Cheapest Car Insurance in Florida (2026)

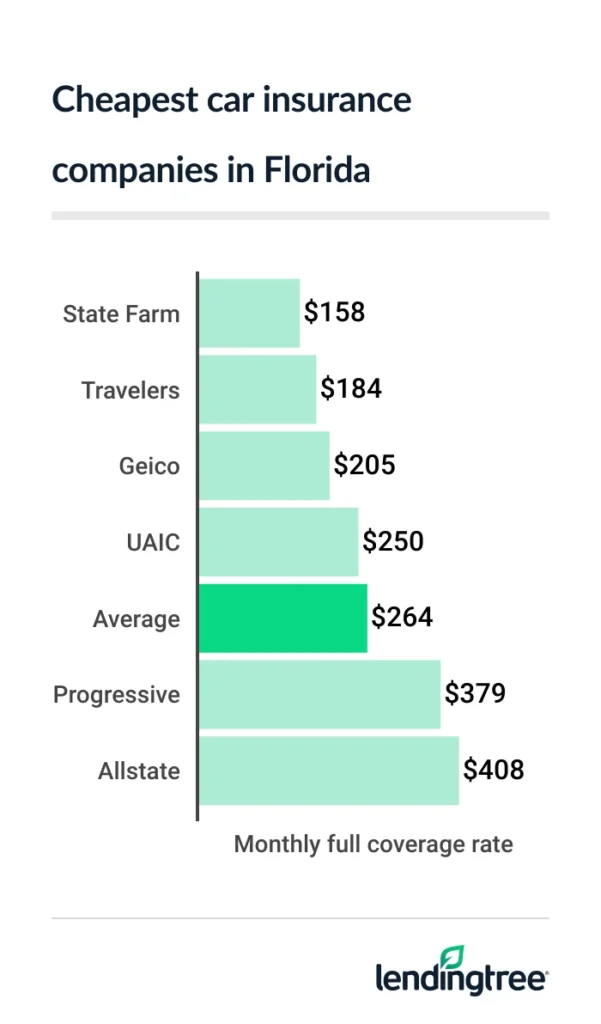

State Farm has Florida’s cheapest full coverage car insurance, at $158 a month. This is $106 less than the state average of $264 a month.

Best cheap Florida car insurance

Cheapest full coverage car insurance in Florida: State Farm

State Farm has the cheapest full coverage car insurance in Florida, at $158 a month. This is 14% less than the next-cheapest rate of $184 a month from Travelers. However, Travelers is a better choice if you need gap insurance

Full coverage

Each company treats these factors differently and offers different car insurance discounts. This makes it good to compare car insurance quotes from a few companies to find the cheapest rate.

Cheap full coverage auto insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| State Farm | $158 | |

| Travelers | $184 | |

| Geico | $205 | |

| UAIC | $250 | |

| Progressive | $379 | |

| Allstate | $408 | |

Florida’s cheapest liability auto insurance: Geico

At $38 a month, Geico has Florida’s cheapest liability insurance. This is less than half the state average of $87 a month. State Farm is the next-cheapest company at $53 a month.

Cheap liability auto insurance

| Company | Monthly rate |

|---|---|

| Geico | $38 |

| State Farm | $53 |

| Travelers | $54 |

| Progressive | $122 |

| UAIC | $127 |

| Allstate | $130 |

Liability insurance in Florida includes personal injury protection

Cheapest car insurance quotes for teens: Geico and State Farm

Geico has the cheapest car insurance for teens at $86 a month for liability policies. This is 30% less than the next-cheapest rate of $122 a month from Travelers.

However, State Farm has Florida’s cheapest full coverage for young drivers at $434 a month. This is 10% less than the next-cheapest rate of $484 a month, also from Travelers.

Cheap teen auto insurance

| Company | Minimum coverage | Full coverage |

|---|---|---|

| Geico | $86 | $499 |

| Travelers | $122 | $484 |

| State Farm | $131 | $434 |

| Allstate | $235 | $1,138 |

| UAIC | $301 | $567 |

| Progressive | $451 | $1,586 |

A lack of driving experience makes teens more likely to get into accidents than older drivers. This is the main reason why young drivers get such high insurance rates.

Young drivers usually get lower rates when added to a parent’s policy than they do on their own. Teens can also get discounts for:

- Getting good grades

- Completing a driver training program

- Going off to college without a car

The details of these and other young driver discounts vary by insurance company. It’s good to ask about them when you get your quotes.

Cheapest Florida car insurance for seniors: State Farm

Florida drivers can get the cheapest car insurance for seniors from State Farm. The company’s full coverage rates for 65-year-olds average $142 a month. This is 11% less than the next-cheapest rate of $159 a month from Travelers.

State Farm also has Florida’s cheapest rates for 75- and 85-year-olds. However, Travelers is a better choice if you want accident forgiveness

Senior car insurance rates

| Company | Age 65 | Age 75 | Age 85 |

|---|---|---|---|

| State Farm | $142 | $160 | $200 |

| Travelers | $159 | $190 | $244 |

| Geico | $175 | $191 | $231 |

| UAIC | $232 | $245 | $245 |

| Progressive | $319 | $444 | $565 |

| Allstate | $398 | $453 | $668 |

Unfortunately, car insurance rates tend to inch up for seniors during your retirement years. For example, auto insurance costs an average $359 a month for 85-year-olds in Florida. This is 51% higher than the average rate of $238 a month for 65-year-olds.

Insurance rates by age

| Driver age | Monthly rate |

|---|---|

| 65 | $238 |

| 75 | $280 |

| 85 | $359 |

You can offset some of these increases by keeping a clean driving record and good credit. Some companies, including State Farm and Geico, give you a discount for completing a defensive driving class. You may also save money by shopping around for a cheaper rate.

Best Florida car insurance rates after a ticket: State Farm

At $170 a month, State Farm has Florida’s cheapest car insurance quotes for a speeding ticket. Geico is the next-cheapest company at $205 a month.

Geico offers a few more discounts than State Farm. These include discounts for federal employees, early shoppers and online shoppers. If you qualify, these may make Geico a cheaper option for you.

Auto insurance rates with a ticket

| Company | Monthly rate |

|---|---|

| State Farm | $170 |

| Geico | $205 |

| Travelers | $224 |

| UAIC | $250 |

| Allstate | $408 |

| Progressive | $509 |

Cheapest Florida auto insurance after an accident: State Farm

Florida drivers with an at-fault accident often get the cheapest auto insurance quotes from State Farm. The company’s rates for drivers with an accident average $183 a month. This is 26% less than the next-cheapest rate of $248 a month from Travelers.

