Cheapest Car Insurance in North Dakota (2026)

State Farm has North Dakota’s cheapest full coverage car insurance at $100 a month. It also has the cheapest minimum coverage at $25 a month.

Best cheap North Dakota car insurance

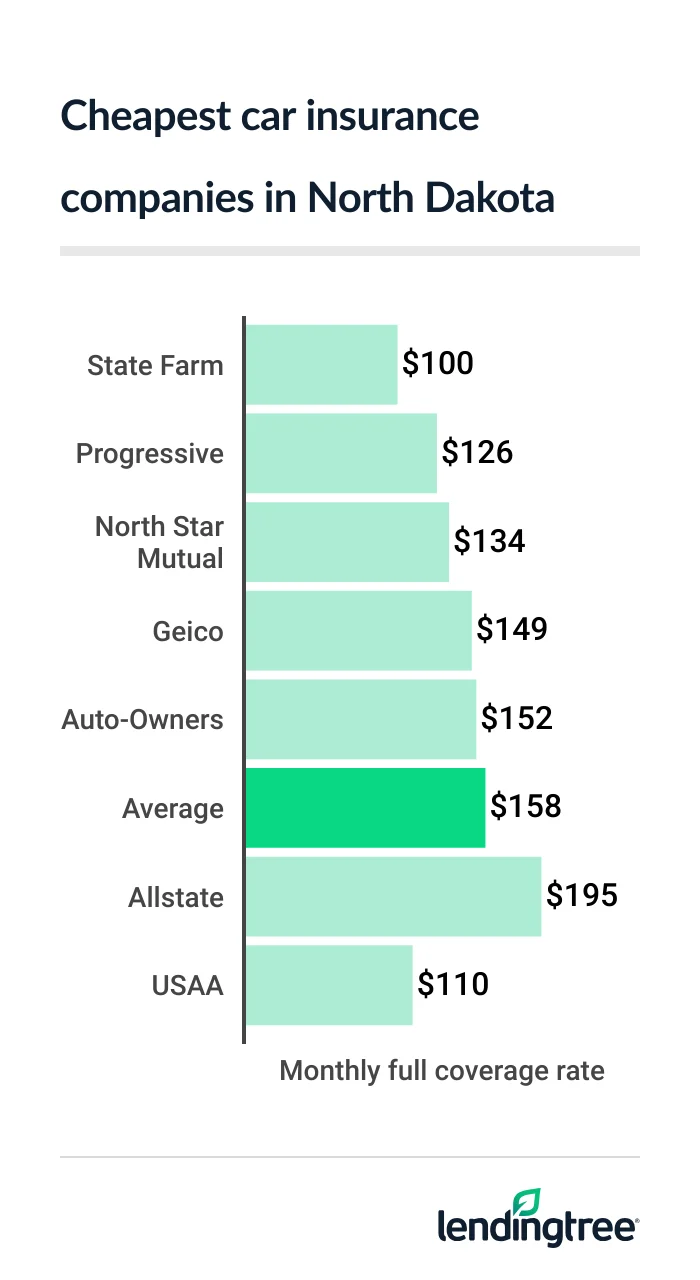

North Dakota’s cheapest full coverage car insurance

State Farm has North Dakota’s cheapest full coverage car insurance at $100 a month. USAA is the next-cheapest company for full coverage

North Dakota drivers pay an average of $158 a month for full coverage. Your actual rate depends on factors like your driving record, credit history and vehicle.

Cheap full coverage

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| State Farm | $100 | |

| Progressive | $126 | |

| North Star Mutual | $134 | |

| Geico | $149 | |

| Auto-Owners | $152 | |

| Allstate | $195 | |

| Nodak | $204 | |

| Farmers | $254 | |

| USAA* | $110 | |

Each company treats these factors differently and offers different car insurance discounts. This makes it good to compare car insurance quotes from a few companies to find the cheapest rate.

