Heritage Home Insurance Review

- Few customer complaints

- Excellent financial strength rating

- Rates are higher than the national average

- No customer satisfaction rating

- No smartphone app

Is Heritage a good home insurance company?

Florida-based Heritage offers standard home insurance policies with a few good perks like replacement cost coverage for your belongings and identity theft protection. Customers also seem happy with Heritage, based on its great complaint rating from the National Association of Insurance Commissioners

On the downside, its home insurance rates are above the national average, and it doesn’t offer some of the modern conveniences many other companies offer like a phone app.

While Heritage’s main region is Florida, it also sells home insurance in 15 other states

How much is Heritage home insurance?

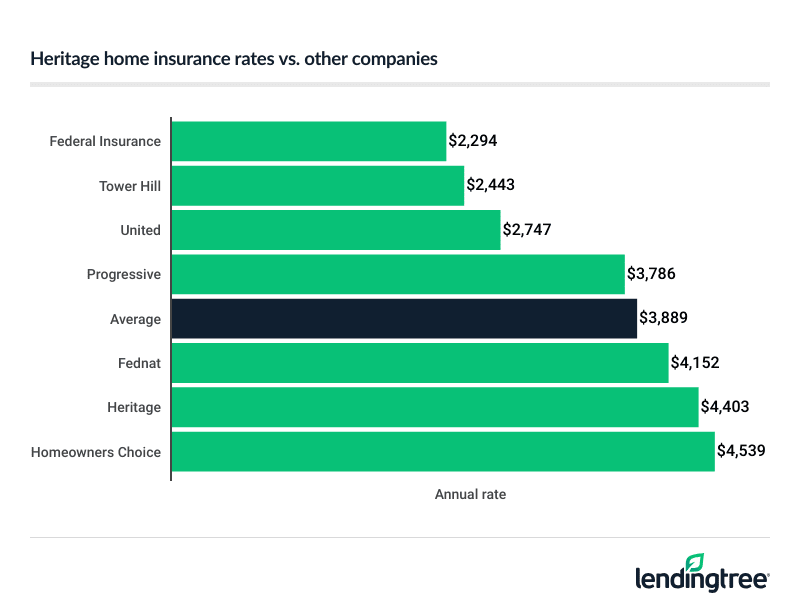

Heritage’s average annual rate for homeowners insurance is $4,403 a year in Florida, its primary territory. This is 13% higher than the Florida state average of $3,889 a year, and 39% higher than the national average of $2,801.

Heritage rates compared to other companies

| Company | Annual rate |

|---|---|

| Federal Insurance | $2,294 |

| Tower Hill | $2,443 |

| United | $2,747 |

| Progressive | $3,786 |

| State average | $3,889 |

| FedNat | $4,152 |

| Heritage | $4,403 |

| Homeowners Choice | $4,539 |

| Universal | $4,655 |

| Florida Peninsula | $4,695 |

| State Farm | $5,180 |

Your final home insurance quote from Heritage is based on several different factors, including:

- The age of your home

- The construction materials used

- ZIP code

- Coverage limits

- Your deductible

Factors like your home’s age, materials and ZIP code carry different risk weights among different companies. For example, one company may see your ZIP code as a bigger risk than another company and charge you more because of it. This is why it’s important to compare home insurance quotes from several companies before you buy or renew a policy.

Heritage home insurance cost and dwelling coverage

Raising your home insurance policy’s dwelling coverage

Heritage rates by coverage limit

| Dwelling coverage limit | Average rate |

|---|---|

| $350,000 | $3,818 |

| $400,000 | $4,403 |

| $450,000 | $4,988 |

You want your dwelling coverage limit to cover a complete rebuild of your home. If you can afford it, make sure your chosen limit will also cover issues like debris removal and code-mandated upgrades for the rebuild.

What does Heritage home insurance cover?

A Heritage home insurance policy covers the structure of your home, external structures on the property, your belongings and more.

Dwelling coverage

Dwelling coverage is the core part of a home insurance policy that covers the repair or rebuild of your house after a covered loss, like fire or theft. It covers the structure of your home, including the siding, roof, windows and interior parts like cabinetry and flooring.

Other structures

This coverage type pays out when structures outside your home are damaged, like sheds and patios. Heritage also offers optional coverage for pool houses and guest houses.

Personal property coverage

Personal property coverage helps you replace clothing, electronic devices, furniture and other belongings after a covered loss.

A Heritage home insurance policy covers personal property at actual cash value. This means if your belongings are damaged, their age and wear and tear will impact your payout.

Heritage offers optional coverage for high-value items like jewelry and art. It also has optional replacement cost coverage for personal property, which means it’ll cover the cost to replace the item without factoring in age or wear and tear.

Liability coverage

Liability coverage helps pay the medical bills of someone who is injured on your property. It also covers property damage you cause, as well as legal fees for lawsuits tied to either incident.

Medical payments

Medical payments coverage also pays the health care bills of others who are injured on your property. This type of coverage usually pays out after the injured person’s health insurance reaches its limit.

Loss of Use

Also known as “additional living expenses,” this coverage pays the extra costs that are tied to relocating while your home is being repaired after certain events. This coverage can help pay for:

- Extra rent costs

- Meals

- Furniture rental

- Pet boarding

- Additional commute costs

Optional coverages from Heritage

Heritage offers a couple of useful add-on coverages that can help you customize your home insurance policy, including coverage for equipment breakdown and identity theft.

Equipment breakdown coverage

This coverage type helps pay for the breakdown of electrical, mechanical or pressure systems in your home, including:

- Computers

- Dishwasher

- Electrical panel

- HVAC system

- Lawn tractor

- Range

- Refrigerator

- Swimming pool pump

- Televisions

- Water heater

- Washer and dryer

- Wells and pumps

Identity theft coverage

Heritage’s ID theft coverage offers free credit monitoring. It can also help you file police reports and pay for repairs tied to ID theft damage.

Methodology

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Home insurance rates are based on an analysis of hundreds of thousands of quotes for a typical Florida homeowner. Your own rates may be different.

Homeowners policies include:

- Dwelling coverage: $400,000

- Other structures: $40,000

- Personal property: $200,000

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

—

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the NAIC and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.