |

| Dolton | $2,867 |

| Dongola | $3,656 |

| Donnellson | $2,872 |

| Donovan | $2,550 |

| Dorsey | $2,934 |

| Dover | $2,643 |

| Dow | $2,938 |

| Dowell | $3,483 |

| Downers Grove | $2,268 |

| Downs | $2,506 |

| Du Quoin | $3,060 |

| Dundas | $2,997 |

| Dunfermline | $2,804 |

| Dunlap | $2,486 |

| Dupo | $3,018 |

| Durand | $2,471 |

| Dwight | $2,458 |

| Eagarville | $2,790 |

| Earlville | $2,506 |

| East Alton | $2,958 |

| East Carondelet | $2,985 |

| East Dubuque | $2,595 |

| East Dundee | $2,408 |

| East Galesburg | $2,700 |

| East Hazel Crest | $2,848 |

| East Lynn | $2,614 |

| East Moline | $2,691 |

| East Peoria | $2,545 |

| East St. Louis | $3,561 |

| Easton | $2,828 |

| Eddyville | $3,485 |

| Edelstein | $2,498 |

| Edgewood | $2,732 |

| Edinburg | $2,907 |

| Edwards | $2,591 |

| Edwardsville | $2,960 |

| Effingham | $2,649 |

| Elburn | $2,308 |

| Eldena | $2,433 |

| Eldorado | $3,501 |

| Eldred | $3,038 |

| Eleroy | $2,381 |

| Elgin | $2,410 |

| Elizabeth | $2,672 |

| Elizabethtown | $3,561 |

| Elk Grove Village | $2,447 |

| Elkville | $3,579 |

| Ellery | $3,232 |

| Elliott | $2,356 |

| Ellisville | $2,863 |

| Ellsworth | $2,493 |

| Elmhurst | $2,282 |

| Elmwood | $2,459 |

| Elmwood Park | $2,518 |

| Elvaston | $2,732 |

| Elwin | $2,531 |

| Elwood | $2,647 |

| Emden | $2,683 |

| Emington | $2,464 |

| Emma | $3,334 |

| Energy | $3,521 |

| Eola | $2,335 |

| Esmond | $2,341 |

| Essex | $2,736 |

| Eureka | $2,445 |

| Evanston | $2,491 |

| Evansville | $2,844 |

| Evergreen Park | $2,654 |

| Ewing | $3,642 |

| Fairbury | $2,415 |

| Fairfield | $3,459 |

| Fairmont | $2,548 |

| Fairmont City | $3,556 |

| Fairmount | $2,720 |

| Fairview Heights | $2,937 |

| Farina | $2,968 |

| Farmer City | $2,683 |

| Farmersville | $2,894 |

| Farmington | $2,787 |

| Fenton | $2,466 |

| Ferris | $2,749 |

| Fiatt | $2,787 |

| Fidelity | $2,893 |

| Fieldon | $2,953 |

| Findlay | $2,756 |

| Fisher | $2,433 |

| Fithian | $2,704 |

| Flanagan | $2,490 |

| Flat Rock | $2,997 |

| Flora | $3,183 |

| Flossmoor | $2,730 |

| Foosland | $2,417 |

| Ford Heights | $2,865 |

| Forest City | $2,858 |

| Forest Lake | $2,686 |

| Forest Park | $2,914 |

| Forest View | $2,575 |

| Forrest | $2,519 |

| Forreston | $2,490 |

| Forsyth | $2,531 |

| Fort Sheridan | $2,646 |

| Fowler | $2,888 |

| Fox Lake | $2,679 |

| Fox Lake Hills | $2,572 |

| Fox River Grove | $2,465 |

| Fox Valley | $2,483 |

| Frankfort | $2,580 |

| Frankfort Heights | $3,417 |

| Frankfort Square | $2,579 |

| Franklin Grove | $2,539 |

| Franklin Park | $2,540 |

| Frederick | $2,736 |

| Freeburg | $2,891 |

| Freeman Spur | $3,434 |

| Freeport | $2,361 |

| Fulton | $2,402 |

| Fults | $2,714 |

| Gages Lake | $2,545 |

| Galatia | $3,560 |

| Galena | $2,556 |

| Galesburg | $2,664 |

| Galt | $2,379 |

| Galva | $2,704 |

| Garden Prairie | $2,489 |

| Gardner | $2,654 |

| Gays | $2,681 |

| Geff | $3,511 |

| Geneseo | $2,647 |

