Cheapest Car Insurance in Massachusetts (2026)

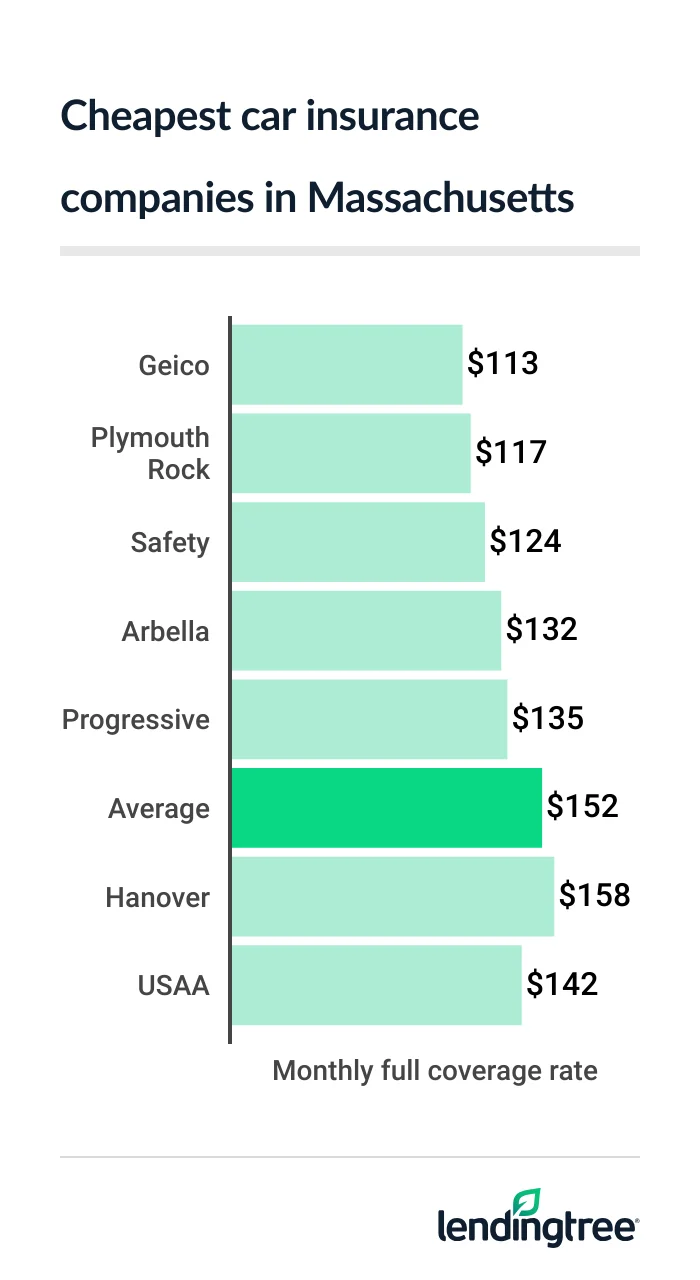

Geico has the cheapest full coverage car insurance in Massachusetts, at $113 a month. This is $39 less than the state average of $152 a month.

Best cheap Massachusetts car insurance

Cheapest full coverage car insurance in Massachusetts: Geico

Geico has Massachusetts’ cheapest full coverage car insurance, at $113 a month. This is only slightly less than Plymouth Rock’s rate of $117 a month for full coverage

The average cost of full coverage car insurance in Massachusetts is $152 a month. Your actual rate depends on factors like your driving record and vehicle.

Cheap full coverage auto insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Geico | $113 | |

| Plymouth Rock | $117 | |

| Safety | $124 | |

| Arbella | $132 | |

| Progressive | $135 | |

| Hanover | $158 | |

| Farmers | $161 | |

| Travelers | $170 | |

| Allstate | $269 | |

| USAA* | $142 | |

Each company looks at these factors differently and has different car insurance discounts. It’s good to compare car insurance quotes to find the cheapest company for your situation.

Cheap Massachusetts liability insurance: Geico

At $49 a month each, Geico and USAA have Massachusetts’ cheapest liability insurance, or minimum coverage. Plymouth Rock and Farmers are also cheap, at about $50 a month each. Minimum coverage includes liability

Cheapest liability auto insurance

| Company | Monthly rate |

|---|---|

| Geico | $49 |

| Plymouth Rock | $50 |

| Farmers | $52 |

| Arbella | $67 |

| Safety | $70 |

| Hanover | $71 |

| Travelers | $80 |

| Progressive | $86 |

| Allstate | $120 |

| USAA* | $49 |

Farmers, Geico, Plymouth Rock and USAA each have discounts for different groups.

