Cheapest Car Insurance in Indiana (2026)

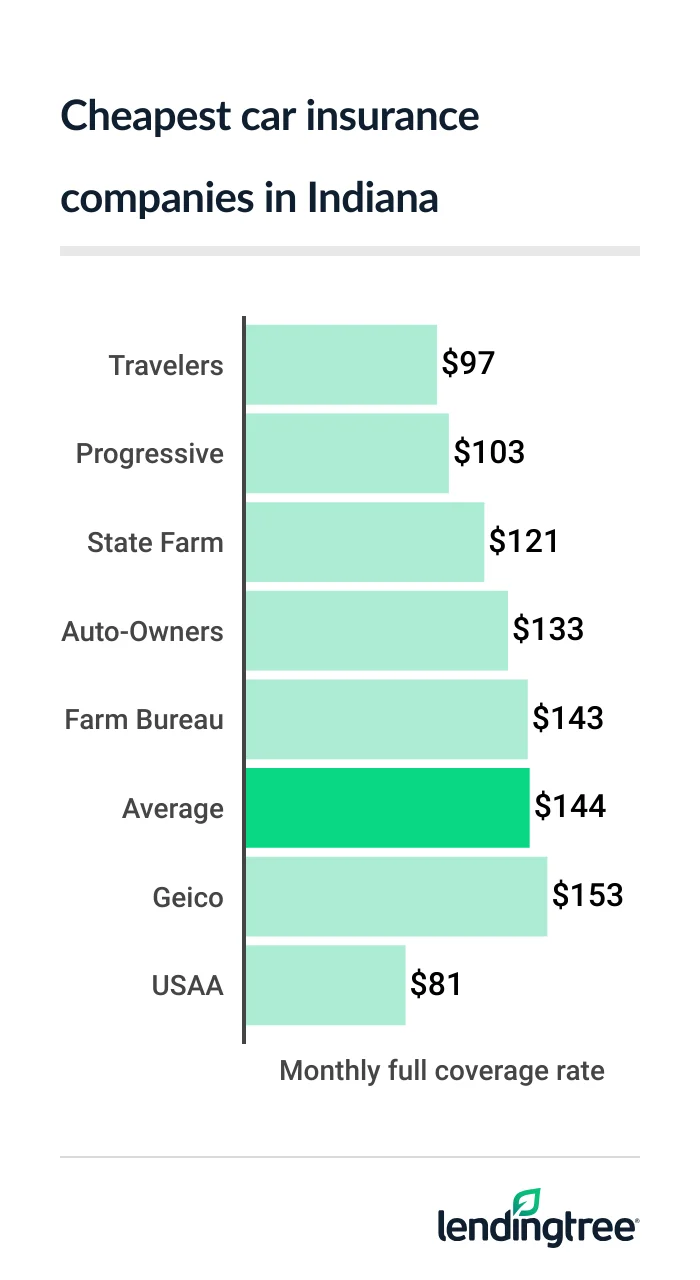

Travelers has Indiana’s cheapest full coverage car insurance, at $97 a month. State Farm has the cheapest liability-only insurance, at $39 a month.

Best cheap Indiana car insurance

Cheapest full coverage car insurance in Indiana: Travelers

Travelers has the cheapest full coverage car insurance for most Indiana drivers, at $97 a month. This is only slightly less than Progressive’s rate of $103 a month. Although USAA is cheaper than both companies, it’s only available to the military community.

-

Indiana drivers pay an average of $144 a month for full coverage

.Full coverage includes collision and comprehensive, which cover your own car for damage and theft.

- Your actual rate depends on factors like your driving record, location and credit.

- Each company treats these factors differently and has different car insurance discounts.

- Comparing car insurance quotes from multiple companies helps you find the cheapest rate.

Cheap full coverage auto insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Travelers | $97 | |

| Progressive | $103 | |

| State Farm | $121 | |

| Auto-Owners | $133 | |

| Farm Bureau | $143 | |

| Geico | $153 | |

| Farmers | $217 | |

| Allstate | $244 | |

| USAA* | $81 | |

Cheap Indiana liability insurance: State Farm and Travelers

At $39 a month each, State Farm and Travelers have the cheapest liability insurance for most Indiana drivers.

Travelers also has discounts for new cars, hybrids and electric vehicles that State Farm doesn’t offer. These can make Travelers your cheapest option, if you qualify.

Liability auto insurance rates

| Company | Monthly rate |

|---|---|

| State Farm | $39 |

| Travelers | $39 |

| Auto-Owners | $44 |

| Progressive | $48 |

| Farm Bureau | $50 |

| Geico | $61 |

| Farmers | $77 |

| Allstate | $95 |

| USAA* | $26 |

Liability insurance meets Indiana’s minimum insurance requirements. It covers injuries and damage you cause to other people and their vehicles. However, it doesn’t cover you or your vehicle for injuries or damage.

Best car insurance rates for Indiana teens: Travelers

Travelers has Indiana’s cheapest car insurance for most teens. Its liability rates for young drivers average $109 a month. This is barely cheaper than Progressive’s rate of $111 a month.

However, young drivers can get cheaper full coverage from Travelers at $255 a month. This is 13% less than Progressive’s rate of $293 a month.