| Geneva | $2,287 |

| Genoa | $2,324 |

| Georgetown | $2,670 |

| Gerlaw | $2,628 |

| German Valley | $2,417 |

| Germantown | $2,903 |

| Germantown Hills | $2,470 |

| Gibson City | $2,347 |

| Gifford | $2,371 |

| Gilberts | $2,382 |

| Gillespie | $2,872 |

| Gilman | $2,558 |

| Gilson | $2,712 |

| Girard | $2,856 |

| Glasford | $2,515 |

| Glen Carbon | $2,983 |

| Glen Ellyn | $2,301 |

| Glenarm | $2,724 |

| Glencoe | $2,485 |

| Glendale Heights | $2,372 |

| Glenview | $2,456 |

| Glenwood | $2,799 |

| Godfrey | $2,962 |

| Golconda | $3,545 |

| Golden | $2,934 |

| Golden Eagle | $2,910 |

| Golden Gate | $3,411 |

| Golf | $2,532 |

| Good Hope | $2,836 |

| Goodfield | $2,441 |

| Goodwine | $2,481 |

| Goreville | $3,522 |

| Gorham | $3,498 |

| Grafton | $2,961 |

| Grand Ridge | $2,524 |

| Grandview | $2,702 |

| Grandwood Park | $2,581 |

| Granite City | $3,086 |

| Grant Park | $2,707 |

| Grantsburg | $3,517 |

| Granville | $2,485 |

| Graymont | $2,463 |

| Grayslake | $2,503 |

| Grayville | $3,327 |

| Great Lakes | $2,591 |

| Green Oaks | $2,541 |

| Green Valley | $2,624 |

| Greenfield | $3,110 |

| Greenup | $3,015 |

| Greenview | $2,803 |

| Greenville | $2,849 |

| Greenwood | $2,490 |

| Griggsville | $2,821 |

| Gurnee | $2,566 |

| Hagaman | $2,884 |

| Hagarstown | $2,799 |

| Hainesville | $2,501 |

| Hamburg | $2,914 |

| Hamel | $3,090 |

| Hamilton | $2,703 |

| Hammond | $2,744 |

| Hampshire | $2,389 |

| Hampton | $2,687 |

| Hanna City | $2,617 |

| Hanover Park | $2,383 |

| Hardin | $2,905 |

| Harrisburg | $3,451 |

| Harrison | $3,455 |

| Harristown | $2,538 |

| Hartford | $2,974 |

| Hartsburg | $2,633 |

| Harvard | $2,470 |

| Harvey | $3,043 |

| Harwood Heights | $2,499 |

| Havana | $2,787 |

| Hawthorn Woods | $2,656 |

| Hazel Crest | $2,855 |

| Hebron | $2,479 |

| Hecker | $2,668 |

| Hennepin | $2,571 |

| Henning | $2,590 |

| Henry | $2,502 |

| Heritage Lake | $2,535 |

| Herod | $3,504 |

| Herrin | $3,520 |

| Herscher | $2,721 |

| Hettick | $2,855 |

| Heyworth | $2,449 |

| Hickory Hills | $2,591 |

| Hidalgo | $3,010 |

| Highland | $2,995 |

| Highland Park | $2,709 |

| Highwood | $2,594 |

| Hillsboro | $2,860 |

| Hillsdale | $2,756 |

| Hillside | $2,507 |

| Hillview | $3,045 |

| Hinckley | $2,311 |

| Hindsboro | $2,579 |

| Hines | $2,943 |

| Hinsdale | $2,283 |

| Hodgkins | $2,445 |

| Hoffman | $2,872 |

| Hoffman Estates | $2,499 |

| Holcomb | $2,406 |

| Holiday Shores | $2,975 |

| Homer | $2,485 |

| Homer Glen | $2,448 |

| Hometown | $2,642 |

| Homewood | $2,833 |

| Hoopeston | $2,599 |

| Hooppole | $2,665 |

| Hopkins Park | $2,649 |

| Hoyleton | $3,125 |

| Hudson | $2,426 |

| Huey | $2,827 |

| Hull | $2,827 |

| Humboldt | $2,553 |

| Hume | $2,776 |

| Huntley | $2,432 |

| Hurst | $3,538 |

| Hutsonville | $2,963 |

| Illinois City | $2,783 |

| Illiopolis | $2,817 |

| Ina | $3,330 |

| Indian Head Park | $2,438 |

| Indianola | $2,721 |

| Ingalls Park | $2,612 |

