Tower Hill Insurance Review

- Cheap home insurance for Florida homeowners

- Many discounts for wind mitigation

- Few customer complaints

- Only offers standard home insurance coverage

- No J.D. Power claim satisfaction rating

- No financial strength rating by A.M. Best

- No smartphone app

Is Tower Hill a good home insurance company?

Tower Hill is a good company if you’re a Florida homeowner looking for cheap home insurance rates.

In 2022, Tower Hill started selling its standard home insurance through Tower Hill Insurance Exchange as a reciprocal insurer. This means that Tower Hill Exchange policyholders insure each other and share in the underwriting profits

Tower Hill also has an excellent complaint rating from the NAIC

How much is Tower Hill home insurance?

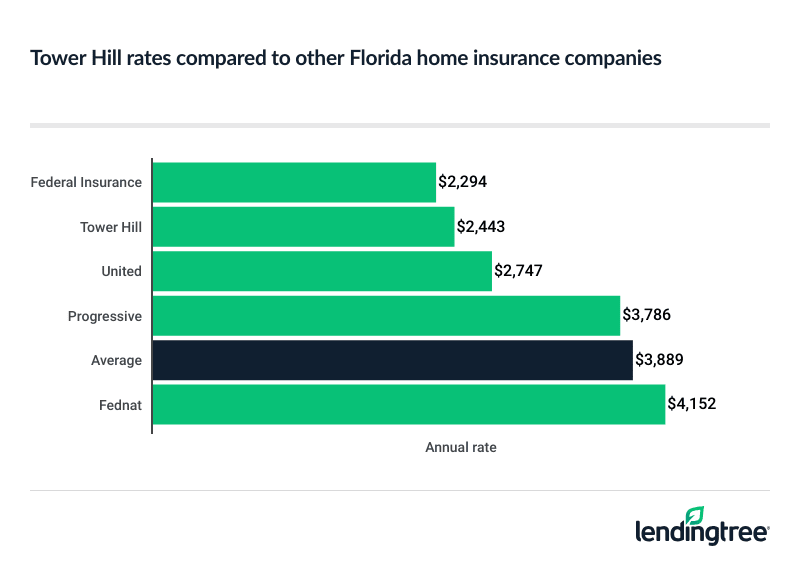

Tower Hill charges an average of $2,443 a year for homeowners insurance. This is 37% cheaper than the Florida state average of $3,889 a year, and 13% cheaper than the national average of $2,801.

Tower Hill rates vs. other companies

| Company | Annual rate |

|---|---|

| Federal Insurance | $2,294 |

| Tower Hill | $2,443 |

| United | $2,747 |

| Progressive | $3,786 |

| Fednat | $4,152 |

| Heritage | $4,403 |

| Homeowners Choice | $4,539 |

| Universal | $4,655 |

| Florida Peninsula | $4,695 |

| State Farm | $5,180 |

Tower Hill home insurance by coverage amount

The higher your dwelling coverage

Tower Hill rates by dwelling coverage limit

| Dwelling coverage | Average rate |

|---|---|

| $350,000 | $2,182 |

| $400,000 | $2,443 |

| $450,000 | $2,700 |

When choosing your dwelling coverage limit, keep in mind that it needs to cover not only the rebuild of your home, but also debris removal and expenses tied to meeting current building codes.

Tower Hill’s home insurance discounts

Tower Hill offers many discounts if you make windstorm mitigation improvements to your home. Tower Hill gives discounts based on:

- Roofing materials

- How the roof is attached

- Roof-to-wall connection

- Shape of the roof

- Secondary water resistance

- Opening protection

Tower Hill also offers home insurance discounts for:

- Living in a gated community

- Being a senior

- Accredited builders

- Smart home water protection

- Companion policies

- Having a Safeco car insurance policy

What does Tower Hill homeowners insurance cover?

A standard Tower Hill home insurance policy covers:

- Dwelling: This coverage helps repair or rebuild the structure of your home.

- Personal property: Includes your belongings, like furniture, clothing and electronics.

- Personal liability: Covers injuries to other people and damage to their property.

Tower Hill also offers a few optional coverages, including:

- Flood insurance

- Equipment breakdown

- Dwelling fire insurance

Methodology

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Home insurance rates are based on an analysis of hundreds of thousands of quotes for a typical Florida homeowner. Your own rates may be different.

Homeowners policies include:

- Dwelling coverage: $400,000

- Other structures: $40,000

- Personal property: $200,000

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

—

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.