Cheap car insurance for teens

| Company | Liability only | Full coverage |

|---|---|---|

| Travelers | $109 | $255 |

| Progressive | $111 | $293 |

| State Farm | $133 | $357 |

| Geico | $143 | $359 |

| Auto-Owners | $145 | $334 |

| Farm Bureau | $180 | $499 |

| Allstate | $235 | $479 |

| Farmers | $236 | $560 |

| USAA* | $65 | $190 |

A lack of driving experience makes teens more likely to get into accidents than older drivers. This is the main reason why teens have such high insurance rates. Most teens get cheaper rates on a parent’s policy than they do on their own.

Teen car insurance discounts

Discounts can also help make car insurance more affordable for teens.

- Progressive gives parents a discount for adding a teen under 18 to your policy.

- Travelers doesn’t have this discount. However, it gives teens a driver training discount that Progressive doesn’t have.

- Both companies give teens a discount for getting good grades.

Other companies have these and other discounts for young drivers. It’s good to ask about them when you get car insurance quotes.

Cheap Indiana car insurance after a speeding ticket: Travelers

Indiana drivers with a speeding ticket can get the cheapest car insurance quotes from Travelers. The company’s rates for drivers with a ticket average $121 a month.

State Farm, Progressive and Auto-Owners are the next-cheapest companies. All three charge about $130 a month.

Auto insurance rates with a ticket

| Company | Monthly rate |

|---|---|

| Travelers | $121 |

| State Farm | $130 |

| Progressive | $133 |

| Auto-Owners | $133 |

| Farm Bureau | $170 |

| Geico | $195 |

| Farmers | $271 |

| Allstate | $315 |

| USAA* | $102 |

A speeding ticket raises the average price of car insurance in Indiana by 21% to $174 a month. However, some companies raise their rates by smaller amounts. Shopping around can help you save money on car insurance with a bad driving record.

Best Indiana auto insurance rates after an accident: Travelers

At $134 a month, Travelers has the cheapest auto insurance for most Indiana drivers with an at-fault accident on their records.

State Farm and Progressive are the next-cheapest companies. Both charge just under $150 a month after an accident.

Car insurance rates with an accident

| Company | Monthly rate |

|---|---|

| Travelers | $134 |

| State Farm | $147 |

| Progressive | $149 |

| Auto-Owners | $163 |

| Farm Bureau | $210 |

| Geico | $254 |

| Farmers | $303 |

| Allstate | $403 |

| USAA* | $117 |

An at-fault accident raises the average price of car insurance in Indiana to $209 a month. This is 45% higher than the rate for drivers with clean records.

You can avoid a rate hike like this by adding accident forgiveness

You add accident forgiveness to your policy before an accident for the protection to kick in. It usually costs extra, but Progressive has paid and free versions.

Best insurance rates for Indiana teens with a ticket or accident: Progressive

Most Indiana teens with a ticket or accident get the cheapest auto insurance from Progressive. The company’s liability rates average $117 a month for teens with a ticket. It charges young drivers $124 a month after an at-fault accident.

Travelers is the next-cheapest company for teens with bad driving records. Its rates average $136 a month after a ticket and $160 a month after an accident.

Insurance rates bad teen drivers

| Company | Ticket | Accident |

|---|---|---|

| Progressive | $117 | $124 |

| Travelers | $136 | $160 |

| State Farm | $146 | $172 |

| Auto-Owners | $148 | $187 |

| Geico | $176 | $224 |

| Farm Bureau | $254 | $323 |

| Farmers | $277 | $313 |

| Allstate | $314 | $428 |

| USAA* | $107 | $119 |

Indiana’s cheapest car insurance with a DUI: Progressive

At $121 a month, Progressive has Indiana’s cheapest DUI insurance for most drivers. Progressive has the next-cheapest rates after a DUI (driving under the influence) at $139 a month.

Cheap DUI insurance

| Company | Monthly rate |

|---|---|

| Progressive | $121 |

| Travelers | $139 |

| State Farm | $213 |

| Farm Bureau | $253 |

| Geico | $279 |

| Auto-Owners | $306 |

| Allstate | $317 |

| Farmers | $384 |

| USAA* | $156 |

A DUI raises the average price of car insurance in Indiana to $241 a month. This is nearly twice as much as drivers with a clean record pay. Shopping around can help you find a company that charges less than the average.

Cheap Indiana car insurance for bad credit: Travelers

Travelers has the cheapest bad-credit car insurance for most Indiana drivers, at $157 a month. Progressive is the next-cheapest company for drivers with bad credit, at $168 a month.

Insurance rates with bad credit

| Company | Monthly rate |

|---|---|

| Travelers | $157 |

| Progressive | $168 |

| Geico | $232 |

| Farm Bureau | $292 |

| Allstate | $342 |

| Farmers | $349 |

| Auto-Owners | $375 |

| State Farm | $535 |

| USAA* | $150 |

Insurance companies check your credit for things like late payments and borrowing amounts. Avoiding late payments and paying down debts can help you get lower rates in the future.

Best car insurance in Indiana

State Farm, Travelers and USAA are Indiana’s best car insurance companies.

Along with low rates, State Farm has a better satisfaction score from J.D. Power

Travelers has Indiana’s best car insurance coverage options. It offers accident forgiveness, gap insurance

- Gap insurance can come in handy if you finance your car with a low down payment.

- Accident forgiveness protects you from an insurance rate hike after an at-fault accident.

- New car replacement makes it easier to replace a totaled car with a new model.

USAA has the best car insurance for drivers in the military community. It has cheap rates and a better satisfaction score than every other Indiana car insurance company.