| Ingleside | $2,722 |

| Ingraham | $3,181 |

| Inverness | $2,455 |

| Ipava | $2,838 |

| Iroquois | $2,505 |

| Irvington | $3,037 |

| Island Lake | $2,564 |

| Itasca | $2,357 |

| Ivesdale | $2,433 |

| Jacksonville | $2,804 |

| Jacob | $3,535 |

| Janesville | $2,985 |

| Jerome | $2,714 |

| Jerseyville | $2,911 |

| Jewett | $3,011 |

| Johnsburg | $2,463 |

| Johnsonville | $3,481 |

| Johnston City | $3,509 |

| Joliet | $2,544 |

| Jonesboro | $3,605 |

| Joppa | $3,471 |

| Joy | $2,723 |

| Junction | $3,486 |

| Justice | $2,512 |

| Kampsville | $3,004 |

| Kane | $3,000 |

| Kaneville | $2,375 |

| Kankakee | $2,709 |

| Kansas | $2,819 |

| Karbers Ridge | $3,434 |

| Kasbeer | $2,668 |

| Keenes | $3,503 |

| Keensburg | $3,163 |

| Keithsburg | $2,742 |

| Kell | $3,169 |

| Kempton | $2,416 |

| Kenilworth | $2,445 |

| Kenney | $2,746 |

| Kent | $2,399 |

| Kewanee | $2,683 |

| Keyesport | $2,925 |

| Kildeer | $2,664 |

| Kincaid | $2,882 |

| Kinderhook | $2,840 |

| Kingston Mines | $2,529 |

| Kinmundy | $3,216 |

| Kinsman | $2,685 |

| Kirkland | $2,337 |

| Kirkwood | $2,697 |

| Knollwood | $2,579 |

| Knoxville | $2,665 |

| La Fayette | $2,585 |

| La Grange | $2,429 |

| La Grange Park | $2,443 |

| La Place | $2,724 |

| La Prairie | $2,874 |

| La Rose | $2,475 |

| Laclede | $2,732 |

| Lacon | $2,567 |

| Ladd | $2,660 |

| Lafox | $2,369 |

| Lake Barrington | $2,438 |

| Lake Bluff | $2,588 |

| Lake Forest | $2,587 |

| Lake Fork | $2,623 |

| Lake Holiday | $2,420 |

| Lake in the Hills | $2,468 |

| Lake of the Woods | $2,317 |

| Lake Petersburg | $2,795 |

| Lake Villa | $2,568 |

| Lake Zurich | $2,678 |

| Lakemoor | $2,573 |

| Lakewood | $2,467 |

| Lakewood Shores | $2,620 |

| Lanark | $2,512 |

| Lane | $2,719 |

| Lansing | $2,753 |

| LaSalle | $2,459 |

| Latham | $2,692 |

| Laura | $2,535 |

| Lawndale | $2,534 |

| Lawrenceville | $3,212 |

| Le Roy | $2,474 |

| Lebanon | $2,892 |

| Lee | $2,433 |

| Lee Center | $2,491 |

| Leland | $2,482 |

| Leland Grove | $2,705 |

| Lemont | $2,448 |

| Lena | $2,394 |

| Lenzburg | $2,968 |

| Leonore | $2,482 |

| Lerna | $2,748 |

| Lewistown | $2,871 |

| Lexington | $2,494 |

| Libertyville | $2,538 |

| Lima | $2,869 |

| Lincoln | $2,576 |

| Lincoln's New Salem | $2,774 |

| Lincolnshire | $2,534 |

| Lincolnwood | $2,453 |

| Lindenhurst | $2,569 |

| Lindenwood | $2,487 |

| Lisle | $2,473 |

| Litchfield | $2,889 |

| Literberry | $2,805 |

| Little York | $2,647 |

| Littleton | $2,808 |

| Liverpool | $2,808 |

| Livingston | $3,042 |

| Loami | $2,817 |

| Lockport | $2,535 |

| Loda | $2,502 |

| Logan | $3,420 |

| Lomax | $2,802 |

| Lombard | $2,353 |

| London Mills | $2,828 |

| Long Grove | $2,603 |

| Long Lake | $2,524 |

| Long Point | $2,492 |

| Longview | $2,478 |

| Loraine | $2,882 |

| Lostant | $2,563 |

| Louisville | $3,217 |

| Lovejoy | $3,145 |

| Loves Park | $2,416 |

| Lowder | $2,759 |

| Lowpoint | $2,456 |

