Best Cheap Car Insurance for Tesla Vehicles

Cheapest Tesla car insurance quotes

How much is Tesla car insurance?

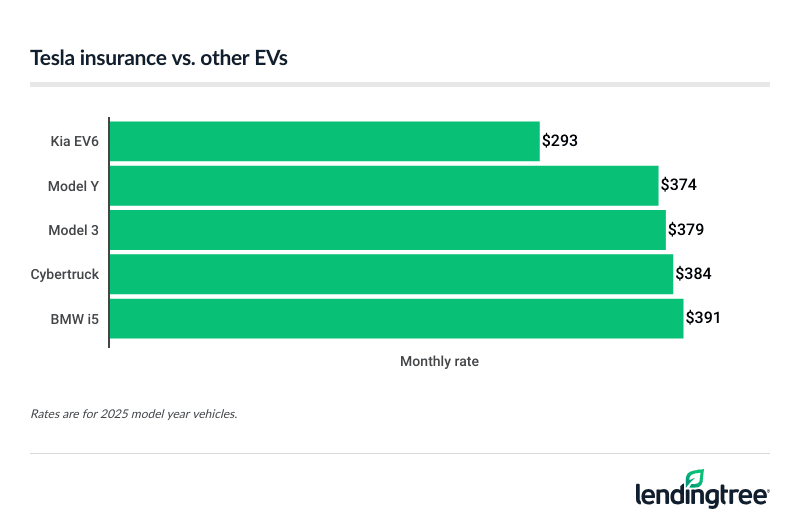

The cost of car insurance for Teslas varies by model. Model Y is the cheapest Tesla to insure at $374 a month, on average. Model X is the most expensive at about $557 a month.

Tesla’s luxury electric vehicles (EVs) cost more to insure than plainer cars like a Honda Accord and electric Kia EV6. However, three of five Tesla models are cheaper to insure than the electric BMW i5.

Tesla insurance rate comparison

| Model | Annual rate | Monthly rate |

|---|---|---|

| Kia EV6 | $3,520 | $293 |

| Honda Civic | $3,553 | $296 |

| Tesla Model Y | $4,483 | $374 |

| Tesla Model 3 | $4,546 | $379 |

| Tesla Cybertruck | $4,613 | $384 |

| BMW i5 | $4,695 | $391 |

| Tesla Model S | $6,659 | $555 |

| Tesla Model X | $6,688 | $557 |

Your actual car insurance rate depends on factors like your driving record, your location and, in most states, your credit. Each company treats these factors differently, and their rates vary by customer. This makes it good to compare car insurance quotes from a few companies to find the cheapest rate.

Cheapest car insurance quotes for Tesla Model Y: Nationwide

Nationwide has the cheapest car insurance for Tesla Model Y at around $196 a month for full coverage

Best Model Y insurance rates

| Company | Annual rate | Monthly rate | LendingTree score | |

|---|---|---|---|---|

| Nationwide | $2,349 | $196 | |

| American Family | $2,458 | $205 | ||

| Progressive | $3,958 | $330 | ||

| State Farm | $4,300 | $358 | ||

| Travelers | $4,673 | $389 | ||

| Geico | $5,245 | $437 | ||

| Farmers | $5,618 | $468 | ||

| USAA* | $3,060 | $255 |

Cheapest Tesla Model 3 car insurance quotes: Nationwide

Nationwide has the cheapest car insurance quotes for most Tesla Model 3 drivers at $281 a month. This is 15% less than the next-cheapest rate of $332 a month from Travelers.

USAA has the cheapest overall insurance rate for Model 3s. However, USAA is only available to the military community.

Best Model 3 insurance rates

| Company | Annual rate | Monthly rate |

|---|---|---|

| Nationwide | $3,375 | $281 |

| Travelers | $3,983 | $332 |

| State Farm | $3,993 | $333 |

| Progressive | $4,148 | $346 |

| American Family | $4,710 | $392 |

| Geico | $5,038 | $420 |

| Farmers | $6,462 | $538 |

| USAA* | $2,678 | $223 |

Best insurance rates for a Tesla Cybertruck: Geico

At $178 a month, Geico has the best insurance rates for Tesla Cybertrucks. Geico’s rate is less than half the average of $384 a month for Cybertruck insurance.

American Family has the next-cheapest Cybertruck insurance at $208 a month. This is 46% less than the average for Tesla’s attention-getting pickup truck.

Cheapest Cybertruck insurance

| Company | Annual rate | Monthly rate |

|---|---|---|

| Geico | $2,138 | $178 |

| American Family | $2,498 | $208 |

| Progressive | $3,632 | $303 |

| Nationwide | $4,191 | $349 |

| Farmers | $4,781 | $398 |

| State Farm | $5,134 | $428 |

| Travelers | $5,250 | $438 |

| USAA* | $4,490 | $374 |

Cheapest Tesla Model S insurance: Nationwide

Most Model S drivers get the cheapest car insurance quotes from Nationwide at $352 a month. This is 20% less than the next-cheapest rate of $442 a month from Progressive. Both companies’ rates are well below the Model S average of $555 a month.