Cheap North Dakota liability insurance: State Farm

At $25 a month, State Farm has North Dakota’s cheapest liability insurance, or minimum coverage. Nodak and North Star Mutual are also cheap at $31 a month each. Minimum coverage includes liability

| Company | Monthly rate |

|---|---|

| State Farm | $25 |

| Nodak | $31 |

| North Star Mutual | $31 |

| Auto-Owners | $33 |

| Progressive | $35 |

| Geico | $39 |

| Allstate | $80 |

| Farmers | $87 |

| USAA* | $25 |

State Farm offers more discounts than Nodak and North State Mutual. These can make State Farm an even cheaper option if you qualify for enough of them.

Best car insurance rates for ND teens: North Star Mutual

North Star Mutual has the cheapest car insurance for teens in North Dakota. The company charges young drivers an average of $44 a month for minimum coverage. Nodak is the next-cheapest company for most teens at $69 a month.

North Star Mutual also has the best full coverage rate for young drivers at $173 a month.

Cheap teen auto insurance

| Company | Minimum coverage | Full coverage |

|---|---|---|

| North Star Mutual | $44 | $173 |

| Nodak | $69 | $402 |

| State Farm | $85 | $256 |

| Auto-Owners | $104 | $344 |

| Geico | $119 | $400 |

| Progressive | $164 | $549 |

| Allstate | $283 | $797 |

| Farmers | $344 | $855 |

| USAA* | $59 | $236 |

A lack of driving experience makes teens more likely to get into accidents than older drivers. This is why their insurance rates are so high. Young drivers usually get cheaper auto insurance on a parent’s policy than they do on their own.

Discounts can also make car insurance more affordable for teens.

- State Farm and Nodak give teens a discount for getting good grades.

- Nodak gives teens a discount for attending its one-hour Route 1000 class with a parent. You also get a $500 check if you avoid tickets and accidents for 1,000 days after that.

-

State Farm and Nodak also offer usage-based insurance

(UBI). These programs are available to drivers of any age, but teens may benefit the most.Most UBI programs use a smartphone to monitor your driving. You get discounts based on how safely you drive. The apps also provide feedback that can make you a better driver.

North Dakota’s cheapest auto insurance after a speeding ticket: State Farm

State Farm has North Dakota’s cheapest auto insurance after a speeding ticket at $105 a month. At $152 a month, Auto-Owners is the cheapest company if you have a ticket and need gap insurance.

Auto insurance rates with a ticket

| Company | Monthly rate |

|---|---|

| State Farm | $105 |

| Auto-Owners | $152 |

| North Star Mutual | $168 |

| Progressive | $171 |

| Allstate | $217 |

| Geico | $219 |

| Nodak | $232 |

| Farmers | $342 |

| USAA* | $133 |

A speeding ticket raises the average cost of car insurance by 22% to $193 a month. However, some companies raise their rates by smaller amounts. Shopping around for a cheaper rate can save you money if you have a bad driving record.

Cheapest ND car insurance after an accident: State Farm

State Farm also has North Dakota’s cheapest car insurance after an at-fault accident at $110 a month. Auto-Owners is the next-cheapest company for most drivers at $181 a month.

Cheap car insurance after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $110 |

| Auto-Owners | $181 |

| Progressive | $203 |

| North Star Mutual | $229 |

| Allstate | $264 |

| Geico | $314 |

| Nodak | $343 |

| Farmers | $344 |

| USAA* | $154 |

An at-fault accident raises the average cost of full coverage by 51% to $238 a month. Rate increases like these usually kick in on your policy’s next renewal date. It’s good to start shopping around for a cheaper rate when you get your renewal notice. A different company may offer a better price.

Best ND car insurance for teens with bad driving records: North Star Mutual

North Dakota teens with a bad driving record get the cheapest car insurance from North Star Mutual. The company charges teens with a speeding ticket $51 a month for minimum coverage. This is 35% less than the next-cheapest rate of $78 a month from Nodak.