- Farmers gives you an affinity discount if you’re in certain fields or professional associations. Current and former military members can also get an affinity discount.

- Geico has a discount for federal employees and certain alumni associations. It also has a military discount for active duty and retired service members, reservists and guardsmen.

- Plymouth Rock has a discount for members of public radio’s WBUR and WFCR.

- USAA is only available to the military community and their families. It has a better satisfaction score from J.D. Power, or happier customers, than every other company.

A company whose discounts match up with your background can often be your cheapest option.

Massachusetts’ cheapest car insurance for teens: Plymouth Rock

Most Bay Staters get the cheapest car insurance for teens from Plymouth Rock. The company charges young drivers $115 a month for minimum coverage. This is 18% less than the next-cheapest rate of $140 a month from Geico.

Plymouth Rock’s full coverage rates for teens average $261 a month. This is 16% less than Geico’s rate of $310 a month.

Teen auto insurance rates

| Company | Minimum coverage | Full coverage |

|---|---|---|

| Plymouth Rock | $115 | $261 |

| Geico | $140 | $310 |

| Travelers | $170 | $351 |

| Farmers | $177 | $506 |

| Progressive | $221 | $409 |

| Hanover | $234 | $503 |

| Arbella | $242 | $443 |

| Safety | $257 | $458 |

| Allstate | $435 | $924 |

| USAA* | $111 | $307 |

Teens’ lack of driving experience makes them more likely to get into accidents. This leads to higher car insurance rates for young drivers. Teens usually get cheaper rates on a parent’s policy than they do on their own.

Discounts can help make car insurance more affordable for young drivers. Several companies give teens a discount for getting good grades. Some give young drivers a discount for completing driver training.

Geico offers both of these teen discounts, while Plymouth Rock does not. This may make Geico the cheapest company for you.

Cheap MA car insurance after a speeding ticket: Arbella

At $125 a month, Geico has Massachusetts’ cheapest car insurance after a speeding ticket. Arbella is only slightly more expensive, at $132 a month. Arbella has discounts for energy-saving vehicles and low-mileage drivers. These may make it your cheapest option if you qualify for one or both of these discounts.

Insurance rates with a ticket

| Company | Monthly rate |

|---|---|

| Geico | $125 |

| Arbella | $132 |

| Safety | $160 |

| Plymouth Rock | $168 |

| Progressive | $174 |

| Farmers | $200 |

| Travelers | $222 |

| Hanover | $259 |

| Allstate | $269 |

| USAA* | $165 |

A speeding ticket raises the average cost of Massachusetts car insurance by 23% to $187 a month. However, some companies have smaller increases. Comparing quotes helps you find the cheapest insurance for a bad driving record.

MA’s cheapest car insurance after an accident: Plymouth Rock

Massachusetts drivers with an accident get the cheapest car insurance from Plymouth Rock. The company’s rates average $134 a month after an at-fault accident. This is 42% less than the state average of $232 a month. Arbella is the next-cheapest company, at $152 a month after an accident.

Insurance rates after an accident

| Company | Monthly rate |

|---|---|

| Plymouth Rock | $134 |

| Arbella | $152 |

| Geico | $163 |

| Progressive | $193 |

| Safety | $194 |

| Travelers | $273 |

| Hanover | $281 |

| Farmers | $288 |

| Allstate | $439 |

| USAA* | $203 |

Best for MA teens with bad driving records: Plymouth Rock

Plymouth Rock has Massachusetts’ best car insurance rates for teens with a bad driving record. The company has the cheapest liability insurance for young drivers with a ticket, at $138 a month. It also has the cheapest liability for teens after an accident, at $127 a month.

Geico is only slightly more expensive for teens with a ticket, at $140 a month. However, it’s 35% more expensive than Plymouth Rock for teens with an accident.

Teen insurance rates after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Plymouth Rock | $138 | $127 |

| Geico | $140 | $171 |

| Farmers | $186 | $228 |

| Travelers | $200 | $257 |

| Progressive | $240 | $248 |

| Arbella | $242 | $276 |

| Safety | $257 | $304 |

| Hanover | $303 | $313 |

| Allstate | $435 | $532 |

| USAA* | $158 | $214 |

Cheap Massachusetts car insurance with an OUI: Progressive

At $159 a month, Progressive has Massachusetts cheapest insurance after an OUI (operating under the influence) conviction. This is 42% less than the state average of $273 a month. Plymouth Rock has the next-cheapest OUI insurance, at $174 a month.

