What Is a Factor Rate and How Do You Calculate It?

Factor rates are decimal numbers used to calculate the cost of certain business financing products, such as merchant cash advances. Using factor rates to figure out interest on business financing may seem tricky at first, but it’s a simple calculation.

- Like an interest rate, a factor rate is a metric for determining the cost of borrowing small business funding.

- Multiplying the factor rate by the loan amount gives you the total amount you’ll need to pay back.

- The factor rate you’re given can depend on a variety of factors, including your industry, time in business, credit history and total sales.

- You can convert a factor rate into an interest rate to compare loans.

What is a factor rate?

Like an interest rate, a factor rate is a number that tells you how much it will cost to borrow a loan or cash advance. Unlike an interest rate, a factor rate is expressed as a decimal (instead of a percentage) and is not annualized. That means it tells you the total amount you’ll pay for the loan, rather than the amount you’ll pay each year.

Factor rates are specific to small business funding and are less common than annual percentage rates (APRs), which incorporate an interest rate and fees. Factor rates, sometimes called buy rates, typically range between 1.1 and 1.5.

Factor rates are generally associated with high-risk lending products, such as merchant cash advances or short-term business loans from alternative, nonbank business lenders. These funding options typically have fast repayment terms and high rates on relatively small amounts, but lenient eligibility requirements.

How are factor rates commonly used?

Merchant cash advances (MCAs), most commonly use factor rates over APRs. It’s important to note that MCAs aren’t loans. Rather, they’re an advance of money in exchange for a percentage of your future credit or debit card sales.

Merchant cash advances often have high fees, and because they aren’t required to follow the Truth in Lending Act, there’s often not enough transparency around what you’ll pay. Calculating the total cost of your loan can help you understand whether it’s affordable for your business.

In most states, loan transactions are regulated by something called usury laws. These laws place a cap on the rates that lenders can charge. However, the regulation doesn’t apply to merchant cash advances because they aren’t technically considered loans, which is why some lenders offer cash advances to get around these laws and charge higher rates.

Before taking out an MCA, make sure you read the full business loan agreement and understand all charges and fees associated with the loan.

Factor rate vs. interest rate vs. APR

Although factor rates, interest rates and annual percentage rates (APR) are all metrics used to show the total cost of borrowing a loan or advance, they all work a bit differently.

- Factor rates are multiplied by your financing amount to show the total cost of funding.

- An interest rate is the percentage of the principal charged by the lender for borrowing.

- A simple interest rate, sometimes called a flat interest rate, shows the total percentage of the principal charged by the lender.

- An annual interest rate shows the percentage of the principal charged by the lender each year.

- The APR reflects the total cost of borrowing as a percentage you’ll pay each year, including the interest rate and additional fees.

Here’s a closer look at how a factor rate and interest rate differ:

Factor rate vs. interest rate

| Factor rate | Interest rate |

|---|---|

|

|

How to calculate a factor rate

To determine how much you’ll pay for a loan or cash advance, multiply the amount you’re borrowing by the factor rate. The total is the amount that you’ll pay back to the lender.

Advance amount x factor rate = total payback amount

Say you get a $10,000 MCA with a 1.25 factor rate. To figure out how much you’ll pay back to the MCA provider, multiply the cash advance amount by the factor rate.

In this instance, the calculation would be:

$10,000 x 1.25 = $12,500

You would pay back $12,500 total to the MCA provider for borrowing $10,000. That means the total cost of the advance is $2,500.

How to convert a factor rate into a flat interest rate

Some loans, especially short-term loans and advances, will express interest as a flat interest rate rather than an annualized one. A flat interest rate means that the same amount of interest will be charged, regardless of how long it takes to repay the loan.

In this case, the calculation is fairly simple:

(Factor rate – 1) x 100 = simple interest rate

If you were given that same $10,000 MCA with a 1.25 factor rate, the equation would look like this:

(1.25 – 1) x 100 = simple interest rate

(0.25) x 100 = simple interest rate

25% = simple interest rate

This means you’ll pay back 25% more than you borrowed.

How to convert a factor rate into an annual percentage rate (APR)

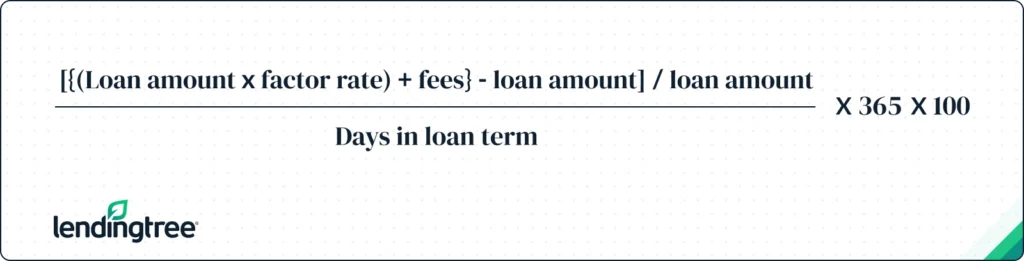

Looking at an APR will give you a good idea of the total cost of borrowing because it takes both interest and fees into account. To calculate the APR, use this equation:

The simplest way to do this is to use a program like Microsoft Excel or Google Sheets to do the equation for you. We’ve created a Google Sheet that you can copy and use to compare lenders. You can add information on your loan amount, fees and different payback terms to estimate the APR automatically.

You can also plug this equation directly into a calculator (including parentheses), adding in the information on how much you’re borrowing, your factor rate, any fees and your term length.

