Cheapest Car Insurance in Alabama (2026)

Travelers has Alabama’s cheapest full coverage car insurance, with an average rate of $103 a month. This is 33% cheaper than the state average of $153 a month.

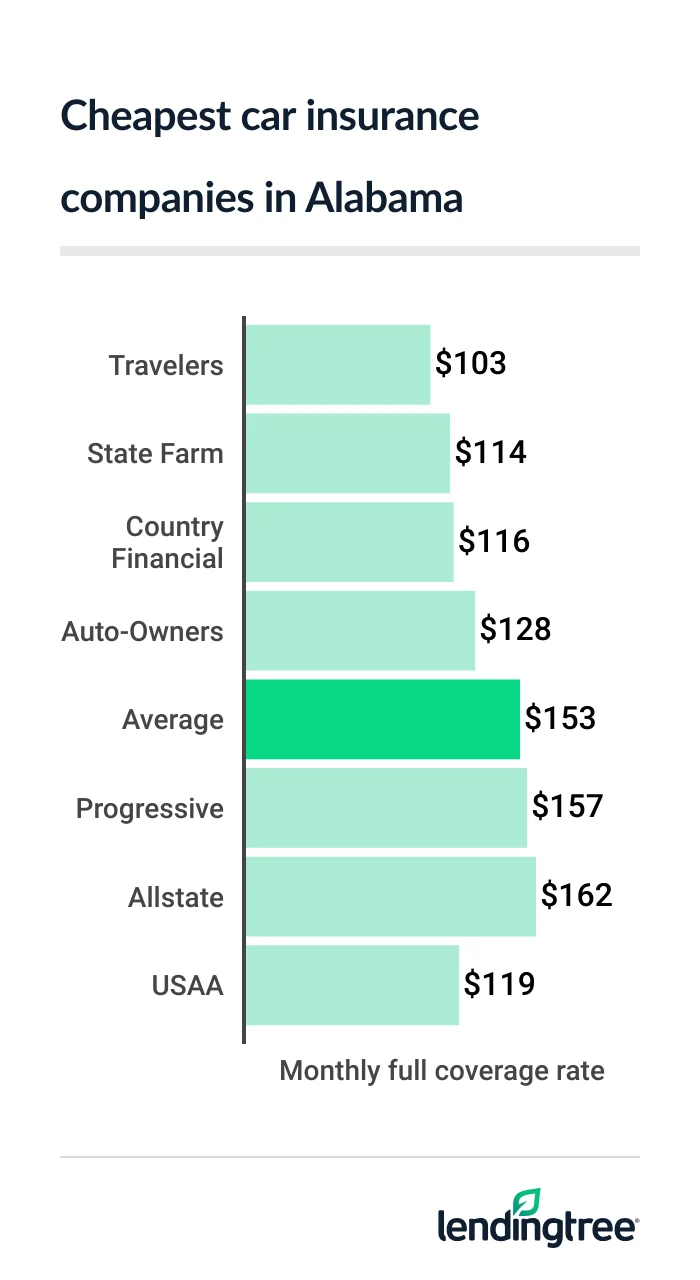

Cheapest car insurance companies in Alabama

Cheapest full coverage car insurance in Alabama: Travelers

Drivers in Alabama looking for the cheapest full coverage car insurance get the best rate with Travelers, at $103 a month. State Farm has the next-cheapest rate of $114 a month for full coverage.

- Travelers is 33% cheaper than the state average of $153 a month.

- Travelers and State Farm both offer about the same number of discounts to help you save money. Their rates are also similar. This means the discounts you qualify for will likely decide which company is the cheapest for you.

Cheapest full coverage insurance companies

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Travelers | $103 |  |

| State Farm | $114 |  |

| Country Financial | $116 | |

| Auto-Owners | $128 | |

| Progressive | $157 | |

| Allstate | $162 | |

| Nationwide | $214 | |

| Geico | $260 | |

| USAA* | $119 | |

State Farm offers a bundling discount that can save you up to $1,273 if you combine your car and home insurance with it, for example. When comparing quotes, ask an agent about all the discounts you might qualify for.

Full coverage car insurance usually combines liability

Cheap liability insurance in Alabama: State Farm

State Farm offers the cheapest liability car insurance in Alabama, at $37 per month. Travelers is close behind, with an average rate of $39 per month.

