Cheapest Car Insurance in Pennsylvania (2026)

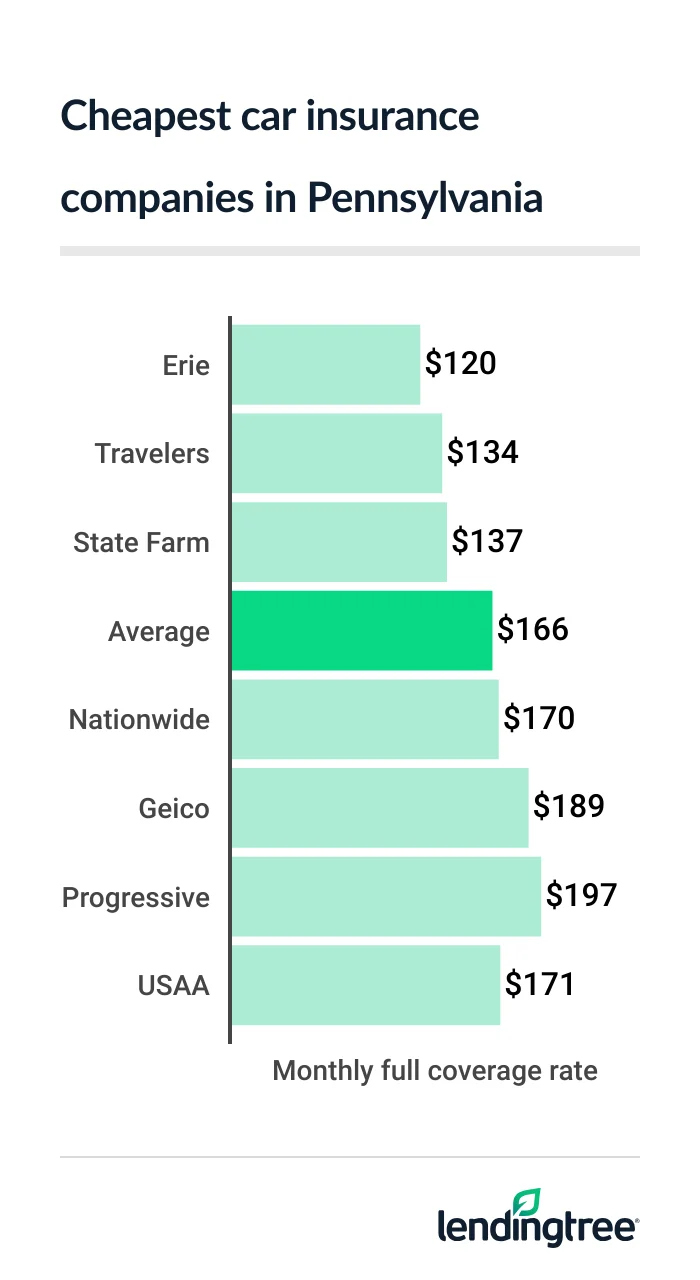

Erie is the best company for cheap auto insurance in Pennsylvania, at $120 per month for full coverage. This is $46 less than the state average.

Best cheap car insurance in Pennsylvania

Pennsylvania’s cheapest full coverage car insurance: Erie

Erie has the cheapest full coverage car insurance in Pennsylvania, with rates of around $120 per month.

Travelers and State Farm are close behind, however. Travelers’ average rate for full coverage

All three companies come in well below the state average of $166 per month for full coverage auto insurance.

Cheapest full coverage insurance rates in PA

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Erie | $120 | |

| Travelers | $134 | |

| State Farm | $137 | |

| Nationwide | $170 | |

| Geico | $189 | |

| Progressive | $197 | |

| Allstate | $213 | |

| USAA* | $171 | |

Though Erie has the lowest rates on average, Travelers and State Farm could be your cheapest option if you can get a few discounts. Both companies offer more car insurance discounts than Erie does.

Travelers and State Farm each give discounts if you have more than one policy or insure more than one vehicle with them. They also have discounts for being loyal customers and going at least three years without accidents or moving violations.

Cheapest liability car insurance in Pennsylvania: Erie

With an average rate of $28 per month, Erie also has Pennsylvania’s cheapest liability insurance. That’s half the state average of $56 per month.

State Farm and Travelers are cheaper than the state average as well, with State Farm being the cheaper of the two at $38 per month. Travelers’ average rate for minimum coverage

Pennsylvania’s cheapest liability insurance quotes

| Company | Monthly rate |

|---|---|

| Erie | $28 |

| State Farm | $38 |

| Travelers | $48 |

| Nationwide | $57 |

| Geico | $70 |

| Progressive | $76 |

| Allstate | $93 |

| USAA* | $39 |

Minimum coverage from USAA costs about $39 per month in Pennsylvania. But only active duty or retired military and some family members can get coverage from USAA.

USAA and Erie have much better customer satisfaction scores from J.D. Power

One of the best ways to find out which of these companies will be the cheapest for you is to compare car insurance quotes from each of them before you renew or buy a policy.

Best car insurance in Pennsylvania for teen drivers: Erie

Pennsylvanians looking for the cheapest teen car insurance should start their search with Erie. It has the state’s lowest insurance rates for teens who only want liability coverage, at $64 per month.

Erie is basically tied with Travelers for the cheapest teen full coverage insurance rates, with each company charging around $270 per month.

Monthly auto insurance rates for young drivers

| Company | Minimum | Full |

|---|---|---|

| Erie | $64 | $271 |

| Travelers | $104 | $270 |

| State Farm | $113 | $379 |

| Geico | $120 | $363 |

| Progressive | $140 | $332 |

| Allstate | $182 | $403 |

| Nationwide | $216 | $545 |

| USAA* | $80 | $332 |

Most car insurance companies have discounts that can make teen car insurance more affordable. Erie and Travelers offer some of the most common ones.

- Erie offers discounts for unmarried drivers under 21 who live with their parents, and unmarried young drivers whose parents used to insure them.

- Travelers gives discounts to students who get good grades.

- Both companies also have discounts for students who go away to school and don’t take a car with them, or who complete an approved driver training course.

Cheap car insurance after a speeding ticket in Pennsylvania: Erie

Erie is the cheapest car insurance company for Pennsylvania drivers with a speeding ticket on their records. Its average rate is $133 per month, or $69 per month less than the state average.

The state’s second-cheapest company for drivers after a speeding ticket is State Farm, at $144 per month. Travelers is next, with an average rate of $172 per month.

Cheapest PA car insurance with a ticket

| Company | Monthly rate |

|---|---|

| Erie | $133 |

| State Farm | $144 |

| Travelers | $172 |

| Progressive | $200 |

| Allstate | $213 |

| Nationwide | $248 |

| Geico | $308 |

| USAA* | $192 |

Not only do State Farm and Travelers offer more discounts than Erie, but Travelers also offers more coverage options. Both companies have roadside assistance

A speeding ticket usually causes car insurance rates to go up by about 21% in Pennsylvania. However, Erie only raises its rates by 11% after a ticket.

Pennsylvania’s cheapest auto insurance after an accident: Erie

At $133 per month, Erie offers the cheapest car insurance for drivers with an accident on their records in Pennsylvania. That’s $55 cheaper than the state average of $188 per month.

State Farm is almost as cheap, though, at $137 per month. Nationwide comes in third, at $170 per month.

Cheapest insurance in PA after an accident

| Company | Monthly rate |

|---|---|

| Erie | $133 |

| State Farm | $137 |

| Nationwide | $170 |

| Travelers | $191 |

| Progressive | $197 |

| Allstate | $213 |

| Geico | $223 |

| USAA* | $238 |

Drivers in Pennsylvania usually see their car insurance go up by 13%, or around $22 per month, after an at-fault accident. If you have a policy with Erie, you should only see your car insurance premium go up by about $13 per month.

Best cheap auto insurance for PA teens with a bad driving record: Erie

Teen drivers in Pennsylvania get the cheapest car insurance from Erie if they have a speeding ticket or accident on their records.

Erie’s average rate for PA teens with a speeding ticket is $77 per month for liability insurance. For the state’s teens with an accident, the company’s rates average $73 per month.

Monthly teen insurance rates after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Erie | $77 | $73 |

| State Farm | $124 | $113 |

| Travelers | $139 | $169 |

| Progressive | $141 | $140 |

| Geico | $175 | $138 |

| Allstate | $182 | $182 |

| Nationwide | $240 | $216 |

| USAA* | $101 | $140 |

State Farm has the second-cheapest rates for these young drivers, at $113 per month after an accident, and $124 per month after a ticket.

Cheapest car insurance rates after a DUI in Pennsylvania: Travelers

Travelers has Pennsylvania’s cheapest DUI insurance quotes of $208 per month. Allstate and Erie aren’t far behind, however. Allstate’s average rate for drivers with a driving under the influence (DUI) conviction is $213 per month, while Erie’s is $216.

Pennsylvania’s cheapest auto insurance with a DUI

| Company | Monthly rate |

|---|---|

| Travelers | $208 |

| Allstate | $213 |

| Erie | $216 |

| Progressive | $229 |

| State Farm | $305 |

| Geico | $350 |

| Nationwide | $433 |

| USAA* | $287 |

The average cost of car insurance after a DUI in Pennsylvania is $280 per month. That’s $114 per month more than what the state’s drivers with clean records pay.

Pennsylvania’s cheapest car insurance with bad credit: Nationwide

With an average quote of $231 per month, Nationwide is the best company for cheap car insurance with bad credit in Pennsylvania. This is about $90 per month cheaper than the state average for these drivers.

Cheapest PA auto insurance with poor credit

| Company | Monthly rate |

|---|---|

| Nationwide | $231 |

| Erie | $277 |

| Geico | $293 |

| Travelers | $317 |

| Progressive | $330 |

| Allstate | $351 |

| State Farm | $591 |

| USAA* | $171 |

Erie and Geico are the next-cheapest companies for most Pennsylvania drivers with poor credit. Erie charges about $277 per month, while Geico charges $293.

Most drivers in Pennsylvania with bad credit pay around $320 per month for full coverage car insurance. That’s almost double what drivers with good credit pay ($166 per month).

Best car insurance companies in Pennsylvania

Erie and State Farm are the best car insurance companies for most drivers in Pennsylvania.

Erie usually has cheaper rates than State Farm, but not always by much. And State Farm offers more discounts, which means it could be cheaper for you in the end if you can get some of them.

Car insurance company ratings

| Company | J.D. Power | AM Best | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Erie | 703 | A | |

| Farm Bureau | 645 | A | |

| Geico | 645 | A++ | |

| Nationwide | 645 | A | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| Travelers | 613 | A++ | |

| USAA* | 735 | A++ |

Both companies have good J.D. Power ratings for customer service, though Erie’s is slightly better than State Farm’s. Erie also offers a few more optional coverages.

Pennsylvania drivers who are active duty or retired military, or are related to someone who is, should also consider USAA one of the state’s best auto insurance companies. Its rates are often among the lowest, and it has the best customer service score of any of the companies we surveyed.