| Lynn Center | $2,749 |

| Lynwood | $2,859 |

| Lyons | $2,468 |

| Macedonia | $3,443 |

| Machesney Park | $2,452 |

| Mackinaw | $2,539 |

| Macomb | $2,747 |

| Macon | $2,613 |

| Madison | $3,255 |

| Maeystown | $2,655 |

| Magnolia | $2,510 |

| Mahomet | $2,320 |

| Malden | $2,744 |

| Malta | $2,344 |

| Manchester | $2,827 |

| Manhattan | $2,581 |

| Manito | $2,785 |

| Manlius | $2,682 |

| Mansfield | $2,681 |

| Manteno | $2,661 |

| Maple Park | $2,375 |

| Mapleton | $2,600 |

| Marengo | $2,473 |

| Marietta | $2,813 |

| Marine | $3,054 |

| Marion | $3,488 |

| Marissa | $3,004 |

| Mark | $2,482 |

| Markham | $2,970 |

| Maroa | $2,644 |

| Marquette Heights | $2,575 |

| Marseilles | $2,491 |

| Marshall | $3,103 |

| Martinsville | $3,071 |

| Maryville | $3,015 |

| Mascoutah | $2,918 |

| Mason | $2,757 |

| Mason City | $2,804 |

| Matherville | $2,672 |

| Matteson | $2,547 |

| Mattoon | $2,462 |

| Maunie | $3,364 |

| Maywood | $2,912 |

| Mazon | $2,683 |

| Mc Connell | $2,444 |

| McHenry | $2,439 |

| McLean | $2,538 |

| McLeansboro | $3,470 |

| McNabb | $2,519 |

| Mechanicsburg | $2,796 |

| Medinah | $2,348 |

| Medora | $2,893 |

| Melrose Park | $2,584 |

| Melvin | $2,444 |

| Menard | $2,711 |

| Mendon | $2,865 |

| Mendota | $2,483 |

| Meredosia | $2,852 |

| Merna | $2,499 |

| Merrionette Park | $2,644 |

| Metamora | $2,477 |

| Metcalf | $2,835 |

| Metropolis | $3,484 |

| Mettawa | $2,583 |

| Michael | $2,885 |

| Middletown | $2,707 |

| Midlothian | $2,674 |

| Milan | $2,716 |

| Milford | $2,553 |

| Mill Shoals | $3,346 |

| Millbrook | $2,392 |

| Milledgeville | $2,582 |

| Miller City | $3,555 |

| Millington | $2,387 |

| Millstadt | $2,954 |

| Milmine | $2,739 |

| Mineral | $2,726 |

| Minier | $2,581 |

| Minonk | $2,483 |

| Minooka | $2,573 |

| Mitchell | $3,081 |

| Mode | $2,813 |

| Modesto | $2,919 |

| Modoc | $2,814 |

| Mokena | $2,492 |

| Moline | $2,697 |

| Momence | $2,690 |

| Monee | $2,633 |

| Monmouth | $2,604 |

| Monroe Center | $2,435 |

| Montgomery | $2,330 |

| Monticello | $2,668 |

| Montrose | $2,982 |

| Mooseheart | $2,301 |

| Morris | $2,652 |

| Morrison | $2,414 |

| Morrisonville | $2,960 |

| Morton | $2,514 |

| Morton Grove | $2,442 |

| Mossville | $2,498 |

| Mound City | $3,596 |

| Mounds | $3,527 |

| Mount Auburn | $2,923 |

| Mount Carmel | $3,094 |

| Mount Carroll | $2,555 |

| Mount Erie | $3,463 |

| Mount Morris | $2,397 |

| Mount Olive | $2,844 |

| Mount Prospect | $2,433 |

| Mount Pulaski | $2,659 |

| Mount Sterling | $2,699 |

| Mount Vernon | $3,235 |

| Mount Zion | $2,538 |

| Moweaqua | $2,847 |

| Mozier | $2,912 |

| Muddy | $3,427 |

| Mulberry Grove | $2,918 |

| Mulkeytown | $3,603 |

| Muncie | $2,590 |

| Mundelein | $2,638 |

| Murdock | $2,589 |

| Murphysboro | $3,457 |

| Nachusa | $2,452 |

| Naperville | $2,337 |

| Nashville | $3,061 |

| Nason | $3,245 |

| National Stock Yards | $3,118 |

| Nauvoo | $2,776 |

| Nebo | $2,853 |