USAA is even cheaper at $35 per month for liability coverage, but it’s only available to military members and their families.

Cheap liability car insurance companies

| Company | Monthly rate |

|---|---|

| State Farm | $37 |

| Travelers | $39 |

| Auto-Owners | $48 |

| Country Financial | $50 |

| Nationwide | $71 |

| Progressive | $76 |

| Allstate | $79 |

| Geico | $91 |

| USAA* | $35 |

If customizing your car insurance policy is important to you, Travelers may be a better option for you than State Farm. It offers more than twice as many add-on coverages as State Farm.

Travelers’ gap insurance is especially helpful if you lease or finance your car. It covers the difference between your car’s actual cash value and the remaining balance on your loan if the car is totaled.

Alabama’s cheapest auto insurance for young drivers: Country Financial

For young Alabama drivers, Country Financial has the cheapest teen car insurance rates of $98 a month for liability coverage and $220 a month for full coverage. Travelers is the next-cheapest, at $110 and $270.

Cheapest auto insurance for young drivers

| Company | Liability coverage | Full coverage |

|---|---|---|

| Country Financial | $98 | $220 |

| Travelers | $110 | $270 |

| State Farm | $127 | $319 |

| Auto-Owners | $165 | $356 |

| Allstate | $206 | $408 |

| Geico | $222 | $552 |

| Progressive | $250 | $646 |

| Nationwide | $276 | $744 |

| USAA* | $81 | $230 |

Both companies offer a good student discount. Full-time students with at least a B average can save money on their car insurance. Country Financial’s good student discount can save you up to 35%, so it’s worth checking out when you compare quotes.

Teens pay the highest car insurance rates because they’re more likely to get into accidents. If you keep a clean driving record, your rates usually start to go down in your early 20s.

Best cheap car insurance in Alabama after a speeding ticket: State Farm

State Farm offers the lowest car insurance rates in Alabama after a speeding ticket, at $123 a month. Travelers and Auto-Owners tie for second place at $128 a month.

Cheapest car insurance with a speeding ticket

| Company | Monthly rate |

|---|---|

| State Farm | $123 |

| Travelers | $128 |

| Auto-Owners | $128 |

| Country Financial | $144 |

| Allstate | $172 |

| Progressive | $214 |

| Nationwide | $306 |

| Geico | $347 |

| USAA* | $137 |

A speeding ticket can raise your car insurance rates by about 24% in Alabama. After two years, your point count will fall off your record, but the ticket will remain on it. You’ll probably pay higher rates during that time.

State Farm, Travelers and Auto-Owners have similar rates and offer about the same number of discounts. When comparing quotes, see which company does the best job of offsetting the rate increase.

Cheapest Alabama auto insurance after an accident: State Farm

With rates that average $135 a month, State Farm has the cheapest car insurance after an accident. Travelers is the next-cheapest company, at $140 a month.

To compare, the average rate for auto insurance in Alabama is $230 a month.

Best insurance rates with an accident

| Company | Monthly rate |

|---|---|

| State Farm | $135 |

| Travelers | $140 |

| Country Financial | $155 |

| Auto-Owners | $193 |

| Allstate | $240 |

| Progressive | $241 |

| Nationwide | $369 |

| Geico | $430 |

| USAA* | $170 |

If good customer service is important to you, make sure you get a quote from Travelers while you shop for a policy. Travelers gets fewer customer complaints than State Farm, based on both companies’ ratings from the National Association of Insurance Commissioners

Cheapest insurance for Alabama teens with bad driving records: Country Financial

In Alabama, teens with poor driving records get the lowest car insurance rates from Country Financial. The company charges the state’s teen drivers about $126 per month after a ticket and $144 per month after an accident.

Best insurance for teens with a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Country Financial | $126 | $144 |

| Travelers | $137 | $162 |

| State Farm | $141 | $163 |

| Auto-Owners | $165 | $228 |

| Allstate | $223 | $262 |

| Progressive | $266 | $270 |

| Geico | $290 | $358 |

| Nationwide | $300 | $303 |

| USAA* | $124 | $143 |

A typical Alabama teen sees their car insurance rates go up by about 15% after a ticket and 32% after an accident. Comparing each company’s good student discount can help you find the best way to lower your rate.

Best car insurance companies after a DUI in Alabama: Travelers

Travelers offers the cheapest DUI insurance rates in Alabama, at about $145 per month. Progressive is the state’s second-cheapest option after a DUI (driving under the influence) conviction, at $201 per month.