Pennsylvania auto insurance rates by city

Houserville is Pennsylvania’s cheapest city for car insurance, with rates that average $133 per month. Drivers in Philadelphia pay the state’s most expensive car insurance rates of $299 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Aaronsburg | $145 | -13% |

| Abbottstown | $140 | -16% |

| Abington | $193 | 16% |

| Ackermanville | $161 | -3% |

| Acme | $169 | 2% |

| Acosta | $164 | -1% |

| Adah | $163 | -2% |

| Adamsburg | $159 | -4% |

| Adamstown | $150 | -10% |

| Adamsville | $179 | 8% |

| Addison | $169 | 2% |

| Adrian | $179 | 8% |

| Airville | $161 | -3% |

| Akron | $148 | -11% |

| Alba | $184 | 11% |

| Albion | $174 | 5% |

| Albrightsville | $184 | 11% |

| Alburtis | $159 | -4% |

| Aldan | $219 | 32% |

| Aleppo | $171 | 3% |

| Alexandria | $161 | -3% |

| Aliquippa | $155 | -7% |

| Allenport | $158 | -5% |

| Allensville | $140 | -16% |

| Allentown | $175 | 5% |

| Allenwood | $144 | -13% |

| Allison | $163 | -2% |

| Allison Park | $159 | -5% |

| Allport | $156 | -6% |

| Alsace Manor | $162 | -2% |

| Altamont | $153 | -8% |

| Altoona | $158 | -5% |

| Alum Bank | $168 | 1% |

| Alverda | $172 | 3% |

| Alverton | $160 | -4% |

| Amberson | $154 | -8% |

| Ambler | $189 | 13% |

| Ambridge | $153 | -8% |

| Amity | $169 | 2% |

| Amity Gardens | $164 | -1% |

| Analomink | $204 | 23% |

| Ancient Oaks | $159 | -4% |

| Andreas | $164 | -1% |

| Anita | $166 | 0% |

| Annville | $138 | -17% |

| Antes Fort | $151 | -9% |

| Apollo | $175 | 5% |

| Aquashicola | $177 | 6% |

| Arcadia | $176 | 6% |

| Archbald | $151 | -9% |

| Ardara | $159 | -5% |

| Ardmore | $204 | 23% |

| Arendtsville | $141 | -15% |

| Aristes | $147 | -11% |

| Arlington Heights | $196 | 18% |

| Armagh | $168 | 1% |

| Armbrust | $163 | -2% |

| Arnold | $163 | -2% |

| Arnot | $165 | -1% |

| Arona | $160 | -4% |

| Artemas | $172 | 4% |

| Ashfield | $161 | -3% |

| Ashland | $155 | -7% |

| Ashley | $156 | -6% |

| Ashville | $165 | -1% |

| Aspers | $142 | -14% |

| Aspinwall | $167 | 0% |

| Aston | $192 | 16% |

| Atglen | $176 | 6% |

| Athens | $157 | -6% |

| Atlantic | $182 | 9% |

| Atlasburg | $234 | 41% |

| Auburn | $154 | -8% |

| Audubon | $178 | 7% |

| Aultman | $174 | 4% |

| Austin | $170 | 2% |

| Avalon | $165 | -1% |

| Avella | $172 | 3% |

| Avis | $138 | -17% |

| Avoca | $153 | -8% |

| Avon | $142 | -14% |

| Avondale | $177 | 6% |

| Avonmore | $176 | 6% |

| Baden | $152 | -9% |

| Baidland | $165 | -1% |

| Bainbridge | $139 | -16% |

| Bairdford | $158 | -5% |

| Bakerstown | $158 | -5% |

| Bala Cynwyd | $225 | 36% |

| Baldwin | $162 | -2% |

| Bally | $159 | -5% |

| Bangor | $163 | -2% |

| Barnesville | $157 | -6% |

| Barto | $158 | -5% |

| Bartonsville | $196 | 18% |

| Bath | $155 | -7% |

| Bausman | $147 | -12% |

| Beach Haven | $153 | -8% |

| Beach Lake | $189 | 14% |

| Beallsville | $166 | 0% |

| Bear Creek Village | $163 | -2% |

| Bear Lake | $177 | 6% |

| Bear Rocks | $170 | 2% |

| Beaver | $148 | -11% |

| Beaver Falls | $150 | -10% |

| Beaver Meadows | $166 | 0% |

| Beaver Springs | $151 | -9% |

| Beaverdale | $152 | -8% |

| Beavertown | $143 | -14% |

| Beccaria | $165 | -1% |

| Bechtelsville | $156 | -6% |

| Bedford | $170 | 2% |

| Beech Creek | $145 | -13% |

| Beech Mountain Lakes | $158 | -5% |

| Belfast | $159 | -4% |

| Bell Acres | $153 | -8% |

| Belle Vernon | $160 | -4% |

| Bellefonte | $139 | -17% |

| Belleville | $141 | -15% |

| Bellevue | $164 | -1% |

| Bellwood | $156 | -6% |

| Belmont | $150 | -10% |

| Belsano | $162 | -3% |

| Ben Avon | $166 | 0% |

| Ben Avon Heights | $165 | -1% |

| Bendersville | $140 | -16% |

| Benezett | $165 | -1% |

| Bensalem | $214 | 29% |

| Bentleyville | $166 | 0% |

| Benton | $166 | 0% |

| Berlin | $166 | 0% |

| Bernville | $153 | -8% |

| Berrysburg | $147 | -12% |

| Berwick | $147 | -12% |

| Berwyn | $179 | 7% |

| Bessemer | $158 | -5% |

| Bethany | $182 | 9% |

| Bethel | $153 | -8% |

| Bethel Park | $156 | -6% |

| Bethlehem | $160 | -4% |

| Beyer | $178 | 7% |

| Big Bass Lake | $178 | 7% |

| Big Beaver | $155 | -7% |

| Big Cove Tannery | $171 | 3% |

| Big Run | $177 | 6% |

| Biglerville | $141 | -15% |

| Birchrunville | $176 | 6% |

| Birchwood Lakes | $203 | 22% |

| Bird-in-Hand | $150 | -10% |

| Birdsboro | $164 | -1% |

| Black Lick | $166 | 0% |

| Blain | $158 | -5% |

| Blairs Mills | $172 | 4% |

| Blairsville | $167 | 0% |

| Blakely | $152 | -9% |

| Blakeslee | $201 | 21% |

| Blanchard | $211 | 27% |

| Blandburg | $169 | 2% |

| Blandon | $155 | -7% |

| Blawnox | $170 | 2% |

| Bloomfield | $153 | -8% |

| Blooming Glen | $172 | 4% |

| Blooming Valley | $177 | 7% |

| Bloomsburg | $148 | -11% |

| Blossburg | $168 | 1% |

| Blue Ball | $147 | -11% |

| Blue Bell | $184 | 11% |

| Blue Ridge Summit | $138 | -17% |

| Boalsburg | $136 | -18% |

| Bobtown | $169 | 1% |

| Boiling Springs | $133 | -20% |

| Bolivar | $169 | 1% |

| Bonneauville | $137 | -18% |

| Boothwyn | $196 | 18% |

| Boston | $163 | -2% |

| Boswell | $167 | 0% |

| Bovard | $162 | -3% |

| Bowers | $156 | -6% |

| Bowmanstown | $159 | -5% |

| Bowmansville | $153 | -8% |

| Boyers | $186 | 12% |

| Boyertown | $160 | -4% |

| Boynton | $166 | 0% |

| Brackenridge | $158 | -5% |

| Brackney | $182 | 9% |

| Braddock | $176 | 6% |

| Braddock Hills | $182 | 9% |

| Bradenville | $167 | 1% |

| Bradford | $159 | -4% |

| Bradford Woods | $159 | -4% |

| Branchdale | $155 | -7% |

| Branchton | $190 | 14% |

| Brandamore | $180 | 8% |

| Brandy Camp | $178 | 7% |

| Brave | $169 | 2% |

| Breezewood | $171 | 3% |

| Breinigsville | $160 | -4% |

| Brentwood | $163 | -2% |

| Bressler | $145 | -13% |

| Briar Creek | $146 | -12% |

| Brickerville | $145 | -13% |

| Bridgeport | $196 | 18% |

| Bridgeville | $157 | -5% |

| Bridgewater | $146 | -12% |

| Brier Hill | $161 | -3% |

| Brisbin | $159 | -4% |

| Bristol | $197 | 19% |

| Brittany Farms-The Highlands | $174 | 5% |

| Broad Top | $172 | 3% |

| Brockport | $164 | -1% |

| Brockton | $158 | -5% |

| Brockway | $165 | -1% |

| Brodheadsville | $189 | 14% |

| Brogue | $154 | -8% |

| Brookhaven | $198 | 19% |

| Brookville | $171 | 3% |

| Broomall | $193 | 16% |

| Brownfield | $160 | -4% |

| Brownstown | $148 | -11% |

| Brownsville | $167 | 0% |

| Browntown | $151 | -9% |

| Bruin | $179 | 8% |

| Bryn Athyn | $215 | 29% |

| Bryn Mawr | $197 | 18% |

| Buck Hill Falls | $202 | 21% |

| Buena Vista | $160 | -4% |

| Buffalo Mills | $177 | 6% |

| Bulger | $157 | -5% |

| Bunola | $158 | -5% |

| Burgettstown | $169 | 1% |

| Burnham | $134 | -19% |

| Burnt Cabins | $170 | 2% |

| Bushkill | $208 | 25% |

| Butler | $168 | 1% |

| Byrnedale | $164 | -2% |

| Cabot | $166 | 0% |

| Cadogan | $174 | 5% |

| Cairnbrook | $160 | -4% |

| California | $163 | -2% |

| Callensburg | $183 | 10% |

| Callery | $163 | -2% |

| Callimont | $169 | 2% |

| Caln | $180 | 9% |

| Calumet | $164 | -1% |

| Calvin | $162 | -2% |

| Cambra | $175 | 5% |

| Cambridge Springs | $184 | 11% |

| Cammal | $170 | 2% |

| Camp Hill | $139 | -16% |

| Campbelltown | $136 | -18% |

| Camptown | $189 | 14% |

| Canadensis | $206 | 24% |

| Canonsburg | $160 | -4% |

| Canton | $173 | 4% |

| Carbondale | $164 | -2% |

| Cardale | $163 | -2% |

| Carlisle | $137 | -18% |

| Carlton | $172 | 3% |

| Carmichaels | $166 | 0% |

| Carnegie | $160 | -4% |

| Carnot-Moon | $154 | -8% |

| Carroll Valley | $139 | -16% |

| Carrolltown | $167 | 0% |

| Carversville | $188 | 13% |

| Cashtown | $140 | -16% |

| Cassandra | $158 | -5% |

| Cassville | $162 | -3% |

| Castanea | $136 | -18% |

| Castle Shannon | $161 | -3% |

| Catasauqua | $163 | -2% |

| Catawissa | $147 | -11% |

| Cecil-Bishop | $159 | -4% |

| Cedar Run | $171 | 3% |

| Cedars | $173 | 4% |

| Cementon | $167 | 1% |

| Center Valley | $167 | 0% |

| Centerport | $154 | -8% |

| Centerville | $186 | 12% |

| Central City | $166 | 0% |

| Centre Hall | $140 | -16% |

| Cetronia | $170 | 2% |

| Chadds Ford | $188 | 13% |

| Chalfant | $177 | 6% |

| Chalfont | $172 | 3% |

| Chalk Hill | $163 | -2% |

| Chambersburg | $139 | -16% |

| Chambersville | $175 | 5% |

| Champion | $170 | 2% |

| Chandlers Valley | $172 | 4% |

| Chapman | $157 | -6% |

| Charleroi | $163 | -2% |

