Cheapest Renters Insurance in San Diego

- Lemonade has San Diego’s cheapest renters insurance rates of $9 a month.

- Progressive is also cheap and has good discounts.

- San Diego’s average renters insurance cost is $14 a month.

Cheapest renters insurance companies in San Diego

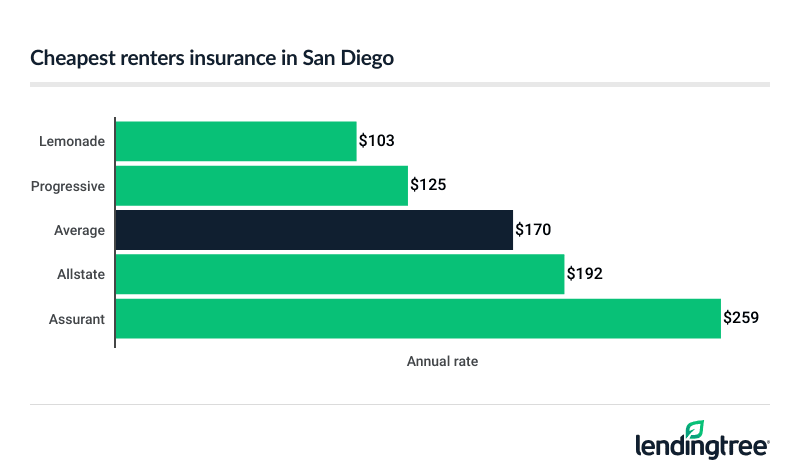

Lemonade is the cheapest renters insurance in San Diego, with an average rate of $103 a year, or $9 a month. Progressive is right behind it at $125 a year, or $10 a month. Both are cheaper than the city’s average renters insurance rate of $14 a month.

Progressive offers more discounts than Lemonade does. This means it could be the cheapest company for many renters.

To find out which company has the best rates for you, compare renters insurance quotes from both before you buy or renew a policy. When comparing quotes, make sure you use the same limits for all companies to get the most accurate comparison.

Cheapest renters insurance in San Diego by company

| Company | Monthly rate | Annual rate | LendingTree score | |

|---|---|---|---|---|

| Lemonade | $9 | $103 | |

| Progressive | $10 | $125 | |

| Allstate | $16 | $192 | |

| Assurant | $22 | $259 |

Best renters insurance companies in San Diego

Lemonade is the best renters insurance company for cheap rates in San Diego. Progressive offers the most discounts.

Best company for cheap rates: Lemonade

Monthly rate: $9

Lemonade has the cheapest renters insurance rates in San Diego, at around $9 a month. Getting a policy and filing a claim with Lemonade is quick and easy since everything is done online.

Also, Lemonade pays out renters insurance claims at replacement cost. This means it replaces your damaged belongings without considering their age or wear and tear.

PROS

- Cheapest renters insurance rates in San Diego

- Easy-to-use app

- Claims paid at replacement cost

CONS

- You can only file claims online

- Limited customer service hours

Best renters insurance discounts: Progressive

Monthly rate: $10

Progressive is nearly as cheap as Lemonade when it comes to San Diego renters insurance, with its average rate of $10 a month. Its menu of discounts can help make it even cheaper, though. Progressive has discounts for:

- Getting a quote before you buy your policy

- Bundling renters and auto or other policies with Progressive

- Signing up for electronic documents

- Paying for your policy upfront

- Living in a secure or gated community

PROS

- Cheap rates

- Good discounts

- Offers a single deductible benefit

CONS

- Limited add-on coverage options

What does renters insurance cover in San Diego?

Standard renters insurance covers your belongings, liability and more.

Personal property

Covers your possessions against damage caused by things like fire, power surges and theft. This includes furniture, clothes and electronics.

Liability

This covers injuries and property damage you cause to other people. It can also cover related legal expenses.

Medical payments

Helps pay the medical bills of others hurt in your rental home, no matter who is at fault.

Additional living expenses

This covers extra living costs if you need to move out while your rental home is being repaired. This includes extra commute costs, meals and rent.

How much renters insurance do I need in San Diego?

California does not require you to carry renters insurance. But landlords can require it as part of a lease. Even if your landlord doesn’t require it, it’s often a good investment. You get thousands of dollars of coverage for paying just a few dollars a month.

The main thing to focus on when buying renters insurance is your personal property limit. You’ll want enough to replace all your belongings if there’s a total loss. Make a home inventory that lists all the stuff you want covered. Include serial numbers and prices when you can. This will help you get the right amount of coverage.

The minimum limit for liability coverage is usually $100,000. This may seem like a lot, but a long hospital stay or court trial can tear through that fast. Any claim-related costs after you hit your limit has to come out of your own pocket. To avoid this, raise your liability limit to at least $300,000, if you can afford it.

Methodology

LendingTree collected thousands of renters insurance quotes from the largest insurance companies in each state, based on data availability.

We used thousands of renters insurance quotes from San Diego for a 30-year-old single woman who has no recent renters insurance claims. Your rates may vary. Coverage limits include:

- Personal property coverage: $20,000

- Deductible: $500

- Personal liability: $100,000

- Guest medical protection: $1,000

- Loss of use: $9,000