- For iPhone: Open the Calculator app and then click the calculator icon to switch to scientific mode, which lets you use parentheses.

- For Android: Google’s calculator app allows parentheses without switching to scientific mode.

- For desktop computers: You can type “online calculator” into Google to access an in-browser calculator.

If you don’t know how many days are in your term, you can also use months to estimate an APR — just swap 365 for 12.

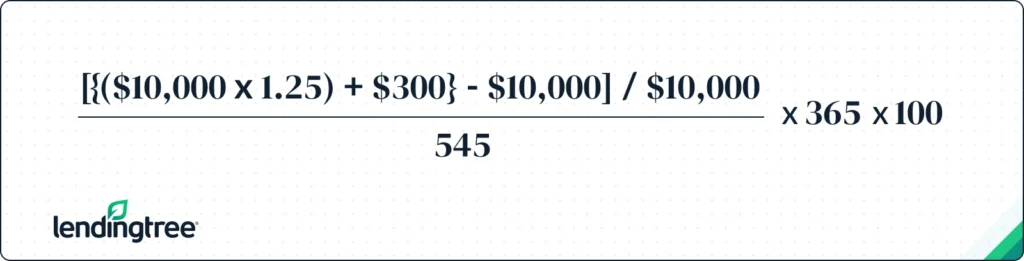

As an example, let’s use a $10,000 merchant cash advance with a 1.25 factor rate and a $300 origination fee, but no other fees, paid back over 545 days (or about 18 months).

To do the equation step by step, break this down into smaller equations, starting with the innermost parentheses.

Step 1: $10,000 x 1.25 factor rate = $12,500 payback amount before fees

Step 2: $12,500 + $300 origination fee = $12,800 total payback amount

Step 3: $12,800 – $10,000 = $2,800 total cost of borrowing

Step 4: $2,800 / $10,000 = 0.28 cost of borrowing as a percentage

Step 5: 0.28 / 545 days = 0.0005138 daily cost of borrowing as a percentage

Step 6:0.0005138 x 365 x 100 = 18.75% APR

Tip: If you’re doing these calculations manually, you’ll typically want to include at least 6 decimal places for accuracy.

How to compare rates across lenders

When getting a business loan or advance, it’s a good idea to gather quotes from multiple lenders and compare them to see who’s offering you the best rate. Doing so can often help you save money. However, it’s important to make sure you’re creating an apples-to-apples comparison.

To do this, do your best to give each lender the same information about your business and the type of small business funding you’re seeking. Then, once you have all your loan offers in hand, take the time to convert them to the same type of rate.

In most cases, APR is likely to give you the clearest picture of what each loan or advance will cost you since it takes both interest and fees into account. But for short-term loans with terms of less than one year, the APR can be misleading, and you may be better off comparing the total cost of borrowing instead.

When you’re dealing with factor rates or simple interest rates, the loan term you select can have a drastic impact on your APR. To illustrate what we mean, consider the cost of a merchant cash advance with a three-month repayment period versus a one-year repayment period where all other factors are the same.

If you take out a $5,000 MCA with no fees at a factor rate of 1.10 and a 90-day repayment period, your APR would be just over 40%. In contrast, with a 365-day repayment period, the APR would only be 10%.

In both cases, you actually pay the same amount of interest, $500, even though the APR is drastically different. This is why it’s crucial to make sure you’re comparing the total cost of borrowing when comparing lenders.

First, let’s do the initial factor rate calculations to determine the total payback amount, the cost of borrowing and the percentage cost of the advance. Note: This information will remain the same, regardless of the loan term.

Total payback amount:

Amount borrowed x factor rate = total payback amount

$5,000 x 1.10 = $5,500

Total cost of borrowing:

Total payback amount – amount borrowed = cost of borrowing

$5,500 – $5,000 = $500

Percentage cost of the advance:

Cost of advance / amount borrowed = percentage cost

$500 / $5,000 = 0.10

Now that we have that information, we can calculate the APR for each of the two loan terms.

90-day loan term:

(0.10 / days in loan term) x 365 x 100

(0.1 / 90) x 365 x 100 = APR

0.00111111 x 365 x 100 = 40.6% APR

One-year loan term:

(0.10 / days in loan term) x 365 x 100

(0.1 / 365) x 365 x 100 = APR

0.00027387 x 365 x 100 = 10.0% APR

How lenders determine your factor rate

While it’s typically easy for business owners to qualify for MCAs and other short-term products associated with factor rates, lenders and financing companies would evaluate several aspects of the business before assigning a rate.

- Type of industry: Businesses with predictable income are more likely to receive a lower factor rate compared to businesses with variable income. For example, cyclical industries, such as hotels or restaurants, experience periods of high and low sales depending on the season or demand, which can be seen as riskier.

- Length of time in business: Businesses with longer operating histories are more likely to receive a lower factor rate compared to startups.

- Business sales and growth: Businesses with consistent sales and patterns of growth are more likely to receive a lower factor rate compared to businesses that are struggling to perform.

- Average monthly credit card sales: This shows how likely the business can repay debt. Businesses with more credit card sales are more likely to receive a lower factor rate compared to those with fewer sales.

- Business credit history: Businesses with solid credit histories are more likely to receive a lower factor rate compared to those with lower scores. This can include both your business credit score and your personal credit history.

Before accepting an offer, shop around for financing to get a factor rate and terms that work for your business. Make sure the cost of financing is within your budget and repayment terms aren’t too fast to keep up with.Before accepting an offer, shop around for financing to get a factor rate and terms that work for your business. Make sure the cost of financing is within your budget and repayment terms aren’t too fast to keep up with.