Cheap auto insurance after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $183 |

| Travelers | $248 |

| Geico | $273 |

| UAIC | $327 |

| Progressive | $567 |

| Allstate | $713 |

A ticket or accident can affect your car insurance rates for three to five years. Some companies have shorter look-back periods than others. Some have smaller rate increases after a ticket or accident. Comparing car insurance quotes with a bad driving record helps you find the cheapest rate.

Best car insurance for FL teens with bad driving records: Geico

Florida teens with bad driving records can get the cheapest car insurance quotes from Geico. The company’s liability rates average $86 a month for young drivers with a ticket. This is 41% less than the next-cheapest rate of $144 a month from State Farm.

Geico’s rates for teens with an accident average $88 a month. This is 44% cheaper than No. 2 State Farm’s rate of $158 a month.

Teen insurance rates by driving record

| Company | Ticket | Accident |

|---|---|---|

| Geico | $86 | $88 |

| State Farm | $144 | $158 |

| Travelers | $149 | $170 |

| Allstate | $235 | $451 |

| UAIC | $301 | $375 |

| Progressive | $486 | $503 |

Cheapest car insurance for Florida drivers with a DUI: Travelers

At $293 a month, Travelers has Florida’s cheapest DUI insurance. Travelers charges 33% less than the state average of $440 a month after a DUI (driving under the influence). At $404 a month, Geico’s rate is 9% less than the state average.

DUI car insurance rates

| Company | Monthly rate |

|---|---|

| Travelers | $293 |

| Geico | $404 |

| UAIC | $444 |

| State Farm | $451 |

| Progressive | $460 |

| Allstate | $589 |

Best Florida car insurance rates for bad credit: UAIC

UAIC has Florida’s cheapest car insurance for bad credit, at $250 a month. Travelers has the next-cheapest bad credit car insurance, at $370 a month. This is 48% higher than UAIC’s rate.

Insurance rates with bad credit

| Company | Monthly rate |

|---|---|

| UAIC | $250 |

| Travelers | $370 |

| Geico | $377 |

| Progressive | $633 |

| Allstate | $749 |

| State Farm | $801 |

Insurance companies check your credit for things like your payment history and borrowing amounts. Avoiding late payments and paying down debts can help you get lower car insurance rates.

Florida’s best car insurance companies

State Farm and Travelers stand out as Florida’s best car insurance companies for different reasons.

State Farm has the cheapest rates for most Florida drivers, including drivers with a ticket or accident. It also has a good satisfaction rating from J.D. Power. This means its customers are generally happy with State Farm’s prices, coverage options and service.

Travelers stands out for its coverage options. Along with gap insurance, it also offers accident forgiveness and new car replacement

- Gap insurance can come in handy if you finance your car with a low down payment.

- Accident forgiveness protects you from a rate increase after your first at-fault accident.

- New car replacement protects the investment in your vehicle for up to five years.

State Farm and Geico don’t offer these optional coverages.

Insurance company ratings

| Company | J.D. Power | AM Best | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Geico | 645 | A++ | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| Travelers | 613 | A++ | |

| UAIC* | NA | NA |

Florida car insurance rates by city

At $186 a month, Santa Rosa Beach has the cheapest car insurance for Florida’s cities and towns. This is only slightly less than the rate of $189 a month in Miramar Beach, Freeport and DeFuniak Springs.

Drivers in Westview have Florida’s most expensive auto insurance at $372 a month. This is 41% higher than the state average.

Auto insurance costs an average of $331 a month in Miami, or 25% more than the state average. It’s much cheaper in Jacksonville, where rates average $250 a month.

Car insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Alachua | $195 | -26% |

