Cheapest Car Insurance for New Drivers (2026)

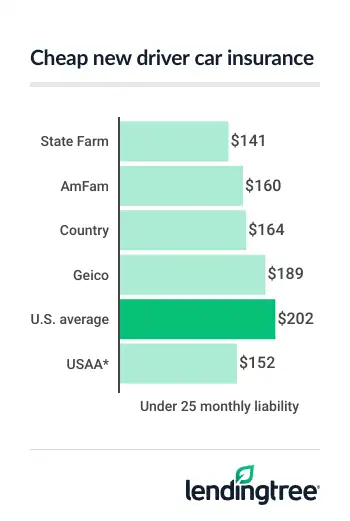

State Farm has the cheapest car insurance for new drivers under 25 at $141 a month. American Family has the cheapest rate for older new drivers at $85 a month.

Best cheap new driver car insurance

Cheapest car insurance for new drivers under 25: State Farm

State Farm has the cheapest car insurance for new drivers under 25 years old. Its rates average $141 a month for liability insurance, or minimum coverage

USAA has the next-cheapest rates, but it’s only available to the military community. American Family, or AmFam, is the next cheapest company after that.

Best insurance rates for drivers under 25

| Company | Monthly liability | Monthly full coverage | LendingTree score | |

|---|---|---|---|---|

| State Farm | $141 | $323 | |

| American Family | $160 | $416 | |

| Country Financial | $164 | $357 | |

| Geico | $189 | $424 | |

| Travelers | $195 | $425 | |

| AAA | $224 | $498 | |

| Progressive | $225 | $575 | |

| Nationwide | $330 | $651 | |

| USAA* | $152 | $377 | |

A lack of driving experience makes new drivers more likely to get into accidents than experienced drivers. This is the main reason why new drivers have higher auto insurance rates than experienced ones. You usually get new driver auto insurance rates if you:

- Just got your first driver’s license

- Have recently immigrated to the U.S.

- Have returned to the U.S. after living abroad

- Have not been driving or insured for a while

It’s good to compare car insurance quotes from a few companies to find the cheapest rate, regardless of your situation.

Cheapest car insurance for new drivers over 25: American Family

American Family has the cheapest car insurance for new drivers over 25. Its rates average $85 a month for liability insurance and $219 a month for full coverage.

State Farm is the next-cheapest company, at $103 a month for liability and $248 a month for full coverage.

Best insurance rates for new drivers over 25

| Company | Monthly liability | Monthly full coverage |

|---|---|---|

| American Family | $85 | $219 |

| State Farm | $103 | $248 |

| Country Financial | $106 | $235 |

| Geico | $155 | $351 |

| Progressive | $160 | $393 |

| Travelers | $176 | $383 |

| Nationwide | $184 | $398 |

| AAA | $193 | $434 |

| USAA* | $118 | $295 |

Cheapest auto insurance for parents with a new young driver

Most parents with a new young driver can get the cheapest auto insurance from Travelers. The company charges parents with a new driver under 20 years old $578 a month for full coverage, or $193 per driver.

Full coverage for two parents and a teen costs an average of $747 a month, or $249 per driver.

Cheap insurance for parents with a young new driver

| Company | Monthly full coverage | Cost per driver |

|---|---|---|

| Travelers | $578 | $193 |

| AAA | $635 | $212 |

| Progressive | $642 | $214 |

| State Farm | $683 | $228 |

| Country Financial | $765 | $255 |

| Geico | $775 | $258 |

| American Family | $933 | $311 |

| Nationwide | $1,253 | $418 |

| USAA* | $493 | $164 |

You can stay on a parent’s car insurance if you live with them or are away at college. You usually need your own car insurance if you live on your own, unless a parent owns or co-owns your vehicle.

Best car insurance for new drivers

State Farm is the best car insurance company for new drivers on your own. Along with low rates, it has a good customer satisfaction score

Travelers is the best choice for parents with a new, young driver on your policy. USAA is the best choice if you meet its military eligibility guidelines

Insurance company ratings

| Company | Best for | Satisfaction score | LendingTree score |

|---|---|---|---|

| State Farm | New drivers on your own | 650 (Good) | |

| Travelers | Young new drivers | 613 (Below average) | |

| USAA | Military families | 735 (Excellent) |

Best for new drivers on your own: State Farm

- Under 25 liability: $141 a month

- Full coverage with two parents: $683 a month

- Satisfaction rating: 650 (Good)

State Farm’s low rates and good customer service scores make it a solid choice for new drivers. Its rates get more affordable if you bundle your car insurance with home or renters coverage.

The company also offers personalized service through local agents in most communities. Help from a local agent can be especially helpful when you’re new to car insurance. If you’re comfortable on your own, State Farm’s website makes it easy to get quotes online.