North Star Mutual charges young drivers $69 a month after an accident. State Farm is the next-cheapest company at $102 a month.

Rates for teens with a bad record

| Company | Ticket | Accident |

|---|---|---|

| North Star Mutual | $51 | $69 |

| Nodak | $78 | $115 |

| State Farm | $93 | $102 |

| Auto-Owners | $104 | $144 |

| Geico | $133 | $191 |

| Progressive | $178 | $191 |

| Allstate | $333 | $407 |

| Farmers | $442 | $428 |

| USAA* | $92 | $107 |

Cheapest DUI car insurance in North Dakota: Progressive

At $153 a month, Progressive has North Dakota’s cheapest car insurance after a DUI (driving under the influence) conviction. State Farm also has cheap DUI insurance at $194 a month. Full coverage costs an average of $295 a month after a DUI.

Cheap car insurance after a DUI

| Company | Monthly rate |

|---|---|

| Progressive | $153 |

| State Farm | $194 |

| Auto-Owners | $245 |

| Nodak | $288 |

| Farmers | $337 |

| Allstate | $345 |

| North Star Mutual | $380 |

| Geico | $500 |

| USAA* | $217 |

Some of Progressive’s discounts can make car insurance more affordable after a DUI. These include discounts for:

- Getting an online quote

- Signing up for your policy online

- Setting up automatic payments

- Going paperless

- Paying for your policy in full and upfront

State Farm doesn’t offer payment and shopping discounts like these. Other companies do. It’s good to ask about these when you get your quotes so they don’t get overlooked.

North Dakota’s best car insurance for bad credit: Progressive

Most North Dakotans with bad credit get the cheapest car insurance quotes from Progressive. The company’s bad credit car insurance rates average $211 a month. Geico is only slightly more expensive at $214 a month.

Cheap bad credit car insurance

| Company | Monthly rate |

|---|---|

| Progressive | $211 |

| Geico | $214 |

| North Star Mutual | $222 |

| Allstate | $298 |

| Nodak | $319 |

| Farmers | $403 |

| Auto-Owners | $441 |

| State Farm | $517 |

| USAA* | $188 |

North Dakota’s best car insurance companies

Low rates and good customer service make State Farm North Dakota’s best car insurance company. It has cheaper rates and a better satisfaction rating from J.D. Power

Auto insurance company ratings

| Company | J.D. Power | AM Best | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Auto-Owners | 638 | A+ | |

| Farmers | 622 | A | |

| Geico | 645 | A++ | |

| Nodak | Not rated | A | |

| North Star Mutual | Not rated | A+ | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ |

Progressive has the state’s best coverage options. These include gap insurance and custom parts and equipment (CPE) coverage. Both of these cost extra, but each can come in handy in certain situations.

- Gap insurance can come in handy if you financed your car with a low down payment.

- CPE protects your investment in your vehicle’s modifications. Normal car insurance doesn’t provide much coverage for custom features.

Progressive also offers accident forgiveness. This prevents your first at-fault accident from causing your rates to go up. You have to add it to your policy before an accident. It usually costs extra, but Progressive has paid and free options.

USAA is your best choice if you meet its military eligibility requirements

USAA gives you accident forgiveness

North Dakota car insurance costs by city

At $129 a month, West Fargo has the cheapest car insurance among North Dakota’s cities and towns. Fargo itself has the next-cheapest rate of $131 a month.

Selfridge drivers pay the most for car insurance at $178 a month. This is 13% higher than the state average. Fort Yates has the next-highest rate at $177 a month.

Car insurance costs $149 a month in Bismarck, or 6% less than the state average.