Insurance rates with a OUI

| Company | Monthly rate |

|---|---|

| Progressive | $159 |

| Plymouth Rock | $174 |

| Geico | $186 |

| Arbella | $217 |

| Hanover | $230 |

| Travelers | $259 |

| Safety | $287 |

| Farmers | $331 |

| Allstate | $540 |

| USAA* | $349 |

Best car insurance in Massachusetts

Geico and Plymouth Rock are Massachusetts’ best car insurance companies for different reasons.

Insurance company ratings

| Company | LendingTree score | J.D. Power | AM Best |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Arbella | 609 | A | |

| Farmers | 622 | A | |

| Geico | 645 | A++ | |

| Hanover | 607 | A | |

| Plymouth Rock | 608 | A- | |

| Progressive | 621 | A+ | |

| Safety | 617 | A | |

| Travelers | 613 | A++ | |

| USAA* | 735 | A++ |

Geico is the best choice for cheap rates with a good driving record or ticket. Its full coverage rates are 26% less than the state average. It also has several discounts that make it more affordable. These include discounts for:

- Good drivers

- Homeowners

- Vehicles with safety devices

Along with low rates, Plymouth Rock has the best coverage options for Massachusetts drivers. It offers gap insurance

Plymouth Rock also offers perks that most other insurance companies don’t have. These include:

- Discounted tickets for the Boston Bruins, Boston Red Sox and New England Patriots

- One free cab or rideshare ride home each year through its Get Home Safe program

Massachusetts car insurance rates by city

Orleans and Eastham have the cheapest car insurance for Massachusetts cities, towns and neighborhoods. Drivers in both Cape Cod towns pay $119 a month for full coverage. This is 22% less than the state average.

At $284 a month, Boston’s Roxbury neighborhood has the state’s most expensive car insurance.

Car insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Abington | $170 | 12% |

