Gen X and Baby Boomers Rely on Credit Cards More than Millennials

Charlotte, N.C. (August 21, 2015) – LendingTree, a leading online loan marketplace, recently conducted a survey among a nationally representative sample of 3,170 Americans to gain insight into credit card behaviors, sentiments and trends. Most notably, the survey data suggests that younger generations are less reliant on credit cards than previous generations. Additionally, both Gen Xers and Baby Boomers are more cash-strapped and debt-dependent than Millennials.

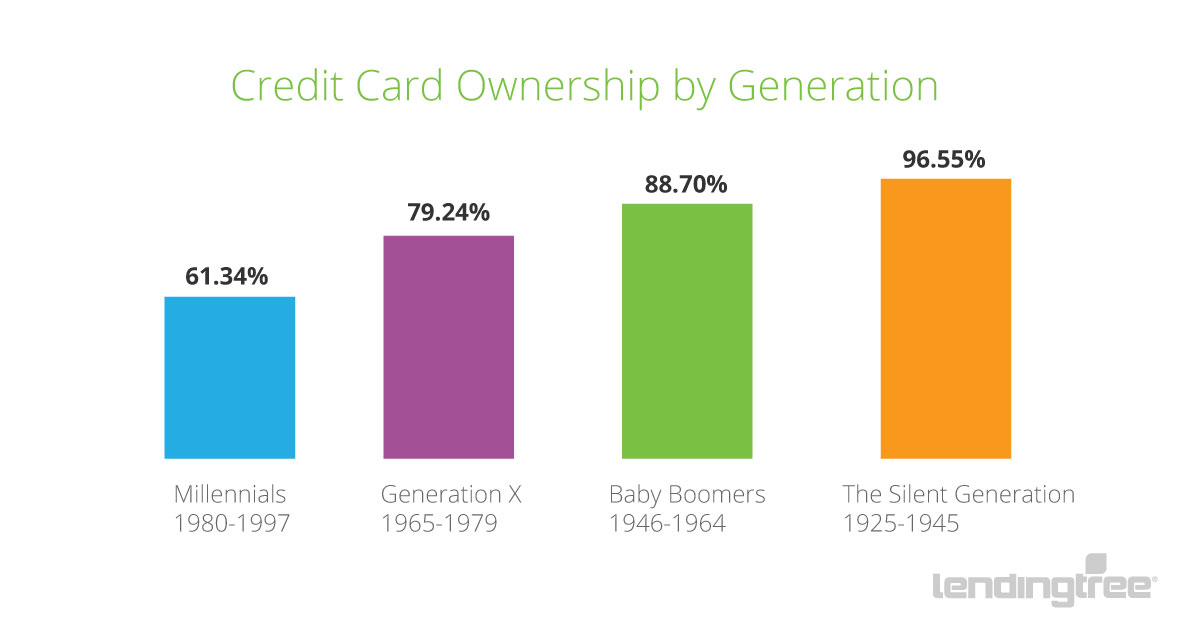

Of the 957 Millennials (b. 1980-1997) included in the survey sample, only 61.34 percent said they own at least one credit card, representing the generation segment with the lowest credit card ownership rate. Following Millennials, 79.24 percent of the 785 Gen Xers (b. 1965-1979) surveyed stated that they owned at least one credit card, and 88.70 percent of the 1,150 Baby Boomers owned at least one credit card. The Silent Generation (b. 1925-1945) had the highest credit card ownership, with an astounding 96.55 percent (of 232 surveyed) owning at least one credit card.

“The millennial generation seems to be more averse to debt as it relates to credit cards, which could be attributed to lasting scars from the financial crisis of 2007-08,” said Doug Lebda, founder and CEO of LendingTree. “Older Americans are more reliant on credit cards to maintain their monthly expenses and cash flows when compared to younger generations. It will be interesting to see how this trend develops with the emergence and adoption of new payment methods.”