| Neoga | $2,937 |

| Neponset | $2,734 |

| New Athens | $2,927 |

| New Baden | $2,866 |

| New Bedford | $2,673 |

| New Berlin | $2,788 |

| New Burnside | $3,652 |

| New Canton | $2,872 |

| New Douglas | $3,035 |

| New Haven | $3,470 |

| New Holland | $2,686 |

| New Lenox | $2,466 |

| New Memphis | $2,831 |

| New Milford | $2,436 |

| New Salem | $2,758 |

| New Windsor | $2,750 |

| Newark | $2,444 |

| Newman | $2,566 |

| Newton | $2,941 |

| Niantic | $2,643 |

| Niles | $2,445 |

| Nilwood | $2,832 |

| Niota | $2,772 |

| Noble | $3,069 |

| Nokomis | $2,905 |

| Nora | $2,566 |

| Normal | $2,446 |

| Norridge | $2,499 |

| Norris | $2,796 |

| Norris City | $3,435 |

| North Aurora | $2,319 |

| North Barrington | $2,456 |

| North Chicago | $2,582 |

| North City | $3,545 |

| North Pekin | $2,575 |

| North Riverside | $2,481 |

| North Utica | $2,550 |

| Northbrook | $2,427 |

| Northfield | $2,436 |

| Northlake | $2,611 |

| O'Fallon | $2,917 |

| Oak Brook | $2,272 |

| Oak Forest | $2,668 |

| Oak Lawn | $2,609 |

| Oak Park | $2,573 |

| Oakbrook Terrace | $2,306 |

| Oakdale | $3,053 |

| Oakford | $2,819 |

| Oakland | $2,586 |

| Oakwood | $2,648 |

| Oakwood Hills | $2,443 |

| Odell | $2,533 |

| Odin | $3,150 |

| Oglesby | $2,461 |

| Ohlman | $2,834 |

| Okawville | $3,103 |

| Olive Branch | $3,582 |

| Olivet | $2,766 |

| Olmsted | $3,534 |

| Olney | $2,980 |

| Olympia Fields | $2,672 |

| Onarga | $2,562 |

| Oneida | $2,767 |

| Opdyke | $3,297 |

| Ophiem | $2,751 |

| Oquawka | $2,778 |

| Orangeville | $2,472 |

| Oraville | $3,421 |

| Oreana | $2,604 |

| Oregon | $2,398 |

| Orient | $3,454 |

| Orion | $2,691 |

| Orland Hills | $2,456 |

| Orland Park | $2,389 |

| Oswego | $2,304 |

| Ottawa | $2,463 |

| Owaneco | $2,936 |

| Palatine | $2,427 |

| Palestine | $3,004 |

| Palmer | $2,947 |

| Palmyra | $2,853 |

| Paloma | $2,860 |

| Palos Heights | $2,578 |

| Palos Hills | $2,579 |

| Palos Park | $2,485 |

| Pana | $2,871 |

| Panama | $2,855 |

| Papineau | $2,513 |

| Paris | $2,790 |

| Park City | $2,614 |

| Park Forest | $2,573 |

| Park Ridge | $2,492 |

| Parkersburg | $3,077 |

| Patoka | $3,231 |

| Patterson | $2,969 |

| Paw Paw | $2,478 |

| Pawnee | $2,766 |

| Paxton | $2,305 |

| Payson | $2,917 |

| Pearl | $2,863 |

| Pearl City | $2,426 |

| Pecatonica | $2,437 |

| Pekin | $2,577 |

| Pembroke Township | $2,720 |

| Penfield | $2,440 |

| Peoria | $2,525 |

| Peoria Heights | $2,452 |

| Peotone | $2,607 |

| Percy | $2,847 |

| Perks | $3,435 |

| Perry | $2,773 |

| Peru | $2,432 |

| Petersburg | $2,806 |

| Philo | $2,408 |

| Phoenix | $3,056 |

| Piasa | $2,910 |

| Pierron | $2,833 |

| Pinckneyville | $3,089 |

| Piper City | $2,419 |

| Pistakee Highlands | $2,459 |

| Pittsburg | $3,614 |

| Pittsfield | $2,806 |

| Plainfield | $2,469 |

| Plainville | $2,901 |

| Plano | $2,380 |

| Plato Center | $2,397 |

| Pleasant Hill | $2,900 |

| Pleasant Plains | $2,752 |