| Accord | $153 | 0% |

| Acton | $127 | -17% |

| Acushnet | $159 | 4% |

| Acushnet Center | $162 | 6% |

| Adams | $120 | -21% |

| Agawam | $156 | 2% |

| Allston | $182 | 20% |

| Amesbury Town | $138 | -9% |

| Amherst | $143 | -6% |

| Amherst Center | $147 | -3% |

| Andover | $141 | -7% |

| Arlington | $147 | -4% |

| Arlington Heights | $148 | -3% |

| Ashburnham | $132 | -13% |

| Ashby | $132 | -13% |

| Ashfield | $120 | -21% |

| Ashland | $152 | 0% |

| Ashley Falls | $128 | -16% |

| Assonet | $154 | 1% |

| Athol | $135 | -11% |

| Attleboro | $150 | -1% |

| Attleboro Falls | $146 | -4% |

| Auburn | $153 | 1% |

| Auburndale | $158 | 4% |

| Avon | $183 | 20% |

| Ayer | $134 | -12% |

| Babson Park | $160 | 5% |

| Baldwinville | $130 | -15% |

| Barnstable | $148 | -3% |

| Barre | $136 | -11% |

| Becket | $132 | -13% |

| Bedford | $138 | -9% |

| Belchertown | $137 | -10% |

| Bellingham | $141 | -7% |

| Belmont | $141 | -8% |

| Berkley | $155 | 2% |

| Berkshire | $131 | -14% |

| Berlin | $129 | -15% |

| Bernardston | $120 | -21% |

| Beverly | $149 | -2% |

| Billerica | $147 | -3% |

| Blackstone | $141 | -7% |

| Blandford | $134 | -12% |

| Bliss Corner | $162 | 7% |

| Bolton | $133 | -13% |

| Bondsville | $145 | -5% |

| Boston | $182 | 20% |

| Bourne | $147 | -4% |

| Boxborough | $129 | -15% |

| Boxford | $140 | -8% |

| Boylston | $140 | -8% |

| Braintree Town | $174 | 14% |

| Brant Rock | $157 | 3% |

| Brewster | $122 | -20% |

| Bridgewater | $157 | 3% |

| Brighton | $181 | 19% |

| Brimfield | $137 | -10% |

| Brockton | $252 | 66% |

| Brookfield | $138 | -10% |

| Brookline | $163 | 7% |

| Brookline Village | $165 | 9% |

| Bryantville | $158 | 4% |

| Buckland | $121 | -21% |

| Burlington | $148 | -3% |

| Buzzards Bay | $155 | 2% |

| Byfield | $136 | -10% |

| Cambridge | $163 | 7% |

| Canton | $171 | 12% |

| Carlisle | $128 | -16% |

| Carver | $158 | 3% |

| Cataumet | $151 | -1% |

| Centerville | $152 | 0% |

| Charlemont | $121 | -20% |

| Charlestown | $227 | 49% |

| Charlton | $145 | -5% |

| Charlton City | $143 | -6% |

| Charlton Depot | $143 | -6% |

| Chartley | $161 | 5% |

| Chatham | $120 | -21% |

| Chelmsford | $136 | -10% |

| Chelsea | $245 | 61% |

| Cherry Valley | $161 | 6% |

| Cheshire | $120 | -21% |

| Chester | $129 | -15% |

| Chesterfield | $121 | -21% |

| Chestnut Hill | $169 | 11% |

| Chicopee | $168 | 10% |

| Chilmark | $124 | -18% |

| Clinton | $148 | -3% |

| Cochituate | $144 | -6% |

| Cohasset | $152 | 0% |

| Colrain | $128 | -16% |

| Concord | $126 | -17% |

| Conway | $122 | -20% |

| Cordaville | $136 | -11% |

| Cotuit | $152 | 0% |

| Cummaquid | $151 | -1% |

| Cummington | $120 | -21% |

| Cuttyhunk | $134 | -12% |

| Dalton | $122 | -20% |

| Danvers | $150 | -1% |

| Dedham | $170 | 12% |

| Deerfield | $121 | -21% |

| Dennis | $134 | -12% |

| Dennis Port | $138 | -9% |

| Devens | $132 | -13% |

| Dighton | $151 | -1% |

| Dorchester | $275 | 80% |

| Dorchester Center | $269 | 76% |

| Douglas | $137 | -10% |

| Dover | $142 | -7% |

| Dracut | $152 | 0% |

| Drury | $130 | -14% |

| Dudley | $140 | -8% |

| Dunstable | $130 | -15% |

| Duxbury | $141 | -7% |

| East Boston | $220 | 44% |

| East Bridgewater | $160 | 5% |

| East Brookfield | $137 | -10% |

| East Dennis | $138 | -9% |

| East Douglas | $144 | -5% |

| East Falmouth | $144 | -5% |

| East Freetown | $154 | 1% |

| East Harwich | $134 | -12% |

| East Longmeadow | $152 | 0% |

| East Orleans | $125 | -18% |

| East Otis | $130 | -14% |

| East Pepperell | $129 | -15% |

| East Princeton | $141 | -7% |

| East Sandwich | $143 | -6% |

| East Taunton | $173 | 14% |

| East Templeton | $138 | -9% |

