LendingTree Study Finds Personal Loans May Increase Credit Scores of Most Borrowers

CHARLOTTE, N.C., February 20, 2019 – LendingTree®, the nation’s leading online loan marketplace, today released its report that found personal loans may increase credit scores of most borrowers.

Americans are increasingly turning to personal loans as another option for their ongoing debt and credit needs. There are many uses for personal loans, and the most prominent are to consolidate existing debt and pay down credit cards, which often carry higher interest rates.

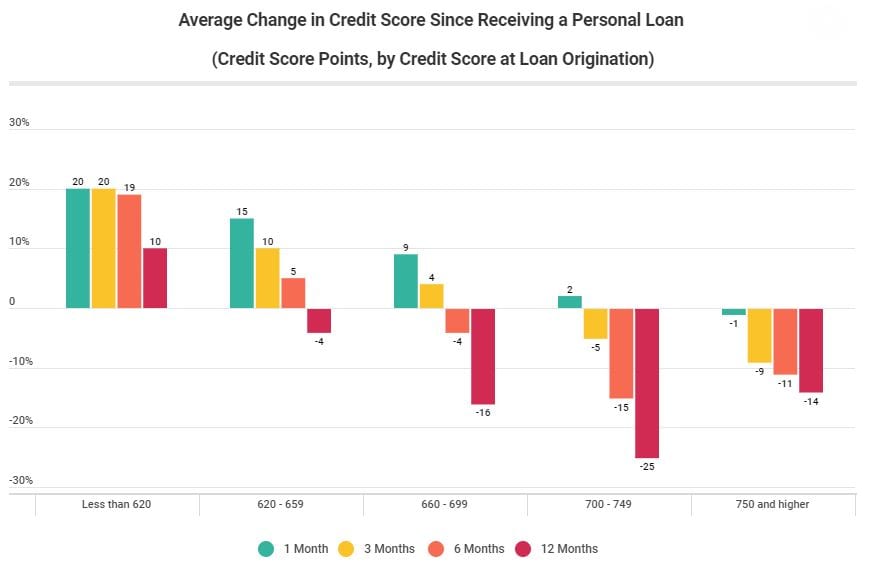

To determine if credit scores rise after taking out a personal loan, LendingTree analysts looked at the scores of people who took out personal loans to see how their credit scores changed after one month, three months, six months and 12 months. They broke the analysis down by credit score band in order to look at people with at least somewhat similar credit profiles.

The study found that most people see a small bump in their scores immediately, but scores tend to decrease and are often a few points lower after one year.

Key findings

- About 62 percent of borrowers see their credit scores go up the month after they take out a personal loan.

- After 12 months, around 45 percent of borrowers still have higher scores than they did in the month of loan origination.

- People with lower scores are more likely to see a credit score bump: 68 percent of those who started with scores under 620 saw their scores increase in one month, 71 percent had higher scores after three and six months, and 58 percent had higher scores after a year.

- People with scores under 620 saw a 20 point, or 3.4 percent, boost after one month. They also saw a 10 point, or 1.8 percent, boost after 12 months, on average.

- On the other end of the spectrum, borrowers who started with higher scores are less likely to see a credit score bump. 57 percent of people with scores of 750 or higher see their scores increase after a month, and about 39 percent have higher scores after a year.

Credit score bumps aren’t long lasting

Sixty-two percent of borrowers see their scores go up a month after taking out a personal loan, but the number of borrowers who maintain that increase goes down over time. After 12 months, 45 percent have scored higher than when they originated the loan.

In fact, after one month, borrowers see their scores rise by 11 points, on average, but after six months scores are back down to where they started. Worse yet, after 12 months borrowers see scores that are an average of 10 points lower than they were during the month that their loans originated.

Lower starting credit scores see higher jumps after loan origination

The lower someone’s starting score, the more likely they are to see a credit score increase, the bigger the increase will be, and the more likely they are to maintain it for a year. This is encouraging and dispels the notion that those with poorer credit scores are more irresponsible with their personal loans.

Across the credit bands reviewed, the lower the starting score band, the higher the percentage of borrowers who saw their scores increase. This holds for all of the time periods reviewed, except for the first and last months, where people with scores of 750 or higher were more likely to have a higher score than the credit band directly below them (700-749).

Seventy-one percent of borrowers with scores below 620 have higher scores three and six months following their loan, which drops down to 58 percent after 12 months — still a clear majority. That translates to an average 20-point increase at one month, before dropping to an average of 10 points after 12 months.

About LendingTree

LendingTree (NASDAQ: TREE) is the nation’s leading online marketplace that connects consumers with the choices they need to be confident in their financial decisions. LendingTree empowers consumers to shop for financial services the same way they would shop for airline tickets or hotel stays, comparing multiple offers from a nationwide network of over 500 partners in one simple search, and can choose the option that best fits their financial needs. Services include mortgage loans, mortgage refinances, auto loans, personal loans, business loans, student refinances, credit cards and more. Through the My LendingTree platform, consumers receive free credit scores, credit monitoring and recommendations to improve credit health. My LendingTree proactively compares consumers’ credit accounts against offers on our network, and notifies consumers when there is an opportunity to save money. In short, LendingTree’s purpose is to help simplify financial decisions for life’s meaningful moments through choice, education and support. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information, go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.