| Alafaya | $249 | -6% |

| Alford | $198 | -25% |

| Allentown | $219 | -17% |

| Altamonte Springs | $232 | -12% |

| Altha | $203 | -23% |

| Altoona | $212 | -20% |

| Alturas | $233 | -12% |

| Alva | $219 | -17% |

| Andrews | $207 | -21% |

| Anna Maria | $238 | -10% |

| Anthony | $217 | -18% |

| Apalachicola | $193 | -27% |

| Apollo Beach | $278 | 5% |

| Apopka | $253 | -4% |

| Arcadia | $217 | -18% |

| Archer | $200 | -24% |

| Argyle | $192 | -27% |

| Aripeka | $291 | 10% |

| Asbury Lake | $227 | -14% |

| Astatula | $216 | -18% |

| Astor | $214 | -19% |

| Atlantic Beach | $232 | -12% |

| Atlantis | $346 | 31% |

| Auburndale | $242 | -8% |

| Aventura | $342 | 30% |

| Avon Park | $223 | -15% |

| Azalea Park | $264 | 0% |

| Babson Park | $232 | -12% |

| Bagdad | $219 | -17% |

| Baker | $199 | -25% |

| Bal Harbour | $316 | 20% |

| Baldwin | $238 | -10% |

| Balm | $274 | 4% |

| Barberville | $218 | -17% |

| Bardmoor | $271 | 3% |

| Bartow | $234 | -11% |

| Bascom | $194 | -26% |

| Bay Harbor Islands | $316 | 20% |

| Bay Hill | $251 | -5% |

| Bay Lake | $248 | -6% |

| Bay Pines | $270 | 2% |

| Bayonet Point | $288 | 9% |

| Bayshore Gardens | $245 | -7% |

| Beacon Square | $294 | 11% |

| Bear Creek | $286 | 8% |

| Bee Ridge | $223 | -16% |

| Bell | $207 | -22% |

| Bellair-Meadowbrook Terrace | $241 | -9% |

| Belle Glade | $289 | 9% |

| Belle Isle | $270 | 2% |

| Belleair | $272 | 3% |

| Belleair Beach | $267 | 1% |

| Belleair Bluffs | $273 | 3% |

| Belleview | $209 | -21% |

| Bellview | $217 | -18% |

| Berrydale | $215 | -18% |

| Beverly Hills | $218 | -18% |

| Big Coppitt Key | $227 | -14% |

| Big Pine Key | $228 | -14% |

| Biscayne Park | $345 | 31% |

| Bithlo | $245 | -7% |

| Black Hammock | $229 | -13% |

| Bloomingdale | $298 | 13% |

| Blountstown | $205 | -23% |

| Boca Grande | $201 | -24% |

| Boca Raton | $316 | 20% |

| Bokeelia | $219 | -17% |

| Bonifay | $194 | -27% |

| Bonita Springs | $199 | -24% |

| Bostwick | $223 | -16% |

| Boulevard Gardens | $346 | 31% |

| Bowling Green | $232 | -12% |

| Boynton Beach | $342 | 30% |

| Bradenton | $234 | -11% |

| Bradenton Beach | $236 | -10% |

| Bradley | $231 | -12% |

| Bradley Junction | $231 | -13% |

| Brandon | $304 | 15% |

| Branford | $206 | -22% |

| Brent | $219 | -17% |

| Bristol | $203 | -23% |

| Broadview Park | $301 | 14% |

| Bronson | $209 | -21% |

| Brooker | $210 | -20% |

| Brookridge | $260 | -2% |

| Brooksville | $256 | -3% |

| Brownsdale | $215 | -18% |

| Brownsville | $358 | 36% |

| Bryceville | $220 | -17% |

| Buckhead Ridge | $233 | -12% |

| Buckingham | $241 | -9% |

| Buenaventura Lakes | $273 | 3% |

| Bunnell | $216 | -18% |

| Burnt Store Marina | $217 | -18% |

| Bushnell | $217 | -18% |

| Butler Beach | $203 | -23% |

| Cabana Colony | $282 | 7% |

| Callahan | $222 | -16% |

| Callaway | $196 | -26% |

| Campbell | $263 | 0% |

| Campbellton | $194 | -27% |

| Canal Point | $288 | 9% |

| Candler | $212 | -20% |

| Cantonment | $213 | -19% |

| Cape Canaveral | $211 | -20% |

| Cape Coral | $224 | -15% |

| Captiva | $199 | -24% |

| Carrabelle | $198 | -25% |

| Carrollwood | $326 | 23% |

| Caryville | $194 | -27% |

| Cassadaga | $229 | -13% |

| Casselberry | $231 | -13% |

| Cedar Grove | $199 | -25% |

| Cedar Key | $204 | -23% |

| Celebration | $252 | -5% |

| Center Hill | $215 | -18% |

| Century | $207 | -22% |

| Charlotte Harbor | $204 | -23% |

| Charlotte Park | $203 | -23% |

| Chattahoochee | $206 | -22% |

| Cheval | $292 | 11% |

| Chiefland | $206 | -22% |

| Chipley | $194 | -27% |

| Chokoloskee | $209 | -21% |

| Christmas | $247 | -6% |

| Chuluota | $226 | -14% |

| Citra | $215 | -19% |

| Citrus Hills | $217 | -18% |

| Citrus Park | $301 | 14% |

| Citrus Springs | $215 | -19% |

| Clarcona | $271 | 3% |

| Clarksville | $207 | -22% |

| Clearwater | $278 | 5% |

| Clearwater Beach | $276 | 5% |

| Clermont | $219 | -17% |

| Cleveland | $211 | -20% |

| Clewiston | $235 | -11% |

| Cocoa | $221 | -16% |

| Cocoa Beach | $215 | -19% |

| Cocoa West | $222 | -16% |

| Coconut Creek | $311 | 18% |

| Coleman | $220 | -17% |

| Combee Settlement | $235 | -11% |

| Connerton | $276 | 5% |

| Conway | $256 | -3% |

| Cooper City | $295 | 12% |

| Copeland | $215 | -19% |

| Coral Gables | $312 | 18% |

| Coral Springs | $314 | 19% |

| Coral Terrace | $333 | 26% |

| Cortez | $237 | -10% |

| Cottondale | $196 | -26% |

| Country Club | $341 | 29% |

| Country Walk | $316 | 20% |

| Crawfordville | $204 | -23% |

| Crescent City | $219 | -17% |

| Crestview | $196 | -26% |

| Crooked Lake Park | $234 | -11% |

| Cross City | $203 | -23% |

| Crystal Beach | $281 | 7% |

| Crystal Lake | $235 | -11% |

| Crystal River | $218 | -17% |

| Crystal Springs | $280 | 6% |

| Cudjoe Key | $227 | -14% |

| Cutler Bay | $324 | 23% |

| Cypress Gardens | $246 | -7% |

| Cypress Lake | $209 | -21% |

| Dade City | $278 | 5% |

| Dade City North | $284 | 8% |

| Dania | $319 | 21% |

| Dania Beach | $339 | 28% |

| Davenport | $248 | -6% |

| Davie | $295 | 12% |

| Daytona Beach | $219 | -17% |

| Daytona Beach Shores | $224 | -15% |

| De Leon Springs | $219 | -17% |

| DeLand Southwest | $227 | -14% |

| Debary | $229 | -13% |

| Deerfield Beach | $320 | 21% |

| Defuniak Springs | $189 | -28% |

| Deland | $225 | -15% |

| Delray Beach | $344 | 30% |

| Deltona | $230 | -13% |

| Desoto Lakes | $227 | -14% |

| Destin | $191 | -28% |

| Doctor Phillips | $250 | -5% |

