54% of Americans Expect to Shop on Small Business Saturday

Small Business Saturday — Nov. 29 this year — was created to celebrate small businesses and generate support. However, according to a LendingTree survey of 2,050 U.S. consumers, 42% of Americans don’t know what Small Business Saturday is.

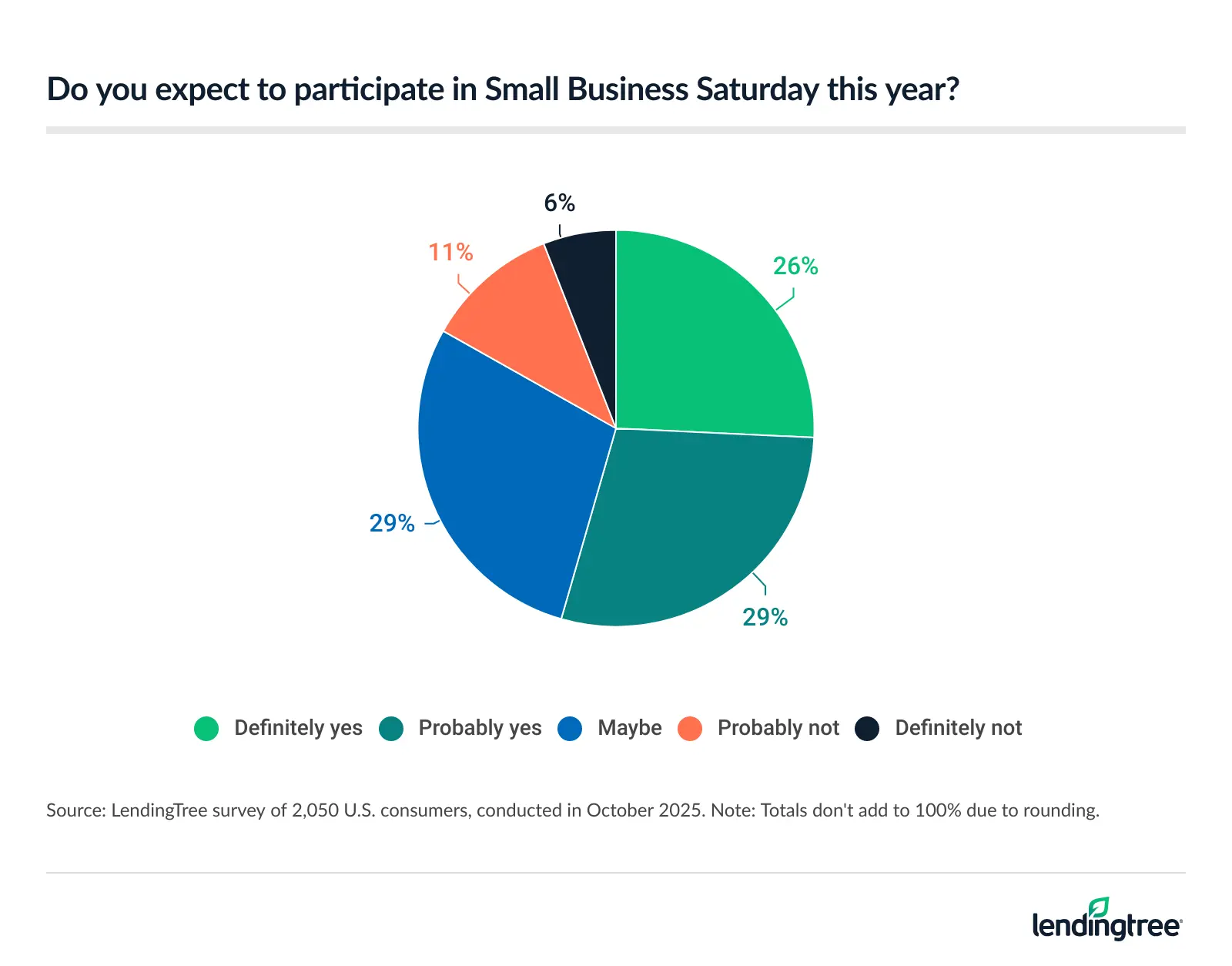

Still, 54% expect to participate this year, while 65% actively seek out small businesses during the holidays.

Here’s a closer look.

- Many Americans plan to show up for Small Business Saturday. Despite more than 2 in 5 (42%) being unfamiliar with Small Business Saturday, 54% expect to participate this year. However, most Americans don’t confine their small business shopping to just that day — only 36% say they do.