| Cheltenham | $237 | 42% |

| Cherry Tree | $183 | 10% |

| Cherryville | $160 | -4% |

| Chest Springs | $168 | 1% |

| Chester | $229 | 38% |

| Chester Heights | $193 | 16% |

| Chester Hill | $156 | -6% |

| Chester Springs | $175 | 5% |

| Chesterbrook | $183 | 10% |

| Chestnut Ridge | $161 | -3% |

| Cheswick | $160 | -4% |

| Chevy Chase Heights | $166 | 0% |

| Cheyney | $199 | 20% |

| Chicora | $178 | 7% |

| Chinchilla | $159 | -4% |

| Christiana | $156 | -6% |

| Churchill | $181 | 9% |

| Churchville | $193 | 16% |

| Clairton | $158 | -5% |

| Clarence | $149 | -11% |

| Clarendon | $165 | -1% |

| Claridge | $161 | -3% |

| Clarington | $178 | 7% |

| Clarion | $171 | 3% |

| Clark | $159 | -4% |

| Clarks Mills | $168 | 1% |

| Clarks Summit | $160 | -4% |

| Clarksburg | $181 | 9% |

| Clarksville | $173 | 4% |

| Clay | $145 | -13% |

| Claysburg | $158 | -5% |

| Claysville | $169 | 1% |

| Clearfield | $155 | -7% |

| Clearville | $176 | 6% |

| Cleona | $140 | -16% |

| Clifton Heights | $215 | 29% |

| Clinton | $160 | -4% |

| Clintonville | $189 | 14% |

| Clune | $174 | 5% |

| Clymer | $172 | 3% |

| Coal Center | $165 | -1% |

| Coal Township | $150 | -10% |

| Coaldale | $161 | -3% |

| Coalport | $177 | 7% |

| Coatesville | $182 | 9% |

| Coburn | $142 | -14% |

| Cochranton | $179 | 8% |

| Cochranville | $177 | 6% |

| Cocolamus | $145 | -13% |

| Cogan Station | $151 | -9% |

| Cokeburg | $171 | 3% |

| Collegeville | $172 | 3% |

| Collingdale | $255 | 53% |

| Collinsburg | $160 | -4% |

| Colmar | $174 | 4% |

| Colonial Park | $144 | -14% |

| Colony Park | $163 | -2% |

| Columbia | $146 | -12% |

| Columbia Cross Roads | $173 | 4% |

| Columbus | $177 | 6% |

| Colver | $161 | -3% |

| Colwyn | $265 | 60% |

| Commodore | $179 | 8% |

| Conashaugh Lakes | $201 | 21% |

| Concord | $151 | -9% |

| Concordville | $257 | 55% |

| Conestoga | $149 | -11% |

| Confluence | $177 | 6% |

| Conneaut Lake | $174 | 4% |

| Conneaut Lakeshore | $174 | 4% |

| Conneautville | $183 | 10% |

| Connellsville | $155 | -7% |

| Conshohocken | $189 | 14% |

| Conway | $151 | -9% |

| Conyngham | $156 | -6% |

| Cooksburg | $179 | 7% |

| Coolspring | $172 | 3% |

| Coopersburg | $163 | -2% |

| Cooperstown | $186 | 12% |

| Coplay | $165 | -1% |

| Coral | $169 | 1% |

| Coraopolis | $154 | -7% |

| Cornwall | $141 | -15% |

| Cornwells Heights | $214 | 29% |

| Corry | $177 | 7% |

| Corsica | $172 | 3% |

| Coudersport | $172 | 3% |

| Coulters | $162 | -3% |

| Coupon | $164 | -2% |

| Courtdale | $156 | -6% |

| Covington | $165 | -1% |

| Cowansville | $185 | 11% |

| Crabtree | $164 | -2% |

| Crafton | $162 | -2% |

| Craley | $146 | -12% |

| Cranberry | $178 | 7% |

| Cranberry Township | $156 | -6% |

| Cranesville | $173 | 4% |

| Creamery | $177 | 7% |

| Creekside | $177 | 6% |

| Creighton | $159 | -4% |

| Crescent | $149 | -10% |

| Cresco | $204 | 23% |

| Cresson | $158 | -5% |

| Cressona | $153 | -8% |

| Crosby | $186 | 12% |

| Cross Fork | $167 | 0% |

| Cross Roads | $152 | -9% |

| Crown | $181 | 9% |

| Croydon | $206 | 24% |

| Crucible | $171 | 3% |

| Crum Lynne | $207 | 25% |

| Crystal Spring | $174 | 5% |

| Cuddy | $159 | -4% |

| Cumbola | $157 | -6% |

| Curllsville | $247 | 49% |

| Curryville | $175 | 5% |

| Curtisville | $159 | -4% |

| Curwensville | $162 | -3% |

| Custer City | $164 | -1% |

| Cyclone | $169 | 2% |

| Dagus Mines | $162 | -3% |

| Daisytown | $167 | 0% |

| Dale | $151 | -9% |

| Dallas | $158 | -5% |

| Dallastown | $145 | -13% |

| Dalmatia | $150 | -10% |

| Dalton | $168 | 1% |

| Damascus | $190 | 14% |

| Danboro | $175 | 5% |

| Danielsville | $159 | -4% |

| Danville | $145 | -13% |

| Darby | $266 | 60% |

| Darlington | $156 | -6% |

| Darragh | $157 | -6% |

| Dauberville | $153 | -8% |

| Dauphin | $149 | -10% |

| Davidsville | $159 | -4% |

| Dawson | $153 | -8% |

| Dayton | $189 | 13% |

| De Lancey | $188 | 13% |

| De Young | $163 | -2% |

| DeSales University | $166 | 0% |

| Deemston | $169 | 2% |

| Defiance | $175 | 5% |

| Delano | $158 | -5% |

| Delaware Water Gap | $198 | 19% |

| Delmont | $159 | -5% |

| Delta | $159 | -4% |

| Denbo | $164 | -1% |

| Denver | $148 | -11% |

| Derrick City | $164 | -1% |

| Derry | $166 | 0% |

| Devault | $175 | 5% |

| Devon | $182 | 10% |

| Dewart | $139 | -16% |

| Dickerson Run | $155 | -7% |

| Dickson City | $153 | -8% |

| Dilliner | $170 | 2% |

| Dillsburg | $141 | -15% |

| Dilltown | $168 | 1% |

| Dingmans Ferry | $204 | 23% |

| Distant | $178 | 7% |

| Dixonville | $172 | 3% |

| Donegal | $169 | 2% |

| Donora | $162 | -2% |

| Dormont | $161 | -3% |

| Dorneyville | $170 | 2% |

| Dornsife | $151 | -9% |

| Douglassville | $164 | -1% |

| Dover | $143 | -14% |

| Downingtown | $175 | 5% |

| Doylesburg | $151 | -9% |

| Doylestown | $177 | 6% |

| Dravosburg | $163 | -2% |

| Dresher | $192 | 15% |

| Drexel Hill | $207 | 25% |

| Drifting | $158 | -5% |

| Drifton | $158 | -5% |

| Driftwood | $168 | 1% |

| Drumore | $157 | -6% |

| Drums | $158 | -5% |

| Dry Run | $155 | -7% |

| DuBois | $158 | -5% |

| Dublin | $172 | 4% |

| Duboistown | $145 | -13% |

| Dudley | $167 | 1% |

| Duke Center | $165 | -1% |

| Dunbar | $153 | -8% |

| Duncannon | $147 | -12% |

| Duncansville | $154 | -8% |

| Dunlevy | $162 | -2% |

| Dunlo | $153 | -8% |

| Dunmore | $160 | -4% |

| Dupont | $153 | -8% |

| Duquesne | $172 | 3% |

| Duryea | $154 | -7% |

| Dushore | $171 | 3% |

| Dysart | $170 | 2% |

| Eagles Mere | $162 | -3% |

| Eagleview | $173 | 4% |

| Eagleville | $185 | 11% |

| Earlington | $170 | 2% |

| Earlston | $163 | -2% |

| Earlville | $163 | -2% |

| East Bangor | $163 | -2% |

| East Berlin | $142 | -15% |

| East Berwick | $148 | -11% |

| East Brady | $188 | 13% |

| East Butler | $167 | 0% |

| East Conemaugh | $151 | -9% |

| East Earl | $145 | -13% |

| East Freedom | $157 | -5% |

| East Greenville | $167 | 1% |

| East Hickory | $188 | 13% |

| East Lansdowne | $274 | 65% |

| East McKeesport | $169 | 2% |

| East Millsboro | $168 | 1% |

| East Petersburg | $145 | -13% |

| East Pittsburgh | $177 | 7% |

| East Prospect | $145 | -13% |

| East Rochester | $149 | -10% |

| East Side | $174 | 4% |

| East Smethport | $170 | 2% |

| East Smithfield | $165 | 0% |

| East Springfield | $171 | 3% |

| East Stroudsburg | $206 | 24% |

| East Texas | $161 | -3% |

| East Uniontown | $157 | -5% |

| East Vandergrift | $171 | 3% |

| East Washington | $162 | -3% |

| East Waterford | $155 | -7% |

| East York | $146 | -12% |

| Eastlawn Gardens | $158 | -5% |

| Easton | $160 | -4% |

| Eau Claire | $179 | 8% |

| Ebensburg | $158 | -5% |

| Ebervale | $166 | 0% |

| Economy | $153 | -8% |

| Eddington | $213 | 28% |

| Eddystone | $209 | 25% |

| Edgemont | $203 | 22% |

| Edgewood | $162 | -3% |

| Edgeworth | $155 | -7% |

| Edinboro | $173 | 4% |

| Edinburg | $159 | -5% |

| Edwardsville | $157 | -6% |

| Effort | $194 | 17% |

| Egypt | $167 | 1% |

| Ehrenfeld | $152 | -9% |

| Eighty Four | $171 | 3% |

| Elco | $165 | -1% |

| Elderton | $179 | 7% |

| Eldred | $171 | 3% |

| Elgin | $173 | 4% |

| Elim | $151 | -9% |

| Elizabeth | $157 | -5% |

| Elizabethtown | $138 | -17% |

| Elizabethville | $149 | -10% |

| Elkins Park | $240 | 44% |

| Elkland | $170 | 2% |

| Elliottsburg | $157 | -6% |

| Ellport | $157 | -6% |

| Ellsworth | $168 | 1% |

| Ellwood City | $156 | -6% |

| Elm | $144 | -13% |

| Elmora | $166 | 0% |

| Elrama | $162 | -3% |

| Elton | $151 | -9% |

| Elverson | $172 | 3% |

| Elysburg | $147 | -12% |

| Emeigh | $176 | 6% |

| Emerald Lakes | $201 | 21% |

| Emigsville | $146 | -12% |

| Emlenton | $187 | 12% |

| Emmaus | $161 | -3% |

| Emporium | $164 | -1% |

| Emsworth | $164 | -1% |

| Endeavor | $180 | 9% |

| Enhaut | $145 | -13% |

| Enola | $138 | -17% |

| Enon Valley | $159 | -4% |

| Entriken | $159 | -4% |

| Ephrata | $146 | -12% |

| Equinunk | $189 | 13% |

| Erie | $165 | -1% |

| Ernest | $174 | 5% |

| Erwinna | $179 | 7% |

| Espy | $147 | -12% |

| Essington | $213 | 28% |

| Etna | $165 | -1% |

| Etters | $141 | -15% |

| Evans City | $169 | 1% |

| Everett | $162 | -2% |

| Everson | $160 | -4% |

| Exeter | $154 | -8% |

| Export | $161 | -3% |

| Exton | $174 | 5% |

| Factoryville | $173 | 4% |