| Plymouth | $2,795 |

| Pocahontas | $2,940 |

| Polo | $2,446 |

| Pomona | $3,517 |

| Pontiac | $2,395 |

| Pontoon Beach | $3,074 |

| Poplar Grove | $2,458 |

| Port Barrington | $2,566 |

| Port Byron | $2,709 |

| Posen | $2,892 |

| Potomac | $2,694 |

| Prairie du Rocher | $2,814 |

| Prairie Grove | $2,446 |

| Preemption | $2,624 |

| Prestbury | $2,294 |

| Preston Heights | $2,638 |

| Princeton | $2,635 |

| Prophetstown | $2,438 |

| Prospect Heights | $2,460 |

| Putnam | $2,522 |

| Quincy | $2,770 |

| Radom | $3,025 |

| Raleigh | $3,524 |

| Rankin | $2,663 |

| Ransom | $2,560 |

| Rantoul | $2,339 |

| Rapids City | $2,710 |

| Raritan | $2,719 |

| Raymond | $2,943 |

| Red Bud | $2,680 |

| Reddick | $2,674 |

| Redmon | $2,668 |

| Renault | $2,684 |

| Reynolds | $2,752 |

| Richmond | $2,462 |

| Richton Park | $2,564 |

| Ridge Farm | $2,769 |

| Rinard | $3,416 |

| Ringwood | $2,493 |

| River Forest | $2,605 |

| River Grove | $2,531 |

| Riverdale | $2,798 |

| Riverside | $2,465 |

| Riverton | $2,768 |

| Riverwoods | $2,693 |

| Robbins | $2,792 |

| Roberts | $2,426 |

| Robinson | $2,890 |

| Roby | $2,796 |

| Rochelle | $2,369 |

| Rochester | $2,682 |

| Rock City | $2,428 |

| Rock Falls | $2,354 |

| Rock Island | $2,693 |

| Rockbridge | $3,038 |

| Rockdale | $2,632 |

| Rockford | $2,479 |

| Rockport | $2,883 |

| Rockton | $2,366 |

| Rockwood | $2,849 |

| Rolling Meadows | $2,420 |

| Rome | $2,477 |

| Romeoville | $2,544 |

| Roodhouse | $3,079 |

| Rosamond | $2,901 |

| Roscoe | $2,373 |

| Roselle | $2,398 |

| Rosemont | $2,561 |

| Roseville | $2,664 |

| Rosewood Heights | $2,967 |

| Rosiclare | $3,590 |

| Rossville | $2,684 |

| Round Lake | $2,519 |

| Round Lake Beach | $2,525 |

| Round Lake Heights | $2,527 |

| Round Lake Park | $2,519 |

| Roxana | $2,945 |

| Royal | $2,406 |

| Royalton | $3,586 |

| Rushville | $2,751 |

| Russell | $2,678 |

| Rutland | $2,513 |

| Sailor Springs | $3,158 |

| Salem | $3,098 |

| San Jose | $2,819 |

| Sandoval | $3,096 |

| Sandwich | $2,323 |

| Sauk Village | $2,865 |

| Savanna | $2,488 |

| Savoy | $2,324 |

| Sawyerville | $2,878 |

| Saybrook | $2,494 |

| Scales Mound | $2,613 |

| Schaumburg | $2,466 |

| Scheller | $3,368 |

| Schiller Park | $2,555 |

| Schram City | $2,862 |

| Sciota | $2,761 |

| Scott AFB | $2,872 |

| Seaton | $2,765 |

| Seatonville | $2,669 |

| Secor | $2,452 |

| Seneca | $2,550 |

| Sesser | $3,549 |

| Seward | $2,405 |

| Seymour | $2,402 |

| Shannon | $2,518 |

| Shawneetown | $3,574 |

| Sheffield | $2,741 |

| Shelbyville | $2,780 |

| Sheldon | $2,512 |

| Sheridan | $2,451 |

| Sherman | $2,689 |

| Sherrard | $2,646 |

| Shiloh | $2,886 |

| Shirland | $2,404 |

| Shirley | $2,491 |

| Shobonier | $2,903 |

| Shorewood | $2,520 |

| Shumway | $2,731 |

| Sibley | $2,404 |

| Sidell | $2,733 |

| Sidney | $2,460 |

| Silvis | $2,677 |

| Sims | $3,471 |

| Skokie | $2,508 |

| Sleepy Hollow | $2,398 |

| Smithboro | $2,877 |