| Doctors Inlet | $231 | -12% |

| Doral | $322 | 22% |

| Dover | $286 | 8% |

| Dundee | $240 | -9% |

| Dunedin | $280 | 6% |

| Dunnellon | $212 | -20% |

| Durant | $286 | 8% |

| Eagle Lake | $250 | -5% |

| Earleton | $198 | -25% |

| East Bronson | $209 | -21% |

| East Lake | $282 | 7% |

| East Lake-Orient Park | $338 | 28% |

| East Milton | $219 | -17% |

| East Palatka | $219 | -17% |

| Eastlake Weir | $206 | -22% |

| Eastpoint | $195 | -26% |

| Eaton Park | $237 | -10% |

| Eatonville | $252 | -5% |

| Ebro | $200 | -24% |

| Edgewater | $210 | -20% |

| Edgewood | $284 | 7% |

| Eglin AFB | $192 | -27% |

| Egypt Lake-Leto | $360 | 36% |

| El Jobean | $206 | -22% |

| El Portal | $327 | 24% |

| Elfers | $291 | 10% |

| Elkton | $209 | -21% |

| Ellenton | $241 | -9% |

| Englewood | $204 | -23% |

| Ensley | $220 | -17% |

| Estero | $202 | -23% |

| Eustis | $218 | -18% |

| Everglades City | $209 | -21% |

| Evinston | $205 | -22% |

| Fairfield | $209 | -21% |

| Fairview Shores | $270 | 2% |

| Feather Sound | $283 | 7% |

| Felda | $217 | -18% |

| Fellsmere | $222 | -16% |

| Fern Park | $231 | -12% |

| Fernandina Beach | $217 | -18% |

| Ferndale | $220 | -17% |

| Ferry Pass | $218 | -18% |

| Fish Hawk | $272 | 3% |

| Fisher Island | $281 | 7% |

| Five Points | $208 | -21% |

| Flagler Beach | $212 | -20% |

| Flagler Estates | $206 | -22% |

| Fleming Island | $237 | -10% |

| Florahome | $225 | -15% |

| Floral City | $217 | -18% |

| Florida City | $327 | 24% |

| Florida Ridge | $223 | -15% |

| Forest City | $235 | -11% |

| Fort Denaud | $221 | -16% |

| Fort Green Springs | $232 | -12% |

| Fort Lauderdale | $310 | 17% |

| Fort McCoy | $219 | -17% |

| Fort Meade | $233 | -12% |

| Fort Myers | $225 | -15% |

| Fort Myers Beach | $203 | -23% |

| Fort Myers Shores | $241 | -9% |

| Fort Ogden | $217 | -18% |

| Fort Pierce | $252 | -5% |

| Fort Pierce North | $251 | -5% |

| Fort Pierce South | $253 | -4% |

| Fort Walton Beach | $194 | -27% |

| Fort White | $214 | -19% |

| Fountain | $202 | -24% |

| Fontainebleau | $338 | 28% |

| Four Corners | $233 | -12% |

| Franklin Park | $346 | 31% |

| Freeport | $189 | -28% |

| Frostproof | $230 | -13% |

| Fruit Cove | $214 | -19% |

| Fruitland Park | $210 | -21% |

| Fruitville | $227 | -14% |

| Fuller Heights | $231 | -13% |

| Fussels Corner | $239 | -10% |

| Gainesville | $197 | -25% |

| Gateway | $219 | -17% |

| Geneva | $227 | -14% |

| Georgetown | $223 | -15% |

| Gibsonton | $297 | 13% |

| Gifford | $224 | -15% |

| Gladeview | $358 | 36% |

| Glen St. Mary | $217 | -18% |

| Glencoe | $214 | -19% |

| Glenvar Heights | $316 | 20% |

| Glenwood | $227 | -14% |

| Golden Beach | $329 | 25% |

| Golden Gate | $208 | -21% |

| Golden Glades | $362 | 37% |

| Goldenrod | $245 | -7% |

| Golf | $343 | 30% |

| Gonzalez | $221 | -16% |

| Goodland | $216 | -18% |

| Gotha | $252 | -5% |

| Goulding | $219 | -17% |

| Goulds | $331 | 25% |

| Graceville | $194 | -26% |

| Graham | $213 | -19% |

| Grand Island | $213 | -19% |

| Grand Ridge | $198 | -25% |

| Grandin | $216 | -18% |

| Grant | $229 | -13% |

| Grant-Valkaria | $229 | -13% |

| Green Cove Springs | $227 | -14% |

| Greenacres | $333 | 26% |

| Greenbriar | $276 | 5% |

| Greensboro | $205 | -22% |

| Greenville | $207 | -22% |

| Greenwood | $194 | -27% |

| Grenelefe | $246 | -7% |

| Gretna | $210 | -21% |

| Grove City | $203 | -23% |

| Groveland | $214 | -19% |

| Gulf Breeze | $216 | -18% |

| Gulf Gate Estates | $222 | -16% |

| Gulf Hammock | $200 | -24% |

| Gulf Stream | $331 | 25% |

| Gulfport | $284 | 8% |

| Gun Club Estates | $340 | 29% |

| Haines City | $248 | -6% |

| Hallandale | $343 | 30% |

| Hallandale Beach | $338 | 28% |

| Hampton | $214 | -19% |

| Harbor Bluffs | $273 | 3% |

| Harbour Heights | $204 | -23% |

| Harlem | $235 | -11% |

| Harold | $219 | -17% |

| Hastings | $206 | -22% |

| Havana | $208 | -21% |

| Haverhill | $338 | 28% |

| Hawthorne | $212 | -20% |

| Heathrow | $226 | -14% |

| Heritage Pines | $285 | 8% |

| Hernando | $216 | -18% |

| Hernando Beach | $258 | -2% |

| Hialeah | $352 | 33% |

| Hialeah Gardens | $342 | 30% |

| High Point | $260 | -2% |

| High Springs | $200 | -24% |

| Highland Beach | $312 | 18% |

| Highland City | $238 | -10% |

| Highland Park | $238 | -10% |

| Hilliard | $215 | -18% |

| Hillsboro Beach | $307 | 16% |

| Hobe Sound | $238 | -10% |

| Holden Heights | $292 | 10% |

| Holder | $213 | -19% |

| Holiday | $295 | 12% |

| Hollister | $218 | -17% |

| Holly Hill | $225 | -15% |

| Hollywood | $322 | 22% |

| Holmes Beach | $236 | -10% |

| Holt | $193 | -27% |

| Homeland | $237 | -10% |

| Homestead | $328 | 24% |

| Homestead Base | $322 | 22% |

| Homosassa | $220 | -17% |

| Homosassa Springs | $220 | -17% |

| Horizon West | $244 | -8% |

| Horseshoe Beach | $201 | -24% |

| Hosford | $203 | -23% |

| Howey-in-the-Hills | $225 | -15% |

| Hudson | $284 | 8% |

| Hunters Creek | $255 | -3% |

| Hurlburt Field | $194 | -27% |

| Hutchinson Island South | $255 | -3% |

| Hypoluxo | $346 | 31% |

| Immokalee | $223 | -16% |

| Indialantic | $210 | -20% |

| Indian Harbour Beach | $210 | -20% |

| Indian Lake Estates | $230 | -13% |

| Indian River Estates | $253 | -4% |

| Indian River Shores | $224 | -15% |

| Indian Rocks Beach | $268 | 2% |

| Indian Shores | $268 | 2% |

| Indiantown | $242 | -8% |

| Inglis | $204 | -23% |

| Inlet Beach | $191 | -28% |

| Intercession City | $265 | 0% |