Insurance company ratings

| Company | J.D. Power | AM Best | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Auto-Owners | 638 | A+ | |

| Farm Bureau | 645 | A | |

| Farmers | 622 | A | |

| Geico | 645 | A++ | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| Travelers | 613 | A++ | |

| USAA* | 735 | A++ |

Indiana car insurance rates by city

Berne, Monroe and Tipton are Indiana’s cheapest cities and towns for car insurance. Drivers in each of these areas pay an average of $135 a month for full coverage. This is 6% less than the state average.

Drivers in Gary have Indiana’s highest rates, at $216 a month. This is 50% more than the state average. Compared to this, car insurance in Indianapolis may seem like a bargain at $173 a month.

Car insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Aberdeen | $157 | 9% |

| Advance | $149 | 4% |

| Akron | $151 | 5% |

| Alamo | $147 | 2% |

| Albany | $140 | -2% |

| Albion | $145 | 1% |

| Alexandria | $142 | -1% |

| Altona | $143 | 0% |

| Ambia | $147 | 3% |

| Amboy | $140 | -3% |

| Americus | $138 | -4% |

| Amo | $153 | 6% |

| Anderson | $144 | 0% |

| Andrews | $139 | -3% |

| Angola | $147 | 2% |

| Arcadia | $142 | -1% |

| Arcola | $152 | 6% |

| Argos | $142 | -1% |

| Arlington | $137 | -5% |

| Ashley | $143 | 0% |

| Athens | $154 | 7% |

| Atlanta | $139 | -4% |

| Attica | $151 | 5% |

| Atwood | $142 | -1% |

| Auburn | $144 | 0% |

| Aurora | $158 | 10% |

| Austin | $158 | 10% |

| Avilla | $145 | 1% |

| Avoca | $157 | 9% |

| Avon | $150 | 4% |

| Bainbridge | $154 | 7% |

| Bargersville | $148 | 3% |

| Bass Lake | $162 | 12% |

| Batesville | $146 | 2% |

| Bath | $144 | 0% |

| Battle Ground | $138 | -4% |

| Bedford | $157 | 9% |

| Beech Grove | $167 | 16% |

| Bellmore | $161 | 12% |

| Bennington | $164 | 14% |

| Bentonville | $143 | -1% |

| Berne | $135 | -6% |

| Bethlehem | $158 | 10% |

| Beverly Shores | $154 | 7% |

| Bicknell | $154 | 7% |

| Bippus | $144 | 0% |

| Birdseye | $145 | 1% |

| Blanford | $154 | 7% |

| Bloomfield | $156 | 9% |

| Bloomingdale | $152 | 6% |

| Bloomington | $149 | 3% |

| Bluffton | $137 | -5% |

| Boggstown | $147 | 2% |

| Boone Grove | $158 | 10% |

| Boonville | $156 | 9% |

| Borden | $162 | 12% |

| Boswell | $149 | 3% |

| Bourbon | $141 | -2% |

| Bowling Green | $162 | 12% |

| Bradford | $169 | 17% |

| Branchville | $153 | 6% |

| Brazil | $159 | 11% |

| Bremen | $140 | -3% |

| Bridgeton | $149 | 4% |

| Bright | $158 | 10% |

| Brimfield | $143 | 0% |

| Bringhurst | $146 | 1% |

| Bristol | $139 | -4% |

| Bristow | $151 | 5% |

| Brook | $152 | 6% |

| Brooklyn | $151 | 5% |

| Brookston | $144 | 0% |

| Brookville | $155 | 8% |

| Brownsburg | $149 | 4% |

| Brownstown | $155 | 8% |

| Brownsville | $138 | -4% |

| Bruceville | $153 | 6% |

| Bryant | $138 | -4% |

| Buckskin | $151 | 5% |

| Buffalo | $153 | 6% |

| Bunker Hill | $142 | -1% |

| Burket | $142 | -1% |

| Burlington | $147 | 2% |

| Burnettsville | $155 | 8% |

| Burns Harbor | $156 | 8% |

| Burrows | $154 | 7% |

| Butler | $144 | 0% |

| Butlerville | $155 | 8% |

| Cambridge City | $136 | -5% |

| Camby | $161 | 12% |

| Camden | $148 | 3% |

| Campbellsburg | $167 | 16% |

| Canaan | $158 | 10% |

| Cannelburg | $151 | 5% |

| Cannelton | $153 | 7% |

| Carbon | $158 | 10% |

| Carlisle | $163 | 13% |

| Carmel | $143 | 0% |

| Carthage | $140 | -3% |

| Cayuga | $155 | 8% |

| Cedar Grove | $152 | 6% |

| Cedar Lake | $165 | 15% |

| Celestine | $142 | -1% |

| Centerpoint | $161 | 12% |

| Centerville | $136 | -5% |

| Central | $169 | 18% |

| Chalmers | $151 | 5% |

| Chandler | $154 | 7% |

| Charlestown | $157 | 9% |

| Charlottesville | $142 | -1% |

| Chesterfield | $141 | -2% |

| Chesterton | $156 | 8% |

| Chrisney | $156 | 8% |

| Churubusco | $140 | -3% |

| Cicero | $144 | 0% |

| Clarks Hill | $144 | 0% |

