Cheap Renters Insurance in Jacksonville, Florida

Jacksonville’s best cheap renters insurance

Cheapest renters insurance companies in Jacksonville

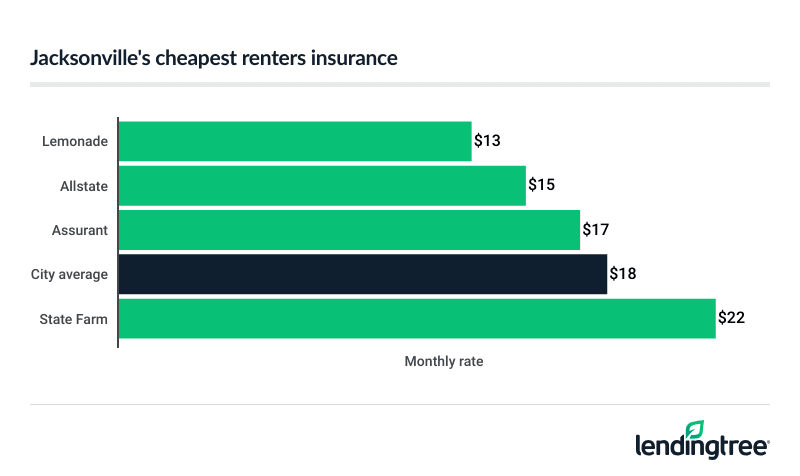

With its average rate of just $13 a month, Lemonade has the cheapest renters insurance in Jacksonville, Florida.

Allstate is close behind at $15 a month, while Assurant is at $17 a month. All three companies come in below the city average rate of $18 a month.

Though we found Lemonade to be Jacksonville’s cheapest company for renters insurance, Allstate could be the cheapest for you if you qualify for a few discounts.

Renters insurance rates in Jacksonville

| Company | Monthly rate | Annual rate | LendingTree score | |

|---|---|---|---|---|

| Lemonade | $13 | $156 | |

| Allstate | $15 | $180 | |

| Assurant | $17 | $204 | |

| State Farm | $22 | $264 | |

| Progressive | $24 | $288 |

To find the cheapest company for you, compare renters insurance quotes from several insurers before you buy or renew a policy.

Best renters insurance companies in Jacksonville

Lemonade is the best renters insurance company in Jacksonville because of its low rates and happy customers. Progressive and Assurant are also worth a look, though, for other reasons.

Best overall and cheapest rates: Lemonade

Lemonade has the lowest renters insurance rates of all the companies we surveyed in Jacksonville, but that’s not all it offers.

PROS

- City’s cheapest rates

- Many optional coverages

- Site and app are easy to use

- Great customer satisfaction rating

CONS

- Few discounts

Some of the coverages you can add onto a standard Lemonade policy include:

- Extra coverage for valuable belongings

-

Water backup

coverageCovers water damage caused by a drain or sewer backing up, or a sump pump breaking.

-

Equipment breakdown

coverageRepairs or replaces home appliances or equipment damaged by sudden and accidental mechanical or electrical breakdowns.

- Tenant pet and water damage coverage

Also, Lemonade’s great customer satisfaction score from J.D. Power

Best discounts: Progressive

Progressive has more renters insurance discounts than any other company we surveyed in Jacksonville. It also has the highest renters insurance rates of those companies. Still, if you qualify for a few discounts, it could make Progressive a lot more affordable.

PROS

- Many discounts

- Offers a few valuable add-ons

- Helpful app and website

CONS

- Expensive without discounts

- Poor customer satisfaction score

You might get discounts from Progressive if you:

- Buy more than one policy from Progressive

- Get a quote before your policy starts

- Go paperless

- Pay in full

- Live in a gated community

Best coverage options: Assurant

If you want to personalize your renters insurance policy, get a quote from Assurant. It offers the most and best coverage options of the companies we surveyed in Jacksonville.

PROS

- Affordable rates

- Great standard coverages

- Many add-on options

CONS

- Few discounts

- No customer satisfaction rating

With Assurant, you can pay extra to cover:

- High-value possessions

- Pet damage

- Damage from drain or sewer backups

- Your rent if you lose your job

- Earthquake damage

- Identity theft

Your Assurant renters insurance policy may come with some great standard coverages, too, including coverage for bed bugs, food spoilage, flooding and mold.

How much is renters insurance in Jacksonville?

The average cost of renters insurance in Jacksonville, Fla., is $18 a month, or $216 a year.

That’s $2 a month, or 10%, cheaper than Florida’s state average renters insurance rate of $20 a month.

What you pay for renters insurance in Jacksonville is based on the:

- Types and amounts of coverage you buy

- Deductible you choose

- Value of your possessions

Frequently asked questions

No Jacksonville or Florida law requires renters insurance, but you may need to buy it as part of your rental or lease agreement.

Many landlords require renters insurance to protect themselves from tenants who damage the building or their unit. They also do it to protect against liability claims and needing to cover relocation costs in some cases if the property becomes unlivable.

Renters insurance usually covers your:

-

Personal property

Covers repair or replacement costs if your belongings are stolen or destroyed by a fire or other covered event.

-

Temporary living expenses

Helps cover temporary housing costs if you move into a hotel or another apartment while your rental home is being repaired or rebuilt.

-

Personal liability

Helps cover legal expenses, medical bills and other damages if someone gets injured at your rental home and sues you.

How much your renters insurance covers for these things depends on your deductible and coverage limits.

Methodology

LendingTree collected thousands of renters insurance quotes from the largest insurance companies in each state, based on data availability.

We used thousands of renters insurance quotes from across the U.S. for a 30-year-old single woman who has no recent renters insurance claims. Your rates may vary. Coverage limits include:

- Personal property coverage: $20,000

- Deductible: $500

- Personal liability: $100,000

- Guest medical protection: $1,000

- Loss of use: $9,000

Overall satisfaction ratings were obtained from J.D. Power’s 2024 U.S. Home Insurance Study. The agency’s scores are based on customer surveys that rate insurance companies on factors like price, policy offerings and claims.