| Interlachen | $223 | -16% |

| Inverness | $216 | -18% |

| Inverness Highlands North | $217 | -18% |

| Inverness Highlands South | $220 | -17% |

| Inwood | $247 | -7% |

| Iona | $205 | -22% |

| Islamorada | $243 | -8% |

| Islamorada, Village of Islands | $244 | -8% |

| Island Grove | $205 | -22% |

| Istachatta | $252 | -5% |

| Ives Estates | $359 | 36% |

| Jacksonville | $250 | -5% |

| Jacksonville Beach | $231 | -13% |

| Jan Phyl Village | $249 | -6% |

| Jasmine Estates | $291 | 10% |

| Jasper | $205 | -22% |

| Jay | $215 | -18% |

| Jennings | $208 | -21% |

| Jensen Beach | $249 | -6% |

| June Park | $216 | -18% |

| Juno Beach | $280 | 6% |

| Juno Ridge | $280 | 6% |

| Jupiter | $254 | -4% |

| Jupiter Farms | $256 | -3% |

| Kathleen | $237 | -10% |

| Kenansville | $259 | -2% |

| Kendale Lakes | $324 | 23% |

| Kendall | $310 | 18% |

| Kendall West | $328 | 24% |

| Kenneth City | $288 | 9% |

| Kensington Park | $227 | -14% |

| Kenwood Estates | $348 | 32% |

| Key Biscayne | $304 | 15% |

| Key Colony Beach | $235 | -11% |

| Key Largo | $249 | -6% |

| Key Vista | $294 | 11% |

| Key West | $227 | -14% |

| Keystone | $291 | 10% |

| Keystone Heights | $220 | -17% |

| Killarney | $247 | -6% |

| Kissimmee | $263 | 0% |

| LaCrosse | $195 | -26% |

| Labelle | $218 | -17% |

| Lacoochee | $284 | 8% |

| Lady Lake | $205 | -22% |

| Laguna Beach | $201 | -24% |

| Lake Alfred | $241 | -9% |

| Lake Belvedere Estates | $329 | 25% |

| Lake Butler | $222 | -16% |

| Lake City | $208 | -21% |

| Lake Clarke Shores | $340 | 29% |

| Lake Como | $216 | -18% |

| Lake Geneva | $211 | -20% |

| Lake Hamilton | $244 | -8% |

| Lake Harbor | $274 | 4% |

| Lake Helen | $226 | -14% |

| Lake Lorraine | $193 | -27% |

| Lake Magdalene | $329 | 25% |

| Lake Mary | $227 | -14% |

| Lake Monroe | $225 | -15% |

| Lake Mystic | $203 | -23% |

| Lake Panasoffkee | $216 | -18% |

| Lake Park | $338 | 28% |

| Lake Placid | $218 | -17% |

| Lake Sarasota | $216 | -18% |

| Lake Wales | $236 | -11% |

| Lake Worth | $347 | 32% |

| Lake Worth Beach | $360 | 36% |

| Lakeland | $239 | -9% |

| Lakeland Highlands | $237 | -10% |

| Lakeshore | $231 | -12% |

| Lakeside | $237 | -10% |

| Lakewood Gardens | $351 | 33% |

| Lakewood Park | $248 | -6% |

| Lamont | $208 | -21% |

| Lanark Village | $204 | -23% |

| Land O’ Lakes | $280 | 6% |

| Lantana | $346 | 31% |

| Largo | $273 | 3% |

| Lauderdale Lakes | $345 | 31% |

| Lauderdale-by-the-Sea | $305 | 16% |

| Lauderhill | $344 | 30% |

| Laurel | $206 | -22% |

| Laurel Hill | $199 | -25% |

| Lawtey | $214 | -19% |

| Lealman | $287 | 9% |

| Lecanto | $219 | -17% |

| Lee | $202 | -24% |

| Leesburg | $211 | -20% |

| Lehigh Acres | $238 | -10% |

| Leisure City | $322 | 22% |

| Lely | $206 | -22% |

| Lely Resort | $206 | -22% |

| Lighthouse Point | $322 | 22% |

| Limestone Creek | $258 | -2% |

| Lithia | $272 | 3% |

| Live Oak | $201 | -24% |

| Lloyd | $209 | -21% |

| Lochloosa | $205 | -22% |

| Lochmoor Waterway Estates | $226 | -14% |

| Lockhart | $285 | 8% |

| Long Key | $228 | -14% |

| Longboat Key | $219 | -17% |

| Longwood | $229 | -13% |

| Lorida | $219 | -17% |

| Loughman | $247 | -6% |

| Lowell | $209 | -21% |

| Lower Grand Lagoon | $200 | -24% |

| Loxahatchee | $289 | 10% |

| Loxahatchee Groves | $289 | 10% |

| Lulu | $215 | -19% |

| Lutz | $293 | 11% |

| Lynn Haven | $200 | -24% |

| Macclenny | $216 | -18% |

| Madeira Beach | $270 | 2% |

| Madison | $204 | -23% |

| Maitland | $268 | 2% |

| Malabar | $232 | -12% |

| Malone | $194 | -27% |

| Manasota Key | $203 | -23% |

| Manatee Road | $206 | -22% |

| Mango | $322 | 22% |

| Mangonia Park | $341 | 29% |

| Marathon | $231 | -12% |

| Marathon Shores | $235 | -11% |

| Marco Island | $211 | -20% |

| Margate | $330 | 25% |

| Marianna | $196 | -26% |

| Mary Esther | $194 | -26% |

| Mascotte | $218 | -18% |

| Matlacha | $222 | -16% |

| Mayo | $201 | -24% |

| McAlpin | $201 | -24% |

| McDavid | $209 | -21% |

| McIntosh | $199 | -25% |

| McGregor | $209 | -21% |

| Meadow Oaks | $283 | 7% |

| Meadow Woods | $278 | 5% |

| Medley | $317 | 20% |

| Medulla | $238 | -10% |

| Melbourne | $216 | -18% |

| Melbourne Beach | $212 | -20% |

| Melbourne Village | $216 | -18% |

| Melrose | $217 | -18% |

| Memphis | $244 | -8% |

| Merritt Island | $215 | -18% |

| Mexico Beach | $199 | -24% |

| Miami | $331 | 25% |

| Miami Beach | $315 | 19% |

| Miami Gardens | $354 | 34% |

| Miami Lakes | $341 | 29% |

| Miami Shores | $351 | 33% |

| Miami Springs | $320 | 21% |

| Micanopy | $198 | -25% |

| Micco | $215 | -19% |

| Mid Florida | $229 | -13% |

| Middleburg | $232 | -12% |

| Midway | $215 | -19% |

| Milligan | $198 | -25% |

| Milton | $220 | -17% |

| Mims | $215 | -19% |

| Minneola | $218 | -17% |

| Miramar | $315 | 19% |

| Miramar Beach | $189 | -29% |

| Molino | $217 | -18% |

| Monticello | $203 | -23% |

| Montura | $235 | -11% |

| Montverde | $219 | -17% |

| Moon Lake | $281 | 6% |

| Moore Haven | $223 | -15% |

| Morriston | $204 | -23% |

| Mossy Head | $193 | -27% |

| Mount Dora | $227 | -14% |

| Mount Plymouth | $220 | -17% |

| Mulberry | $231 | -13% |

| Murdock | $214 | -19% |

| Myakka City | $224 | -15% |

| Myrtle Grove | $216 | -18% |

| Nalcrest | $237 | -10% |

| Naples | $206 | -22% |

| Naples Manor | $206 | -22% |

| Naples Park | $205 | -22% |

| Naranja | $324 | 23% |

| Nassau Village-Ratliff | $222 | -16% |

| Navarre | $218 | -18% |

| Navarre Beach | $218 | -18% |