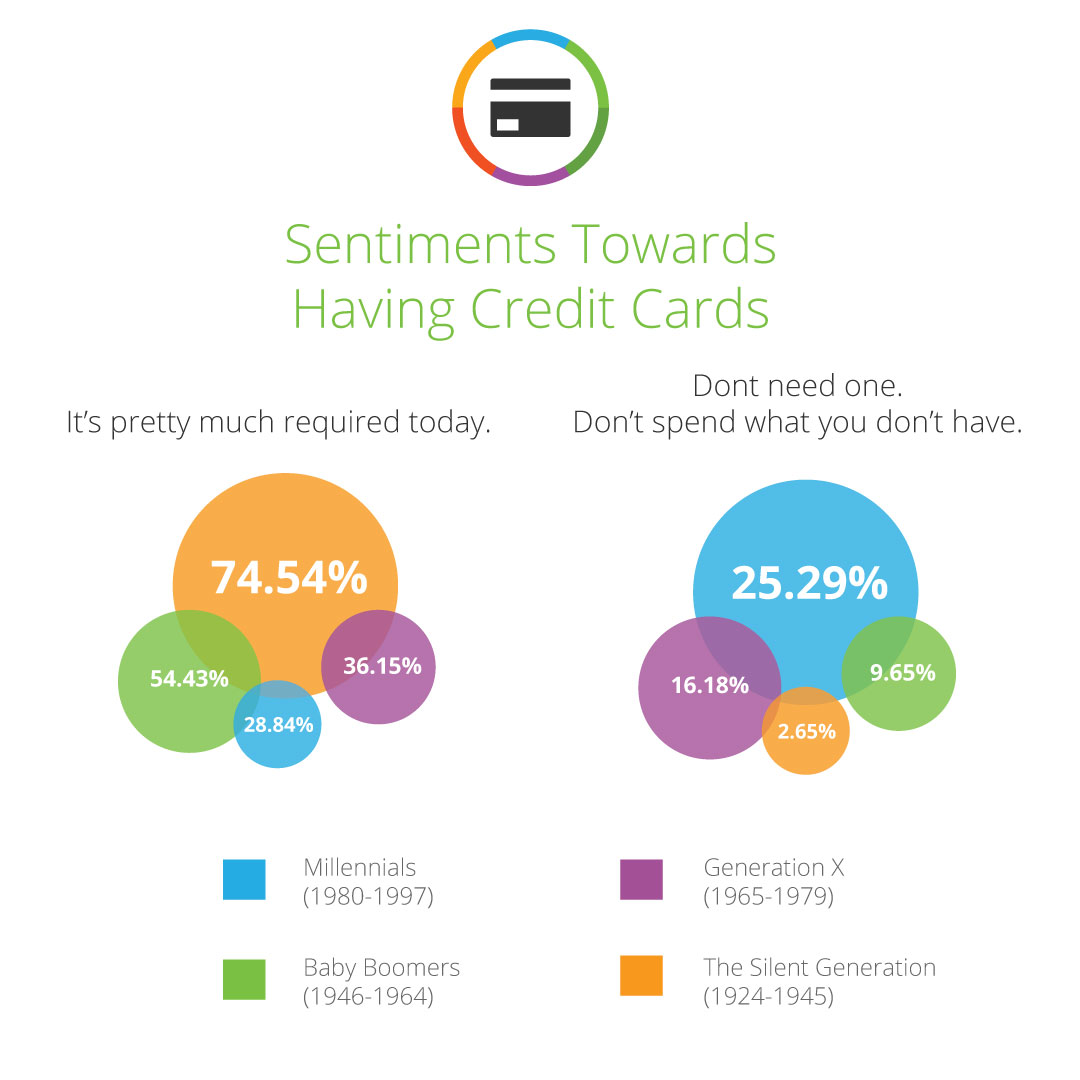

When respondents were asked for their sentiments related to owning a credit card, Millennials were the least likely to feel they were needed. Only 28.84 percent said credit cards were “pretty much required today,” and over one-fourth (25.29 percent) of Millennials believed they “Don’t need one. Don’t spend what you don’t have.”