| Smithfield | $2,840 |

| Smithshire | $2,653 |

| Smithton | $2,907 |

| Somonauk | $2,331 |

| Sorento | $2,928 |

| South Barrington | $2,471 |

| South Beloit | $2,379 |

| South Chicago Heights | $2,858 |

| South Elgin | $2,380 |

| South Holland | $2,830 |

| South Jacksonville | $2,801 |

| South Pekin | $2,598 |

| South Roxana | $2,982 |

| South Suburban | $2,613 |

| South Wilmington | $2,667 |

| Southern View | $2,777 |

| Sparland | $2,575 |

| Sparta | $2,759 |

| Speer | $2,578 |

| Spring Grove | $2,436 |

| Spring Valley | $2,655 |

| Springerton | $3,438 |

| Springfield | $2,708 |

| St. Anne | $2,753 |

| St. Augustine | $2,692 |

| St. Charles | $2,272 |

| St. David | $2,851 |

| St. Elmo | $2,873 |

| St. Francisville | $3,225 |

| St. Joseph | $2,316 |

| St. Libory | $2,943 |

| St. Peter | $2,900 |

| Standard | $2,473 |

| Stanford | $2,542 |

| Staunton | $2,867 |

| Ste. Marie | $2,929 |

| Steeleville | $2,754 |

| Steger | $2,748 |

| Sterling | $2,379 |

| Steward | $2,464 |

| Stewardson | $2,818 |

| Stickney | $2,600 |

| Stillman Valley | $2,404 |

| Stockland | $2,476 |

| Stockton | $2,600 |

| Stone Park | $2,618 |

| Stonington | $2,962 |

| Stoy | $2,897 |

| Strasburg | $2,858 |

| Strawn | $2,474 |

| Streamwood | $2,476 |

| Streator | $2,475 |

| Stronghurst | $2,771 |

| Sugar Grove | $2,299 |

| Sullivan | $2,608 |

| Summerfield | $2,869 |

| Summit | $2,514 |

| Summit Argo | $2,530 |

| Sumner | $3,203 |

| Sun River Terrace | $2,754 |

| Sutter | $2,773 |

| Swansea | $2,895 |

| Sycamore | $2,307 |

| Table Grove | $2,864 |

| Tallula | $2,836 |

| Tamaroa | $3,098 |

| Tampico | $2,400 |

| Taylor Ridge | $2,793 |

| Taylor Springs | $2,910 |

| Taylorville | $2,861 |

| Techny | $2,510 |

| Teutopolis | $2,664 |

| Texico | $3,328 |

| Thawville | $2,489 |

| Thayer | $2,745 |

| The Galena Territory | $2,555 |

| Thebes | $3,716 |

| Thomasboro | $2,352 |

| Thompsonville | $3,618 |

| Thomson | $2,536 |

| Thornton | $2,792 |

| Tilden | $2,782 |

| Tilton | $2,625 |

| Timewell | $2,634 |

| Tinley Park | $2,463 |

| Tiskilwa | $2,731 |

| Toledo | $2,980 |

| Tolono | $2,376 |

| Toluca | $2,488 |

| Tonica | $2,543 |

| Topeka | $2,773 |

| Toulon | $2,581 |

| Tovey | $2,825 |

| Tower Hill | $2,786 |

| Tower Lakes | $2,427 |

| Tremont | $2,532 |

| Trenton | $2,870 |

| Trilla | $2,572 |

| Triumph | $2,496 |

| Troy | $2,967 |

| Troy Grove | $2,502 |

| Tuscola | $2,444 |

| Twin Grove | $2,425 |

| Ullin | $3,624 |

| Union | $2,451 |

| Union Hill | $2,632 |

| Unity | $3,503 |

| University Park | $2,652 |

| Urbana | $2,359 |

| Valier | $3,513 |

| Valmeyer | $2,773 |

| Van Orin | $2,648 |

| Vandalia | $2,813 |

| Varna | $2,528 |

| Venetian Village | $2,570 |

| Venice | $3,272 |

| Vermilion | $2,676 |

| Vermont | $2,903 |

| Vernon | $3,158 |

| Vernon Hills | $2,643 |

| Verona | $2,708 |

| Vienna | $3,590 |

| Villa Grove | $2,505 |

| Villa Park | $2,303 |

| Viola | $2,748 |