| East Walpole | $154 | 1% |

| East Wareham | $166 | 9% |

| East Weymouth | $176 | 16% |

| Eastham | $119 | -22% |

| Easthampton | $133 | -12% |

| Easthampton Town | $138 | -9% |

| Edgartown | $125 | -18% |

| Elmwood | $165 | 8% |

| Erving | $120 | -21% |

| Essex | $136 | -11% |

| Everett | $222 | 46% |

| Fairhaven | $161 | 6% |

| Fall River | $197 | 29% |

| Falmouth | $140 | -8% |

| Fayville | $136 | -11% |

| Feeding Hills | $157 | 3% |

| Fiskdale | $138 | -9% |

| Fitchburg | $154 | 1% |

| Florence | $138 | -9% |

| Forestdale | $143 | -6% |

| Foxboro | $145 | -5% |

| Foxborough | $145 | -5% |

| Framingham | $164 | 8% |

| Franklin | $135 | -11% |

| Franklin Town | $140 | -8% |

| Gardner | $137 | -10% |

| Georgetown | $138 | -9% |

| Gilbertville | $133 | -13% |

| Gill | $123 | -19% |

| Glendale | $133 | -13% |

| Gloucester | $144 | -5% |

| Goshen | $121 | -21% |

| Grafton | $141 | -7% |

| Granby | $142 | -6% |

| Granville | $134 | -12% |

| Great Barrington | $128 | -16% |

| Green Harbor | $159 | 5% |

| Green Harbor-Cedar Crest | $161 | 6% |

| Greenbush | $159 | 4% |

| Greenfield Town | $133 | -12% |

| Groton | $124 | -19% |

| Groveland | $136 | -11% |

| Hadley | $123 | -19% |

| Halifax | $153 | 0% |

| Hampden | $147 | -3% |

| Hanover | $151 | -1% |

| Hanscom AFB | $143 | -6% |

| Hanson | $154 | 1% |

| Harvard | $126 | -17% |

| Harwich Center | $134 | -12% |

| Harwich Port | $134 | -12% |

| Hatfield | $122 | -20% |

| Hathorne | $142 | -7% |

| Haverhill | $160 | 5% |

| Haydenville | $127 | -17% |

| Heath | $135 | -11% |

| Hingham | $150 | -2% |

| Hinsdale | $130 | -15% |

| Holbrook | $180 | 18% |

| Holden | $142 | -7% |

| Holland | $133 | -13% |

| Holliston | $142 | -7% |

| Holyoke | $184 | 21% |

| Hopedale | $141 | -7% |

| Hopkinton | $131 | -14% |

| Housatonic | $133 | -13% |

| Hubbardston | $133 | -13% |

| Hudson | $138 | -9% |

| Hull | $169 | 11% |

| Humarock | $159 | 4% |

| Huntington | $133 | -13% |

| Hyannis | $152 | 0% |

| Hyannis Port | $137 | -10% |

| Hyde Park | $235 | 54% |

| Indian Orchard | $212 | 39% |

| Ipswich | $136 | -11% |

| Jamaica Plain | $204 | 34% |

| Jefferson | $145 | -4% |

| Kingston | $148 | -3% |

| Lake Pleasant | $133 | -12% |

| Lakeville | $149 | -2% |

| Lancaster | $137 | -10% |

| Lanesboro | $129 | -15% |

| Lawrence | $204 | 34% |

| Lee | $122 | -20% |

| Leeds | $138 | -9% |

| Leicester | $159 | 5% |

| Lenox | $123 | -19% |

| Lenox Dale | $139 | -9% |

| Leominster | $145 | -5% |

| Leverett | $127 | -16% |

| Lexington | $140 | -8% |

| Lincoln | $137 | -10% |

| Linwood | $176 | 16% |

| Littleton | $126 | -17% |

| Littleton Common | $131 | -14% |

| Longmeadow | $148 | -3% |

| Lowell | $174 | 14% |

| Ludlow | $154 | 1% |

| Lunenburg | $132 | -13% |

| Lynn | $228 | 50% |

| Lynnfield | $161 | 6% |

| Malden | $217 | 43% |

| Manchaug | $175 | 15% |

| Manchester | $129 | -15% |

| Manchester-by-the-Sea | $143 | -6% |

| Manomet | $157 | 3% |

| Mansfield | $144 | -5% |

| Mansfield Center | $147 | -3% |

| Marblehead | $154 | 1% |

| Marion | $142 | -7% |

| Marion Center | $146 | -4% |

| Marlborough | $148 | -3% |

| Marshfield | $159 | 4% |

| Marshfield Hills | $161 | 6% |

| Marstons Mills | $152 | 0% |

| Mashpee | $148 | -3% |

| Mashpee Neck | $152 | 0% |

| Mattapan | $256 | 68% |

| Mattapoisett | $143 | -6% |

| Mattapoisett Center | $147 | -3% |

| Maynard | $127 | -16% |

| Medfield | $132 | -14% |

| Medford | $180 | 18% |

| Medway | $132 | -13% |

| Melrose | $161 | 6% |

| Mendon | $130 | -14% |

| Menemsha | $130 | -14% |

| Merrimac | $136 | -10% |

| Methuen Town | $173 | 14% |

| Middleboro | $156 | 3% |