| Clarksburg | $150 | 5% |

| Clarksville | $156 | 8% |

| Clay City | $159 | 10% |

| Claypool | $144 | 0% |

| Clayton | $144 | 0% |

| Clear Lake | $147 | 2% |

| Clermont | $164 | 14% |

| Clifford | $142 | -1% |

| Clinton | $153 | 6% |

| Coal City | $163 | 13% |

| Coalmont | $163 | 14% |

| Coatesville | $153 | 7% |

| Colfax | $138 | -4% |

| Columbia City | $141 | -2% |

| Columbus | $142 | -1% |

| Commiskey | $156 | 9% |

| Connersville | $141 | -2% |

| Converse | $140 | -2% |

| Cordry Sweetwater Lakes | $159 | 11% |

| Cortland | $157 | 9% |

| Corunna | $145 | 1% |

| Cory | $158 | 10% |

| Corydon | $168 | 17% |

| Country Club Heights | $143 | -1% |

| Country Squire Lakes | $156 | 8% |

| Covington | $151 | 5% |

| Craigville | $138 | -4% |

| Crandall | $169 | 17% |

| Crane | $158 | 10% |

| Crane Naval Depot | $158 | 10% |

| Crawfordsville | $142 | -1% |

| Cromwell | $145 | 1% |

| Cross Plains | $160 | 11% |

| Crothersville | $150 | 4% |

| Crown Point | $165 | 15% |

| Culver | $152 | 6% |

| Cumberland | $173 | 20% |

| Cutler | $146 | 1% |

| Cynthiana | $158 | 10% |

| Dale | $150 | 4% |

| Daleville | $140 | -3% |

| Dana | $154 | 7% |

| Danville | $144 | 0% |

| Darlington | $141 | -2% |

| Dayton | $139 | -3% |

| DeMotte | $159 | 10% |

| Decatur | $136 | -5% |

| Decker | $150 | 5% |

| Deedsville | $150 | 4% |

| Delong | $156 | 9% |

| Delphi | $149 | 4% |

| Denver | $144 | 0% |

| Depauw | $170 | 18% |

| Deputy | $156 | 9% |

| Derby | $153 | 7% |

| Dillsboro | $161 | 12% |

| Donaldson | $148 | 3% |

| Dublin | $147 | 2% |

| Dubois | $143 | 0% |

| Dugger | $156 | 9% |

| Dunkirk | $141 | -2% |

| Dunlap | $139 | -3% |

| Dunreith | $143 | -1% |

| Dupont | $161 | 12% |

| Dyer | $164 | 14% |

| Earl Park | $146 | 2% |

| East Chicago | $206 | 44% |

| East Enterprise | $160 | 11% |

| Eaton | $141 | -2% |

| Eckerty | $161 | 12% |

| Economy | $137 | -5% |

| Edgewood | $143 | -1% |

| Edinburgh | $147 | 2% |

| Edwardsport | $154 | 7% |

| Elberfeld | $152 | 6% |

| Elizabeth | $163 | 14% |

| Elizabethtown | $142 | -1% |

| Elkhart | $139 | -3% |

| Ellettsville | $151 | 5% |

| Elnora | $159 | 10% |

| Elwood | $141 | -2% |

| Eminence | $151 | 5% |

| English | $159 | 11% |

| Etna Green | $144 | 0% |

| Evanston | $149 | 4% |

| Evansville | $157 | 9% |

| Fair Oaks | $157 | 10% |

| Fairland | $150 | 5% |

| Fairmount | $139 | -3% |

| Fairview Park | $153 | 6% |

| Falmouth | $145 | 1% |

| Farmersburg | $157 | 9% |

| Farmland | $140 | -3% |

| Fillmore | $154 | 7% |

| Finly | $149 | 4% |

| Fish Lake | $152 | 6% |

| Fishers | $144 | 0% |

| Flat Rock | $141 | -2% |

| Flora | $147 | 2% |

| Florence | $165 | 15% |

| Floyds Knobs | $158 | 10% |

| Fontanet | $157 | 9% |

| Fort Branch | $154 | 7% |

| Fort Wayne | $150 | 4% |

| Fortville | $150 | 4% |

| Fountain City | $138 | -4% |

| Fountaintown | $151 | 5% |

| Fowler | $148 | 3% |

| Fowlerton | $145 | 1% |

| Francesville | $156 | 9% |

| Francisco | $151 | 5% |

| Frankfort | $137 | -5% |

| Franklin | $149 | 4% |

| Frankton | $139 | -3% |

| Fredericksburg | $170 | 19% |

| Freedom | $156 | 9% |

| Freelandville | $156 | 9% |

| Freetown | $157 | 9% |

| Fremont | $147 | 2% |

| French Lick | $159 | 10% |

| Friendship | $155 | 8% |

| Fulda | $154 | 7% |

| Fulton | $150 | 4% |

| Galveston | $143 | -1% |

| Garrett | $143 | 0% |

| Gary | $216 | 50% |

| Gas City | $143 | -1% |

| Gaston | $136 | -6% |

| Geneva | $136 | -5% |

| Gentryville | $151 | 5% |

| Georgetown | $161 | 12% |

| Glenwood | $141 | -2% |

| Goldsmith | $142 | -1% |

| Goodland | $150 | 4% |

| Goshen | $139 | -3% |

| Gosport | $157 | 10% |

| Grabill | $142 | -1% |

| Grammer | $144 | 0% |

| Grandview | $154 | 7% |

| Granger | $140 | -3% |

| Grantsburg | $162 | 13% |

| Grass Creek | $155 | 8% |

| Graysville | $156 | 8% |