| Virden | $2,774 |

| Virginia | $2,835 |

| Wadsworth | $2,568 |

| Waggoner | $2,897 |

| Walnut Hill | $3,278 |

| Walsh | $2,768 |

| Walshville | $2,945 |

| Waltonville | $3,322 |

| Wamac | $2,958 |

| Warren | $2,631 |

| Warrensburg | $2,605 |

| Warrenville | $2,472 |

| Warsaw | $2,788 |

| Wasco | $2,359 |

| Washburn | $2,454 |

| Washington | $2,553 |

| Washington Park | $3,596 |

| Wataga | $2,711 |

| Waterloo | $2,709 |

| Waterman | $2,393 |

| Watseka | $2,471 |

| Watson | $2,747 |

| Wauconda | $2,674 |

| Waukegan | $2,596 |

| Waverly | $2,869 |

| Wayne | $2,335 |

| Wayne City | $3,498 |

| Wedron | $2,415 |

| Weldon | $2,775 |

| Wellington | $2,526 |

| Wenona | $2,481 |

| West Brooklyn | $2,479 |

| West Chicago | $2,382 |

| West City | $3,549 |

| West Dundee | $2,401 |

| West Frankfort | $3,523 |

| West Liberty | $2,956 |

| West Peoria | $2,573 |

| West Point | $2,762 |

| West Salem | $3,275 |

| West Union | $3,067 |

| West York | $2,947 |

| Westchester | $2,477 |

| Western Springs | $2,433 |

| Westfield | $3,019 |

| Westmont | $2,300 |

| Westville | $2,662 |

| Wheaton | $2,329 |

| Wheeler | $2,963 |

| Wheeling | $2,470 |

| White Hall | $3,071 |

| White Heath | $2,670 |

| Whittington | $3,496 |

| Williamsfield | $2,722 |

| Williamsville | $2,713 |

| Willisville | $3,129 |

| Willow Springs | $2,528 |

| Willowbrook | $2,383 |

| Wilmette | $2,456 |

| Wilmington | $2,621 |

| Wilsonville | $2,825 |

| Winchester | $2,909 |

| Winfield | $2,381 |

| Winnebago | $2,412 |

| Winnetka | $2,461 |

| Winthrop Harbor | $2,627 |

| Witt | $2,942 |

| Wolf Lake | $3,583 |

| Wonder Lake | $2,488 |

| Wood Dale | $2,351 |

| Wood River | $2,951 |

| Woodhull | $2,784 |

| Woodland | $2,467 |

| Woodlawn | $3,299 |

| Woodridge | $2,362 |

| Woodson | $2,789 |

| Woodstock | $2,458 |

| Woosung | $2,389 |

| Worden | $3,030 |

| Worth | $2,623 |

| Wrights | $2,931 |

| Wyanet | $2,730 |

| Wyoming | $2,587 |

| Yale | $3,042 |

| Yates City | $2,744 |

| Yorkville | $2,361 |

| Zeigler | $3,585 |

| Zion | $2,624 |

Severe weather and home insurance in Illinois

Illinois’ hot summers and cold winters can cause havoc for the state’s homeowners. Thunderstorms and tornadoes are common in the summer, while snow and ice are common in the winter — especially in certain parts of the state.

Thankfully, a standard home insurance policy will protect you and your property from these extreme weather events.

Flood insurance in Illinois

Depending on where you live, though, you might need to buy flood insurance. This is because regular home insurance policies don’t cover floods.

You can buy flood insurance through insurance companies that participate in the National Flood Insurance Program (NFIP). Or you can buy flood insurance through some private companies.

The average cost of flood insurance in Illinois is $985 a year, or $82 a month, through the NFIP. You’ll usually pay more for flood insurance if you live in an area that often floods.