- Holiday shoppers balance budgets with support for small businesses. During the holidays, 65% of Americans actively seek out small businesses, and just over 3 in 4 (76%) plan to buy at least some of their gifts from them. However, 83% of those who plan to shop at these businesses say they expect to do less than half of their shopping at them. Inflation has a mixed effect, with 56% of Americans saying it makes them more likely to shop small.

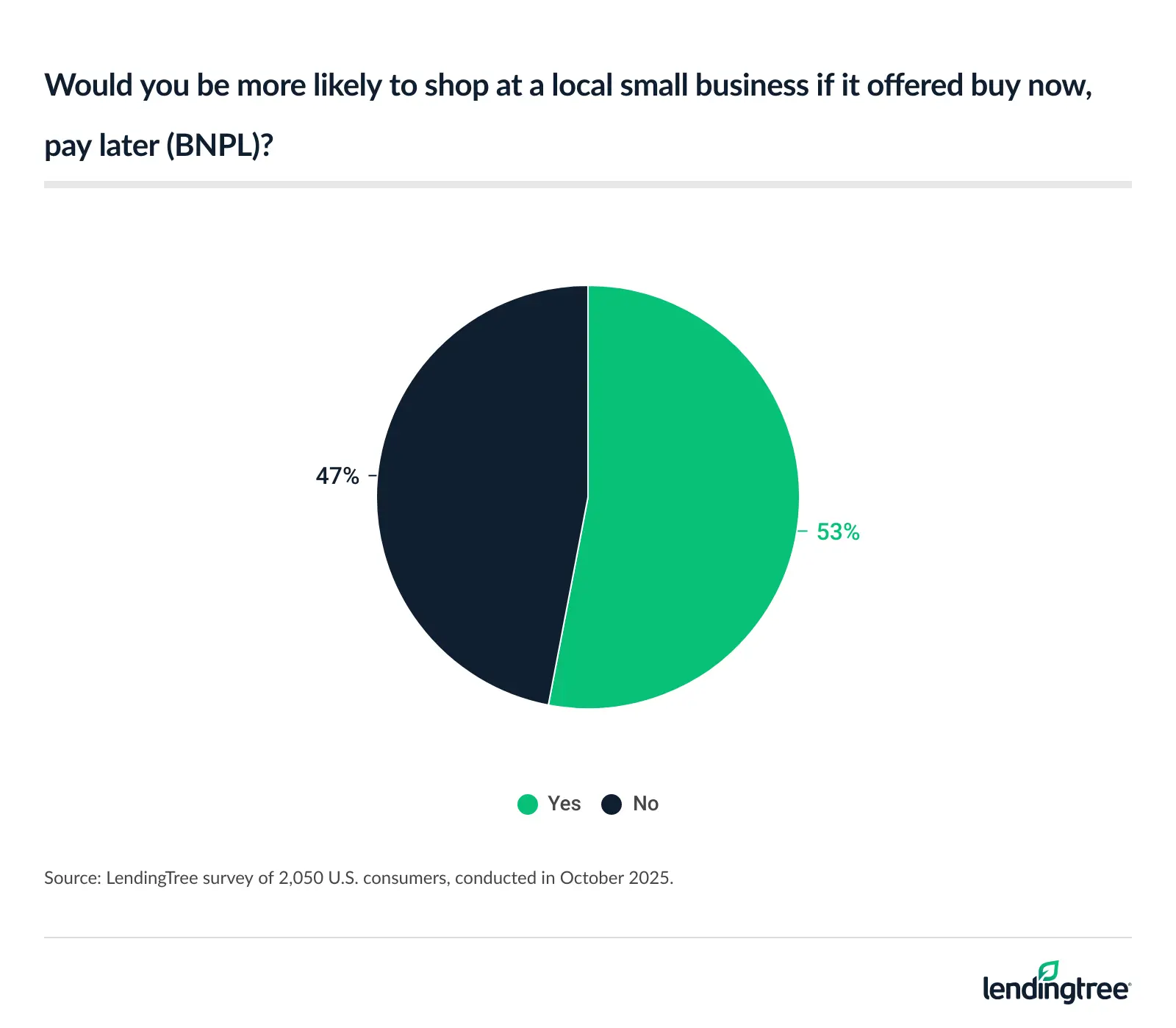

- Some turn to buy now, pay later (BNPL) to shop small. 53% of consumers say they’d be more likely to shop local if small businesses offered BNPL options. However, trust remains relatively low, as 42% believe in BNPL providers less than they do credit card companies. Even so, over half (56%) of this year’s likely Small Business Saturday shoppers plan to use BNPL.