Cheapest car insurance rates with a DUI

| Company | Monthly rate |

|---|---|

| Travelers | $145 |

| Progressive | $201 |

| Allstate | $213 |

| Country Financial | $243 |

| State Farm | $267 |

| Auto-Owners | $293 |

| Geico | $454 |

| Nationwide | $496 |

| USAA* | $250 |

If your license is suspended after a DUI in Alabama, you’ll need to file an SR-22 to get it reinstated. This form shows that you have the state’s minimum required car insurance. Your insurance company will file the SR-22 with the state Department of Motor Vehicles (DMV) for you.

Alabama’s cheapest auto insurance for bad credit: Country Financial

Alabama drivers needing bad-credit car insurance get the cheapest rates with Country Financial, at $160 a month. Travelers has the next-cheapest rates of $174 a month. The average car insurance rate for Alabama drivers with poor credit is $285 a month.

Cheap car insurance quotes with poor credit

| Company | Monthly rate |

|---|---|

| Country Financial | $160 |

| Travelers | $174 |

| Progressive | $242 |

| Allstate | $271 |

| Nationwide | $319 |

| Auto-Owners | $369 |

| Geico | $392 |

| State Farm | $436 |

| USAA* | $205 |

Insurance companies use credit scores in different ways, and some don’t use them at all when calculating your quote. If your credit isn’t great, compare car insurance quotes from several companies before you buy or renew. It may help you save a lot of money.

Best car insurance companies in Alabama

Travelers and State Farm are the best car insurance companies in Alabama. Both offer the lowest rates in the state and provide plenty of discounts to help you save. Young drivers get the best rate in Alabama with Country Financial.

For customer satisfaction, Country Financial comes out on top for most Alabama drivers. State Farm comes in second.

Alabama car insurance company ratings

| Company | LendingTree | J.D. Power** | AM Best |

|---|---|---|---|

| Country Financial | 4.8 | 659 | A+ |

| Auto-Owners | 4.8 | 638 | A+ |

| State Farm | 4.5 | 650 | A++ |

| Travelers | 4.4 | 613 | A++ |

| USAA* | 4.1 | 735 | A++ |

| Progressive | 3.8 | 621 | A+ |

| Geico | 3.7 | 645 | A++ |

| Allstate | 3.2 | 635 | A+ |

| Nationwide | 2.8 | 645 | A |

Alabama car insurance rates by city

Sheffield has the cheapest car insurance among Alabama cities, with rates that average $138 a month. This is about 10% cheaper than the state average of $153 a month.

Fairfield drivers pay the state’s most expensive car insurance rates of about $176 a month, which is 15% higher than average.

Alabama’s other major cities have average rates that fall between those extremes.