Auto insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Abercrombie | $144 | -9% |

| Absaraka | $144 | -9% |

| Adams | $155 | -2% |

| Agate | $157 | -1% |

| Alamo | $164 | 4% |

| Alexander | $163 | 3% |

| Almont | $170 | 7% |

| Alsen | $154 | -3% |

| Ambrose | $165 | 4% |

| Amenia | $142 | -10% |

| Amidon | $165 | 4% |

| Anamoose | $162 | 2% |

| Aneta | $156 | -2% |

| Antler | $162 | 2% |

| Argusville | $138 | -13% |

| Arnegard | $164 | 3% |

| Arthur | $142 | -10% |

| Arvilla | $146 | -8% |

| Ashley | $154 | -3% |

| Ayr | $144 | -9% |

| Baldwin | $155 | -2% |

| Balfour | $163 | 3% |

| Balta | $162 | 2% |

| Bantry | $161 | 2% |

| Barney | $144 | -9% |

| Bathgate | $154 | -3% |

| Beach | $161 | 1% |

| Belcourt | $158 | 0% |

| Belfield | $159 | 1% |

| Benedict | $160 | 1% |

| Berlin | $154 | -2% |

| Berthold | $169 | 7% |

| Beulah | $161 | 2% |

| Binford | $151 | -5% |

| Bisbee | $155 | -2% |

| Bismarck | $149 | -6% |

| Blanchard | $148 | -7% |

| Bottineau | $158 | 0% |

| Bowbells | $169 | 7% |

| Bowdon | $159 | 1% |

| Bowman | $165 | 4% |

| Braddock | $162 | 2% |

| Brocket | $156 | -2% |

| Buchanan | $145 | -9% |

| Buffalo | $145 | -9% |

| Burlington | $155 | -2% |

| Butte | $164 | 4% |

| Buxton | $148 | -7% |

| Caledonia | $147 | -7% |

| Calvin | $154 | -3% |

| Cando | $155 | -2% |

| Cannon Ball | $176 | 11% |

| Carpio | $170 | 8% |

| Carrington | $156 | -2% |

| Carson | $174 | 10% |

| Cartwright | $163 | 3% |

| Casselton | $139 | -12% |

| Cathay | $157 | -1% |

| Cavalier | $153 | -3% |

| Cayuga | $146 | -8% |

| Center | $165 | 4% |

| Chaseley | $157 | -1% |

| Christine | $141 | -11% |

| Churchs Ferry | $155 | -2% |

| Cleveland | $145 | -8% |

| Clifford | $150 | -5% |

| Cogswell | $145 | -8% |

| Coleharbor | $163 | 3% |

| Colfax | $144 | -9% |

| Columbus | $167 | 6% |

| Cooperstown | $151 | -4% |

| Courtenay | $146 | -8% |

| Crary | $152 | -4% |

| Crosby | $166 | 5% |

| Crystal | $154 | -3% |

| Cummings | $148 | -7% |

| Dahlen | $156 | -2% |

| Davenport | $141 | -11% |

| Dawson | $157 | -1% |

| Dazey | $147 | -7% |

| Deering | $161 | 2% |

| Denhoff | $162 | 2% |

| Des Lacs | $164 | 3% |

| Devils Lake | $151 | -5% |

| Dickey | $153 | -3% |

| Dickinson | $151 | -5% |

| Dodge | $163 | 3% |

| Donnybrook | $168 | 6% |

| Douglas | $164 | 4% |

| Drake | $165 | 4% |

| Drayton | $154 | -3% |

| Driscoll | $154 | -3% |

| Dunn Center | $164 | 4% |

| Dunseith | $158 | 0% |

| Edgeley | $154 | -3% |

| Edinburg | $155 | -2% |

| Edmore | $153 | -3% |

| Egeland | $156 | -2% |

| Elgin | $173 | 9% |

| Ellendale | $154 | -3% |

| Emerado | $140 | -12% |

| Enderlin | $146 | -8% |

| Epping | $164 | 3% |

| Erie | $144 | -9% |

| Esmond | $161 | 2% |

| Fairdale | $155 | -2% |

| Fairfield | $163 | 3% |

| Fairmount | $144 | -9% |

| Fargo | $131 | -17% |