| Fairbank | $162 | -2% |

| Fairchance | $158 | -5% |

| Fairdale | $167 | 0% |

| Fairfield | $139 | -16% |

| Fairhope | $167 | 0% |

| Fairless Hills | $190 | 14% |

| Fairmount City | $182 | 9% |

| Fairview | $163 | -2% |

| Fairview Village | $183 | 10% |

| Fairview-Ferndale | $150 | -10% |

| Fallentimber | $174 | 4% |

| Falls | $172 | 3% |

| Falls Creek | $163 | -2% |

| Fannettsburg | $155 | -7% |

| Farmersville | $145 | -13% |

| Farmington | $167 | 0% |

| Farrell | $155 | -7% |

| Fawn Grove | $159 | -5% |

| Faxon | $146 | -12% |

| Fayette City | $160 | -4% |

| Fayetteville | $137 | -17% |

| Feasterville | $207 | 24% |

| Feasterville Trevose | $198 | 19% |

| Felton | $153 | -8% |

| Fenelton | $170 | 2% |

| Ferndale | $151 | -9% |

| Fernville | $147 | -11% |

| Fernway | $156 | -6% |

| Finleyville | $164 | -1% |

| Fisher | $176 | 6% |

| Fishertown | $166 | 0% |

| Fleetville | $165 | -1% |

| Fleetwood | $156 | -6% |

| Fleming | $143 | -14% |

| Flemington | $136 | -18% |

| Flicksville | $160 | -4% |

| Flinton | $171 | 3% |

| Flourtown | $195 | 17% |

| Flying Hills | $163 | -2% |

| Fogelsville | $160 | -4% |

| Folcroft | $232 | 40% |

| Folsom | $202 | 21% |

| Fombell | $155 | -7% |

| Forbes Road | $163 | -2% |

| Force | $162 | -2% |

| Ford City | $168 | 1% |

| Ford Cliff | $169 | 2% |

| Forest City | $178 | 7% |

| Forest Grove | $178 | 7% |

| Forest Hills | $182 | 9% |

| Forestville | $175 | 5% |

| Forksville | $171 | 3% |

| Fort Hill | $169 | 2% |

| Fort Littleton | $170 | 2% |

| Fort Loudon | $146 | -12% |

| Fort Washington | $191 | 15% |

| Forty Fort | $156 | -6% |

| Fountain Hill | $162 | -3% |

| Fountainville | $176 | 6% |

| Fox Chapel | $166 | 0% |

| Fox Chase | $162 | -3% |

| Fox Run | $157 | -6% |

| Foxburg | $183 | 10% |

| Frackville | $154 | -7% |

| Franklin | $175 | 5% |

| Franklin Park | $158 | -5% |

| Franklintown | $143 | -14% |

| Frederick | $176 | 6% |

| Fredericksburg | $157 | -6% |

| Fredericktown | $167 | 1% |

| Fredonia | $169 | 2% |

| Freeburg | $140 | -16% |

| Freedom | $151 | -9% |

| Freeland | $157 | -5% |

| Freemansburg | $160 | -4% |

| Freeport | $171 | 3% |

| Frenchville | $161 | -3% |

| Friedens | $163 | -2% |

| Friedensburg | $154 | -7% |

| Friendsville | $187 | 13% |

| Fryburg | $182 | 10% |

| Fullerton | $171 | 3% |

| Furlong | $182 | 9% |

| Gaines | $169 | 2% |

| Galeton | $172 | 4% |

| Gallitzin | $159 | -4% |

| Gans | $161 | -3% |

| Gap | $156 | -6% |

| Garards Fort | $168 | 1% |

| Garden View | $146 | -12% |

| Gardners | $139 | -17% |

| Garland | $173 | 4% |

| Garnet Valley | $201 | 21% |

| Garrett | $166 | 0% |

| Gastonville | $161 | -3% |

| Geigertown | $163 | -2% |

| Geistown | $148 | -11% |

| Genesee | $181 | 9% |

| Georgetown | $159 | -4% |

| Germansville | $166 | 0% |

| Gettysburg | $137 | -18% |

| Gibbon Glade | $167 | 0% |

| Gibsonia | $158 | -5% |

| Gifford | $166 | 0% |

| Gilbert | $193 | 16% |

| Gilberton | $157 | -6% |

| Gilbertsville | $173 | 4% |

| Gillett | $167 | 1% |

| Gipsy | $254 | 53% |

| Girard | $165 | -1% |

| Girardville | $155 | -7% |

| Gladwyne | $203 | 22% |

| Glasgow | $169 | 2% |

| Glassport | $164 | -1% |

| Glen Campbell | $176 | 6% |

| Glen Hope | $169 | 1% |

| Glen Lyon | $160 | -4% |

| Glen Mills | $193 | 16% |

| Glen Osborne | $155 | -7% |

| Glen Richey | $160 | -4% |

| Glen Riddle Lima | $197 | 19% |

| Glen Rock | $151 | -9% |

| Glenburn | $161 | -3% |

| Glenfield | $157 | -5% |

| Glenmoore | $173 | 4% |

| Glenolden | $216 | 30% |

| Glenshaw | $161 | -3% |

| Glenside | $197 | 18% |

| Glenville | $150 | -10% |

| Gold Key Lake | $201 | 21% |

| Goodville | $147 | -11% |

| Gordon | $154 | -7% |

| Gordonville | $148 | -11% |

| Gouldsboro | $182 | 9% |

| Gradyville | $202 | 21% |

| Grampian | $162 | -3% |

| Grand Valley | $185 | 11% |

| Grantham | $137 | -17% |

| Grantley | $152 | -8% |

| Grantville | $143 | -14% |

| Granville | $138 | -17% |

| Granville Summit | $176 | 6% |

| Grapeville | $164 | -1% |

| Grassflat | $158 | -5% |

| Gratz | $153 | -8% |

| Gray | $168 | 1% |

| Graysville | $176 | 6% |

| Grazierville | $156 | -6% |

| Great Bend | $179 | 7% |

| Greeley | $200 | 20% |

| Green Hills | $163 | -2% |

| Green Lane | $172 | 3% |

| Green Tree | $164 | -1% |

| Greencastle | $138 | -17% |

| Greenfields | $186 | 12% |

| Greenock | $162 | -3% |

| Greens Landing | $157 | -6% |

| Greensboro | $169 | 2% |

| Greensburg | $164 | -1% |

| Greentown | $199 | 19% |

| Greenville | $165 | -1% |

| Greenwood | $157 | -5% |

| Grier City | $158 | -5% |

| Grill | $163 | -2% |

| Grindstone | $163 | -2% |

| Grove City | $165 | -1% |

| Grover | $167 | 0% |

| Guilford | $140 | -16% |

| Guys Mills | $182 | 10% |

| Gwynedd | $182 | 9% |

| Gwynedd Valley | $188 | 13% |

| Hadley | $174 | 4% |

| Halfway House | $174 | 5% |

| Halifax | $149 | -10% |

| Hallam | $145 | -13% |

| Hallstead | $180 | 8% |

| Hamburg | $153 | -8% |

| Hamilton | $172 | 3% |

| Hampton | $140 | -16% |

| Hannastown | $163 | -2% |

| Hanover | $143 | -14% |

| Harborcreek | $164 | -1% |

| Harford | $184 | 10% |

| Harleigh | $166 | 0% |

| Harleysville | $169 | 2% |

| Harmonsburg | $177 | 7% |

| Harmony | $161 | -3% |

| Harrisburg | $149 | -10% |

| Harrison City | $156 | -6% |

| Harrison Valley | $177 | 6% |

| Harrisonville | $175 | 5% |

| Harrisville | $180 | 8% |

| Hartleton | $141 | -15% |

| Hartstown | $179 | 8% |

| Harveys Lake | $162 | -3% |

| Harwick | $161 | -3% |

| Hasson Heights | $172 | 3% |

| Hastings | $171 | 3% |

| Hatboro | $184 | 11% |

| Hatfield | $174 | 4% |

| Haverford | $199 | 20% |

| Haverford College | $197 | 19% |

| Havertown | $201 | 21% |

| Hawk Run | $155 | -7% |

| Hawley | $191 | 15% |

| Hawthorn | $250 | 50% |

| Haysville | $155 | -7% |

| Hazel Hurst | $169 | 1% |

| Hazleton | $165 | -1% |

| Hebron | $142 | -14% |

| Hegins | $156 | -6% |

| Heidelberg | $159 | -5% |

| Heilwood | $171 | 3% |

| Hellertown | $160 | -4% |

| Hemlock Farms | $196 | 18% |

| Hendersonville | $163 | -2% |

| Henryville | $201 | 21% |

| Hereford | $165 | -1% |

| Herman | $168 | 1% |

| Herminie | $156 | -6% |

| Hermitage | $154 | -7% |

| Herndon | $153 | -8% |

| Herrick Center | $188 | 13% |

| Hershey | $140 | -16% |

| Hesston | $159 | -4% |

| Hibbs | $163 | -2% |

| Hickory | $168 | 1% |

| Hickory Hills | $172 | 4% |

| Hidden Valley | $165 | -1% |

| Highland Park | $135 | -19% |

| Highspire | $140 | -16% |

| Hilldale | $154 | -8% |

| Hiller | $162 | -3% |

| Hilliards | $180 | 8% |

| Hillsdale | $175 | 5% |

| Hillsgrove | $169 | 2% |

| Hillsville | $159 | -5% |

| Hilltown | $175 | 5% |

| Hokendauqua | $167 | 1% |

| Holbrook | $172 | 3% |

| Holicong | $180 | 8% |

| Hollidaysburg | $155 | -7% |

| Hollsopple | $158 | -5% |

| Holmes | $206 | 24% |

| Holtwood | $157 | -6% |

| Home | $185 | 11% |

| Homeacre-Lyndora | $165 | -1% |

| Homer City | $164 | -1% |

| Homestead | $169 | 1% |

| Hometown | $162 | -3% |

| Honesdale | $183 | 10% |

| Honey Brook | $172 | 3% |

| Honey Grove | $152 | -8% |

| Hookstown | $164 | -2% |

| Hooversville | $162 | -3% |

| Hop Bottom | $181 | 9% |

| Hopeland | $144 | -13% |

| Hopewell | $168 | 1% |

| Hopwood | $157 | -6% |

| Horsham | $184 | 11% |

| Hostetter | $162 | -2% |

| Houserville | $133 | -20% |

| Houston | $159 | -4% |

| Houtzdale | $166 | 0% |

| Howard | $145 | -13% |

| Hudson | $154 | -7% |

| Hughestown | $151 | -9% |

| Hughesville | $160 | -4% |

| Hulmeville | $195 | 18% |

| Hummels Wharf | $136 | -18% |

| Hummelstown | $141 | -15% |

| Hunker | $160 | -4% |

| Hunlock Creek | $162 | -3% |

| Huntingdon | $160 | -4% |

| Huntingdon Valley | $220 | 32% |

| Huntington Mills | $165 | -1% |

| Hustontown | $176 | 6% |

| Hutchinson | $157 | -5% |

| Hyde | $154 | -7% |

| Hyde Park | $166 | 0% |

| Hydetown | $188 | 13% |

| Hyndman | $179 | 7% |

| Ickesburg | $153 | -8% |

| Idaville | $137 | -17% |

| Imler | $165 | -1% |

| Immaculata | $182 | 10% |

| Imperial | $155 | -7% |

| Indian Head | $165 | -1% |

| Indian Lake | $168 | 1% |

| Indian Mountain Lake | $193 | 16% |

| Indiana | $167 | 0% |

| Indianola | $161 | -3% |

| Industry | $153 | -8% |

| Ingomar | $155 | -7% |

| Ingram | $164 | -1% |

| Inkerman | $150 | -10% |

| Intercourse | $147 | -12% |