- Huntsville: $145 a month

- Mobile: $164 a month

- Birmingham: $170 a month

- Montgomery: $163 a month

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Abbeville | $147 | -3% |

| Abernant | $159 | 4% |

| Adamsville | $167 | 9% |

| Adger | $158 | 4% |

| Akron | $160 | 5% |

| Alabaster | $151 | -1% |

| Albertville | $143 | -6% |

| Alexander City | $151 | -1% |

| Alexandria | $150 | -1% |

| Allgood | $155 | 2% |

| Alpine | $156 | 2% |

| Alton | $166 | 9% |

| Andalusia | $150 | -2% |

| Anderson | $142 | -7% |

| Annemanie | $171 | 12% |

| Anniston | $150 | -2% |

| Arab | $141 | -7% |

| Ardmore | $145 | -5% |

| Argo | $150 | -2% |

| Ariton | $146 | -4% |

| Arley | $157 | 3% |

| Arlington | $172 | 12% |

| Ashford | $141 | -8% |

| Ashland | $151 | -1% |

| Ashville | $150 | -2% |

| Athens | $141 | -7% |

| Atmore | $157 | 3% |

| Attalla | $152 | 0% |

| Auburn | $151 | -1% |

| Auburn University | $150 | -1% |

| Axis | $153 | 0% |

| Babbie | $148 | -3% |

| Baileyton | $147 | -3% |

| Ballplay | $153 | 0% |

| Banks | $160 | 5% |

| Bankston | $152 | 0% |

| Bay Minette | $141 | -8% |

| Bayou La Batre | $163 | 7% |

| Beaverton | $147 | -4% |

| Belk | $151 | -1% |

| Bellamy | $163 | 7% |

| Belle Fontaine | $165 | 8% |

| Belle Mina | $146 | -4% |

| Bellwood | $145 | -5% |

| Berry | $155 | 2% |

| Bessemer | $163 | 7% |

| Billingsley | $151 | -1% |

| Birmingham | $170 | 12% |

| Black | $144 | -6% |

| Blue Ridge | $152 | 0% |

| Boaz | $147 | -4% |

| Boligee | $161 | 5% |

| Bon Air | $158 | 4% |

| Bon Secour | $144 | -5% |

| Booth | $154 | 1% |

| Boykin | $166 | 9% |

| Brent | $152 | -1% |

| Brewton | $156 | 2% |

| Bridgeport | $148 | -3% |

| Brierfield | $151 | -1% |

| Brighton | $173 | 13% |

| Brilliant | $152 | 0% |

| Brook Highland | $160 | 5% |

| Brooklyn | $164 | 8% |

| Brookside | $166 | 9% |

| Brookwood | $155 | 1% |

| Brownsboro | $145 | -5% |

| Brundidge | $149 | -2% |

| Bryant | $149 | -3% |

| Bucks | $161 | 6% |

| Buhl | $153 | 0% |

| Burnwell | $163 | 7% |

| Bynum | $153 | 0% |

| Calera | $150 | -2% |

| Calvert | $165 | 8% |

| Camden | $169 | 11% |

| Camp Hill | $151 | -1% |

| Campbell | $163 | 7% |

| Capshaw | $143 | -6% |

| Carbon Hill | $156 | 2% |

| Cardiff | $163 | 7% |

| Carlisle-Rockledge | $151 | -1% |

| Carlton | $169 | 11% |

| Carrollton | $154 | 1% |

| Catherine | $166 | 9% |

| Cecil | $157 | 3% |

| Cedar Bluff | $150 | -2% |

| Center Point | $172 | 13% |

| Centre | $151 | -1% |

| Centreville | $150 | -2% |

| Chancellor | $144 | -5% |

| Chapman | $163 | 7% |

| Chatom | $165 | 8% |

| Chelsea | $160 | 5% |

| Cherokee | $140 | -8% |

| Chickasaw | $159 | 4% |

| Childersburg | $158 | 3% |

| Choccolocco | $149 | -2% |

| Chunchula | $161 | 5% |

| Citronelle | $162 | 6% |

| Clanton | $149 | -3% |

| Clay | $162 | 6% |

| Clinton | $158 | 3% |

| Clopton | $147 | -4% |

| Cloverdale | $144 | -6% |

| Coaling | $155 | 1% |

| Coats Bend | $153 | 0% |

| Coden | $164 | 7% |

| Coffee Springs | $145 | -5% |

| Columbia | $142 | -7% |

| Columbiana | $150 | -1% |

| Cook Springs | $152 | -1% |

| Coosada | $153 | 1% |

| Cordova | $165 | 8% |

| Cottondale | $155 | 2% |

| Cottonton | $168 | 10% |

| Courtland | $147 | -4% |

| Cowarts | $141 | -7% |

| Coy | $169 | 11% |

| Cragford | $151 | -1% |

