Best Renters Insurance in Ohio

Best cheap Ohio renters insurance

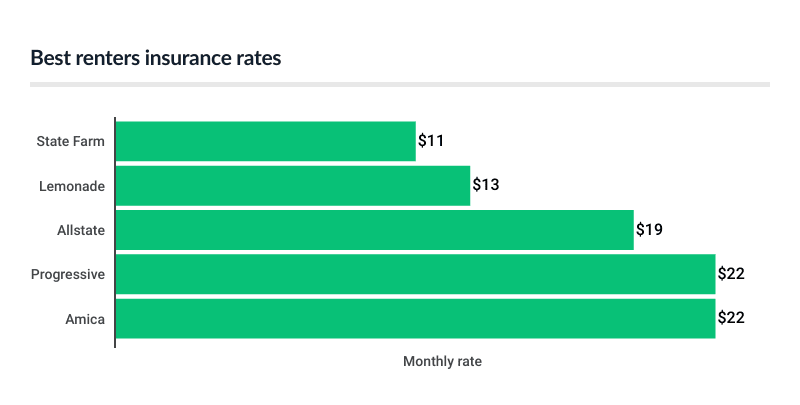

Cheapest renters insurance in Ohio

State Farm has the cheapest renters insurance in Ohio, charging an average of $11 a month. This is half the state average of $22 a month.

Lemonade has Ohio’s next-cheapest renters insurance quotes at $13 a month.

Discounts can make a big difference with renters insurance, given how cheap it usually is. Allstate is more expensive than State Farm and Lemonade, but it also offers more discounts. If you can get a few, Allstate could be the cheapest company for you.

Ohio renters insurance rates

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| State Farm | $11 | |

| Lemonade | $13 | |

| Allstate | $19 | |

| Progressive | $22 | |

| Amica | $22 | |

| Assurant | $24 | |

| Farmers | $26 | |

| American Family | $35 |

Your renters insurance rate also is based on several factors about you and your home. These include your location and the type of home you rent, as well as your insurance and credit history.

Each company treats these factors a little differently. This makes it good to compare renters insurance quotes from a few different companies when you buy or renew your policy.

Best renters insurance companies in Ohio

State Farm, Amica and Lemonade are Ohio’s best renters insurance companies. State Farm has the best rates, while Amica has the best coverage options. Lemonade has the best online shopping.

All three have good overall customer satisfaction ratings from J.D. Power

| Company | Best for | Monthly rate | Customer satisfaction score

Source: J.D. Power 2024 U.S. Home Insurance Study. Higher is better; 659 is average.

|

|---|---|---|---|

| State Farm | Cheap rates | $11 | 679 |

| Amica | Coverage options | $22 | 695 |

| Lemonade | Online shopping | $13 | 682 |

Best for cheap rates: State Farm

Monthly rate: $11

State Farm’s cheap rates get even lower when you bundle your renters insurance with car insurance. The company offers basic coverages like personal property

A good satisfaction rating means State Farm’s customers generally like the company’s prices, coverage and service. This is nice, but Amica and Lemonade have higher satisfaction ratings.

PROS

- Cheapest renters insurance in Ohio

- Deep discount for bundling renters and car insurance

- Good satisfaction rating from J.D. Power

CONS

- Other companies have better satisfaction scores

- Only a few extra coverages beyond the basics

- Limited discounts for additional savings

Best coverage options: Amica

Monthly rate: $22

Amica’s high satisfaction ratings show it has happier customers than most other companies. Its rates are just average. However, it offers discounts for bundling, setting up automatic payments and going paperless. These help make Amica more affordable for many renters.

Amica’s optional electronics coverage provides enhanced protection for laptops, smartphones and other devices. It includes coverage for accidental damage to these items. Amica also offers water backup coverage

PROS

- Accidental damage coverage available for your devices

- Optional water backup coverage

- Higher satisfaction score than most competitors

CONS

- Other companies have cheaper rates

Best online shopping: Lemonade

Monthly rate: $13

Lemonade’s online shopping platform is a cut above most competitors’ systems. You only need to answer a few questions to get a quote. Other companies also offer online shopping, but few systems are as easy to use as Lemonade’s.

Like most other companies, Lemonade gives you a discount for bundling multiple policies. Its bundling options include car, life and pet health insurance. The company’s extra protections for valuables like jewelry and fine art cover accidental damage. Unfortunately, these extra protections are not available for electronic devices.

PROS

- User-friendly online shopping

- Rates are 39% less than state average

- Excellent satisfaction rating from J.D. Power

CONS

- Limited discounts for additional savings

- Extra protections not available for personal electronics

How much is renters insurance in Ohio?

The average cost of renters insurance in Ohio is $22 a month. This is higher than the national average of $18 a month, but only by 7%.

You can save money on renters insurance by choosing a higher deductible. It’s also good to make sure you are getting all the deductibles you qualify to receive. If you’re not sure, check with your insurance agent or the agents you contact for quotes.

Ohio renters insurance rates by city

Toledo has the most expensive renters insurance among Ohio’s largest cities at $31 a month. This is 41% higher than the state average. Parma has the state’s cheapest renters insurance at $19 a month.

Insurance companies generally charge more in areas where they pay out more in claims. This makes renters insurance more expensive in places with severe weather or high crime rates.

Renters insurance rates near you

| City | Monthly rate |

|---|---|

| Akron | $24 |

| Beavercreek | $21 |

| Canton | $22 |

| Cincinnati | $21 |

| Cleveland | $23 |

| Cleveland Heights | $21 |

| Columbus | $23 |

| Cuyahoga Falls | $21 |

| Dayton | $22 |

| Dublin | $21 |

| Elyria | $20 |

| Euclid | $21 |

| Hamilton | $21 |

| Lakewood | $20 |

| Lorain | $20 |

| Mansfield | $21 |

| Mentor | $20 |

| Middletown | $24 |

| New Albany | $20 |

| Newark | $20 |

| Parma | $19 |

| Springfield | $21 |

| Strongsville | $20 |

| Toledo | $31 |

| Youngstown | $23 |

Is renters insurance required in Ohio?

Renters insurance is not required by law in Ohio. However, your landlord can make you get renters insurance for a lease.

Renters insurance is often worth getting even when it’s not required for a lease. Your landlord’s insurance doesn’t cover your belongings, but renters insurance does. Renters insurance normally also covers additional living expense (ALE), or loss of use, coverage. This helps pay for temporary living expenses if a covered disaster forces you out of your unit.

Although renters insurance covers fire, theft, windstorms and other common disasters, it doesn’t cover everything. Renters insurance does not cover floods or earth movements, including earthquakes and sinkholes. However, you can buy separate insurance to cover these risks.

Methodology

LendingTree collected thousands of renters insurance quotes from Ohio’s largest renters insurance companies.

Rates are based on coverage for a 30-year-old single woman who has no recent renters insurance claims. Your rates may vary. Coverage limits include:

- Personal property coverage: $20,000

- Deductible: $500

- Personal liability: $100,000

- Guest medical protection: $1,000

- Loss of use: $9,000