| Irvine | $171 | 3% |

| Irvona | $170 | 2% |

| Irwin | $156 | -6% |

| Isabella | $166 | 0% |

| Jackson | $185 | 12% |

| Jackson Center | $173 | 4% |

| Jacksonville | $174 | 4% |

| Jacksonwald | $165 | -1% |

| Jacobs Creek | $175 | 5% |

| Jacobus | $150 | -10% |

| James City | $180 | 9% |

| James Creek | $162 | -2% |

| Jamestown | $177 | 6% |

| Jamison | $182 | 9% |

| Jeannette | $163 | -2% |

| Jefferson | $166 | 0% |

| Jefferson Hills | $158 | -5% |

| Jenkintown | $211 | 27% |

| Jenners | $166 | 0% |

| Jennerstown | $168 | 1% |

| Jermyn | $156 | -6% |

| Jerome | $161 | -3% |

| Jersey Mills | $158 | -5% |

| Jersey Shore | $144 | -13% |

| Jessup | $155 | -7% |

| Jim Thorpe | $168 | 1% |

| Joffre | $165 | -1% |

| Johnsonburg | $159 | -4% |

| Johnstown | $152 | -9% |

| Jones Mills | $168 | 1% |

| Jonestown | $144 | -13% |

| Josephine | $168 | 1% |

| Julian | $140 | -16% |

| Junedale | $166 | 0% |

| Kane | $164 | -1% |

| Kantner | $181 | 9% |

| Karns City | $188 | 13% |

| Karthaus | $160 | -4% |

| Keisterville | $159 | -4% |

| Kelayres | $159 | -4% |

| Kelton | $178 | 7% |

| Kemblesville | $174 | 5% |

| Kempton | $162 | -3% |

| Kenhorst | $163 | -2% |

| Kenilworth | $175 | 5% |

| Kenmar | $146 | -12% |

| Kennerdell | $181 | 9% |

| Kennett Square | $182 | 9% |

| Kent | $171 | 3% |

| Kersey | $158 | -5% |

| Kimberton | $173 | 4% |

| King of Prussia | $188 | 13% |

| Kingsley | $183 | 10% |

| Kingston | $156 | -6% |

| Kintnersville | $176 | 6% |

| Kinzers | $156 | -6% |

| Kirkwood | $155 | -7% |

| Kittanning | $171 | 3% |

| Kleinfeltersville | $144 | -13% |

| Klingerstown | $155 | -7% |

| Knox | $181 | 9% |

| Knox Dale | $171 | 3% |

| Knoxville | $171 | 3% |

| Koppel | $220 | 32% |

| Kossuth | $198 | 19% |

| Kreamer | $138 | -17% |

| Kresgeville | $189 | 14% |

| Kulpmont | $150 | -10% |

| Kulpsville | $172 | 3% |

| Kunkletown | $188 | 13% |

| Kutztown | $151 | -9% |

| Kutztown University | $151 | -9% |

| Kylertown | $158 | -5% |

| La Belle | $186 | 12% |

| La Jose | $176 | 6% |

| Laceyville | $183 | 10% |

| Lackawaxen | $200 | 20% |

| Lafayette Hill | $194 | 17% |

| Laflin | $157 | -5% |

| Lahaska | $180 | 8% |

| Lairdsville | $175 | 5% |

| Lake Ariel | $175 | 5% |

| Lake City | $166 | 0% |

| Lake Como | $188 | 13% |

| Lake Harmony | $190 | 14% |

| Lake Lynn | $164 | -1% |

| Lake Meade | $142 | -15% |

| Lake Winola | $174 | 5% |

| Lake Wynonah | $153 | -8% |

| Lakemont | $157 | -6% |

| Lakeville | $184 | 11% |

| Lakewood | $189 | 14% |

| Lamartine | $179 | 8% |

| Lampeter | $156 | -6% |

| Lancaster | $153 | -8% |

| Landenberg | $175 | 5% |

| Landisburg | $158 | -5% |

| Landisville | $144 | -13% |

| Lanesboro | $183 | 10% |

| Langeloth | $168 | 1% |

| Langhorne | $192 | 15% |

| Langhorne Manor | $192 | 15% |

| Lansdale | $178 | 7% |

| Lansdowne | $268 | 61% |

| Lanse | $160 | -4% |

| Lansford | $162 | -2% |

| Larimer | $158 | -5% |

| Larksville | $155 | -7% |

| Latrobe | $163 | -2% |

| Lattimer | $164 | -1% |

| Lattimer Mines | $165 | -1% |

| Laughlintown | $177 | 6% |

| Laurel Run | $157 | -6% |

| Laureldale | $162 | -2% |

| Laurelton | $140 | -16% |

| Laurys Station | $165 | -1% |

| Lavelle | $155 | -7% |

| Lawn | $158 | -5% |

| Lawnton | $144 | -13% |

| Lawrence | $159 | -4% |

| Lawrence Park | $161 | -3% |

| Lawrenceville | $167 | 0% |

| Lawson Heights | $162 | -2% |

| Lawton | $182 | 10% |

| Le Raysville | $183 | 10% |

| Lebanon | $142 | -15% |

| Lebanon South | $142 | -15% |

| Leck Kill | $148 | -11% |

| Leckrone | $162 | -3% |

| Lecontes Mills | $161 | -3% |

| Lederach | $170 | 2% |

| Leechburg | $174 | 5% |

| Leeper | $185 | 11% |

| Leesport | $154 | -8% |

| Leetsdale | $152 | -9% |

| Lehigh Valley | $230 | 38% |

| Lehighton | $161 | -3% |

| Leisenring | $157 | -6% |

| Leith-Hatfield | $158 | -5% |

| Lemasters | $143 | -14% |

| Lemont | $134 | -19% |

| Lemont Furnace | $157 | -6% |

| Lemoyne | $141 | -15% |

| Lenhartsville | $154 | -8% |

| Lenni | $200 | 21% |

| Lenoxville | $183 | 10% |

| Leola | $147 | -12% |

| Level Green | $159 | -5% |

| Levittown | $191 | 15% |

| Lewis Run | $165 | -1% |

| Lewisberry | $143 | -14% |

| Lewisburg | $135 | -19% |

| Lewistown | $137 | -17% |

| Lewisville | $173 | 4% |

| Liberty | $168 | 1% |

| Lickingville | $185 | 11% |

| Lightstreet | $146 | -12% |

| Ligonier | $174 | 5% |

| Lilly | $154 | -8% |

| Lima | $189 | 14% |

| Lime Ridge | $146 | -12% |

| Limekiln | $161 | -3% |

| Limeport | $228 | 37% |

| Lincoln | $160 | -4% |

| Lincoln Park | $162 | -2% |

| Lincoln University | $175 | 5% |

| Linden | $143 | -14% |

| Line Lexington | $172 | 3% |

| Linesville | $182 | 9% |

| Linglestown | $142 | -15% |

| Linntown | $135 | -19% |

| Linwood | $200 | 21% |

| Lionville | $174 | 5% |

| Listie | $180 | 9% |

| Lititz | $145 | -13% |

| Little Meadows | $184 | 11% |

| Littlestown | $142 | -15% |

| Liverpool | $150 | -10% |

| Llewellyn | $156 | -6% |

| Lock Haven | $136 | -18% |

| Locust Gap | $149 | -10% |

| Locustdale | $155 | -7% |

| Loganton | $140 | -16% |

| Loganville | $148 | -11% |

| Long Branch | $164 | -1% |

| Long Pond | $202 | 21% |

| Lopez | $163 | -2% |

| Lorain | $151 | -9% |

| Lorane | $166 | 0% |

| Loretto | $157 | -5% |

| Lost Creek | $157 | -6% |

| Lowber | $157 | -6% |

| Lower Allen | $140 | -16% |

| Lower Burrell | $163 | -2% |

| Loyalhanna | $163 | -2% |

| Loysburg | $171 | 3% |

| Loysville | $158 | -5% |

| Lucernemines | $169 | 1% |

| Lucinda | $179 | 7% |

| Ludlow | $168 | 1% |

| Lumberville | $185 | 11% |

| Lurgan | $139 | -17% |

| Luthersburg | $158 | -5% |

| Luxor | $164 | -1% |

| Luzerne | $156 | -6% |

| Lykens | $154 | -7% |

| Lyndell | $178 | 7% |

| Lyndora | $168 | 1% |

| Lynnwood-Pricedale | $157 | -5% |

| Lyon Station | $157 | -6% |

| Mackeyville | $153 | -8% |

| Macungie | $160 | -4% |

| Madera | $175 | 5% |

| Madisonburg | $146 | -12% |

| Mahaffey | $182 | 9% |

| Mahanoy City | $157 | -6% |

| Mahanoy Plane | $158 | -5% |

| Mainesburg | $183 | 10% |

| Mainland | $169 | 2% |

| Malvern | $174 | 5% |

| Mammoth | $158 | -5% |

| Manchester | $143 | -14% |

| Manheim | $140 | -16% |

| Manns Choice | $172 | 4% |

| Manor | $157 | -5% |

| Manorville | $171 | 3% |

| Mansfield | $167 | 0% |

| Maple Glen | $186 | 12% |

| Mapleton | $158 | -5% |

| Mapleton Depot | $162 | -3% |

| Mar Lin | $156 | -6% |

| Marble | $181 | 9% |

| Marchand | $190 | 14% |

| Marcus Hook | $198 | 19% |

| Marianna | $172 | 3% |

| Marianne | $175 | 5% |

| Marienville | $181 | 9% |

| Marietta | $142 | -15% |

| Marion | $138 | -17% |

| Marion Center | $180 | 8% |

| Marion Heights | $150 | -10% |

| Markleton | $174 | 4% |

| Markleysburg | $176 | 6% |

| Marlin | $151 | -9% |

| Mars | $162 | -3% |

| Marshalls Creek | $206 | 24% |

| Marshallton | $149 | -11% |

| Marsteller | $184 | 11% |

| Martin | $162 | -2% |

| Martindale | $141 | -15% |

| Martins Creek | $163 | -2% |

| Martinsburg | $157 | -6% |

| Mary D | $159 | -4% |

| Marysville | $150 | -10% |

| Masontown | $162 | -3% |

| Masthope | $193 | 16% |

| Matamoras | $197 | 18% |

| Mather | $167 | 0% |

| Mattawana | $145 | -13% |

| Mayfield | $156 | -6% |

| Mayport | $183 | 10% |

| Maytown | $142 | -15% |

| Mc Alisterville | $146 | -12% |

| Mc Clellandtown | $161 | -3% |

| Mc Elhattan | $137 | -18% |

| Mc Ewensville | $143 | -14% |

| Mc Grann | $171 | 3% |

| Mc Intyre | $176 | 6% |

| Mc Kean | $171 | 3% |

| Mc Knightstown | $139 | -16% |

| Mc Veytown | $148 | -11% |

| McAdoo | $153 | -8% |

| McClure | $144 | -13% |

| McConnellsburg | $167 | 0% |

| McConnellstown | $160 | -4% |

| McDonald | $161 | -3% |

| McGovern | $159 | -4% |

| McKees Rocks | $166 | 0% |

| McKeesport | $164 | -1% |

| McMurray | $159 | -4% |

| McSherrystown | $143 | -14% |

| Meadow Lands | $165 | -1% |

| Meadowood | $165 | -1% |

| Meadville | $171 | 3% |

| Mechanicsburg | $136 | -18% |

| Mechanicsville | $176 | 6% |

| Media | $188 | 13% |

| Mehoopany | $182 | 9% |

| Melcroft | $166 | 0% |

| Mendenhall | $178 | 7% |

| Mentcle | $193 | 16% |

| Mercer | $162 | -2% |

| Mercersburg | $151 | -9% |

| Meridian | $166 | 0% |

| Merion Station | $223 | 34% |

| Merrittstown | $164 | -2% |

| Mertztown | $156 | -6% |

| Meshoppen | $182 | 10% |