| Creola | $154 | 1% |

| Cropwell | $148 | -3% |

| Crossville | $147 | -4% |

| Cuba | $165 | 8% |

| Cullman | $151 | -1% |

| Cusseta | $153 | 0% |

| Dadeville | $151 | -1% |

| Daleville | $144 | -5% |

| Daphne | $144 | -5% |

| Dauphin Island | $156 | 2% |

| Daviston | $152 | -1% |

| Dawson | $145 | -5% |

| De Armanville | $153 | 0% |

| Deatsville | $151 | -1% |

| Decatur | $143 | -6% |

| Deer Park | $166 | 9% |

| Delmar | $155 | 2% |

| Delta | $152 | 0% |

| Demopolis | $165 | 8% |

| Detroit | $153 | 0% |

| Dickinson | $166 | 9% |

| Dixons Mills | $169 | 11% |

| Docena | $169 | 10% |

| Dolomite | $170 | 12% |

| Dora | $160 | 5% |

| Dothan | $140 | -8% |

| Dozier | $149 | -2% |

| Duncanville | $156 | 2% |

| Dunnavant | $156 | 3% |

| Dutton | $147 | -3% |

| East Brewton | $156 | 2% |

| East Tallassee | $157 | 3% |

| Eastaboga | $151 | -1% |

| Echola | $151 | -1% |

| Edgewater | $172 | 13% |

| Edwardsville | $152 | 0% |

| Eight Mile | $160 | 5% |

| Elba | $147 | -4% |

| Eldridge | $157 | 3% |

| Elkmont | $142 | -7% |

| Elmore | $152 | 0% |

| Elrod | $151 | -1% |

| Emelle | $165 | 8% |

| Emerald Mountain | $152 | 0% |

| Enterprise | $145 | -5% |

| Epes | $162 | 6% |

| Equality | $153 | 0% |

| Estillfork | $151 | -1% |

| Eufaula | $156 | 2% |

| Eutaw | $159 | 4% |

| Evergreen | $160 | 5% |

| Excel | $165 | 8% |

| Fackler | $150 | -2% |

| Fairfield | $176 | 15% |

| Fairhope | $143 | -6% |

| Fairview | $147 | -3% |

| Falkville | $143 | -6% |

| Fayette | $152 | -1% |

| Five Points | $156 | 2% |

| Flat Rock | $149 | -2% |

| Florala | $146 | -4% |

| Florence | $141 | -8% |

| Foley | $141 | -8% |

| Forest Home | $162 | 6% |

| Forestdale | $171 | 12% |

| Forkland | $158 | 4% |

| Fort Deposit | $163 | 7% |

| Fort Mitchell | $171 | 12% |

| Fort Novosel | $144 | -5% |

| Fort Payne | $143 | -6% |

| Fort Rucker | $143 | -6% |

| Franklin | $164 | 8% |

| Frankville | $164 | 7% |

| Fulton | $165 | 8% |

| Fultondale | $164 | 8% |

| Furman | $169 | 11% |

| Gadsden | $153 | 0% |

| Gainestown | $163 | 7% |

| Gallant | $150 | -2% |

| Gallion | $165 | 8% |

| Gantt | $150 | -2% |

| Garden City | $156 | 2% |

| Gardendale | $159 | 4% |

| Gaylesville | $149 | -2% |

| Geneva | $143 | -6% |

| Georgiana | $160 | 5% |

| Geraldine | $146 | -5% |

| Gilbertown | $165 | 8% |

| Glen Allen | $150 | -2% |

| Glencoe | $153 | 0% |

| Glenwood | $156 | 2% |

| Good Hope | $151 | -1% |

| Goodsprings | $161 | 6% |

| Goodwater | $152 | 0% |

| Goodway | $171 | 12% |

| Gordonville | $168 | 10% |

| Goshen | $155 | 1% |

| Grady | $154 | 1% |

| Graham | $153 | 0% |

| Grand Bay | $162 | 6% |

| Grayson Valley | $169 | 11% |

| Graysville | $163 | 7% |

| Green Pond | $150 | -2% |

| Greensboro | $159 | 4% |

| Greenville | $160 | 5% |

| Grimes | $146 | -4% |

| Groveoak | $145 | -5% |

| Guin | $152 | 0% |

| Gulf Shores | $144 | -5% |

| Guntersville | $143 | -6% |

| Gurley | $146 | -4% |

| Hackleburg | $154 | 1% |

| Hackneyville | $151 | -1% |

| Haleyville | $147 | -4% |

| Hamilton | $153 | 1% |

| Hammondville | $145 | -5% |

| Hanceville | $152 | 0% |

| Hardaway | $167 | 9% |

| Harpersville | $156 | 2% |

| Hartford | $143 | -6% |

| Hartselle | $142 | -7% |

| Harvest | $145 | -5% |

| Hatchechubbee | $167 | 10% |