| Neptune Beach | $231 | -13% |

| New Port Richey | $286 | 8% |

| New Port Richey East | $289 | 9% |

| New Smyrna Beach | $210 | -20% |

| Newberry | $199 | -25% |

| Niceville | $191 | -28% |

| Nichols | $233 | -12% |

| Nobleton | $253 | -4% |

| Nocatee | $210 | -21% |

| Nokomis | $206 | -22% |

| Noma | $200 | -24% |

| North Bay Village | $311 | 18% |

| North Brooksville | $254 | -4% |

| North DeLand | $223 | -16% |

| North Fort Myers | $225 | -15% |

| North Key Largo | $249 | -6% |

| North Lauderdale | $346 | 31% |

| North Miami | $354 | 34% |

| North Miami Beach | $365 | 38% |

| North Palm Beach | $281 | 6% |

| North Port | $206 | -22% |

| North Redington Beach | $270 | 2% |

| North River Shores | $243 | -8% |

| North Sarasota | $225 | -15% |

| North Weeki Wachee | $260 | -2% |

| Northdale | $303 | 15% |

| O’Brien | $201 | -24% |

| Oak Hill | $218 | -17% |

| Oak Ridge | $285 | 8% |

| Oakland | $240 | -9% |

| Oakland Park | $324 | 23% |

| Oakleaf Plantation | $239 | -9% |

| Ocala | $220 | -17% |

| Ocean Breeze Park | $243 | -8% |

| Ocean City | $193 | -27% |

| Ocean Ridge | $351 | 33% |

| Ochopee | $224 | -15% |

| Ocklawaha | $206 | -22% |

| Ocoee | $248 | -6% |

| Odessa | $283 | 7% |

| Ojus | $338 | 28% |

| Okahumpka | $214 | -19% |

| Okeechobee | $231 | -12% |

| Old Town | $204 | -23% |

| Oldsmar | $281 | 6% |

| Olga | $230 | -13% |

| Olustee | $213 | -19% |

| Olympia Heights | $329 | 25% |

| Ona | $226 | -14% |

| Oneco | $227 | -14% |

| Opa-locka | $348 | 32% |

| Orange City | $230 | -13% |

| Orange Lake | $199 | -25% |

| Orange Park | $245 | -7% |

| Orange Springs | $206 | -22% |

| Orangetree | $209 | -21% |

| Orlando | $263 | 0% |

| Orlovista | $279 | 6% |

| Ormond Beach | $216 | -18% |

| Ormond-by-the-Sea | $224 | -15% |

| Osprey | $208 | -21% |

| Osteen | $227 | -14% |

| Otter Creek | $201 | -24% |

| Oviedo | $228 | -14% |

| Oxford | $206 | -22% |

| Ozona | $282 | 7% |

| Pace | $227 | -14% |

| Pahokee | $295 | 12% |

| Paisley | $222 | -16% |

| Palatka | $220 | -17% |

| Palm Bay | $229 | -13% |

| Palm Beach | $351 | 33% |

| Palm Beach Gardens | $285 | 8% |

| Palm Beach Shores | $338 | 28% |

| Palm City | $240 | -9% |

| Palm Coast | $212 | -20% |

| Palm Harbor | $284 | 7% |

| Palm River-Clair Mel | $319 | 21% |

| Palm Shores | $223 | -16% |

| Palm Springs | $345 | 31% |

| Palm Springs North | $341 | 29% |

| Palm Valley | $212 | -20% |

| Palmdale | $215 | -19% |

| Palmetto | $242 | -8% |

| Palmetto Bay | $313 | 19% |

| Palmetto Estates | $307 | 16% |

| Palmona Park | $226 | -14% |

| Panacea | $197 | -25% |

| Panama City | $198 | -25% |

| Panama City Beach | $200 | -24% |

| Parker | $196 | -26% |

| Parkland | $306 | 16% |

| Parrish | $231 | -12% |

| Pasadena Hills | $273 | 4% |

| Patrick AFB | $215 | -18% |

| Paxton | $194 | -26% |

| Pea Ridge | $218 | -17% |

| Pebble Creek | $293 | 11% |

| Pelican Bay | $205 | -22% |

| Pembroke Park | $336 | 27% |

| Pembroke Pines | $303 | 15% |

| Pensacola | $217 | -18% |

| Perry | $203 | -23% |

| Pierson | $218 | -17% |

| Pine Air | $340 | 29% |

| Pine Castle | $285 | 8% |

| Pine Hills | $297 | 13% |

| Pine Island Center | $219 | -17% |

| Pine Manor | $210 | -21% |

| Pine Ridge | $215 | -19% |

| Pinecrest | $314 | 19% |

| Pineland | $210 | -20% |

| Pinellas Park | $278 | 5% |

| Pinetta | $205 | -22% |

| Pinewood | $365 | 38% |

| Pioneer | $235 | -11% |

| Placida | $201 | -24% |

| Plant City | $274 | 4% |

| Plantation | $301 | 14% |

| Plantation Mobile Home Park | $340 | 29% |

| Plymouth | $242 | -8% |

| Poinciana | $258 | -2% |

| Point Baker | $219 | -17% |

| Polk City | $236 | -11% |

| Pomona Park | $219 | -17% |

| Pompano Beach | $320 | 21% |

| Ponce Inlet | $212 | -20% |

| Ponce de Leon | $194 | -26% |

| Ponte Vedra | $210 | -21% |

| Ponte Vedra Beach | $211 | -20% |

| Port Charlotte | $205 | -22% |

| Port LaBelle | $221 | -16% |

| Port Orange | $213 | -19% |

| Port Richey | $293 | 11% |

| Port Salerno | $239 | -9% |

| Port St. Joe | $194 | -26% |

| Port St. John | $219 | -17% |

| Port St. Lucie | $250 | -5% |

| Pretty Bayou | $199 | -25% |

| Princeton | $328 | 24% |

| Progress Village | $319 | 21% |

| Punta Gorda | $205 | -22% |

| Punta Rassa | $205 | -22% |

| Putnam Hall | $216 | -18% |

| Quail Ridge | $267 | 1% |

| Quincy | $204 | -23% |

| Raiford | $209 | -21% |

| Raleigh | $206 | -22% |

| Reddick | $212 | -20% |

| Redington Beach | $270 | 2% |

| Redington Shores | $270 | 2% |

| Richmond Heights | $297 | 13% |

| Richmond West | $329 | 24% |

| Ridge Manor | $262 | -1% |

| Ridge Wood Heights | $222 | -16% |

| Ridgecrest | $268 | 1% |

| Rio | $243 | -8% |

| Rio Pinar | $252 | -4% |

| River Park | $249 | -6% |

| River Ranch | $237 | -10% |

| River Ridge | $281 | 6% |

| Riverview | $296 | 12% |

| Riviera Beach | $307 | 16% |

| Rockledge | $220 | -17% |

| Roeville | $219 | -17% |

| Roosevelt Gardens | $346 | 31% |

| Roseland | $219 | -17% |

| Rotonda | $203 | -23% |

| Rotonda West | $203 | -23% |

| Royal Palm Beach | $327 | 24% |

| Royal Palm Estates | $329 | 25% |

| Ruskin | $274 | 4% |

| Safety Harbor | $277 | 5% |

| Salem | $203 | -23% |

| Samoset | $246 | -7% |

| Samsula-Spruce Creek | $215 | -19% |

| San Antonio | $284 | 8% |

| San Carlos Park | $204 | -23% |

| San Castle | $346 | 31% |

| San Mateo | $217 | -18% |

| Sanderson | $214 | -19% |

| Sanford | $225 | -15% |

| Sanibel | $200 | -24% |