| Greencastle | $153 | 7% |

| Greendale | $157 | 9% |

| Greenfield | $148 | 3% |

| Greens Fork | $141 | -2% |

| Greensburg | $141 | -2% |

| Greentown | $142 | -1% |

| Greenwood | $151 | 5% |

| Griffin | $156 | 8% |

| Griffith | $169 | 18% |

| Grissom AFB | $142 | -1% |

| Grovertown | $157 | 9% |

| Guilford | $158 | 10% |

| Gwynneville | $144 | 1% |

| Hagerstown | $139 | -3% |

| Hamilton | $144 | 0% |

| Hamlet | $158 | 10% |

| Hammond | $196 | 37% |

| Hanna | $159 | 11% |

| Hanover | $155 | 8% |

| Hardinsburg | $170 | 18% |

| Harlan | $142 | -1% |

| Harrodsburg | $146 | 2% |

| Hartford City | $141 | -2% |

| Hartsville | $140 | -3% |

| Hatfield | $159 | 11% |

| Haubstadt | $155 | 8% |

| Hayden | $155 | 8% |

| Hazleton | $153 | 6% |

| Hebron | $159 | 11% |

| Helmsburg | $154 | 7% |

| Heltonville | $157 | 9% |

| Hemlock | $146 | 2% |

| Henryville | $162 | 13% |

| Heritage Lake | $154 | 7% |

| Hidden Valley | $158 | 10% |

| Highland | $162 | 13% |

| Hillsboro | $155 | 8% |

| Hillsdale | $161 | 12% |

| Hoagland | $144 | 0% |

| Hobart | $172 | 20% |

| Hobbs | $145 | 1% |

| Holland | $142 | -1% |

| Holton | $152 | 6% |

| Homecroft | $173 | 21% |

| Homer | $145 | 1% |

| Hope | $138 | -4% |

| Howe | $146 | 1% |

| Hudson | $144 | 0% |

| Hudson Lake | $152 | 6% |

| Huntertown | $144 | 0% |

| Huntingburg | $141 | -2% |

| Huntington | $139 | -3% |

| Huron | $162 | 12% |

| Hymera | $153 | 6% |

| Idaville | $153 | 6% |

| Indian Heights | $141 | -2% |

| Indianapolis | $173 | 20% |

| Ingalls | $150 | 5% |

| Inglefield | $158 | 10% |

| Ireland | $145 | 1% |

| Jamestown | $146 | 2% |

| Jasonville | $159 | 10% |

| Jasper | $141 | -2% |

| Jeffersonville | $159 | 11% |

| Jonesboro | $144 | 0% |

| Jonesville | $143 | -1% |

| Kempton | $138 | -4% |

| Kendallville | $141 | -2% |

| Kennard | $143 | -1% |

| Kentland | $146 | 1% |

| Kewanna | $153 | 7% |

| Keystone | $140 | -3% |

| Kimmell | $146 | 1% |

| Kingman | $157 | 9% |

| Kingsbury | $155 | 8% |

| Kingsford Heights | $154 | 7% |

| Knightstown | $141 | -2% |

| Knightsville | $159 | 11% |

| Knox | $162 | 12% |

| Kokomo | $141 | -2% |

| Koleen | $164 | 14% |

| Koontz Lake | $152 | 6% |

| Kouts | $156 | 8% |

| Kurtz | $158 | 10% |

| La Crosse | $159 | 11% |

| La Fontaine | $141 | -2% |

| La Paz | $146 | 2% |

| La Porte | $155 | 8% |

| Laconia | $166 | 15% |

| Ladoga | $144 | 0% |

| Lafayette | $137 | -5% |

| LaGrange | $146 | 1% |

| Lake Cicott | $147 | 2% |

| Lake Dalecarlia | $158 | 10% |

| Lake Santee | $142 | -1% |

| Lake Station | $186 | 29% |

| Lake Village | $159 | 11% |

| Lakes of the Four Seasons | $165 | 15% |

| Laketon | $143 | -1% |

| Lakeville | $148 | 3% |

| Lamar | $150 | 5% |

| Landess | $146 | 1% |

| Lanesville | $163 | 13% |

| Laotto | $141 | -2% |

| Lapel | $142 | -1% |

| Larwill | $142 | -1% |

| Lawrence | $177 | 23% |

| Lawrenceburg | $157 | 9% |

| Leavenworth | $164 | 14% |

| Lebanon | $139 | -3% |

| Leesburg | $142 | -1% |

| Leiters Ford | $155 | 8% |

| Leo | $142 | -1% |

| Leo-Cedarville | $141 | -2% |

| Leopold | $156 | 8% |

| Leroy | $161 | 12% |

| Lewis | $161 | 12% |

| Lewisville | $139 | -3% |

| Liberty | $140 | -3% |

| Liberty Center | $141 | -2% |

| Liberty Mills | $142 | -1% |

| Ligonier | $144 | 0% |

| Lincoln City | $150 | 4% |

| Linden | $142 | -1% |

| Linn Grove | $142 | -1% |

| Linton | $161 | 12% |

| Lizton | $142 | -1% |

| Logansport | $143 | -1% |

| Long Beach | $156 | 8% |

| Loogootee | $151 | 5% |

| Losantville | $139 | -3% |

| Lowell | $158 | 10% |

| Lucerne | $149 | 4% |

| Lynn | $137 | -5% |

| Lynnville | $148 | 3% |

| Lyons | $162 | 12% |

| Mackey | $154 | 7% |

| Macy | $151 | 5% |

| Madison | $156 | 8% |

| Manilla | $137 | -5% |

| Marengo | $164 | 14% |

| Mariah Hill | $158 | 10% |

| Marion | $144 | 0% |