- Younger Americans are most optimistic about the impact of shopping small, but many still don’t make it a habit. Over half (53%) of Americans say shopping at small businesses makes a big difference. Younger generations feel this more strongly, with 60% of millennials and 57% of Gen Zers agreeing. Still, optimism doesn’t always lead to action, particularly as 48% of Americans admit they don’t go out of their way to shop small and 59% expect to pay more when they do.

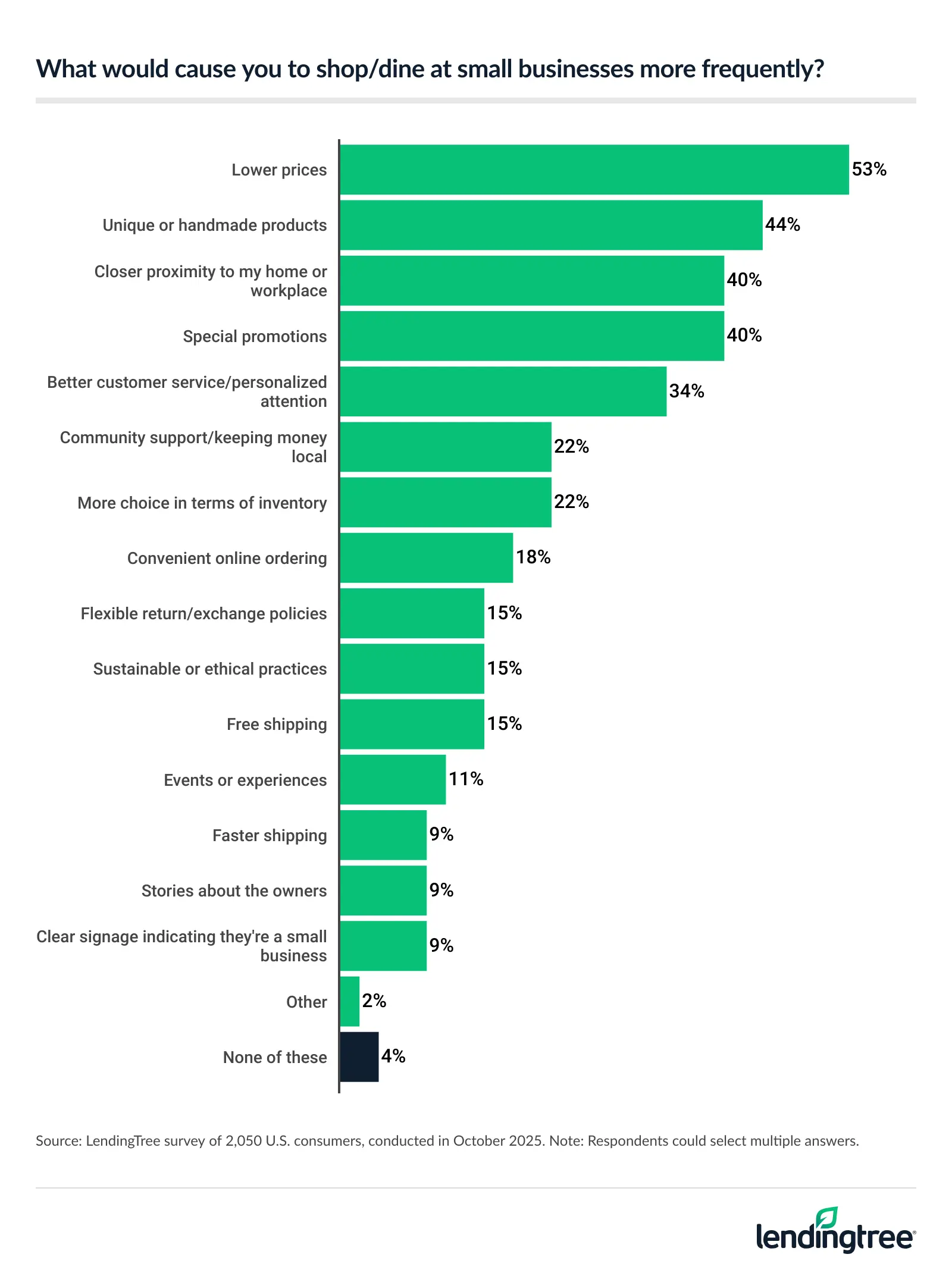

- Barriers prevent Americans from shopping small more often. When asked what could make them shop small more often, 53% said lower prices, 44% said unique or handmade items and 40% said closer proximity to home or work. Additionally, 46% find it difficult to determine whether a business is small or part of a chain.

54% of Americans expect to participate in Small Business Saturday

Many believe small businesses are the backbone of the economy, but Small Business Saturday isn’t a well-known day. Overall, 42% of Americans aren’t familiar with it.