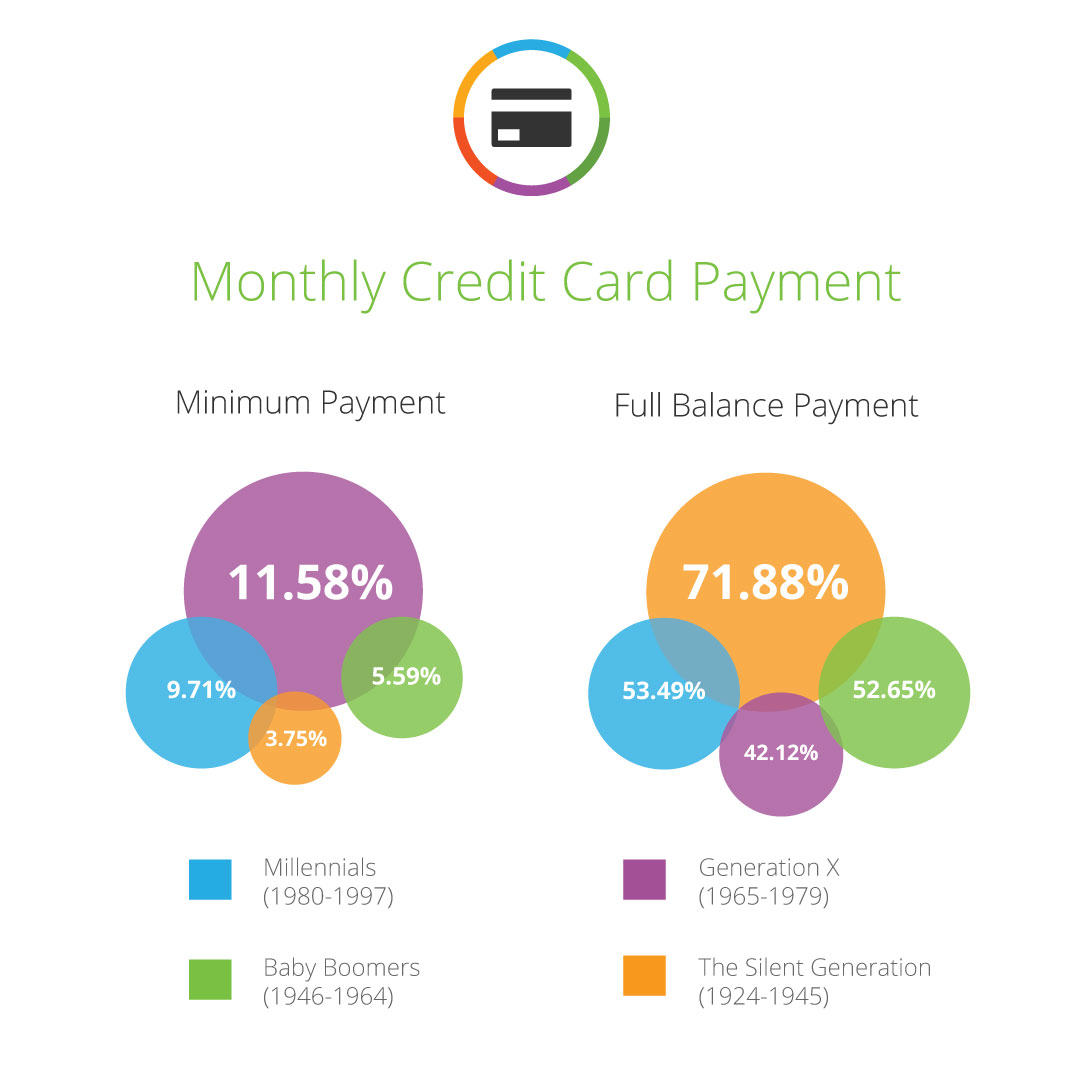

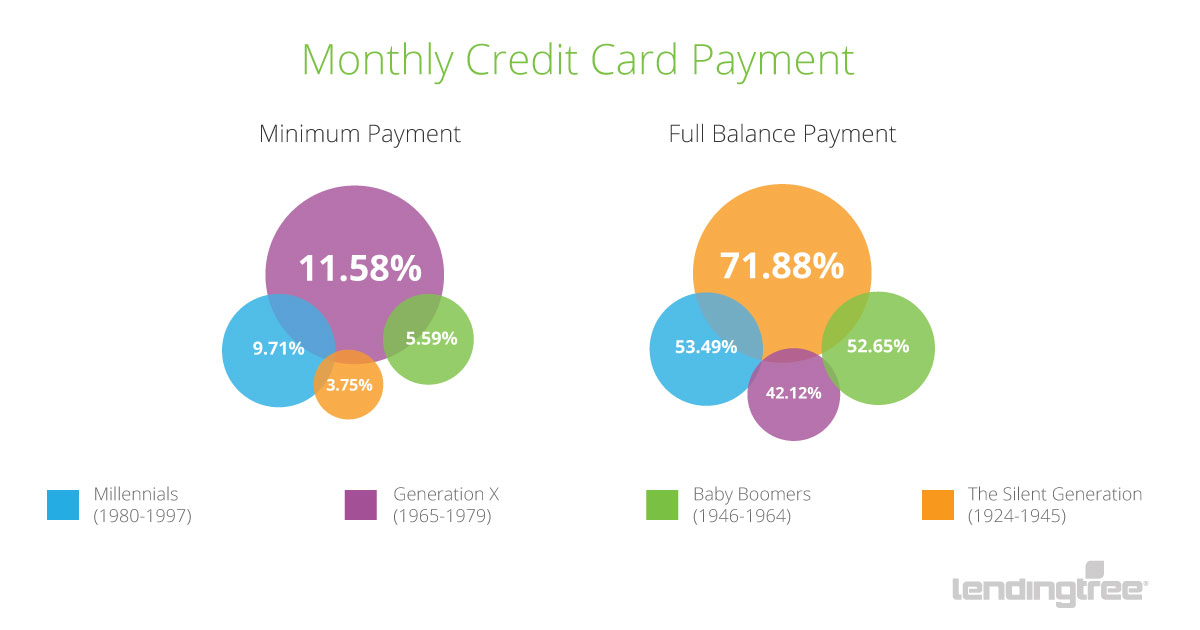

Not only do Millennials feel they do not need credit cards, but among those that still use cards, they were better at paying off their balance in full each month when compared to both Gen Xers and Baby Boomers. 53.49 percent of Millennials paid their balance in full each month while Baby Boomers were close behind, with 52.65 percent paying off their complete balance each bill cycle.

The generation that was the worst at paying off their credit card balances each month was Gen X. Only 42.12 percent paid their balance in full each month. Additionally, Gen Xers have the highest percentage of respondents stating they only pay off the minimum balance each month, with 11.58 percent paying the minimum and revolving the rest.

While the Silent Generation were the most likely to both have a credit card and state they were pretty much required today, they were also the most responsible in paying their debts with 71.88 percent paying credit card balances in full each month.

“Using credit cards as a primary form of payment absolutely has its benefits, as long as the card user is responsible in managing their credit,” continued Lebda. “While it may be surprising to see that the conservative Silent Generation is the age group with the most credit card dependency, they also have the proper cash flow and financial discipline to support the behavior, getting the most benefit out of credit card perks and rewards. Millennials may still be burdened by other economic factors such as student debt and a historically weak job market, so their lower reliance on credit cards could be seen as a positive indicator of their fiscal responsibility. As millennials enter the housing market, lower debt levels could translate into more sustainable housing and economic growth.”

For Gen Xers, the data does suggest the generation was negatively impacted by the economic bubble, perhaps more so than even Millennials. Members of Generation X still have plenty of time and working years to get back on track and improve their spending habits. Resources such as debt consolidation loans can help lower monthly payments or lower total interest payments. LendingTree recommends comparing offers from lenders and credit providers as well as researching ratings and reviews to find a trusted financial partner.

Infographics

To download, please right click and save as.

Methodology

The 2015 U.S. Credit Card Survey was conducted online within the United States by SurveyMonkey on behalf of LendingTree between July 16 and July 21, 2015 among a nationally representative sample of 3,170 Americans ages 18 and up.

About LendingTree

LendingTree (NASDAQ: TREE) is a leading online loan marketplace with one of the largest networks of lenders in the nation, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 55 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 350 lenders offering home loans, personal loans, credit cards, student loans, personal loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.