Best Model S insurance rates

| Company | Annual rate | Monthly rate |

|---|---|---|

| Nationwide | $4,225 | $352 |

| Progressive | $5,304 | $442 |

| State Farm | $5,711 | $476 |

| Travelers | $6,296 | $525 |

| Geico | $8,552 | $713 |

| American Family | $8,565 | $714 |

| Farmers | $8,604 | $717 |

| USAA* | $4,143 | $345 |

Cheapest car insurance for Tesla Model X: Nationwide

Nationwide also has the cheapest car insurance for the Tesla Model X at $203 a month. However, this is only slightly cheaper than American Family’s rate of $208 a month. Both companies charge less than half as much as the next-cheapest company, Progressive.

Best Tesla Model X insurance rates

| Company | Annual rate | Monthly rate |

|---|---|---|

| Nationwide | $2,440 | $203 |

| American Family | $2,498 | $208 |

| Progressive | $5,250 | $438 |

| Travelers | $6,019 | $502 |

| State Farm | $6,154 | $513 |

| Geico | $7,833 | $653 |

| Farmers | $7,895 | $658 |

| USAA* | $7,427 | $619 |

Best car insurance companies for Tesla drivers

American Family is the best overall car insurance company for most Tesla drivers. Along with low rates, it has better customer service ratings than many other companies. This includes an excellent complaint rating

Nationwide is the best choice for cheap rates on Tesla insurance, while USAA is best for military families.

Best Tesla car insurance

| Company | Monthly rate | Complaint rating | Satisfaction rating | LendingTree score |

|---|---|---|---|---|

| American Family | $345 | 0.5 (Excellent) | 660 (Excellent) | |

| Nationwide | $276 | 0.7 (Good) | 641 (Average) | |

| USAA* | $363 | 1.0 (Average) | 739 (Excellent) |

Best overall for Teslas: American Family

Pros

- Excellent customer service ratings

- Cheap rates for Model X, Model Y and Cybertrucks

- Several discounts make its rates more affordable

Cons

- Expensive rates for Model 3 and Model S

A high satisfaction rating means customers like the prices, coverage options and service they get from American Family. The company’s excellent complaint score means you can trust it to pay claims.

American Family’s rates are 23% less than the average for all Tesla models. Its rates for Model X, Model Y and Cybertruck are especially low. The company also offers gap insurance

Best for cheap rates: Nationwide

Pros

- Cheapest rates for most Tesla models

- Especially cheap for Model X

- Good add-on coverages available

Cons

- Customer satisfaction is slightly worse than average

Nationwide’s rates for Teslas are 39% less than the average. Its Model X rates are especially cheap at 64% less than the average for the vehicle. Nationwide has a good complaint rating, which means you can trust it to follow through on claims. Its satisfaction score is just average.

Like American Family, Nationwide also offers gap insurance. You can add vanishing deductible

Best overall for Teslas: American Family

Pros

- Rates are 19% cheaper than the average for Teslas

- Cheapest overall for Model 3 and Model S

- Best customer satisfaction rating

Cons

- Only available to the military community

A sky-high satisfaction score makes USAA a great choice if you or a close family member have military ties. Its complaint rating is just average, which means the company is not perfect.

USAA’s website and smartphone app make it easy to manage your policy and file claims yourself. You can also call the service center or use online chat for live assistance. However, you usually get a different agent each time you contact the company. You can often get more personalized service from a company that lets you regularly work with the same agent.

How does Tesla’s car insurance work?

Pros

- Cheap rates for Tesla drivers

- Convenient full-service smartphone app

- Safe driving reduces your rate

Cons

- Only available in 12 states

- Bad complaint rating

Tesla’s own car insurance is another option for Tesla drivers in these states:

- Arizona

- California

- Colorado

- Illinois

- Maryland

- Minnesota

- Nevada

- Ohio

- Oregon

- Texas

- Utah

- Virginia

Tesla Insurance tends to have cheap rates for Tesla drivers. For example, it has the third-cheapest Model S insurance in California, behind Progressive and USAA.

You can get quotes and start your policy through Tesla’s smartphone app. The company pulls data from your Tesla to give you a Safety Score, except in California. You can raise your Safety Score by not speeding, braking hard or displaying other risky driving habits. This, in turn, lowers your rate, which gets updated each month.

Unfortunately, Tesla Insurance has nearly four times as many complaints as average, according to the NAIC. This suggests that Tesla Insurance does not handle claims as well as other car insurance companies do.

Why is Tesla car insurance so expensive?

High repair costs are blamed for making Tesla vehicles expensive to insure. Teslas have advanced sensors and cameras that make them safer and more efficient. Unfortunately, these devices also make Teslas more expensive to repair after an accident.

Methodology

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of car insurance quotes for drivers in California, Georgia, Illinois, Ohio and Texas.

Quotes are for a 30-year-old man with good credit and a clean driving record. All vehicles are from the 2025 model year.

Full coverage policies include:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $25,000

- Uninsured motorist: $50,000 per person, $100,000 per accident

- Personal injury protection in Maryland and Minnesota

- Collision: $500 deductible

- Comprehensive: $500 deductible

–

For LendingTree scores, our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the NAIC and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military and their families.