| Messiah College | $136 | -18% |

| Mexico | $139 | -16% |

| Meyersdale | $168 | 1% |

| Middleburg | $140 | -16% |

| Middlebury Center | $167 | 0% |

| Middleport | $156 | -6% |

| Middletown | $144 | -13% |

| Midland | $156 | -6% |

| Midway | $151 | -9% |

| Mifflin | $144 | -14% |

| Mifflinburg | $137 | -18% |

| Mifflintown | $142 | -14% |

| Mifflinville | $145 | -13% |

| Milan | $162 | -3% |

| Milanville | $191 | 15% |

| Mildred | $164 | -2% |

| Milesburg | $140 | -16% |

| Milford | $200 | 20% |

| Milford Square | $170 | 2% |

| Mill Creek | $154 | -7% |

| Mill Hall | $137 | -18% |

| Mill Run | $165 | -1% |

| Mill Village | $171 | 3% |

| Millbourne | $263 | 58% |

| Millersburg | $149 | -10% |

| Millerstown | $153 | -8% |

| Millersville | $149 | -10% |

| Millerton | $171 | 3% |

| Millheim | $143 | -14% |

| Millmont | $146 | -12% |

| Millrift | $197 | 19% |

| Mills | $187 | 13% |

| Millsboro | $169 | 1% |

| Millvale | $166 | 0% |

| Millville | $161 | -3% |

| Milnesville | $165 | -1% |

| Milroy | $138 | -17% |

| Milton | $138 | -17% |

| Mineral Point | $151 | -9% |

| Mineral Springs | $155 | -7% |

| Minersville | $153 | -8% |

| Mingoville | $137 | -18% |

| Minisink Hills | $208 | 25% |

| Mocanaqua | $161 | -3% |

| Modena | $182 | 9% |

| Mohnton | $161 | -3% |

| Mohrsville | $153 | -8% |

| Monaca | $150 | -10% |

| Monessen | $159 | -5% |

| Monocacy Station | $161 | -3% |

| Monongahela | $163 | -2% |

| Monroeton | $169 | 1% |

| Monroeville | $171 | 3% |

| Mont Alto | $137 | -18% |

| Mont Clare | $174 | 4% |

| Montandon | $139 | -16% |

| Montgomery | $147 | -11% |

| Montgomeryville | $175 | 5% |

| Montoursville | $149 | -10% |

| Montrose | $187 | 12% |

| Montrose Manor | $163 | -2% |

| Moosic | $159 | -4% |

| Morann | $164 | -1% |

| Morgan | $158 | -5% |

| Morgantown | $167 | 0% |

| Morris | $169 | 2% |

| Morris Run | $182 | 10% |

| Morrisdale | $158 | -5% |

| Morrisville | $179 | 8% |

| Morton | $198 | 19% |

| Moscow | $171 | 3% |

| Moshannon | $149 | -10% |

| Mount Aetna | $152 | -9% |

| Mount Bethel | $168 | 1% |

| Mount Braddock | $158 | -5% |

| Mount Carmel | $151 | -9% |

| Mount Cobb | $167 | 0% |

| Mount Gretna | $142 | -15% |

| Mount Holly Springs | $134 | -20% |

| Mount Jewett | $168 | 1% |

| Mount Joy | $142 | -15% |

| Mount Morris | $167 | 1% |

| Mount Oliver | $179 | 8% |

| Mount Penn | $171 | 3% |

| Mount Pleasant | $161 | -3% |

| Mount Pleasant Mills | $144 | -14% |

| Mount Pocono | $204 | 23% |

| Mount Union | $156 | -6% |

| Mount Wolf | $143 | -14% |

| Mountain Top | $160 | -4% |

| Mountainhome | $205 | 23% |

| Mountville | $146 | -12% |

| Muhlenberg Park | $162 | -3% |

| Muir | $156 | -6% |

| Muncy | $157 | -6% |

| Muncy Valley | $169 | 2% |

| Mundys Corner | $150 | -10% |

| Munhall | $169 | 1% |

| Munson | $154 | -7% |

| Murrysville | $159 | -4% |

| Muse | $159 | -5% |

| Myerstown | $145 | -13% |

| Nanticoke | $155 | -7% |

| Nanty-Glo | $159 | -4% |

| Narberth | $210 | 26% |

| Narvon | $154 | -7% |

| Natrona Heights | $157 | -6% |

| Nazareth | $157 | -5% |

| Needmore | $176 | 6% |

| Neelyton | $164 | -1% |

| Neffs | $162 | -3% |

| Nelson | $165 | 0% |

| Nemacolin | $168 | 1% |

| Nescopeck | $150 | -10% |

| Nesquehoning | $162 | -3% |

| New Albany | $173 | 4% |

| New Alexandria | $169 | 1% |

| New Baltimore | $181 | 9% |

| New Beaver | $160 | -4% |

| New Bedford | $158 | -5% |

| New Berlin | $137 | -18% |

| New Berlinville | $160 | -4% |

| New Bethlehem | $187 | 12% |

| New Bloomfield | $154 | -8% |

| New Brighton | $151 | -9% |

| New Britain | $173 | 4% |

| New Buffalo | $151 | -9% |

| New Castle | $160 | -4% |

| New Castle Northwest | $160 | -4% |

| New Columbia | $136 | -18% |

| New Cumberland | $140 | -16% |

| New Derry | $167 | 0% |

| New Eagle | $165 | -1% |

| New Enterprise | $164 | -1% |

| New Florence | $169 | 2% |

| New Freedom | $151 | -9% |

| New Freeport | $173 | 4% |

| New Galilee | $156 | -6% |

| New Geneva | $161 | -3% |

| New Germantown | $153 | -8% |

| New Holland | $147 | -11% |

| New Hope | $185 | 11% |

| New Kensington | $164 | -1% |

| New Kingstown | $138 | -17% |

| New Milford | $182 | 9% |

| New Millport | $174 | 5% |

| New Oxford | $140 | -16% |

| New Paris | $163 | -2% |

| New Park | $158 | -5% |

| New Philadelphia | $155 | -7% |

| New Providence | $150 | -10% |

| New Ringgold | $163 | -2% |

| New Salem | $158 | -5% |

| New Stanton | $159 | -4% |

| New Tripoli | $165 | -1% |

| New Wilmington | $159 | -5% |

| Newburg | $138 | -17% |

| Newell | $159 | -4% |

| Newfoundland | $192 | 16% |

| Newmanstown | $147 | -12% |

| Newport | $150 | -10% |

| Newry | $154 | -8% |

| Newton Hamilton | $153 | -8% |

| Newtown | $187 | 13% |

| Newtown Grant | $188 | 13% |

| Newtown Square | $191 | 15% |

| Newville | $139 | -17% |

| Nicholson | $179 | 8% |

| Nicktown | $170 | 2% |

| Nineveh | $171 | 3% |

| Nixon | $169 | 1% |

| Normalville | $168 | 1% |

| Norristown | $190 | 14% |

| North Apollo | $173 | 4% |

| North Belle Vernon | $158 | -5% |

| North Bend | $148 | -11% |

| North Braddock | $175 | 6% |

| North Catasauqua | $160 | -4% |

| North Charleroi | $164 | -1% |

| North East | $168 | 1% |

| North Springfield | $167 | 1% |

| North Versailles | $171 | 3% |

| North Wales | $177 | 7% |

| North Warren | $165 | -1% |

| North Washington | $180 | 8% |

| North York | $148 | -11% |

| Northampton | $156 | -6% |

| Northern Cambria | $173 | 4% |

| Northpoint | $189 | 14% |

| Northumberland | $140 | -16% |

| Northwest Harborcreek | $159 | -4% |

| Norvelt | $162 | -3% |

| Norwood | $214 | 29% |

| Nottingham | $167 | 0% |

| Noxen | $180 | 8% |

| Nu Mine | $184 | 11% |

| Nuangola | $160 | -4% |

| Numidia | $146 | -12% |

| Nuremberg | $162 | -2% |

| Oak Hills | $166 | 0% |

| Oak Ridge | $244 | 46% |

| Oakdale | $157 | -6% |

| Oakland | $164 | -1% |

| Oakland Mills | $143 | -14% |

| Oakmont | $167 | 0% |

| Oaks | $173 | 4% |

| Oakwood | $159 | -4% |

| Oberlin | $144 | -13% |

| Ohiopyle | $166 | 0% |

| Ohioville | $156 | -6% |

| Oil City | $174 | 5% |

| Oklahoma | $165 | -1% |

| Olanta | $164 | -2% |

| Old Forge | $159 | -4% |

| Old Orchard | $159 | -4% |

| Old Zionsville | $162 | -2% |

| Oley | $161 | -3% |

| Oliveburg | $188 | 13% |

| Oliver | $157 | -6% |

| Olyphant | $154 | -7% |

| Ono | $147 | -12% |

| Orangeville | $154 | -7% |

| Orbisonia | $169 | 2% |

| Orchard Hills | $178 | 7% |

| Orefield | $162 | -3% |

| Oreland | $194 | 17% |

| Orrstown | $140 | -16% |

| Orrtanna | $140 | -16% |

| Orson | $240 | 45% |

| Orviston | $160 | -4% |

| Orwigsburg | $156 | -6% |

| Osceola | $170 | 2% |

| Osceola Mills | $157 | -6% |

| Osterburg | $168 | 1% |

| Ottsville | $183 | 10% |

| Oval | $146 | -12% |

| Oxford | $169 | 1% |

| Paint | $149 | -10% |

| Palm | $168 | 1% |

| Palmdale | $141 | -16% |

| Palmer Heights | $159 | -4% |

| Palmerton | $159 | -5% |

| Palmyra | $137 | -18% |

| Paoli | $175 | 5% |

| Paradise | $153 | -8% |

| Paris | $169 | 1% |

| Park Forest Village | $133 | -20% |

| Parker | $189 | 13% |

| Parker Ford | $174 | 5% |

| Parkesburg | $176 | 6% |

| Parkhill | $157 | -6% |

| Parkside | $196 | 18% |

| Parkville | $143 | -14% |

| Parryville | $160 | -4% |

| Patton | $171 | 3% |

| Paupack | $193 | 16% |

| Paxinos | $151 | -9% |

| Paxtang | $146 | -12% |

| Paxtonia | $143 | -14% |

| Paxtonville | $138 | -17% |

| Peach Bottom | $159 | -5% |

| Peach Glen | $157 | -6% |

| Peckville | $151 | -9% |

| Pen Argyl | $159 | -4% |

| Penbrook | $150 | -10% |

| Penfield | $162 | -3% |

| Penn | $160 | -4% |

| Penn Estates | $202 | 21% |

| Penn Run | $169 | 2% |

| Penn State Erie (Behrend) | $159 | -5% |

| Penn Wynne | $209 | 26% |

| Penndel | $193 | 16% |

| Penns Creek | $138 | -17% |

| Penns Park | $182 | 10% |

| Pennsburg | $171 | 3% |

| Pennsbury Village | $162 | -3% |

| Pennside | $167 | 0% |

| Pennsylvania Furnace | $139 | -16% |

| Pennville | $143 | -14% |

| Penryn | $144 | -13% |

| Pequea | $154 | -8% |

| Perkasie | $173 | 4% |

| Perkiomenville | $176 | 6% |

| Perryopolis | $159 | -4% |

| Petersburg | $160 | -4% |

| Petrolia | $188 | 13% |

| Philadelphia | $299 | 80% |

| Philipsburg | $148 | -11% |

| Phoenixville | $173 | 4% |

| Picture Rocks | $158 | -5% |