| Markle | $139 | -3% |

| Markleville | $146 | 2% |

| Marshall | $157 | 9% |

| Martinsville | $154 | 7% |

| Marysville | $162 | 13% |

| Matthews | $144 | 0% |

| Mauckport | $169 | 18% |

| Maxwell | $152 | 6% |

| Mays | $145 | 1% |

| McCordsville | $151 | 5% |

| Mecca | $156 | 9% |

| Medaryville | $162 | 12% |

| Medora | $158 | 10% |

| Mellott | $147 | 3% |

| Melody Hill | $158 | 10% |

| Memphis | $160 | 11% |

| Mentone | $144 | 0% |

| Meridian Hills | $163 | 13% |

| Merom | $162 | 12% |

| Merrillville | $175 | 22% |

| Metamora | $147 | 2% |

| Mexico | $143 | 0% |

| Miami | $142 | -1% |

| Michiana Shores | $156 | 8% |

| Michigan City | $156 | 8% |

| Michigantown | $141 | -2% |

| Middlebury | $141 | -2% |

| Middletown | $141 | -2% |

| Midland | $159 | 11% |

| Milan | $157 | 10% |

| Milford | $139 | -3% |

| Mill Creek | $155 | 8% |

| Millersburg | $141 | -2% |

| Millhousen | $159 | 10% |

| Milltown | $164 | 14% |

| Milroy | $142 | -1% |

| Milton | $139 | -3% |

| Mishawaka | $141 | -2% |

| Mitchell | $159 | 11% |

| Modoc | $137 | -5% |

| Mongo | $150 | 4% |

| Monon | $153 | 6% |

| Monroe | $135 | -6% |

| Monroe City | $151 | 5% |

| Monroeville | $140 | -3% |

| Monrovia | $151 | 5% |

| Monterey | $156 | 9% |

| Montezuma | $159 | 11% |

| Montgomery | $154 | 7% |

| Monticello | $148 | 3% |

| Montmorenci | $138 | -4% |

| Montpelier | $141 | -2% |

| Mooreland | $139 | -3% |

| Moores Hill | $159 | 11% |

| Mooresville | $150 | 4% |

| Morgantown | $158 | 10% |

| Morocco | $156 | 9% |

| Morris | $156 | 9% |

| Morristown | $144 | 0% |

| Mount Auburn | $136 | -5% |

| Mount Ayr | $149 | 3% |

| Mount St. Francis | $159 | 10% |

| Mount Summit | $142 | -1% |

| Mount Vernon | $156 | 8% |

| Mulberry | $138 | -4% |

| Muncie | $138 | -4% |

| Munster | $170 | 18% |

| Muscatatuck | $155 | 8% |

| Nabb | $167 | 16% |

| Napoleon | $153 | 7% |

| Nappanee | $139 | -3% |

| Nashville | $161 | 12% |

| Nebraska | $155 | 8% |

| Needham | $145 | 1% |

| New Albany | $156 | 8% |

| New Carlisle | $149 | 4% |

| New Castle | $139 | -3% |

| New Chicago | $169 | 17% |

| New Goshen | $156 | 9% |

| New Harmony | $156 | 9% |

| New Haven | $144 | 0% |

| New Lisbon | $148 | 3% |

| New Market | $149 | 4% |

| New Middletown | $167 | 17% |

| New Palestine | $156 | 8% |

| New Paris | $140 | -3% |

| New Point | $144 | 1% |

| New Richmond | $144 | 0% |

| New Ross | $141 | -2% |

| New Salisbury | $167 | 16% |

| New Trenton | $151 | 5% |

| New Washington | $164 | 14% |

| New Waverly | $142 | -1% |

| New Whiteland | $146 | 2% |

| Newberry | $161 | 12% |

| Newburgh | $155 | 8% |

| Newport | $153 | 6% |

| Newtown | $151 | 5% |

| Noblesville | $144 | 0% |

| Nora | $149 | 4% |

| Norman | $158 | 10% |

| North Judson | $164 | 14% |

| North Liberty | $148 | 3% |

| North Manchester | $142 | -1% |

| North Salem | $148 | 3% |

| North Terre Haute | $158 | 10% |

| North Vernon | $156 | 8% |

| North Webster | $144 | 0% |

| Norway | $148 | 3% |

| Notre Dame | $145 | 1% |

| Oakford | $147 | 2% |

| Oakland City | $150 | 5% |

| Oaktown | $157 | 9% |

| Oakville | $148 | 3% |

| Odon | $152 | 5% |

| Ogden Dunes | $160 | 12% |

| Oldenburg | $146 | 2% |

| Onward | $152 | 6% |

| Oolitic | $156 | 9% |

| Ora | $158 | 10% |

| Orestes | $140 | -3% |

| Orland | $145 | 1% |

| Orleans | $160 | 11% |

| Osceola | $145 | 1% |

| Osgood | $150 | 4% |

| Ossian | $137 | -5% |

| Otisco | $163 | 14% |

| Otterbein | $144 | 0% |

| Otwell | $147 | 2% |

| Owensburg | $160 | 12% |

| Owensville | $156 | 8% |

| Oxford | $149 | 4% |

| Palmyra | $167 | 16% |

| Paoli | $162 | 12% |

| Paragon | $162 | 13% |

| Paris Crossing | $153 | 6% |

| Parker City | $139 | -3% |

| Patoka | $150 | 4% |

| Patricksburg | $155 | 8% |

| Patriot | $159 | 11% |

| Paxton | $158 | 10% |

| Pekin | $168 | 17% |