| Fessenden | $158 | 0% |

| Fingal | $146 | -8% |

| Finley | $150 | -5% |

| Flasher | $169 | 7% |

| Flaxton | $167 | 5% |

| Forbes | $152 | -4% |

| Fordville | $153 | -3% |

| Forest River | $155 | -2% |

| Forman | $148 | -7% |

| Fort Ransom | $146 | -8% |

| Fort Totten | $157 | -1% |

| Fort Yates | $177 | 12% |

| Fortuna | $165 | 4% |

| Fredonia | $151 | -4% |

| Fullerton | $153 | -3% |

| Gackle | $151 | -4% |

| Galesburg | $147 | -7% |

| Gardner | $142 | -10% |

| Garrison | $164 | 4% |

| Gilby | $148 | -7% |

| Gladstone | $162 | 2% |

| Glasston | $154 | -2% |

| Glen Ullin | $163 | 3% |

| Glenburn | $165 | 5% |

| Glenfield | $155 | -2% |

| Golden Valley | $163 | 3% |

| Golva | $162 | 2% |

| Goodrich | $162 | 2% |

| Grace City | $158 | 0% |

| Grafton | $154 | -3% |

| Grand Forks | $133 | -16% |

| Grand Forks AFB | $136 | -14% |

| Grandin | $144 | -9% |

| Granville | $164 | 3% |

| Grassy Butte | $166 | 5% |

| Grenora | $165 | 4% |

| Gwinner | $147 | -7% |

| Hague | $158 | 0% |

| Halliday | $164 | 4% |

| Hamilton | $154 | -2% |

| Hampden | $154 | -3% |

| Hankinson | $144 | -9% |

| Hannaford | $150 | -5% |

| Hannah | $152 | -4% |

| Hansboro | $156 | -2% |

| Harvey | $162 | 2% |

| Harwood | $137 | -13% |

| Hatton | $150 | -5% |

| Havana | $147 | -7% |

| Hazelton | $160 | 1% |

| Hazen | $162 | 2% |

| Hebron | $164 | 4% |

| Hensel | $154 | -2% |

| Hettinger | $168 | 6% |

| Hillsboro | $148 | -7% |

| Hoople | $154 | -3% |

| Hope | $149 | -6% |

| Horace | $134 | -15% |

| Hunter | $142 | -11% |

| Hurdsfield | $158 | 0% |

| Inkster | $149 | -6% |

| Jamestown | $138 | -13% |

| Jessie | $150 | -5% |

| Jud | $152 | -4% |

| Karlsruhe | $162 | 2% |

| Kathryn | $146 | -8% |

| Keene | $164 | 4% |

| Kenmare | $172 | 8% |

| Kensal | $147 | -7% |

| Killdeer | $165 | 4% |

| Kindred | $141 | -11% |

| Kintyre | $162 | 2% |

| Knox | $161 | 2% |

| Kramer | $159 | 1% |

| Kulm | $152 | -4% |

| LaMoure | $155 | -2% |

| Lakota | $158 | 0% |

| Langdon | $153 | -3% |

| Lankin | $155 | -2% |

| Lansford | $160 | 1% |

| Larimore | $150 | -5% |

| Lawton | $154 | -3% |

| Leeds | $156 | -2% |

| Lefor | $164 | 3% |

| Lehr | $149 | -6% |

| Leonard | $142 | -10% |

| Lidgerwood | $145 | -9% |

| Lignite | $167 | 5% |

| Lincoln | $149 | -6% |

| Linton | $163 | 3% |

| Lisbon | $149 | -6% |

| Litchville | $151 | -5% |

| Luverne | $148 | -7% |

| Maddock | $160 | 1% |

| Maida | $154 | -3% |

| Makoti | $169 | 7% |

| Mandan | $156 | -1% |

| Mandaree | $164 | 4% |

| Manning | $164 | 4% |

| Mantador | $144 | -9% |

| Manvel | $142 | -11% |

| Mapleton | $138 | -13% |

| Marion | $152 | -4% |

| Marmarth | $166 | 5% |

| Marshall | $162 | 3% |

| Martin | $162 | 2% |

| Max | $162 | 3% |

| Maxbass | $165 | 4% |

| Mayville | $148 | -7% |

| McClusky | $163 | 3% |