| Pillow | $150 | -10% |

| Pine Forge | $160 | -4% |

| Pine Grove | $160 | -4% |

| Pine Grove Mills | $133 | -20% |

| Pine Ridge | $209 | 25% |

| Pineville | $181 | 9% |

| Pipersville | $183 | 10% |

| Pitcairn | $173 | 4% |

| Pitman | $156 | -6% |

| Pittsburgh | $172 | 3% |

| Pittsfield | $176 | 6% |

| Pittston | $152 | -9% |

| Plains | $155 | -7% |

| Platea | $166 | 0% |

| Pleasant Gap | $138 | -17% |

| Pleasant Hall | $144 | -13% |

| Pleasant Hill | $140 | -16% |

| Pleasant Hills | $158 | -5% |

| Pleasant Mount | $187 | 13% |

| Pleasant Unity | $162 | -2% |

| Pleasant View | $175 | 5% |

| Pleasantville | $185 | 11% |

| Plum | $167 | 1% |

| Plumsteadville | $183 | 10% |

| Plumville | $179 | 7% |

| Plymouth | $154 | -8% |

| Plymouth Meeting | $189 | 14% |

| Plymptonville | $154 | -7% |

| Pocono Lake | $200 | 20% |

| Pocono Lake Preserve | $197 | 18% |

| Pocono Manor | $202 | 22% |

| Pocono Pines | $202 | 21% |

| Pocono Ranch Lands | $207 | 25% |

| Pocono Springs | $186 | 12% |

| Pocono Summit | $203 | 22% |

| Pocono Woodland Lakes | $200 | 20% |

| Point Marion | $165 | -1% |

| Point Pleasant | $182 | 9% |

| Polk | $187 | 13% |

| Pomeroy | $181 | 9% |

| Port Allegany | $174 | 5% |

| Port Carbon | $152 | -8% |

| Port Clinton | $155 | -7% |

| Port Matilda | $141 | -15% |

| Port Royal | $147 | -11% |

| Port Trevorton | $142 | -14% |

| Port Vue | $164 | -1% |

| Portage | $153 | -8% |

| Porters Sideling | $161 | -3% |

| Portersville | $166 | 0% |

| Portland | $166 | 0% |

| Pottersdale | $163 | -2% |

| Potts Grove | $141 | -15% |

| Pottsgrove | $175 | 5% |

| Pottstown | $174 | 5% |

| Pottsville | $152 | -9% |

| Poyntelle | $186 | 12% |

| Presto | $160 | -4% |

| Preston Park | $182 | 9% |

| Pricedale | $160 | -4% |

| Pringle | $156 | -6% |

| Progress | $145 | -13% |

| Prompton | $181 | 9% |

| Prospect | $165 | 0% |

| Prospect Park | $203 | 22% |

| Prosperity | $170 | 2% |

| Pulaski | $158 | -5% |

| Punxsutawney | $178 | 7% |

| Pymatuning Central | $182 | 9% |

| Pymatuning South | $182 | 9% |

| Quakake | $160 | -4% |

| Quakertown | $167 | 0% |

| Quarryville | $152 | -8% |

| Quecreek | $166 | 0% |

| Queen | $171 | 3% |

| Queens Gate | $150 | -10% |

| Quentin | $142 | -15% |

| Railroad | $149 | -11% |

| Ralston | $166 | 0% |

| Ramblewood | $140 | -16% |

| Ramey | $165 | -1% |

| Rankin | $174 | 5% |

| Ransom | $156 | -6% |

| Raubsville | $161 | -3% |

| Ravine | $160 | -3% |

| Reading | $168 | 1% |

| Reamstown | $148 | -11% |

| Rebersburg | $146 | -12% |

| Rebuck | $153 | -8% |

| Rector | $172 | 3% |

| Red Hill | $173 | 4% |

| Red Lion | $147 | -12% |

| Reeders | $191 | 15% |

| Reedsville | $137 | -17% |

| Refton | $152 | -9% |

| Rehrersburg | $152 | -8% |

| Reiffton | $166 | 0% |

| Reinerton | $158 | -5% |

| Reinholds | $149 | -10% |

| Renfrew | $165 | -1% |

| Rennerdale | $159 | -4% |

| Renningers | $153 | -8% |

| Reno | $171 | 3% |

| Renovo | $153 | -8% |

| Republic | $164 | -1% |

| Revere | $174 | 5% |

| Revloc | $161 | -3% |

| Rew | $166 | 0% |

| Rexmont | $142 | -15% |

| Reynolds Heights | $162 | -3% |

| Reynoldsville | $168 | 1% |

| Rheems | $138 | -17% |

| Rices Landing | $172 | 4% |

| Riceville | $197 | 18% |

| Richboro | $189 | 14% |

| Richeyville | $167 | 0% |

| Richfield | $145 | -13% |

| Richland | $144 | -13% |

| Richlandtown | $167 | 0% |

| Riddlesburg | $174 | 5% |

| Ridgway | $160 | -4% |

| Ridley Park | $204 | 23% |

| Riegelsville | $168 | 1% |

| Rillton | $157 | -6% |

| Rimersburg | $186 | 12% |

| Ringgold | $195 | 17% |

| Ringtown | $157 | -5% |

| Riverside | $146 | -12% |

| Riverview Park | $162 | -3% |

| Rixford | $165 | -1% |

| Roaring Branch | $174 | 5% |

| Roaring Spring | $156 | -6% |

| Robertsdale | $174 | 4% |

| Robesonia | $156 | -6% |

| Robinson | $169 | 1% |

| Rochester | $150 | -10% |

| Rochester Mills | $176 | 6% |

| Rock Glen | $171 | 3% |

| Rockhill | $170 | 2% |

| Rockhill Furnace | $163 | -2% |

| Rockledge | $211 | 27% |

| Rockton | $160 | -4% |

| Rockwood | $169 | 2% |

| Rogersville | $169 | 1% |

| Rome | $175 | 5% |

| Ronco | $162 | -2% |

| Ronks | $149 | -11% |

| Roscoe | $162 | -3% |

| Rose Valley | $196 | 18% |

| Roseto | $161 | -3% |

| Rossiter | $183 | 10% |

| Rosslyn Farms | $160 | -4% |

| Rossville | $144 | -13% |

| Rothsville | $146 | -12% |

| Roulette | $171 | 3% |

| Rouseville | $174 | 5% |

| Rouzerville | $138 | -17% |

| Rowland | $200 | 20% |

| Roxbury | $141 | -15% |

| Royalton | $139 | -16% |

| Royersford | $174 | 5% |

| Ruffs Dale | $160 | -4% |

| Rural Ridge | $159 | -4% |

| Rural Valley | $184 | 11% |

| Rushland | $178 | 7% |

| Russell | $166 | 0% |

| Russellton | $159 | -4% |

| Rutherford | $143 | -14% |

| Rutledge | $201 | 21% |

| Sabinsville | $168 | 1% |

| Sacramento | $158 | -5% |

| Sadsburyville | $175 | 5% |

| Saegertown | $172 | 4% |

| Sagamore | $176 | 6% |

| Salfordville | $170 | 2% |

| Salina | $169 | 1% |

| Salisbury | $168 | 1% |

| Salix | $152 | -8% |

| Salladasburg | $146 | -12% |

| Salona | $158 | -5% |

| Saltillo | $163 | -2% |

| Saltsburg | $180 | 8% |

| Salunga | $144 | -13% |

| Sanatoga | $174 | 5% |

| Sand Hill | $143 | -14% |

| Sandy | $159 | -5% |

| Sandy Lake | $178 | 7% |

| Sandy Ridge | $210 | 26% |

| Sankertown | $157 | -5% |

| Sarver | $165 | -1% |

| Sassamansville | $177 | 7% |

| Saw Creek | $208 | 25% |

| Saxonburg | $166 | 0% |

| Saxton | $166 | 0% |

| Saylorsburg | $189 | 14% |

| Sayre | $157 | -6% |

| Scalp Level | $149 | -10% |

| Scenery Hill | $172 | 3% |

| Schaefferstown | $145 | -13% |

| Schellsburg | $168 | 1% |

| Schenley | $175 | 5% |

| Schlusser | $134 | -20% |

| Schnecksville | $160 | -4% |

| Schoeneck | $147 | -12% |

| Schuylkill Haven | $153 | -8% |

| Schwenksville | $179 | 8% |

| Sciota | $191 | 15% |

| Scotland | $139 | -16% |

| Scotrun | $200 | 20% |

| Scottdale | $158 | -5% |

| Scranton | $162 | -3% |

| Seanor | $157 | -5% |

| Selinsgrove | $136 | -18% |

| Sellersville | $169 | 2% |

| Seltzer | $155 | -7% |

| Seminole | $193 | 16% |

| Seneca | $172 | 3% |

| Seven Fields | $160 | -4% |

| Seven Valleys | $149 | -10% |

| Seward | $169 | 2% |

| Sewickley | $155 | -7% |

| Sewickley Heights | $155 | -7% |

| Sewickley Hills | $155 | -7% |

| Shade Gap | $170 | 2% |

| Shady Grove | $139 | -17% |

| Shamokin | $152 | -9% |

| Shamokin Dam | $136 | -18% |

| Shanksville | $164 | -2% |

| Shanor-Northvue | $167 | 1% |

| Sharon | $155 | -7% |

| Sharon Hill | $264 | 59% |

| Sharpsburg | $165 | -1% |

| Sharpsville | $155 | -7% |

| Shartlesville | $153 | -8% |

| Shavertown | $159 | -4% |

| Shawanese | $155 | -7% |

| Shawnee On Delaware | $204 | 23% |

| Shawville | $157 | -6% |

| Sheakleyville | $168 | 1% |

| Sheffield | $165 | -1% |

| Shelocta | $180 | 8% |

| Shenandoah | $158 | -5% |

| Sheppton | $157 | -6% |

| Shermans Dale | $152 | -8% |

| Shickshinny | $163 | -2% |

| Shillington | $163 | -2% |

| Shiloh | $149 | -10% |

| Shinglehouse | $175 | 5% |

| Shippensburg | $134 | -19% |

| Shippensburg University | $134 | -20% |

| Shippenville | $175 | 5% |

| Shippingport | $159 | -4% |

| Shiremanstown | $139 | -17% |

| Shirleysburg | $160 | -4% |

| Shoemakersville | $155 | -7% |

| Shohola | $199 | 20% |

| Shrewsbury | $151 | -9% |

| Shunk | $163 | -2% |

| Sidman | $151 | -9% |

| Sierra View | $197 | 18% |

| Sigel | $173 | 4% |

| Silkworth | $163 | -2% |

| Silverdale | $175 | 5% |

| Sinking Spring | $159 | -4% |

| Sinnamahoning | $167 | 1% |

| Sipesville | $165 | -1% |

| Six Mile Run | $176 | 6% |

| Skippack | $173 | 4% |

| Skyline View | $145 | -13% |

| Skytop | $200 | 20% |

| Slabtown | $148 | -11% |

| Slate Run | $153 | -8% |

| Slatedale | $162 | -2% |

| Slatington | $162 | -3% |

| Slickville | $166 | 0% |

| Sligo | $181 | 9% |

| Slippery Rock | $172 | 3% |

| Slippery Rock University | $173 | 4% |

| Slovan | $167 | 1% |

| Smethport | $175 | 6% |

| Smicksburg | $185 | 11% |

| Smithfield | $159 | -4% |

| Smithmill | $163 | -2% |

| Smithton | $157 | -6% |

| Smock | $159 | -4% |

| Smokerun | $165 | -1% |

| Smoketown | $157 | -6% |

| Snow Shoe | $148 | -11% |

| Snydersburg | $196 | 18% |

| Snydertown | $145 | -13% |

| Somerset | $164 | -2% |

| Soudersburg | $150 | -10% |