| Pendleton | $146 | 2% |

| Pennville | $140 | -3% |

| Perrysville | $157 | 9% |

| Peru | $143 | -1% |

| Petersburg | $151 | 5% |

| Petroleum | $143 | 0% |

| Pierceton | $143 | -1% |

| Pierceville | $159 | 10% |

| Pimento | $161 | 12% |

| Pine Village | $146 | 2% |

| Pittsboro | $144 | 0% |

| Plainfield | $153 | 6% |

| Plainville | $158 | 10% |

| Pleasant Lake | $147 | 2% |

| Pleasant Mills | $146 | 2% |

| Plymouth | $142 | -1% |

| Point Isabel | $139 | -3% |

| Poland | $159 | 10% |

| Poneto | $138 | -4% |

| Portage | $160 | 11% |

| Porter | $156 | 8% |

| Portland | $138 | -4% |

| Poseyville | $158 | 10% |

| Princes Lakes | $157 | 9% |

| Princeton | $154 | 7% |

| Purdue University | $136 | -5% |

| Putnamville | $149 | 4% |

| Quincy | $160 | 11% |

| Ragsdale | $150 | 4% |

| Ramsey | $169 | 17% |

| Redkey | $140 | -3% |

| Reelsville | $151 | 5% |

| Remington | $147 | 2% |

| Rensselaer | $154 | 7% |

| Reynolds | $152 | 6% |

| Richland | $156 | 8% |

| Richmond | $136 | -6% |

| Ridgeville | $138 | -4% |

| Rising Sun | $159 | 11% |

| Roachdale | $152 | 5% |

| Roann | $144 | 0% |

| Roanoke | $143 | -1% |

| Rochester | $146 | 2% |

| Rockfield | $153 | 7% |

| Rockport | $155 | 8% |

| Rockville | $158 | 10% |

| Rocky Ripple | $185 | 29% |

| Rolling Prairie | $156 | 9% |

| Rome | $151 | 5% |

| Rome City | $144 | 0% |

| Romney | $140 | -3% |

| Rosedale | $157 | 9% |

| Roseland | $147 | 3% |

| Roselawn | $158 | 10% |

| Rossville | $143 | 0% |

| Royal Center | $151 | 5% |

| Rushville | $140 | -3% |

| Russellville | $154 | 7% |

| Russiaville | $147 | 2% |

| Salamonia | $139 | -4% |

| Salem | $169 | 17% |

| Salt Creek Commons | $158 | 10% |

| San Pierre | $162 | 12% |

| Sandborn | $158 | 10% |

| Santa Claus | $148 | 3% |

| Saratoga | $136 | -5% |

| Schererville | $165 | 15% |

| Schneider | $157 | 9% |

| Schnellville | $143 | 0% |

| Scipio | $151 | 5% |

| Scotland | $162 | 13% |

| Scottsburg | $167 | 16% |

| Sedalia | $149 | 4% |

| Seelyville | $157 | 9% |

| Sellersburg | $156 | 8% |

| Selma | $138 | -4% |

| Servia | $146 | 2% |

| Seymour | $151 | 5% |

| Shadeland | $137 | -4% |

| Sharpsville | $144 | 0% |

| Shelburn | $156 | 9% |

| Shelbyville | $142 | -1% |

| Shepardsville | $160 | 12% |

| Sheridan | $140 | -3% |

| Shipshewana | $143 | 0% |

| Shirley | $142 | -1% |

| Shoals | $158 | 10% |

| Shorewood Forest | $158 | 10% |

| Silver Lake | $145 | 1% |

| Simonton Lake | $138 | -4% |

| Smithville | $157 | 9% |

| Smithville-Sanders | $150 | 5% |

| Solsberry | $156 | 8% |

| Somerset | $145 | 1% |

| Somerville | $154 | 7% |

| South Bend | $152 | 6% |

| South Haven | $160 | 11% |

| South Milford | $154 | 7% |

| South Whitley | $141 | -2% |

| Southport | $173 | 20% |

| Speedway | $174 | 21% |

| Spencer | $156 | 9% |

| Spencerville | $142 | -1% |

| Spiceland | $136 | -6% |

| Springport | $139 | -3% |

| Springville | $158 | 10% |

| Spurgeon | $148 | 3% |

| St. Anthony | $143 | 0% |

| St. Bernice | $153 | 7% |

| St. Croix | $157 | 9% |

| St. Joe | $142 | -1% |

| St. John | $164 | 14% |

| St. Mary of the Woods | $161 | 12% |

| St. Meinrad | $149 | 3% |

| St. Paul | $143 | -1% |

| Stanford | $154 | 7% |

| Star City | $151 | 5% |

| State Line | $148 | 3% |

| Staunton | $158 | 10% |

| Stendal | $150 | 4% |

| Stilesville | $153 | 7% |

| Stinesville | $153 | 6% |

| Stockwell | $137 | -4% |

| Straughn | $136 | -5% |

| Stroh | $150 | 4% |

| Sullivan | $161 | 12% |

| Sulphur | $158 | 10% |

| Sulphur Springs | $145 | 1% |

| Sumava Resorts | $151 | 5% |

| Summitville | $139 | -3% |

| Sunman | $157 | 9% |

| Swayzee | $142 | -1% |

| Sweetser | $141 | -2% |

| Switz City | $160 | 12% |

| Syracuse | $140 | -3% |

| Talbot | $158 | 10% |

| Taswell | $162 | 13% |

| Taylorsville | $143 | 0% |

| Tefft | $154 | 7% |

| Tell City | $150 | 4% |