| Middleborough Center | $156 | 3% |

| Middlefield | $131 | -14% |

| Middleton | $153 | 1% |

| Milford | $149 | -2% |

| Mill River | $132 | -13% |

| Millbury | $149 | -2% |

| Millers Falls | $127 | -16% |

| Millis | $132 | -14% |

| Millis-Clicquot | $136 | -11% |

| Millville | $137 | -10% |

| Milton | $179 | 17% |

| Milton Village | $209 | 37% |

| Minot | $160 | 5% |

| Monponsett | $154 | 1% |

| Monroe Bridge | $134 | -12% |

| Monson | $138 | -9% |

| Monson Center | $142 | -7% |

| Montague | $122 | -20% |

| Monterey | $123 | -19% |

| Monument Beach | $151 | -1% |

| Nahant | $175 | 15% |

| Nantucket | $121 | -20% |

| Natick | $140 | -8% |

| Needham | $142 | -6% |

| Needham Heights | $146 | -4% |

| New Bedford | $196 | 28% |

| New Braintree | $128 | -16% |

| New Salem | $125 | -18% |

| New Seabury | $152 | 0% |

| New Town | $159 | 5% |

| Newbury | $131 | -14% |

| Newburyport | $129 | -15% |

| Newton | $155 | 2% |

| Newton Center | $158 | 4% |

| Newton Highlands | $158 | 4% |

| Newton Lower Falls | $158 | 4% |

| Newton Upper Falls | $158 | 4% |

| Newtonville | $158 | 4% |

| Nonantum | $158 | 4% |

| Norfolk | $136 | -11% |

| North Adams | $130 | -15% |

| North Amherst | $147 | -3% |

| North Andover | $149 | -2% |

| North Attleboro | $145 | -5% |

| North Billerica | $150 | -2% |

| North Brookfield | $137 | -10% |

| North Carver | $222 | 46% |

| North Chatham | $126 | -17% |

| North Chelmsford | $141 | -7% |

| North Dartmouth | $162 | 7% |

| North Dighton | $155 | 2% |

| North Eastham | $125 | -18% |

| North Easton | $167 | 10% |

| North Egremont | $136 | -11% |

| North Falmouth | $144 | -5% |

| North Grafton | $145 | -5% |

| North Hatfield | $136 | -11% |

| North Lakeville | $152 | 0% |

| North Marshfield | $159 | 4% |

| North Oxford | $151 | -1% |

| North Pembroke | $159 | 4% |

| North Plymouth | $160 | 5% |

| North Reading | $149 | -2% |

| North Scituate | $159 | 4% |

| North Seekonk | $155 | 2% |

| North Truro | $132 | -13% |

| North Uxbridge | $147 | -3% |

| North Waltham | $158 | 4% |

| North Westport | $155 | 2% |

| North Weymouth | $177 | 16% |

| Northampton | $133 | -12% |

| Northborough | $130 | -14% |

| Northbridge | $139 | -8% |

| Northfield | $120 | -21% |

| Northwest Harwich | $134 | -12% |

| Norton | $151 | -1% |

| Norton Center | $154 | 1% |

| Norwell | $147 | -4% |

| Norwood | $163 | 7% |

| Nutting Lake | $149 | -2% |

| Oak Bluffs | $124 | -18% |

| Oakham | $135 | -11% |

| Ocean Bluff | $161 | 6% |

| Ocean Bluff-Brant Rock | $161 | 6% |

| Ocean Grove | $153 | 1% |

| Onset | $166 | 9% |

| Orange | $133 | -13% |

| Orleans | $119 | -22% |

| Osterville | $152 | 0% |

| Otis | $125 | -18% |

| Oxford | $149 | -2% |

| Palmer | $142 | -7% |

| Paxton | $150 | -1% |

| Peabody | $170 | 12% |

| Pembroke | $156 | 3% |

| Pepperell | $124 | -19% |

| Petersham | $123 | -19% |

| Pinehurst | $150 | -1% |

| Pittsfield | $141 | -8% |

| Plainfield | $122 | -20% |

| Plainville | $147 | -3% |

| Plymouth | $158 | 4% |

| Plympton | $155 | 2% |

| Pocasset | $151 | -1% |

| Prides Crossing | $141 | -7% |

| Princeton | $125 | -18% |

| Provincetown | $124 | -18% |

| Quincy | $185 | 22% |

| Randolph | $220 | 45% |

| Raynham | $156 | 3% |

| Raynham Center | $159 | 4% |

| Reading | $140 | -8% |

| Readville | $239 | 57% |

| Rehoboth | $149 | -2% |

| Revere | $245 | 61% |

| Richmond | $124 | -18% |

| Rochdale | $161 | 6% |

| Rochester | $144 | -6% |

| Rockland | $171 | 13% |

| Rockport | $134 | -12% |

| Roslindale | $218 | 43% |

| Rowe | $120 | -21% |

| Rowley | $137 | -10% |

| Roxbury | $284 | 86% |

| Roxbury Crossing | $276 | 81% |

| Royalston | $133 | -13% |