Regardless of whether they are aware of it, 54% expect to participate this year by shopping at a small business that day. That figure is especially high among those with kids younger than 18 (75%) and six-figure earners (71%).

Small business shopping isn’t limited to the holiday. In fact, 64% of Americans shop at small businesses outside of Small Business Saturday.

For small businesses looking to improve awareness of the holiday, Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — says teaming with other small businesses to spread the word can be helpful.

“If you run a small clothing store, consider reaching out to small restaurants, bookstores or other small businesses for some cross-promotion,” he says. “It could be as simple as signage or fliers in these stores that promote the others, or it could be a special discount you could offer to customers of those stores. Also, reaching out to your local Chamber of Commerce to take part in their Small Business Saturday events could be a great way to get more visibility.”

Many seek small businesses for holiday shopping

Holiday shopping presents a significant opportunity for small businesses, with 65% of Americans actively seeking out small businesses to complete their holiday shopping lists — particularly those with children younger than 18 (79%) and six-figure earners (78%).

In total, 76% plan to buy at least some of their gifts from them this year. Breaking that down, 83% who plan to do so expect to do less than half of their shopping at them.

With that in mind, how can small businesses effectively compete with larger retailers during the holiday season?

“The most obvious move would be to compete more when it comes to price,” Schulz says. “However, that isn’t always realistic. You could differentiate yourself through the products you offer, leaning on unique, niche items that can’t be found elsewhere. You could lean heavily on service and loyalty, offering an experience you can’t get elsewhere. You can also emphasize your local ties. Tell your story and share your unique identity that makes you a valuable part of the community.”

The good news is that inflation has increased consumers’ interest in small businesses: While 33% say they’re more likely to help support small businesses because of inflation, 23% say they’re more likely to shop small because it offers better value.

BNPL would incentivize small business shoppers

Buy now, pay later (BNPL) is a common payment method nowadays, and many would use it to shop small if they could. In fact, over half (53%) of consumers say they’d be more likely to shop local if small businesses offered BNPL options. Those with children younger than 18 (75%) and millennials ages 29 to 44 (71%) are the most likely to say so.

Still, though, 42% of Americans don’t trust BNPL providers at small businesses over credit card companies. Even so, 56% of this year’s likely Small Business Saturday shoppers plan to use BNPL that day.

Schulz says there are some difficulties small businesses face that big businesses wouldn’t when it comes to BNPL access.

“Many BNPL services have done a good job of making it possible to use them pretty much anywhere, including at small businesses,” he says. “However, mega-retailers tend to get promoted in BNPL apps. Given that, it might make sense for a business to promote in-store purchases that can be made using a BNPL app. Otherwise, people may not realize it’s possible. It may require some extra effort and hand-holding, such as a ‘Want to pay with BNPL? Ask me how’ sign, but it could be a way to keep BNPL fans from walking out of your store without making a purchase.”

Majority believe shopping small makes big difference

Shopping small is a good way to support your local community, but not everyone is convinced it makes a difference. In fact, just 53% of Americans say shopping at small businesses makes a big difference.

Younger generations feel this more strongly, with 60% of millennials and 57% of Gen Zers ages 18 to 28 agreeing. That compares with 51% of Gen Xers ages 45 to 60 and 43% of baby boomers ages 61 to 79.

Also, 41% think online retailers like Amazon hurt small businesses, while 22% feel they have no effect.

That doesn’t always mean anything will come of it, though, as 48% of Americans don’t go out of their way to shop small and 59% expect to pay more when they do.

High prices and generic items keep Americans from shopping small

Why aren’t Americans shopping small more often? A lot of it boils down to affordability. Overall, 53% believe lower prices would make them shop small more frequently — the highest response.

Following that, 44% say unique or handmade items and 40% say closer proximity to home or work.

Meanwhile, 46% of Americans find it difficult to determine whether a business is small or a chain — which may also make it more challenging to shop small.

Taking advantage of Small Business Saturday: Top expert tips

Small Business Saturday is a great opportunity to get feet in the door. If you’re looking to improve awareness, we offer the following advice:

- Leverage the resources in your community. Googling “small business resources near me” can yield a treasure trove of information to help you grow your business.

- Partner with other small businesses in your area. “There’s definite power when many small businesses join together to create more visibility,” Schulz says.

- Offer incentives for first-time customers. Whether it’s a small discount or a free sample, anything that creates a sense of urgency and makes the customer feel appreciated can turn a one-time visitor into a repeat buyer.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,050 U.S. consumers ages 18 to 79 from Oct. 9 to 13, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennials: 29 to 44

- Generation X: 45 to 60

- Baby boomers: 61 to 79

Compare business loan offers