PROS

- Cheapest rates for new drivers under 25

- Also cheap for new drivers over 25

- Personalized service from local insurance agents

CONS

- American Family is cheaper for new drivers over 25

- Not as cheap for parents with a young new driver

Best for parents with a new young driver: Travelers

- Under 25 liability: $195 a month

- Full coverage with two parents: $578 a month

- Satisfaction rating: 613 (Below average)

Along with affordable rates for families with a new young driver, Travelers offers useful extras. These include gap insurance

Travelers offers online quotes, but it’s also available through independent insurance agents. An independent agent can get you quotes from a few different companies at once. This helps make it easier to compare rates. Unfortunately, independent agents can’t get quotes from exclusive agent companies like State Farm.

PROS

- Cheapest rates for families with a new young driver

- Useful add-on coverages like gap and accident forgiveness

- Discounts help bring down your rate more

CONS

- Low satisfaction rating means unhappy customers

- Other companies are cheaper for teens on their own

Best for military families: USAA

- Under 25 liability: $152 a month

- Full coverage with two parents: $493 a month

- Satisfaction rating: 735 (Excellent)

USAA has cheap rates for new drivers on their own or on a parent’s policy. It also has a higher satisfaction rating than almost every other car insurance company. This means its customers generally like USAA’s prices, coverage options and service.

The company’s user-friendly website makes it easy to get quotes. You can also call its service center for help.

With most other companies, you work with the same agent on an ongoing basis. This often leads to more personalized service. With USAA, you usually get a different agent each time you call.

PROS

- Cheapest rates for parents with teens

- Below-average rates for teens on their own

- Excellent customer satisfaction

CONS

- Only available to the military community

- Less-personalized service than other companies

How much is car insurance for a new driver?

Car insurance costs for new drivers depend largely on your age and coverage needs. Liability-only policies cost an average of $202 a month for new drivers under 25 years old. New drivers over 25 pay 24% less at $155 a month.

Young drivers under 25 pay an average of $455 a month for full coverage. The average rate comes down to $351 a month for new drivers over 25.

New driver insurance costs by age

| New driver age | Monthly liability | Monthly full coverage |

|---|---|---|

| 16 | $335 | $690 |

| 18 | $302 | $655 |

| 20 | $236 | $527 |

| 25 | $169 | $383 |

| 30 | $156 | $353 |

| 35 | $154 | $348 |

Is it cheaper to add a new young driver to a parent’s policy?

Young new drivers usually get cheaper car insurance on a parent’s policy than they do on their own.

For example, it costs $385 a month to add a new 18-year-old driver to a parent’s policy with full coverage. This is 41% less than the cost of full coverage for an 18-year-old on their own.

Insurance costs for new young drivers

| Type of policy | Own policy monthly | With parent monthly* | Difference |

|---|---|---|---|

| Liability | $302 | $183 | 41% |

| Full coverage | $655 | $385 | 40% |

How to get cheaper car insurance as a new driver?

Shopping around and car insurance discounts can help new drivers get cheaper car insurance.

Why shop around for car insurance?

Shopping around can help you save 20% or more on car insurance. Your car insurance rate depends on things like your location, vehicle and, in most states, your credit. Each company treats these factors differently and offers different discounts.

This means one company may charge you a lot less for car insurance than the others do. Comparing quotes helps you find the company with the best rate for your situation.

Best car insurance discounts for new drivers

The various discounts insurance companies offer can add up to serious savings. Some are available to drivers with no experience behind the wheel. Here are the best discounts for new drivers.

Bundling

Most companies give you a generous discount for bundling your car insurance with a home or renters policy. It’s good to get quotes for all the policies in your insurance bundle when you shop. This lets you find the company with the cheapest combined rate.

Payment and shopping discounts

Setting up automatic payments and going paperless are easy ways to save with most car insurance companies. You’ll save more by paying in full for your policy up front, if you can afford it. Geico, Progressive and many other companies give you a discount for getting quotes online.

Safe driving apps

You can often also save money by signing up for a usage-based insurance (UBI) plan. Most UBI programs use a smartphone app to monitor your driving. You get a discount just for signing up. If you drive safely enough, you get another discount each time you renew.

It may feel weird to be monitored while you drive, but the savings can add up. For example, good drivers can save up to 30% with State Farm’s Drive Safe & Save program.

Affinity discounts

Some companies have discounts for drivers with certain occupational or educational backgrounds. Geico, for example, has discounts for federal workers and members in participating professional and alumni groups. Geico, Farmers and Liberty Mutual are among the better-known companies with discounts for military service members.

How much car insurance does a new driver need?

The exact amount of car insurance you need as a new driver depends on your vehicle and financial situation.

Your state’s minimum requirements are a good place to start. Most states make you get liability insurance

If you have a car loan, your lender will likely require you to get collision

It’s often worth considering higher liability limits than your state requires. If an accident victim’s costs exceed your liability limit, you can be held personally responsible for the shortfall. Higher liability limits can protect you from having to cover expenses like these out of your own pocket.

How we obtained car insurance rates for new drivers

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for new drivers and families in California, Georgia, Illinois and Texas. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for new drivers with a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with each state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.