| Russell | $136 | -11% |

| Rutland | $141 | -7% |

| Sagamore | $151 | -1% |

| Sagamore Beach | $151 | -1% |

| Salem | $180 | 18% |

| Salisbury | $140 | -8% |

| Sandisfield | $124 | -19% |

| Sandwich | $138 | -9% |

| Saugus | $190 | 25% |

| Savoy | $121 | -20% |

| Scituate | $157 | 3% |

| Seekonk | $151 | -1% |

| Sharon | $161 | 6% |

| Sheffield | $123 | -19% |

| Shelburne Falls | $129 | -16% |

| Sheldonville | $148 | -2% |

| Sherborn | $138 | -10% |

| Shirley | $133 | -13% |

| Shrewsbury | $150 | -1% |

| Shutesbury | $132 | -13% |

| Siasconset | $127 | -16% |

| Silver Beach | $145 | -5% |

| Smith Mills | $162 | 7% |

| Somerset | $154 | 1% |

| Somerville | $175 | 15% |

| South Amherst | $147 | -3% |

| South Ashburnham | $137 | -10% |

| South Barre | $149 | -2% |

| South Boston | $195 | 28% |

| South Carver | $158 | 4% |

| South Chatham | $126 | -17% |

| South Dartmouth | $162 | 7% |

| South Deerfield | $126 | -17% |

| South Dennis | $138 | -9% |

| South Duxbury | $145 | -5% |

| South Easton | $167 | 10% |

| South Egremont | $127 | -16% |

| South Grafton | $145 | -5% |

| South Hadley | $144 | -5% |

| South Hamilton | $137 | -10% |

| South Harwich | $144 | -5% |

| South Lancaster | $141 | -7% |

| South Lee | $128 | -16% |

| South Orleans | $142 | -7% |

| South Walpole | $154 | 1% |

| South Wellfleet | $143 | -6% |

| South Weymouth | $176 | 16% |

| South Yarmouth | $146 | -4% |

| Southampton | $131 | -14% |

| Southborough | $131 | -14% |

| Southbridge | $150 | -1% |

| Southbridge Town | $151 | -1% |

| Southfield | $127 | -16% |

| Southwick | $144 | -5% |

| Spencer | $151 | -1% |

| Springfield | $211 | 39% |

| Sterling | $126 | -17% |

| Still River | $136 | -10% |

| Stockbridge | $128 | -16% |

| Stoneham | $165 | 8% |

| Stoughton | $190 | 25% |

| Stow | $128 | -16% |

| Sturbridge | $133 | -12% |

| Sudbury | $129 | -15% |

| Sunderland | $131 | -14% |

| Sutton | $130 | -15% |

| Swampscott | $174 | 14% |

| Swansea | $150 | -2% |

| Taunton | $172 | 13% |

| Teaticket | $144 | -5% |

| Templeton | $125 | -18% |

| Tewksbury | $149 | -2% |

| Thorndike | $148 | -3% |

| Three Rivers | $147 | -4% |

| Topsfield | $148 | -3% |

| Townsend | $125 | -18% |

| Truro | $126 | -17% |

| Turners Falls | $127 | -16% |

| Tyngsboro | $141 | -7% |

| Upton | $129 | -15% |

| Uxbridge | $129 | -15% |

| Village of Nagog Woods | $131 | -14% |

| Vineyard Haven | $130 | -15% |

| Waban | $158 | 4% |

| Wakefield | $156 | 2% |

| Wales | $135 | -11% |

| Walpole | $151 | -1% |

| Waltham | $156 | 2% |

| Ware | $135 | -11% |

| Wareham | $164 | 7% |

| Wareham Center | $166 | 9% |

| Warren | $137 | -10% |

| Warwick | $124 | -18% |

| Watertown Town | $159 | 4% |

| Waverley | $155 | 2% |

| Wayland | $140 | -8% |

| Webster | $155 | 2% |

| Wellesley | $138 | -10% |

| Wellesley Hills | $142 | -7% |

| Wellfleet | $122 | -20% |

| Wendell | $122 | -20% |

| Wendell Depot | $128 | -16% |

| Wenham | $138 | -9% |

| West Barnstable | $152 | 0% |

| West Boxford | $148 | -3% |

| West Boylston | $138 | -10% |

| West Bridgewater | $170 | 12% |

| West Brookfield | $126 | -17% |

| West Chatham | $126 | -17% |

| West Chesterfield | $134 | -12% |

| West Chop | $131 | -14% |

| West Concord | $132 | -14% |

| West Dennis | $138 | -9% |

| West Falmouth | $144 | -5% |

| West Groton | $129 | -15% |

| West Harwich | $134 | -12% |

| West Hatfield | $135 | -11% |

| West Hyannisport | $137 | -10% |

| West Medford | $154 | 1% |

| West Millbury | $153 | 1% |

| West Newbury | $126 | -17% |

| West Newton | $158 | 4% |

| West Roxbury | $182 | 19% |

| West Springfield Town | $166 | 9% |

| West Stockbridge | $128 | -16% |