| Templeton | $149 | 4% |

| Tennyson | $149 | 4% |

| Terre Haute | $158 | 10% |

| Thayer | $151 | 5% |

| Thorntown | $143 | -1% |

| Tipton | $135 | -6% |

| Topeka | $144 | 0% |

| Town of Pines | $156 | 9% |

| Trafalgar | $154 | 7% |

| Trail Creek | $155 | 8% |

| Tri-Lakes | $141 | -2% |

| Troy | $153 | 6% |

| Tunnelton | $156 | 8% |

| Twelve Mile | $144 | 0% |

| Tyner | $151 | 5% |

| Underwood | $166 | 15% |

| Union City | $137 | -5% |

| Union Mills | $158 | 10% |

| Uniondale | $139 | -4% |

| Unionville | $155 | 8% |

| Universal | $154 | 7% |

| Upland | $143 | 0% |

| Urbana | $144 | 0% |

| Utica | $158 | 10% |

| Vallonia | $160 | 11% |

| Valparaiso | $156 | 9% |

| Van Buren | $146 | 1% |

| Veedersburg | $155 | 8% |

| Velpen | $149 | 4% |

| Versailles | $156 | 9% |

| Vevay | $162 | 12% |

| Vincennes | $153 | 7% |

| Wabash | $140 | -2% |

| Wadesville | $158 | 10% |

| Wakarusa | $140 | -3% |

| Waldron | $137 | -5% |

| Walkerton | $149 | 4% |

| Wallace | $156 | 8% |

| Walton | $142 | -1% |

| Wanatah | $159 | 11% |

| Warren | $140 | -2% |

| Warren Park | $176 | 23% |

| Warsaw | $143 | 0% |

| Washington | $154 | 7% |

| Waterloo | $145 | 1% |

| Waveland | $148 | 3% |

| Wawaka | $143 | 0% |

| Waynetown | $145 | 1% |

| Webster | $137 | -5% |

| West Baden Springs | $159 | 11% |

| West College Corner | $145 | 1% |

| West Harrison | $153 | 6% |

| West Lafayette | $137 | -5% |

| West Lebanon | $148 | 3% |

| West Middleton | $148 | 3% |

| West Newton | $167 | 16% |

| West Terre Haute | $161 | 12% |

| Westfield | $142 | -1% |

| Westphalia | $155 | 8% |

| Westpoint | $139 | -3% |

| Westport | $146 | 1% |

| Westville | $157 | 9% |

| Wheatfield | $157 | 10% |

| Wheatland | $155 | 8% |

| Wheeler | $156 | 9% |

| Whiteland | $146 | 2% |

| Whitestown | $141 | -2% |

| Whiting | $194 | 35% |

| Wilkinson | $141 | -2% |

| Williams | $160 | 11% |

| Williams Creek | $163 | 13% |

| Williamsburg | $136 | -5% |

| Williamsport | $149 | 4% |

| Winamac | $153 | 6% |

| Winchester | $136 | -5% |

| Windfall | $140 | -3% |

| Winfield | $166 | 15% |

| Wingate | $146 | 2% |

| Winona Lake | $140 | -2% |

| Winslow | $150 | 5% |

| Wolcott | $149 | 4% |

| Wolcottville | $146 | 1% |

| Wolflake | $149 | 3% |

| Woodburn | $139 | -4% |

| Worthington | $157 | 9% |

| Wyatt | $148 | 3% |

| Yeoman | $151 | 5% |

| Yoder | $142 | -1% |

| Yorktown | $138 | -4% |

| Young America | $142 | -1% |

| Zanesville | $146 | 2% |

| Zionsville | $147 | 3% |

Indiana auto insurance requirements

You need car insurance to drive legally in Indiana. The state’s minimum car insurance requirements include:

-

Bodily injury liability

: $25,000 per person, $50,000 per accidentBodily injury liability helps cover the medical bills of other people you injure in a car accident.

-

Property damage liability

: $25,000Property damage liability covers damage you cause to property like fences, toll booths and light posts.

All Indiana car insurance policies include uninsured motorist

You have to add collision

How does SR-22 insurance work in Indiana?

You may need SR-22 car insurance to reinstate your driver’s license after certain violations. An SR-22 is a certificate that shows you have valid car insurance. Your insurance company sends it to the BMV when you buy your policy.

Most companies offer SR-22 insurance, but some don’t. Some add a filing fee of about $25 to your rate. The actual price you pay for SR-22 insurance depends on factors like your driving record.

- SR-22 insurance rates average about $240 a month after a major violation like DUI.

- Rates are closer to $174 a month after a lesser offense like driving without insurance.

How we selected the cheapest car insurance companies in Indiana

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Indiana

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.