Cheap Renters Insurance in Fort Worth, Texas

Best cheap Fort Worth renters insurance

Cheapest renters insurance quotes in Fort Worth

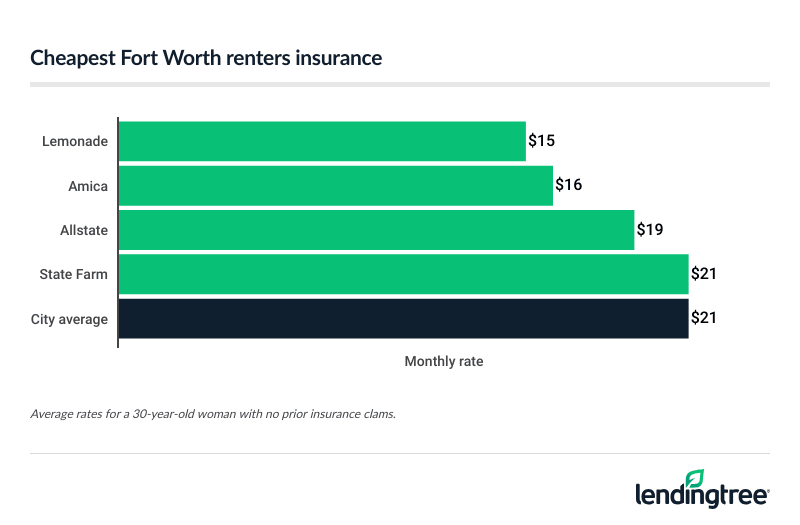

At $15 a month, Lemonade has the cheapest renters insurance quotes in Fort Worth. Amica is only slightly more expensive at $16 a month. However, Amica offers a few more discounts than Lemonade, which could make it a cheaper option for you.

Fort Worth renters insurance rates

| Company | Monthly rate | Annual rate | LendingTree score | |

|---|---|---|---|---|

| Lemonade | $15 | $179 | |

| Amica | $16 | $192 | |

| Allstate | $19 | $228 | |

| State Farm | $21 | $248 | |

| Assurant | $24 | $282 | |

| Farmers | $25 | $304 | |

| Progressive | $28 | $333 | |

Your actual renters insurance rate depends on factors like your unit, coverage needs and location. Each company treats these factors differently, and their rates vary by customer. This makes it good to compare renters insurance quotes from a few different companies.

Best renters insurance companies in Fort Worth

Amica’s low rates, coverage options and ratings make it Fort Worth’s best renters insurance company. Lemonade has the best quotes, while State Farm is best for bundling.

Best companies for renters

| Company | Monthly rate | Satisfaction score

Source: J.D. Power 2024 U.S. Home Insurance Study. Higher is better; 659 is average.

| LendingTree score |

|---|---|---|---|

| Amica | $16 | 695 | |

| Lemonade | $15 | 682 | |

| State Farm | $21 | 679 |

Best overall: Amica

Monthly rate: $16

Amica has a better overall customer satisfaction score than most other Fort Worth renters insurance companies. This means it generally has happier customers than its competitors do, based on factors like price and service.

Its easy-to-earn discounts help make it more affordable. For example, you can get a discount for switching to Amica if you’ve been with your current company for at least two years.

Amica also has a few coverage options its competitors don’t offer. Its add-on electronics coverage is especially notable. It protects your devices more than typical renters insurance does, including coverage for accidental damage.

PROS

- Rates are 24% less than city average

- Accidental damage protection for devices

- Excellent customer satisfaction

- Several discounts to help bring down your rate

CONS

- Slightly more expensive than Lemonade

Best for cheap quotes: Lemonade

Monthly rate: $15

Lemonade’s cheap quotes make it a good choice for renters insurance shoppers on a budget. It has a worse satisfaction rating than Amica, but not by much.

Lemonade also offers an alternative to traditional renters insurance companies. Its website lets you get quotes and activate your policy in minutes, without sales pitches. You can also feel good about Lemonade’s B Corporation certification. It donates a portion of your premiums to an eligible charity you choose.

PROS

- Cheapest rates in Fort Worth

- Very good satisfaction rating

- Easy online quotes and policy management

- Donates to charity

CONS

- Few discounts available for added savings

Best for bundling: State Farm

Monthly rate: $21

State Farm’s renters insurance rates are just average. However, you can save a lot of money on your car insurance when you bundle it with a renters policy. Its car insurance rates are already 39% less than the Texas state average. Bundling makes them cheaper.

State Farm also makes it easy to shop and manage your policy any way you choose. Its website and smartphone app offer a DIY experience. If you prefer personal assistance, the company has dozens of agents available in the Fort Worth area.

PROS

- Bundling gets you a big discount on car insurance

- Good customer satisfaction rating

- Personalized service from local agents

- Online services for DIY shoppers

CONS

- Other companies have cheaper renters insurance

Is renters insurance required in Fort Worth?

Renters insurance is not required by law. However, your landlord may make you get it for a lease. The low cost of renters insurance often makes it worth getting even if your landlord doesn’t require it.

Your landlord’s insurance covers structural damage to your building, but not your belongings.

What does renters insurance cover?

Renters insurance covers your belongings for damage and theft. It also covers certain other expenses that could arise after a disaster or burglary. A typical policy includes coverage for:

- Your personal property, or the stuff you own

- Additional living expenses if a disaster forces you to find temporary housing

- Personal liability for injuries or damage you cause to someone else or their property

- Medical expenses for a guest injured at your home

Most renters insurance covers damage from common disasters like fires and windstorms. However, renters insurance does not cover floods. You can get flood insurance separately to protect your belongings from this risk.

Frequently asked questions

Renters insurance costs an average of $21 a month in Fort Worth, or $252 a year. You can often find a cheaper rate when you shop around.

Lemonade and Amica have the lowest average renters insurance costs in Fort Worth. Lemonade’s rates average $15 a month, while Amica charges $16 a month.

Methodology

LendingTree collected renters insurance quotes from the largest insurance companies in Fort Worth, based on data availability.

Our rates are based on quotes for a 30-year-old single woman who has no recent renters insurance claims. Your rates may vary. Coverage limits include:

- Personal property coverage: $20,000

- Deductible: $500

- Personal liability: $100,000

- Guest medical protection: $1,000

- Loss of use: $9,000