| West Tisbury | $125 | -18% |

| West Townsend | $130 | -15% |

| West Wareham | $166 | 9% |

| West Warren | $141 | -7% |

| West Yarmouth | $146 | -4% |

| Westborough | $140 | -8% |

| Westfield | $143 | -6% |

| Westford | $126 | -17% |

| Westminster | $132 | -13% |

| Weston | $141 | -7% |

| Westport | $152 | 0% |

| Westport Point | $155 | 2% |

| Westwood | $151 | -1% |

| Weweantic | $166 | 9% |

| Weymouth | $174 | 15% |

| Whately | $120 | -21% |

| Wheelwright | $140 | -8% |

| White Horse Beach | $157 | 3% |

| White Island Shores | $166 | 9% |

| Whitinsville | $143 | -6% |

| Whitman | $167 | 10% |

| Wilbraham | $147 | -4% |

| Williamsburg | $121 | -20% |

| Williamstown | $120 | -21% |

| Wilmington | $146 | -4% |

| Winchendon | $136 | -11% |

| Winchendon Springs | $140 | -8% |

| Winchester | $142 | -7% |

| Windsor | $126 | -17% |

| Winthrop Town | $212 | 39% |

| Woburn | $158 | 4% |

| Woods Hole | $144 | -5% |

| Woodville | $158 | 4% |

| Worcester | $191 | 25% |

| Woronoco | $148 | -3% |

| Worthington | $128 | -16% |

| Wrentham | $142 | -7% |

| Yarmouth Port | $147 | -4% |

Car insurance tends to cost more in areas with high accident rates, high crime rates or both. Above-average health care and car repair costs can also drive up an area’s car insurance costs.

Boston’s citywide insurance rate works out to $182 a month. This is 20% higher than the state average. Worcester drivers pay an average $191 a month, or 25% more than the state average.

Minimum coverage for car insurance in Massachusetts

The minimum car insurance requirements in Massachusetts went up on July 1, 2025. The minimum coverages and limits now required to drive legally include:

- Bodily injury liability liability: $25,000 per person, $50,000 per accident

- Personal injury protection (PIP): $8,000

- Uninsured motorist bodily injury: $25,000 per person, $50,000 per accident

- Property Damage liability: $30,000

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property.

Collision

How does no-fault car insurance work in MA?

Under Massachusetts’ no-fault car insurance laws, your PIP covers injuries to you and your passengers.

If you cause an accident, you are responsible for other people’s car repairs. Your policy’s property damage liability covers expenses like these.

If you severely injure someone, you may have to cover their medical treatment. Your bodily injury liability would kick in for a situation like this.

It’s important to make sure you have enough liability coverage. If your victim’s expenses are greater than your limits, you may have to cover the shortfall yourself. This could put your savings and other financial resources at risk.

Frequently asked questions

The average cost of car insurance in Massachusetts is $152 a month for full coverage. Liability insurance, or minimum coverage, costs an average of $70 a month. You can often get a cheaper rate by shopping around.

Geico and Plymouth Rock have the cheapest car insurance for most Massachusetts drivers. USAA also has cheap rates, but it’s only available to the military community. Each company’s rates vary by customer. Comparing quotes helps you find the cheapest rate for your situation.

Minimum coverage car insurance in Massachusetts includes liability, uninsured motorist and personal injury protection (PIP). PIP covers your own car accident injuries. If your injuries are severe, an at-fault driver’s liability insurance helps cover your costs.

How we selected the cheapest car insurance companies in Massachusetts

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: $8,000

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Massachusetts

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.