| Hayneville | $168 | 10% |

| Hazel Green | $145 | -5% |

| Headland | $146 | -4% |

| Heflin | $152 | 0% |

| Helena | $157 | 3% |

| Henagar | $144 | -6% |

| Higdon | $148 | -3% |

| Highland Home | $161 | 5% |

| Highland Lake | $153 | 0% |

| Highland Lakes | $161 | 5% |

| Hodges | $149 | -2% |

| Hokes Bluff | $153 | 0% |

| Hollins | $152 | 0% |

| Holly Pond | $151 | -1% |

| Hollytree | $152 | -1% |

| Hollywood | $148 | -3% |

| Holt | $154 | 1% |

| Holtville | $151 | -1% |

| Holy Trinity | $175 | 14% |

| Homewood | $163 | 7% |

| Honoraville | $159 | 4% |

| Hoover | $159 | 4% |

| Horton | $144 | -6% |

| Houston | $147 | -3% |

| Hueytown | $162 | 6% |

| Huguley | $154 | 1% |

| Huntsville | $145 | -5% |

| Huxford | $164 | 7% |

| Indian Springs Village | $159 | 4% |

| Irondale | $166 | 9% |

| Irvington | $164 | 7% |

| Ivalee | $152 | -1% |

| Jachin | $161 | 6% |

| Jack | $147 | -4% |

| Jackson | $166 | 9% |

| Jacksons Gap | $149 | -2% |

| Jacksonville | $149 | -2% |

| Jasper | $162 | 6% |

| Jefferson | $169 | 11% |

| Jemison | $151 | -1% |

| Jones | $155 | 2% |

| Joppa | $148 | -3% |

| Kansas | $155 | 2% |

| Kellerman | $159 | 4% |

| Kellyton | $151 | -1% |

| Kennedy | $151 | -1% |

| Kent | $155 | 2% |

| Kimberly | $155 | 2% |

| Kinsey | $140 | -8% |

| Kinston | $145 | -5% |

| Knoxville | $156 | 2% |

| La Fayette | $154 | 1% |

| Lanett | $154 | 1% |

| Langston | $149 | -2% |

| Lapine | $160 | 5% |

| Lawley | $150 | -2% |

| Leeds | $158 | 4% |

| Lenox | $162 | 6% |

| Leroy | $165 | 8% |

| Lester | $141 | -8% |

| Letohatchee | $164 | 8% |

| Level Plains | $145 | -5% |

| Lexington | $139 | -9% |

| Lillian | $142 | -7% |

| Lincoln | $151 | -1% |

| Linden | $168 | 10% |

| Lineville | $150 | -2% |

| Lipscomb | $174 | 14% |

| Little River | $143 | -6% |

| Littleville | $139 | -9% |

| Livingston | $165 | 8% |

| Loachapoka | $157 | 3% |

| Lockhart | $149 | -2% |

| Locust Fork | $154 | 1% |

| Lookout Mountain | $152 | -1% |

| Lower Peach Tree | $166 | 9% |

| Loxley | $143 | -6% |

| Luverne | $159 | 4% |

| Lynn | $150 | -2% |

| Madison | $143 | -7% |

| Magnolia | $166 | 9% |

| Magnolia Springs | $143 | -6% |

| Malcolm | $164 | 8% |

| Malvern | $146 | -4% |

| Marbury | $150 | -2% |

| Margaret | $149 | -2% |

| Marion | $159 | 4% |

| Marion Junction | $164 | 7% |

| Mathews | $154 | 1% |

| Maxwell Air Force Base | $158 | 4% |

| Maxwell Air Force Base Gunter Annex | $159 | 4% |

| Maylene | $151 | -1% |

| Mc Shan | $150 | -1% |

| Mc Williams | $168 | 10% |

| McCalla | $157 | 3% |

| McDonald Chapel | $173 | 13% |

| McKenzie | $160 | 5% |

| Meadowbrook | $160 | 5% |

| Megargel | $164 | 8% |

| Melvin | $160 | 5% |

| Mentone | $145 | -5% |

| Meridianville | $147 | -4% |

| Mexia | $165 | 8% |

| Midfield | $175 | 14% |

| Midland City | $146 | -4% |

| Millbrook | $151 | -1% |

| Millerville | $152 | 0% |

| Minor | $173 | 13% |

| Minter | $165 | 8% |

| Mobile | $164 | 8% |

| Monroeville | $162 | 6% |

| Montevallo | $148 | -3% |

| Montgomery | $163 | 7% |

| Montrose | $145 | -5% |

| Moody | $152 | -1% |

| Moores Mill | $145 | -5% |

| Mooresville | $141 | -7% |

| Morris | $158 | 3% |

| Morvin | $170 | 12% |

| Moulton | $147 | -3% |

| Moundville | $161 | 5% |

| Mount Olive | $159 | 4% |

| Mountain Brook | $160 | 5% |