| Souderton | $172 | 3% |

| South Canaan | $173 | 4% |

| South Coatesville | $183 | 10% |

| South Connellsville | $154 | -7% |

| South Fork | $153 | -8% |

| South Gibson | $187 | 13% |

| South Greensburg | $164 | -1% |

| South Heights | $153 | -8% |

| South Montrose | $184 | 11% |

| South Mountain | $139 | -16% |

| South New Castle | $159 | -4% |

| South Park Township | $158 | -5% |

| South Philipsburg | $147 | -12% |

| South Pottstown | $175 | 5% |

| South Renovo | $153 | -8% |

| South Sterling | $191 | 15% |

| South Temple | $163 | -2% |

| South Uniontown | $157 | -5% |

| South Waverly | $156 | -6% |

| South Williamsport | $146 | -12% |

| Southampton | $198 | 19% |

| Southeastern | $220 | 32% |

| Southmont | $150 | -10% |

| Southview | $162 | -3% |

| Southwest | $160 | -4% |

| Southwest Greensburg | $164 | -2% |

| Spangler | $167 | 0% |

| Spartansburg | $186 | 12% |

| Speers | $164 | -2% |

| Spinnerstown | $168 | 1% |

| Spraggs | $167 | 0% |

| Sprankle Mills | $172 | 3% |

| Spring Church | $181 | 9% |

| Spring City | $177 | 6% |

| Spring Creek | $182 | 10% |

| Spring Glen | $153 | -8% |

| Spring Grove | $148 | -11% |

| Spring Hill | $154 | -7% |

| Spring House | $187 | 13% |

| Spring Mills | $140 | -16% |

| Spring Mount | $178 | 7% |

| Spring Ridge | $162 | -3% |

| Spring Run | $149 | -10% |

| Springboro | $187 | 12% |

| Springdale | $163 | -2% |

| Springfield | $197 | 18% |

| Springmont | $161 | -3% |

| Springs | $169 | 2% |

| Springtown | $162 | -3% |

| Springville | $183 | 10% |

| Sproul | $159 | -4% |

| Spruce Creek | $157 | -6% |

| Spry | $145 | -13% |

| St. Benedict | $165 | -1% |

| St. Boniface | $168 | 1% |

| St. Clair | $151 | -9% |

| St. Johns | $171 | 3% |

| St. Lawrence | $166 | 0% |

| St. Marys | $156 | -6% |

| St. Michael | $153 | -8% |

| St. Peters | $169 | 2% |

| St. Petersburg | $189 | 14% |

| St. Thomas | $141 | -15% |

| St. Vincent College | $162 | -2% |

| Stahlstown | $173 | 4% |

| Star Junction | $158 | -5% |

| Starford | $173 | 4% |

| Starlight | $182 | 10% |

| Starrucca | $189 | 14% |

| State College | $133 | -20% |

| State Line | $137 | -17% |

| Steelton | $145 | -13% |

| Sterling | $181 | 9% |

| Stevens | $147 | -12% |

| Stevensville | $175 | 5% |

| Stewartstown | $154 | -8% |

| Stiles | $167 | 1% |

| Stillwater | $162 | -2% |

| Stockdale | $161 | -3% |

| Stockertown | $158 | -5% |

| Stoneboro | $175 | 6% |

| Stonerstown | $165 | -1% |

| Stony Creek Mills | $166 | 0% |

| Stonybrook | $146 | -12% |

| Stormstown | $140 | -16% |

| Stouchsburg | $153 | -8% |

| Stowe | $175 | 5% |

| Stoystown | $164 | -2% |

| Strabane | $161 | -3% |

| Strasburg | $151 | -9% |

| Strattanville | $175 | 5% |

| Strausstown | $154 | -7% |

| Strongstown | $174 | 4% |

| Stroudsburg | $190 | 14% |

| Stump Creek | $164 | -1% |

| Sturgeon | $160 | -4% |

| Sugar Grove | $172 | 4% |

| Sugar Notch | $157 | -6% |

| Sugar Run | $177 | 6% |

| Sugarcreek | $176 | 6% |

| Sugarloaf | $157 | -5% |

| Summerdale | $140 | -16% |

| Summerhill | $158 | -5% |

| Summerville | $175 | 5% |

| Summit Hill | $163 | -2% |

| Summit Station | $152 | -9% |

| Sumneytown | $171 | 3% |

| Sun Valley | $197 | 19% |

| Sunbury | $142 | -15% |

| Suplee | $172 | 3% |

| Susquehanna | $184 | 11% |

| Susquehanna Depot | $183 | 10% |

| Susquehanna Trails | $160 | -4% |

| Sutersville | $160 | -4% |

| Swarthmore | $194 | 17% |

| Swartzville | $149 | -11% |

| Sweet Valley | $170 | 2% |

| Swengel | $141 | -15% |

| Swiftwater | $201 | 21% |

| Swissvale | $172 | 4% |

| Swoyersville | $156 | -6% |

| Sybertsville | $157 | -6% |

| Sycamore | $168 | 1% |

| Sykesville | $164 | -2% |

| Sylvania | $171 | 3% |

| Tafton | $193 | 16% |

| Talmage | $146 | -12% |

| Tamaqua | $163 | -2% |

| Tamiment | $202 | 22% |

| Tannersville | $193 | 16% |

| Tarentum | $160 | -4% |

| Tarrs | $161 | -3% |

| Tatamy | $161 | -3% |

| Taylor | $159 | -4% |

| Taylorstown | $168 | 1% |

| Telford | $167 | 0% |

| Temple | $163 | -2% |

| Templeton | $184 | 11% |

| Terre Hill | $147 | -12% |

| The Hideout | $176 | 6% |

| Thomasville | $142 | -14% |

| Thompson | $193 | 16% |

| Thompsontown | $147 | -12% |

| Thompsonville | $159 | -4% |

| Thornburg | $162 | -3% |

| Thorndale | $176 | 6% |

| Thornton | $190 | 14% |

| Three Springs | $173 | 4% |

| Throop | $157 | -6% |

| Tidioute | $186 | 12% |

| Timblin | $176 | 6% |

| Tioga | $168 | 1% |

| Tiona | $167 | 0% |

| Tionesta | $186 | 12% |

| Tipton | $155 | -7% |

| Tire Hill | $159 | -5% |

| Titusville | $187 | 13% |

| Tobyhanna | $208 | 25% |

| Todd | $164 | -1% |

| Toftrees | $134 | -19% |

| Topton | $153 | -8% |

| Torrance | $165 | -1% |

| Toughkenamon | $179 | 8% |

| Towamensing Trails | $189 | 14% |

| Towanda | $167 | 1% |

| Tower City | $158 | -5% |

| Townville | $190 | 14% |

| Trafford | $161 | -3% |

| Trainer | $203 | 22% |

| Transfer | $160 | -4% |

| Trappe | $171 | 3% |

| Treasure Lake | $158 | -5% |

| Treichlers | $160 | -4% |

| Tremont | $155 | -7% |

| Tresckow | $157 | -5% |

| Trevorton | $152 | -9% |

| Trevose | $210 | 26% |

| Trexlertown | $158 | -5% |

| Trooper | $184 | 11% |

| Trout Run | $159 | -4% |

| Troutville | $158 | -5% |

| Troxelville | $158 | -5% |

| Troy | $176 | 6% |

| Trucksville | $159 | -5% |

| Trumbauersville | $168 | 1% |

| Tullytown | $189 | 13% |

| Tunkhannock | $176 | 6% |

| Turbotville | $146 | -12% |

| Turkey City | $246 | 48% |

| Turtle Creek | $176 | 6% |

| Turtlepoint | $175 | 5% |

| Tuscarora | $159 | -4% |

| Twin Rocks | $164 | -1% |

| Tyler Hill | $186 | 12% |

| Tyler Run | $149 | -11% |

| Tylersburg | $198 | 19% |

| Tylersport | $169 | 2% |

| Tyrone | $157 | -5% |

| Uledi | $158 | -5% |

| Ulster | $164 | -1% |

| Ulysses | $175 | 5% |

| Union City | $180 | 8% |

| Union Dale | $191 | 15% |

| Uniontown | $158 | -5% |

| Unionville | $181 | 9% |

| United | $160 | -4% |

| Unity House | $201 | 21% |

| Unityville | $165 | -1% |

| University Park | $134 | -19% |

| University of Pittsburgh Johnstown | $151 | -9% |

| Upland | $197 | 18% |

| Upper Black Eddy | $174 | 5% |

| Upper Darby | $260 | 56% |

| Upper St. Clair | $158 | -5% |

| Upperstrasburg | $145 | -13% |

| Ursina | $171 | 3% |

| Utica | $187 | 12% |

| Uwchland | $177 | 6% |

| Valencia | $166 | 0% |

| Valier | $187 | 13% |

| Valley Forge | $199 | 20% |

| Valley Green | $141 | -15% |

| Valley View | $155 | -7% |

| Van Voorhis | $166 | 0% |

| Vanderbilt | $157 | -6% |

| Vandergrift | $173 | 4% |

| Venango | $176 | 6% |

| Venetia | $161 | -3% |

| Venus | $182 | 10% |

| Verona | $173 | 4% |

| Versailles | $169 | 1% |

| Vestaburg | $169 | 2% |

| Vicksburg | $225 | 35% |

| Villa Maria | $160 | -4% |

| Village Green-Green Ridge | $193 | 16% |

| Village Shires | $197 | 18% |

| Villanova | $189 | 13% |

| Vinco | $151 | -9% |

| Vintondale | $163 | -2% |

| Virginville | $155 | -7% |

| Volant | $163 | -2% |

| Vowinckel | $180 | 8% |

| Wagner | $144 | -14% |

| Wagontown | $184 | 11% |

| Wall | $172 | 3% |

| Wallaceton | $157 | -6% |

| Wallingford | $196 | 18% |

| Walnut Bottom | $136 | -18% |

| Walnutport | $157 | -6% |

| Walston | $172 | 3% |

| Waltersburg | $159 | -4% |

| Wampum | $158 | -5% |

| Wapwallopen | $162 | -3% |

| Warfordsburg | $180 | 8% |

| Warminster | $185 | 11% |

| Warminster Heights | $185 | 11% |

| Warren | $165 | -1% |

| Warren Center | $176 | 6% |

| Warrendale | $159 | -5% |

| Warrington | $182 | 9% |

| Warrior Run | $156 | -6% |

| Warriors Mark | $153 | -8% |

| Washington | $164 | -2% |

| Washington Boro | $147 | -11% |

| Washington Crossing | $187 | 13% |

| Washingtonville | $144 | -13% |

| Waterfall | $173 | 4% |

| Waterford | $174 | 4% |

| Waterville | $153 | -8% |

| Watsontown | $140 | -16% |

| Wattsburg | $173 | 4% |

| Waverly | $162 | -2% |

| Waymart | $173 | 4% |

| Wayne | $187 | 13% |

| Waynesboro | $137 | -17% |

| Waynesburg | $167 | 1% |

| Weatherly | $166 | 0% |

| Webster | $159 | -5% |

| Weedville | $161 | -3% |

| Weigelstown | $145 | -13% |

| Weikert | $142 | -15% |

| Weissport East | $160 | -4% |

| Wellersburg | $163 | -2% |

| Wells Tannery | $174 | 4% |

| Wellsboro | $165 | -1% |

| Wellsville | $142 | -15% |

| Wendel | $161 | -3% |

| Wernersville | $155 | -7% |

| Wescosville | $163 | -2% |