| McHenry | $156 | -2% |

| McVille | $158 | 0% |

| Mcgregor | $165 | 4% |

| Mcleod | $145 | -8% |

| Medina | $146 | -8% |

| Medora | $161 | 2% |

| Mekinock | $138 | -13% |

| Menoken | $151 | -5% |

| Mercer | $164 | 3% |

| Michigan | $157 | -1% |

| Milnor | $147 | -7% |

| Milton | $154 | -3% |

| Minnewaukan | $155 | -2% |

| Minot | $150 | -6% |

| Minot AFB | $146 | -7% |

| Minto | $153 | -3% |

| Moffit | $153 | -4% |

| Mohall | $172 | 8% |

| Montpelier | $147 | -7% |

| Mooreton | $144 | -9% |

| Mott | $170 | 7% |

| Mountain | $154 | -3% |

| Munich | $154 | -3% |

| Mylo | $157 | -1% |

| Napoleon | $154 | -3% |

| Neche | $155 | -2% |

| Nekoma | $154 | -3% |

| New England | $163 | 3% |

| New Leipzig | $170 | 7% |

| New Rockford | $158 | 0% |

| New Salem | $163 | 3% |

| New Town | $166 | 5% |

| Newburg | $161 | 2% |

| Niagara | $151 | -5% |

| Nome | $146 | -8% |

| Noonan | $165 | 4% |

| Northwood | $152 | -4% |

| Norwich | $160 | 1% |

| Oakes | $153 | -3% |

| Oberon | $156 | -1% |

| Oriska | $146 | -8% |

| Osnabrock | $153 | -3% |

| Page | $146 | -8% |

| Palermo | $169 | 7% |

| Park River | $154 | -3% |

| Parshall | $168 | 6% |

| Pekin | $157 | -1% |

| Pembina | $155 | -2% |

| Penn | $153 | -3% |

| Perth | $157 | -1% |

| Petersburg | $158 | 0% |

| Pettibone | $156 | -1% |

| Pillsbury | $147 | -7% |

| Pingree | $146 | -8% |

| Pisek | $154 | -2% |

| Plaza | $168 | 6% |

| Portal | $167 | 5% |

| Portland | $152 | -4% |

| Powers Lake | $165 | 5% |

| Raleigh | $171 | 8% |

| Ray | $163 | 3% |

| Reeder | $169 | 7% |

| Regan | $156 | -1% |

| Regent | $167 | 6% |

| Reynolds | $145 | -8% |

| Rhame | $165 | 4% |

| Richardton | $161 | 2% |

| Riverdale | $162 | 2% |

| Robinson | $158 | 0% |

| Rocklake | $155 | -2% |

| Rogers | $146 | -8% |

| Rolette | $158 | 0% |

| Rolla | $158 | 0% |

| Roseglen | $165 | 4% |

| Ross | $167 | 5% |

| Rugby | $162 | 2% |

| Ruso | $166 | 5% |

| Rutland | $145 | -9% |

| Ryder | $168 | 6% |

| Sanborn | $146 | -8% |

| Sarles | $154 | -2% |

| Sawyer | $161 | 2% |

| Scranton | $167 | 5% |

| Selfridge | $178 | 12% |

| Sentinel Butte | $162 | 3% |

| Sharon | $148 | -7% |

| Sheldon | $146 | -8% |

| Shell Valley | $158 | 0% |

| Sherwood | $174 | 10% |

| Sheyenne | $157 | -1% |

| Shields | $173 | 9% |

| Solen | $172 | 9% |

| Souris | $160 | 1% |

| South Heart | $160 | 1% |

| Spiritwood | $148 | -7% |

| St. Anthony | $170 | 7% |

| St. John | $158 | -1% |

| St. Michael | $156 | -1% |

| St. Thomas | $154 | -3% |

| Stanley | $168 | 6% |

| Stanton | $162 | 2% |

| Starkweather | $153 | -3% |

| Steele | $159 | 1% |

| Sterling | $155 | -2% |

| Stirum | $146 | -8% |

| Strasburg | $163 | 3% |

| Streeter | $147 | -7% |

| Surrey | $153 | -3% |

| Sutton | $150 | -5% |

| Sykeston | $159 | 0% |

| Tappen | $156 | -1% |

| Taylor | $162 | 2% |