| Santa Rosa Beach | $186 | -29% |

| Sarasota | $228 | -14% |

| Sarasota Springs | $226 | -14% |

| Satellite Beach | $210 | -20% |

| Satsuma | $223 | -16% |

| Sawgrass | $212 | -20% |

| Schall Circle | $340 | 29% |

| Scottsmoor | $229 | -13% |

| Sebastian | $217 | -18% |

| Sebring | $218 | -17% |

| Seffner | $294 | 11% |

| Seminole | $272 | 3% |

| Seminole Manor | $346 | 31% |

| Seville | $220 | -17% |

| Sewall’s Point | $238 | -10% |

| Shady Grove | $207 | -21% |

| Shady Hills | $278 | 5% |

| Shalimar | $193 | -27% |

| Sharpes | $221 | -16% |

| Siesta Key | $221 | -16% |

| Silver Lake | $214 | -19% |

| Silver Springs | $215 | -18% |

| Silver Springs Shores | $216 | -18% |

| Sky Lake | $286 | 8% |

| Sneads | $198 | -25% |

| Solana | $203 | -23% |

| Sopchoppy | $198 | -25% |

| Sorrento | $220 | -17% |

| South Apopka | $248 | -6% |

| South Bay | $287 | 9% |

| South Beach | $224 | -15% |

| South Bradenton | $246 | -7% |

| South Brooksville | $255 | -3% |

| South Daytona | $214 | -19% |

| South Gate Ridge | $223 | -16% |

| South Highpoint | $281 | 6% |

| South Miami | $305 | 16% |

| South Miami Heights | $322 | 22% |

| South Palm Beach | $336 | 27% |

| South Pasadena | $286 | 8% |

| South Patrick Shores | $210 | -20% |

| South Sarasota | $222 | -16% |

| South Venice | $204 | -23% |

| Southchase | $266 | 1% |

| Southeast Arcadia | $218 | -17% |

| Southgate | $222 | -16% |

| Southwest Ranches | $290 | 10% |

| Sparr | $206 | -22% |

| Spring Hill | $259 | -2% |

| Springfield | $198 | -25% |

| Springhill | $219 | -17% |

| St. Augustine | $206 | -22% |

| St. Augustine Beach | $203 | -23% |

| St. Augustine Shores | $203 | -23% |

| St. Augustine South | $203 | -23% |

| St. Cloud | $262 | -1% |

| St. James City | $216 | -18% |

| St. Johns | $214 | -19% |

| St. Leo | $277 | 5% |

| St. Lucie Village | $246 | -7% |

| St. Marks | $199 | -24% |

| St. Pete Beach | $271 | 3% |

| St. Petersburg | $284 | 7% |

| Stacey Street | $340 | 29% |

| Starke | $216 | -18% |

| Steinhatchee | $204 | -23% |

| Stock Island | $227 | -14% |

| Stuart | $240 | -9% |

| Sugarmill Woods | $222 | -16% |

| Sumatra | $207 | -22% |

| Summerfield | $205 | -22% |

| Summerland Key | $227 | -14% |

| Sumterville | $213 | -19% |

| Sun City | $282 | 7% |

| Sun City Center | $277 | 5% |

| Suncoast Estates | $223 | -15% |

| Sunny Isles Beach | $329 | 25% |

| Sunrise | $325 | 23% |

| Sunset | $311 | 18% |

| Surfside | $316 | 20% |

| Suwannee | $202 | -23% |

| Sweetwater | $335 | 27% |

| Sydney | $282 | 7% |

| Taft | $278 | 5% |

| Tallahassee | $210 | -20% |

| Tallevast | $219 | -17% |

| Tamarac | $340 | 29% |

| Tamiami | $334 | 26% |

| Tampa | $327 | 24% |

| Tangelo Park | $251 | -5% |

| Tangerine | $242 | -8% |

| Tarpon Springs | $284 | 8% |

| Tavares | $215 | -19% |

| Tavernier | $245 | -7% |

| Taylor Creek | $234 | -11% |

| Telogia | $205 | -22% |

| Temple Terrace | $325 | 23% |

| Tequesta | $256 | -3% |

| Terra Ceia | $240 | -9% |

| The Acreage | $297 | 13% |

| The Crossings | $314 | 19% |

| The Hammocks | $316 | 20% |

| The Meadows | $227 | -14% |

| The Villages | $207 | -22% |

| Thonotosassa | $289 | 10% |

| Three Lakes | $314 | 19% |

| Three Oaks | $204 | -23% |

| Tice | $241 | -9% |

| Tierra Verde | $274 | 4% |

| Tiger Point | $216 | -18% |

| Timber Pines | $258 | -2% |

| Titusville | $216 | -18% |

| Town ‘n’ Country | $343 | 30% |

| Treasure Island | $271 | 3% |

| Trenton | $207 | -22% |

| Trilby | $274 | 4% |

| Trinity | $282 | 7% |

| Tyndall AFB | $196 | -26% |

| Umatilla | $210 | -20% |

| Union Park | $251 | -5% |

| University | $293 | 11% |

| University Park | $337 | 28% |

| Upper Grand Lagoon | $201 | -24% |

| Valparaiso | $191 | -28% |

| Valrico | $295 | 12% |

| Vamo | $222 | -16% |

| Venice | $205 | -22% |

| Venice Gardens | $204 | -23% |

| Venus | $211 | -20% |

| Vernon | $198 | -25% |

| Vero Beach | $221 | -16% |

| Vero Beach South | $221 | -16% |

| Viera East | $214 | -19% |

| Villano Beach | $205 | -22% |

| Villas | $214 | -19% |

| Vineyards | $204 | -23% |

| Virginia Gardens | $320 | 21% |

| Wabasso | $222 | -16% |

| Wabasso Beach | $224 | -15% |

| Wacissa | $203 | -23% |

| Wahneta | $249 | -6% |

| Waldo | $198 | -25% |

| Wallace | $218 | -17% |

| Warm Mineral Springs | $206 | -22% |

| Warrington | $216 | -18% |

| Washington Park | $346 | 31% |

| Watergate | $302 | 14% |

| Watertown | $208 | -21% |

| Wauchula | $224 | -15% |

| Wausau | $198 | -25% |

| Waverly | $234 | -11% |

| Webster | $222 | -16% |

| Wedgefield | $246 | -7% |

| Weeki Wachee Gardens | $258 | -2% |

| Weirsdale | $206 | -22% |

| Wekiwa Springs | $229 | -13% |

| Welaka | $228 | -14% |

| Wellborn | $202 | -23% |

| Wellington | $327 | 24% |

| Wesley Chapel | $282 | 7% |

| West Bradenton | $236 | -10% |

| West DeLand | $227 | -14% |

| West Lealman | $286 | 8% |

| West Little River | $358 | 36% |

| West Melbourne | $216 | -18% |

| West Miami | $333 | 26% |

| West Palm Beach | $346 | 31% |

| West Park | $336 | 27% |

| West Pensacola | $217 | -18% |

| West Perrine | $307 | 16% |

| West Samoset | $237 | -10% |

| West Vero Corridor | $219 | -17% |

| Westchase | $290 | 10% |

| Westchester | $335 | 27% |

| Westgate | $338 | 28% |

| Weston | $289 | 10% |

| Westview | $372 | 41% |

| Westville | $195 | -26% |

| Westwood Lakes | $332 | 26% |

| Wewahitchka | $197 | -26% |

| Whiskey Creek | $209 | -21% |

| White City | $253 | -4% |

| White Springs | $203 | -23% |