| Mulga | $167 | 9% |

| Muscadine | $152 | 0% |

| Muscle Shoals | $138 | -9% |

| Myrtlewood | $164 | 8% |

| Nanafalia | $168 | 10% |

| Napier Field | $147 | -4% |

| Natural Bridge | $154 | 1% |

| Needham | $165 | 8% |

| New Brockton | $146 | -4% |

| New Castle | $162 | 6% |

| New Hope | $146 | -5% |

| New Site | $151 | -1% |

| Newton | $144 | -5% |

| Newville | $147 | -4% |

| Normal | $149 | -2% |

| Northport | $153 | 0% |

| Notasulga | $160 | 5% |

| Oak Hill | $169 | 11% |

| Odenville | $149 | -2% |

| Ohatchee | $153 | 0% |

| Oneonta | $154 | 1% |

| Opelika | $152 | 0% |

| Opp | $145 | -5% |

| Orange Beach | $144 | -5% |

| Our Town | $151 | -1% |

| Owens Cross Roads | $146 | -4% |

| Oxford | $152 | -1% |

| Ozark | $143 | -6% |

| Paint Rock | $154 | 1% |

| Palmerdale | $164 | 8% |

| Panola | $161 | 5% |

| Pansey | $141 | -8% |

| Parrish | $165 | 8% |

| Pelham | $158 | 3% |

| Pell City | $148 | -3% |

| Pennington | $166 | 9% |

| Perdido | $141 | -7% |

| Perdido Beach | $142 | -7% |

| Perdue Hill | $162 | 6% |

| Perote | $168 | 10% |

| Peterman | $163 | 7% |

| Peterson | $156 | 2% |

| Petrey | $164 | 8% |

| Phenix City | $166 | 9% |

| Phil Campbell | $148 | -3% |

| Piedmont | $149 | -3% |

| Pike Road | $162 | 6% |

| Pinckard | $146 | -4% |

| Pine Level | $152 | 0% |

| Pinson | $165 | 8% |

| Pisgah | $149 | -2% |

| Pittsview | $169 | 11% |

| Plantersville | $159 | 4% |

| Pleasant Grove | $168 | 10% |

| Point Clear | $143 | -6% |

| Powell | $144 | -6% |

| Prairie | $166 | 9% |

| Prattville | $153 | 0% |

| Priceville | $143 | -7% |

| Prichard | $161 | 5% |

| Princeton | $153 | 0% |

| Quinton | $164 | 8% |

| Rainbow City | $154 | 1% |

| Rainsville | $143 | -6% |

| Ralph | $153 | 1% |

| Randolph | $150 | -2% |

| Range | $160 | 5% |

| Red Bay | $149 | -2% |

| Red Level | $152 | 0% |

| Redland | $152 | 0% |

| Reeltown | $155 | 2% |

| Rehobeth | $140 | -8% |

| Remlap | $157 | 3% |

| River Falls | $150 | -2% |

| Riverside | $147 | -4% |

| Roanoke | $155 | 2% |

| Robertsdale | $141 | -8% |

| Rock Mills | $155 | 2% |

| Rockford | $154 | 1% |

| Rogersville | $141 | -8% |

| Russellville | $147 | -4% |

| Rutledge | $158 | 3% |

| Ryland | $151 | -1% |

| Safford | $160 | 5% |

| Saginaw | $156 | 2% |

| Saks | $150 | -1% |

| Salem | $163 | 7% |

| Samantha | $158 | 3% |

| Samson | $144 | -6% |

| Saraland | $156 | 2% |

| Sardis City | $149 | -2% |

| Satsuma | $152 | 0% |

| Sayre | $162 | 6% |

| Scottsboro | $148 | -3% |

| Seale | $170 | 12% |

| Selma | $162 | 6% |

| Selmont-West Selmont | $163 | 7% |

| Seminole | $142 | -7% |

| Shannon | $160 | 5% |

| Sheffield | $138 | -9% |

| Shelby | $147 | -3% |

| Shoal Creek | $160 | 5% |

| Shorter | $166 | 9% |

| Shorterville | $147 | -4% |

| Siluria | $153 | 1% |

| Silverhill | $143 | -6% |

| Sipsey | $163 | 7% |

| Skipperville | $146 | -4% |

| Slocomb | $145 | -5% |

| Smiths Station | $161 | 6% |

| Smoke Rise | $157 | 3% |

| Southside | $154 | 1% |

| Spanish Fort | $143 | -7% |

| Spring Garden | $155 | 2% |

| Spruce Pine | $148 | -3% |

| St. Elmo | $166 | 9% |

| St. Stephens | $166 | 9% |

| Stanton | $153 | 0% |

| Stapleton | $142 | -7% |

| Steele | $147 | -4% |

| Sterrett | $154 | 1% |

| Stevenson | $149 | -2% |

| Stewartville | $155 | 2% |