| Thompson | $143 | -10% |

| Tioga | $163 | 3% |

| Tokio | $159 | 0% |

| Tolley | $168 | 6% |

| Tolna | $159 | 1% |

| Tower City | $145 | -8% |

| Towner | $165 | 4% |

| Trenton | $156 | -1% |

| Turtle Lake | $165 | 4% |

| Tuttle | $158 | 0% |

| Underwood | $162 | 2% |

| Upham | $162 | 2% |

| Valley City | $143 | -10% |

| Velva | $160 | 1% |

| Verona | $152 | -4% |

| Voltaire | $163 | 3% |

| Wahpeton | $143 | -10% |

| Walcott | $143 | -10% |

| Wales | $154 | -3% |

| Walhalla | $155 | -2% |

| Warwick | $157 | -1% |

| Washburn | $163 | 3% |

| Watford City | $162 | 2% |

| Webster | $154 | -3% |

| West Fargo | $129 | -19% |

| Westhope | $163 | 3% |

| Wheatland | $142 | -10% |

| White Earth | $166 | 5% |

| Wildrose | $165 | 4% |

| Williston | $154 | -3% |

| Willow City | $158 | 0% |

| Wilton | $161 | 2% |

| Wimbledon | $146 | -8% |

| Wing | $156 | -2% |

| Wishek | $154 | -3% |

| Wolford | $161 | 2% |

| Woodworth | $145 | -8% |

| Wyndmere | $144 | -9% |

| York | $161 | 2% |

| Ypsilanti | $146 | -8% |

| Zahl | $163 | 3% |

| Zap | $163 | 3% |

| Zeeland | $151 | -4% |

North Dakota auto insurance requirements

You need auto insurance to drive legally in North Dakota. The state’s minimum car insurance requirements include:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $25,000

- Uninsured motorist: $25,000 per person, $50,000 per accident

- Basic no-fault: $30,000

Bodily injury liability coverage helps pay the medical bills of anyone you injure in a car accident other than you and the passengers in your car.

Property damage liability pays for damage you cause to property like fences, toll booths and light posts.

Uninsured motorist covers you and your passengers for injuries and damage caused by a driver with no insurance.

Basic no-fault covers injuries to you and your passengers, whether you or another driver causes the accident. It’s also known as personal injury protection (PIP).

Collision

Car insurance laws in North Dakota

North Dakota has no-fault car insurance laws. Your own policy covers injuries to you and your passengers, regardless of fault.

If you cause an accident, you have to cover a victim’s medical costs if their injuries are severe. You can also be sued for causing pain and suffering in this situation. Your bodily injury liability covers expenses like these, including the costs of defending you in court.

The state’s no-fault laws only apply to car accident injuries. If you cause an accident, you’re responsible for other people’s car repairs. This is what property damage liability covers.

How we selected the cheapest car insurance companies in North Dakota

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Basic no-fault: $30,000

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in North Dakota

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.