| Whitfield | $236 | -11% |

| Wildwood | $215 | -19% |

| Williamsburg | $249 | -6% |

| Williston | $208 | -21% |

| Willow Oak | $234 | -11% |

| Wilton Manors | $321 | 22% |

| Wimauma | $274 | 4% |

| Windermere | $247 | -6% |

| Windsor | $224 | -15% |

| Winter Beach | $224 | -15% |

| Winter Garden | $242 | -8% |

| Winter Haven | $247 | -7% |

| Winter Park | $246 | -7% |

| Winter Springs | $227 | -14% |

| Woodville | $209 | -21% |

| World Golf Village | $210 | -21% |

| Wright | $194 | -27% |

| Yalaha | $215 | -18% |

| Yankeetown | $200 | -24% |

| Youngstown | $197 | -25% |

| Yulee | $217 | -18% |

| Zellwood | $244 | -8% |

| Zephyrhills | $281 | 7% |

| Zephyrhills North | $280 | 6% |

| Zephyrhills South | $282 | 7% |

| Zephyrhills West | $282 | 7% |

| Zolfo Springs | $219 | -17% |

Best and worst drivers in Florida

Drivers in Davie and Coral Springs are involved in the fewest traffic incidents in Florida, while drivers in Miami Gardens are involved in the most incidents. Driving incidents include speeding tickets, accidents and DUIs.

Best drivers in Florida by city

Among major cities, Davie and Coral Springs have the best drivers in Florida based on driving incident rates between October 2023 and October 2024. There were about eight driving incidents per 1,000 drivers in both of these cities during that time.

Pembroke Pines, Fort Lauderdale and West Palm Beach round out Florida’s best driving cities.

| City | Incidents per 1,000 drivers |

|---|---|

| Davie | 7.9 |

| Coral Springs | 7.9 |

| Pembroke Pines | 9.1 |

| Fort Lauderdale | 10.7 |

| West Palm Beach | 10.9 |

Although Davie and Coral Springs have the best drivers in Florida, the average car insurance rates in these cities are slightly higher than the state average of $3,267 a year.

Worst drivers by city

Miami Gardens has the most driving incidents and the worst drivers in Florida. About 23 incidents occur per 1,000 drivers in Miami Gardens. Miami Gardens also has above-average car insurance rates at $4,401 a year.

| City | Incidents per 1,000 drivers |

|---|---|

| Miami Gardens | 22.5 |

| Tallahassee | 20.1 |

| Miramar | 19.9 |

| Jacksonville | 18.7 |

| Cape Coral | 17.5 |

Best and worst drivers by generation

Younger drivers have the highest number of traffic-related incidents in Florida, while older drivers are involved in the fewest incidents.

Gen Z drivers are three times more likely to be involved in traffic incidents than the Silent Generation. About 52 incidents occur per 1,000 Gen Z drivers in Florida, while the Silent Generation is involved in just under 17 incidents per 1,000 drivers.

| Generation | Incidents per 1,000 drivers |

|---|---|

| Gen Z | 51.99 |

| Millennial | 29.22 |

| Gen X | 22.61 |

| Boomer | 18.2 |

| Silent generation | 16.89 |

Teens and young adults also pay high car insurance rates due to their limited driving experience.

Best and worst drivers by car make

Volvo is the car brand that’s involved in the fewest traffic-related incidents in Florida at around 16 incidents per 1,000 drivers. Mercury is the state’s next-best car make for driving incidents. Lincoln, Chrysler and Cadillac round out Florida’s best drivers by car make.

Best drivers by car make

| Make | Incidents per 1,000 drivers |

|---|---|

| Volvo | 15.9 |

| Mercury | 17.9 |

| Lincoln | 18.1 |

| Chrysler | 18.8 |

| Cadillac | 20.7 |

Ram drivers are the most likely to be involved in a traffic incident in Florida. Ram drivers are involved in 28 incidents per 1,000 drivers.

Worst drivers by car make

| Make | Incidents per 1,000 drivers |

|---|---|

| Ram | 28.24 |

| Dodge | 27.88 |

| Tesla | 27.29 |

| Volkswagen | 26.67 |

| Jeep | 25.73 |

Florida car insurance requirements

Car insurance is required by law in Florida. The state’s minimum car insurance requirements include:

- Personal injury protection (PIP): $10,000

- Property damage liability: $10,000

You usually also have to get bodily injury liability

- Caused an injury in an accident, or

- Been convicted of certain violations, including DUI

You have to add collision

Under Florida’s no-fault laws, your policy’s PIP covers injuries to you and your passengers. However, you’re responsible for damage to other people’s vehicles if you’re at fault. This is what your policy’s property damage liability covers.

If you severely injure someone, you may have to cover portions of their medical costs. Adding bodily injury liability to your policy protects you from expenses like these.

Uninsured motorist

Frequently asked questions

Car insurance in Florida costs an average of $87 a month for minimum coverage. Full coverage rates average $264 a month for a typical driver.

Yes, you need car insurance to drive legally in Florida. The minimum coverages required for most drivers include personal injury protection (PIP) and property damage liability.

Full coverage car insurance includes more protection than Florida’s minimum requirements. There is no specific definition of full coverage. However, full coverage usually includes PIP, liability, collision and comprehensive coverage. Other coverages are available for more protection.

How we selected the cheapest car insurance companies in Florida

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:Bodily injury liability: $50,000 per person, $100,000 per accident

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: $10,000

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Florida

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.