| Sulligent | $149 | -3% |

| Sumiton | $162 | 6% |

| Sunflower | $162 | 6% |

| Susan Moore | $146 | -4% |

| Sycamore | $154 | 1% |

| Sylacauga | $154 | 1% |

| Sylvania | $144 | -6% |

| Talladega | $151 | -1% |

| Tallassee | $153 | 1% |

| Tanner | $141 | -8% |

| Tarrant | $173 | 13% |

| Taylor | $139 | -9% |

| Theodore | $164 | 8% |

| Thomasville | $168 | 10% |

| Thorsby | $149 | -2% |

| Tibbie | $165 | 8% |

| Tidmore Bend | $153 | 1% |

| Tillmans Corner | $163 | 7% |

| Toney | $146 | -4% |

| Town Creek | $147 | -3% |

| Toxey | $164 | 8% |

| Trafford | $157 | 3% |

| Trenton | $151 | -1% |

| Trinity | $142 | -7% |

| Troy | $155 | 1% |

| Trussville | $161 | 6% |

| Tuscaloosa | $154 | 1% |

| Tuscumbia | $139 | -9% |

| Tuskegee | $164 | 7% |

| Tuskegee Institute | $165 | 8% |

| Tyler | $169 | 11% |

| Underwood-Petersville | $138 | -9% |

| Union Springs | $173 | 13% |

| Uniontown | $164 | 7% |

| Valhermoso Springs | $145 | -5% |

| Valley | $155 | 2% |

| Valley Grande | $162 | 6% |

| Valley Head | $144 | -5% |

| Vance | $155 | 2% |

| Vandiver | $152 | 0% |

| Vernon | $150 | -2% |

| Vestavia Hills | $159 | 4% |

| Vina | $150 | -2% |

| Vincent | $154 | 1% |

| Vinegar Bend | $166 | 9% |

| Wagarville | $164 | 8% |

| Walnut Grove | $148 | -3% |

| Ward | $161 | 6% |

| Warrior | $156 | 2% |

| Watson | $163 | 7% |

| Wattsville | $157 | 3% |

| Waverly | $152 | -1% |

| Weaver | $150 | -2% |

| Webb | $141 | -7% |

| Wellington | $151 | -1% |

| Weogufka | $155 | 1% |

| West End-Cobb Town | $151 | -1% |

| West Greene | $158 | 3% |

| Westover | $161 | 6% |

| Wetumpka | $151 | -1% |

| Whatley | $166 | 9% |

| White Plains | $149 | -2% |

| Wilmer | $164 | 7% |

| Wilton | $157 | 3% |

| Winfield | $154 | 1% |

| Wing | $147 | -4% |

| Woodstock | $154 | 1% |

| Woodville | $150 | -1% |

| York | $163 | 7% |

The city you live in is only one factor insurance companies use to set your car insurance rate. They also consider your:

- Age

- Gender

- Driving history

- Insurance claim history

- Marital status

- Vehicle make and model

Minimum coverage for car insurance in Alabama

Alabama drivers must have at least 25/50/25 liability car insurance coverage. This means:

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $25,000 property damage liability

Bodily injury liability coverage helps pay the medical bills of anyone you injure in a car accident. Property damage liability coverage pays for damage you may cause to property like fences, toll booths and light posts.

One difference between liability and full coverage car insurance is that Alabama law doesn’t require full coverage. However, if you lease or finance your car, your lender will require you to have it as part of your loan agreement.

Frequently asked questions

In Alabama, liability car insurance costs $59 a month, on average. Full coverage costs about $153 a month.

State Farm has Alabama’s cheapest liability car insurance rates of $59 a month. Travelers has the cheapest full coverage of $153 a month.

How we selected the cheapest car insurance companies in Alabama

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Alabama

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

* USAA is only available to current and former members of the military as well as certain family members.